Greater China Beef & Sheepmeat Market Snapshot

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Greater China: the Next Economic Superpower?

Washington University in St. Louis Washington University Open Scholarship Weidenbaum Center on the Economy, Murray Weidenbaum Publications Government, and Public Policy Contemporary Issues Series 57 2-1-1993 Greater China: The Next Economic Superpower? Murray L. Weidenbaum Washington University in St Louis Follow this and additional works at: https://openscholarship.wustl.edu/mlw_papers Part of the Economics Commons, and the Public Policy Commons Recommended Citation Weidenbaum, Murray L., "Greater China: The Next Economic Superpower?", Contemporary Issues Series 57, 1993, doi:10.7936/K7DB7ZZ6. Murray Weidenbaum Publications, https://openscholarship.wustl.edu/mlw_papers/25. Weidenbaum Center on the Economy, Government, and Public Policy — Washington University in St. Louis Campus Box 1027, St. Louis, MO 63130. Other titles available in this series: 46. The Seeds ofEntrepreneurship, Dwight Lee Greater China: The 47. Capital Mobility: Challenges for Next Economic Superpower? Business and Government, Richard B. McKenzie and Dwight Lee Murray Weidenbaum 48. Business Responsibility in a World of Global Competition, I James B. Burnham 49. Small Wars, Big Defense: Living in a World ofLower Tensions, Murray Weidenbaum 50. "Earth Summit": UN Spectacle with a Cast of Thousands, Murray Weidenbaum Contemporary 51. Fiscal Pollution and the Case Issues Series 57 for Congressional Term Limits, Dwight Lee February 1993 53. Global Warming Research: Learning from NAPAP 's Mistakes, Edward S. Rubin 54. The Case for Taxing Consumption, Murray Weidenbaum 55. Japan's Growing Influence in Asia: Implications for U.S. Business, Steven B. Schlossstein 56. The Mirage of Sustainable Development, Thomas J. DiLorenzo Additional copies are available from: i Center for the Study of American Business Washington University CS1- Campus Box 1208 One Brookings Drive Center for the Study of St. -

Information on How to Buy Lamb

LAMB Lamb is produced from animals less than a year old. Since the quality of lamb varies according to the age of the animal, it is advisable to buy lamb that has been USDA-graded. USDA Prime: Prime grade lamb is very high in tenderness, juiciness, and flavor. It has moderate marbling, which enhances both flavor and juiciness. Prime chops and roasts are excellent for dry-heat cooking (broiling and roasting). USDA Choice: Choice grade lamb has slightly less marbling than Prime, but still is of very high quality. Choice chops and roasts also are very tender, juicy, and flavorful and suited to dry-heat cooking. Lower grades of lamb and mutton (USDA Good, Utility, and Cull) are seldom marked with the grade if sold at retail. Most cuts of USDA Prime and Choice lamb - including shoulder cuts - are tender and can be oven roasted, broiled, or pan broiled. A leg of lamb graded Choice or Prime, for example, is delectable when oven roasted. The less tender cuts - the breast, riblets, neck, and shank - can be braised slowly to make excellent (and tender) lamb dishes. Meat from older sheep is called yearling mutton or mutton and, if it is graded, these words will be stamped on the meat along with the shield-shaped grade mark. Grades for yearling mutton and mutton are the same as for lamb, except that mutton does not qualify for the Prime grade and the Cull grade applies only to mutton. The best way to identify lamb cuts is with the lamb carcass chart shown above. -

United States Standards for Grades of Lamb, Yearling Mutton, and Mutton Carcasses

United States Department of Agriculture United States Standards Agricultural Marketing for Grades of Service Livestock Lamb, Yearling Mutton, and and Seed Division Mutton Carcasses Effective date July 6, 1992 United States Standards for Grades of Lamb, Yearling Mutton, and Mutton Carcasses The following is a reprint of the Official United States Standards for the Grades of Lamb, Yearling Mutton, and Mutton Carcasses promulgated by the Secretary of Agriculture under the Agricultural Marketing Act of 1946 (60 Stat. 1087; 7 U.S.C. 1621-1627) as amended and related authority in the annual appropriation acts for the Department of Agriculture. The standards are reprinted with amendments effective July 6, 1992. Development of the Standards The official standards for grades of lamb and mutton carcasses were initially promulgated and made effective on February 16, 1931. The standards were amended in October 1940 (Amendment No. 1 to S.R.A. 123) so as to change the grade designations Medium and common to Commercial and Utility, respectively. In April 1951, the official standards were again amended (Amendment No. 2 to S.R.A. 123). By this amendment, Prime and Choice grades were combined and designated as Prime. The Good grade was renamed Choice, which also became the highest grade for carcasses of mutton older than yearlings. The top two-thirds of the Commercial grade was combined with the top two-third of the Utility grade and designated as Utility, thereby eliminating the Commercial grade name. The lower one-third of the Utility grade was combined with the Cull grade and designated as Cull. This amendment also provided for reflecting the minimum requirements for each grade, specified the grade requirements for varying degrees of maturity, and clarified the method for differentiating between lamb, yearling mutton, and mutton carcasses. -

Sensory Evaluation of Various Lamb Meat Foods by Judging Consumers

KUKOVICS & NÉMETH: SENSORY EVALUATION OF LAMB MEAT FOODS BY CONSUMERS Acta Alimentaria, Vol. 43 (2), pp. 254–263 (2014) DOI: 10.1556/AAlim.43.2014.2.9 SENSORY EVALUATION OF VARIOUS LAMB MEAT FOODS BY JUDGING CONSUMERS S. KUKOVICS* and T. NÉMETH Research Institute for Animal Breeding and Nutrition, 2053 Herceghalom, Gesztenyés u. 1. Hungary (Received: 6 November 2012; accepted: 24 February 2013) Four kinds of lamb meat foods (Wiener sausage, ham, roasted meat, and roasted leg) were developed based on 8 different genotypes to improve lamb meat quality and quantity, and to study the differences among them. The stringiness, flavour, and odour of the products were judged in food sensory evaluation by a total of 265 (60% male and 40% female) randomly selected consumers. In stringiness and flavour five (from 1 to 5), and concerning odour three (from 1 to 3) categories were created according to decreasing quality. The consumers represented different age groups: below 20 years, between 21–30, 31–40, 41–50, 51–60, 61–70, and above 70 years. The groups of consumers were involved in sheep farming, other animal farming, other agriculture sector, industry, catering, education, other service; administrative department of the state, were students, and others. Analyses of variance were calculated to estimate the effects of the genotype of lamb, the gender, age, and occupation of judging consumers on the sensory evaluation of the meat foods. In conclusion, new lamb meat foods were highly appreciated by consumers, who made definite distinctions among genotypes according to flavour, stinginess, and odour. There were significant interactions between gender, age, and occupation of consumers as well as sensory evaluation of various lamb meat foods. -

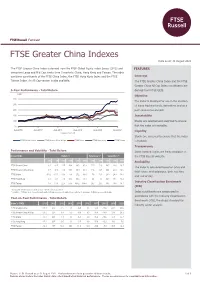

FTSE Greater China Indexes

FTSE Russell Factsheet FTSE Greater China Indexes Data as at: 31 August 2021 bmkTitle1 The FTSE Greater China Index is derived from the FTSE Global Equity Index Series (GEIS) and FEATURES comprises Large and Mid Cap stocks from 3 markets: China, Hong Kong and Taiwan. The index combines constituents of the FTSE China Index, the FTSE Hong Kong Index and the FTSE Coverage Taiwan Index. An All Cap version is also available. The FTSE Greater China Index and the FTSE Greater China All Cap Index constituents are 5-Year Performance - Total Return derived from FTSE GEIS. (HKD) Objective 300 The index is designed for use in the creation 250 of index tracking funds, derivatives and as a 200 performance benchmark. 150 Investability 100 Stocks are selected and weighted to ensure 50 that the index is investable. Aug-2016 Aug-2017 Aug-2018 Aug-2019 Aug-2020 Aug-2021 Liquidity Data as at month end Stocks are screened to ensure that the index FTSE Greater China FTSE Greater China All Cap FTSE China FTSE Hong Kong FTSE Taiwan is tradable. Transparency Performance and Volatility - Total Return Index methodologies are freely available on Index (HKD) Return % Return pa %* Volatility %** the FTSE Russell website. 3M 6M YTD 12M 3YR 5YR 3YR 5YR 1YR 3YR 5YR Availability FTSE Greater China -8.1 -8.7 -1.7 10.4 38.5 81.0 11.5 12.6 18.5 20.6 16.7 The index is calculated based on price and FTSE Greater China All Cap -7.5 -7.6 -0.6 11.5 38.9 80.3 11.6 12.5 18.1 20.4 16.6 total return methodologies, both real time FTSE China -13.2 -17.0 -11.6 -3.9 25.2 63.4 7.8 10.3 23.3 24.0 19.0 and end of day. -

Scoring One for the Other Team

FIVE TURTLES IN A FLASK: FOR TAIWAN’S OUTER ISLANDS, AN UNCERTAIN FUTURE HOLDS A CERTAIN FATE A THESIS SUBMITTED TO THE GRADUATE DIVISION OF THE UNIVERSITY OF HAWAI‘I AT MĀNOA IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF ARTS IN ASIAN STUDIES MAY 2018 By Edward W. Green, Jr. Thesis Committee: Eric Harwit, Chairperson Shana J. Brown Cathryn H. Clayton Keywords: Taiwan independence, offshore islands, strait crisis, military intervention TABLE OF CONTENTS Page List of Tables ................................................................................................................ ii List of Figures ............................................................................................................... iii I. Introduction ............................................................................................................... 1 II. Scope and Organization ........................................................................................... 6 III. Dramatis Personae: The Five Islands ...................................................................... 9 III.1. Itu Aba ..................................................................................................... 11 III.2. Matsu ........................................................................................................ 14 III.3. The Pescadores ......................................................................................... 16 III.4. Pratas ....................................................................................................... -

Sheep Skill-A-Thon Booklet

2016-2017 Citrus County Fair Sheep Skill-a-Thon Sheep Skill-a-thon 1 INTRODUCTION This manual has been developed by the Animal Sciences Department Faculty at the University of Florida as a study guide for the Sheep Skill-a-thon. The topic for this year’s Skill-a-thon is Products and Marketing. The Citrus County Fair recognizes that agricultural education instructors, parents, 4H agents and leaders provide the traditional and logical instructional link between youth, their livestock projects and current trends in the animal agriculture industry. PLEASE NOTE: This manual is provided as a study guide for the Skill-a-thon competition and should be used as an additional aid to ongoing educational programs. Sections are labeled Junior, Intermediate & Senior, Intermediate & Senior, or Senior to help exhibitors and educators identify which materials are required for each age level. The knowledge and skills vary by age group and may include: Juniors (age 8-10 as of September 1, 2016) By Products, Wholesale cuts & Primal Intermediates (age 11-13 as of September 1, 2016) all of the above plus... Retail Cuts Cookery Seniors (age 14 and over as of September 1, 2016) all of the above plus.... Sheep/Lamb Evaluation Wool Grades Quality Assurance Skeletal Anatomy GOOD LUCK! Sheep Skill -a-thon 2 Products and Marketing Youth livestock projects focus on the selection, raising, showing and often selling of animals. By virtue of their participation in livestock projects, youth become part of an industry that provides food and fiber for the world. Steps involved in the movement of animals and animal products from producer to consumer are known as processing and marketing. -

FTSE Greater China HKD Index

FTSE Russell Factsheet FTSE Greater China HKD Index Data as at: 31 August 2021 bmkTitle1 The FTSE Greater China HKD Index is an index derived from the FTSE All-World Index and FEATURES comprises Large and Mid Cap stocks providing coverage of 3 markets: China, Hong Kong SAR and Taiwan. For China, the index includes H shares, P Chips and Red Chips listed in Hong Kong Objective and A Shares, B Shares listed in China. Price return, total return and net return versions are The index is designed for use in the creation available for this index. of index tracking funds, derivatives and as a 5-Year Performance - Total Return performance benchmark. (HKD) Investability 300 Stocks are selected and weighted to ensure 250 that the index is investable. 200 Liquidity 150 Stocks are screened to ensure that the index 100 is tradable. 50 Transparency Aug-2016 Aug-2017 Aug-2018 Aug-2019 Aug-2020 Aug-2021 Data as at month end Index methodologies are freely available on the FTSE Russell website. FTSE Greater China HKD FTSE Greater China HKD Net of Tax FTSE China FTSE Hong Kong FTSE Taiwan Availability The index is calculated based on price and Performance and Volatility - Total Return total return methodologies, both real time Index (HKD) Return % Return pa %* Volatility %** and end of day. 3M 6M YTD 12M 3YR 5YR 3YR 5YR 1YR 3YR 5YR Industry Classification Benchmark FTSE Greater China HKD -7.1 -5.5 1.0 13.1 36.4 80.9 10.9 12.6 19.1 20.1 16.2 (ICB) FTSE Greater China HKD Net of Tax -7.3 -5.7 0.8 12.8 35.1 78.0 10.6 12.2 19.1 20.1 16.2 Index constituents are categorized in FTSE China -13.2 -17.0 -11.6 -3.9 25.2 63.4 7.8 10.3 23.3 24.0 19.0 accordance with the Industry Classification FTSE Hong Kong -5.0 -0.1 7.0 18.5 19.3 50.3 6.1 8.5 16.8 19.5 17.2 Benchmark (ICB), the global standard for FTSE Taiwan 3.5 10.3 22.5 53.6 103.2 184.4 26.7 23.3 19.5 19.6 18.1 industry sector analysis. -

China Research Trip – UBS Greater China Conference

China Research Trip January 2019 RESEARCH TRIP AGENDA • UBS Greater China Conference and visited nine domestic companies covering: − Logistic and warehousing businesses including e- commerce supply chain fulfillment centres and express delivery parcel sorting facilities − Industrial and advanced robotics manufacturer − Excavator, roller, loader and forklift manufacturers − High precision machinery manufacturers for auto, electronics, white goods, healthcare industries − Plastic moulding machinery manufacturer • Shanghai − Tier 1 city, population of circa 24-25 million • Hangzhou − Tier 2 city, population of circa 6-7 million • Ningbo − Tier 2 city, population of 7-8 million − Busiest port globally (by cargo tonnage) Source: Google Maps 1 KEY THEMES • Key insights • Global outlook • US-China trade tension • Chinese government deleveraging drive • Business, infrastructure and real estate investments • Domestic consumption • Policy response 2 KEY INSIGHTS • Chinese growth is expected to slow structurally (due to demographics, size and economic transition) but economic growth has slowed further over the last 12 months due to government policy on deleveraging and trade uncertainty − Broad-based slowdown in domestic demand, but in particular, slowdown in the auto industry and property market. However, electric vehicle (EV) and online retail sales still growing strongly • Clear evidence of trade uncertainty impacting on demand (both domestic and foreign) from company visits − Decline in new orders over 2018. Some orders cancellation. Logistics -

Invesco Greater China Fund

Mutual Fund Retail Share Classes Invesco Greater China Data as of June 30, 2021 Fund Emerging markets Investment objective An all-cap, long-term investment strategy that offers investors exposure to the Chinese equity market. The fund seeks long-term growth of capital. Performance of a $10,000 investment Portfolio management Class A shares at NAV (June 30, 2011 – June 30, 2021) Mike Shiao • Invesco Greater China Fund - $18,649 Fund facts $20,000 Nasdaq A: AACFX C: CACFX Y: AMCYX R: IGCRX R6: CACSX R5: IACFX Total Net Assets $171,042,766 Total Number of Holdings 35 $10,000 Annual Turnover (as of 10/31/20) 59% Distribution Frequency Annually 0 6/11 6/12 6/13 6/14 6/15 6/16 6/17 6/18 6/19 6/20 6/21 Top 10 holdings (% of total net assets) Alibaba 9.84 Tencent 9.36 Investment results Meituan 'B' 6.16 Average annual total returns (%) as of June 30, 2021 Pinduoduo ADR 4.80 Class A Shares Class C Shares Class Y Shares NetEase ADR 4.80 Inception: Inception: Inception: Style-Specific 03/31/06 03/31/06 10/03/08 Index Asustek Computer 4.48 AIA 4.46 Max Max Load CDSC MSCI China All Gourmet Master 4.22 Period 5.50% NAV 1.00% NAV NAV Shares Index JD.com ADR 4.21 Inception 9.54 9.95 9.51 9.51 10.35 - iQIYI ADR 4.15 10 Years 5.83 6.43 5.79 5.79 6.70 7.42 Holdings are subject to change and are not buy/sell 5 Years 11.75 13.02 12.17 12.17 13.30 14.56 recommendations. -

Import Demand for Goat Meat, Sheep and Lamb, and Other Lesser

IMPORT DEMAND FOR GOAT MEAT, SHEEP AND LAMB, AND OTHER LESSER MEAT BY THE UNITED STATES by DORIS NEKESA SANDE (Under the Direction of Jack E. Houston) ABSTRACT American diets, especially meat consumption, have changed dramatically over the past decade. There has been a shift away from red meats towards white meats. These changes are not in isolation; they seem to be in line with dietary changes worldwide. Changes in consumption patterns in the United States have mainly been prompted by the current wave of population diversity, as well as the health consciousness of the American population. These factors have created a favorable environment for goat meat. This thesis investigates the import demand elasticity for goat meat, along with sheep and lamb, and other lesser meats as a system of minor meats. Due to lack of local production data on goat meat, import data was utilized to determine the import demand. The Generalized Composite Commodity Theorem was employed to test for separability of imports from local production. It was determined that import demand for goat meat and sheep and lamb are both price inelastic and luxury goods, which implies that import demand does not vary much with changes in import prices. INDEX WORDS: Food Consumption, Import Demand, Minor Meats, Goat Meat, Ethnic Community, Separability, LA/AIDS Demand System IMPORT DEMAND FOR GOAT MEAT, LAMB AND MUTTON, AND OTHER LESSER MEAT BY THE UNITED STATES by DORIS NEKESA SANDE B.Sc. Agriculture, The University of Nairobi, Kenya, 1994 A Thesis Submitted to the Graduate Faculty of The University of Georgia in Partial Fulfillment of the Requirements for the Degree MASTER OF SCIENCE ATHENS, GEORGIA 2005 © 2005 Doris Nekesa Sande All Rights Reserved IMPORT DEMAND FOR GOAT MEAT, LAMB AND MUTTON, AND OTHER LESSER MEAT BY THE UNITED STATES by DORIS NEKESA SANDE Major Professor: Jack E. -

Involuntary Migrants, Political Revolutionaries and Economic Energisers: a History of the Image of Overseas Chinese in Southeast Asia GORDON C

Journal of Contemporary China (2005), 14(42), February, 55–66 Involuntary Migrants, Political Revolutionaries and Economic Energisers: a history of the image of overseas Chinese in Southeast Asia GORDON C. K. CHEUNG* Along the contemporary migration history of the overseas Chinese in Southeast Asia, three distinctive images have been constructed through the interaction between the overseas Chinese and Mainland China. First, the image of involuntary migrant, formulated by their migration activity and the continuous remittance they sent back to their hometowns, closely linked to the political and social-economic disturbances in the early years of the twentieth century. Second, the image of the overseas Chinese as political revolutionary was heavily politicised by the revolutionary policies of Mainland China in the 1950s and 1960s. Third, through the operational means of foreign direct investment, the overseas Chinese image of economic energiser was re-focused and mirror-imaged with the imperative of the economic reform of Mainland China in the 1970s and 1980s. On the one hand, the images of involuntary migrant, political revolutionary and economic energiser of the Southeast Asian overseas Chinese describe their situational status. On the other hand, these images also reflect the contemporary historical development of Mainland China. Whatever the reasons for studying the Overseas Chinese, there is no doubt that they are a bona fide object of research. The diversity of cultures represented by these people, the diversity of settings in which they have found themselves, the wide differences in the histories of specific Chinese ‘colonies’, all of these things make them a fascinating laboratory for social scientists of various disciplinary bents.1 In Southeast Asia the capitalists were the Chinese.