Manager at a Glance TOTAL INTERNATIONAL EQUITY Vs. MSCI

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PRESS RELEASE Safran Announces the Availability of Its 2021 Interim

PRESS RELEASE Safran announces the availability of its 2021 Interim Financial Report Paris, August 4, 2021 Safran (Euronext Paris: SAF) has filed the French version of its 2021 Interim Financial Report (Rapport Financier Semestriel) with the French financial markets authority (Autorité des marchés financiers – AMF). From August 4 2021, this document (PDF) can be viewed on or downloaded from: Safran’s website, at www.safrangroup.com under the heading “Finance”/sub-heading “Publications”, The French Financial Markets Authority’s website, at www.amf-france.org Agenda Q3 2021 revenue October 29, 2021 Capital Markets Day 2021 December 2, 2021 2021 annual results February 24, 2021 * * * * * Safran is an international high-technology group, operating in the aviation (propulsion, equipment and interiors), defense and space markets. Its core purpose is to contribute to a safer, more sustainable world, where air transport is more environmentally friendly, comfortable and accessible. Safran has a global presence, with 76,000 employees and sales of 16.5 billion euros in 2020, and holds, alone or in partnership, world or regional leadership positions in its core markets. Safran undertakes research and development programs to maintain the environmental priorities of its R&T and Innovation roadmap. Safran is listed on the Euronext Paris stock exchange and is part of the CAC 40 and Euro Stoxx 50 indices. For more information : www.safran-group.com / Follow @Safran on Twitter Press Catherine Malek : [email protected] / T +33 (0)1 40 -

Safran Aircraft Engines Download

SAFRAN AIRCRAFT ENGINES This is a multi-site certificate, additional site details are listed in the appendix to this certificate 10 ALLEE DU BREVENT - COURCOURONNES 91019 EVRY CEDEX - FRANCE Bureau Veritas Certification certify that the Management System of the above organisation has been audited in accordance with the relevant Aerospace Supplier Quality system Certification Scheme EN 9104-001:2013 and found to be in accordance with the requirements of the management system standard detailed below: Standard EN 9100:2018 AS 9100:D - JISQ 9100:2016 Scope of certification DESIGN, DEVELOPMENT, PRODUCTION, DISTRIBUTION, TEST AND SERVICING OF CIVIL AND MILITARY AIRCRAFT ENGINES - DESIGN, DEVELOPMENT, PRODUCTION, DISTRIBUTION, TEST AND SERVICING SATELLITE AND SPACECRAFT PROPULSION SYSTEMS - ASSOCIATED SERVICES PROVIDED TO CIVIL AND MILITARY CUSTOMERS. Certification structure : Campus Certification Issue date: 15 September 2018 Subject to the continued satisfactory operation of the organization’s Management System, this certificate expires on (Certification Expiry date): 14 September 2021 Original certification date: 15 July 2004 Certificate : 7098050-Rev0 Date: 06 September 2018 File number : FR044707-1 Jacques Matillon – Managing DIrector Bureau Veritas Certification France 60, avenue du Général de Gaulle – Immeuble Le Guillaumet - 92046 Paris La Défense Further clarifications regarding the scope of this certificate the applicability of the management system requirements may be obtained by consulting the organization. To check this certificate validity, please call + 33(0) 1 41 97 00 60. APPENDIX SAFRAN AIRCRAFT ENGINES Standard EN 9100:2018 AS 9100:D - JISQ 9100:2016 Scope of certification Site Address Scope 10 ALLEE DU BREVENT COURCOURONNES SIEGE CENTRAL FUNCTIONS 91019 EVRY CEDEX, France RUE HENRI AUGUSTE INDUSTRIALIZATION AND MANUFACTURING OF PARTS AND EVRY-CORBEIL DESBRUÈRES - BP 81 COMPONENTS FOR AIRCRAFT ENGINES. -

French Aeronautical Players to Fly 100% Alternative Fuel on Single-Aisle Aircraft End of 2021

French aeronautical players to fly 100% alternative fuel on single-aisle aircraft end of 2021 Toulouse, Paris, 10 June 2021- Airbus, Safran, Dassault Aviation, ONERA and Ministry of Transport are jointly launching an in-flight study, at the end of 2021, to analyse the compatibility of unblended sustainable aviation fuel (SAF) with single-aisle aircraft and commercial aircraft engine and fuel systems, as well as with helicopter engines. This flight will be made with the support of the “Plan de relance aéronautique” (the French government‘s aviation recovery plan) managed by Jean Baptiste Djebbari, French Transport Minister. Known as VOLCAN (VOL avec Carburants Alternatifs Nouveaux), this project is the first time that in-flight emissions will be measured using 100% SAF in a single-aisle aircraft. Airbus is responsible for characterising and analysing the impact of 100% SAF on-ground and in- flight emissions using an A320neo test aircraft powered by a CFM LEAP-1A engine1. Safran will focus on compatibility studies related to the fuel system and engine adaptation for commercial and helicopter aircraft and their optimisation for various types of 100% SAF fuels. ONERA will support Airbus and Safran in analysing the compatibility of the fuel with aircraft systems and will be in charge of preparing, analysing and interpreting test results for the impact of 100% SAF on emissions and contrail formation. In addition, Dassault Aviation will contribute to the material and equipment compatibility studies and verify 100% SAF biocontamination susceptibility. The various SAFs used for the VOLCAN project will be provided by TotalEnergies. Moreover, this study will support efforts currently underway at Airbus and Safran to ensure the aviation sector is ready for the large-scale deployment and use of SAF as part of the wider initiative to decarbonise the industry. -

AXA Rosenberg European Fund

SHORT REPORT YEAR ENDING 31 JANUARY 2018 ROSENBERG EQUITES AXA Rosenberg European Fund Investment objective and policy AXA Investment The aim of the Fund is to achieve medium to long term capital growth above that of the MSCI Europe ex-UK Index on a rolling three to five year basis. Managers (AXA IM) The MSCI Europe ex-UK Index is designed to measure the performance of the shares of companies is a dedicated listed on stock exchanges in developed European countries (excluding the UK). investment manager The Fund invests in a diversified portfolio of shares of large and medium sized companies in all industry sectors which are listed on European stock exchanges (excluding those in the UK). The Fund within the AXA manager uses a proprietary stock selection model to identify companies that it believes to be attractive, relative to their industry peers, based on the model's analysis of their financial data. In Group, a world constructing the Fund's portfolio, the Fund manager references the index which means that, while the Fund manager has discretion to select the investments for the Fund, the Fund's divergence from the leader in financial index is controlled. protection and The Fund may use derivatives (financial instruments that derive their value from the value of other wealth assets) in an attempt to reduce the overall risk of its investments, reduce the costs of investing or generate additional capital or income known as Efficient Portfolio Management (EPM). management. Rosenberg Equities is AXA IM’s systematic Rosenberg Equities investment process fundamental equity investment specialist, Rosenberg Equities core investment belief has remained unchanged since the formation of the and deploys a pioneering and unique company in 1985. -

SAFRAN ROTORCRAFT SOLUTIONS 2021 PROPULSION SYSTEMS Safran Helicopter Engines Safran Transmission Systems Safran Electronics & Defense

SAFRAN ROTORCRAFT SOLUTIONS 2021 PROPULSION SYSTEMS Safran Helicopter Engines Safran Transmission Systems Safran Electronics & Defense ELECTRICAL POWER SYSTEMS Safran Electrical & Power Safran Power Units LANDING AND BRAKING SYSTEMS Safran Landing Systems AVIONICS SYSTEMS AND FLIGHT CONTROLS Safran Electronics & Defense AEROSYSTEMS Safran Aerosystems SEATS Safran Seats Photo credits: cover: Anthony Pecchi/Safran - p. 4: Philipp Franceschini/Airbus Helicopters, Philippe Stroppa/Safran - p. 5: Jean-Pascal Donnot - p. 6: Philippe Stroppa/Safran, Cyril Abad/CAPA Pictures/Safran, Thomas Garza/Safran - p. 8: Jean-Pascal Donnot - p. 9: Philippe Stroppa/Safran - p. 10: Anthony Pecchi/Airbus Helicopters - p. 12: Jean-Pascal Donnot - p. 13: Anthony Pecchi/Airbus Helicopters, Eric Drouin/Safran - p. 14: Patrick Penna / Airbus Helicopter - p. 15: Krasker-Studio / Safran, Airbus Helicopters - p. 16: Cyril Abad / CAPA Pictures / Safran - p. 17: Cyril Abad / CAPA Pictures / Safran - p. 18: Ricardo Funari/CAPA Pictures/Safran. 2 SAFRAN OVERVIEW SAFRAN IS AN INTERNATIONAL HIGH-TECHNOLOGY GROUP, OPERATING IN THE AVIATION (PROPULSION, EQUIPMENT AND INTERIORS), DEFENSE AND SPACE MARKETS. ITS CORE PURPOSE IS TO CONTRIBUTE TO A SAFER, MORE SUSTAINABLE WORLD, WHERE AIR TRANSPORT IS MORE ENVIRONMENTALLY FRIENDLY, COMFORTABLE AND ACCESSIBLE. SAFRAN HAS A GLOBAL PRESENCE, WITH 79,000 EMPLOYEES AND SALES OF 16.5 BILLION EUROS IN 2020 AND HOLDS, ALONE OR IN PARTNERSHIP, WORLD OR REGIONAL LEADERSHIP POSITIONS IN ITS CORE MARKETS. SAFRAN UNDERTAKES RESEARCH AND DEVELOPMENT -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Growth Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 99.4% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Argentina 1.1% France 9.9% (a) MercadoLibre, Inc. 11,044 11,954,909 Air Liquide SA 33,000 5,230,820 Australia 3.3% Airbus Group SE(a) 115,226 8,356,836 Aristocrat Leisure Ltd. 382,096 8,332,956 Capgemini SE 100,870 12,941,155 Atlassian Corp. PLC, Class A(a) 34,922 6,348,471 Dassault Systemes 30,100 5,616,121 Cochlear Ltd. 21,100 3,014,527 L’Oreal SA 53,085 17,275,402 CSL Ltd. 90,068 18,605,054 LVMH Moet Hennessy Louis Vuitton SE 60,510 28,312,668 Total 36,301,008 Safran SA(a) 109,109 10,734,920 Canada 3.6% Sartorius Stedim Biotech 23,028 7,948,411 Alimentation Couche-Tard, Inc., Class B 179,500 6,250,922 Teleperformance SA 26,943 8,306,583 Brookfield Asset Management, Inc., Class A 129,004 4,264,872 Total SE 113,620 3,902,001 Canadian National Railway Co. 187,926 20,014,109 Total 108,624,917 Dollarama, Inc. 223,415 8,563,780 Germany 5.5% Total 39,093,683 Adidas AG(a) 18,700 6,039,018 China 9.0% Infineon Technologies AG 652,214 18,383,168 Alibaba Group Holding Ltd.(a) 950,520 34,894,654 Rational AG 13,768 10,799,191 CNOOC Ltd. -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

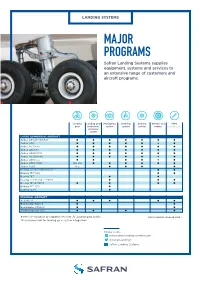

MAJOR PROGRAMS Safran Landing Systems Supplies Equipment, Systems and Services to an Extensive Range of Customers and Aircraft Programs

LANDING SYSTEMS MAJOR PROGRAMS Safran Landing Systems supplies equipment, systems and services to an extensive range of customers and aircraft programs. Landing Landing gear Monitoring Steering Braking Wheels and MRO gear extension/ system system system brakes (including JVs) retraction system LARGE COMMERCIAL AIRCRAFT Airbus A318/A319/A320 GGGGGGG Airbus A321 GGGGG#G Airbus A320neo GGGGGGG Airbus A321neo GGGGGGG Airbus A300/A310 GGGGGGG Airbus A330/A340 GGGGG#G Airbus A330neo GG GG#G Airbus A350 XWB MLG 900 GGGGGG Airbus A380 NLG GGG G Boeing 737 Next-Generation GG Boeing 737 MAX GG Boeing 767 GG Boeing 777LR and 777-8/-9 GGG Boeing 787-8/787-9 GG GG Boeing 747-400 G Boeing 747-8 G REGIONAL AIRCRAFT ATR 42/72 GGG GG Bombardier Dash 8 G G Bombardier CRJ200 G G Sukhoi Superjet 100* GG G G # Messier-Goodrich or Goodrich-Messier JV according to Airline Continued on reverse side > *Also responsible for landing gear system integration Follow us on: www.safran-landing-systems.com @SafranLandingS Safran Landing Systems Landing Landing gear Monitoring Steering Braking Wheels and MRO gear extension/ system system system brakes (including JVs) retraction system HELICOPTERS Airbus Helicopters Alouette III G Airbus Helicopters Dauphin GG GGGG Airbus Helicopters EC175 G Airbus Helicopters Puma GG G GG Airbus Helicopters Super Puma GG G GG Airbus Helicopters Tigre GG G GG Airbus Helicopters H160 GG Sikorsky S-92 G BUSINESS JETS Dassault Falcon GGGGGGG Dassault F7X /F8X * GGGG G Bombardier CRJ/850 GGGG Bombardier Challenger 300/350 GGGG G Bombardier -

June 22, 2020 CURRICULUM VITAE HOWARD SAFRAN, MD Business

June 22, 2020 CURRICULUM VITAE HOWARD SAFRAN, MD Business or Mailing Address: The Rhode Island Hospital 593 Eddy Street Providence, RI 02903 Business Phone Number: 401-444-4830 Business Fax Number: 401-444-8441 Email: [email protected] Clinical Sites: The Rhode Island Hospital The Miriam Hospital Newport Hospital EDUCATION Undergraduate: 1979-1983 Boston University B.S. Biology, 6/83 Phi Beta Kappa Summa cum laude Medical School: 1983-1987 Boston University MD, 6/87 AOA HONORARY DEGREES: Master of Arts Ad Eundum Brown University 2003 POST GRADUATE AWARDS: Award for outstanding teacher Hematology Oncology Fellowship Brown University 2007 POST GRADUATE TRAINING Internship/Residency 1987-1990 Internal Medicine The Boston University Medical Center Boston, Massachusetts Fellowship: 1990-1993 Hematology/Oncology The Boston University Medical Center Boston, Massachusetts 1 PROFESSIONAL LICENSES AND BOARD CERTIFICATION Certification: 1990 - Diplomate, American Board of Internal Medicine (ABIM) 1994 - Diplomate, Oncology, ABIM 1995 - Diplomate, Hematology, ABIM 2000 Recertified, Internal Medicine 2004 Recertified Hematology and Oncology 2013 Recertified Oncology 2013 Recertified Hematology Licensure: 1990 - Commonwealth of Massachusetts 1993 - State of Rhode Island HOSPITAL APPOINTMENTS 1993 - The Miriam Hospital Department of Medicine Division of Hematology/Oncology 1995 - Co-Chairman Gastrointestinal Oncology Brown University Oncology Group 1997- The Rhode Island Hospital Department of Medicine 2001 - Rhode Island Hospital Clinical Director -

PUSHING BACK the FRONTIERS a Key Partner for Life Support in Aerospace

PUSHING BACK THE FRONTIERS A key partner for life support in aerospace Aerospace press kit June 2019 Air Liquide, a major player in aerospace and space A world leader in gases, technologies and services for Industry and Health, Air Liquide is a major partner in civil and military aviation and has participated in the space adventure for more than 50 years. Air Liquide designs systems that generate gas for use both onboard aircraft and on the ground. Air Liquide has also established its reputation in the field of space thanks to its expertise with rocket launchers (ground resources and Ariane launchers), in the design of cryogenic equipment for satellites as well as space exploration (MTG, Herschel, Planck, Melfi, Curiosity, ExoMars, etc.). The Group continues to innovate and is constantly pushing back the frontiers of technology, helping to shape the contours of the world of tomorrow by developing industrial solutions that address the major economic and environmental challenges of today. On the occasion of this new edition of SIAE, Air Liquide will present its latest innovations in space and aerospace, such as the use of hydrogen as a viable energy alternative for aircraft, solutions for the additive manufacturing of exchangers/reactors and for using supercritical carbon dioxide when cleaning metal parts. You will also discover new technologies developed for the future Ariane 6 launcher or for electric propulsion for satellites and it projects in connection with space exploration (moon village analogue, Mars, etc.). Press kit / 3 Air Liquide, a key partner for life support in aerospace A world leader in the field of air gas separation technologies, Air Liquide has developed cutting-edge expertise in aerospace and, today, is a favored partner in civil and military aviation. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Growth Fund, March 31, 2021 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 98.4% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Argentina 0.9% Sartorius Stedim Biotech 30,884 12,710,261 MercadoLibre, Inc.(a) 8,451 12,441,055 Teleperformance SA 30,119 10,981,253 Australia 3.0% Total SE 137,200 6,396,233 Aristocrat Leisure Ltd. 664,347 17,429,567 Total 165,752,414 Cochlear Ltd. 25,500 4,101,802 Germany 4.0% CSL Ltd. 103,017 20,820,136 Adidas AG(a) 20,400 6,372,775 Total 42,351,505 Infineon Technologies AG 592,181 25,195,879 Canada 2.8% Rational AG 15,392 11,956,544 Alimentation Couche-Tard, Inc., Class B 216,700 6,987,096 SAP SE 53,900 6,611,196 (a) Canadian National Railway Co. 275,350 31,954,360 TeamViewer AG 143,772 6,148,594 Total 38,941,456 Total 56,284,988 China 6.2% Hong Kong 4.1% Alibaba Group Holding Ltd.(a) 901,220 25,606,027 AIA Group Ltd. 2,518,000 30,812,188 NetEase, Inc. 909,175 18,695,307 CLP Holdings Ltd. 603,000 5,871,227 TAL Education Group, ADR(a) 267,889 14,425,823 Hang Lung Properties Ltd. 2,855,000 7,452,245 Tencent Holdings Ltd. 349,100 27,860,817 Hong Kong & China Gas Co., Ltd. 2,771,500 4,394,460 Total 86,587,974 Jardine Matheson Holdings Ltd. -

2020 Integrated Report Contents Safran at a Glance 2020 Key Figures

2020 INTEGRATED REPORT CONTENTS SAFRAN AT A GLANCE 2020 KEY FIGURES SAFRAN AT A GLANCE €1,073 million FREE CASH FLOW P. 01 rd Global aerospace group, excluding * RISK 3 airframers €2,792 million EDITORIAL MANAGEMENT NET DEBT P. 02 P. 40 REVENUE(1) CORPORATE down 33.0% (down 32.5% €449 million GROUP €16,498 million CAPEX PROFILE GOVERNANCE on organic basis) on 2019 P. 04 P. 42 RECURRING OPERATING INCOME(1) €1,213 million €1,686 million down 55.9% (down 58.6% TOTAL R&D ECOSYSTEM PERFORMANCE AND VALUE on organic basis) on 2019 (including customer-funded R&D) P. 10 CREATION (1) P. 50 PROFIT €844 million (Group share) 78,892 STRATEGY down 68.3% on 2019 EMPLOYEES AND BUSINESS (at December 31, 2020) MODEL P. 18 Long-term credit rating: BBB+ (with stable outlook) Our activities AEROSPACE AIRCRAFT AIRCRAFT PROPULSION EQUIPMENT/ INTERIORS DEFENSE/ AEROSYSTEMS BREAKDOWN OF REVENUE(1) BY SEGMENT €7,633 million €6,893 million €1,922 million BREAKDOWN OF RECURRING OPERATING INCOME(1) BY SEGMENT €1,192 million €687 million €(174) million BREAKDOWN OF RECURRING OPERATING MARGIN(1) BY SEGMENT 15.6% 10.0% (9.1)% * Classification criteria: revenue - Source: Safran. (1) Adjusted data. See section 2.1.1 of the 2020 Universal Registration Document for a reconciliation of the consolidated income statement with the adjusted income statement and a breakdown of the adjustment. 1 I SAFRAN 2020 INTEGRATED REPORT EDITORIAL EDITORIAL Message from the Chairman of the Board of Directors IN 2021, SAFRAN WILL ROSS McINNES and the Chief Executive Officer CONTINUE TO DRAW OLIVIER ANDRIÈS STRENGTH FROM ITS The total mobilization of all teams enabled Safran to tackle the crisis in 2020.