The Development of Corporate Governance in Toulouse: 1372-1946

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nationalism in the French Revolution of 1789

The University of Maine DigitalCommons@UMaine Honors College 5-2014 Nationalism in the French Revolution of 1789 Kiley Bickford University of Maine - Main Follow this and additional works at: https://digitalcommons.library.umaine.edu/honors Part of the Cultural History Commons Recommended Citation Bickford, Kiley, "Nationalism in the French Revolution of 1789" (2014). Honors College. 147. https://digitalcommons.library.umaine.edu/honors/147 This Honors Thesis is brought to you for free and open access by DigitalCommons@UMaine. It has been accepted for inclusion in Honors College by an authorized administrator of DigitalCommons@UMaine. For more information, please contact [email protected]. NATIONALISM IN THE FRENCH REVOLUTION OF 1789 by Kiley Bickford A Thesis Submitted in Partial Fulfillment of the Requirement for a Degree with Honors (History) The Honors College University of Maine May 2014 Advisory Committee: Richard Blanke, Professor of History Alexander Grab, Adelaide & Alan Bird Professor of History Angela Haas, Visiting Assistant Professor of History Raymond Pelletier, Associate Professor of French, Emeritus Chris Mares, Director of the Intensive English Institute, Honors College Copyright 2014 by Kiley Bickford All rights reserved. Abstract The French Revolution of 1789 was instrumental in the emergence and growth of modern nationalism, the idea that a state should represent, and serve the interests of, a people, or "nation," that shares a common culture and history and feels as one. But national ideas, often with their source in the otherwise cosmopolitan world of the Enlightenment, were also an important cause of the Revolution itself. The rhetoric and documents of the Revolution demonstrate the importance of national ideas. -

Arbeidsmarkedskriminalitet I Norge – Situasjonsbeskrivelse 2014

Situasjonsbeskrivelse 2014 ARBEIDSMARKEDSKRIMINALITET I NORGE Rapporten er utarbeidet av Arbeidstilsynet, Kriminalomsorgen, Kripos, Mattilsynet, NAV, Politiets utlendingsenhet, Skatteetaten, Tollvesenet, Utlendingsdirektoratet og Økokrim Grafisk utforming og trykk ved Hustrykkeriet Kripos, 2014 FORORD Arbeidsmarkedskriminalitet har vokst frem som en utfordring det av flere årsaker er viktig for det norske samfunnet å forebygge og bekjempe. Den undergraver blant annet sentrale velferds- ordninger og bidrar til å utkonkurrere lovlydige virksomheter. Konsekvensene på lang sikt kan i verste fall være at vi i Norge vil mangle lovlydige virksomheter til å utføre større og mindre opp- drag for private og det offentlige. Dette kan skape en situasjon der hele bransjer, eksempelvis innen bygg- og anleggsbransjen, kontrolleres av kriminelle aktører. I brev fra Politidirektoratet til Kripos den 27. mars 2014 fikk Kripos i oppdrag å lede utarbeidelsen av en situasjonsbeskrivelse av arbeidsmarkedskriminalitet i Norge. Formålet med arbeidet var følgende: 1. definere arbeidsmarkedskriminalitet 2. beskrive utviklingen i samfunnet som påvirker arbeidsmarkedskriminalitet 3. beskrive dagens utfordringer og gi en vurdering av fremtidig utvikling innenfor arbeidsmarkedskriminalitet 4. synliggjøre kunnskapshull innenfor arbeidsmarkedskriminalitet Arbeidsgruppen som har utarbeidet denne rapporten, ble nedsatt etter et møte i Samordnings- organet der flere av kontrolletatene deltok. Arbeidet har vært preget av at kriminalitetsbildet er svært sammensatt og oppfattes -

Organisering Av Norske Havner Fra Kommunal Etat Til Selskap

rapport av adv. Vibeke Resch-Knudsen Organisering av norske havner Fra kommunal etat til selskap 4. april 2013 Innhold 1. ORGANISASJONSMULIGHETER FOR KOMMUNALE HAVNER 4 1.1. Utpekte havner 4 1.2. Stamnetthavner 5 2. KoMMUNERS MYNDIGHETSUTØVELSE ETTER HFL 8 3. ORGANISERING 9 3.1. Kommunal etat 11 3.2. Kommunale foretak (KF) 12 3.3. Interkommunale samarbeidsløsninger 12 3.3.1. Interkommunale samarbeid etter kml. § 27 13 3.3.2. Vertskommunesamarbeid med nemnd 14 3.4. Havnen organisert i et selskap 14 3.4.1. Interkommunale selskaper etter kml. § 27 15 3.4.2. Interkommunale selskaper (IKS) 16 3.4.3. Aksjeselskaper 17 3.4.4. Samvirkeforetak 19 3.4.5. Allmennaksjeselskap 19 3.5. Vurdering av de ulike organisasjonsformene (tabell) 20 4. STYRING AV HAVNESELSKAP 24 4.1. Operative eierorgan i selskaper 24 4.2. Styrets sammensetning og rolle 24 4.3. Selskapets formål 25 4.4. Konsernhavnen 26 5. SKATTEPLIKT 27 6. UTBYTTE AV HAVNESELSKAP 29 7. GARANTIER OG OFFENTLIG STØTTE 31 8. MVA 33 9. OFFENTLEGLOVA OG FORVALTNINGSLOVEN 33 10. ETABLERING AV SELSKAP/OMDANNING 35 10.1. Regnskapsmessige forhold 35 10.2. Skatte og avgiftsmessige forhold ved omdanning 35 10.3. Dokumentavgift 36 10.4. Ansattes rettigheter og plikter 36 11. OPPSUMMERING 37 Fotnoter finner du i margene under denne lilla streken. 1. ORGANISASJONSMULIGHETER betegnelse for lokale havner, fiskeri- FOR KOMMUNALE HAVNER havner, fritidsbåthavner eller lignende. I dag består havnestrukturen i Norge av Begrepet havn er definert i havne- og 5 utpekte havner og 31 stamnetthavner. farvannsloven (HFL) § 4: 1.1. Utpekte havner «Med havn menes i denne loven områder som er Transportpolitikken legger opp til at til bruk for fartøy; transport bør flyttes over fra vei til sjø så langt det lar seg gjøre, gjennom å • som skal laste eller losse gods eller trans- portere passasjerer som ledd i sjøtransport legge opp til at sjøtransport skal være en eller annen næringsvirksomhet, foretrukket transportform for transport av gods over lange avstander. -

The Magisterium of the Faculty of Theology of Paris in the Seventeenth Century

Theological Studies 53 (1992) THE MAGISTERIUM OF THE FACULTY OF THEOLOGY OF PARIS IN THE SEVENTEENTH CENTURY JACQUES M. GRES-GAYER Catholic University of America S THEOLOGIANS know well, the term "magisterium" denotes the ex A ercise of teaching authority in the Catholic Church.1 The transfer of this teaching authority from those who had acquired knowledge to those who received power2 was a long, gradual, and complicated pro cess, the history of which has only partially been written. Some sig nificant elements of this history have been overlooked, impairing a full appreciation of one of the most significant semantic shifts in Catholic ecclesiology. One might well ascribe this mutation to the impetus of the Triden tine renewal and the "second Roman centralization" it fostered.3 It would be simplistic, however, to assume that this desire by the hier archy to control better the exposition of doctrine4 was never chal lenged. There were serious resistances that reveal the complexity of the issue, as the case of the Faculty of Theology of Paris during the seventeenth century abundantly shows. 1 F. A. Sullivan, Magisterium (New York: Paulist, 1983) 181-83. 2 Y. Congar, 'Tour une histoire sémantique du terme Magisterium/ Revue des Sci ences philosophiques et théologiques 60 (1976) 85-98; "Bref historique des formes du 'Magistère' et de ses relations avec les docteurs," RSPhTh 60 (1976) 99-112 (also in Droit ancien et structures ecclésiales [London: Variorum Reprints, 1982]; English trans, in Readings in Moral Theology 3: The Magisterium and Morality [New York: Paulist, 1982] 314-31). In Magisterium and Theologians: Historical Perspectives (Chicago Stud ies 17 [1978]), see the remarks of Y. -

Eierskapsmelding 2014

EIERSKAP SM ELDING Haugfoss kraftstasjon ved Blaafarveværket. Eier er Modum Kraftprod 2014 Inntaksdammen i Ramfoss, Ramfoss Kraftlag Eierskapsmelding, vedtatt i Kommunestyret 20.6.11, sak 51/11. Oppdatert august 2012 (K-sak 70/12), 1 oppdatert august 2013 (K-sak 66/13), sist oppdatert august 2014. Innhold Del I Eierstyring ........................................................................................................................ 4 1.1 Innledning ......................................................................................................................... 4 1.1.1 Bakgrunn for eierskapsmeldingen ................................................................................. 4 1.1.2 Oppbygning av eierskapsmeldingen .............................................................................. 4 1.2 Å eie er å ville, motiver for selskapsdannelse................................................................... 4 1.2.1 Finansielt motivert ......................................................................................................... 5 1.2.2 Politisk motivert ............................................................................................................. 5 1.2.3 Effektivisering................................................................................................................ 5 1.2.4 Samfunnsøkonomisk motivert ....................................................................................... 5 1.2.5 Regionalpolitisk motivert.............................................................................................. -

Les Boiseries De La Salle Du Conseil D'état

Les boiseries de la salle du Conseil d'État Autor(en): Roth-Lochner, Barbara Objekttyp: Article Zeitschrift: Genava : revue d'histoire de l'art et d'archéologie Band (Jahr): 28 (1980) PDF erstellt am: 11.10.2021 Persistenter Link: http://doi.org/10.5169/seals-728521 Nutzungsbedingungen Die ETH-Bibliothek ist Anbieterin der digitalisierten Zeitschriften. Sie besitzt keine Urheberrechte an den Inhalten der Zeitschriften. Die Rechte liegen in der Regel bei den Herausgebern. Die auf der Plattform e-periodica veröffentlichten Dokumente stehen für nicht-kommerzielle Zwecke in Lehre und Forschung sowie für die private Nutzung frei zur Verfügung. Einzelne Dateien oder Ausdrucke aus diesem Angebot können zusammen mit diesen Nutzungsbedingungen und den korrekten Herkunftsbezeichnungen weitergegeben werden. Das Veröffentlichen von Bildern in Print- und Online-Publikationen ist nur mit vorheriger Genehmigung der Rechteinhaber erlaubt. Die systematische Speicherung von Teilen des elektronischen Angebots auf anderen Servern bedarf ebenfalls des schriftlichen Einverständnisses der Rechteinhaber. Haftungsausschluss Alle Angaben erfolgen ohne Gewähr für Vollständigkeit oder Richtigkeit. Es wird keine Haftung übernommen für Schäden durch die Verwendung von Informationen aus diesem Online-Angebot oder durch das Fehlen von Informationen. Dies gilt auch für Inhalte Dritter, die über dieses Angebot zugänglich sind. Ein Dienst der ETH-Bibliothek ETH Zürich, Rämistrasse 101, 8092 Zürich, Schweiz, www.library.ethz.ch http://www.e-periodica.ch Les boiseries de la salle du Conseil d'Etat par Barbara Roth-Lochner Lorsque les travaux de rénovation de la la salle du Conseil. Ce texte m'a incité à entre- salle du Conseil d'Etat à la Tour Baudet sont prendre une recherche, dont je livre ici les entrepris en 1901, les ouvriers ont la surprise résultats. -

Stéreoplexie STEREOTOMIES NUMERIQUES Entre Tradition Et

Séminaire doctoral 2018-2019 Domaine : Matérialité Pensée et Culture constructives STEREOTOMIES NUMERIQUES entre tradition et innovation Organisation, conception : Antonella Mastrorilli Professeure Sciences et Techniques pour l’Architecture – HDR- 15 mai 2019 Responsable du domaine Matérialité - LACTH Chercheur invité : Maurizio Brocato 14h30-17h30 Professeur Sciences et Techniques pour l’Architecture – HDR - salle Jean Challet Directeur du Laboratoire Géométrie, Structure, Architecture (1er étage) (GSA) – ENSA Paris Malaquais Autre chercheur : Mohammad Mansouri Architecte, Maître de conférence associé ENSAP Lille, chercheur au GSA Doctorant LACTH : Emmanuel Breton (LACTH-EDSHS Lille3) Architecte, Maître de conférence associé à l’ENSA de Marseille Discutant : Gilles Maury, Maître de conférence ENSAP Lille, chercheur au LACTH, domaine Histoire Apparemment désuète, oubliée, la stéréotomie, n’est plus enseignée dans les écoles d’architecture ni d’ingénieurs, pourtant elle offre des outils et des méthodes intéressants pour la recherche autour de l’architecture contemporaine. Aujourd’hui, des nouvelles déclinaisons morphologiques, rendues possibles par le tournant numérique permettent de revoir le registre d’écriture des matériaux employés. Les interventions proposées dans cette séance visent surtout à développer certains aspects de ces questions en interrogeant l’expérimentation constructive et le prototypage numérique. Mots clés : Construction, expérimentation constructive, géométrie constructive, modélisation, morphogenèse, morphologie -

L' Abbaye De Maizières

Domaine de L’ ABBAYE DE MAIZIÈRES Origin and history e 666 YEARS OF HISTORY Founded in 1125, Maizières Abbey had a decisive spiritual and economic part to play in the region of Beaune and Chalon for nearly seven centuries, from 1125 to 1791. aizières Abbey followed the footsteps of La Ferté Abbey (1113), heir of Citeaux Abbey (1098), founding abbey of the Cistercian order. Based on the virtues of poverty, soli- tude and labor, the Cistercian movement experienced a M significant expansion throughout the Middle Ages thanks to saint Bernard de Clairvaux’s determining impulsion with the construction of hundreds of monasteries all across Europe. Many lords were seduced by this spiritual renewal and these values. In the hope for salvation, they offered the monks part of their lands to found new monasteries. It is this certainty that led lord Flouques de Réon to beg Barthélémy, abbot of La Ferté Abbey, to establish a Cistercian abbey on his lands in honor of God, Saint Mary, and all the Saints. Although originally reluctant to the idea, Barthélémy finally accepted the donation that made possible the foundation of this new abbey on the lands of “Scotéria” now called “Gouttières” in Saint- Loup-Géanges in 1125. The monks moved a bit from this first location a few years later and they built the final monastery on the ruins of an old Roman house “Maceria” that became Maizières. e2 e3 The construction of the monastery spread over a century and ended with the blessing of the church in 1236. This was followed by a period commonly referred to as the Golden Age of the Cistercian order. -

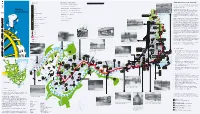

Walking Downstream

legende practical information 0 120 240 360 480 600 720 m technology and nature Scale 1:12 000 • "Plan piétons" Internet site www.ville-ge.ch/plan-pietons This newest course is a mix of technology and nature. Dams, Games bridges, pumping stations, baths, factories, tanks… water and • Commune of Vernier Internet site www.vernier.ch more water at man’s service. Commune Telephone de Vernier • Municipal information point 1, pont de la Machine, Tel. 311 99 70 We will go from the Pearl of the Lake to the Chèvres Walking Restroom • Mouettes Genevoises passenger ferry (reservation) Tel. 732 29 44 footbridge, strolling the length of the quay and following the anne Beverages banks of the Rhone for 15 miles along this “impetuous river” • Lake Geneva General Shipping Company (CGN) infoline: 0848 811 848 Mouettes Downstream (Celtic meaning of Rhone), which winds through the Genevoises Public Transportation (TPG) Jardin Botanique rte de Laus Baths of Pâquis around 1932 (SU) communes of Geneva and Vernier. For the return, why not • Public transportation (TPG) Tel. 308 34 34 7 Train station board one of the boats along the Rhone and take in its gentle • Taxi Tel. 33 141 33 18 stream? Lake Geneva General Shipping Co. (CGN) • Cornavin train station Tel. 157 22 22 Water is omnipresent along this walk. The very name Geneva Mouettes Genevoises passenger ferry comes from the Celtic words “gen,” mouth, and “ava,” water. • Weather conditions Tel. 162 av. de la Paix OMC OMM Car park The name Vernier also evokes water, deriving from “verne,” 4 meaning the alder, a tree particularly partial to river banks and r Sport, stadium, pool, paddleboats, tennis . -

European Added Value Assessment on a Directive on the Cross-Border Transfer of Company Seats (14Th Company Law Directive)

European Added Value Assessment on a Directive on the cross-border transfer of company seats (14th company law Directive) ANNEX I Legal effects of the requested legislative instrument Research paper by Jeantet Associés Aarpi Abstract Case-law of the ECJ allowed for company mobility but did not provide the necessary clarification with regard to the procedures for transferring the company’s registered office or head office from one Member State to another with a change on the applicable law. Certain aspects, such as the protection of stakeholders, may be affected, which could confirm the need for minimum standard rules. A legislative initiative should ensure that the transfer should not affect the rights of stakeholders. It should also be tax neutral and must avoid the misuse of post-box offices and shell companies. AUTHOR This study has been written by Ms Catherine Cathiard ([email protected]), Member of the Paris Bar, under the management of Jeantet Associés AARPI, Law Firm, at the request of the European Added Value Unit, of the Directorate for Impact Assessment and European Added Value, within the Directorate General for Internal Policies (DG IPOL) of the General Secretariat of the European Parliament. IN COLLABORATION WITH: - Mr Didier Poracchia, Professor at the University of Aix-Marseille, Director of the Institute of Business Law ([email protected]) - Mr Philippe Portier, Member of the Paris and New York Bars ([email protected]) - Mr Francis Collin, Member of the Paris Bar ([email protected]) - Mr Denis Andres, Member -

State Owned Enterprises and the Principle of Competitive Neutrality 2009

State Owned Enterprises and the Principle of Competitive Neutrality 2009 The OECD Competition Committee debated the application of competition rules to state owned enterprises and the principle of competitive neutrality in October 2009. This document includes an executive summary, a background note and an issues paper by Mr. Antonio Capobianco for the OECD and country contributions from Brazil, Canada, Chile, China, Czech Republic, European Commission, Finland, France, Germany, Greece, India, Indonesia, Korea, Lithuania, Netherlands, Norway, Poland, Romania, Russia, Spain, Sweden, Switzerland, Chinese Taipei, Turkey, United Kingdom, United States and BIAC, as well as two aides memoires for the discussions. Due to their privileged position SOEs may negatively affect competition and it is therefore important to ensure that, to the greatest extent possible consistent with their public service responsibilities, they are subject to similar competition disciplines as private enterprises. Although enforcing competition rules against SOEs presents enforcers with particular challenges, competition rules should, and generally do, apply to both private and state-owned enterprises, subject to very limited exceptions. Competition law alone is not sufficient in ensuring a level playing field for SOEs and private enterprises, which is why policies aimed at achieving competitive neutrality between the two play an essential role. Competitive neutrality can be understood as a regulatory framework (i) within which public and private enterprises face the same set of rules and (ii) where no contact with the state brings competitive advantage to any market participant. Presence of competitive neutrality policies is of particular importance in recently liberalised sectors, where they play a crucial role in leveling the playing field between former state monopoly incumbents and private entrants. -

Rapporten «Kriminelle I Arbeidslivet

Kriminelle i arbeidslivet Nasjonalt tverretatlig analyse- og etterretningssenter NTAES Side 1/21 Publikasjonens tittel: Kriminelle i arbeidslivet Utgitt: november 2018 Utgitt av: Nasjonalt tverretatlig analyse- og etterretningssenter (NTAES) Kontakt: [email protected] Postadresse: c/o ØKOKRIM, Postboks 8193 Dep, N-0034 Oslo Besøksadresse: C.J. Hambros plass 2, 0164 Oslo Illustrasjoner: Shutterstock Grafisk design: ØKOKRIM NTAES Side 2/21 Sammendrag Mer enn 28 000 personer har de siste ti år blitt anmeldt for mistanke om lovbrudd på forvaltningsområdene til Skatteetaten, NAV, Arbeidstilsynet og Tolletaten. Situasjonsbeskrivelse 20171 ga en kvalitativ beskrivelse av metoder i arbeidslivskriminaliteten. Denne rapporten tar utgangspunkt i funnene om at virksomheter tilstreber å fremstå med en lovlydig fasade i myndighetenes registre, og aktivitet flyttes til nye virksomheter som en respons på myndighetenes krav. Kriminelle i arbeidslivet gir noen sentrale funn som kan styrke arbeidet mot kriminelle aktører som påtreffes gjentatte ganger i kontrollarbeidet. Personer som har blitt anmeldt av kontrolletatene flere ganger og har, eller har hatt, ledende rolle i virksomhet, er ofte også siktet eller dømt i profittmotivert kriminalitet. En relativt liten gruppe personer med ledende roller i arbeidslivet kan knyttes til et stort omfang straffbare forhold. Konkurshyppighet i virksomheter ledet av personer registrert med flere straffbare forhold er meget høy. Blant personer med konkurshistorikk er dobbelt så mange siktet for annen økonomisk kriminalitet, sammenliknet med personer uten konkurser. Konkurs benyttes for å unngå personlig ansvar for kriminalitet begått i virksomhetens navn, og som verktøy ved unndragelse av verdier. Rapporten sender også et varsku mot bruk av stråmenn. Sannsynligheten er stor for at kriminelle med konkurshistorikk og flere straffbare forhold, men uten rolle i dag, benytter stråmenn for å fortsette sin aktivitet.