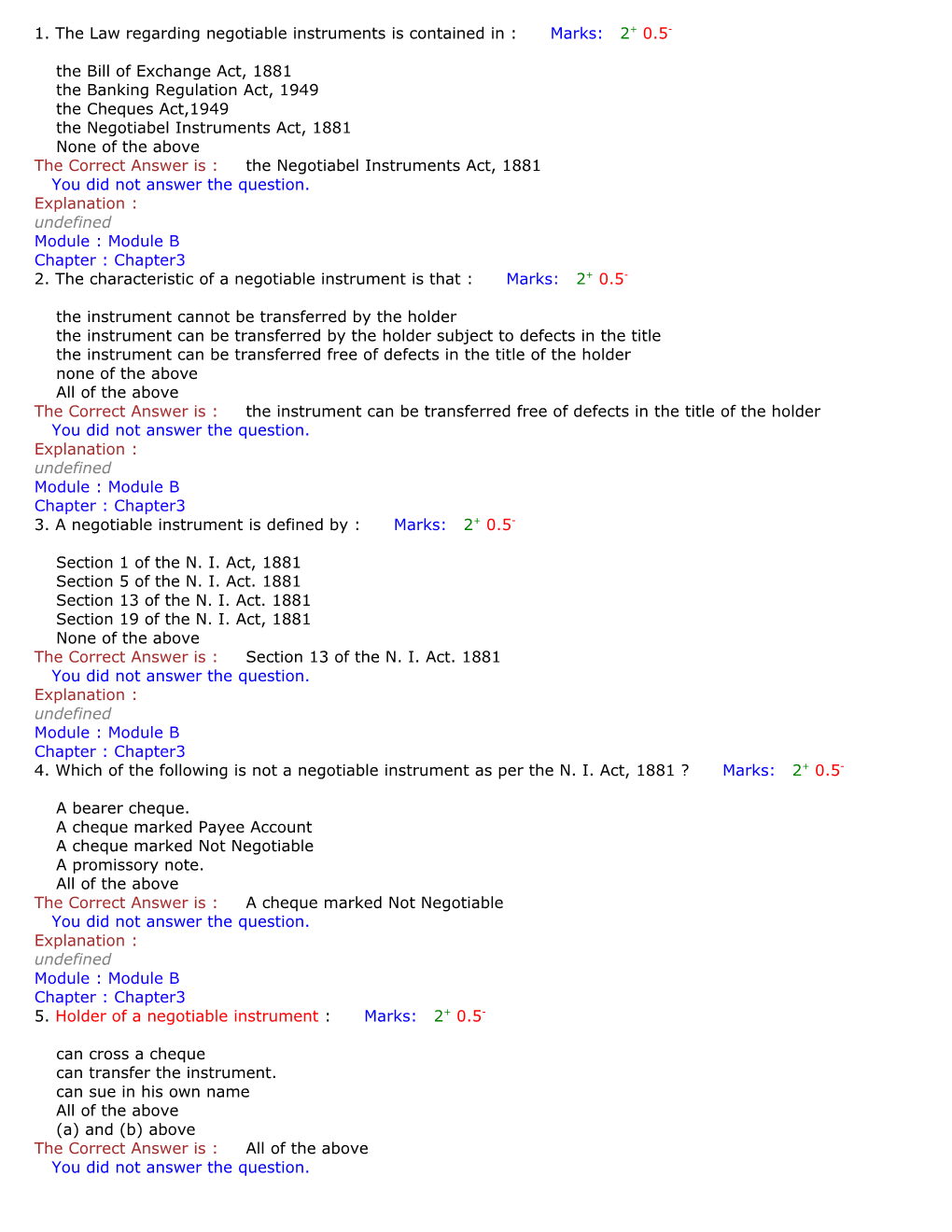

1. The Law regarding negotiable instruments is contained in : Marks: 2+ 0.5-

the Bill of Exchange Act, 1881 the Banking Regulation Act, 1949 the Cheques Act,1949 the Negotiabel Instruments Act, 1881 None of the above The Correct Answer is : the Negotiabel Instruments Act, 1881 You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 2. The characteristic of a negotiable instrument is that : Marks: 2+ 0.5-

the instrument cannot be transferred by the holder the instrument can be transferred by the holder subject to defects in the title the instrument can be transferred free of defects in the title of the holder none of the above All of the above The Correct Answer is : the instrument can be transferred free of defects in the title of the holder You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 3. A negotiable instrument is defined by : Marks: 2+ 0.5-

Section 1 of the N. I. Act, 1881 Section 5 of the N. I. Act. 1881 Section 13 of the N. I. Act. 1881 Section 19 of the N. I. Act, 1881 None of the above The Correct Answer is : Section 13 of the N. I. Act. 1881 You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 4. Which of the following is not a negotiable instrument as per the N. I. Act, 1881 ? Marks: 2+ 0.5-

A bearer cheque. A cheque marked Payee Account A cheque marked Not Negotiable A promissory note. All of the above The Correct Answer is : A cheque marked Not Negotiable You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 5. Holder of a negotiable instrument : Marks: 2+ 0.5-

can cross a cheque can transfer the instrument. can sue in his own name All of the above (a) and (b) above The Correct Answer is : All of the above You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 6. Which of the following statements in true ? Marks: 2+ 0.5-

Holder in due course can sue in his own name. Holder in due course can acquire a better title than that of the tansferer. Holder in due course can negotiable the instrument. All of the above None of the above The Correct Answer is : All of the above You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 7. A minor is not competent to : Marks: 2+ 0.5-

draw a negotiable instrument endorse a negotiable instrument be a drawee of a negotiable instrument be a payee of a negotiable instrument None of the above The Correct Answer is : be a drawee of a negotiable instrument You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 8. When a cheque has been obtained by way of gift the person becomes : Marks: 2+ 0.5-

a holder. a holder for value. a holder in due course. None of these (a) and (b) The Correct Answer is : a holder. You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 9. No protection is available to the holder in due course of a cheque on account of : Marks: 2+ 0.5-

forged endorsement irregularity of endorsement defect in the title of the previous holder All of the above None of the above The Correct Answer is : forged endorsement You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 10. Issue of promissory note payable to bearer is prohibited under: Marks: 2+ 0.5-

Section 31 of the N. I. Act, 1881 Section 31 of the R.B.I. Act, 1934 Section 31 of the B.R. Act, 1949 Section 31 of the Bills of Exchange Act, 1956 None of the above The Correct Answer is : Section 31 of the R.B.I. Act, 1934 You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 11. The process of transferring a negotiable instrument to any person making him the holder of the instrument is known as : Marks: 2+ 0.5-

endorsement negotiation crossing None of the above a) and (c) The Correct Answer is : endorsement You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 12. case of dishonour of an instrument endorsed 'Sans Recourse: ' Marks: 2+ 0.5-

endorse is not liable endorser is not liable payee is not liable drawee is not liable. None of the above The Correct Answer is : drawee is not liable. You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 13. An instrument the part payment of which has already been made can be endorsed further : Marks: 2+ 0.5-

for the remaining sum or the entire sum statement is not correct None of these Any of the above The Correct Answer is : None of these

You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 14. Endorsement after maturity of the instrument is : Marks: 2+ 0.5-

valid invalid impossible valid subject to the defects in the title of the endorser None of the above The Correct Answer is : invalid You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 15. A minor is competent to endorse an instrument: Marks: 2+ 0.5-

subject to approval of the guardian without incurring of all liability with the consent of all parties the statement is not true None of the above The Correct Answer is : without incurring of all liability You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 16. A cheque was payable to Mr. Ramesh Mehta or order. Mr. Mehta endorsed it in favour of Mr. Kripal Singh but Mr. Mehta died before it could be delivered to Mr. Kripal Singh. What is the course available to the legal heirs of Mr. Mehta ? Marks: 2+ 0.5-

They cannot complete the negotiation by delivery. They can complete the negotiation by delivery. They can cancel the endorsement and re-endorse it to Mr. Kripal Singh. They can cancel the endorsement and complete the negotiation by mere delivery to Mr. Kripal Singh. None of the above The Correct Answer is : They cannot complete the negotiation by delivery. You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 17. An order instrument endorsed in blank, can be further negotiated by : Marks: 2+ 0.5-

making it an endorsement in full mere delivery endorsement by the last holder endorsement by the last holder and delivery None of the above The Correct Answer is : mere delivery You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 18. When the endorser waives the notice of dishonour, it is called : Marks: 1+ 0.25-

facultative endorsement restrictive endorsement endorsement s recourse conditional endorsement None of the above The Correct Answer is : facultative endorsement You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 19. Which of the following is a Sans Recourse endorsement ? Marks: 2+ 0.5-

Pay to Shri M.L. Gupta without my liability. Pay to Shri M.L. Gupta notice of dishonour waived. Pay to Shri M. L. Gupta for my use. Pay to Shri M. L. Gupta when he visits Mumbai.. None of the above The Correct Answer is : Pay to Shri M.L. Gupta without my liability. You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 20. Which of the following is a restrictive endorsement ? Marks: 1+ 0.25-

Pay to Shri M.L. Gupta only. Pay to Shri M.L. Gupta or order at his risk. Pay to Shri M.L. Gupta when he visits Mumbai. Pay to Shri M. L. Gupta or order notice waived. None of the above The Correct Answer is : Pay to Shri M.L. Gupta only. You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 21. A cheque bearing the following endorsement should not be paid : Marks: 2+ 0.5-

conditional endorsement partial endorsement restrictive endorsement facultative endorsement All of the above The Correct Answer is : partial endorsement You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 22. The endorsement on a cheque is valid for a period of : Marks: 2+ 0.5-

six months from the date endorsement six months from the date cheque six months from the date of delivery None of the above All of the above The Correct Answer is : None of the above You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 23. The effect of crossing a cheque is : Marks: 2+ 0.5-

The payee can obtain payment only through a bank. The payee is compelled to open an account. The payee will have to endorse the cheque to a bank. None of the above All of the above The Correct Answer is : The payee can obtain payment only through a bank. You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 24. When a Bill is re-endorsed to a previous endorser : Marks: 2+ 0.5- he becomes a holder he may sue upon it he may negotiate it further All of these None of these The Correct Answer is : All of these You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 25. A cheque is drawn payable to John or order. It is stolen by Tom. He fores Johns endorsement and receives payment from the bank. Who I liable to pay the amount to John ? Marks: 2+ 0.5-

No body Tom Drawee bank Drawer None of these The Correct Answer is : Tom You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 26. A person acquiring an instrument under a forged endorsement, even through he received it for value and in good faith can never be a : Marks: 2+ 0.5-

holder in due course endorser transferer None of these All of these The Correct Answer is : holder in due course You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 27. X draws a Bill on Y.Y accepts the bill without any consideration. The bill is transferred to Z without consideration. Z transfers it to A for value, A can sue : Marks: 2+ 0.5-

X, Y or Z X only Y only Z only None of these The Correct Answer is : X, Y or Z You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 28. In the case default in presentment, all parties are absolved from the liability except : Marks: 2+ 0.5-

drawee of a cheque acceptor of bill of exchange maker of promissory note All of the above None of the above The Correct Answer is : All of the above You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 29. Under Negotiable Instruments Act, whereby such words are added to a endorsement whereby the endorser waives his right to receive notice to dishonour, it is known as : Marks: 2+ 0.5-

Blank endorsement Endorsement in full Restrictive endorsement None of these (a) and (b) above The Correct Answer is : facultative endorsement You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 30. Ram of Kolkata draws a Bill of exchange on Prakash of Banglore payable at Tokyo. It is : Marks: 2+ 0.5-

Inland Bill Foreign Bill Accommodation Bill All of the above None of the above The Correct Answer is : Foreign Bill You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 31. Under Negotiable Instruments Act, if in Bill no time for payment is mentioned, it will be taken as : Marks: 1+ 0.25-

A Demand Bill Usance Bill Term Bill As liked by the drawer None of these The Correct Answer is : A Demand Bill You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 32. Bill of Exchange, Promissory Notes and Cheques are defined as : Marks: 2+ 0.5-

Negotiable Instruments Trust Receipts Documents of Title to Goods None of these Stamped Instruments The Correct Answer is : Negotiable Instruments You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 33. A cheque is payable to : Marks: 2+ 0.5-

demand 24 hours after presentation a fixed future date happening of certain event None of these The Correct Answer is : demand You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 34. Two parallel transverse lines across the cheque is called : Marks: 2+ 0.5-

Crossing Endorsement Assignment Transfer None of these The Correct Answer is : Crossing You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 35. The crossing in a crossed cheque can be cancelled by : Marks: 2+ 0.5-

Drawer Endorser Payee drawee None of these The Correct Answer is : Drawer You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 36. 'Sans recourse' means : Marks: 2+ 0.5-

Do not talk to me Without liability to me Ask the drawer All of these None of the above The Correct Answer is : Without liability to me You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 37. Mere signature on the reverse of the instrument is called : Marks: 2+ 0.5-

sale instrument null and void instrument blank endorsement conditional endorsement None of the above The Correct Answer is : blank endorsement You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 38. How many types of bills are there ? Marks: 2+ 0.5-

Demand Bills Usance Bills Both of the above None of the above Accommodation Bill The Correct Answer is : Both of the above You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 39. Demand Bill means : Marks: 1+ 0.25-

A Bill, which is expressed to be payable on demand, at sight on presentation. No time for payment is specified None of these Both of these Time for payment is specified. The Correct Answer is : Both of these You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 40. A Bill which is payable after a specified time or on a future date, is called : Marks: 2+ 0.5-

Future Bill Usance Bill Clean Bill Documentary Bill None of these The Correct Answer is : Usance Bill You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 41. When the day on which a bill of exchange or promissory note is payable happens to be a public holiday, the instrument shall be deemed to be due on : Marks: 2+ 0.5-

the next preceding business day the following day the same day by special arrangement None of these All of the above The Correct Answer is : the next preceding business day You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 42. Days of grace, in case of bills of exchange and promissory notes, are allowed, if these are payable : Marks: 2+ 0.5-

on demand on demand at a certain period after date or after sight All of these None of the above The Correct Answer is : at a certain period after date or after sight You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 43. Days of grace are not allowed in the case of : Marks: 2+ 0.5-

cheques bill of exchange and promissory note where no time for payment is specified Both (a) and (b) None of the above Any of (a) and (b) The Correct Answer is : Both (a) and (b) You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 44. In the case of an instrument payable in instalments, days of grace are allowed for : Marks: 2+ 0.5-

each instalment any one of the instalement first instalment last instalment None of these The Correct Answer is : each instalment You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 45. Days of grace are allowed in India, because Marks: 2+ 0.5-

it is provided under the Negotiable Instruments Act, 1881 it is a banking practice it is a custom of traders None of the above (a) and (b) The Correct Answer is : it is provided under the Negotiable Instruments Act, 1881 You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 46. 'Escrow' is a term used to denote : Marks: 2+ 0.5-

negotiability of the instruement an instrument incomplete in respect of date an instrument without consideration conditional delivery of the instrument None of the above The Correct Answer is : conditional delivery of the instrument You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 47. 'Kite flying' means Marks: 2+ 0.5-

a clean bill a bill drawn/accepted without any genuine trade transaction a clean demand bill a clean demand usance bill None of the above The Correct Answer is : a bill drawn/accepted without any genuine trade transaction You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 48. A Bill of exchange drawn on a partnership firm must be accepted by Marks: 2+ 0.5-

all the partners jointly any two partners any partner the managing partner None of the above The Correct Answer is : any partner You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 49. A Bill drawn addressed to two or more drawees should be accepted by : Marks: 2+ 0.5-

any one of the drawees any two of the drawees all the drawees None of these Any of the above The Correct Answer is : all the drawees You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 50. Non-presentment of a Bill to the drawee within a reasonable time : Marks: 2+ 0.5-

does not discharged the drawee of the liability discharged the drawee from his liability has no effect on the drawees liability None of the above (a) and (b) The Correct Answer is : discharged the drawee from his liability You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 51. Presentment for payment to a banker is required to be made : Marks: 2+ 0.5-

during public holidays at the residence o the manager during working hours only after office hours None of the above The Correct Answer is : during working hours only You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 52. Where specific agreement to usage authorizes presentment by post, it should be done by : Marks: 2+ 0.5- Ordinary post Registered post Recorded delivery V.P.P Courier service The Correct Answer is : Registered post You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 53. In the event of the death of the maker or the acceptor : Marks: 2+ 0.5-

the bill is treated as discharged the bill is treated as dishonoured the bill is treated as null and void the bill may be presented to his legal representative None of the above The Correct Answer is : the bill may be presented to his legal representative You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 54. Under Section 131 of the N.I. Act the collecting banker is not protected for the collection of : Marks: 2+ 0.5-

crossed cheques uncrossed cheques order cheques bearer cheques (a) and (c) The Correct Answer is : uncrossed cheques You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 55. Section 131 of the N.I. Act provided statutory protection to a collecting Banker if Marks: 2+ 0.5-

the cheque is crossed the cheque is collected for a customer the cheque is collected in good faith and without negligence All of the above None of the above The Correct Answer is : All of the above You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 56. Which of the following does not constitute Payment in due course ? Marks: 2+ 0.5-

Payment of a post dated cheque. Payment of a crossed cheque across the counter. Payment of a cheque the payment of which has been countermanded. All of the above None of the above The Correct Answer is : All of the above You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 57. A paying banker is provided protection under Section 85(1) of the N.I. Act in respect of : Marks: 1+ 0.25-

forged endorsement forgery of the drawers signature Both of the above None of the above Any of the above The Correct Answer is : forged endorsement You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 58. A cheque crossed as 'payees a/c only' is a direction to : Marks: 2+ 0.5-

the payee not to negotiate the cheque the paying banke to ensure that the proceeds of the cheques are credited to the payees a/c only the collecting banker to ensure that the proceeds of the cheque are collected for the account of the payee only None of the above All of the above The Correct Answer is : the collecting banker to ensure that the proceeds of the cheque are collected for the account of the payee only You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 59. 'Conversion' means : Marks: 2+ 0.5-

an unjustifiable denial of a persons title in relation to his goods collection of a cheque for a customer drawn on another bank converting a crossed cheque into uncrossed one the act of crossing a cheque All of the above The Correct Answer is : an unjustifiable denial of a persons title in relation to his goods You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 60. Which of the following is material alteration ? Marks: 2+ 0.5-

Crossing of a cheque. Conversion of blank endorsement into an endorsement in full. Filling blanks in an inchoate instruement Alteration of the rate of interest. All of the above The Correct Answer is : Alteration of the rate of interest. You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 61. A cheque can be endorsed on : Marks: 2+ 0.5-

a stamped paper intended to be completed as a negotiable instrument face or back of the instrument a piece of paper annexed to the instrument Any one of the above None of the above The Correct Answer is : Any one of the above You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 62. A Bill dated 01.01.2004 is payable thirty one days after date. It falls due on : Marks: 2+ 0.5-

February 04th, 2004 February 01st, 2004 January 01st, 2004 Feb. 03rd, 2004 None of the above The Correct Answer is : February 04th, 2004 You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 63. A Bill dated 05th Nov. 2003 is payable three months after sight. Bill is sighted on 60th November 2003. The bill will fall due on : Marks: 2+ 0.5-

09th February, 2004 08th February, 2004 05th February, 2004 06th February, 2004 None of the above The Correct Answer is : 09th February, 2004 You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3 64. A Bill is payable ten days after marriage of D. D;s marriage takes place on 15th July, 2003. It will fall due on : Marks: 2+ 0.5-

a) 25th July, 2003 b) 28th July, 2003 c) 27th July, 2003 d) None of the above e) 24th July 2003 The Correct Answer is : b) 28th July, 2003 You did not answer the question. Explanation : undefined Module : Module B Chapter : Chapter3