Guidelines on Reporting Obligations Under Articles 3(3)(D) and 24(1), (2) and (4) of the AIFMD

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Here We Go Again

2015, 2016 MDDC News Organization of the Year! Celebrating 161 years of service! Vol. 163, No. 3 • 50¢ SINCE 1855 July 13 - July 19, 2017 TODAY’S GAS Here we go again . PRICE Rockville political differences rise to the surface in routine commission appointment $2.28 per gallon Last Week pointee to the City’s Historic District the three members of “Team him from serving on the HDC. $2.26 per gallon By Neal Earley @neal_earley Commission turned into a heated de- Rockville,” a Rockville political- The HDC is responsible for re- bate highlighting the City’s main po- block made up of Council members viewing applications for modification A month ago ROCKVILLE – In most jurisdic- litical division. Julie Palakovich Carr, Mark Pierzcha- to the exteriors of historic buildings, $2.36 per gallon tions, board and commission appoint- Mayor Bridget Donnell Newton la and Virginia Onley who ran on the as well as recommending boundaries A year ago ments are usually toward the bottom called the City Council’s rejection of same platform with mayoral candi- for the City’s historic districts. If ap- $2.28 per gallon of the list in terms of public interest her pick for Historic District Commis- date Sima Osdoby and city council proved Giammo, would have re- and controversy -- but not in sion – former three-term Rockville candidate Clark Reed. placed Matthew Goguen, whose term AVERAGE PRICE PER GALLON OF Rockville. UNLEADED REGULAR GAS IN Mayor Larry Giammo – political. While Onley and Palakovich expired in May. MARYLAND/D.C. METRO AREA For many municipalities, may- “I find it absolutely disappoint- Carr said they opposed Giammo’s ap- Giammo previously endorsed ACCORDING TO AAA oral appointments are a formality of- ing that politics has entered into the pointment based on his lack of qualifi- Newton in her campaign against ten given rubberstamped approval by boards and commission nomination cations, Giammo said it was his polit- INSIDE the city council, but in Rockville what process once again,” Newton said. -

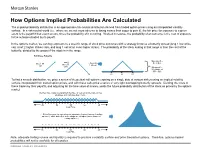

How Options Implied Probabilities Are Calculated

No content left No content right of this line of this line How Options Implied Probabilities Are Calculated The implied probability distribution is an approximate risk-neutral distribution derived from traded option prices using an interpolated volatility surface. In a risk-neutral world (i.e., where we are not more adverse to losing money than eager to gain it), the fair price for exposure to a given event is the payoff if that event occurs, times the probability of it occurring. Worked in reverse, the probability of an outcome is the cost of exposure Place content to the outcome divided by its payoff. Place content below this line below this line In the options market, we can buy exposure to a specific range of stock price outcomes with a strategy know as a butterfly spread (long 1 low strike call, short 2 higher strikes calls, and long 1 call at an even higher strike). The probability of the stock ending in that range is then the cost of the butterfly, divided by the payout if the stock is in the range. Building a Butterfly: Max payoff = …add 2 …then Buy $5 at $55 Buy 1 50 short 55 call 1 60 call calls Min payoff = $0 outside of $50 - $60 50 55 60 To find a smooth distribution, we price a series of theoretical call options expiring on a single date at various strikes using an implied volatility surface interpolated from traded option prices, and with these calls price a series of very tight overlapping butterfly spreads. Dividing the costs of these trades by their payoffs, and adjusting for the time value of money, yields the future probability distribution of the stock as priced by the options market. -

Tax Treatment of Derivatives

United States Viva Hammer* Tax Treatment of Derivatives 1. Introduction instruments, as well as principles of general applicability. Often, the nature of the derivative instrument will dictate The US federal income taxation of derivative instruments whether it is taxed as a capital asset or an ordinary asset is determined under numerous tax rules set forth in the US (see discussion of section 1256 contracts, below). In other tax code, the regulations thereunder (and supplemented instances, the nature of the taxpayer will dictate whether it by various forms of published and unpublished guidance is taxed as a capital asset or an ordinary asset (see discus- from the US tax authorities and by the case law).1 These tax sion of dealers versus traders, below). rules dictate the US federal income taxation of derivative instruments without regard to applicable accounting rules. Generally, the starting point will be to determine whether the instrument is a “capital asset” or an “ordinary asset” The tax rules applicable to derivative instruments have in the hands of the taxpayer. Section 1221 defines “capital developed over time in piecemeal fashion. There are no assets” by exclusion – unless an asset falls within one of general principles governing the taxation of derivatives eight enumerated exceptions, it is viewed as a capital asset. in the United States. Every transaction must be examined Exceptions to capital asset treatment relevant to taxpayers in light of these piecemeal rules. Key considerations for transacting in derivative instruments include the excep- issuers and holders of derivative instruments under US tions for (1) hedging transactions3 and (2) “commodities tax principles will include the character of income, gain, derivative financial instruments” held by a “commodities loss and deduction related to the instrument (ordinary derivatives dealer”.4 vs. -

Bond Futures Calendar Spread Trading

Black Algo Technologies Bond Futures Calendar Spread Trading Part 2 – Understanding the Fundamentals Strategy Overview Asset to be traded: Three-month Canadian Bankers' Acceptance Futures (BAX) Price chart of BAXH20 Strategy idea: Create a duration neutral (i.e. market neutral) synthetic asset and trade the mean reversion The general idea is straightforward to most professional futures traders. This is not some market secret. The success of this strategy lies in the execution. Understanding Our Asset and Synthetic Asset These are the prices and volume data of BAX as seen in the Interactive Brokers platform. blackalgotechnologies.com Black Algo Technologies Notice that the volume decreases as we move to the far month contracts What is BAX BAX is a future whose underlying asset is a group of short-term (30, 60, 90 days, 6 months or 1 year) loans that major Canadian banks make to each other. BAX futures reflect the Canadian Dollar Offered Rate (CDOR) (the overnight interest rate that Canadian banks charge each other) for a three-month loan period. Settlement: It is cash-settled. This means that no physical products are transferred at the futures’ expiry. Minimum price fluctuation: 0.005, which equates to C$12.50 per contract. This means that for every 0.005 move in price, you make or lose $12.50 Canadian dollar. Link to full specification details: • https://m-x.ca/produits_taux_int_bax_en.php (Note that the minimum price fluctuation is 0.01 for contracts further out from the first 10 expiries. Not too important as we won’t trade contracts that are that far out.) • https://www.m-x.ca/f_publications_en/bax_en.pdf Other STIR Futures BAX are just one type of short-term interest rate (STIR) future. -

RRP Sector Assessment

OrbiMed Asia Partners III, LP Fund (RRP REG 51072) OWNERSHIP, MANAGEMENT, AND GOVERNANCE A. The Fund Structure 1. The Asian Development Bank (ADB) proposes to invest in OrbiMed Asia Partners III, LP Fund (OAP III), which is a Cayman Islands exempted limited partnership seeking to raise up to $500 million in capital commitments. It is managed by OrbiMed Asia GP III, LP (the general partner), a Cayman Islands exempted limited partnership. The sole limited partner of the general partner is OrbiMed Advisors III Limited, a Cayman Islands exempted company. OrbiMed Advisors LLC (the investment advisor), a registered investment advisor with the United States (US) Securities and Exchange Commission, will provide investment advisory services to OAP III. This structure is illustrated in the figure below. Table 1 shows the ultimate beneficial owners (UBOs) of the general partner and the investment advisor. Table 1: Ultimate Beneficial Owners of the General Partner and the Investment Advisor (ownership stake, %) Name Investment Advisor General Partner Sven H. Borho (~10–25%) (~8%) Alexander M. Cooper (~8%) Carl L. Gordon (~10–25%) (~8%) (also Director) Geoffrey C. Hsu (<5%) (~8%) Samuel D. Isaly (~50–75%) (~8%) W. Carter Neild (<5%) (~8%) (also Director) Jonathan T. Silverstein (~5–10%) (~8%) (also Director) Sunny Sharma (~8%) (also Officer) Evan D. Sotiriou (~8%) David G. Wang (~8%) (also Officer) Jonathan Wang (~8%) (also Officer) Sam Block III (~8%) Source: OrbiMed Group. 2 2. Investors. The fund held a first closing of approximately $233.5 million on 1 March 2017, and a second closing of approximately $137.6 million on 26 April 2017. -

Understanding Private Equity. What Is Private Equity? EXAMPLES of PRIVATELY HELD COMPANIES

Understanding private equity. What is private equity? EXAMPLES OF PRIVATELY HELD COMPANIES: A private equity investor is an individual or entity that invests capital into a private company (i.e. firms not traded on a public exchange) in exchange for equity interest in that business. In the US, there are approximately 18,000 publicly traded companies, and more than 300,000 privately held companies. WHO MIGHT SEEK A PRIVATE EQUITY INVESTOR AS A SOURCE OF CAPITAL? • Companies looking to fund a capital need that is beyond traditional bank financing • Owners considering a partial or complete sale of their business • Managers looking to buy a business Private equity strategies. EXAMPLES OF PRIVATE EQUITY FIRMS: MOST PRIVATE EQUITY INVESTORS WILL LIMIT THEIR INVESTMENTS TO ONE OR TWO OF THE FOLLOWING STRATEGIES: • Angel investing • Growth capital • Venture capital • Distressed investments • Leveraged buyouts (LBO) • Mezzanine capital Sources of capital for PE funds. THERE ARE TWO TYPES OF PRIVATE EQUITY FIRMS: • Firms with a dedicated fund, with the majority of the capital sourced from institutional investors (i.e. pension funds, banks, endowments, etc.) and accredited investors (i.e. high net worth individual investors) • Firms that raise capital from investors on a per-deal basis (pledge funds) INVESTMENT DURATION AND RETURNS. • Typical investment period is 3−10 years, after which capital is distributed to investors • Rates of return are higher than public market returns, typically 15−30%, depending on the strategy HISTORICAL S&P 500 RETURNS S&P 500 Returns Average Source: Standard & Poor’s LCD Private equity fund structure. PRIVATE EQUITY FIRM LIMITED PARTNERS (Investors) (Public pension funds, corporate pension funds, insurance companies, high net worth individuals, family offices, endowments, banks, foundations, funds-of-funds, etc.) Management Company General Partner Fund Ownership Fund Investment Management PRIVATE EQUITY FUND (Limited Partnership) Fund’s Ownership of Portfolio Investments Etc. -

Investor Lunch, New York – 3 March 2006

Investor lunch, New York – 3 March 2006 1 3i team Philip Yea Simon Ball Jonathan Russell Michael Queen Jo Taylor Chris Rowlands Group Chief Executive Group Finance Director Managing Partner Managing Partner Managing Partner Head of Group Markets Buyouts Growth Capital Venture Capital Patrick Dunne Anil Ahuja Gustav Bard Graeme Sword Guy Zarzavatdjian Group Communications Managing Director, India Managing Director, Director, Oil and Gas Managing Director, Director Nordic Region France 2 Investor lunch, New York – 3 March 2006 Contents • Introduction to 3i • The private equity market • Interim results to 30 September 2005 • Investor relations • Closing remarks 3 Investor lunch, New York – 3 March 2006 Introduction to 3i 3i at a glance • A world leader in private equity and venture capital • Established 1945; IPO on London Stock Exchange 1994 (IPO at 272p) • Market capitalisation £5.0bn (as at 31 January 2006) • 3i has invested over £15bn in over 14,000 businesses • Portfolio value £4.4bn, in 1,285 businesses (as at 30 September 2005) • Network of teams located in 14 countries in Europe, Asia and the US • 3i also manages and advises third party funds totalling £1.8bn (as at 30 September 2005) • Member of the MSCI Europe, FTSE100, Eurotop 300 and DJ Stoxx indices 4 Investor lunch, New York – 3 March 2006 Introduction to 3i Our Board • Chairman Baroness Hogg • Six independent non-executive directors − Oliver Stocken (Deputy Chairman; Senior Independent Director) − Dr Peter Mihatsch − Christine Morin-Postel − Danny Rosenkranz − Sir Robert Smith -

Corporate Venturing Report 2019

Corporate Venturing 2019 Report SUMMIT@RSM All Rights Reserved. Copyright © 2019. Created by Joshua Eckblad, Academic Researcher at TiSEM in The Netherlands. 2 TABLE OF CONTENTS LEAD AUTHORS 03 Forewords Joshua G. Eckblad 06 All Investors In External Startups [email protected] 21 Corporate VC Investors https://www.corporateventuringresearch.org/ 38 Accelerator Investors CentER PhD Candidate, Department of Management 43 2018 Global Startup Fundraising Survey (Our Results) Tilburg School of Economics and Management (TiSEM) Tilburg University, The Netherlands 56 2019 Global Startup Fundraising Survey (Please Distribute) Dr. Tobias Gutmann [email protected] https://www.corporateventuringresearch.org/ LEGAL DISCLAIMER Post-Doctoral Researcher Dr. Ing. h.c. F. Porsche AG Chair of Strategic Management and Digital Entrepreneurship The information contained herein is for the prospects of specific companies. While HHL Leipzig Graduate School of Management, Germany general guidance on matters of interest, and every attempt has been made to ensure that intended for the personal use of the reader the information contained in this report has only. The analyses and conclusions are been obtained and arranged with due care, Christian Lindener based on publicly available information, Wayra is not responsible for any Pitchbook, CBInsights and information inaccuracies, errors or omissions contained [email protected] provided in the course of recent surveys in or relating to, this information. No Managing Director with a sample of startups and corporate information herein may be replicated Wayra Germany firms. without prior consent by Wayra. Wayra Germany GmbH (“Wayra”) accepts no Wayra Germany GmbH liability for any actions taken as response Kaufingerstraße 15 hereto. -

Caris Life Sciences Raises $830 Million in Growth Equity Capital to Continue to Expand Its Precision Medicine Platform

FOR IMMEDIATE RELEASE Caris Life Sciences Raises $830 Million in Growth Equity Capital to Continue to Expand its Precision Medicine Platform Accelerates Caris’ rapid growth as the market leader reshaping precision oncology through basic science research and the application of artificial intelligence to one of the largest clinico-genomic databases Capital raise represents one of the largest private financings in precision medicine supported by a diverse, high-quality syndicate of leading investors IRVING, Texas, May 11, 2021 – Caris Life Sciences®, a leading innovator in molecular science and artificial intelligence (AI) focused on fulfilling the promise of precision medicine, announced an $830 million growth equity round at a post-money valuation of $7.83 billion. With this investment, Caris has raised approximately $1.3 billion in external financing since 2018. This financing represents one of the largest capital raises in precision medicine and includes a diverse syndicate of leading investors. The round was led by Sixth Street, a leading global investment firm making its third investment in Caris since 2018. Funds and accounts advised by T. Rowe Price Associates, Inc., Silver Lake, Fidelity Management & Research Company LLC, and Coatue were significant participants in the round. Additional investors included Columbia Threadneedle Investments, Canada Pension Plan Investment Board, Millennium Management, Neuberger Berman Funds, Highland Capital Management, Rock Springs Capital, OrbiMed, ClearBridge Investments, Tudor Investment Corporation, Eaton Vance Equity (Morgan Stanley), Pura Vida Investments and First Light Asset Management. All existing investors from the 2020 financing participated in this deal along with a number of new investors. The Caris Molecular Intelligence approach allows oncologists to assess all 22,000 genes in both DNA and RNA, utilizing whole exome sequencing, whole transcriptome sequencing, protein analysis, and proprietary AI models and signatures. -

Eurazeo Confirms Its Excellent Growth

EURAZEO CONFIRMS ITS EXCELLENT GROWTH MOMENTUM IN THE FIRST QUARTER OF 2021: AUM +21% OVER 12 MONTHS AND REVENUES +20% EXCLUDING TRAVEL AND LEISURE Paris, May 20, 2021 Asset management momentum strengthens at end-March • Assets Under Management (AUM): €22.7bn, +21% over LTM, of which +27% for third party • Third-party fundraising: €785m at end-March and c.€1,200m YTD, versus €283m in Q1 2020 • Management fees: €59m, of which +13% for limited partners (+4% overall1 given balance sheet divestments) • The Group expects further growth in fundraising in 2021 thanks to the strong market attractiveness of its current funds, particularly for small-mid buyout, growth and private debt funds Strong growth in portfolio performance • Portfolio economic revenue2 up +20% in Q1 2021 year-on-year (+15% compared to Q1 2019), excluding the Travel & Leisure segment • 61% increase in revenues of Growth portfolio companies (non-consolidated) • Early recovery prospects in Travel & Leisure (10% of NAV) Sustained investment activity • €1.1bn invested (€0.5bn in Q1 2020), with business flows in buoyant sectors notably tech (Questel, PPRO, Message Bird), consumer tech (UPD, Aroma-Zone) and financial services (Groupe Premium) • A high level of asset divestments expected in 2021-2022, as announced Balance sheet remains robust • NAV per share of €85.5 (not revalued quarterly) • Net cash and cash equivalents of €255m at end-March – confirmed RCF of €1.5bn • Dry powder of €3.7bn Virginie Morgon, Chairwoman of the Executive Board, stated: “This first quarter of 2021 reflects Eurazeo's growth momentum in all aspects of its business. The growth in our fundraising and assets under management, but also the strong rebound in our portfolio activity, the sustained pace of our investments in growth sectors, value-creating exits and our ability to support the major shifts towards a more sustainable economy perfectly illustrate our "Power Better Growth" positioning and its attractiveness. -

Unpacking Private Equity Characteristics and Implications by Asset Class

Unpacking Private Equity Characteristics and Implications by Asset Class www.mccombiegroup.com | +1 (786) 664-8340 Unpacking Private Equity: Characteristics & implications by asset class The term private equity is often treated as a catchall, used interchangeably to describe a broad variety of investments. Such loose use of the phrase fails to capture the range of nuanced business ownership strategies it refers to and risks branding an entire asset class with characteristics and implications that are typically relevant to only a particular sub-category. Recently, this has especially been the case given the outsized global attention placed on the leveraged buyout deals of Bain Capital, a private equity firm founded by Republican U.S. presidential candidate Mitt Romney. In this context, popular discourse has inappropriately attached the label of private equity to a general practice of debt-fueled corporate takeovers that disproportionately focus on cost cutting. In reality, however, private equity refers to an array of investment strategies each with a unique risk-return profile and differing core skillsets for success. This article is intended to help family office executives better understand the nuances of the various sub-categories of private equity. It seeks to draw high-level distinctions, serving as a practical guide for investors entering the private equity arena, be it directly or through a more curated fund structure. Ultimately by understanding the characteristics and implications of each asset class, the reader should be equipped to make an educated choice regarding the most relevant and appropriate strategy for their unique profile. From a technical perspective, private equity is nothing more than making investments into illiquid non-publicly traded companies— i.e. -

Astro Case Study

Case Study ASTRO RADIO: VIRTUAL CONSOLE TECHNOLOGY MALAYSIA’S LARGEST BROADCASTER REINVENTS RADIO STUDIOS WITH LAWO VIRTUAL MIXING Case Study VIRTUAL MIXING AT ASTRO RADIO “A RADICAL RE-IMAGINING OF WHAT AN ON-AIR STUDIO COULD LOOK LIKE.” Astro Radio, headquartered in Kuala Lumpur, has become one of Southeast Asia‘s most influential broadcasters since their inception in 1996. With 11 radio formats in multiple languages, including the popular Era, Sinar, Gegar, My, Hitz and other channels, Astro Radio reaches over 15.8 million listeners every week in Malaysia alone. Astro began operations in 1996 and immediately became known for their technological excellence, employing a cutting-edge audio routing system and digital broadcast consoles custom manufactured to meet their technical requirements. But by 2006, Astro needed more capabilities and simpler studio workflows, so that on-air talent could focus on content creation rather than technical duties. “Around 2015, we picked up on the touchscreen trend,” says Bala Murali Subramaney, Astro Radio’s Chief Technology Officer. “We envisioned a full-blown radio broadcast console - on a touchscreen. Not a ‘lite’ console with only some console features nor a touchscreen with a console ‘simulation’.” Astro Radio Broadcast Center, Kuala Lumpur The virtual console Astro engineers envisioned would be a true radio broadcast console, with all the features and functionalities of the professional broadcast consoles they relied on. “We took the best features of our first console, analyzed common operator mistakes and asked for improvement suggestions, then we condensed this data into a comprehensive document and presented it as our mandate to Lawo – whose response was the Zirkon-2s modular broadcast console,” says Bala.