Rating Rationale John Distilleries Private Limited 30 Oct 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UNITED SPIRITS Alcohol Beverage Industry India

UNITED SPIRITS Alcohol beverage industry India INDIAN ALCHOLBEV INDUSTRY IndianIndian Made IndianIndian Made BeerBeer Wine ForeignForeign LiquorLiquor IndianIndian Liquor (IMFL) (IMIL) IMFL category accounts for almost 72% of the market. Alcohol industry growth rate Spirits Market in India by Volume 5% 5% 5% 4% 4% 4% 3% 4% 4% 4% 15% 15% 15% 14% 14% 14% 13% 20% 19% 17% 22% 22% 21% 21% 19% 16% 17% 18% 22% 22% 59% 59% 60% 59% 59% 60% 60% 61% 61% 64% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Whisky Brandy Rum White Spirits Spirit Market in India by Value 5% 5% 4% 4% 6% 6% 5% 6% 6% 6% 14% 14% 13% 12% 10% 10% 10% 10% 10% 9% 11% 10% 11% 12% 12% 12% 12% 12% 12% 11% 70% 69% 71% 72% 72% 73% 73% 73% 74% 75% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Whisky Brandy Rum White Spirits Source: Equrius Report Major players in the industry Major Companies in the Indian Liquor Market Source: Equrius Report Top liquor brands in India Source: Equrius Report United Spirits – Diageo India World’s second largest liquor company by Volume. Subsidiary of Diageo PLC. One of the leading players of IMFL in India with a strong bouquet of brands like Mcdowell’s, Signature, Royal Challenge etc. In 2013, Diageo PLC acquired 10% stake in the company and gradually ramped up its share to 55% by the end of 2014. The main inflexion point came in 2015, after the whole company came under the control of Diageo PLC. -

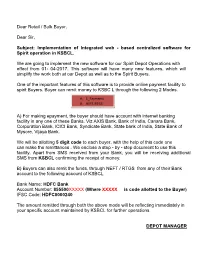

Rs Buyer Code

Dear Retail / Bulk Buyer, Dear Sir, Subject: Implementation of Integrated web - based centralized software for Spirit operation in KSBCL. We are going to implement the new software for our Spirit Depot Operations with effect from 01- 04-2017. This software will have many new features, which will simplify the work both at our Depot as well as to the Spirit Buyers. One of the important features of this software is to provide online payment facility to spirit Buyers. Buyer can remit money to KSBC L through the following 2 Modes. A. E_Payments B. NEFT/RTGS A) For making epayment, the buyer should have account with internet banking facility in any one of these Banks. Viz AXIS Bank, Bank of India, Canara Bank, Corporation Bank, ICICI Bank, Syndicate Bank, State bank of India, State Bank of Mysore, Vijaya Bank. We will be allotting 5 digit code to each buyer, with the help of this code one can make the remittances . We enclose a step - by - step document to use this facility. Apart from SMS received from your Bank, you will be receiving additional SMS from KSBCL confirming the receipt of money. B) Buyers can also remit the funds, through NEFT / RTGS from any of their Bank account to the following account of KSBCL. Bank Name: HDFC Bank Account Number: 855500XXXXX (Where XXXXX is code allotted to the Buyer) IFSC Code: HDFC0000240 The amount remitted through both the above mode will be reflecting immediately in your specific account maintained by KSBCL for further operations. DEPOT MANAGER PARTY BUYER- List of Party-name with Party Code PARTY Beneficiary Acct IFSC NUMBER CODE Categor Number 81001 A.P. -

International Registration Designating India Trade Marks Journal No: 1835 , 05/02/2018 Class 1

International Registration designating India Trade Marks Journal No: 1835 , 05/02/2018 Class 1 Priority claimed from 19/11/2015; Application No. : 014818769 ;European Union 3391941 12/04/2016 [International Registration No. : 1307170] GELITA AG Uferstr. 7 69412 Eberbach Germany Address for service in India/Attorney address: LALL & SETHI D-17, N.D.S.E.-II NEW DELHI-49 Proposed to be Used IR DIVISION Chemicals for industrial purposes; gelatine for industrial purposes; gelatine hydrolysate [raw material] for industrial use and for the preparation of foodstuffs and beverages, pharmaceutical, cosmetic and veterinary products, dietary products and nutritional supplements; protein [raw material]. 8456 Trade Marks Journal No: 1835 , 05/02/2018 Class 1 Priority claimed from 17/10/2016; Application No. : 1341145 ;Benelux 3518971 18/11/2016 [International Registration No. : 1330622] STAHL INTERNATIONAL B.V. Sluisweg 10 NL-5145 PE WAALWIJK Proposed to be Used IR DIVISION Chemicals for industry purposes, including leather, processing of leather, textile, floor, tapestry, improvement and furniture industries; synthetic resins and synthetic resins including chemical additives wanted by processing of these resins; plastics as raw materials in powder, liquid or paste form; tempering preparations, tanning substances, adhesives for industrial purposes; oils for tanning leather; all the aforementioned goods being products used in the leather processing industry in order to make lightweight leather. 8457 Trade Marks Journal No: 1835 , 05/02/2018 Class 1 Priority -

Cheers! the Indian Alcobev Industry Era

Cheers! The Indian Alcobev Industry Era by Vincent Fernandes and Trilok Desai 2 3 Cheers! The Indian Alcobev Industry Era Published by Trilok Desai Publisher: Special Audience Publications Pvt. Ltd. in 2013 Printed at JAK Printers Pvt. Ltd., JAK Compound, Dadoji Konddeo Cross Lane, Off Dr. Babasaheb Ambedkar Marg, Byculla (E), Mumbai - 400 027 Photographs, Cartoons & Illustrations National Museum (Delhi), Mathura Museum, Mario Miranda Foundation, Ambrosia Archives Editorial Team Amitabh Joshi, Rojita Tiwari, Lopamudra Ganguly, Yashnashree, Nivedita Nagpal, Alan Fernandes Photographers Shirish Karale, Steve D’souza and Ajay Singh Design and image editing Shirish Karale, Varsha Karale and Rajendra Gaikwad Marketing SAP Media Worldwide Ltd. Production Manoj Surve Advertisements Nivedita Hegde and Sudeshna Chakravarty Special Thanks CIABC, AIBA , AIDA, ISWA, ABDVI, USL, UB Group, Mohan Meakins,Tilaknagar Industries, Bacardi, Carlsberg, Radico Khaitan, Munjral Brothers & Mohan Bros Distributors: BD Distributors & Variety Book Depot Price: `.4,000 US$ 100 Special Audience Publications Pvt. Ltd. Mumbai Office: Delhi Office: 509 & 511, Dilkap Chambers, F-22 Green Park, Fun Republic Street, Off New Delhi-110 016, India Veera Desai Road, Andheri (W) Tel: 91-011-26532567/68 Mumbai 400 053. India Fax: 91-011-26863028 Tel: 91-22-40401919 E-mail: [email protected] Fax: 91-22-40401927 Email: [email protected] 4 5 It gives me great pleasure to present the first Coffee Table Book “Cheers! The Indian Alcobev Industry Era”, documenting the past, present, and possible future of the Indian Alcobev Industry”. As Ambrosia has completed more than two decades of publishing the magazine, it was only fitting that we archive the industry happenings over the years.The book is a complete retrospect with pictures of the alcobev scenario, the way it was. -

Local File List 1

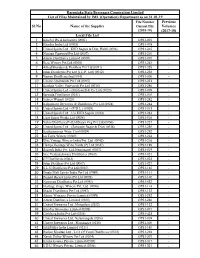

Karnataka State Beverages Corporation Limited List of Files Maintained by IML (Operation) Department as on 31.03.19 File Number Previous Sl.No Name of the Supplier Current File Volumes (2018-19) (2017-18) Local File List 1 Khoday RCA Industries (0001) OPS1-001 - 2 Khoday India Ltd (0003) OPS1-003 - 3 United Spirits Ltd –KBD Sugars & Dist, Hubli (0006) OPS1-265 - 4 Nisarga Vineyard Pvt Ltd (0007) OPS1-260 - 5 Amrut Distilleries Limited (0009) OPS1-005 - 6 Rico Winery Pvt Ltd (0010) OPS1-245 - 7 Allied Blenders & Distillers Pvt Ltd (0011) OPS1-258 - 8 John Distilleries Pvt Ltd (I.C.P. Ltd) (0012) OPS1-256 - 9 Vorion DistilleriesInc(0014) OPS1-006 - 10 Unistil Alcoblends Pvt Ltd (0015) OPS1-253 - 11 Krishna Valley Vineyards Pvt Ltd (0018) OPS1-246 - 12 United Spirits Ltd – (Mcdowell & Co Ltd) (0020) OPS1-009 - 13 Sarvada Distilleries (0021) OPS1-010 - 14 Suloco Winery (0023) OPS1-242 - 15 Kalpatharu Breweries & Distilleries Pvt Ltd (0024) OPS1-244 - 16 United Spirits Ltd – (P.D.L.) (0029) OPS1-013 - 17 United Spirits Ltd – l/o KBD Sugars (0033) OPS1-233 - 18 Ugar Sugar Works Ltd (0034) OPS1-016 - 19 Vahni DistilleriesPvtLtd(Surya Org Pvt Ltd)(0036) OPS1-227 - 20 United Spirits Ltd – (Sahyadri Sugar & Dist) (0038) OPS1-230 - 21 Krishnamruga Wine Yard (0039) OPS1-292 - 22 La Terra Winery (0040) OPS1-224 - 23 Elite Vintage Winery India Pvt. Ltd. (0042) OPS1-216 - 24 Hampi Heritage Wine Yards (P) Ltd (0047) OPS1-198 - 25 Bacardi India Pvt. Ltd,Nanjangud. (0057) OPS1-019 - 26 Sree Venkateshwara Distilleries (0060) OPS1-021 - 27 J.P.Distilleries (0063) OPS1-023 - 28 John Distillery Pvt Ltd (0067) OPS1-027 - 29 S.L.N.Distilleries Pvt Ltd (0087) OPS1-165 - 30 Single Malt Spirits India Pvt Ltd (0089) OPS1-161 - 31 Pernod Ricard India Pvt Ltd (0091) OPS1-160 - 32 Netravati Distilleries Pvt Ltd (0095) OPS1-032 - 33 Heritage Grape Winery Pvt. -

Resume Format

Ritesh Raman, 31 Category Management | Brand Management | Ex – John Distilleries | Ex – Myntra | NIFT, Mumbai Email: [email protected] | M: 6366242457 PROFILE SUMMARY ● 8 years of experience across Retail, e-Commerce and the alco-bev industry ● Expertise in Category Management, brand management, marketing, and Strategic Sourcing and Procurement ● Exposed to Data Analytics, Marketing Frameworks, business strategy, Platform Economics and consumer behavior ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- PROFESSIONAL EXPERIENCE Senior Manager (Trade Marketing), John Distilleries Pvt Ltd | Jul ’19 – Sept ’20 Defining, designing and managing delivery of Trade Marketing Initiatives across 5 Indian states: Telangana, AP, Karnataka,TN and Kerala ● Managed Sourcing for 5 flagship beverage brands, viz. Fireball Paul John Whiskey, Nirvana, Original choice and Big Banyan Wines ● Carried out Inventory Management worth INR 30 Cr ● Led the creation and publication of all Marketing Collateral in line with brand guidelines and marketing plans ● Planned and implemented Promotional Campaigns Assistant Category Manager, Xiaomi | Aug ’18 – Mar ’19 ● Managed the Lifestyle Portfolio worth INR 100 Cr from international manufacturers in China ● Led category management, Sales Monitoring, inventory management, P&L, marketing campaigns and Product Launch Events ● Launched 6 products within 8 months in the lifestyle category, -

8 Nov 2017 Soaring Spirits Private Limited

Brief Rationale Soaring Spirits Private Limited November 8, 2017 Rating Amount Facilities Rating1 Rating Action (Rs. crore) CARE BB; Stable Long-term Bank Facilities 6.00 Assigned (Double B; Outlook: Stable) Total 6.00 (Rupees Six crore only) Details of facilities in Annexure-1 Detailed Rationale & Key Rating Drivers The ratings assigned to the bank facilities of Soaring Spirits Private Limited are tempered by the small scale of operations although increasing total operating income during review period, geographic concentration risk and highly regulated user industry with change in government policies. The ratings, however, derive its strengths from long track record of the company and experienced management, satisfactory profit margins albeit fluctuating during review period, comfortable capital structure and debt coverage indicators, moderate working capital cycle during review period and positive demand prospect of distilleries. Going forward, ability of the company to increase the scale of operations, along with efficient management of working capital requirements are the key rating sensitivities. Detailed Description of the key rating drivers Key Rating Weaknesses Small scale of operations although increasing total operating income during review period Despite having a long track record, the scale of operations are relatively small marked by total operating income (TOI) of Rs. 15.01 crore during FY17(Prov.) with moderate networth base of Rs. 8.12 crore as March 31, 2017(Prov.) as compared to other peers in the industry. The total operating income has been increasing during review period FY15-FY17. The company witnessed significant increase in TOI from Rs. 8.93 crore in FY16 to Rs. 15.01 crore in FY17(Prov.) due to addition of more customers resulting in addition of 2 new machinery worth Rs. -

United Spirits

COMPANY UPDATE 04 OCT 2017 United Spirits SELL INDUSTRY FMCG Persistent hangover… CMP (as on 4 Oct 2017) Rs 2,400 United Spirits (UNSP) is the undisputed liquor Why is UNSP a SELL? leader in India. Long term investors in India’s . The Indian liquor industry’s volume growth slowed Target Price Rs 2,060 consumption story have been motivated by the from 13% CAGR over FY10-12 to 3.5% over FY13-16. It Nifty 9,915 transformation of UNSP under Diageo. Mgt has is running negative in FY18 YTD. The liquor ban along Sensex 31,672 pushed for premiumisation, cost control, de- highways is only one instance of an unrelenting hostile environment. Distribution and pricing KEY STOCK DATA leveraging and has franchised out low-end brands. continue to be mired in complex, state-specific Bloomberg UNSP IN This has fuelled investor aspirations of sustainably regulations. UNSP has not manufactured liquor in No. of Shares (mn) 145 better margins and falling debt. Tamil Nadu (18% of India’s liquor volume) after MCap (Rs bn) / ($ mn) 349/5,359 While we are believers in most of the repair work at exiting this market in 2013. 6m avg traded value (Rs mn) 1,386 UNSP (as well as the broader Indian consumption . Profit margins for brand owners are falling, especially STOCK PERFORMANCE (%) story), we are skeptical on stock return hereon. Our in the economy segment. Indirect taxes have risen to 66% (FY17) from 42% in FY10 for UNSP. We expect 52 Week high / low Rs 2,774/1,773 thesis is premised on three important factors, states to continue milking the industry. -

78 Virtual Annual Convention & International Sugar Expo

STAI e-SOUVENIR Released on the Occasion of 7878thth VirVirtualtual AAnnualnnual CCononvvenentiontion && InIntternaernationaltional SugarSugar ExpoExpo 20202020 20th - 21st October 2020 New Delhi THE SUGAR TECHNOLOGISTS’ ASSOCIATION OF INDIA Plot No. 15, 301 Aggarwal Okhla Plaza, Community Centre, Behind Hotel Crowne Plaza, Okhla Phase - I, New Delhi-110020 Tel: 011-45960930, 31, 32 • E-mail: offi[email protected] Website : www.staionline.org (I) (II) (III) (IV) (V) (VI) (VII) (VIII) (IX) India’s first Integrated Agro Industrial Complex (IAIC) with Sugar Mill, Molasses based Distillery, Grain based Distillery and Malt / Rice based Brewery with Biocomposting Facilities along with Packaging Plant in one complex. Group is having following companies located at Vill. Kiri Afgana, Tehsil Batala, Distt. Gurdaspur, Punjab. 1. M/s. Chadha Sugars & Industries Pvt. Ltd. Capacity 7500 TCD, with Cogeneration 23 MW. 2. M/s. Adie Broswon Breweries Capacity 5 Lakh Hecto litrs per annum 3. M/s. A.B. Grain Spirits Pvt. Ltd. Distillery having capacity 160 KLPD 4. M/s. Chadha Sugars & Industries Pvt. Ltd. Distilleries 2 Nos. capacity 30 KLPD each Ethanol Plant of 50 KLPD already installed & Commissioned. 5. M/s. A.B.T.C. & A.B.G.S.P.L Bus Division – Operating more than 700 buses in Delhi & NCR Group marching fast towards Socio-economic promotion and Infra Structure Development of International Border area of District Gurdaspur, Punjab. SALIENT FEATURES l ISO Certified Company. l Obtained Food Safety Certificate. l Winner of Punjab State award for highest tax payer amongst districts. l Best efforts for upliftment of the society and infra structure of the area. -

Consumer Pulse October 2017 Monthly Industry Newsletter

Consumer Pulse | October 2017 1xw Consumer Pulse October 2017 Monthly Industry Newsletter Consumer Pulse | October 2017 WPI & CPI Inflation 4.5% 4.0% 3.85% 3.28% 3.28% WPI dipped to 2.60% in September 2017 3.5% 2.99% after rising sharply for last two months, 3.0% 2.36% 3.24% majorily driven by fall in inflation for two 2.5% 2.18% 2.0% 2.60% major sub-groups - primary articles and 2.17% 1.46% 1.88% fuel products, while the manufactured 1.5% products group has exhibited an increase in 1.0% 0.90% inflation in September 2017. 0.5% 0.0% CPI for September 2017 came in at 3.28%, Apr-17 May-17 Jun-17 Jul-17 Aug-17 Sep-17 the same level as previous month, below the CPI WPI Reserve Bank of India’s medium target of 4.0% Consumer Sentiments Disposable Income (INR) In October 2017, monthly index of consumer sentiments was down 1.31% to 96.0 1,80,000 94.37 1,53,795 93.13 95.0 1,60,000 1,39,353 Monthly index of consumer expectations 94.0 1,40,000 1,27,029 was down 2.16% to 91.33 93.35 1,20,000 1,14,927 The monthly index of urban consumer 93.0 93.13 1,00,000 sentiments was down 3.65% at 87.54, as 92.0 compared to the previous month. 80,000 91.0 91.33 The monthly index of rural consumer 60,000 90.0 sentiments was down 0.57% to 95.99, as 17 17 17 17 17 17 17 17 17 17 17 17 17 17 17 17 40,000 - - - - - - - - - - - - - - - compared to the previous month. -

Chennai Tla Hearing Board

TLA HEARING BOARD Hearing Schedule from 05/10/2015 to 20/10/2015 Location: CHENNAI S.No. TM No. Class Hearing Date Hearing Schedule Proprietor Name Agent Name 1 2136304 45 10/5/2015 Morning (10.30 am to BRB. OLIMUTHU A. ARIVAZHAGAN 1.00 pm) 2 2136308 99 10/5/2015 Morning (10.30 am to UNIVERSITA COMMERCIALE LUIGI DEPENNING & DEPENNING 1.00 pm) BOCCONI 3 2088437 29 10/5/2015 Morning (10.30 am to NATURO FOOD & FRUIT PRODCUTS APR ASSOCIATES. 1.00 pm) PVT. LTD 4 2091509 11 10/5/2015 Morning (10.30 am to THERMEN HEATING TECHNOLOGIES MAKHIJA & ASSOCIATES. 1.00 pm) PVT. LTD 5 2097485 5 10/5/2015 Morning (10.30 am to RADHA RAMANA HEALTH CARE PVT R.K. DEWAN AND COMPANY 1.00 pm) LTD 6 2097486 5 10/5/2015 Morning (10.30 am to AVA DUTTA MARKETING PVT LTD. R.K. DEWAN AND COMPANY 1.00 pm) 7 2105156 99 10/5/2015 Morning (10.30 am to GREYNIUM INFORMATION INDUS LAW 1.00 pm) TECHNOLOGIES PRIVATE LTD. 8 2105157 99 10/5/2015 Morning (10.30 am to GREYNIUM INFORMATION INDUS LAW 1.00 pm) TECHNOLOGIES PRIVATE LTD. 9 2106315 5 10/5/2015 Morning (10.30 am to M.HEMALATHA INPRO TRADE MARK SERVICES. 1.00 pm) 10 815599 19 10/5/2015 Morning (10.30 am to PALLAVA GRANITE INDUSTRIES A. PRABHAKARA REDDY. 1.00 pm) (INDIA) LTD 11 1518296 41 10/5/2015 Morning (10.30 am to BASHEERUDDIN BABUKHAN I-WIN IP SERVICES 1.00 pm) 12 2017784 99 10/5/2015 Morning (10.30 am to SAMI LABS LIMITED SAMI LABS LIMITED 1.00 pm) 13 2032031 33 10/5/2015 Morning (10.30 am to SPR GROUP HOLDINGS PVT. -

FA1 Sl. No. Subject File No. 1

KARNATAKA STATE BEVERAGES CORPORATION LTD General – FA1 Sl. Subject File No. No. 1 MSIL – TAKING OVER OF ASSETS FA1 – 001 2 ACCOUNTING SYSTEM OF THE CORPORATION FA1 – 002 3 FUNDS REQUIREMENT FROM GOK FA1 – 003 4 FINANCIAL REPORTING TO THE BOARD FA1 – 004 5 CORPORATE TAX FA1 – 005 6 PREVILEGE FEE FA1 – 006 7 RELEASE OF AMOUNT TO EXCISE DEPT. FA1 – 007 8 LOAN FROM GOK FA1 – 008 9 AUTHORISED AND PAID UP CAPITAL FA1 – 009 10 FUNDS FLOW FA1 – 010 11 REWARD SYSTEM FOR ENFORCEMENT ACTIVITIES FA1 – 011 12 BANKING ARRANGEMENTS FA1 – 012 13 LOAN – UTI BANK FA1 – 013 14 LOAN – VIJAYA BANK FA1 – 014 15 LOAN – ING VYSYA BANK FA1 – 015 16 LOAN – CORPORATION BANK FA1 – 016 17 LOAN – SBI FA1 – 017 18 OPERATIONS – UTI BANK FA1 – 018 19 OPERATIONS – ING VYSYA BANK FA1 – 019 20 OPERATIONS – CORPORATION BANK FA1 – 020 21 OPERATIONS - CANARA BANK FA1 – 021 22 CMS – SBI MUTUAL FUND FA1 – 022 23 APPOINTMENT OF STATUTORY ADUITORS FA1 – 023 24 CORRSPONDENCE WITH DEPOTES FA1 – 024 25 CORRSPONDENCE - GENERAL FA1 – 025 26 APPOINTMENT OF TAX AUDITOR FA1 – 026 27 BANK - RECONCILATION - IML FA1 – 027 28 TALY SOFTWARE – A/CG PACKAG, MODIFICATIONS FA1 – 028 29 PAYMENT APPROVAL – DISTILLERIES & BREWARIES ( IML / Beer ) FA1 – 029 30 PAYMENT APPROVAL –( RS / ENA ) FA1 – 030 31 DEMURRAGE FA1 – 031 32 COMMERCIAL TAXES FA1 – 032 33 TAX COLLECTION AT SOURCE (TCS) FA1 – 033 34 TCS REMITTANCE FA1 – 034 35 T A BILLS claims ( Approval for payment bills ) FA1 – 035 36 TDS – RETURNS FA1 – 036 37 Specimen signature of officers of designated banks. FA1 – 037 38 Petty cash to depots