News Brief 49

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CTBUH Journal

About the Council The Council on Tall Buildings and Urban Habitat, based at the Illinois Institute of Technology in CTBUH Journal Chicago and with a China offi ce at Tongji International Journal on Tall Buildings and Urban Habitat University in Shanghai, is an international not-for-profi t organization supported by architecture, engineering, planning, development, and construction professionals. Founded in 1969, the Council’s mission is to disseminate multi- Tall buildings: design, construction, and operation | 2014 Issue IV disciplinary information on tall buildings and sustainable urban environments, to maximize the international interaction of professionals involved Case Study: One Central Park, Sydney in creating the built environment, and to make the latest knowledge available to professionals in High-Rise Housing: The Singapore Experience a useful form. The Emergence of Asian Supertalls The CTBUH disseminates its fi ndings, and facilitates business exchange, through: the Achieving Six Stars in Sydney publication of books, monographs, proceedings, and reports; the organization of world congresses, Ethical Implications of international, regional, and specialty conferences The Skyscraper Race and workshops; the maintaining of an extensive website and tall building databases of built, under Tall Buildings in Numbers: construction, and proposed buildings; the Unfi nished Projects distribution of a monthly international tall building e-newsletter; the maintaining of an Talking Tall: Ben van Berkel international resource center; the bestowing of annual awards for design and construction excellence and individual lifetime achievement; the management of special task forces/working groups; the hosting of technical forums; and the publication of the CTBUH Journal, a professional journal containing refereed papers written by researchers, scholars, and practicing professionals. -

Presentation Slides

A Developer’s Perspective of Creating a Healthy Community for All Ages Friday, May 7, 2021 Delivering more, through balance 3 Triple Chinachem Group takes tremendous pride in its balanced approach to business. We operate not solely for profit, but with the higher aim of Bottom Line contributing to society. We want to create positive value for our users and customers, the community and the environment, thereby achieving the triple bottom line of benefits to People, Prosperity and Planet. People Prosperity Planet 4 How a triple bottom line works? 5 Sustainability PEOPLE Principles To engage stakeholders and staff, while respecting each other, in contributing to sustainable development as well Derived From as nurturing diversity and a culture of inclusiveness in Triple Bottom communities Line PROSPERITY To deliver products and services that meet the community's current and future needs in a safe, efficient and sustainable manner, and to make our city more liveable and sustainable PLANET To integrate environmental considerations into all aspects of planning, design and operations for minimising resource and energy consumption as well as reducing the environmental impacts "Sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs.” United Nations 1987 Brundtland Commission Report 7 United Nations Sustainable Development Goals The Group makes reference to the United Nations Sustainable Development Goals (SDGs) in developing its short, medium and long-term goals 8 Carbon The Strategic Roadmaps and Sustainability Plan (CCG3038) was developed in 2019 Reduction Target - All business units should provide their roadmaps to achieve the group target of 38% carbon emissions reduction in 2030 as compared with 2015. -

An All-Time Record 97 Buildings of 200 Meters Or Higher Completed In

CTBUH Year in Review: Tall Trends All building data, images and drawings can be found at end of 2014, and Forecasts for 2015 Click on building names to be taken to the Skyscraper Center An All-Time Record 97 Buildings of 200 Meters or Higher Completed in 2014 Report by Daniel Safarik and Antony Wood, CTBUH Research by Marty Carver and Marshall Gerometta, CTBUH 2014 showed further shifts towards Asia, and also surprising developments in building 60 58 14,000 13,549 2014 Completions: 200m+ Buildings by Country functions and structural materials. Note: One tall building 200m+ in height was also completed during 13,000 2014 in these countries: Chile, Kuwait, Malaysia, Singapore, South Korea, 50 Taiwan, United Kingdom, Vietnam 60 58 2014 Completions: 200m+ Buildings by Countr5,00y 0 14,000 60 13,54958 14,000 13,549 2014 Completions: 200m+ Buildings by Country Executive Summary 40 Note: One tall building 200m+ in height was also completed during ) Note: One tall building 200m+ in height was also completed during 13,000 60 58 13,0014,000 2014 in these countries: Chile, Kuwait, Malaysia, Singapore, South Korea, (m 13,549 2014 in these Completions: countries: Chile, Kuwait, 200m+ Malaysia, BuildingsSingapore, South byKorea, C ountry 50 Total Number (Total = 97) 4,000 s 50 Taiwan,Taiwan, United United Kingdom, Kingdom, Vietnam Vietnam Note: One tall building 200m+ in height was also completed during ht er 13,000 Sum of He2014 igin theseht scountries: (Tot alChile, = Kuwait, 23,333 Malaysia, m) Singapore, South Korea, 5,000 mb 30 50 5,000 The Council -

EVERSENDAI CORPORATION BERHAD EVERSENDAI ENGINEERING FZE EVERSENDAI ENGINEERING LLC EVERSENDAI Offshore SDN BHD Plot No

Towering – Powering – Energising – Innovating Moving to New Frontiers MANAGEMENT SYSTEMS EXECUTIVE CHAIRMAN & GROUP MANAGING DIRECTOR’s MESSAGE TAN SRI A.K. NATHAN Moving To New Frontiers The history of Eversendai goes back to 1984 and As we move to new frontiers, we are certain we after three decades of unparalleled experience, will be able to provide our clients the certainty and engineering, technical expertise and a strong network comfort of knowing that their projects are in capable across various countries, we are recognised as a and experienced hands. These developments will leading global organisation in undertaking turnkey complement our vision, mission and core values and contracts; delivering highly complex projects with simultaneously allow us to remain one of the most innovative construction methodologies for high rise successful organisations in the Asian and Middle buildings, power & petrochemical plants as well as Eastern Region and beyond with corresponding composite and reinforced concrete building structures efficiency and reliability. in the Asian and Middle Eastern regions. The successful and timely completion of our projects We have a dedicated workforce of over 10,000 accompanied by soaring innovation, creativity and people and an impressive portfolio of more than 290 our aspiration to move to new frontiers have been the accomplished projects in over 14 different countries key drivers for achieving continuous growth through with 5 steel fabrication factories located in Malaysia, the years and we remain committed to these values. Dubai, Sharjah, Qatar and India, with an annual This stamps our firm intent to dominate the various capacity of 150,000 tonnes. With our state-of-the-art industries which we are involved in and also marks steel fabrication factories, we have constructed some the next phase in our development to be amongst the of the world’s most iconic landmark structures. -

List of World's Tallest Buildings in the World

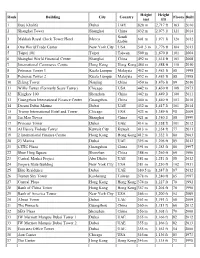

Height Height Rank Building City Country Floors Built (m) (ft) 1 Burj Khalifa Dubai UAE 828 m 2,717 ft 163 2010 2 Shanghai Tower Shanghai China 632 m 2,073 ft 121 2014 Saudi 3 Makkah Royal Clock Tower Hotel Mecca 601 m 1,971 ft 120 2012 Arabia 4 One World Trade Center New York City USA 541.3 m 1,776 ft 104 2013 5 Taipei 101 Taipei Taiwan 509 m 1,670 ft 101 2004 6 Shanghai World Financial Center Shanghai China 492 m 1,614 ft 101 2008 7 International Commerce Centre Hong Kong Hong Kong 484 m 1,588 ft 118 2010 8 Petronas Tower 1 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 8 Petronas Tower 2 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 10 Zifeng Tower Nanjing China 450 m 1,476 ft 89 2010 11 Willis Tower (Formerly Sears Tower) Chicago USA 442 m 1,450 ft 108 1973 12 Kingkey 100 Shenzhen China 442 m 1,449 ft 100 2011 13 Guangzhou International Finance Center Guangzhou China 440 m 1,440 ft 103 2010 14 Dream Dubai Marina Dubai UAE 432 m 1,417 ft 101 2014 15 Trump International Hotel and Tower Chicago USA 423 m 1,389 ft 98 2009 16 Jin Mao Tower Shanghai China 421 m 1,380 ft 88 1999 17 Princess Tower Dubai UAE 414 m 1,358 ft 101 2012 18 Al Hamra Firdous Tower Kuwait City Kuwait 413 m 1,354 ft 77 2011 19 2 International Finance Centre Hong Kong Hong Kong 412 m 1,352 ft 88 2003 20 23 Marina Dubai UAE 395 m 1,296 ft 89 2012 21 CITIC Plaza Guangzhou China 391 m 1,283 ft 80 1997 22 Shun Hing Square Shenzhen China 384 m 1,260 ft 69 1996 23 Central Market Project Abu Dhabi UAE 381 m 1,251 ft 88 2012 24 Empire State Building New York City USA 381 m 1,250 -

Burj Khalifa Tower

Burj Khalifa Tower The tallest structure in the world, standing at 2,722 ft (830 meters), just over 1/2 mile high, Burj Khalifa (Khalifa Tower) opened in 2010 as a centerpiece building in a large-scale, mixed-use development called Downtown Dubai. The building originally referred to as Dubai Tower was renamed in honor of the president of the United Arab Emirates, Khalifa bin Zayed Al Nahyan. Burj Khalifa Dubai, United Arab Emirates Architecture Style Modern Skyscraper | Neo-Futurism Glass, Steel, Aluminum & Reinforced Concrete Prominent Architecture Features Y-Shaped Floor Plan Maximizes Window Perimeter Areas for residential and hotel space Buttressed central core and wing design to support the height of the building 27 setbacks in a spiraling pattern Main Structure 430,000 cubic yards reinforced concrete and 61,000 tons rebar Foundation - 59,000 cubic yards concrete and 192 piles 164 ft (50 m) deep Highly compartmentalized, pressurized refuge floors for life safety Facade Aluminum and textured stainless steel spandrel panels with low-E glass Vertical polished stainless steel fins Observation Deck - 148th Floor PROJECT SUMMARY Project Description Burj Kahlifa, the tallest building in the world, has redefined the possibilities in the design, engineering, and construction of mega-tall buildings. Incorporating periodic setbacks at the ends of each wing, the tower tapers in an upward spiraling pattern that decreases is mass as the height of the tower increases. The building’s design included multiple wind tunnel tests and design adjustments to develop optimum performance relative to wind and natural forces. The building serves as a model for the concept of future, compact, livable, urban centers with direct connections to mass transit systems. -

Reflecting on the Inauguration of the Burj Khalifa, Dubai 2010

ctbuh.org/papers Title: Reflecting on the Inauguration of the Burj Khalifa, Dubai 2010 Author: Pierre Marcout, President & Artistic Director, Prisme Entertainment Subjects: Building Case Study History, Theory & Criticism Keywords: Community Height Megatall Publication Date: 2015 Original Publication: The Middle East: A Selection of Written Works on Iconic Towers and Global Place-Making Paper Type: 1. Book chapter/Part chapter 2. Journal paper 3. Conference proceeding 4. Unpublished conference paper 5. Magazine article 6. Unpublished © Council on Tall Buildings and Urban Habitat / Pierre Marcout Reflecting on the Inauguration of the Burj Khalifa, Dubai 2010 Pierre Marcout, President & Artistic Director, Prisme Entertainment Inc. & Prisme International Dubai is a city that emerged in only a decade. be intrigued to discover the real amazing story Later in life, my first job was to manage Though facing successive challenges it has behind presenting this new global icon. a branch for an important distributor built an attractive reputation around the of electric materials. Of course, my own world. Criticized and envied, it multiplies the interests in lighting led me to develop a new superlatives and keeps being talked about. Its I was always fascinated by light. In the market segment that exposed new designs and presentations for lighting. I jumped notoriety is impressive compared to its relative beginning, I was drawn to the colored lights in my bedroom, but my goal was not to on this success to learn more about the size. Dubai holds in its name a fantastic power create a night club, because at 10 years of capacity to create different atmospheres in of attraction, and Burj Khalifa (828m, 162 floors) age, my parents would have never allowed offices and homes through lighting alone, became the emblem of the new century upon that to happen. -

Burj Khalifa Gatehouses

Burj Khalifa Gatehouses Dubai, United Arab Emirates Burj Khalifa Gatehouses Dubai, United Arab Emirates As the world’s tallest building and Dubai’s top tourist destination, Burj Khalifa has thousands of visitors daily, most of whom arrive in automobiles—each of which must undergo security inspection. SERVICES A key component of that mission is the AS+GG-designed gatehouses, which are as beautiful as they are functional. Architecture In keeping with the client’s desire for a consistent style for all structures within the Burj complex, the gatehouses take their aesthetic cues from the tower and related offi ce building. The curving lines of the gatehouses derive from the CLIENT Emaar Properties undulating form of the tower massing (opposite page, left) and site design; the stainless steel cladding is similar to that used in the tower’s mullions and spandrels, while the panelization echoes the modular framing of the curtain wall. There are six gatehouses in the Burj Khalifa complex, each with its own function and identity, including the main hotel entrance, the main residential entrance, the hotel entrance, a taxi stand, the offi ce annex entrance and the truck service entrance. Some of the gatehouses have electronic automobile scanners, the housing for which was designed by AS+GG. All of the gatehouses feature teak louvers and ceilings (for added functionality and contrast with the stainless steel exterior walls and columns) as well as offi ces with observation rooms for the security checkpoint staff. The offi ce windows are glazed with tinted glass that provide additional insulation and glare mitigation while shielding the staff from view. -

8 Days Opulent Emirates

34 | OPULENT EMIRATES OPULENT EMIRATES DUBAI ABU DHABI 8 DAYS Explore a country where ancient traditions have merged with the modern ways of the West on this 8-day from journey to the cosmopolitan cities of Dubai and Abu Dhabi. With spectacular landscapes and beaches to unrivaled architecture, a visit to the United Arab Emirates is like no other. Experience world-class shopping, $2,449 hospitality and luxury at its finest. USD$, P P, DBL. OCC. TOUR OVERVIEW Total of 7 nights accommodation; Day 1 Day 4 B/D 5-Star hotels DUBAI Arrival in Dubai, the cosmopolitan metropolis within the DESERT SAFARI After breakfast at the hotel, enjoy your 5 nights in Dubai Arabian Desert, known for its extraordinary opulence and morning at leisure. In the afternoon, begin your Desert Safari 2 nights in Abu Dhabi unparalleled hospitality. Relax, refresh and recharge in the by boarding your luxury 4x4 in Dubai. Head out towards the Premier concierge service upon lounge, while your Premier Concierge agent and porter handle desert and watch the sunset before you arrive at the campsite arrival in Dubai all your immigration formalities and obtain your luggage from where you will be greeted with a traditional cup of Arabic the baggage carousels. Your private driver will transfer you to coffee. Have an opportunity to ride a camel before your Private transfers; touring as your luxury hotel, one of the most stunning architectural barbeque dinner is prepared on an open-flame. A belly dancer indicated highlights on the Dubai skyline. Jumeirah Emirates Towers Hotel will enchant you on this magical night. -

Ahmed Sameer

© Ahmed Sameer © Ahmed Sameer On 29th of March, 2014, Earth Hour celebrated its 8th anniversary. Once again, Earth Hour called on the world to unite and demonstrate the necessity of taking action against climate change by switching off their light for one hour. This year, Earth Hour’s impact was record-breaking worldwide, reaching over hundreds of millions of people in 162 countries in over 7000 cities. Famous landmarks all over the world switched off for the hour, such as the Petronas Towers in Kuala Lumpur, Golden Gate Bridge in California and a new landmark this year - the Sultan Ahmed Mosque in Turkey. Beyond the global switch off, Earth Hour called for an amplified, multiplied and powerful hour through the launch of a new platform “Earth Hour Blue”. 2014 marks the UAE’s 7th year participating in Earth Hour; and as darkness swept over the 7 emirates on the night of 29th March 2014, the world’s tallest building, the UAE’s Burj Khalifa and the iconic Sheikh Zayed Grand Mosque switched off in support of the hour. Residents also participated in an amplified Earth Hour in response to EWS-WWF’s call to not only to switch off for the hour, but also to switch to energy efficient lighting as a first step towards long term impact and change. Andy Ridley, the CEO of Earth Hour commented on how the crescendo of Earth Hour made 2014 to be one of the most influential year yet. “It is a fairly wild experience to watch as countries and cities from around the world start to share their plans for the night and beyond the hour, each story builds momentum and inspires other teams to share and do more. -

Abu Dhabi, UAE Architect

The Address Skyview, Dubai Project Manager: TURNER Consultant: NORR Main Contractor : Arabian Construction Company Façade Consultant: Koltay Facades Façade Contractor: Al Ghurair Aluminium and Glass Folcra Beach Product: JTA , Curtain Wall Burj Vista, Dubai Consultant: BH-NS Consultants Main Contractor : Consolidated Construction Company Façade Consultant: Koltay Facades Façade Contractor: Folcra Beach Product: JTA, Curtain Wall Al Fattan Sky Towers, Dubai Consultant: AE7 Main Contractor : Delta Emirates Façade Contractor: Engineering Aluminium System Product: JTA, Curtain Wall Ta’azeez Tower, Dammam, Saudi Arabia Client : Ta’azeez Real Estate Development Co. Consultant: Samir Khairallah & Partners, Architects, Planners Engineers Main Contractor : Project Build General Contracting Co. Ltd. Façade Contractor: Aluminium Manufacturing Co. Ltd. (ALUMACO) Product: JTA, Curtain Wall The Louvre - Abu Dhabi Client: Tourism Development & Investment Company (TDIC) Architect : Jean Nouvel Structural Consultant : Buro Happold Contractors : Arabtec – San Jose Construction – Oger JV Steel and Glass Works : Metallic Equipment Product: JM, Mechanical, Electrical, Plumbing Opera, Dubai Client: Emaar Main Consultant: Atkins Main Contractor: Consolidated Contractors Company Elevator Company: ThyssenKrupp Elevator Product: JM, Elevator Abu Dhabi Airport Client: Abu Dhabi Airports Company (ADAC) Main Contractor 1: Arabtec Main Contractor 2: TAV Construction (TAV) Main Contractor 3: Consolidated Contractors International Co. (CCC) Product: JTA, Baggage Handling -

Driving Services Section

DRIVING SERVICES SECTION Taxi Written Test - Part B (Location Question Booklet) Note: This pamphlet is for reference only and has no legal authority. The Driving Services Section of Transport Department may amend any part of its contents at any time as required without giving any notice. Location (Que stion) Place (Answer) Location (Question) Place (Answer) 1. Aberdeen Centre Nam Ning Street 19. Dah Sing Financial Wan Chai Centre 2. Allied Kajima Building Wan Chai 20. Duke of Windsor Social Wan Chai Service Building 3. Argyle Centre Nathan Road 21. East Ocean Centre Tsim Sha Tsui 4. Houston Centre Mody Road 22. Eastern Harbour Centre Quarry Bay 5. Cable TV Tower Tsuen Wan 23. Energy Plaza Tsim Sha Tsui 6. Caroline Centre Ca useway Bay 24. Entertainment Building Central 7. C.C. Wu Building Wan Chai 25. Eton Tower Causeway Bay 8. Central Building Pedder Street 26. Fo Tan Railway House Lok King Street 9. Cheung Kong Center Central 27. Fortress Tower King's Road 10. China Hong Kong City Tsim Sha Tsui 28. Ginza Square Yau Ma Tei 11. China Overseas Wan Chai 29. Grand Millennium Plaza Sheung Wan Building 12. Chinachem Exchange Quarry Bay 30. Hilton Plaza Sha Tin Square 13. Chow Tai Fook Centre Mong Kok 31. HKPC Buil ding Kowloon Tong 14. Prince ’s Building Chater Road 32. i Square Tsim Sha Tsui 15. Clothing Industry Lai King Hill Road 33. Kowloonbay Trademart Drive Training Authority Lai International Trade & King Training Centre Exhibition Centre 16. CNT Tower Wan Chai 34. Hong Kong Plaza Sai Wan 17. Concordia Plaza Tsim Sha Tsui 35.