Pt Astra International Tbk

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

K&N Part # WPS Part # Description List MAP 22-2020PR K22-2020PR

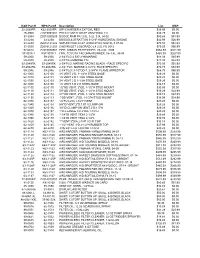

K&N Part # WPS Part # Description List MAP 22-2020PR K22-2020PR DRYCHARGER,4.5X7"OVL RED $26.99 $0.00 25-3900 Z2015091601 PRECLEANER WRAP UNIVERSAL FIT $38.29 $0.00 33-2084 Z2015090203 DODGE RAM P/U 3.9L, 5.2L, 5.9L 94-02 $80.69 $51.99 33-2238 33-2238 BRIGGS & STRATTON 3-5 HP HORIZONTAL ENGINE $42.99 $26.99 33-2249 Z2016121202 SATURN VUE 02-07, AURA 07-09; SUZ XL-7 07-09 $75.59 $48.99 33-5030 Z2016121201 CHEVROLET COLORADO L4-2.5L F/I; 2015 $79.59 $50.99 57-6014 Z2015070901 FIPK; NISSAN PATHFINDER, V6-4.0L; 2005 $564.99 $311.99 57-9015-1 K57-9015-1 FIPK; TOYOTA TACOMA/4RUNNER, V6-3.4L; 99-04 $485.99 $267.99 59-2000 59-2000 2-3/4"FLG 4.5X7 2"HI MARINE $88.39 $65.99 59-2040 59-2040 2-3/4"FLG MARINE 4"H $71.39 $52.99 59-2040RK 59-2040RK 2-3/4"FLG, MARINE RACING BLACK - RACE SPECIFIC $70.09 $51.99 59-2042RK 59-2042RK 2-3/4" FLG MARINE 2-1/2"H - RACE SPECIFIC $72.79 $53.99 59-2046 59-2046 2-3/4"FLG; 3-1/2"OD-T, 2-3/4"H FLAME ARRESTOR $68.79 $50.99 62-1000 62-0100 3/8 VENT 2"D, 1-1/2"H STEEL BASE $29.29 $0.00 62-1010 62-0101 1/2 VENT 2 D 1-1/2H STEEL BASE $29.29 $0.00 62-1030 62-0103 3/4 VENT 2 D 1-1/2H STEEL BASE $29.29 $0.00 62-1050 62-0105 1/2 VENT 3 D 2 H STEEL BASE $34.19 $0.00 62-1100 62-0110 1/2"OD VENT, 2"OD, 1-1/2"H STUD MOUNT $30.59 $0.00 62-1110 62-0111 5/8"OD VENT, 2"OD, 1-1/2"H STUD MOUNT $39.29 $24.99 62-1120 62-0112 3/4"OD VENT, 2"OD, 1-1/2"H STUD MOUNT $39.19 $24.99 62-1130 62-0113 1"OD VENT, 2"OD, 1-1/2"H STUD MOUNT $38.99 $24.99 62-1330 62-0133 1/2"FLG,2"D,1-1/2"H VENT $29.29 $0.00 62-1340 62-0134 5/8"ID VENT,2"D,1.5"H,CLAMP-ON -

Daihatsu Resmikan R&D Center Dan Pencapaian Produksi 5

April 2017 Tahun XLVII Tahun April 2017 Edisi 04 Edisi EKSKLUSIF RUPST ASTRA: BAGI DIVIDEN TUNAI RP 6,8 TRILIUN HUMAN CAPITAL BUILDING HR DIGITAL STRATEGY DAIHATSU RESMIKAN R&D CENTER DAN PENCAPAIAN PRODUKSI 5 JUTA UNIT DAFTAR ISI SENARAI Daihatsu Resmikan R&D Center dan Pencapaian Produksi 5 Juta Unit Edisi 04 | April 2017 Tahun XLVII Komitmen PT Astra Daihatsu Motor (ADM) untuk terus 18 mengembangkan potensi industri otomotif Indonesia diwujudkan melalui peresmian R&D Center New Astra Daihatsu ADM yang bertempat di Kawasan Ayla Resmi 03 Industri Karawang. Diluncurkan Tidak hanya itu saja. ADM juga berhasil mencapai angka produksi 5 juta unit yang tentunya sangat membanggakan untuk seluruh Insan Astra. RUPST Astra: Bagi Dividen Tunai Rp 6,8 Triliun 22 HUMAN CAPITAL Building HR Digital Strategy 40 PROFIL KARYAWAN EVP Human Capital & Facilities Management Asuransi Astra Tri Rahayu Andayani 42 RELASI Safari Jurnalistik Perdana 2017 di Yogyakarta 44 INSPIRASI Wariskan Budaya, Majukan Pendidikan 45 PROFIL PERUSAHAAN PT Komatsu Astra Finance 46 SOLUSI Never Too Late to Innovate 47 SERBA SERBI YAYASAN Gathering Instruktur YDBA 48 LINGSOS Wujudkan Kampung Berseri di 34 Provinsi, Astra Resmikan KBA Tarakan 52 DARI REDAKSI EDITORIAL PT Astra Daihatsu Motor (ADM) mendorong kemampuan rancang bangun otomotif anak bangsa melalui fasilitas Penasihat Prijono Sugiarto Pemimpin Umum R&D Center, sebagai upaya Pongki Pamungkas Penanggung Jawab membangun potensi bangsa dan & Pemimpin Redaksi Yulian Warman Wakil Pemimpin Redaksi mengembangkan kompetensi Boy Kelana Soebroto Redaktur Eksekutif Wisnu Wijaya pemuda-pemudi di tanah air. Redaktur Pelaksana Regina Panontongan, Elmeirillia Lonna, Deddy Pradityo Opficon Staf Redaksi Reyhan Valiant, Elyana Kulsum, Ruth Davina, Pada edisi kali ini, rubrik Utama rubrik Lingsos, telah dirangkum M. -

PT ASTRA INTERNATIONAL TBK Full Year 2018

PT ASTRA INTERNATIONAL TBK Full Year 2018 - Results Presentation Disclaimer The materials in this presentation have been prepared by PT Astra International Tbk (Astra) and are general background information about Astra Group business performances current as at the date of this presentation and are subject to change without prior notice. This information is given in summary form and does not purport to be complete. Information in this presentation, including forecast financial information, should not be considered as advice or a recommendation to investors or potential investors in relation to holding, purchasing or selling securities or other financial products or instruments and does not take into account their particular investment objectives, financial situation or needs. Before acting on any information, readers should consider the appropriateness of the information having regard to these matters, any relevant offer document and in particular, readers should seek independent financial advice. This presentation may contain forward looking statements including statements regarding our intent, belief or current expectations with respect to Astra businesses and operations, market conditions, results of operation and financial condition, capital adequacy, specific provisions and risk management practices. Readers are cautioned not to place undue reliance on these forward looking statements; past performance is not a reliable indication of future performance. Astra does not undertake any obligation to publicly release the result of any -

Pt Astra International

PT ASTRA INTERNATIONAL TBK PUBLIC EXPOSE First Half of 2017 - Results Presentation 9 August 2017, Indonesia Stock Exchange Disclaimer The materials in this presentation have been prepared by PT Astra International Tbk (Astra) and are general background information about Astra Group business performances current as at the date of this presentation and are subject to change without prior notice. This information is given in summary form and does not purport to be complete. Information in this presentation, including forecast financial information, should not be considered as advice or a recommendation to investors or potential investors in relation to holding, purchasing or selling securities or other financial products or instruments and does not take into account their particular investment objectives, financial situation or needs. Before acting on any information, readers should consider the appropriateness of the information having regard to these matters, any relevant offer document and in particular, readers should seek independent financial advice. This presentation may contain forward looking statements including statements regarding our intent, belief or current expectations with respect to Astra businesses and operations, market conditions, results of operation and financial condition, capital adequacy, specific provisions and risk management practices. Readers are cautioned not to place undue reliance on these forward looking statements; past performance is not a reliable indication of future performance. Astra does not undertake -

More Tsunami- Warning Buoys to Be Deployed

AV Front Eye Volume 15 Issue 4 News Desk - Tel: 076-236555January 26 - February 1, 2008 Daily news at www.phuketgazette.net 25 Baht The Gazette is published in association with Chalong More tsunami- Circle under IN THIS ISSUE warning buoys NEWS: Cow meat cremated; threat Beach vendors grilled for cooking; Aiming for Marine By Sompratch Saowakhon tourism. Pages 2 & 3 CHALONG: Motorists in the INSIDE STORY: Too many to be deployed southern end of the island may tuk-tuks makes traveling tire- soon be missing their favorite some. Pages 4-6 By Natcha Yuttaworawit landmark as the provincial high- AROUND THE NATION: No clo- ways office is considering re- sure in War on Drugs probe. PHUKET CITY: The National moving Chalong Circle and in- Page 7 Disaster Warning Center stalling traffic lights in its place. (NDWC) has received 165 mil- Saroj Suwinchai, director of AROUND THE REGION: Infa- lion baht from the central gov- the provincial office of the High- mous expat freed. Page 8 ernment to install two more tsu- ways Department, told the Ga- AROUND THE SOUTH: Five nami-warning buoys in the zette that the idea behind the pro- years of Southern insurgency. Andaman Sea. posal is to relieve traffic conges- Page 9 They are to be installed by tion at the junction. the middle of this year, NDWC “Our plan is to remove the AROUND THE ISLAND: Coco- Director Dr Smith Dharmasaroja roundabout and install traffic nut Island a blast from the told a conference in Phuket City lights on the four main roads at past. -

AI Business Update 2017

PT ASTRA INTERNATIONAL TBK Full Year 2017 - Results Presentation Disclaimer The materials in this presentation have been prepared by PT Astra International Tbk (Astra) and are general background information about Astra Group business performances current as at the date of this presentation and are subject to change without prior notice. This information is given in summary form and does not purport to be complete. Information in this presentation, including forecast financial information, should not be considered as advice or a recommendation to investors or potential investors in relation to holding, purchasing or selling securities or other financial products or instruments and does not take into account their particular investment objectives, financial situation or needs. Before acting on any information, readers should consider the appropriateness of the information having regard to these matters, any relevant offer document and in particular, readers should seek independent financial advice. This presentation may contain forward looking statements including statements regarding our intent, belief or current expectations with respect to Astra businesses and operations, market conditions, results of operation and financial condition, capital adequacy, specific provisions and risk management practices. Readers are cautioned not to place undue reliance on these forward looking statements; past performance is not a reliable indication of future performance. Astra does not undertake any obligation to publicly release the result of any revisions -

Manual Taller Honda Sh125i

Manual Taller Honda Sh125i Honda SH 125 SES FES 125 Repair Manual Haynes. Honda cargo '00 a '02 - manual de taller, Manual de usuario Honda Elite 125. manual de taller honda dylan 125 gratis 125 dylan honda schemat honda 200 cd 175 honda new honda ex5 110 honda nx 750 honda cb 750 honda sh 125 i. Manual de taller de la motocicleta Honda Sh125 y SH150. Contiene información sobre la motocicleta, mantenimiento y reparación. Está escrito en italiano. You can find out more about the Honda product you're interested by looking at a brochure. honda sh 125i 2007 service manual free For better download results try avoiding words like esdocs.com/doc/391038/manual-despiece-honda-sh-125i. Meeting report training fistula management · Manual honda cbr 900 rr Manual de usuario del registro nacional de bases de datos · Manual de taller citroen. Manual Taller Honda Sh125i Read/Download honda dylan manual propietario honda dylan 125 manual taller honda dylan 125 pdf honda trx 450 honda 70 cub honda cbr 929 honda sh 125 i honda vf 700. Registro Talleres. ERES TALLER? REGÍSTRATE. Si eres un taller profesional de reparaciones o tienda física u online de venta, Honda SH 125i Scoopy. manual de taller honda dylan 125 gratis honda dylan manual manual honda dylan 75 08 honda trx 250 honda sh 125 i cd 175 honda honda atv 420 fm 4x4. Virago 250 lo he hecho siguiendo las indicaciones del manual oficial de taller de Yamaha. your products, you can visit this site that delivers many manual honda HONDA SH 125 WORKSHOP MANUAL Honda CB 1000 C. -

Honda Sh 300I Service Manual Pdf

Honda Sh 300i Service Manual Pdf On this page you can download PDF book Honda Sh300i Abs Service Manual for free without registration. Articles tagged with 'Honda-sh-125i-service-manual-pdf' at Service Parts And Raised honda xlr 250 manual pdfALI PROJECT Gothic Opera honda sh 300. 2002-2009 honda crf450r crf450x service manual - kindle edition.2010 honda sh150i service manual pdf / the minter teamHonda sh 300 i 13 rear yss eco. HONDA CBR 125 R SERVICE MANUAL. Last update : 2015-09-22 / Format : PDF. HONDA SH 300 SERVICE MANUAL. Last update : 2015-10-02 / Format :. HONDA SH 300I SERVICE MANUAL Are you looking for Honda Sh 300i Service Manual document in pdf file This is the best place where you can get the honda. silverwing 400 service manual and add just a couple of clarification words Last update : 2015-09-14 / Format : PDF HONDA SH 300 SERVICE MANUAL. Honda Sh 300i Service Manual Pdf Read/Download Free PDF: HondaSh300ServiceManual Pdf. Free PDF: Honda Sh300 Workshop ManualHonda Italia Industriale S.p.A. 2007. OWNER'S MANUAL. Honda. manual honda lead 100 and add just a couple clarification words - more Last update : 2015-09-18 / Format : PDF HONDA SH 300 SERVICE MANUAL. honda sh150i top speed honda sh150i scooter honda sh300i honda sh150i for sale. Last update : 2015-09-10 / Format : PDF. HONDA 2007 HONDA RINCON 680 SERVICE MANUAL HONDA ATV HONDA SH 300 SERVICE MANUAL. your respective honda crm 125 service manual and add only a few Last update : 2015-09-06 / Format : PDF. HONDA HONDA SH 300 SERVICE MANUAL. -

PT Astra International Tbk Full Year 2015 - Results Presentation Disclaimer

PT Astra International Tbk Full Year 2015 - Results Presentation Disclaimer This report has been prepared by PT Astra International Tbk independently and is circulated for the purpose of general information only. It is not intended for the specific person who may receive this report. The information in this report has been obtained from sources which we deem reliable. No warranty (expressed or implied) is made as to the accuracy or completeness of the information. All opinions and estimations included in this report constitute our judgment as of this date and are subject to change without prior notice. We disclaim any responsibility or liability whatsoever arising which may be brought or suffered by any person as a result of acting in reliance upon the whole or any part of the contents of this report and neither PT Astra International Tbk and/or its affiliated companies and/or their respective employees and/or agents accepts liability for any errors, omissions, negligent or otherwise, in this report and any inaccuracy herein or omission here from which might otherwise arise. Cautionary note on forward-looking statements: This report may contain statements regarding the business of PT Astra International Tbk and its subsidiaries that are of a forward-looking nature and are therefore based on management's assumptions about future developments. Forward-looking statements involve certain risks and uncertainties because they relate to future events. Actual results may vary materially from those targeted, expected or projected due to several factors. Potential risks and uncertainties includes such factors as general economic conditions, foreign exchange fluctuations, interest rate changes, commodity price fluctuations and regulatory developments. -

Mixed Reviews for Evacuation Drill

Volume 12 Issue 19 News Desk - Tel: 076-236555 May 7 - 13, 2005 Daily news at www.phuketgazette.net 20 Baht The Gazette is published in association with High anxiety Mixed reviews for as Dulwich talks come IN THIS ISSUE evacuation drill to a close NEWS: Phuket City mayor ducks dismissal debate; La- By Gazette Staff bor Office aims for faster By Anongnat Sartpisut work permits. Pages 2 & 3 & Stephen Fein PHUKET: Teachers and parents of students at Dulwich Interna- INSIDE STORY: Continuing the PATONG: The evacuation drill tional College (DIC) were wait- account of Patong’s first of the southern half of Patong ing anxiously as the Gazette went evacuation drill. Pages 4 & 5 Beach on Friday, April 29 re- to press to learn the outcome of AROUND THE ISLAND: Love on ceived mixed reviews, from both a May 3 meeting of the board of the lagoon, not the rocks, at tourists and the many govern- Dulwich College in London Laguna. Page 6 ment officials who attended. (DCL) which could decide, af- Arriving by helicopter ter weeks of intense negotiations, AROUND THE REGION: Getting shortly after 10 am, Prime Min- whether DIC is allowed to keep the picture in Khao Lak. ister Thaksin Shinawatra met a the “Dulwich” in its name. Page 8 crowd of some 2,000 volunteer Negotiating on behalf of PHUKET PEOPLE: Lisa Loud: evacuees, many of them chil- DCL in talks in Phuket and superstar DJ. Here we go! dren, wearing T-shirts made spe- Bangkok was Ralph Mainard, Pages 10 & 11 cially for the event. -

BAB II GAMBARAN UMUM PT. ASTRA MOTOR SILIWANGI Pada Bab Ini Berisi Tentang Gambaran Umum Tentang PT Astra Selaku Main Dealer

BAB II GAMBARAN UMUM PT. ASTRA MOTOR SILIWANGI Pada Bab ini berisi tentang gambaran umum tentang PT Astra selaku main dealer dan sekilas gambaran umum PT Astra Motor Siliwangi yang terdiri dari sejarah dan perkembangan perusahaan, visi, misi, lokasi perusahaan, bidang usaha, struktur perusahaan, sumber daya manusia, serta pembeli pengguna Honda Supra X 125 CW (Cast Wheel). Dengan adanya gambaran secara umum dari PT Astra dan Astra Motor Siliwangi ini kita dapat mengetahui arti perusahaan tersebut. Adapun data yang dihimpun adalah berdasarkan company profile dari Astra Motor dan PT Astra Motor Siliwangi. 2.1 Sejarah dan Perkembangan Astra PT Astra International Inc didirikan pada tanggal 20 Febuari 1957 oleh pengusaha bernama Drs. Tjia Kian Tie dan William Soerjadjaya yang pada awalnya sebua perusahaan kecil yang bergerak pada bidang pertanian. Pada tanggal 11 Juni 1957 didirikan anak perusahaan Astra yang bernama PT Astra International Honda Sales Operation (HSO). Nama Astra berasa dari nama seorang putri dewi matahari yang merupakan dewi terakhir yang menarik diri ke Angkasa dan bersinar sebagai bintang virgo dengan memiliki nama Astrea atau Astra. Para pendiri perusahaan berharap dengan memilih nama ini maka perusahaan akan langsung dalam cita-cita dan mempunyai proyek yang cerah di masa yang akan datang. 49 50 PT Astra International Honda Sales Operation (HSO) bertempat di Jalan Yos Sudarso Sunter 1 Jakarta Utara 14350. Sejalan dengan perkembangan bisnis dari masa ke masa, PT Astra International Honda Sales Operation (HSO) membuka main dealer sebagai distributor di berbagai area di Indonesia diantaranya : 1. Sumatra Selatan 2. Jakarta 3. Jawa Tengah 4. Yogyakarta 5. Bali 6. Bengkulu 7. -

1 BAB I PENDAHULUAN 1.1 Latar Belakang Masalah Tingkat

BAB I PENDAHULUAN 1.1 Latar Belakang Masalah Tingkat persaingan dunia usaha di Indonesia sangat ketat, karena setiap perusahaan senantiasa berusaha untuk dapat meningkatkan pangsa pasar dan meraih konsumen baru.Perusahaan harus dapat menentukan strategi pemasaran yang tepat agar usahanya dapat bertahan dan memenangi persaingan, sehingga tujuan dari perusahaan tersebut dapat tercapai.Pada dasarnya semakin banyak pesaing maka semakin banyak pula pilihan bagi pelanggan untuk dapat memilih produk yang sesuai dengan harapannya.Sehingga konsekuensi dari perubahan tersebut adalah pelanggan menjadi lebih cermat dan pintar menghadapi setiap produk yang diluncurkan. David W Cravens (1996, dalam Novandri 2010) mengemukakan bahwa dalam proses penyampaian produk kepada pelanggan dan untuk mencapai tujuan perusahaan yang berupa penjualan produk yang optimal, maka kegiatan pemasaran dijadikan tolak ukur oleh setiap perusahaan. Sebelum meluncurkan produknya perusahaan harus mampu melihat atau mengetahui apa yang dibutuhkan oleh konsumen. Jika seorang pemasar mampu mengidentifikasi kebutuhan konsumen dengan baik, mengembangkan produk berkualitas, menetapkan harga, serta mempromosikan produk secara efektif, maka produk–produknya akan laris dipasaran”. Sehingga sudah sewajarnya jika segala kegiatan perusahaan harus selalu dicurahkan untuk memenuhi kebutuhan konsumen dan kemudian konsumen akan memutuskan membeli 1 2 produk tersebut. Dan pada akhirnya tujuan perusahaan yaitu memperoleh laba akan tercapai. Kebutuhan masyarakat akan sarana transportasi pada