Competition Issues in Television and Broadcasting

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Comcast/NBC Universal Merger CASE STUDY

Comcast/NBC Universal Merger CASE STUDY Client In 2010, US cable company Comcast, a Multichannel Video Programming Distributor, and NBC Universal Inc (NBCU), a broadcast and for-pay programming provider, sought BLOOMBERG TV government approval for their proposed merger. During the merger review, Bates White Partner, Duke University professor, and former FCC chief economist Leslie M. Industry Marx submitted a report on behalf of Bloomberg TV, a video programming provider that had concerns about the merger impeding its effective competition in this market. COMMUNICATIONS Professor Marx suggested a number of remedies that were subsequently imposed on the merging parties by the FCC. Professor Marx showed how the integration between NBCU-owned CNBC, the dominant business channel, and Comcast, the dominant programming distributor in areas where demand for financial news is highest (e.g., New York and Chicago), would greatly increase the merged firm’s ability and incentive to anticompetitively foreclose Bloomberg TV from accessing end users (TV viewers and Internet users). After explaining the economic theories that led to a conclusion regarding competitive harm from the merger’s vertical integration, Professor Marx empirically measured the extent to which the merged firm could distort competition in the provision of financial news programming. Among other avenues, competitive harm could come from Comcast’s refusal to include Bloomberg TV in some of its programming bundles. This action would place Bloomberg TV in a tier with fewer subscribers, thereby disadvantaging Bloomberg TV and making end users more likely to turn to CNBC. Professor Marx also proposed conditions that could alleviate the anticipated competitive harms she had identified. -

Moments That Matter Executive Summary 2017 Corporate Social Responsibility Report (Covering 2016)

Moments that matter Executive Summary 2017 Corporate Social Responsibility Report (covering 2016) At Comcast NBCUniversal, we bring people closer to what matters. To the moments of purpose and passion that make our world a better place. About our commitment “Across all of our businesses “As a technology and broadband and platforms, we have a unique leader, it is our responsibility opportunity to connect people and obligation to do what to the moments that matter we can to help close the most to them.” digital divide.” BRIAN L. ROBERTS DAVID L. COHEN Chairman and CEO Senior Executive Vice President and Chief Diversity Officer From our place as one of the largest media, technology, and broadband companies in the world, we have the unique ability to help solve some of the most challenging social issues of our time. Our impact starts with our philanthropy and volunteerism, and it grows with our efforts to connect the unconnected and our ability to amplify the voices of today’s change- makers in our communities and within our own walls. That’s why we invest in digital inclusion, foster the brightest innovators and entrepreneurs, and spotlight young, diverse filmmakers. It’s why we hold up the microphone for community problem-solvers, and uphold and empower our own Comcast NBCUniversal family to make a lasting difference. Our influence and reach make it possible to create a positive impact every day. $500+ million In 2016, Comcast NBCUniversal provided more than $500 million in cash and in-kind contributions to local and national organizations that share our commitment to improving communities. -

Las Vegas Channel Lineup

Las Vegas Channel Lineup PrismTM TV 222 Bloomberg Interactive Channels 5145 Tropicales 225 The Weather Channel 90 Interactive Dashboard 5146 Mexicana 2 City of Las Vegas Television 230 C-SPAN 92 Interactive Games 5147 Romances 3 NBC 231 C-SPAN2 4 Clark County Television 251 TLC Digital Music Channels PrismTM Complete 5 FOX 255 Travel Channel 5101 Hit List TM 6 FOX 5 Weather 24/7 265 National Geographic Channel 5102 Hip Hop & R&B Includes Prism TV Package channels, plus 7 Universal Sports 271 History 5103 Mix Tape 132 American Life 8 CBS 303 Disney Channel 5104 Dance/Electronica 149 G4 9 LATV 314 Nickelodeon 5105 Rap (uncensored) 153 Chiller 10 PBS 326 Cartoon Network 5106 Hip Hop Classics 157 TV One 11 V-Me 327 Boomerang 5107 Throwback Jamz 161 Sleuth 12 PBS Create 337 Sprout 5108 R&B Classics 173 GSN 13 ABC 361 Lifetime Television 5109 R&B Soul 188 BBC America 14 Mexicanal 362 Lifetime Movie Network 5110 Gospel 189 Current TV 15 Univision 364 Lifetime Real Women 5111 Reggae 195 ION 17 Telefutura 368 Oxygen 5112 Classic Rock 253 Animal Planet 18 QVC 420 QVC 5113 Retro Rock 257 Oprah Winfrey Network 19 Home Shopping Network 422 Home Shopping Network 5114 Rock 258 Science Channel 21 My Network TV 424 ShopNBC 5115 Metal (uncensored) 259 Military Channel 25 Vegas TV 428 Jewelry Television 5116 Alternative (uncensored) 260 ID 27 ESPN 451 HGTV 5117 Classic Alternative 272 Biography 28 ESPN2 453 Food Network 5118 Adult Alternative (uncensored) 274 History International 33 CW 503 MTV 5120 Soft Rock 305 Disney XD 39 Telemundo 519 VH1 5121 Pop Hits 315 Nick Too 109 TNT 526 CMT 5122 90s 316 Nicktoons 113 TBS 560 Trinity Broadcasting Network 5123 80s 320 Nick Jr. -

Alphabetical Channel Guide 800-355-5668

Miami www.gethotwired.com ALPHABETICAL CHANNEL GUIDE 800-355-5668 Looking for your favorite channel? Our alphabetical channel reference guide makes it easy to find, and you’ll see the packages that include it! Availability of local channels varies by region. Please see your rate sheet for the packages available at your property. Subscription Channel Name Number HD Number Digital Digital Digital Access Favorites Premium The Works Package 5StarMAX 712 774 Cinemax A&E 95 488 ABC 10 WPLG 10 410 Local Local Local Local ABC Family 62 432 AccuWeather 27 ActionMAX 713 775 Cinemax AMC 84 479 America TeVe WJAN 21 Local Local Local Local En Espanol Package American Heroes Channel 112 Animal Planet 61 420 AWE 256 491 AXS TV 493 Azteca America 399 Local Local Local Local En Espanol Package Bandamax 625 En Espanol Package Bang U 810 Adult BBC America 51 BBC World 115 Becon WBEC 397 Local Local Local Local beIN Sports 214 502 beIN Sports (en Espanol) 602 En Espanol Package BET 85 499 BET Gospel 114 Big Ten Network 208 458 Bloomberg 222 Boomerang 302 Bravo 77 471 Brazzers TV 811 Adult CanalSur 618 En Espanol Package Cartoon Network 301 433 CBS 4 WFOR 4 404 Local Local Local Local CBS Sports Network 201 459 Centric 106 Chiller 109 CineLatino 630 En Espanol Package Cinemax 710 772 Cinemax Cloo Network 108 CMT 93 CMT Pure Country 94 CNBC 48 473 CNBC World 116 CNN 49 465 CNN en Espanol 617 En Espanol Package CNN International 221 Comedy Central 29 426 Subscription Channel Name Number HD Number Digital Digital Digital Access Favorites Premium The Works Package -

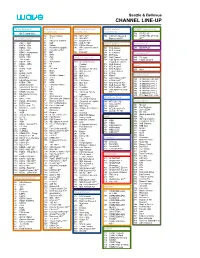

Channel Lineup

Seattle & Bellevue CHANNEL LINEUP TV On Demand* Expanded Content* Expanded Content* Digital Variety* STARZ* (continued) (continued) (continued) (continued) 1 On Demand Menu 716 STARZ HD** 50 Travel Channel 774 MTV HD** 791 Hallmark Movies & 720 STARZ Kids & Family Local Broadcast* 51 TLC 775 VH1 HD** Mysteries HD** HD** 52 Discovery Channel 777 Oxygen HD** 2 CBUT CBC 53 A&E 778 AXS TV HD** Digital Sports* MOVIEPLEX* 3 KWPX ION 54 History 779 HDNet Movies** 4 KOMO ABC 55 National Geographic 782 NBC Sports Network 501 FCS Atlantic 450 MOVIEPLEX 5 KING NBC 56 Comedy Central HD** 502 FCS Central 6 KONG Independent 57 BET 784 FXX HD** 503 FCS Pacific International* 7 KIRO CBS 58 Spike 505 ESPNews 8 KCTS PBS 59 Syfy Digital Favorites* 507 Golf Channel 335 TV Japan 9 TV Listings 60 TBS 508 CBS Sports Network 339 Filipino Channel 10 KSTW CW 62 Nickelodeon 200 American Heroes Expanded Content 11 KZJO JOEtv 63 FX Channel 511 MLB Network Here!* 12 HSN 64 E! 201 Science 513 NFL Network 65 TV Land 13 KCPQ FOX 203 Destination America 514 NFL RedZone 460 Here! 14 QVC 66 Bravo 205 BBC America 515 Tennis Channel 15 KVOS MeTV 67 TCM 206 MTV2 516 ESPNU 17 EVINE Live 68 Weather Channel 207 BET Jams 517 HRTV PayPerView* 18 KCTS Plus 69 TruTV 208 Tr3s 738 Golf Channel HD** 800 IN DEMAND HD PPV 19 Educational Access 70 GSN 209 CMT Music 743 ESPNU HD** 801 IN DEMAND PPV 1 20 KTBW TBN 71 OWN 210 BET Soul 749 NFL Network HD** 802 IN DEMAND PPV 2 21 Seattle Channel 72 Cooking Channel 211 Nick Jr. -

Philadelphia

Business TV Basic SD HD SD HD SD HD SD HD 2 601 KJWP Me TV 9 602 WTXF - Fox 20 614 WWSI - Telemundo 191 HSN 3 604 KYW - CBS 10 610 WCAU - NBC 21 607 QVC 615 WPPX ION 5 605 WPSG - CW 12 612 WHYY - PBS 22 609 HSN 853-902 Music Choice 6 606 WPVI - ABC Affiliate 13 613 WNJN PBS 24 603 WUVP - Univision Digital Music 7 617 WPHL 15 WLVT - PBS 25 Retro TV 8 608 RCN TV 19 WFMZ - Independent 190 QVC Business TV News SD HD SD HD SD HD SD HD 126 550 BBC America 305 650 CNN Custom 311 652 MSNBC 320 655 TWC 189 Discover Lehigh 306 656 CNN Headline News 315 653 Fox News Channel 322 Fusion Valley 310 651 CNBC 316 654 Fox Business 325 657 Bloomberg 301 C-SPAN Network Business TV Entertainment SD HD SD HD SD HD SD HD 101 619 BET 115 637 E! Entertainment 221 669 TV Land 333 660 Travel 105 620 A&E 116 658 truTV 222 641 Freeform 335 661 Discovery 106 621 Bravo 141 596 FXM 224 642 Food 340 662 History 107 622 TBS 142 667 American Movie 225 643 HGTV 345 663 TLC 108 623 TNT Classics 241 649 Nickelodeon 350 670 Nat Geo 109 624 USA 160 675 MTV 250 647 Disney 362 698 FXX 111 626 FX 165 676 VH1 256 Sprout 202 639 Lifetime Business TV Sports SD HD SD HD SD HD SD HD 363 681 ESPN 370 685 Comcast 376 YES National 389 690 NFL Network 364 682 ESPN 2 Sportsnet PA 380 575 CBS College Sports 391 695 MLB Network 365 683 ESPNEWS 372 686 Big Ten Network 381 694 The Golf Channel 392 697 NBA TV 368 680 ESPNU 374 MSG National 382 691 NBC Sports Network 375 689 Fox Sports 1 388 693 NHL Network Philadelphia Not all channels are available in all areas. -

Adelphia-Time Warner=Comcast Transaction Is Not in the Public I N Terest

Adelphia-Time Warner=Comcast Transaction is Not in the Public In terest CWA Presentation to FCC February 22,2006 Transaction is Not in the Public Interest . Anti-Competitive Impact . Negative Impact on Employees 2 Part 1. Anti-Competitive Impact . Cable companies have already used their market power to stifle video competition by limiting access to Regional Sports Networks or raising prices w The transaction will significantly increase market power in regions with RSNs Cable companies will have even more incentive and power to limit prospective Telco competitors 3 Cable Companies Have Utilized their Market Power over RSNs to Stifle Current DBS Competition . Exclusive Deals Comcast in Philadelphia has exclusive access to its RSN that carries Phillies, 76ers and Flyers Time Warner in Charlotte obtained exclusive access to an unaffiliated RSN that carried Bobcats games - even after this RSN went off the air Bobcat games are still only carried by Time Warner. 9 Increased Rates Comcast in Chicago bought the RSN and doubled the rate charged to DirecTV Time Warner in Cleveland has exclusive marketing deal with a new RSN that only carries Indians games but is charging competitors a rate that is almost the same as previously paid to carry Indians, Cavaliers, Reds and Blue Jackets games. Comcast and Time Warner own Sportsnet NY a new RSN that will carry Mets games but is charging higher prices than the YES network that carries Yankees games - even though the Mets have 1/3 the ratings The Impact of Cable’s Strategy: Less Competition Where cable companies have exclusive Regional Sports Networks, satellite penetration is half the national rate National Satellite Penetration 25.1 percent San Diego (Cox exclusive Padres) 12.8 percent . -

Spinco to Be Known As Greatland Connections Inc

Filed by Charter Communications Inc. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Charter Communications Inc. Commission File No. 001-33664 The following is a joint press release that was issued on September 3, 2014 by Charter Communications, Inc. and Comcast Corporation: SpinCo to be known as GreatLand Connections Inc. STAMFORD, Conn. and PHILADELPHIA - September 3, 2014 - Charter Communications, Inc. (NASDAQ:CHTR) and Comcast Corporation (NASDAQ: CMCSA, CMCSK) today announced the name of the new cable company that will be spun off from Comcast upon completion of the Comcast - Time Warner Cable merger and the Comcast - Charter transactions. The company referred to as “SpinCo” or “Midwest Cable LLC” will be known as GreatLand Connections Inc. “We are pleased to publicly announce the name of this exciting new company we are building,” said Michael Willner, President and Chief Executive Officer of GreatLand Connections. “The name GreatLand Connections pays homage to the rich history and striking geographies of the diverse communities in which the company will operate. It brings to mind our commitment to connecting people and businesses with terrific products and excellent service in the almost 1000 historic communities - large and small - across the 11 states we will serve.” GreatLand Connections Inc., a new, independent, publicly-traded company, will own and operate former Comcast systems serving approximately 2.5 million customers across the Midwest and Southeast. At its inception, it is expected to be the fifth largest cable company in the United States. -

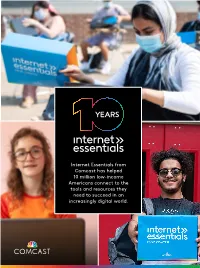

Internet Essentials from Comcast Has Helped 10 Million Low-Income Americans Connect to the Tools and Resources They Need to Succeed in an Increasingly Digital World

Internet Essentials from Comcast has helped 10 million low-income Americans connect to the tools and resources they need to succeed in an increasingly digital world. TABLE OF CONTENTS Letter from Dave Watson .................................................................2 Digital Divide in the U.S. ...................................................................5 Program Timeline ............................................................................6 Program Retrospective .....................................................................8 Program Design ............................................................................ 10 Elements of Success ...................................................................... 16 Program Impact ................................................................................ 20 What’s Next ....................................................................................... 24 Commitment to Digital Equity ........................................................ 26 Student from Northeast High School III 1 Letter from Dave Watson $ about Comcast’s Commitment 7to 00Digital EquityM When we launched Internet Essentials 10 years ago, we began an ambitious journey to connect low-income Americans to the Internet. Thanks to the hard work and support of so many, Internet Essentials is now the largest and most comprehensive Internet adoption program in the country, connecting more than 10 million* people. Ten million people over 10 years is an exciting milestone, but it’s just the beginning -

Xumo Taps Newsy As News Content Partner on Its Smart TV Platform

Xumo taps Newsy as news content partner on its smart TV platform Oct. 27, 2015 CINCINNATI – Viewers of Newsy, the leading over-the-top video news service that brings context and perspective to a growing millennial audience, will now have another way to access its content. As part of a deal announced today, Newsy will offer a channel on Xumo, a new connected TV technology platform that provides free access to programming across multiple content delivery options. The partnership provides for easy viewing of Newsy’s live and on-demand content on smart television sets. Newsy is a wholly owned subsidiary of The E.W. Scripps Company (NYSE: SSP). The deal is the latest in Newsy’s growing roster of OTT distribution partners, which also includes Comcast’s Watchable, Pluto TV, Roku and Amazon Fire TV. Xumo viewers will be able to view Newsy via Newsy Live, a continually updated feed of the day’s top stories as well as hourly updates from the newsroom, as well as on-demand. “With connected TV households reaching majority this year, Newsy’s partnership with Xumo is all about positioning the company to deliver our brand of journalism when and where our younger audience is seeking it,” said Blake Sabatinelli, general manager of Newsy. Xumo sought to strengthen its news offerings with Newsy’s world and national news coverage across verticals including politics, entertainment, science and technology. Newsy is known for delivering video news and analysis of the top stories from around the world, without the hype and bias found in some other news providers. -

Achieving "The Franchise": the Comcast-Nbc Universal Merger and the New Media Marketplace

ACHIEVING "THE FRANCHISE": THE COMCAST-NBC UNIVERSAL MERGER AND THE NEW MEDIA MARKETPLACE Thomas Curtint I. INTRODUCTION In 1997, then-Chairman of the Federal Communications Commission ("FCC" or "Commission") Reed Hundt delivered a speech to the leaders of the cable industry in which he described the future of cable television in terms of what he called "the Franchise."' According to Hundt, this model "consists of the core package of the most popular TV channels and the most popular way to deliver them." Hundt acknowledged that the cable industry "has made huge inroads on the delivery side," and classified broadcast television as "the other side of the Franchise." 2 The Chairman further forecasted that "the core pro- gramming package may or may not be possessed by local broadcasters in the future."' Nearly thirteen years after Chairman Hundt foretold an all-in-one entertain- ment content and delivery service, the Comcast Corporation ("Comcast") is on its way to realizing this vision of "the Franchise," as the media delivery giant undertakes efforts to merge with NBC Universal.' If successful, the merger would give the nation's largest cable corporation control over NBC Univer- t J.D. Candidate, May 2011. Tom would like to thank his parents, Thomas and Donna Curtin, his brother Frank and his extended family for always encouraging the writing proc- ess. He would also like to thank his friends for their constant support, and the Editors and Associates of COMMLAW CONSPECTUS Volumes 18 and 19 for their valued input and advice. I Reed Hundt, Chairman, Fed. Commc'ns Comm'n, Speech at the National Cable Television Association: Cable, Broadcasting, and The Franchise (Mar. -

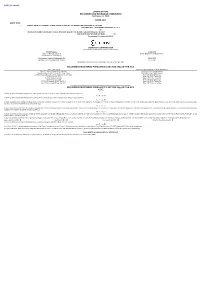

Downloading of Movies, Television Shows and Other Video Programming, Some of Which Charge a Nominal Or No Fee for Access

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO Commission file number 001-32871 COMCAST CORPORATION (Exact name of registrant as specified in its charter) PENNSYLVANIA 27-0000798 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) One Comcast Center, Philadelphia, PA 19103-2838 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (215) 286-1700 SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: Title of Each Class Name of Each Exchange on which Registered Class A Common Stock, $0.01 par value NASDAQ Global Select Market Class A Special Common Stock, $0.01 par value NASDAQ Global Select Market 2.0% Exchangeable Subordinated Debentures due 2029 New York Stock Exchange 5.50% Notes due 2029 New York Stock Exchange 6.625% Notes due 2056 New York Stock Exchange 7.00% Notes due 2055 New York Stock Exchange 8.375% Guaranteed Notes due 2013 New York Stock Exchange 9.455% Guaranteed Notes due 2022 New York Stock Exchange SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.