Part 2 Business Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stock Comparison

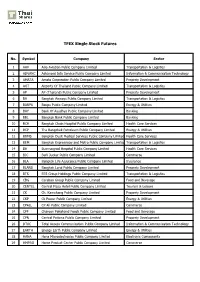

TFEX Single Stock Futures No. Symbol Company Sector 1 AAV Asia Aviation Public Company Limited Transportation & Logistics 2 ADVANC Advanced Info Service Public Company Limited Information & Communication Technology 3 AMATA Amata Corporation Public Company Limited Property Development 4 AOT Airports Of Thailand Public Company Limited Transportation & Logistics 5 AP AP (Thailand) Public Company Limited Property Development 6 BA Bangkok Airways Public Company Limited Transportation & Logistics 7 BANPU Banpu Public Company Limited Energy & Utilities 8 BAY Bank Of Ayudhya Public Company Limited Banking 9 BBL Bangkok Bank Public Company Limited Banking 10 BCH Bangkok Chain Hospital Public Company Limited Health Care Services 11 BCP The Bangchak Petroleum Public Company Limited Energy & Utilities 12 BDMS Bangkok Dusit Medical Services Public Company Limited Health Care Services 13 BEM Bangkok Expressway and Metro Public Company Limited Transportation & Logistics 14 BH Bumrungrad Hospital Public Company Limited Health Care Services 15 BJC Berli Jucker Public Company Limited Commerce 16 BLA Bangkok Life Assurance Public Company Limited Insurance 17 BLAND Bangkok Land Public Company Limited Property Development 18 BTS BTS Group Holdings Public Company Limited Transportation & Logistics 19 CBG Carabao Group Public Company Limited Food and Beverage 20 CENTEL Central Plaza Hotel Public Company Limited Tourism & Leisure 21 CK Ch. Karnchang Public Company Limited Property Development 22 CKP Ck Power Public Company Limited Energy & Utilities 23 CPALL CP All Public Company Limited Commerce 24 CPF Charoen Pokphand Foods Public Company Limited Food and Beverage 25 CPN Central Pattana Public Company Limited Property Development 26 DTAC Total Access Communication Public Company Limited Information & Communication Technology 27 EARTH Energy Earth Public Company Limited Energy & Utilities 28 HANA Hana Microelectronics Public Company Limited Electronic Components 29 HMPRO Home Product Center Public Company Limited Commerce TFEX Single Stock Futures No. -

1Q21 Results Opportunity Day

1Q21 results Opportunity Day 21st May 2021 DISCLAIMER The information contained in this presentation is intended solely for your reference. This presentation contains “forward-looking” statements that relate to future events, which are, by their nature, subject to significant risks and uncertainties. All statements, other than statements of historical fact contained in this presentation including, without limitation, those regarding Banpu’s future financial position and results of operations, strategy, plans, objectives, goals and targets, future developments in the markets where Banpu participates or is seeking to participate and any statements preceded by, followed by or that include the words “believe”, “expect”, “aim”, “intend”, “will”, “may”, “project”, “estimate”, “anticipate”, “predict”, “seek”, “should” or similar words or expressions, are forward-looking statements. The future events referred to in these forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control, which may cause the actual results, performance or achievements, or industry results to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These forward-looking statements are based on numerous assumptions regarding our present and future business strategies and the environment in which Banpu will operate in the future and are not a guarantee of future performance. Such forward-looking statements speak only as of the date on which they are made. Banpu does not undertake any obligation to update or revise any of them, whether as a result of new information, future events or otherwise. The information set out herein is subject to change without notice, its accuracy is not guaranteed, has not been independently verified and it may not contain all material information concerning the Company. -

Banpu Public Co Ltd (BANPU TB)

BUY (Unchanged) TP: Bt 25.00 (From: Bt 22.00 ) 21 SEPTEMBER 2017 Change in Numbers Upside : 47.1% Banpu Public Co Ltd (BANPU TB) New Dawn We maintain our BUY call on BANPU and raise our TP to Bt25 from Bt22. We are now more bullish on coal prices, as we expect China to keep coal prices elevated amid its push for a greener energy mix. CHAK REUNGSINPINYA BANPU remains attractive at 7-8x 2018-19F P/E with 6%+ dividend 662 – 617 4965 [email protected] yield. We see strong 2H17F results as a key share price catalyst. Coal price supported by China’s policies COMPANY VALUATION It has been a year since China began to curb domestic coal Y/E Dec (Bt m) 2016A 2017F 2018F 2019F production and we are more positive than ever that authorities there will continue to support high coal prices in order to Sales 79,737 88,347 94,324 95,132 discourage coal consumption and accelerate the shift towards Net profit 1,677 8,961 11,937 11,130 cleaner energy sources. We believe this policy favors major Consensus NP 9,054 8,682 8,988 seaborne coal suppliers, of which BANPU is among the foremost Diff frm cons (%) (1.0) 37.5 23.8 players. We raise our coal price forecasts (based on the Norm profit 2,100 10,961 11,937 11,130 Newcastle Export Index) by $5/ton to $85/80/80 for 2017/18/19F Prev. Norm profit 10,530 10,682 9,633 and $75/ton in the longer term. -

2Q21 Results Investor and Analyst Update

2Q21 results Investor and analyst update 17th August 2021 DISCLAIMER The information contained in this presentation is intended solely for your reference. This presentation contains “forward-looking” statements that relate to future events, which are, by their nature, subject to significant risks and uncertainties. All statements, other than statements of historical fact contained in this presentation including, without limitation, those regarding Banpu’s future financial position and results of operations, strategy, plans, objectives, goals and targets, future developments in the markets where Banpu participates or is seeking to participate and any statements preceded by, followed by or that include the words “believe”, “expect”, “aim”, “intend”, “will”, “may”, “project”, “estimate”, “anticipate”, “predict”, “seek”, “should” or similar words or expressions, are forward-looking statements. The future events referred to in these forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control, which may cause the actual results, performance or achievements, or industry results to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These forward-looking statements are based on numerous assumptions regarding our present and future business strategies and the environment in which Banpu will operate in the future and are not a guarantee of future performance. Such forward-looking statements speak only as of the date on which they are made. Banpu does not undertake any obligation to update or revise any of them, whether as a result of new information, future events or otherwise. The information set out herein is subject to change without notice, its accuracy is not guaranteed, has not been independently verified and it may not contain all material information concerning the Company. -

Bangkok Airways (BA TB) Share Price: Bt11.8 Target Price: Bt12.0 (+1.7%) Expect Losses to Halve Yoy in 4Q18 Company Update

January 7, 2019 NEUTRAL Bangkok Airways (BA TB) Share Price: Bt11.8 Target Price: Bt12.0 (+1.7%) Expect losses to halve yoy in 4Q18 Company Update Expect Bt222m core loss in 4Q18F vs Bt451m loss in 4Q17 and Bt96m profit in previous quarter; yoy drop due to higher fuel cost Revised up FY19-20F core profit after imputing lower fuel cost Maintain NEUTRAL, trimmed TP to Bt12/sh (from Bt13); prefer AAV (sector top pick) on its better hedging position Higher fuel cost and low season on Samui to drag 4Q18F earnings We expect BA to book Bt222m core loss in 4Q18 vs Bt451m loss in 4Q17 and Bt96m profit in the previous quarter. Ticket sales should drop 4% qoq to Bt5.0bn (flat yoy) driven by 6% drop in passenger yield due to low season on Samui, fewer European and Chinese tourist arrivals, and weak demand for Phuket and Chiang Mai routes. Cabin factor should drop 3ppt qoq and 1ppt yoy to 69% following decision to maintain yield Kitti PITAKTEERABANDIT (+1% yoy). Fuel cost should jump 25% yoy (+3% qoq) on higher jet fuel 662 - 659 7000 ext 50 08 price net of hedging (US$85/bbl in 4Q18 vs US$65 in 4Q17). CASK ex- [email protected] COMPANY RESEARCH | fuel should drop 8% yoy as BA managed seat capacity to match Key Data demand. Including Bt11m FX loss in the quarter, BA should report 12 -mth High/Low (Bt) 17.4 / 11.0 Bt233m net loss vs Bt930m net profit in 4Q17, led by extra gain from Market capital (Btm/US$m) 24,428.7 / 759.0 sales of BDMS shares. -

Capital Profile Prasarttong-Osoth Family

7 NOVEMBER 2014 Prasarttong-Osoth Family — Bangkok Dusit Medical Services, Bangkok Airways Founding family and controlling shareholder of Thailand-listed Bangkok Dusit Medical Services and Bangkok Airways Bangkok Dusit Medical Services merged with Wichai Thongtang's Phyathai Hospital Group in 2011. Wichai Thongtang was Thaksin Shinawatra's lawyer in the former Thai PM's asset-concealment case in 2001 and is a close friend of Thaksin's brother-in-law Somchai Wongsawat. Bangkok Airways owns and operates four Thai airports: the Suvarnabhumi International Ilya Garger Airport, Samui Airport, Sukothai Airport and Trat Airport Editor in Chief Bangkok Airways' joint venture WFS-PG Cargo has reportedly been investigated for Su- [email protected] varnabhumi International Airport projects awarded during Thaksin's reign Sze Toh Yuin Munn Research Editor Capital Profile covers 12 family members and 21 companies [email protected] David Wu INTRODUCTION Researcher [email protected] The Prasert Prasarttong-Osoth family is be- of THB 25 per share, which crowned it hind SET-listed hospital operator Bangkok Thailand’s largest IPO of 2014, as of early Felix Tjandra Dusit Medical Services Group, one of the big- November. Research Analyst gest private medical services operator in Asia [email protected] Prasert Prasarttong-Osoth had a net worth of with a market capitalization of around THB USD 2.3bn as of June 2014, according to Jacob Li 78.4 billion in assets as of June 2014. The Forbes, which ranked him the eighth richest Analyst family also owns media businesses English- man in Thailand. [email protected] language cable TV channel THN Network (In Channel) and Bangkok Media and Broadcast Origin and Background Jessica Kurnia Co Ltd, which launched digital TV channel Researcher Prasert Prasarttong-Osoth was a surgeon by PPTV. -

Banpu Fact Sheet for Revision

Fact Sheet Banpu Spirit Innovation Integrity Care Synergy 27 5 4,300 Years since Banpu’s Countries in which Total number of workers in establishment Banpu operates and three countries (FY2009) invests CHINA Shareholding Structure (Jun10) Luannan Founders: 100MW, 128tph 24% 17% Zhengding 367 Mt Gaohe (45%) 48MW, 180tph 6Mtpa Zouping (70%) Foreign and Total coal reserves Daning (56%) 100MW, 490tph Other Thai 4Mtpa NVDR: 63% (2009 equity basis) Hebi (40%) shareholders: 20 % 1.5Mtpa THAILAND Hong Sa (40%) 1,800MW Ratch (15%) Baht per share dividend (2009) 21.3 Mt 4,345MW BLCP (50%) 16 9% 1,434MW Total coal output Trubaindo (74%) INDONESIA 5.2 Mtpa Indominco (74 %) (2009 equity basis) Bharinto (73%) 12.4Mtpa Banpu vs. SET index changes Jan 08 – Jun 10 2 Mtpa Kitadin (74%) % 0.7Mtpa 67% Jorong (73%) 3.1Mtpa 80 Banpu +55% AUSTRALIA 40 % of total workers 2,307 MWh Coal mine 0 SET Coal mine project -5% Total power installed Coal-fired power -40 Centennial (20%) Coal-fired power project (2009 equity basis) 14.2Mtpa Gas-fired power -80 2008 2009 2010 Gross revenues THB Millions (1992 – 2010) 2010 Acquired 19.9% of 1983 Centennial Established in 2001 (Australian coal Thailand as a coal- Won the bid for 2008 business mining venture acquisition of 2003 Acquired "Indocoal” Acquired 2006 additional 78% of 57,865 a 22% 1989 Acquired 100% AACI 50,530 1991 Refocused its strategy on stake in Listed on 1993 of PPIC (China Started becoming a leading coal- AACI the Stock Diversified into power business) coal based energy player in (China coal 33,378 32,442 Exchange power project business in the Asia-Pacific region business) 25,209 of Thailand development in Indonesia Thailand 17,227 10,909 12,482 7,423 3,945 5,078 5,303 5,415 1,486 2,388 3,238 3,662 1992 1993 1994 1995 1996 1997 1998 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Last updated on 6 Aug 2010. -

AR-Banpu-2014-Eng NEW 145431

002 003 004 Policy and Vision & Mission Financial CONTENTS Business Highlights Overview 016 018 022 023 Summary of Major Banpu Group Organisation Management Changes and Structure Chart Structure Developments in the Past Year and Major Current Events 054 056 058 060 Internal Sustainable Human Resource Corporate Control Development Management Governance and Supervision on the Use of Internal Information 091 093 094 095 Remuneration of Major Dividend Connected Persons the Board of Shareholders Policy and Transactions Directors and Management 005 006 008 014 Operational Board of Directors’ Chief Executive Key Financial Results Review Officer Review Results 027 041 042 Marketing and Revenue Risk Competition Structure Management 073 080 090 Corporate Social Board of Shareholdings of Responsibility Directors and the Board of Management Directors and Management 097 098 102 Other Details of the Financial References Company and Its Statements Subsidiaries and Associated Companies 002 Annual Report 2014 I Banpu Public Company Limited Policy and Business Overview Banpu Public Company Limited was incorporated on 16 May 1983 with the name ‘Ban Pu Coal Company Limited’ with THB 25 million registered capital. The Company was founded by members of the Vongkusolkit and Auapinyakul families in order to sub-contract a coal mining operation at Banpu Mine (BP-1 Mine) located in Li District, Lamphun Province from Department of Alternative Energy Development and Efficiency. Banpu went on to expand its coal operations both in Thailand and Indonesia to produce and sell coal locally and overseas. Aside from producing and On 4 May 1989 when Banpu was distributing coal, the firm also committed listed in the Stock Exchange of Thailand itself to remove overburden and coal for (SET). -

FY20 & 4Q20 Results

FY20 & 4Q20 results Investor and analyst update 25th February 2021 DISCLAIMER The information contained in this presentation is intended solely for your reference. This presentation contains “forward-looking” statements that relate to future events, which are, by their nature, subject to significant risks and uncertainties. All statements, other than statements of historical fact contained in this presentation including, without limitation, those regarding Banpu’s future financial position and results of operations, strategy, plans, objectives, goals and targets, future developments in the markets where Banpu participates or is seeking to participate and any statements preceded by, followed by or that include the words “believe”, “expect”, “aim”, “intend”, “will”, “may”, “project”, “estimate”, “anticipate”, “predict”, “seek”, “should” or similar words or expressions, are forward-looking statements. The future events referred to in these forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control, which may cause the actual results, performance or achievements, or industry results to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These forward-looking statements are based on numerous assumptions regarding our present and future business strategies and the environment in which Banpu will operate in the future and are not a guarantee of future performance. Such forward-looking statements speak only as of the date on which they are made. Banpu does not undertake any obligation to update or revise any of them, whether as a result of new information, future events or otherwise. The information set out herein is subject to change without notice, its accuracy is not guaranteed, has not been independently verified and it may not contain all material information concerning the Company. -

Banpu Cheat Sheet 1Q10

Last updated by the Banpu IR team on 28 May 2010. No representation or warranty is made as to the accuracy, completeness or reliability of the information shown here. Nothing in this 'cheat sheet' should be construed as a solicitation of an offer to buy or sell INVESTOR RELATIONS CHEAT SHEET shares in any jurisdiction. BANPU CORPORATE Company profile Banpu consolidated income statement summary and ratios (quarterly) Banpu consolidated balance sheet summary and ratios (quarterly) Banpu is a pan‐Asian coal‐focused energy group with a diverse THB millions 1Q09 2Q09 3Q09 4Q09 1Q10 THB millions 1Q09 2Q09 3Q09 4Q09 1Q10 portfolio of coalmining and power assets clustured around three main geographic poles: China, Thailand and Indonesia. Coal output Revenues 13,624 12,932 13,881 17,428 15,251 Cash & MS 12,560 15,560 15,816 21,050 23,498 in 2009 was 21.1Mt. Banpu's Indonesian coal business, PT Indo Gross profit 7,173 6,501 6,824 7,376 6,492 Other ST assets 15,174 14,654 16,253 16,552 14,884 Tambangraya Megah ('ITMG'), was floated on the Jakarta Stock EBITDA 7,080 6,833 6,088 3,686 5,405 Fixed assets 61,106 62,953 64,544 63,814 64,859 Exchange in December 2007. The Banpu group has power D&A 523 427 506 565 490 Total assets 88,841 93,167 96,613 101,417 103,242 generation capacity (equity basis) of around 1.5GW and a project Net interest paid (379) (379) (360) (344) (324) of 0.7GW. -

Enclosure 1 Notification of the Allocation of Newly Issued Ordinary Shares in Combination with Warrants Representing the Right T

Enclosure 1 Notification of the Allocation of Newly Issued Ordinary Shares in Combination with Warrants Representing the Right to Purchase Ordinary Shares of Banpu Public Company Limited No.4 (BANPU-W4) and Warrants Representing the Right to Purchase Ordinary Shares of Banpu Public Company Limited No.5 (BANPU-W5) of Banpu Public Company Limited Important Disclaimers By accepting delivery of this notification of the rights to subscribe (the “Notice of Subscription Rights”) for newly issued ordinary shares offered to the existing shareholders of Banpu Public Company Limited (the “Company”) in proportion to their respective shareholdings (the “New Shares”) together with warrants representing the right to purchase ordinary shares of Banpu Public Company Limited No. 4 (“Warrants BANPU-W4”) and warrants representing the right to purchase ordinary shares of the Company No. 5 ("Warrants BANPU-W5”) which shall be issued and allocated to the existing shareholders of the Company who subscribe for and are allocated with newly issued ordinary shares offered to such existing shareholders in proportion to their respective shareholdings, the shareholders acknowledge and agree to the disclaimers and conditions set forth below. This offering of the New Shares together with Warrants BANPU-W4 and Warrants BANPU-W5 to the existing shareholders of the Company in proportion to their respective shareholdings is an offering of securities in Thailand pursuant to Section 33 of the Securities and Exchange Act B.E. 2535 (as amended) and will only take place in Thailand. These New Shares, Warrants BANPU-W4 and Warrants BANPU-W5 (i) have not been and will not be registered with the U.S. -

34 Business Acquisition

Contents 3 Report of the Board of Directors’ Responsibilities for the Financial Statements 4 Report of the Audit Committee to Shareholders 6 Management’s Discussion and Analysis of the Consolidated Financial Statements 16 Independent Auditor’s Report 21 Statement of Financial Position 27 Statement of Comprehensive Income 30 Statement of Changes in Equity 34 Statement of Cash Flows 39 Notes to the Consolidated and Separate Financial Statements Report of the Board of Directors’ Responsibilities for the Financial Statements The main priority of the Board of Directors is to supervise the Company’s operations, making sure they are in line with good corporate governance policy and that the financial statements and financial information appearing in the Company’s annual report are accurate, complete and adequate. Its duty is also to make sure that the financial statements are in line with Thai Financial Reporting Standards and that an appropriate accounting policy has been chosen and is being carefully pursued on a regular basis. In addition, the Board of Directors must also ensure that the Company has an effective internal control system to assure the credibility of its financial statements. The Board also ensures protection over potential conflicts of interest through systems which are place to prevent unusual transactions. Connected transactions which might lead to possible conflicts of interest are closely monitored to ensure they are genuine transactions and are reasonably carried out, based on the normal course of business and for the Company’s maximum benefits, and that the Company is in compliance with relevant laws and regulations. The Audit Committee has already reported the result of its action to the Board of Directors and has also reported its opinions in the Audit Committee’s Report as seen in the annual report.