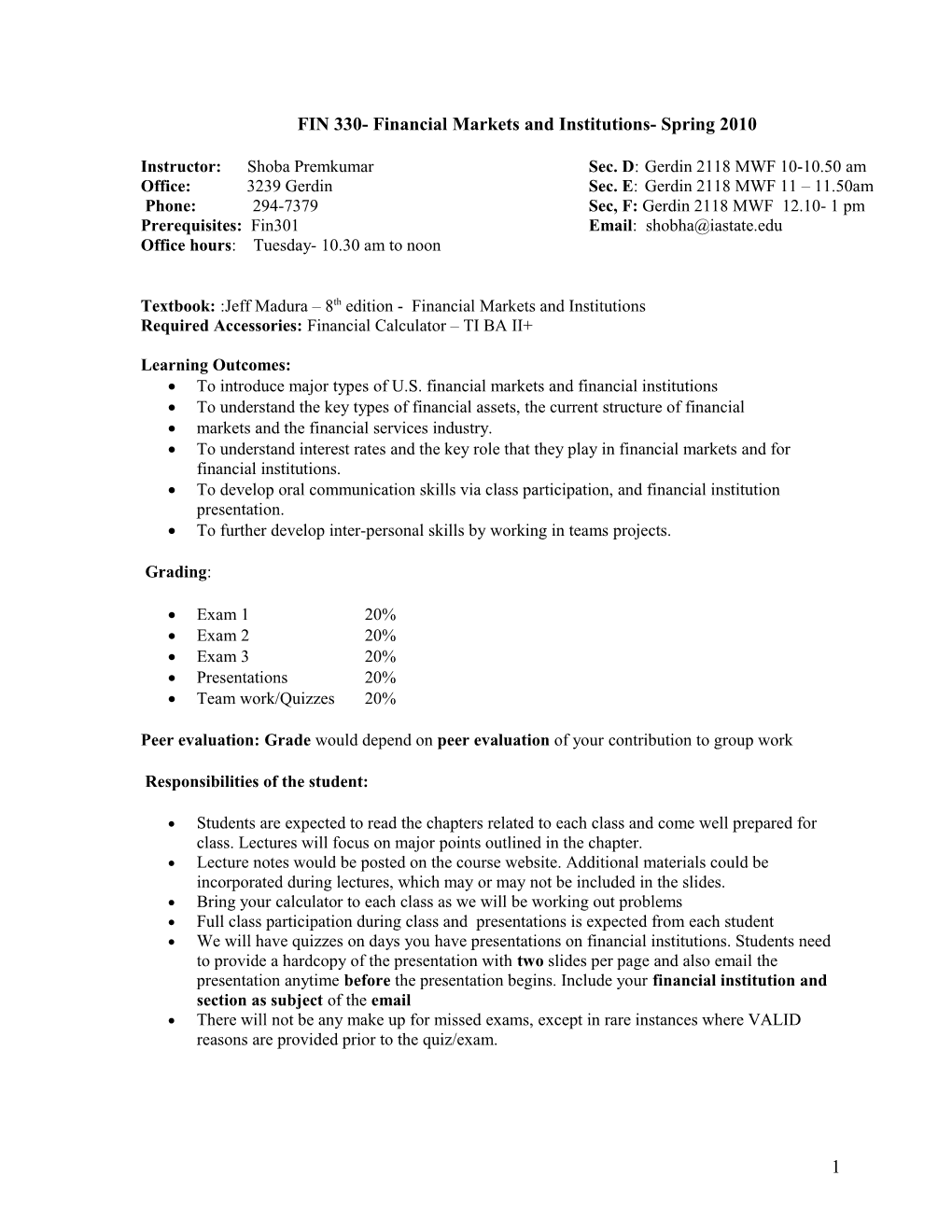

FIN 330- Financial Markets and Institutions- Spring 2010

Instructor: Shoba Premkumar Sec. D: Gerdin 2118 MWF 10-10.50 am Office: 3239 Gerdin Sec. E: Gerdin 2118 MWF 11 – 11.50am Phone: 294-7379 Sec, F: Gerdin 2118 MWF 12.10- 1 pm Prerequisites: Fin301 Email: [email protected] Office hours: Tuesday- 10.30 am to noon

Textbook: :Jeff Madura – 8th edition - Financial Markets and Institutions Required Accessories: Financial Calculator – TI BA II+

Learning Outcomes: To introduce major types of U.S. financial markets and financial institutions To understand the key types of financial assets, the current structure of financial markets and the financial services industry. To understand interest rates and the key role that they play in financial markets and for financial institutions. To develop oral communication skills via class participation, and financial institution presentation. To further develop inter-personal skills by working in teams projects.

Grading:

Exam 1 20% Exam 2 20% Exam 3 20% Presentations 20% Team work/Quizzes 20%

Peer evaluation: Grade would depend on peer evaluation of your contribution to group work

Responsibilities of the student:

Students are expected to read the chapters related to each class and come well prepared for class. Lectures will focus on major points outlined in the chapter. Lecture notes would be posted on the course website. Additional materials could be incorporated during lectures, which may or may not be included in the slides. Bring your calculator to each class as we will be working out problems Full class participation during class and presentations is expected from each student We will have quizzes on days you have presentations on financial institutions. Students need to provide a hardcopy of the presentation with two slides per page and also email the presentation anytime before the presentation begins. Include your financial institution and section as subject of the email There will not be any make up for missed exams, except in rare instances where VALID reasons are provided prior to the quiz/exam.

1 Students with disabilities needing specific accommodations for the class should make this known to the instructor

Tentative Schedule

Date Topic Chapters Presentations Jan Role of Financial Markets 1 11,13,15 and Institutions 18 Holiday 20,22,25 Determination of Interest 2 & 3 rates 27,29, feb 1 Structure of interest rates 3 Money markets 6 Feb 3 Presentation Citi Group 5 Presentation Wells Fargo 8 Presentation Ameritrade 10 Exam Review

12 Exam 1 15,17,19 Bonds 7 &8 22,24,26 Mortgages 9 March 1 Presentation Freddie Mac 3 Presentation AIG 5 Presentation Principal Financial Group 8 Presentation JP Morgan 10 Exam Review 12 Exam 2 15- 19 Spring Break 22,24,26 Stock Market 10 29,31 April 2 Options Market 14 April, 5 Finance Companies 22 7,9,12,14 Mutual Funds 23 16 Presentation Black Rock 19 Presentation American Express 21 Presentation Goldman Sachs 23 TBA 26,28 Exam Review Finals TBA

2 Finance 330 – Guidelines for Presentations

Each team will research one financial institution throughout the semester and will have one presentation during the last week. The presentation should take approximately 25 minutes. All team members must participate in the presentation.

Financial Institutions

The following financial institutions are assigned to teams:

Team 1 – Citi Group Team 2 – Wells Fargo Team 3- Ameritrade Team 4 – Freddie Mac Team 5 – AIG Team 6- Principal Financial Group Team 7- JP Morgan Team 8 - Black Rock Team 9 – American Express Team 10- Goldman Sachs

Teams need to track the stock performance of financial institution every day and the presentation should include information on all recent company/industry specific events that might impact the financial institution. The presentation should address the following areas:

Profile and Business Mix : Company background Information on top management In what businesses does the firm compete? Which business segments are its largest? Which business segments are growing the fastest? Is the firm a market leader in any of its business segments? What geographic areas does the firm principally serve?

Financial Performance:

How large is the firm in terms of market capitalization and sales revenue? What was its net income and net operating income for the most recent year? What was its ROA? ROE? EPS? DPS? PM? How does its financial performance compare to its industry or to representative competitors? What about its debt ratio? Is there any information on company specific risk or market risk as measured by beta? Does it have adequate cash on hand?

3 Market Performance and Ownership:

What is its current market capitalization? What have been its stock price trends over the past 12 months in comparison to the S&P 500? YTD? Over the past five years (or its life as a public company, if shorter)? What is the current P/E ratio for the common stock? How much is owned by institutions? Insiders? What are analysts forecasting for the firm in the future? Specifically what would be the earnings and growth estimates for the next few years

Competitor analysis

Who are the major competitors? How do they compare with competition in terms of market capitalization, revenues, net income, PE, and revenue growth? Does it have any sustainable competitive edge?

Recent developments:

Has this company made any recent public announcement that would significantly enhance stock holder value? How has this institution been affected by the sub prime mortgage lending crisis? Is there any recent acquisition? Has it expanded its operations recently or introduced any new product/services?

Grading

A one page summary and a list of references must be provided to the instructor at the time of the presentation. The presentation should be well organized and include a good introduction, effective analysis and interpretation of financial information, good transitions, recent developments and a good summarizing conclusion. The grading scale would be based on the following criteria:

Introduction Analysis and interpretation Accuracy Completeness Quality Communication skills Conclusion

Information Sources Visit Yahoo finance which is a comprehensive finance website that contains all the information needed for successfully completing your research and presentation. For additional information visit smartmoney.com, Forbes, and business week online. The web page of the financial institution would also contain a wealth of information.

4