1 Preliminary Prospectus

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Memorandum of Agreement

LIST OF POWER MAC CENTER PARTICIPATING REDEMPTION OUTLETS BRANCH (METRO MANILA) ADDRESS 1 Ayala Malls Cloverleaf 2/L Ayala Malls Cloverleaf, A. Bonifacio Ave., Brgy. Balingasa, Quezon City 2 Circuit Lane G/L Ayala Malls Circuit Lane, Hippodromo, Makati City 3 Festival Supermall UGF Expansion Area, Festival Supermall, Filinvest City, Alabang, Muntinlupa City 4 Glorietta 5 3/L Glorietta 5, Ayala Center, Makati City 5 Greenbelt 3 2/L Greenbelt 3, Ayala Center, Makati City 6 Power Plant Mall 2/L Power Plant Mall, Rockwell Center, Poblacion, Makati City 7 SM Aura Premier 3/L SM Aura Premier, 26th St. Corner McKinley Parkway, Bonifacio Global City, Taguig City 8 SM City Bacoor 4/L Cyberzone, SM City Bacoor Gen. Aguinaldo Cor. Tirona Bacoor, Cavite 9 SM City BF Parañaque 3/L Cyberzone, SM City BF Paranaque, Dr. A. SantoS Ave., Brgy. BF HomeS, Paranaque City 10 SM City Dasmariñas 2/L Cyberzone, SM City DaSmarinaS Brgy. Sampaloc 1, DaSmarinaS City, Cavite 11 SM City Fairview 3/L Cyberzone, SM Fairview, Brgy. Greater Lagro, Quezon City 12 SM City Marikina G/L SM City Marikina, Marcos Highway, Marikina City 13 SM Mall of Asia 2/L SM Mall of Asia, Central Business Park Bay Blvd., Pasay City 14 SM Megamall 4/L Cyberzone, SM Megamall Bldg. B, EDSA, Mandaluyong City 15 SM South Mall 3/L Cyberzone, SM Southmall, Alabang Zapote Road, LaS PinaS City 16 The Annex at SM City North EDSA 4/L Cyberzone, Annex Bldg at SM City North EDSA, Quezon City 17 The Podium 3/L The Podium, 18 ADB Avenue, Ortigas Center, Mandaluyong City 18 TriNoma 3/L Mindanao Wing, TriNoma, Quezon City BRANCH (PROVINCIAL) ADDRESS 1 Abreeza Mall 2/L Abreeza Ayala Mall, J.P. -

2015 SMPHI Annual Report

SUSTAINING GROWTH, DELIVERING VALUE 10th Floor, OneE-com Center Harbor Drive, Mall of Asia Complex Pasay City 1300, Philippines Email: [email protected] www.sminvestments.com 2 IFC Our Business Philosophy 2 Business Highlights & Impact 6 Financial Highlights 7 Shareholder Value SM INVESTMENTS CORPORATION SM INVESTMENTS OUR BUSINESS PHILOSOPHY 8 Ten-Year Performance Overview 10 Our Business Footprint 12 Message to Shareholders SM Investments Corporation is the Philippines’ largest 14 President’s Report publicly-listed holding company that holds a group of sustainable businesses in retail, property and financial services. The Group thrives on leadership, innovation 18 RETAIL OPERATIONS and highly synergistic operations. • THE SM STORE Our Vision is to build world-class businesses that are • SM Markets catalysts for development in the communities we serve. Our long history of sustained growth is an indication of our ability to deliver value for all our stakeholders through sound financial management, leadership, innovation, long-term sustainability efforts and a comprehensive development program for all our host communities. Through our interests and activities, Our Mission is to strive to be a good corporate citizen by partnering with our host communities in providing consistently high standards of service to our customers, look after the welfare of our employees, and deliver sustainable returns to our shareholders at all times, upholding the highest standards of corporate governance in all our businesses. 28 PROPERTY Over the years, we have been committed to sustaining • Malls our growth, in creating value and delivering quality • Residences products and services that our millions of customers aspire for. We are here to serve. -

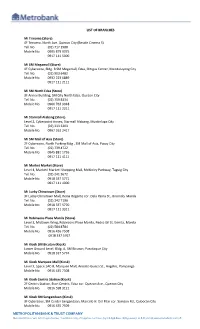

Metropolitan Bank & Trust Company List

LIST OF BRANCHES Mi Trinoma (Store) 4F Trinoma, North Ave. Quezon City (Beside Cinema 5) Tel. No. (02) 717 1980 Mobile No. 0995 879 9075 0917 111 5000 Mi SM Megamall (Store) 4F Cyberzone, Bldg. B SM Megamall, Edsa, Ortigas Center, Mandaluyong City Tel. No. (02) 903 6482 Mobile No. 0932 223 6889 0917 111 2111 Mi SM North Edsa (Store) 3F Annex Building, SM City North Edsa, Quezon City Tel. No. (02) 759 8334 Mobile No. 0966 763 9048 0917 111 2211 Mi Starmall Alabang (Store) Level 2, Cyberpoint Annex, Starmall Alabang, Muntinlupa City Tel. No. (02) 333 3203 Mobile No. 0967 262 2417 Mi SM Mall of Asia (Store) 2F Cyberzone, North Parking Bldg., SM Mall of Asia, Pasay City Tel. No. (02) 739 4722 Mobile No. 0945 881 1726 0917 111 4111 Mi Market Market (Store) Level 4, Market! Market! Shopping Mall, McKinley Parkway, Taguig City Tel. No. (02) 241 3672 Mobile No. 0918 337 5771 0917 111 4000 Mi Lucky Chinatown (Store) 3F Lucky Chinatown Mall, Reina Regente cor. Dela Reina St., Binondo, Manila Tel. No. (02) 242 7190 Mobile No. 0918 337 5770 0917 111 3311 Mi Robinsons Place Manila (Store) Level 3, Midtown Wing, Robinsons Place Manila, Pedro Gil St. Ermita, Manila Tel. No. (02) 584 8784 Mobile No. 0916 436 7508 0918 337 5767 Mi Kiosk SM Bicutan (Kiosk) Lower Ground Level, Bldg. A, SM Bicutan, Parañaque City Mobile No. 0918 337 5774 Mi Kiosk Marquee Mall (Kiosk) Level 3, Space 1AC-8, Marquee Mall, Aniceto Gueco St., Angeles, Pampanga Mobile No. 0916 435 7508 Mi Kiosk Centris Station (Kiosk) 2F Centris Station, Eton Centris, Edsa cor. -

1623400766-2020-Sec17a.Pdf

COVER SHEET 2 0 5 7 3 SEC Registration Number M E T R O P O L I T A N B A N K & T R U S T C O M P A N Y (Company’s Full Name) M e t r o b a n k P l a z a , S e n . G i l P u y a t A v e n u e , U r d a n e t a V i l l a g e , M a k a t i C i t y , M e t r o M a n i l a (Business Address: No. Street City/Town/Province) RENATO K. DE BORJA, JR. 8898-8805 (Contact Person) (Company Telephone Number) 1 2 3 1 1 7 - A 0 4 2 8 Month Day (Form Type) Month Day (Fiscal Year) (Annual Meeting) NONE (Secondary License Type, If Applicable) Corporation Finance Department Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings 2,999 as of 12-31-2020 Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. 2 SEC Number 20573 File Number______ METROPOLITAN BANK & TRUST COMPANY (Company’s Full Name) Metrobank Plaza, Sen. Gil Puyat Avenue, Urdaneta Village, Makati City, Metro Manila (Company’s Address) 8898-8805 (Telephone Number) December 31 (Fiscal year ending) FORM 17-A (ANNUAL REPORT) (Form Type) (Amendment Designation, if applicable) December 31, 2020 (Period Ended Date) None (Secondary License Type and File Number) 3 SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-A ANNUAL REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SECTION 141 OF CORPORATION CODE OF THE PHILIPPINES 1. -

MEMO EXPRESS.Pdf

MERCHANT BRANCHES MEMO EXPRESS SM SOUTHMALL ALABANG ZAPOTE RD ALMANZA UNO LAS PINAS CITY 1740 MEMO EXPRESS CYBERZONE SM CITY FAIRVIEW REGALADO AVE. GREATER LAGRO QUEZON CITY 1100 MEMO EXPRESS UNIT CZ24 SM CITY BF D.A.S.A COR PRES AVE BRGY BF HOMES PARANAQUE CITY 1700 MEMO EXPRESS 345 ALABANG ZAPOTE RD ROBINSON PLACE LAS PINAS BRGY TALON LAS PINAS CITY 1740 MEMO EXPRESS UNIT 303 2F ARCADIA BLDG SANTA ROSA TAGAYTAY ROAD DON JOSE STA. ROSA CITY LAGUNA 4026 MEMO EXPRESS CZ234 SM CITY BACOLOD RECLAMATION ARE BACOLOD CITY 6100 MEMO EXPRESS SM CENTER ANGONO MANILA EAST ROAD SAN ISIDRO ANGONO RIZAL 1930 MEMO EXPRESS SM MEGA CENTER MELENCIO SAN ROQUE CABANATUAN CITY NUEVA ECIJA 3100 MEMO EXPRESS CY 20 SM CITY GENSAN CORNER SANTIAGO BLVD SAN MIGUEL ST. LAGAO GEN SANTOS CITY 9500 MEMO EXPRESS SPACE 3-052 3F NEW GLORIETTA 2 AYALA CENTER SAN LORENZO MAKATI CITY 1224 MEMO EXPRESS L3-341 ROBINSONS NORTH ABUCAY BRGY 91 TACLOBAN CITY 6500 MEMO EXPRESS L2 2019 ROBINSON PLACE ORMOC CHRYSANTHEMUM SUBD. COGON ORMOC CITY 6541 MEMO EXPRESS CZ 3008 17 SM CITY LEGAZPI TAHAO ROAD LEGAZPI CITY ALBAY 4500 MEMO EXPRESS RM 814 PACIFIC LAND CTR BLDG QUITIN PAREDES ST. BRGY 289 ZONE 027 DIST 111 BINONDO MANILA 1006 MEMO EXPRESS SPACE 3111 ABREEZA MALL JP LAUREL AVE DAVAO CITY 8000 MEMO EXPRESS THE DISTRICT MALL AGUINALDO HIWAY COR. DAANG HARI ROAD ANABU II D CITY OF IMUS CAVITE 4103 MEMO EXPRESS L3 ROBINSON PLACE SANTIAGO MABINI SANTIAGO CITY 3311 MEMO EXPRESS 239 SM CITY CAUAYAN MAHARLIKA HIGHWAY DISTRICT 2 CAUAYAN CITY ISABELA 3305 MEMO EXPRESS CENTRIO MALL CM RECTO AVENUE BRGY 24 CAGAYAN DE ORO CITY 9000 MEMO EXPRESS L3-338 ROBINSON PLACE MALOLOS SUMAPANG MATANDA CITY MALOLOS BULACAN 3300 MEMO EXPRESS 3RD LEVEL SPACE 3029A FAIRVIEW TERRACES QUIRINO HIGHWAY PASONG PUTIK QUEZON CITY 1012 MEMO EXPRESS SPACE 2 02448 ROBINSON PLACE PUEBLO DE PANAY LAWAAN ROXAS CITY 5800 MEMO EXPRESS CZ 015 25 SM CITY SAN JOSE DEL MONTE BRGY TUNGKONG MANGGA CITY OF SAN JOSE DEL MONTE BULACAN 3023 MEMO EXPRESS UNIT 326 3RD FLR AYALA MALLS LEGAZPI RIZAL ST. -

Moldex-New-City-San-Jose-Bulacan

Getting To Know . A trusted name in the real estate industry; . The Moldex brand assures customers of the same quality and excellence found in every Moldex product for the past 25 years denotes denotes FRESH COMPLETE The simple sans serif fonts used in the words ‘new city’ and the color green gives the logo a clean and simple look ACCESS SUPER CITY ENTRYWAY SAN JOSE DEL MONTE Target Market Target Market: Residential Target Market: Commercial Value Proposition WHAT Moldex New City is a sprawling 130-hectare masterplanned community located in the Super City of historic Bulacan, WHERE in San Jose del Monte - near the foot of Sierra Madre mountains with residential, commercial, and HOW institutional components WHO for hardworking locals of Bulacan and OFWs who want the best & safest place for their family and WHY want to venture into a new business WHEN in a time of stressful urban living Reasons-to-Believe VALUE COMPLETE FLOOD-FREE SECURED FOR MONEY Development Concept Study Project Location Moldex Realty Inc.’s first masterplanned project in historic Bulacan is located in what is dubbed as the province’s ‘Super City’ – San Jose del Monte. It may be accessed via North Luzon Expressway ( NLEX ) or via Quirino Highway. San Jose del Monte • Located in San Jose del Monte, Bulacan • San Jose del Monte is the largest and most populous component city in Bulacan. • Also dubbed as Bulacan’s “Super City”. • With more than half a million residents, it also ranks as #1 in terms of internally generated income among all the local government units in the province. -

Proximity Indexing of Public Transport Terminals in Metro Manila

sustainability Article Proximity Indexing of Public Transport Terminals in Metro Manila Krister Ian Daniel Roquel *, Raymund Paolo Abad and Alexis Fillone Civil Engineering Department, De La Salle University, Manila 1004, Philippines; [email protected] (R.P.A.); alexis.fi[email protected] (A.F.) * Correspondence: [email protected] Abstract: Despite the extensive transit network in Metro Manila, intermodal connections between public transportation services are still fragmented. In response, authorities proposed various mul- timodal transport terminals around the periphery of the metropolis. However, there is a need to understand how these proposed terminals will impact existing transportation infrastructure and services as well as the current travel demand. This paper proposes a method that quantifies the nearness of any subject to any metric of interest, or in this case, the location of the terminal based on its proximity to existing transit supply and demand at different points in the transport network. It involves a simple methodology that requires only the spatial distribution of relevant transport planning data (e.g., public transport services, public transport passenger activity). It was found that the spatial distribution of the transport terminals in the study area is more closely related to the transit supply. Using the same methodology, several potential locations in Metro Manila (e.g., central terminal, terminal along a major junction) were assessed to see whether these are viable sites for a multimodal terminal. One scenario configuration was found to be better integrated with where trips start and/or end, while another seemed to improve integration of the existing railways. Keywords: intermodal; transit demand; transit supply; Metro Manila Citation: Roquel, K.I.D.; Abad, R.P.; Fillone, A. -

Cebu-Ebook.Pdf

About Cebu .........................................................................................................................................2 Sinulog festival....................................................................................................................................3 Cebu Facts and Figures .....................................................................................................................4 Cebu Province Towns & Municipalities...........................................................................................5 Sites About Cebu and Cebu City ......................................................................................................6 Cebu Island, Malapascus, Moalboal Dive Sites...............................................................................8 Cebu City Hotels...............................................................................................................................10 Lapu Lapu Hotels.............................................................................................................................13 Mactan Island Hotels and Resorts..................................................................................................14 Safety Travel Tips ............................................................................................................................16 Cebu City ( Digital pdf Map ) .........................................................................................................17 Mactan Island ( Digital -

Download Rate 82 Sessions Conducted 526 Childcare Leaves Credited 81% Access Rate 42% Activated Accounts Vs

Integrated Report 2020 1 Our Story Inspiring Resilience Integrated Report 2020 2 Integrated Report 2020 Our Story About this Report (102-46, 102-47, 102-49, 102-50, 102-51, 102-54) SM Prime Holdings, Inc. presents the first annual Integrated Report and the ninth edition following the Global Reporting Initiative (GRI) Framework. This Integrated Report features the International Integrated Reporting Council (IIRC) framework that uses the economic, environment, social and governance pillars of sustainability in combination with the six capitals: Financial, Manufactured, Intellectual, Environment, Human and Social and Relationship. The financial and non-financial information contained herein covers reporting from January to December 2020 and discusses SM Prime’s assets where the business has an organizational boundary. The report shares the performance and consolidated data of its malls, residences, leisure resorts, offices, hotels and convention centers. This report has been prepared in accordance with the GRI Standards: Core Option and the Task Force on Climate-related Financial Disclosures alongside multiple internationally recognized frameworks such as the UN Sustainable Development Goals, UN Global Compact and the Sendai Framework for Disaster Risk Reduction (2015-2030). This report is entitled Inspiring Resilience to describe the year in terms of the Company’s strength, dedication and response to Cover Photo: any challenge. SM Mall of Asia’s iconic globe reflects a public health and safety message in line with #SafeMallingatSM. The online version of the 2020 SM Prime Integrated Report is Next Page: available at the SM Prime website (www.smprime.com). Part of the Bike-Friendly SM program, commuters ply the new bike lane at the Feedback on the report may be sent to [email protected]. -

2015Suspension 2008Registere

LIST OF SEC REGISTERED CORPORATIONS FY 2008 WHICH FAILED TO SUBMIT FS AND GIS FOR PERIOD 2009 TO 2013 Date SEC Number Company Name Registered 1 CN200808877 "CASTLESPRING ELDERLY & SENIOR CITIZEN ASSOCIATION (CESCA)," INC. 06/11/2008 2 CS200719335 "GO" GENERICS SUPERDRUG INC. 01/30/2008 3 CS200802980 "JUST US" INDUSTRIAL & CONSTRUCTION SERVICES INC. 02/28/2008 4 CN200812088 "KABAGANG" NI DOC LOUIE CHUA INC. 08/05/2008 5 CN200803880 #1-PROBINSYANG MAUNLAD SANDIGAN NG BAYAN (#1-PRO-MASA NG 03/12/2008 6 CN200831927 (CEAG) CARCAR EMERGENCY ASSISTANCE GROUP RESCUE UNIT, INC. 12/10/2008 CN200830435 (D'EXTRA TOURS) DO EXCEL XENOS TEAM RIDERS ASSOCIATION AND TRACK 11/11/2008 7 OVER UNITED ROADS OR SEAS INC. 8 CN200804630 (MAZBDA) MARAGONDONZAPOTE BUS DRIVERS ASSN. INC. 03/28/2008 9 CN200813013 *CASTULE URBAN POOR ASSOCIATION INC. 08/28/2008 10 CS200830445 1 MORE ENTERTAINMENT INC. 11/12/2008 11 CN200811216 1 TULONG AT AGAPAY SA KABATAAN INC. 07/17/2008 12 CN200815933 1004 SHALOM METHODIST CHURCH, INC. 10/10/2008 13 CS200804199 1129 GOLDEN BRIDGE INTL INC. 03/19/2008 14 CS200809641 12-STAR REALTY DEVELOPMENT CORP. 06/24/2008 15 CS200828395 138 YE SEN FA INC. 07/07/2008 16 CN200801915 13TH CLUB OF ANTIPOLO INC. 02/11/2008 17 CS200818390 1415 GROUP, INC. 11/25/2008 18 CN200805092 15 LUCKY STARS OFW ASSOCIATION INC. 04/04/2008 19 CS200807505 153 METALS & MINING CORP. 05/19/2008 20 CS200828236 168 CREDIT CORPORATION 06/05/2008 21 CS200812630 168 MEGASAVE TRADING CORP. 08/14/2008 22 CS200819056 168 TAXI CORP. -

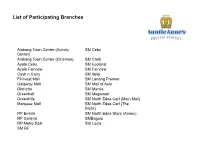

List of Participating Branches

List of Participating Branches Alabang Town Center (Activity SM Cebu Center) Alabang Town Center (Cinemas) SM Clark Ayala Cebu SM Ecoland Ayala Fairview SM Fairview Cash n Carry SM Iloilo Filinvest Mall SM Lanang Premier Gateway Mall SM Mall of Asia Glorietta SM Manila Greenbelt SM Megamall Greenhills SM North Edsa Cart (Main Mall) Marquee Mall SM North Edsa Cart (The Block) RP Ermita SM North Edsa Store (Annex) RP Galleria SMBaguio RP Metro East Sta Lucia SM BF List of Participating Branches Bonifacio High St BGC Visayas Jcentre Mall Bakilid Robinson's Bacolod Glorie;a 5 Cebu Mactan Domes@c Airport SM City Bacolod Jupiter St., Maka Asiatown I.T. Park Mactan Internaonal Airport Island City Mall Tagbilaran Bohol Kapunan Loyola Heights Ayala Center, Ac@ve Zone Parkmall Cebu Port Center Rizal Plaza Tagbilaran Bohol Molito Mun@nlupa Ayala Center, Kiosk Pueblo Verde Brgy Basak Umbria cor Rosales Calbayog NAIA1 Ayala Center, Fully Booked Raintree Mall Robinson's Dumaguete NAIA3 Ayala Center, Terraces Robinsons Cybergate Sol Y Mar Bldg. Dumaguete City Robinsons Galleria Banilad Town Centre Robinsons Place SM City Manduriao- iloilo SM Mall of Asia Capitol Site, Osmena Blvd Shopwise Basak SM Megamall Cebu Doctors Hospital SM City, Cinema Mindanao Solenad 2 Laguna C.P Bldg, Maribago SM City Consolacion Samping Bldg Butuan Star Cruises Bldg., Newport City Gaisano Tabunok SM City, Fiesta Strip Centrio Mall CDO Virra Mall Greenhills Insular JP Rizal St., Tabok SM City, Kiosk Alnor Complex Cotabato Synergis I.T. Center Abreeza Mall Davao SM City The Annex Davao Metro Lifestyle Complex Davao SM City Davao SM City Gensan List of Participating Branches Festival Supermall SM City Marilao Glorietta SM City North Edsa Harrison Plaza SM City Novaliches Lucky Chinatown Mall SM City Olongapo Robinsons Galleria SM City Pampanga Robinsons Place SM City Sta. -

NATIONWIDE Appliance & Furniture Retail Shops Retail Shops

NATIONWIDE Appliance & Furniture Retail Shops Retail Shops Specialty Shops & Services Abenson Adidas* Merrell Astroplus Automatic Centre Aldo Mothercare Astrovision AV Surfer Athlete's Foot Native Backjoy Avid Sales Bauhaus Nautica Case Logic Blims Fine Furniture Bench New Balance Delsey Promate Bootcamp Nike Park Executive Optical Robinsons Appliances Bratpack Nike Stadium Expressions SM Appliance Brics O Neill EZ Shop Call It Spring Occhialli GA Yupangco Department Store Celio Odyssey George Optical M1 Department Store Charles & Keith Olympic Village Ideal Vision Center Robinsons Department Store Chris Sports Payless Shoe Source Juego SM Department Store Claire's Penguin Juego by Badminton Hub Cole Hann Plains & Prints LTS Luggage Gadgets Collezione Planet Sports Lyric Piano Accenthub Columbia Premium Sole International Mountain Hard Ware Acro Tech Micro Device Cotton On Quicksilver National Bookstore Allphones DC Res Toe Run Perfect Pitch Asianic Fitflop Rockport RJ Guitar Beyond The Box Flight 001 Runnr ROX Canon D Zone Forever 21 Salomon Rusty Lopez Complink FOX Sanuk Seen Optical Digital Walker G Force Sebago Shoe Salon Electroworld Giordano Skechers The Opticians Enigma Technologies Grind Sledgers Yamaha Games and Gadgets Hedgren Sneak Peek Your Eyewear Specialist Henrys Professional Herbench Sperry Iclick Digishop Human Sportshouse Watches & Jewelry Jr Mx memoxpress Hurley Sunglass Hut Paraiba Kingpad Hush Puppies Surplus Shop Yak Pak memoxpress Kashieca The Body Shop Micro Valley Computer Keds The Face Shop Mobile Networks Kipling