Passenger Car Component and Spare Part Market in Russia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The History of Success of Central Asian Company in Automobile Industry

Review Article, ISSN 2304-2613 (Print); ISSN 2305-8730 (Online) The History of Success of Central Asian Company in Automobile Industry Kanat Zhumanov1, Anel Zhumanova2, Benjamin Chan Yin-Fah3 1,2,3Faculty of Business Management, Asia Pacific University of Technology & Innovation (APU), Kuala Lumpur, MALAYSIA 3Center of Entrepreneurship and Leadership, (APU), Technology Park Malaysia, MALAYSIA *E-mail for correspondence: [email protected] https://doi.org/10.18034/abr.v8i2.155 ABSTRACT The paper analyzes the key success factors of automobile industry in Central Asia, Kazakhstan. In particularly, strategies used, experienced challenges faced by “Bipek Auto – Asia Auto” will be presented in this paper. Key words: Success factors, Kazakhstan, Auto Company INTRODUCTION Kazakhstan in the form of tax and other payments; more than $ 24 million was directed by the company for Today Asia is a platform for a successful business. The charitable and social purposes. The staff of Bipek Auto - rapid development of innovation in Asia is facilitated by Asia Auto has over 4,500 employees in 19 cities of a large number of people, a fast temp of life, and the Kazakhstan and 13 regions of Russia. progress of the economy GDP per capita is higher than in other regions. And one-third of global companies are From 1992 to 2017 (Figure 2), Kazakhstan’s people located in Asia - Taiwan, Japan, China, and Korea. If we purchased more than 475,000 new cars at the company's look are the record provided by Ernst & Young's, Asia branches (Cursive Kazakhstan, 2018). Within 25 years accounted for 14% of world consumer spending in 2011 Bipek Auto - Asia Auto is a leader both in an automobile but been projected to 25% in 2020 and 40% in year 2030. -

Voronezh Tyre Plant Company Profile Company Name (Short): Vshz CJSC CEO: Valeriy Y

Dear readers, The industrial policy pursued by the regional government is in close alignment with the Devel- opment Strategy of Voronezh region up to 2020. It has been approved after thorough consideration and negotiations with non-governmental organi- zations and professional experts. Thus, the region is in for radical system changes in the regional economy. The regional government is successfully develop- ing innovative system. The main directions of clus- ter development policy have been outlined, which increases the region’s competitive advantages and enhances connections between branches and in- dustries. The regional government has managed to create congenial investment climate in the region. The government is coming up with new ways of supporting Rus- sian and foreign investors, developing the system of subsidies and preferences. Innovative industrial parks and zones are set up. Their infrastructure is financed from the state and regional budgets. Voronezh region is one of top 10 in the investment attractiveness rating and is carrying out over 30 investment projects. All the projects are connected with technical re-equipment of companies and creation of high-technology manufac- turers. The number of Russian and foreign investors is constantly increasing. In the Catalogue of Industrial Companies of Voronezh Region, you will find in- formation on the development of industries in Voronezh region, structural and quality changes in the industrial system. Having read this catalogue, you will learn about the industrial potential of Vo- ronezh region, the companies’ production facilities, history and product range. The regional strategy is based on coordinated efforts, a constructive dialogue between private businesses, the government and non-governmental organiza- tions. -

Baltic Rim Economies

Baltic Rim Economies Estonia - Latvia - Lithuania - Poland - Baltic Russia Bimonthly Review ISSUE NO. 5, 31 OCTOBER 2008 ECONOMIC REVIEWS: ESTONIA Page 1 LATVIA Page 2 LITHUANIA Page 3 POLAND Page 4 ST. PETERSBURG Page 5 LENINGRAD REGION Page 6 KALININGRAD REGION Page 7 EXPERT ARTICLES: José Manuel Durão Barroso: EU Strategy for the Baltic Sea Region Page 8 Paula Lehtomäki : Cleaner, safer and brighter future of the Baltic Sea Page 9 Jaak Aaviksoo: Events in Georgia provoke discussions on security in good, old, peaceful Europe Page 10 Siiri Oviir: Gas pipeline to the Baltic Sea – should it come in a civilized way or under the dictate of the big and the powerful? Page 12 Artis Pabriks: Baltic security reflections in the aftermath of the Russian-Georgian conflict Page 13 Efthimios E. Mitropoulos: Busy Baltic to benefit from global pollution measures Page 14 Jari Luoto: EU focuses on the Baltic Sea Page 15 André Mernier: A role for the Energy Charter in a new Russia-EU Partnership Agreement Page 16 Timo Rajala: Finland is facing major energy decisions Page 18 Karlis Mikelsons: Environmentally friendly for sustainable growth Page 19 Reinier Zwitserloot: Nord Stream – making more European energy solidarity possible Page 20 Viktoras Valentukevicius: Current and future activities of Lietuvos Dujos AB Page 21 Seppo Remes: Russian gas can unite Europe – if we allow it Page 22 Aleksandra Mierzyńska and Krzysztof Parkoła: PGNiG – trying to be one step further Page 24 Tapio Reponen: Profiling as a key success factor in modern university strategies Page 25 EXPERT ARTICLES CONTINUED ON NEXT PAGE To receive a free copy, print or register at www.tse.fi/pei Baltic Rim Economies ISSUE NO. -

Competing in the Global Truck Industry Emerging Markets Spotlight

KPMG INTERNATIONAL Competing in the Global Truck Industry Emerging Markets Spotlight Challenges and future winning strategies September 2011 kpmg.com ii | Competing in the Global Truck Industry – Emerging Markets Spotlight Acknowledgements We would like to express our special thanks to the Institut für Automobilwirtschaft (Institute for Automotive Research) under the lead of Prof. Dr. Willi Diez for its longstanding cooperation and valuable contribution to this study. Prof. Dr. Willi Diez Director Institut für Automobilwirtschaft (IfA) [Institute for Automotive Research] [email protected] www.ifa-info.de We would also like to thank deeply the following senior executives who participated in in-depth interviews to provide further insight: (Listed alphabetically by organization name) Shen Yang Senior Director of Strategy and Development Beiqi Foton Motor Co., Ltd. (China) Andreas Renschler Member of the Board and Head of Daimler Trucks Division Daimler AG (Germany) Ashot Aroutunyan Director of Marketing and Advertising KAMAZ OAO (Russia) Prof. Dr.-Ing. Heinz Junker Chairman of the Management Board MAHLE Group (Germany) Dee Kapur President of the Truck Group Navistar International Corporation (USA) Jack Allen President of the North American Truck Group Navistar International Corporation (USA) George Kapitelli Vice President SAIC GM Wuling Automobile Co., Ltd. (SGMW) (China) Ravi Pisharody President (Commercial Vehicle Business Unit) Tata Motors Ltd. (India) © 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved. Competing in the Global Truck Industry – Emerging Markets Spotlight | iii Editorial Commercial vehicle sales are spurred by far exceeded the most optimistic on by economic growth going in hand expectations – how can we foresee the with the rising demand for the transport potentials and importance of issues of goods. -

Why the Russians Backed the Opel-Magna-GAZ Deal??

Why the Russians backed the Opel-Magna-GAZ deal?? Evolution of Russian Market PC Regs. Credit: R L Polk Keep three facts in mind: the Russian car market will be the largest in ‘Europe’ by 2012. The average amount people are willing to spend on a car is rising rapidly ($21,700 in 2008). Foreign car makers are taking a growing slice of the market away from domestic producers. Potentially, Russia is one of the globe’s ‘prize’ markets and its domestic car makers do not intend to give it all away to foreigners. Since the collapse of the Soviet Union in 1991, the car market in Russia has split into two broad geographic segments: in west Russia, the affluent ‘have’ buyers acquire cars that match European standards. They are mostly full or Russian-built imports; in east Russia, the majority ‘have-nots’ buy cheaper, domestic cars. The challenge facing the domestic producers is that their customer base want cars of similar standards as the imports. Domestic and Foreign Shares of the lucrative Russian Car Market 2002 - 2008 So, what’s the problem? To start with, domestic cars are still plagued with sub-standard suppliers and counterfeit after-market parts. Quality control in the factory’s is embryonic, so electrical and trim parts are poor, engineering in unreliability. To cap it all, many domestic brands are tarnished by their terrible reputation established in the ‘90’s—with the fall of the Soviet Union—when production quality collapsed as they couldn’t pay their workers. Another obstacle is emissions compliance. Most domestic cars meet Euro 0 standards and only in 2010 will Euro 2 be required. -

Jsc Avtovaz Avtovaz Group* Operating Highlights for 2003

ANNUAL REPORT | 2003 | JSC AVTOVAZ AVTOVAZ GROUP* OPERATING HIGHLIGHTS FOR 2003 Vehicle unit sales, JSC AVTOVAZ 2003 2002 Change 000’s units 000’s units % Domestic market 626 577 8.49 Export market 92 98 (6.12) Total 718 675 6.3 Automotive assembly kits sales 98 101 (2.97) RR mln RR mln % Net sales 130,772 119,432 9.49 Operating income 5,941 5,591 6.26 Consolidated Statement 2003 2002 Change of Income** RR mln RR mln % For the year ended 31 December Net sales 130,772 119,432 9.49 Cost of sales (110,003) (99,331) 10.74 Gross profit 20,769 20,101 3.32 Interest expense (3,416) (3,077) (11.02) Other expense, net (14,402) (15,896) (9.4) Net income for the year 2,951 1,128 161.61 Consolidated Balance Sheet** 2003 2002 Change At 31 December RR mln RR mln % Cash and cash equivalents 6,767 2,751 145.98 Other current assets 37,069 33,393 11.01 Non-current assets 108,228 102,836 5.24 Total liabilities 72,562 62,166 16.72 Minority interest 1,290 1,587 (18.71) Total shareholders’ equity 78,212 75,227 3.97 Share price and dividend 2003 2002 Change development, JSC AVTOVAZ*** Share price RR RR % For the year ended 31 December Ordinary share Closing 774.7 679.72 +13.97 Annual high 906.42 1201.31 -24.55 Annual low 582.06 558.64 +4.19 Preference share Closing 471.88 371.17 +27.13 Annual high 525.68 667.54 -21.25 Annual low 339.77 319.10 +6.48 Dividends Per ordinary share 6.00 5.00 +20.0 Per preference share 95.00 17.00 +458.82 * The AVTOVAZ Group mentioned hereinafter is the parent company (JSC AVTOVAZ or the “Company”) and all of its subsidiaries and associated companies. -

Global Monthly Is Property of John Doe Total Toyota Brand

A publication from April 2012 Volume 01 | Issue 02 global europe.autonews.com/globalmonthly monthly Your source for everything automotive. China beckons an industry answers— How foreign brands are shifting strategies to cash in on the world’s biggest auto market © 2012 Crain Communications Inc. All rights reserved. March 2012 A publication from Defeatglobal spurs monthly dAtA Toyota’s global Volume 01 | Issue 01 design boss Will Zoe spark WESTERN EUROPE SALES BY MODEL, 9 MONTHSRenault-Nissan’sbrought to you courtesy of EV push? www.jato.com February 9 months 9 months Unit Percent 9 months 9 months Unit Percent 2011 2010 change change 2011 2010 change change European sales Scenic/Grand Scenic ......... 116,475 137,093 –20,618 –15% A1 ................................. 73,394 6,307 +67,087 – Espace/Grand Espace ...... 12,656 12,340 +316 3% A3/S3/RS3 ..................... 107,684 135,284 –27,600 –20% data from JATO Koleos ........................... 11,474 9,386 +2,088 22% A4/S4/RS4 ..................... 120,301 133,366 –13,065 –10% Kangoo ......................... 24,693 27,159 –2,466 –9% A6/S6/RS6/Allroad ......... 56,012 51,950 +4,062 8% Trafic ............................. 8,142 7,057 +1,085 15% A7 ................................. 14,475 220 +14,255 – Other ............................ 592 1,075 –483 –45% A8/S8 ............................ 6,985 5,549 +1,436 26% Total Renault brand ........ 747,129 832,216 –85,087 –10% TT .................................. 14,401 13,435 +966 7% RENAULT ........................ 898,644 994,894 –96,250 –10% A5/S5/RS5 ..................... 54,387 59,925 –5,538 –9% RENAULT-NISSAN ............ 1,239,749 1,288,257 –48,508 –4% R8 ................................ -

Brochure (.Pdf)

COMPANY PROFILE Sumitomo Riko Company Limited Founded: December 1929. Work force: Headquarter: From October 1st 2014 Higashi 3-1 is a member of Sumitomo Group Capital: ¥ 12,145 million about 24,000 worldwide. Komaki, 485-8550 TOKAI RUBBER INDUSTRIES, LTD (Ranked 14th place on Largest 100 (90 million euro). Listed on the First Section of OEM suppliers) with more than 80 Tokyo StockExchange and Na- Aichi Prefecture - Japan year of experience in Automotive Tu rnover: 3,542 billion euro goya Stock Exchange,TOPIX (Nagoya metropolitan area). SUMITOMO RIKO Company Limited Components. (fi scal year 2016). index. portfolio is spread between. Hello to all of you example of how an organization ABOUT can transform itself to keep at the My name is Yoji Suzuki and I’m forefront of industry demands. US President of Automotive Hose Business Headquarters Our Corporate Philosophy is right balance of Human Resources As SumiRiko, we have stayed Development putting value on in business for over 40 years by Employees, Fair Business with our listening to our customers and Customers & Suppliers Sharehold- building one-on-one relationships. ers Satisfaction, and Respect for We are a company with core Community in which we live and values, but we also recognize the on which we act day by day. importance of constantly innovat- ing and adapting to new ways of Our Goals for the Future is ensur- doing business and technology. ing that we will continue to be a corporation trusted by people SumiRiko has been founded around the world as one of the around 1977. In 2013 we have unique and indispensable been selected by Sumitomo Riko Sumitomo Riko Group Company. -

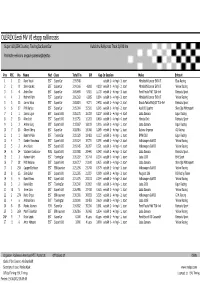

Parimad Eelsõitude Ajad

OLEREX Eesti MV VI etapp rallikrossis Super1600,ERK Juunior, TouringCar,SuperCar Kulbilohu Rallycross Track 0,930 Km Parimate eelvooru aegade paremusjärjestus Pos PIC No. Name Nat Class Total Tm Diff Gap In Session Make Entrant 1 1 12 Ruve Veski EST SuperCar 2:59.548 eelsõit 1 - 4 ringi - 3. start Mitsubishi Lancer EVO VI Elea Racing 2 2 8 Sten Karuks EST SuperCar 3:04.366 4.818 4.818 eelsõit 1 - 4 ringi - 2. start Mitsubishi Lancer EVO VI Yellow Racing 3 3 4 Andri Õun EST SuperCar 3:05.469 5.921 1.103 eelsõit 1 - 4 ringi - 3. start Ford Fiesta Mk7 T16 4x4 Reinsalu Sport 4 4 3 Helmet Palm EST SuperCar 3:06.363 6.815 0.894 eelsõit 1 - 4 ringi - 3. start Mitsubishi Lancer EVO VI Yellow Racing 5 5 15 Jarmo Võsa EST SuperCar 3:08.819 9.271 2.456 eelsõit 1 - 4 ringi - 2. start Skoda Fabia Mk1/6Y T16 4x4 Reinsalu Sport 6 6 17 Priit Karjus EST SuperCar 3:15.064 15.516 6.245 eelsõit 1 - 4 ringi - 2. start Audi 80 Quattro Sten Oja Motorsport 7 1 1 Janno Ligur EST Super1600 3:15.271 15.723 0.207 eelsõit 1 - 4 ringi - 4. start Lada Samara Ligur Racing 8 2 20 Riho Loit EST Super1600 3:15.751 16.203 0.480 eelsõit 1 - 4 ringi - 4. start Honda Civic Reinsalu Sport 9 3 3 Andre Kurg EST Super1600 3:17.667 18.119 1.916 eelsõit 1 - 4 ringi - 1. start Lada Samara Ligur Racing 10 7 13 Oliver Oberg EST SuperCar 3:18.916 19.368 1.249 eelsõit 1 - 4 ringi - 1. -

AVTOVAZ Call with Financial Analysts

AVTOVAZ Call with Financial Analysts Nicolas MAURE / Dr. Stefan MAUERER CEO / CFO 16.01.2017 Disclaimer Information contained within this document may contain forward looking statements. Although the Company considers that such information and statements are based on reasonable assumptions taken on the date of this report, due to their nature, they can be risky and uncertain and can lead to a difference between the exact figures and those given or deduced from said information and statements. PJSC AVTOVAZ does not undertake to provide updates or revisions, should any new statements and information be available, should any new specific events occur or for any other reason. PJSC AVTOVAZ makes no representation, declaration or warranty as regards the accuracy, sufficiency, adequacy, effectiveness and genuineness of any statements and information contained in this report. Further information on PJSC AVTOVAZ can be found on AVTOVAZ’s web sites (www.lada.ru/en and http://info.avtovaz.ru). AVTOVAZ Call with Financial Analysts 16.01.2017 2 AVTOVAZ Overview Moscow International Automobile Salon 2016 AVTOVAZ 50-years History 1966/1970 VAZ 2101 2016 LADA XRAY AVTOVAZ Call with Financial Analysts 16.01.2017 4 AVTOVAZ Group: Key information 408 467 Cars & KDs produced 20.1% MOSCOW AVTOVAZ 331 Representative office sales points 30 IZHEVSK LADA-Izhevsk countries TOGLIATTI plant AVTOVAZ Head-office & 2015: 176.5 B-Rub (2.6 B-Euro) Togliatti plants 2016: estimated T/O > 2015 51 527 p. AVTOVAZ Call with Financial Analysts 16.01.2017 5 LADA product portfolio -

LADA Granta Sport. Дорожная Версия

AVTOVAZ Press-Info December, 17 Togliatti _______ Jean-Philippe Salar will lead LADA Design team Effective January 1, 2021, Jean-Philippe Salar will take a position of Vice-President, LADA Design Director. Steve Mattin, who acted in this position for the past 9 years, took a decision to step off the operational activities for personal reasons. Jean-Philippe Salar, born in 1973, is coming to AVTOVAZ from position of the Design Director for Groupe Renault in Eastern Europe (based in Bucharest), where he worked for the past 5 years and was in charge of the design development of all the Dacia line-up (Duster, new Sandero, new Logan, including Arkana for Russia). In 2013-2015 Mr Salar headed the design team at Renault Samsung Motors in Korea, in 2008-2013 worked in position of studio chief designer in charge of the Renault Design Center Mumbai in India. Mr Caracatzanis stated: “Steve has successfully led the team at LADA Design. He has been fully engaged in the LADA design renewal for 9 years and is a key contributor to the strong renewal of the LADA model line-up. I thank him for these major achievements and I am happy that Steve has accepted my proposal to continue his relationship with AVTOVAZ as my advisor. I wish Mr Salar all the best in the new position and count on his strong contribution in implementation of the LADA ambitious product plan.” _______ Additional information: AVTOVAZ Group is part of Groupe Renault and manufactures cars in full production cycle and auto components for 3 brands: LADA, Renault, Datsun. -

XXI CENTURY.Pdf

ТОЛЬЯТТИ- НОВЫЙ ГОРОД РОССИИ Cтраницы истории Сергей Андреев Тольятти сегодня Мэр города Тольятти Sergei Andreev The mayor, city of Togliatti Togliatti a new city of Russia Дорогие друзья! история города не замерла, она развивается, го- History род растет, появляются новые необычные места Today’s Togliatti Рад тому, что мы с вами находимся на удивитель- и рождаются новые жители, которым предстоит ной земле, которую многие считают одним из са- уже самостоятельно создавать будущее Тольят- мых необычных мест Поволжья. ти. И каждый, кто приезжает в наш город, вносит История Тольятти наполнена событиями, людьми частичку своих знаний, впечатлений, чувств и и достопримечательностями, повлиявшими не эмоций в завтрашний день. Надеюсь, что эти чув- только на развитие города, но и на всю Россию. ства окрашены только в позитивные цвета. У нас множество интереснейших мест, в Тольятти Мы все смотрим в будущее, но помним о на- родились и работали выдающиеся ученые, дей- шей истории, которая вершилась на улицах, по ствуют уникальные предприятия. Наша природа которым мы ходим сегодня. Мы открыты ново- относится к красивейшим уголкам страны. Сло- му, рады каждому, кто готов вершить, творить вом, здесь есть чем заняться и на что посмотреть. и работать вместе с нами. Добро пожаловать Именно поэтому мы всегда рады гостям. Ведь в Тольятти! Dear friends! and many sights to see. This is why we are always glad to meet guests. The city’s history is evolving, the I am happy to live on this wonderful land which is city is growing, new and unusual places appear, and believed by many to be one of the most unusual new residents are being born, who will create their places of the Volga region.