Unaudited Financial Statements for the Year Ended 31 December 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

53 Bus Time Schedule & Line Route

53 bus time schedule & line map 53 Bracknell View In Website Mode The 53 bus line (Bracknell) has 3 routes. For regular weekdays, their operation hours are: (1) Bracknell: 6:50 AM - 7:18 PM (2) Wexham Court: 5:40 AM - 6:00 PM (3) Whitegrove: 7:50 AM - 5:50 PM Use the Moovit App to ƒnd the closest 53 bus station near you and ƒnd out when is the next 53 bus arriving. Direction: Bracknell 53 bus Time Schedule 54 stops Bracknell Route Timetable: VIEW LINE SCHEDULE Sunday Not Operational Monday 6:50 AM - 7:18 PM Wexham Park Hospital, Wexham Court Tuesday 6:50 AM - 7:18 PM Stoke House, Stoke Poges Wednesday 6:50 AM - 7:18 PM Stoke Park, Farnham Royal Thursday 6:50 AM - 7:18 PM Beaconsƒeld Road, Farnham Royal Civil Parish Friday 6:50 AM - 7:18 PM Farnham Lane, Britwell Travis Court, Britwell Civil Parish Saturday 8:05 AM - 6:07 PM The Britwell Centre, Britwell Wentworth Avenue, Britwell 53 bus Info Kennedy Park Shops, Britwell Direction: Bracknell Stops: 54 St George's Church, Britwell Trip Duration: 70 min Line Summary: Wexham Park Hospital, Wexham Lynch Pin Ph, Britwell Court, Stoke House, Stoke Poges, Stoke Park, Farnham Royal, Farnham Lane, Britwell, The Britwell 228 Long Furlong Drive, Slough Centre, Britwell, Wentworth Avenue, Britwell, Wordsworth Road, Britwell Kennedy Park Shops, Britwell, St George's Church, Britwell, Lynch Pin Ph, Britwell, Wordsworth Road, Britwell, Ramsey Court, Burnham, Grammar School, Ramsey Court, Burnham Burnham, Fairƒeld Road, Burnham, Gore Road, Shoreham Rise, Slough Burnham, Bredward Close, Lent Rise, Lent -

Church Lane, Warfield Conservation Area Appraisal

Bracknell Forest Borough Council Church Lane, Warfield Conservation Area Appraisal The Church of St. Michael the Archangel, Warfield August 2006 Jacobs Babtie School Green, Shinfield, Reading RG2 9HL 0118 988 1555 Fax: 0118 988 1666 Jacobs UK Limited School Green Shinfield Reading RG2 9HL Controlled Copy No. Report No: Bracknell Forest Borough Council Church Lane, Warfield Conservation Area Appraisal Approved by Bracknell Forest Borough Council Executive Member for Planning and Transportation ……………………………………… ………………………………………………….. Jacobs Babtie Technical Director Issue History Date Revision Status August 2005 1 Draft November 2005 2 Draft February 2006 3 Draft July 2006 4 Final Draft August 2006 5 Final Copyright Jacobs UK Limited. All Rights reserved. No part of this report may be copied or reproduced by any means without prior written permission from Jacobs UK Limited. If you have received this report in error, please destroy all copies in your possession or control and notify Jacobs UK Limited. This report has been prepared for the exclusive use of the commissioning party and unless otherwise agreed in writing by Jacobs UK Limited, no other party may use, make use of or rely on the contents of the report. No liability is accepted by Jacobs UK Limited for any use of this report, other than the purposes for which it was originally prepared and provided. Opinions and information provided in the report are on the basis of the Jacobs UK Limited using due skill, care and diligence in preparation of the same and no explicit warranty is provided as to their accuracy. It should be noted and it is expressly stated that no independent verification of any of the documents or information supplied to Jacobs UK Limited has been made. -

Applewood Kitchens and Bedrooms

WWW.WORDMAG.CO.UK FREE 2 To advertise call 01344 444657 or E-mail [email protected] Please quote The Word when responding to advertisements 3 For further information: Tel. 01344 444657 Men’s formal wear to hire or to buy Email for Weddings, Ascot, Evening wear, Office suits, Designer Menswear [email protected] Website www.elegansmenswear.com www.wordmag.co.uk Publisher House Plans & The Warfield Word Ltd Architectural Drawings Printer We provide a complete design and plan- Warwick Printing Company Ltd ning service for householders who wish to improve or enlarge their homes. We specialise in preparing plans for approval and will deal with all the paper- While all reasonable care is taken to ensure accuracy, the work. We will visit you to talk over your publisher cannot accept liability for errors or omissions requirements, suggest design ideas to relating to the adverts or editorials in this magazine nor for losses arising as a result. make your project a success and submit your plans for approval. No part of this publication may be reproduced without the permission of the authors as it is protected by copyright. We are also NHBC registered builders and have spent many years working The publisher does not endorse any product or service offered in this publication. ‘hands on’, building extensions and new homes, enabling us to bring a wealth of practical experience to your project. 01189 122 319 free consultatio n Good Developments Ltd [email protected] www.gooddevelopments.co.uk 2 To advertise -

Hawthorn Lodge

HAWTHORN LODGE WARFIELD • BERKSHIRE HAWTHORN LODGE MOSS END • WARFIELD • BERKSHIRE • RG42 6EL M4 (Junction 8/9) 5 miles, Ascot 6.5 miles, Windsor 8.5 miles, Bracknell Station (serving London Waterloo) 3 miles; Maidenhead Station (serving London Paddington) 6 miles, Heathrow Airport 20 miles, Central London (SW1) 32 miles. (All distances are approximate) A REFINED COUNTRY HOUSE WITH SUPERB POLO/EQUESTRIAN FACILITIES SET IN OVER 12 ACRES OF GARDENS AND PADDOCKS WITH ANCILLARY ACCOMMODATION AND OUTBUILDINGS MAIN HOUSE Reception Hall, Drawing room, Dining room, Family room, Conservatory, Kitchen/breakfast room, Master bedroom with balcony and en suite bathroom, 5 further bedrooms (3 en suite), Cloakroom, Boot room, Linked annexe with magnificent vaulted reception/games room, Study, Kitchen, 2 bedrooms (1 with balcony), Shower room, Cloakroom. EQUESTRIAN 10 loose boxes, Tack room, All-weather arena, Paddocks, Corrals, Polo field with land-drains for stick and ball, Horse-walker for 6 horses. OUTBUILDINGS 2 self-contained studio apartments, 4 car bespoke oak framed garage, Wine store (temperature controlled), Log stores, Laundry/gym, Utility room, Store, Machine store, Gardener’s WC. GARDENS AND GROUNDS Gardens, Pond with island, Swimming pool, Tennis court, Orchard, Woodland path, Further gated access points, Driveway with turning circle, Parking area. In excess of 12 acres (4.8 hectares). Freehold. Tucked away in a discrete location overlooking extensive gardens and grounds, Hawthorn Lodge is a truly unique property with outstanding equestrian facilities. DESCRIPTION Hawthorn Lodge is an exceptional country house believed to date back to the 1650s, with 19th Century additions. In recent years it has been the subject of a comprehensive and sympathetic refurbishment to ensure that whilst character is retained, the house has modern and luxurious features. -

Applewood Kitchens and Bedrooms

WWW.WORDMAG.CO.UK FREE 2 To advertise call 01344 444657 or E-mail [email protected] Please quote The Word when responding to advertisements 3 REAT GET FIT, FEEL G IN ONLY 4 WEEKS For further information: All sessions are just 45 minutes run by motivating and supportive instructors. To find out how to work out with like Tel. 01344 444657 minded friendly people visit www.fasttrack-fitcamp.co.uk Email Call Heidi 07968 774804 New to Fit Camp and want to try us out? [email protected] Come for free! Go to www.fasttrack-fitcamp.co.uk/trial-week-sign-up Website WOKINGHAM • SWALLOWFIELD • WARFIELD • TWYFORD • WINNERSH • YATELEY www.wordmag.co.uk Publisher House Plans & The Warfield Word Ltd Architectural Printer Drawings We provide a complete design and plan- Warwick Printing Company Ltd ning service for householders who wish to improve or enlarge their homes. We specialise in preparing plans for approval and will deal with all the paper- While all reasonable care is taken to ensure accuracy, the work. We will visit you to talk over your publisher cannot accept liability for errors or omissions relating to the adverts or editorials in this magazine nor for requirements, suggest design ideas to losses arising as a result. make your project a success and submit your plans for approval. No part of this publication may be reproduced without the permission of the authors as it is protected by copyright. We have spent many years working The publisher does not endorse any product or service ‘hands on’, building extensions and new offered in this publication. -

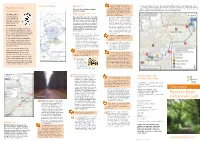

Bracknell Forest Ramblers Route

This broad, straight track is part of a Follow a cinder track for 350 yards (315m) and then turn left off the footpath by some white fencing, where Location map Roman road which once linked London Section 1 you’ll follow an old tarmac road for a further 350 yards. Turn right just after the gas pumping station and follow a with the Roman town of Silchester. Even Ramblers route bridleway, which runs parallel to power lines, in a westerly direction, crossing a stream at one point. Stay on this The Look Out to Wildmoor Heath: though the Romans constructed the road, path for 0.8 miles (1.3 km) until you reach the Crowthorne to Sandhurst road. 4.5 miles (7.2 km) local people who lived here after the Roman Introduction Occupation believed that only the Devil could Numbered text relates to numbered route The Ramblers Route have been responsible for such a feat of sections in the maps. engineering - hence its name. is 26 mile/ 41.8km Section 1 The Look Out Discovery Centre is open daily circular walking trail Continue straight along the Devil’s Highway, and provides many attractions for the family, drop down a slope to a gate and follow the that passes through with over 90 science and nature exhibits. The track beneath the route of the Sandhurst- attractive countryside Look Out is situated on the edge of Swinley Crowthorne bypass. About 175 yards (160m) on the outskirts of Forest which is the largest area of unbroken beyond the bypass, turn left onto a footpath woodland (mostly Scots Pine) in Berkshire at and head south. -

Larks-Hill-Green Brochure.Pdf

LARKS HILL GREEN 1 YOUR PERFECT RETREAT FIND YOUR STYLE OF COUNTRY LIVING AT LARKS HILL GREEN, A BEAUTIFUL COLLECTION OF TWENTY-SEVEN 1 & 2 BEDROOM APARTMENTS, AND 3 & 4 BEDROOM HOUSES. Larks Hill Green is located in the tiny hamlet of Newell Green, surrounded by gentle green countryside. It’s the hideaway you’ve been looking for. 2 LARKS HILL GREEN ENJOY SOME FRESH AIR WITH THE OPEN SPACE OF LARKS HILL ON YOUR DOORSTEP. LARKS HILL GREEN 3 THE CRICKETERS 2 FREEDOM TO RELAX MILES* VILLAGE LIFE IS UNHURRIED AND PEACEFUL. IT FOLLOWS ITS OWN PACE, AS IT HAS FOR GENERATIONS. Around Newell Green, and its slightly larger If you like your food to be locally produced, you’ll neighbour Warfield, you’ll find all the elements soon become a regular customer at Moss End that define English country village living. Farm Shop, where much of the produce comes from local farms, and quality meat is provided At the heart of the village is a selection of pubs. by award-winning Al’s family butchers. It’s only The Plough and Harrow, popular for its food, and 1.1 miles from Larks Hill Green. THE SPLASH The Yorkshire Rose which offers Mediterranean cuisine in its smart restaurant, both a short The community comes together for the annual 1 walk away from Larks Hill Green. Further afield, village fête in June, and all year round there are MILE* The Cricketers is a traditional whitewashed events and clubs in the Memorial Hall and the country inn with a delightful patio and beer medieval church. -

Questions for Your Councillors and Mps

Questions for your Councillors and MPs 27th February 2020 1. Local Housing Need – The October 2019 revised BFC Local Plan states that the Local Housing Need from 2021 to 2036 has already been met with existing sites without needing any contribution from Jealott’s Hill. Why is BFC proposing this un-necessary Green Belt development? 2. BFC is making an argument of “Exceptional Circumstances” to justify surrendering 242 hectares of Green Belt, in order to support nationally important agri-tech research and development based in a new 13 hectare Science and Innovation Park. Yet the Syngenta existing built on area is around 25 hectares. Why is there any need to surrender over 200 hectares of irreplaceable agricultural Green Belt for housing which is not required within the Local Plan period? 3. Exceptional Circumstances for changing Green Belt Status require all reasonable alternative options to be evaluated and rejected before considering any change of Green Belt Status? What specific alternative options were considered and why were each of them rejected? 4. Surrendering Green Belt status at Jealott’s Hill could deliver a massive £0.5 Billion uplift in land value to heavily indebted Syngenta, prior to the planned floatation of its owner, ChemChina, on the Shanghai stock market. At the 2019 consultation meetings councillors sought to justify their assessment of “Special Circumstances” allowing the Green Belt status on the land as being the price we have to pay to keep Syngenta as a local employer in the future. Yet when questioned not one of them were able to give a satisfactory answer as to why there do not appear to be any assurances or restrictions which would force Syngenta to retain employment at the site. -

Bracknell Forest

Landscape Character Area A1: Bracknell Forest Map 1: Location of Landscape Character Area A1 22 Image 1: Typical landscape of conifer plantation and new mixed broadleaf plantation on former heathland, with Round Hill in Crowthorne Wood in the middle distance, looking north from the Devil’s Highway at grid reference: 484936 164454. Location 5.3 This character area comprises a large expanse of forest plantation between the settlements of Bracknell to the north, Crowthorne and Sandhurst to the west, Camberley to the south (outside the study area within Surrey) and South Ascot to the east. The landscape continues into the Forested Settled Sands landscape type in Wokingham to the west and the Settled Wooded Sands in the Royal Borough of Windsor and Maidenhead to the east. Key Characteristics • Large areas of forestry plantation interspersed with broadleaf woodland and limited areas of open heath, giving a sense of enclosure and remoteness. • Typically short views, contained by trees, with occasional long views along historic, straight rides (such as the Devils’ Highway) and glimpsed views from more elevated areas. • A very low settlement density and few transport corridors. Suburban settlement and development related to light-industry occur at its peripheries, but these are mostly well screened by trees and not discernible from the interior. • Well-used recreation areas valued by the local community, including provisions for a range of formal recreational uses. • Despite the non-native land cover and presence of forestry operations the area has a sense of remoteness; a sense of removal from the surrounding urban settlements and a connection to the history of Windsor Forest. -

Download Report

The Birds of Berkshire Annual Report 2014 Published 2018 Berkshire Ornithological Club Registered charity no. 1011776 The Berkshire Ornithological Club (BOC) was founded as Reading Ornithological Club in 1947 to promote education and study of wild birds, their habitats and their conservation, initially in the Reading area but now on a county wide basis. It is affiliated to the British Trust for Ornithology (BTO). Membership is open to anyone interested in birds and bird-watching, beginner or expert, local patch enthusiast or international twitcher. The Club provides the following in return for a modest annual subscription: • A programme of indoor meetings with expert • Conservation involvement in important local speakers on ornithological subjects habitats and species. BOC members are involved in practical conservation work with groups such • Occasional social meetings as Friends of Lavell’s Lake, Theale Area Bird • An annual photographic competition of very high Conservation Group and Moor Green Lakes Group. standard • Opportunities to participate in survey work to • A programme of field meetings both locally and help understand birds better. The surveys include further afield. These can be for half days, whole supporting the BTO in its work and monitoring for days or weekends. local conservation management. • Regular mid week bird walks in and around many • The Club runs the Birds of Berkshire Conservation of Berkshire’s and neighbouring counties’ best Fund to support local bird conservation projects. birdwatching areas. • Exclusive access to the pre-eminent site Queen Mother Reservoir (subject to permit) This Berkshire Bird Report is published by the Club and provided free to members. Members are encouraged to keep records of their local observations and submit them, electronically or in writing, to the Recorder for collation and analysis. -

Benefit Scheme

CHAVEY DOWN January 2020 NEWS AND VIEWS Published by The Chavey Down Association Number 64 [email protected] Happy New Year Planning We hope you all had an enjoyable Christmas and New Year and we Land Adjacent to Silver Trees, Birch Lane - Erection of single 2- start our newsletter with a huge thank you to those of you who storey dwelling - 19/00862/FUL: Pending Consideration. supported the village carol concert in St Martin’s Church prior to Christmas. A total of £282.10 was collected on the evening, which Longhill House, Long Hill Road - Erection of two storey dwelling together with a donation from the Chavey Down Association, following demolition of existing bungalow (resubmission of raised £382.10 for Buckinghamshire Mind, which delivers high 19/00154/FUL) - 19/00813/FUL: Pending Consideration. quality community-based activities in and around our area in East Berkshire and in Buckinghamshire. White Gates, Long Hill Road - Erection of 13 dwellings, together with access to Long Hill Drive, via the drive to the Warfield Park A thank you to George and Brenda Howe in Long Hill Road for the Home site, following the demolition of the existing dwelling. wondrous Christmas light display of woodland animals and Santa Appeal Ref: APP/R0335/W/18/3210759. Much to the shock of BFC Claus. We all look forward to the annual event and this year they and many residents, this appeal was granted and planning raised an impressive £6674.88 for the Alexander Devine Children’s approved by Planning Inspector. Hospice, which provides essential support to children with life- limiting and life-threatening conditions and their families across Jealotts Hill – Proposed Development Berkshire and the surrounding communities. -

Moss End Show Schedule

This show will benefit the MOSS END SHOW Warfield RDA Group, Sunday 27 June 2021 Charity No. 1074001 Billingbear Farm, Billingbear Lane Binfield, Nr Bracknell RG42 5PS Two or three tier rosettes, a trophy by kind permission of and prize money awarded in every class Howard and Eva Bellm Website: www.mossendshows.com Show Organiser: Mrs M-A Hodson MBE, CHAPS UK AFFILIATION NUMBER 21102 Online entries at www.horse-events.co.uk Spring Lanes House, Holly Spring Lane, Please note this new rule: All classes in Ring 1 will be run as Bracknell, Berkshire RG12 2JL follows: Second disobedience during the course of a round Tel: 01344 483347 anywhere on the course will incur elimination, EXCEPT FOR email: [email protected] CLASS 1, where a Third disobedience will incur elimination. DO NOT CALL AN AMBULANCE WITHOUT FIRST SPEAKING TO OUR MEDICAL TEAM!! Special thanks to: 3 Refunds will be made on receipt of S.A.E. with vet or doctor’s certificate less £6.00 administration fee. OTHERWISE REFUNDS ARE NOT AVAIL- Arena Party: Royal County Army Cadets Force ABLE FOR RETURN OF FEES IF THE CLASS TAKES PLACE. Public Address by ESS Event Sound Services 4 Hard hats must be worn when mounted. Photographer: Fotos4Events.co.uk Mobile Tack Shop – Green Lease 5 The judge's decision is final. 6 Horses or ponies must be the minimum age of four years. Show Jumps: New Forest Jumps: sponsored by Mrs S Pidgley 7 The Organisers accept no liability for any damage to competitors, spectators, RJK Medics will be present for First Aid officials or property.