A Behind the Scenes Look at Sterlite Technologies' Efforts To

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

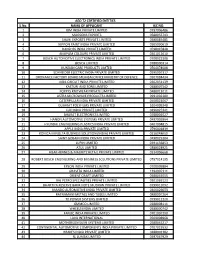

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Conference Ofc & Telecom Infrastructure.Qxp

15th Edition TELECOM INFRASTRUCTURE IN INDIA A VIRTUAL CONFERENCE Growth Drivers, Emerging Business Models and Future Outlook March 18-119, 2021 30 per cent “Early Bird” discount ends on February 25, 2021 Register Now Supported by: Tower and Infrastructure Providers Association 10th Edition OFC NETWORKS IN INDIA A VIRTUAL CONFERENCE Growth Strategies, Emerging Opportunities and Market Outlook April 15-116, 2021 30 per cent “Early Bird” discount ends on March 25, 2021 Register Now Co-sponsors so far*: Organisers: *Lead and Co-sponsorship opportunities are available TELECOM INFRASTRUCTURE IN INDIA Mission z The Indian telecom infrastructure industry has demonstrated great strength and resilience in managing massive data loads during the Covid pandemic in 2020. Despite the data consumption peaking at 12 GB per user per month, the telecom networks did not fail even for a day. z The pandemic has accelerated the adoption of next-generation technologies such as automation and virtualisation, and has given a new impetus to indoor connectivity, creating a robust demand for digital infrastructure. These trends will continue to shape the sector in a post-Covid world as well, and IP-1s are geared up to seize this opportunity. z In recent years, towercos have shifted their business focus from traditional offerings to new and emerging areas such as fibre, small cells, Wi-Fi, IoT, smart poles and data centres, in a bid to become end-to-end digital infrastructure providers. This has helped towercos in strengthening their position in the evolving digital value chain, with greater participation in programmes like Digital India and the Smart Cities Mission. -

Hapag Lloyd India Pvt B/L Wise List of Containers

HAPAG LLOYD INDIA PVT B/L WISE LIST OF CONTAINERS Date : 09/01/20 Page: 1 Vessel Name : EXPRESS ATHENS Voyage : 9350W Call Sign : A8YC3 Arrival Date : 11/01/20 IGM No. : 2243765 IGM Date : 09/01/20 ---------------------------------------------------------------------------------------------- S.No. Line BL No. BL Date Pkgs Gr. Wt. Cont. No. Seal No. CFS Name ---------------------------------------------------------------------------------------------- 1 312 HLCUAU2191204562 03/01/20 3960 101376.000 HLBU2455657 HLD7270181 STERLITE TECHNOLOGIES LTD HLXU8279573 HLD7270182 STERLITE TECHNOLOGIES LTD TRLU7014678 HLD7270183 STERLITE TECHNOLOGIES LTD UACU6006997 HLD7270184 STERLITE TECHNOLOGIES LTD 2 313 HLCUAU2191204613 03/01/20 2970 76032.000 SEGU5686680 HLD7256523 BHAVIK ENTERPRISES LTD/Speedy Multimode Ltd CFS TCLU5125863 HLD7256525 BHAVIK ENTERPRISES LTD/Speedy Multimode Ltd CFS UACU5117764 HLD7256524 BHAVIK ENTERPRISES LTD/Speedy Multimode Ltd CFS 3 314 HLCUDX3191248932 07/01/20 1980 50589.000 HLBU2533981 AC35344 United Liner Agencies (ULA CFS) HLXU8103183 AC35345 United Liner Agencies (ULA CFS) 4 315 HLCUDX3191250199 07/01/20 160 38287.200 HLXU1352306 HLD7308612 VIMAL INTERTRADE PVT. LTD./Ashte CFS UACU4052817 HLD7308618 VIMAL INTERTRADE PVT. LTD./Ashte CFS 5 316 HLCUDX3191250206 07/01/20 80 19143.600 UACU4070981 HLD7308619 VIMAL INTERTRADE PVT. LTD./Ashte CFS 6 317 HLCUDX3191250217 07/01/20 28 31350.860 HLXU3103344 HLD7242795 United Liner Agencies (ULA CFS) HAPAG LLOYD INDIA PVT B/L WISE LIST OF CONTAINERS Date : 09/01/20 Page: 2 Vessel -

Indie - Energetický Profil

Věc: Indie - energetický profil 1. Skladba energetického mixu 1.1. Celková nabídka primárních zdrojů energie – TPES Indický energetický sektor je velmi diverzifikovaný. Primárním zdrojem energie jsou jak konvenční zdroje (uhlí, lignit, zemní plyn, ropa, voda a jádro), tak i nekonvenční zdroje (vítr, slunce, zemědělský a komunální odpad). V roce 2015 bylo procentuální složení výroby elektrické energie následující: 69-70 % tepelné elektrárny, 15 % vodní elektrárny, 2 % jaderné elektrárny a 13 % obnovitelné zdroje. Indie je 5. největším výrobcem elektřiny na světě. Indie je zároveň 4. největším spotřebitelem energie na světě po Číně, USA a Rusku. Populace Indie se blíží počtu obyvatel Číny, ale energetická spotřeba Indie je pouhá jedna čtvrtina spotřeby Číny. V roce 2016 činí poptávka po elektřině cca 155 GW. Odhaduje se, že v letech 2021-22 to bude cca 217 GW. TIC, strana 1 1.2. Podíl jednotlivých zdrojů na celkové výrobě elektřiny Údaje jsou v gigawattech (GW), poslední sloupec udává procentuální zastoupení Rok 1997 2002 2007 2012 2015 2015 (%) uhlí 54,2 62,1 71,1 112,0 164,6 60,6% zemní plyn 6,6 11,1 13,7 18,4 23,1 8,5% diesel 0,3 1,1 1,2 1,2 1,2 0,4% hydro 21,7 26,1 36,4 42,6 41,3 15,2% malé hydro 3,4 3,8 1,4% jádro 2,2 2,7 3,9 4,8 5,8 2,1% vítr 0,4 0,8 4,1 16,5 24,2 8,9% solár 0,0 0,0 0,0 0,6 3,7 1,4% biomasa 0,5 0,9 1,9 3,8 4,1 1,5% Celkem 85,9 GW 104,9 GW 132,3 GW 203,3 GW 271,7 GW 100,0% 1.3. -

Sterlite Technologies (STRTECH

PRIVATE CLIENT GROUP Sterlite Technologies (STRTECH IN) 14 November 2018 INDIA | MIDCAP| VISIT NOTE Not Rated We recently visited Sterlite Technologies Limited’s plant, below are our key takeaways: COMPANY DATA Sterlite Technologies (STL) is one of the leading global players providing data network solutions viz optical fiber O/S SHARES (MN) : 402.2 MARKET CAP (RS BN) : 146.1 (OF), OF cables, software solutions and system integration services. STL is a fully integrated manufacturer of MARKET CAP (USD MN) : 2021.2 52 ‐ WK HI/LO (RS) : 415.0/253.3 optical fiber cables and is among a handful of players that can undertake the entire process of manufacturing TRADING VOL. 3M (000) : 75809.5 from silicon to pre‐form to fiber to cables. In addition to its product setup STL has forward integrated into PAR VALUE (RS) : 2.0 providing services to its customers like system integration and software which allow it to provide comprehensive SHARE HOLDING PATTERN, % and integrated offerings to customers sharply differentiating it and thereby positioning it to capture greater PROMOTERS : 53.86 FII / FPI : 6.81 share of wallet from sharply increasing global demand for creation of next generation data networks. FI / MF : 12.69 PUBLIC & OTHERS : 26.64 STL has optical fiber manufacturing facilities located in India & China (JV), optic fiber cabling facilities in India, China (JV), Italy and Brazil (JV) and has a sales network across 5 continents globally. In 2015, with the acquisition PRICE Vs. SENSEX of EliteCore Technologies, STL added Telecom Software to its service offerings. With a strong presence internationally STL generates nearly 54% of revenues from international markets with 8 of the top 10 global telecom players its customers. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

Sterlite Technologies Ltd Lightning Technology Connecting Growth… Initiating Coverage

INDIA Institutional Research Cables & Conductors Sterlite Technologies Ltd Lightning technology connecting growth… Initiating Coverage Analyst: Backward integration ‐ a unique advantage: Sterlite Rating Buy Kanika Bihany Dugar Technologies Ltd (STL) is the solo integrated optical fiber Target Price Rs640 [email protected] manufacturer in India. The process of converting silicon CMP* Rs360 91 22 3951 7618 into glass and further to fiber helps the company to realize Date: 8th January 2010 Upside 77% 35‐40% OPMs only from this integration; in addition to 14‐ Sensex 17615 15% OPMs from manufacturing of fiber‐optic cables from the optical fibers. Golden goose ‐ Optical fiber and fiber‐optic cables: The Key Data company is currently the 5th largest manufacturer of Bloomberg Code SOTL IN Equity optical fiber and fiber‐optic cables globally and is moving rd Reuters Code STTE.BO towards 3 largest globally with increasing its capacity to 20mn Km for optical fiber and 10mn FKm for fiber optic NSE Code STRTECH cables by FY12E. This will assist the company to capture Current Share o/s (mn) 64.6 10% global market share from the current 5%. MktCap (Rsbn/USDmn) 23.5/510 Enduring growth in conductors backed by continuing 52 Wk H/L (Rs) 383.9/44.2 investments in T&D sector: The power conductor business Daily Vol. (3m NSE Avg) 255881 segment, contributing 63% to net sales in FY09, will Face Value (Rs) 5 maintain the growth trajectory with investments of about Beta 1.44 Rs315bn in conductors segment alone in the XIth plan out 1USD/INR 45.7 of total investments of Rs4.3tn on power T&D. -

S.No. NAME of APPLICANT IEC NO. 1 IBM INDIA PRIVATE LIMITED

AEO T2 CERTIFIED ENTITIES S.No. NAME OF APPLICANT IEC NO. 1 IBM INDIA PRIVATE LIMITED 0797006486 2 MAGSONS EXPORTS 0588055743 3 SHAHI EXPORTS PRIVATE LIMITED 0588085481 4 NIPPON PAINT INDIA PRIVATE LIMITED 0505090619 5 DANFOSS INDIA PRIVATE LIMITED 0598045848 6 ANUPAM COLOURS PRIVATE LIMITED 0301012610 7 BOSCH AUTOMOTIVE ELECTRONICS INDIA PRIVATE LIMITED 0708022308 8 BOSCH LIMITED 0788000314 9 KUNDAN CARE PRODUCTS LIMTED 0504074008 10 SCHNEIDER ELECTRIC INDIA PRIVATE LIMITED 0595007317 11 ORDNANCE FACTORY BOARD MUMBAI OFFICE MINISTRY OF DEFENCE 0307084434 12 JABIL CIRCUIT INDIA PRIVATE LIMITED 0302051139 13 KASTURI AND SONS LIMITED 0488007542 14 POPPYS KNITWEAR PRIVATE LIMITED 0488013011 15 ASTRA MICROWAVE PRODUCTS LIMITED 0991002300 16 CATERPILLAR INDIA PRIVATE LIMITED 0400023067 17 GUJARAT POLYFILMS PRIVATE LIMITED 5204009248 18 LUK INDIA PRIVATE LIMITED 0496025341 19 BHARAT ELECTRONICS LIMITED 0788001027 20 HANON AUTOMOTIVE SYSTEMS PRIVATE LIMITED 0497005964 21 HYUNDAI ENGINEERING PLASTICS INDIA PRIVATE LIMITED 0407004815 22 APPLE INDIA PRIVATE LIMITED 0796001839 23 KONICA MINOLTA BUSINESS SOLUTION (INDIA) PRIVATE LIMITED 0510048650 24 SAINT GOBAIN INDIA PRIVATE LIMITED 0498029204 25 LUPIN LIMITED 0391156853 26 ATUL LIMITED 0388028921 27 H&M HENNES & MAURITZ RETAIL PRIVATE LIMITED 0514006668 28 ROBERT BOSCH ENGINEERING AND BUSINESS SOLUTIONS PRIVATE LIMITED 0797014195 29 EPSON INDIA PRIVATE LIMITED 0700009884 30 GRAVITA INDIA LIMITED 1394007311 31 ORIENT CRAFT LIMITED 0588045055 32 RAJ PETRO SPECIALITIES PRIVATE LIMITED 0301069123 -

20203316422Imfor 2000Crs 20000Ncds Vedanta

economic/commercial risk of investing in the Debentures. Potential investors should conduct their own investigation, due diligence and analysis before applying for the Debentures. Nothing in this Private Placement Offer Letter should be construed as advice or recommendation by the Issuer to subscribers to the Debentures. Potential investors should also consult their own advisors on the implications of application, allotment, sale, holding, ownership and redemption of these Debentures and matters incidental thereto. The Issuer confirms that, as of the date hereof, this Private Placement Offer Letter (including the documents incorporated by reference herein, if any) contains all information that is material in the context of the Issue of the Debentures, is accurate in all material respects and does not contain any untrue statement of a material fact. It has not omitted any material fact necessary to make and the statements made herein are not misleading in the light of the circumstances under which they are made. No person has been authorized to give any information or to make any representation not contained or incorporated by reference in this Private Placement Offer Letter or in any material made available by the Issuer to any potential investor pursuant hereto and, if given or made, such information or representation must not be relied upon as having been authorized by the Issuer. The Issuer reserves the right to withdraw the private placement of the Debentures Issue prior to the issue closing date(s) in the event of any unforeseen development adversely affecting the economic and regulatory environment or any other force majeure condition including any change in the applicable laws. -

Vanguard FTSE International Index Funds Annual

Annual Report | October 31, 2020 Vanguard FTSE International Index Funds Vanguard FTSE All-World ex-US Index Fund Vanguard FTSE All-World ex-US Small-Cap Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. -

Fundamentals and Estimations of Vedanta Buyout of Cairn India

Munich Personal RePEc Archive International Diversification through Acquisition: Fundamentals and Estimations of Vedanta buyout of Cairn India Reddy, Kotapati Srinivasa 2010 Online at https://mpra.ub.uni-muenchen.de/74304/ MPRA Paper No. 74304, posted 06 Oct 2016 17:43 UTC Page 1 of 43 International Diversification through Acquisition: Fundamentals and Estimations of Vedanta buyout of Cairn India Kotapati Srinivasa Reddy First draft July – October 2010 Under the kind guidance of V.K. Nangia Professor& Head, Department of Management Studies Rajat Agrawal Assistant Professor, Department of Management Studies Indian Institute of Technology (IIT) Roorkee, Roorkee - 247667 Uttarakhand. (India). Page 2 of 43 International Diversification through Acquisition: Fundamentals and Estimations of Vedanta buyout of Cairn India Abstract Corporate valuations, financial strength in cash flows and opening up of debt facility favour more overseas acquisitions. Historically, corporate restructuring is a strategic, mechanized and chemical formula for achieving external growth to become a globalized diverse company. The phenomenon of ‘diversification’ is not new, where it was born in the timeline of the Kings. Markets are becoming highly connective, accessible, communicative and are reaching maturity at a very high phase. Acquisition is a choice to enhance the emerging and diversified markets. This case- based research study presents a case discussion, case analysis and opinion based inference on Vedanta – Cairn India cross-border acquisition deal in Indian oil and exploration industry. We also suggest a new forecasting model to estimate future free cash flows and firm valuation in the upcoming research field of corporate finance. The study exclusively shows reaction of stocks against acquisition announcement and compares with market performance. -

We Are Vedanta

We are Vedanta Vedanta Limited Annual Report 2014-15 Our assets Vedanta Limited (formerly Oil & Gas • Cairn India is one of India’s Sesa Sterlite Ltd. / Sesa Goa largest private sector oil and gas companies • Interest in seven blocks in Ltd.) is a global diversified India, and one each in Sri Lanka and South Africa • Contributes ~27% of India’s natural resources company domestic crude oil production with operations across zinc, lead, silver, oil & gas, iron ore, Zinc-Lead-Silver • Zinc operations in India, Namibia, South Africa and copper, aluminium and Ireland. • India’s largest and world’s second largest zinc miner • Operators of the world’s commercial power. largest zinc mine at Rampura Agucha, India • One of the largest silver producers globally with an annual capacity of 16 moz Iron Ore • Operations in India and Liberia • Goa iron ore exported and Karnataka iron ore sold domestically • Large iron ore deposit in Liberia Copper • Smelting and mining operations across India and Australia • Largest custom copper smelter and copper rod producer in India Aluminium • The largest aluminium producer in India with a capacity of 2.3 mtpa • Strategically located large- scale assets with integrated power from captive power plants in Indian states of Chhattisgarh and Odisha Power The name change from Sesa Sterlite Limited to Vedanta Limited positions us • 3.2 GW of commercial power as a united and aligned identity, strengthening the linkage between our generation capacity global businesses and communities. • Largest supercritical unit in India operational at Talwandi The refreshed logo signifies Vedanta’s approach to the triple bottom line that Sabo power plant • One of the largest producers focuses on People, Planet and Prosperity.