Solow and Heterogeneous Labor: a Neoclassical Explanation of Wage Inequality

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hip Hop As Oral Literature Patrick M

Bates College SCARAB Honors Theses Capstone Projects Spring 5-2016 "That's the Way We Flow": Hip Hop as Oral Literature Patrick M. Smith Bates College, [email protected] Follow this and additional works at: http://scarab.bates.edu/honorstheses Recommended Citation Smith, Patrick M., ""That's the Way We Flow": Hip Hop as Oral Literature" (2016). Honors Theses. 177. http://scarab.bates.edu/honorstheses/177 This Open Access is brought to you for free and open access by the Capstone Projects at SCARAB. It has been accepted for inclusion in Honors Theses by an authorized administrator of SCARAB. For more information, please contact [email protected]. “That’s the Way We Flow”: Hip Hop as Oral Literature An Honor Thesis Presented to The Faculty of the Program of African American Studies Bates College in partial fulfillment of the requirements for the Degree of Bachelor of Arts by Patrick Miller Smith Lewiston, Maine 3/28/16 2 Acknowledgments I would like to thank all of my Bates Professors for all of their help during my career at Bates College. Specifically, I would like to thank my thesis advisor, Professor Sue Houchins, for all her hard work, helping me wrestle with this thesis, and for being a source of friendship and guidance since I first met her. Professor Nero, I would also like to send a big thank you to you, you have inspired me countless times and have pushed me since day one. Professors Rubin, Chapman, Jensen, and Carnegie, thank you all very much, each of you helped me on my way to this point and I am very grateful for your guidance. -

Sample Some of This

Sample Some Of This, Sample Some Of That (169) ✔ KEELY SMITH / I Wish You Love [Capitol (LP)] JEHST / Bluebells [Low Life (EP)] RAMSEY LEWIS TRIO / Concierto De Aranjuez [Cadet (LP)] THE COUP / The Liberation Of Lonzo Williams [Wild Pitch (12")] EYEDEA & ABILITIES / E&A Day [Epitaph (LP)] CEE-KNOWLEDGE f/ Sun Ra's Arkestra / Space Is The Place [Counterflow (12")] JOHN DANKWORTH & HIS ORCHESTRA / Bernie's Tune ("Off Duty", O.S.T.) [Fontana (LP)] COMMON & MARK THE 45 KING / Car Horn (Madlib remix) [Madlib (LP)] GANG STARR / All For Da Ca$h [Cooltempo/Noo Trybe (LP)] JOHN DANKWORTH & HIS ORCHESTRA / Theme From "Return From The Ashes", O.S.T. [RCA (LP)] 7 NOTAS 7 COLORES / Este Es Un Trabajo Para Mis… [La Madre (LP)] QUASIMOTO / Astronaut [Antidote (12")] DJ ROB SWIFT / The Age Of Television [Om (LP)] JOHN DANKWORTH & HIS ORCHESTRA / Look Stranger (From BBC-TV Series) [RCA (LP)] THE LARGE PROFESSOR & PETE ROCK / The Rap World [Big Beat/Atlantic (LP)] JOHN DANKWORTH & HIS ORCHESTRA / Two-Piece Flower [Montana (LP)] GANG STARR f/ Inspectah Deck / Above The Clouds [Noo Trybe (LP)] Sample Some Of This, Sample Some Of That (168) ✔ GABOR SZABO / Ziggidy Zag [Salvation (LP)] MAKEBA MOONCYCLE / Judgement Day [B.U.K.A. (12")] GABOR SZABO / The Look Of Love [Buddah (LP)] DIAMOND D & SADAT X f/ C-Low, Severe & K-Terrible / Feel It [H.O.L.A. (12")] GABOR SZABO / Love Theme From "Spartacus" [Blue Thumb (LP)] BLACK STAR f/ Weldon Irvine / Astronomy (8th Light) [Rawkus (LP)] GABOR SZABO / Sombrero Man [Blue Thumb (LP)] ACEYALONE / The Hunt [Project Blowed (LP)] GABOR SZABO / Gloomy Day [Mercury (LP)] HEADNODIC f/ The Procussions / The Drive [Tres (12")] GABOR SZABO / The Biz [Orpheum Musicwerks (LP)] GHETTO PHILHARMONIC / Something 2 Funk About [Tuff City (LP)] GABOR SZABO / Macho [Salvation (LP)] B.A. -

No Bitin' Allowed a Hip-Hop Copying Paradigm for All Of

20 Tex. Intell. Prop. L.J. 115 Texas Intellectual Property Law Journal Fall, 2011 Article NO BITIN’ ALLOWED: A HIP-HOP COPYING PARADIGM FOR ALL OF US Horace E. Anderson, Jr.a1 Copyright (c) 2011 Intellectual Property Law Section of the State Bar of Texas; Horace E. Anderson, Jr. I. History and Purpose of Copyright Act’s Regulation of Copying 119 II. Impact of Technology 126 A. The Act of Copying and Attitudes Toward Copying 126 B. Suggestions from the Literature for Bridging the Gap 127 III. Potential Influence of Norms-Based Approaches to Regulation of Copying 129 IV. The Hip-Hop Imitation Paradigm 131 A. Structure 131 1. Biting 131 2. Beat Jacking 133 3. Ghosting 135 4. Quoting 136 5. Sampling 139 B. The Trademark Connection 140 C. The Authors’ Rights Connection 142 D. The New Style - What the Future of Copyright Could Look Like 143 V. Conclusion 143 VI. Appendix A 145 VII. Appendix B 157 VIII. Appendix C 163 *116 Introduction I’m not a biter, I’m a writer for myself and others. I say a B.I.G. verse, I’m only biggin’ up my brother1 It is long past time to reform the Copyright Act. The law of copyright in the United States is at one of its periodic inflection points. In the past, major technological change and major shifts in the way copyrightable works were used have rightly led to major changes in the law. The invention of the printing press prompted the first codification of copyright. The popularity of the player piano contributed to a reevaluation of how musical works should be protected.2 The dawn of the computer age led to an explicit expansion of copyrightable subject matter to include computer programs.3 These are but a few examples of past inflection points; the current one demands a similar level of change. -

CONTEMPORARY RADIO's MUSIC 11 MAY 7, 1993 Conversation With

CONTEMPORARY RADIO'S MUSIC 11 NEWS RESOURCE e ver. MAY 7, 1993 Conversation With Burt Baumgartner B-96 Spotlight Station Naked Picture On Page 6 www.americanradiohistory.com e e © THE PROCLAIMERS "I'M GONNA BE (500 MILES)" FROM THE HIT MOVIE INSTANT PHONES AT RADIO IMMEDIATE REACTION AT RETAIL!1 www.americanradiohistory.com THE Ci1&iuhs MAINSTREAM LF;ar PLAYS PER WEEK R AV6. 2W LW 1W AImsT/SOND LABEL 2W LW 11 AansT/Saec sus. PLAYSPPw 4 2 0 PM DAWN. Looking Through Patient Eyes Gee Street/Island/PLG 4 3 JO PM DAWN. Looking Through Patient Eyes 91 42.2 3842 2 1 2 VANESSA WILLIAMS and BRIAN McKNIGIR. Love Is Giant 2 1 2 VANESSA WILLIAMS and BRIAN MCKNIGHT. Love Is 90 42.5 3826 5 4 0 MICHAEL JACKSON. Who Is It Epic 26 8 Q JANET JACKSON. That's The Way Love Goes 101 34.0 3436 27 10 Q JANET JACKSON. That's The Way Love Goes Virgin 1 2 4 WHITNEY HOUSTON.I Have Nothing 86 37.0 3185 9 5 0 JOEY LAWRENCE. Nothin' My Love Can't Fix Impact/MCA 6 4 5 MICHAEL JACKSON. Who Is It 89 35.6 3165 7 6 Q BOY GEORGE. The Crying Game SBK/ERG 3 5 6 STING. If I Ever Lose My Faith In You 85 32.4 2751 10 10 JO Freak Me 11 7 0 SILK. Freak Me Keia/Elektra SILK. 66 40.2 2653 8 6 8 BOY GEORGE. Crying 12 8 Q PRINCE & THE NEW POWER GENERATION. -

Hip Hop History Cipher Sounds

Hip Hop History Cipher Sounds Written by Robert ID3295 Tuesday, 06 February 2007 13:22 - Hip Hop History: Cipher Sounds The original hip-hop D.J.Cipher Sounds was established in South Side Jamaica, Queens, New York in the year 1975. Little more than a year after the originators of the hip hop genre; Kool Herc, Afrikka Bambatatta, Grand Master Flash and others had created the hip hop culture and had begun to guide it through its infant stages in the Bronx, DJs Divine, Understanding, and Divine Justice had the idea to create their own sound system that would play in the parks and community centers of their neighborhood in Jamaica Queens. Thus Cipher Sounds was born. In the dictionary a cipher is defined as; A series of well-defined steps that can be followed as a procedure. On the streets of NY in the early 70s the word cipher had become widely associated with a spiritual sect known as; The Five Percent Nation (5%). They utilized the word to describe a group of their members who had gathered together in a circle to pass along knowledge to one another. This knowledge was known as "Divine Mathematics” The original founding members of Cipher Sounds; Divine Justice, Divine and Understanding, were practicing members of the culture. Cipher Sounds did their first gig at the Southern Queens Community Center and quickly became a neighborhood favorite. Their style of incorporating European disco records together with soulful break beats was popular with mobile DJs across the city, but Cipher Sounds added a unique aspect to their performance by incorporating an echo chamber for the microphone, adding reverb and effects to the voice of the M.C. -

Page 1 February 2016 Edition by Song Title #Icanteven (I Can't Even)

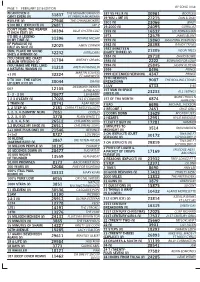

PAGE 1 FEBRUARY 2016 EDITION BY SONG TITLE #ICANTEVEN (I 31837 THE NEIGHBOURHOOD 187 VS FELIX (V) 30961 BOOTLEG CAN'T EVEN) (V) FT FRENCH MONTANA 19 YOU + ME (V) 27215 DAN & SHAY #SELFIE (V) 27946 THE CHAINSMOKERS 1901 (V) 23066 BIRDY $100 BILL (EXPLICIT) (V) 26811 JAY-Z 19-2000 (V) 24095 GORILLAZ (DON'T FEAR) THE REAPER BLUE OYSTER CULT (7 INCH EDIT) (V) 30394 1959 (V) 16532 LEE KERNAGHAN 1973 12579 JAMES BLUNT (I'D BE) A LEGEND RONNIE MILSAP IN MY TIME (V) 31396 1979 (V) 19860 SMASHING PUMPKINS (IF PARADISE IS) AMEN CORNER 1982 (V) 28398 RANDY TRAVIS HALF AS NICE (V) 32025 1983 (NINETEEN 21305 NEON TREES (WIN, PLACE OR SHOW) INTRUDERS EIGHTY THREE) (V) SHE'S A WINNER (V) 32232 1984 (V) 29718 DAVID BOWIE (YOU DRIVE ME) CRAZY BRITNEY SPEARS (ALBUM VERSION) (V) 31784 1985 (V) 2222 BOWLING FOR SOUP 1994 (V) 25845 JASON ALDEAN (YOU MAKE ME FEEL LIKE) 31218 ARETHA FRANKLIN A NATURAL WOMAN (V) 1999 8496 PRINCE MARTIN SOLVEIG 1999 (EXTENDED VERSION) PRINCE +1 (V) 32224 FT SAM WHITE 4347 19TH NERVOUS 0 TO 100 - THE CATCH DRAKE 9087 THE ROLLING STONES UP (EXPLICIT) (V) 30044 BREAKDOWN DESMOND DEKKER 1-LUV 6733 E-40 007 12105 & THE ACES 1ST MAN IN SPACE 23233 ALL SEEING I 1 - 2 - 3 (V) 20677 LEN BARRY (FIRST) (V) BONE THUGS N 1 2 3 O'LEARY (V) 17028 DES O'CONNOR 1ST OF THA MONTH 6874 HARMONY 1 TRAIN (V) 30741 A$AP ROCKY 2 BAD 6696 MICHAEL JACKSON 1, 2 STEP (V) 2181 CIARA FT MISSY ELLIOTT 2 BECOME 1 7451 SPICE GIRLS 1, 2, 3, 4 (SUMPIN' NEW) 7051 COOLIO 2 DOORS DOWN 13629 MYSTERY JETS 1, 2, 3, 4 (V) 3778 PLAIN WHITE T'S 2 HEARTS 12951 KYLIE MINOGUE -

Old School Rap Album Free Download the Best Rap Songs of All Time

old school rap album free download The Best Rap Songs of All Time. Calling all hip hop heads, we're ranking the greatest rap songs ever. From old school classics and 2000s gangsta throwbacks to hype tracks and some of the most popular rap songs today, this list of good rap songs includes famous chart-topping singles everyone knows and underrated tracks only real fans will know. It's hard to keep track of the names of your favorite rap songs, so this essential hip hop playlist should come in handy. Whether you're looking for the hardest tracks, new and current songs hot on the charts right now, or lyrical hits, this list features a bunch of fire songs that will make anyone get lit. Vote up the best raps based on lyrics, the beat, catchy hooks, cool instrumentals, and everything else that goes into making a legendary hit. Do you agree with our top 100 rap songs? How about the top 10? If not, add your favorites and get those votes in! The Best Rap Songs of All Time. Calling all hip hop heads, we're ranking the greatest rap songs ever. From old school classics and 2000s gangsta throwbacks to hype tracks and some of the most popular rap songs today, this list of good rap songs includes famous chart-topping singles everyone knows and underrated tracks only real fans will know. It's hard to keep track of the names of your favorite rap songs, so this essential hip hop playlist should come in handy. Whether you're looking for the hardest tracks, new and current songs hot on the charts right now, or lyrical hits, this list features a bunch of fire songs that will make anyone get lit. -

Diary Mix Tracklist

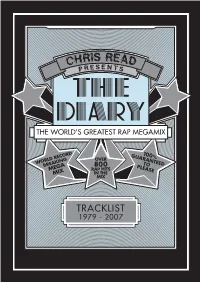

Diary Mix Tracklist INTRO – 1979 to 1987 Sugarhill Gang – Rapper’s Delight (1979) The Sequence – Funk You Up (1979) Spoonie Gee Meets The Sequence – Monster Jam (1979) Fatback – King Tim III (Personlaity Jock) (1979) Sugarhill Gang – 8th Wonder (1980) Kurtis Blow – The Breaks (1980) Arka Bambaataa and the Jazzy 5 – Jazzy Sensation (1981) Grandmaster Flash – The Adventures Of Grandmaster Flash On The Wheels of Steel (1981) Blondie – Rapture (1981) Afrika Bambaataa And The Soul Sonic Force – Looking For The Perfect Beat (1982) Masterdon Committee – Funk Box Party (1982) Man Parrish – Hip Hop Be Bop (Don’t Stop) (1983) Run DMC – It’s Like That (1983) Art Of Noise – Beatbox (1983) Double Dee And Steinski – Play That Beat Mr DJ (Lesson 1: Payo Mix) (1983) Run DMC – Sucker MCs (1983) Newcleus – Jam On It (1984) Doug E Fresh And The Get Fresh Crew – The Show (1985) Whistle – (Nothing Serious) Just Buggin (1985) Eric B Featuring Rakim – Eric B Is President (1986) Run DMC – Peter Piper (1986) Epee MD – It’s My Thing (1987) Big Daddy Kane – Raw (1987) BDP – D Nice Rocks The House (1987) Eric B And Rakim – I Know You Got Soul (Double Trouble Remix) (1987) BDP – South Bronx (1987) 1988 1989 BDP - Jimmy EPMD – So Watcha Sayin BDP – Still Number 1 BDP feat D Nice – And You Don’t Stop Sweet Tee & Jazzy Joice – It’s My Beat Def Jef – Black To The Future Audio 2 – Top Billin Nice and Smooth – More And More Hits NWA – Compton’s In The House (Remix) LL Cool J – Droppin Em BDP – Stop The Violence Special Ed – Got It Made Marley Marl – The Symphony (Remix) -

Icons of Hip Hop: an Encyclopedia of the Movement, Music, and Culture, Volumes 1 & 2

Icons of Hip Hop: An Encyclopedia of the Movement, Music, and Culture, Volumes 1 & 2 Edited by Mickey Hess Greenwood Press ICONS OF HIP HOP Recent Titles in Greenwood Icons Icons of Horror and the Supernatural: An Encyclopedia of Our Worst Nightmares Edited by S.T. Joshi Icons of Business: An Encyclopedia of Mavericks, Movers, and Shakers Kateri Drexler ICONS OF HIP HOP An Encyclopedia of the Movement, Music, And Culture VOLUME 1 Edited by Mickey Hess Greenwood Icons GREENWOOD PRESS Westport, Connecticut . London Library of Congress Cataloging-in-Publication Data Icons of hip hop : an encyclopedia of the movement, music, and culture / edited by Mickey Hess p. cm. – (Greenwood icons) Includes bibliographical references, discographies, and index. ISBN-13: 978-0-313-33902-8 (set: alk. paper) ISBN-13: 978-0-313-33903-5 (vol 1: alk. paper) ISBN-13: 978-0-313-33904-2 (vol 2: alk. paper) 1. Rap musicians—Biography. 2. Turntablists—Biography. 3. Rap (Music)—History and criticism. 4. Hip-hop. I. Hess, Mickey, 1975– ML394. I26 2007 782.421649'03—dc22 2007008194 British Library Cataloguing in Publication Data is available. Copyright Ó 2007 by Mickey Hess All rights reserved. No portion of this book may be reproduced, by any process or technique, without the express written consent of the publisher. Library of Congress Catalog Card Number: 2007008194 ISBN-10: 0-313-33902-3 (set) ISBN-13: 978-0-313-33902-8 (set) 0-313-33903-1 (vol. 1) 978-0-313-33903-5 (vol. 1) 0-313-33904-X (vol. 2) 978-0-313-33904-2 (vol. -

Print/Download Entire Issue (PDF)

American Music Review The H. Wiley Hitchcock Institute for Studies in American Music Conservatory of Music, Brooklyn College of the City University of New York Volume XLIX, Issue 2 Spring 2020 Special Issue: Scoring Madly Accidental Ideas: An Interview with Sara Landeau Lindsey Eckenroth Back in the pre-COVID times, I sat down with musician, teacher, and The Julie Ruin guitarist Sara Landeau at The Coffee Project in Fort Greene, Brooklyn. We talked composing, performing, teaching, timbre, genre, CBGB, inspirations from everywhere, rockumentaries, and the inexorable challenge of knowing when it’s done. The following is an approximate transcript of our sprawling conversation. *** LE: To start, can you tell me about how you got into playing music, when you decided you wanted to make it your career, and how you made that happen? SL: I thought I was going to go to art school, so I just planned to be an artist. I started playing drums at eighteen and guitar at nineteen. I got very into it … just practiced eight hours a day. Then I went to Columbia University for art history. I also worked at CBGB as a bartender, and my band played there. We were an all-woman band; there were three of us, and we played a lot because we all worked at CBGB. At the same time, I kept studying. I went to Juilliard for a while to study classical guitar, which was great, and I just kept taking courses. Then, starting in Sara Landeau performs with The Julie Ruin 2005, I became a volunteer at the Girls Rock Camp. -

Introducing the New Sexuality Studies

Introducing the New Sexuality Studies Original essays and interviews Edited by Steven Seidman Nancy Fischer Chet Meeks Routledge Taylor &Franc85 Group LONDON AND NMI YORK Wait . hip hop sexualities Thomas F: DeFrantz Massachusetts Institute of Technology Summer 2005, driving home from the gym in Bull City (Durham, NC, if you don't know), FM radio cranked. A new beat catches my body. Hot and lean. I ride its tones downward, catching the finger snaps in between the throaty, falling and rising bassline that asks a question then answers itself in one continuous swoop. Funky, hot, and full of potential, the spare beat is only a basstone and a fingerpop, but it is defiant and inevitable as it commands me to move my shoulders, 111y neck, my pelvis. A whispering male voice draws me toward the radio speaker; for a moment, I focus only on the sound and its desire for me to pay attention to its musical imperative. "Wait till I show you this . You will never get enough." Like any hip hop academic - corny as that may sound - I rush home, fire up the laptop, and Google the hook. In seconds I get it: Ying Yang Twins, the lead single from their just-released CD United States of Atlanta, and the version 1 heard in my car was a "clean" version of a "dirty" song. I download the real deal. In anticipation, I position the laptop speakers and let loose the preferred, original, explicit version. This is more like it. The beat bounces just as hard in its insistent groove, but now the rhyme sizzles with exhortations to fin, to give head, to hck, switch positions often, and finally the provocative hook - "Wait till you see my dick . -

Girl Talk's Indefinite Role in the Digital Sampling Saga

Touro Law Review Volume 26 Number 1 Article 6 December 2012 Play Your Part: Girl Talk's Indefinite Role in the Digital Sampling Saga Shervin Rezaie Touro Law Center Follow this and additional works at: https://digitalcommons.tourolaw.edu/lawreview Part of the Business Organizations Law Commons, Entertainment, Arts, and Sports Law Commons, and the Intellectual Property Law Commons Recommended Citation Rezaie, Shervin (2012) "Play Your Part: Girl Talk's Indefinite Role in the Digital Sampling Saga," Touro Law Review: Vol. 26 : No. 1 , Article 6. Available at: https://digitalcommons.tourolaw.edu/lawreview/vol26/iss1/6 This Intellectual Property Comments is brought to you for free and open access by Digital Commons @ Touro Law Center. It has been accepted for inclusion in Touro Law Review by an authorized editor of Digital Commons @ Touro Law Center. For more information, please contact [email protected]. Play Your Part: Girl Talk's Indefinite Role in the Digital Sampling Saga Cover Page Footnote 26-1 This intellectual property comments is available in Touro Law Review: https://digitalcommons.tourolaw.edu/ lawreview/vol26/iss1/6 Rezaie: Play Your Part PLAY YOUR PART: GIRL TALK'S INDEFINITE ROLE IN THE DIGITAL SAMPLING SAGA Shervin Rezaie INTRODUCTION In 2006, Greg Gillis was a twenty-four year old leading a double-life. During the day he was a biomedical engineer,' but by night he was slowly becoming an infamous mash-up artist. His al- bums mixed "Top 40" radio hits into a unique postmodern audio pas- tiche.2 Under the moniker Girl Talk, Greg made his entrance into the limelight with the release of Night Ripper, his third album.3 Night Ripper began gaining attention as audiences became intrigued and excited by Greg's ability to blend numerous artists, old and new, into one seamless track.