Q2 2012 Nexon Investor Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sistematización De Un Nuevo Paradigma Ontológico Del Videojuego: El Formativismo

UNIVERSIDAD DE SEVILLA DPTO. COMUNICACIÓN AUDIOVISUAL Y PUBLICIDAD TESIS DOCTORAL SISTEMATIZACIÓN DE UN NUEVO PARADIGMA ONTOLÓGICO DEL VIDEOJUEGO: EL FORMATIVISMO Juan José Vargas Iglesias Sevilla, 2015 SISTEMATIZACIÓN DE UN NUEVO PARADIGMA ONTOLÓGICO DEL VIDEOJUEGO: EL FORMATIVISMO 2 TESIS DOCTORAL Presentada por Juan José Vargas Iglesias bajo la dirección del Prof. Dr. D. Luis Navarrete Cardero SISTEMATIZACIÓN DE UN NUEVO PARADIGMA ONTOLÓGICO DEL VIDEOJUEGO: EL FORMATIVISMO Vº Bº del Director de la Tesis, Prof. Dr. D. Luis Navarrete Cardero Sevilla, a 13 de octubre de 2015 3 A mis padres. 4 Uno podría aventurar la afirmación de que una histeria es una caricatura de una creación artística; una neurosis obsesiva, de una religión; y un delirio paranoico, de un sistema filosófico. Sigmund Freud, Totem y tabú Mientras Dios juega viene a ser mundo. Martin Heidegger, La proposición del fundamento 5 Agradecimientos Agradezco, en primer lugar, a Luis por aceptar la dirección de esta tesis, por su genero- sidad, por su compromiso irreductible y por concederme el privilegio de su amistad. A mis alumnos y alumnas, porque no pasa un día sin que me enseñen algo nuevo. A mis compañeros y compañeras del Departamento, y a quienes componen y han com- puesto el Aula de Videojuegos. A Mario, por las conversaciones inagotables en la cumbre intemporal de las Abstrac- ciones, por su galvanizante entusiasmo y su brillantez inspiradora. A Alejandra, por ser capaz de redimirme con una sonrisa. Por cambiar el mundo en que vivía. Por su paciencia sin límites. Por ser Ella. A Sofi, por las horas y horas dedicadas a completar aventuras gráficas de todo pelaje cuando éramos niños. -

UNO Template

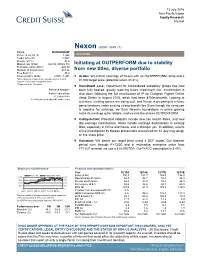

13 July 2016 Asia Pacific/Japan Equity Research Internet Nexon (3659 / 3659 JT) Rating OUTPERFORM* Price (12 Jul 16, ¥) 1,444 INITIATION Target price (¥) 1,900¹ Chg to TP (%) 31.6 Market cap. (¥ bn) 629.93 (US$ 6.10) Initiating at OUTPERFORM due to stability Enterprise value (¥ bn) 440.12 Number of shares (mn) 436.24 from new titles, diverse portfolio Free float (%) 35.0 52-week price range 2,065 - 1,401 ■ Action: We initiate coverage of Nexon with an OUTPERFORM rating and a *Stock ratings are relative to the coverage universe in each ¥1,900 target price (potential return 31.6%). analyst's or each team's respective sector. ¹Target price is for 12 months. ■ Investment case: Impairment for consolidated subsidiary gloops has now Research Analysts been fully booked, greatly reducing future impairment risk. Amortization is Keiichi Yoneshima also down following the full amortization of IP for Dungeon Fighter Online 81 3 4550 9740 (Arad Senki) in August 2015, which had been ¥700mn/month. Looking at [email protected] revenues, existing games are doing well, and Nexon is preparing to release game iterations under existing strong brand titles. Even though the rising yen is negative for earnings, we think Nexon’s foundations in online gaming make its earnings quite reliable, and we rate the shares OUTPERFORM. ■ Catalysts/risk: Potential catalysts include new title launch dates, and new title earnings contributions. Risks include earnings deterioration in existing titles, especially in China and Korea, and a stronger yen. In addition, results of the investigation by Korean prosecutors announced on 12 July may weigh on the share price. -

EA SPORTSTM FIFA Online 3 M Tops 3 Million Downloads in Korea

June 20, 2014 EA SPORTSTM FIFA Online 3 M Tops 3 Million Downloads in Korea Mobile app fully synced with PC-based FIFA Online 3 continues to gain popularity TOKYO – June 20, 2014 – NEXON Co., Ltd. (“Nexon”) (3659.TO), a worldwide leader in free- to-play online games, today announced that EA SPORTSTM FIFA Online 3 M, developed by EA Seoul Studio (Electronic Arts Seoul Studio LLC) and published by Nexon’s wholly-owned subsidiary, NEXON Korea Corporation, surpassed 3 million downloads in Korea on June 17th. FIFA Online 3 M is the latest instalment of the world’s bestselling sports videogame franchise, EA SPORTSTM FIFA. FIFA Online 3 M was launched on March 27, 2014 on the Naver App Store and later launched on Google Play on May 29th. Fully synced with its PC counterpart, FIFA Online 3 M offers players functional team management in a high-quality graphic mobile environment using team and player data, in- game points and other data saved on players’ PC game version. The game also features exclusive mobile-only content to further enhance players’ mobile experience. EA SPORTSTM FIFA Online 3 M EA SPORTS and the EA SPORTS logo are trademarks of Electronic Arts Inc. Official FIFA licensed product. © The FIFA name and OLP Logo are copyright or trademark protected by FIFA. All rights reserved. Manufactured under license by Electronic Arts Inc. The use of real player names and likenesses is authorized by FIFPro Commercial Enterprises BV. About NEXON Co., Ltd. http://company.nexon.co.jp/ NEXON Co., Ltd. (“Nexon”) (3659.TO) is a worldwide leader in free-to-play online games. -

EA SPORTS FIFA Online 3 Comes to China

July 24, 2013 EA SPORTS FIFA Online 3 Comes to China Tencent Games and EA Announce Publishing Agreement SHANGHAI--(BUSINESS WIRE)-- EA SPORTS™FIFA Online 3, the new PC online soccer game from the world's most popular sports videogame franchise, is coming to Chinese gamers and soccer fans. Tencent Games, under Tencent Group as the leading internet service provider in China, and Electronic Arts Inc. (NASDAQ: EA), a global leader in digital interactive entertainment, today announced an agreement through which FIFA Online 3 will be published in mainland China by Tencent Games. The first testing is expected to begin in the fourth quarter of calendar 2013. FIFA Online 3, with the exclusive license from FIFA, delivers the best technologies and all the realism and authenticity of the world's best-selling sports game franchise from EA. Players will experience improved gameplay and strategies, enhanced graphics, the latest rosters, and extensive use of official licenses, including close to 15,000 real world players from 30 leagues and 40 national teams. The game adds new techniques and features, improved artificial intelligence, enhanced animation and dynamic 5-on-5 multiplayer competition. The game is developed by EA Seoul Studio. EA SPORTS FIFA Online 3 holds the number 2 spot in Korean PC café rankings according to Gametrics. The game will also operate in Thailand and Vietnam. Steven Ma, Vice President of Tencent, said, "Tencent Games' agreement with EA is a cooperation between the leading online game company in China and the world's top sports game developer and franchise. The launch of FIFA Online 3 will provide strong momentum for the development of e-sports in China and create a true ‘virtual world of sports' for all Chinese users." Steven Ma also said, "The partnership with EA is an important milestone in Tencent Games' strategy of internationalization. -

ELECTRONIC ARTS INC. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-Q þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Quarterly Period Ended September 30, 2018 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from to Commission File No. 000-17948 ELECTRONIC ARTS INC. (Exact name of registrant as specified in its charter) Delaware 94-2838567 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 209 Redwood Shores Parkway Redwood City, California 94065 (Address of principal executive offices) (Zip Code) (650) 628-1500 (Registrant’s telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES þ NO ¨ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. -

First Quarter Fiscal 2012 Results

May 10, 2012 Dear Fellow Shareholders: Today, we are very happy to share with you our strong first quarter results. NEXON Co., Ltd. (“Nexon”) delivered record revenue, operating income and net income, and these results come on the back of a very strong 2011. Nexon’s solid performance in Q1 underscores yet again that our unique free-to-play business model and focus on immersive online games together are a robust engine for growth and profitability at scale. We experienced growth across all of our key financial metrics, which we will discuss in more detail below. Our performance in China was particularly robust during the quarter, and Korea delivered very strong growth as well. Performance in North America suffered as a result of certain operational challenges from Q4 that continued in Q1. Overall, our performance exceeded our revised guidance for the first quarter. As we mentioned in our previous shareholder letter, our approach to financial reporting is different from many public companies. Each quarter, we post a shareholder letter like this one, along with our financial statements, on our website at http://ir.nexon.co.jp/en/. We host a question-and-answer conference call the same day with our management team, on which we answer as many questions as we have time for. We ask that interested analysts and investors please submit questions for management prior to the earnings conference call via the following email address: [email protected]. We believe this approach ensures that we are providing the information shareholders want in order to gain a deeper understanding of our business. -

ELECTRONIC ARTS Q3 FY14 PREPARED COMMENTS January 28, 2014

ELECTRONIC ARTS Q3 FY14 PREPARED COMMENTS January 28, 2014 ROB: Thank you. Welcome to EA’s fiscal 2014 third quarter earnings call. With me on the call today are Andrew Wilson, our CEO, and Blake Jorgensen, our CFO. Peter Moore, our COO, and Patrick Söderlund, our EVP of EA Studios, will be joining us for the Q&A portion of the call. Please note that our SEC filings and our earnings release are available at ir.ea.com. In addition, we have posted earnings slides to accompany our prepared remarks. Lastly, after the call, we will post our prepared remarks, an audio replay of this call, and a transcript. This presentation and our comments include forward-looking statements regarding future events and the future financial performance of the Company. Actual events and results may differ materially from our expectations. We refer you to our most recent Form 10-Q for a discussion of risks that could cause actual results to differ materially from those discussed today. Electronic Arts makes these statements as of January 28, 2014 and disclaims any duty to update them. During this call unless otherwise stated, the financial metrics will be presented on a non-GAAP basis. Our earnings release and the earnings slides provide a reconciliation of our GAAP to non-GAAP measures. These non-GAAP measures are not intended to be considered in isolation from, as a substitute for, or superior to our GAAP results. We encourage investors to consider all measures before making an investment decision. All comparisons made in the course of this call are against the same period in the prior year unless otherwise stated. -

Electronic Arts Reports Q2 Fy11 Financial Results

ELECTRONIC ARTS REPORTS Q2 FY11 FINANCIAL RESULTS Reports Q2 Non-GAAP Revenue and EPS Ahead of Expectations Reaffirms Full-Year Non-GAAP EPS and Net Revenue Guidance FIFA 11 Scores With 8.0 Million Units Sold In Need For Speed Hot Pursuit with Autolog, Ships November 16 REDWOOD CITY, CA – November 2, 2010 – Electronic Arts Inc. (NASDAQ: ERTS) today announced preliminary financial results for its second fiscal quarter ended September 30, 2010. “We had another strong quarter, beating expectations both top and bottom line,” said John Riccitiello, Chief Executive Officer. “We credit our results to blockbusters like FIFA 11 and to innovative digital offerings like The Sims 3 Ambitions and Madden NFL 11 on the iPad.” “EA reaffirms its FY11 non-GAAP guidance,” said Eric Brown, Chief Financial Officer. “EA is the world’s #1 publisher calendar year-to-date and our portfolio is focused on high- growth platforms -- high definition consoles, PC, and mobile.” Selected Quarterly Operating Highlights and Metrics: EA is the #1 publisher on high-definition consoles with 25% segment share calendar year-to date, two points higher than the same period a year ago. In North America and Europe, the high-definition console software market is growing strongly with the combined PlayStation®3 and Xbox 360® segments up 23% calendar year-to-date. The PlayStation 3 software market is up 36% calendar year-to-date. EA is the #1 PC publisher with 27% segment share at retail calendar year-to-date and strong growth in digital downloads of full-game software. For the quarter, EA had six of the top 20 selling games in Western markets with FIFA 11, Madden NFL 11, NCAA® Football 11, NHL®11, Battlefield: Bad Company™ 2 and FIFA 10. -

Electronic Arts, Inc. (EA) Q3 2014 Earnings Call

Electronic Arts, Inc. EA Q3 2014 Earnings Call Jan. 28, 2014 Company▲ Ticker▲ Event Type▲ Date▲ PARTICIPANTS Corporate Participants Rob Sison – Vice President-Investor Relations, Electronic Arts, Inc. Andrew Wilson – Chief Executive Officer & Director, Electronic Arts, Inc. Blake J. Jorgensen – Chief Financial Officer & Executive Vice President, Electronic Arts, Inc. Peter Robert Moore – Chief Operating Officer, Electronic Arts, Inc. Patrick Söderlund – Executive Vice President-EA Games Label, Electronic Arts, Inc. Other Participants Colin A. Sebastian – Analyst, Robert W. Baird & Co. Equity Capital Markets Edward S. Williams – Analyst, BMO Capital Markets (United States) Doug L. Creutz – Analyst, Cowen & Co. LLC Arvind Bhatia – Analyst, Sterne, Agee & Leach, Inc. Michael J. Olson – Analyst, Piper Jaffray, Inc. James L. Hardiman – Analyst, Longbow Research LLC Brian J. Pitz – Analyst, Jefferies LLC Drew E. Crum – Analyst, Stifel, Nicolaus & Co., Inc. Stephen D. Ju – Analyst, Credit Suisse Securities (USA) LLC (Broker) Ryan Gee – Analyst, Bank of America Merrill Lynch Mike Hickey – Analyst, The Benchmark Co. LLC Ben Schachter – Analyst, Macquarie Capital (USA), Inc. Neil A. Doshi – Analyst, CRT Capital Group LLC MANAGEMENT DISCUSSION SECTION Operator: Welcome, and thank you for standing by. At this time, all participants are in a listen-only mode. [Operator Instructions] Today’s conference is being recorded. If you have any objections, you may disconnect at this time. Now, I’ll turn the meeting over to Mr. Rob Sison, Vice President of Investor Relations. You may begin. Rob Sison, Vice President-Investor Relations Thank you. Welcome to EA’s Fiscal 2014 Third Quarter Earnings Call. With me on the call today are Andrew Wilson, our CEO; and Blake Jorgensen, our CFO. -

Sports Newsletter

APEC Sports Newsletter 04 March 2018 ISSUE Digital Economy X Esports Foreword / 02 APEC Economies' Policies / 03 -Overview of Current Esports Policies in Different Economies / 03 -Introduction of the Development of esports in the Republic of Korea; Malaysia; and the Netherlands / 06 Perspectives on Regional Sports Issues / 21 -Anticipation and Excitement at the 2018 Taipei Game Show / 21 -The 2018 IeSF ESports World Championship Will Take Place in Kaohsiung / 25 -Countdown to Jakarta Palembang 2018 – the 18th Asian Games / 29 -Korfball aims for the 2023 Southeast Asian Games in Cambodia / 32 -An Assembly of Olympians - The Establishment of the Chinese Taipei Olympians Association / 34 ASPN Related Events / 36 APEC Economies' Perspectives on ASPN Related Foreword Policies Regional Sports Issues Events Foreword APEC's theme for 2018 is "Harnessing Inclusive Opportunities, Embracing the Digital Future." The digital economy is an essential aspect of APEC's trade and investment facilitation action plans to promote the growth of interregional productivity, foster innovation and structural reforms, encourage the economic participation of small and medium enterprises (SME) and vulnerable groups, and support human resources development in the region. The rise of the digital economy has had a tremendous impact on all walks of life. It is a key force driving global economic development and has transformed economic and social activities and work behaviors of individuals and entire societies. Thus, the various member economies of APEC must guide and assist their citizens in preparing for this changing work environment and developing the skills necessary to meet the needs of the digital market. In recent years, the esports trend has swept the world to become a digital industry with great economic potential. -

Investor Presentation Q2 2014 August 14, 2014

Investor Presentation Q2 2014 August 14, 2014 NEXON Co., Ltd. © 2014 NEXON Co., Ltd. All Rights Reserved. Owen Mahoney President and Chief Executive Officer 2 © 2014 NEXON Co., Ltd. All Rights Reserved. 1H 2014 Financial Results (Unit: ¥ billions) Revenue Operating Income Net Income1 84.4 81.0 34.1 31.1 26.5 20.2 1H 2013 1H 2014 1H 2013 1H 2014 1H 2013 1H 2014 1 Net Income refers to net income attributable to owners of the parent company, as stated in Nexon’s consolidated financial results. 3 © 2014 NEXON Co., Ltd. All Rights Reserved. Core Strategic Theme: Focus Products: . New games: Laser-like focus on quality. Pare down development and pipeline to games that really matter – those that are fun and differentiated . Live games: Focus on long-term growth and player retention People: . Demand a commitment to highest standard of game development and operations. Set and adhere to a clear mission and goals Partners: . Be highly selective and work only with the best. Partner with developers who are as dedicated to online game quality as we are 4 © 2014 NEXON Co., Ltd. All Rights Reserved. Legion of Heroes: Trailer 5 © 2014 NEXON Co., Ltd. All Rights Reserved. Legion of Heroes: Strong and Consistent Metrics DAU Trend Since Launch 014/02/14 2014/03/14 2014/04/14 2014/05/14 2014/06/14 2014/07/14 1 Above graph illustrates DAU trend excluding impact from Kakao version launched at the end of July 6 © 2014 NEXON Co., Ltd. All Rights Reserved. EA SPORTS™ FIFA Online 3 : Trailer 7 © 2014 NEXON Co., Ltd. -

Electronic Arts Reports Q1 Fy14 Financial Results

ELECTRONIC ARTS REPORTS Q1 FY14 FINANCIAL RESULTS Q1 Non-GAAP Net Revenue and EPS Results Exceed Guidance Q1 Non-GAAP Digital Net Revenue Up 17% Versus Prior Year EA Signs Publishing Agreement with TenCent for FIFA Online 3 in China EA Received 116 Awards from Over 220 Industry Nominations at E3 REDWOOD CITY, CA – July 23, 2013 – Electronic Arts Inc. (NASDAQ: EA) today announced preliminary financial results for its first fiscal quarter ended June 30, 2013. “EA had a solid quarter driven by continued digital growth and disciplined cost management,” said Executive Chairman Larry Probst. “We are also executing on a clear set of goals for leadership on mobile, PC, current and next generation consoles.” “EA delivered first quarter EPS above our guidance through a combination of revenue growth, phasing of expenses, and cost control,” said Chief Financial Officer Blake Jorgensen. “We are reaffirming our annual non-GAAP guidance of $4 billion net revenue and $1.20 earnings per share.” This release, along with ongoing updates regarding EA’s business, is available on EA’s blog at http://ea.com/news. Selected Operating Highlights and Metrics: *On a non-GAAP basis EA was the #1 publisher in Western retail markets in calendar year 2013, and the #4 global publisher in the iOS game market in the June quarter. EA received 116 E3 awards from over 220 industry nominations, including 8 out of 15 awards from the official E3 Game Critics. Battlefield 4™ won a total of 21 awards at E3, including GameSpot’s Best of E3 award, Need for Speed™ Rivals was named Best Racing Game, and NHL® 14 took the honors for Best Sports Game.