Fiscal Issues and Allocative Efficiency Executive Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1. Cause List of Cases Filed Between 01.01.2018 to 21.03.2020 Shall Not Be Published Till Further Orders

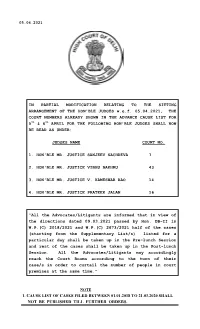

05.04.2021 IN PARTIAL MODIFICATION RELATING TO THE SITTING ARRANGEMENT OF THE HON'BLE JUDGES w.e.f. 05.04.2021, THE COURT NUMBERS ALREADY SHOWN IN THE ADVANCE CAUSE LIST FOR 5th & 6th APRIL FOR THE FOLLOWING HON'BLE JUDGES SHALL NOW BE READ AS UNDER: JUDGES NAME COURT NO. 1. HON'BLE MR. JUSTICE SANJEEV SACHDEVA 7 2. HON'BLE MR. JUSTICE VIBHU BAKHRU 43 3. HON'BLE MR. JUSTICE V. KAMESWAR RAO 14 4. HON'BLE MR. JUSTICE PRATEEK JALAN 16 “All the Advocates/Litigants are informed that in view of the directions dated 09.03.2021 passed by Hon. DB-II in W.P.(C) 2018/2021 and W.P.(C) 2673/2021 half of the cases (starting from the Supplementary List/s) listed for a particular day shall be taken up in the Pre-lunch Session and rest of the cases shall be taken up in the Post-lunch Session. All the Advocates/Litigants may accordingly reach the Court Rooms according to the turn of their case/s in order to curtail the number of people in court premises at the same time.” NOTE 1. CAUSE LIST OF CASES FILED BETWEEN 01.01.2018 TO 21.03.2020 SHALL NOT BE PUBLISHED TILL FURTHER ORDERS. HIGH COURT OF DELHI: NEW DELHI No. 384/RG/DHC/2020 DATED: 19.3.2021 OFFICE ORDER HON'BLE ADMINISTRATIVE AND GENERAL SUPERVISION COMMITTEE IN ITS MEETING HELD ON 19.03.2021 HAS BEEN PLEASED TO RESOLVE THAT HENCEFORTH THIS COURT SHALL PERMIT HYBRID/VIDEO CONFERENCE HEARING WHERE A REQUEST TO THIS EFFECT IS MADE BY ANY OF THE PARTIES AND/OR THEIR COUNSEL. -

Development of Heritage in Rajasthan Tourism Reservation in Public Sector Undertakings Foreign Investment

79 Written Answers JULY 25. 1996 Written Answers 80 since 1992 7“ 2 3 (c) The Government of Rajasthan has a scheme 3 Continental Aviation 36.83 from 1993 providing for 20% of the eligible capital 4 City Link Airways 0.59 investment or 20 00 lakhs whichever is less for Heritage Hotel projects anywhere in the state of Rajasthan and Cosmos Flights Ltd. 1 55 5 also grant of 25% of the cost of Diesel generating sets 6 Damania Airways 128.39 or Rs.50.000/- whichever is less for Heritage projects 7. Delhi Gulf Airways 0 65 as from 6 6 1994. 8. Elbee Airlines 3 87 (d) There are 30 classified 'Heritage hotels functioning in Rajasthan at present 9. East West Airlines 1 185.06 (e) Under the above scheme, the Government of . Eastern Airways 10 0 10 Rajasthan has so far provided assistance of Rs.19.62 11 Gujarat Airways 2.76 lakhs The Central Government has also released 12 Jet Airways 208 06 Rs 63 15 lakhs under its scheme for Capital and interest subsidy 13 Jagson Airlines 20 84 14. KCV Airlines 0.95 Reservation in Public Sector Undertakings 15 Mals Deoghar Airways 0 32 16 Modiluft Airlines 248.90 1737 SHRI RAM KRIPAL YADAV Will the Minister 17. Megapode Airlines 0 24 of WELFARE be pleased to state 18 NEPC Airlines 113 20 (a) whether it is a fact that the Public Sector Undertakings are not following the recommendations of 19 Raj Aviation 4 59 the Mendal Commission in regard to reservation Sahara India Ltd 143.67 20 (b) if so. -

SP's Aviation June 2011

SP’s AN SP GUIDE PUBLICATION ED BUYER ONLY) ED BUYER AS -B A NDI I News Flies. We Gather Intelligence. Every Month. From India. 75.00 ( ` Aviationwww.spsaviation.net JUNE • 2011 ENGINE POWERPAGE 18 Regional Aviation FBO Services in India Interview with CAS No Slowdown in Indo-US Relationship LENG/2008/24199 Interview: Pratt & Whitney EBACE 2011 RNI NUMBER: DELENG/2008/24199 DE Show Report Our jets aren’t built tO airline standards. FOr which Our custOmers thank us daily. some manufacturers tout the merits of building business jets to airline standards. we build to an even higher standard: our own. consider the citation mustang. its airframe service life is rated at 37,500 cycles, exceeding that of competing airframes built to “airline standards.” in fact, it’s equivalent to 140 years of typical use. excessive? no. just one of the many ways we go beyond what’s required to do what’s expected of the world’s leading maker of business aircraft. CALL US TODAY. DEMO A CITATION MUSTANG TOMORROW. 000-800-100-3829 | WWW.AvIATOR.CESSNA.COM The Citation MUSTANG Cessna102804 Mustang Airline SP Av.indd 1 12/22/10 12:57 PM BAILEY LAUERMAN Cessna Cessna102804 Mustang Airline SP Av Cessna102804 Pub: SP’s Aviation Color: 4-color Size: Trim 210mm x 267mm, Bleed 277mm x 220mm SP’s AN SP GUIDE PUBLICATION TABLE of CONTENTS News Flies. We Gather Intelligence. Every Month. From India. AviationIssue 6 • 2011 Dassault Rafale along with EurofighterT yphoon were found 25 Indo-US Relationship compliant with the IAF requirements of a medium multi-role No Slowdown -

Indie - Energetický Profil

Věc: Indie - energetický profil 1. Skladba energetického mixu 1.1. Celková nabídka primárních zdrojů energie – TPES Indický energetický sektor je velmi diverzifikovaný. Primárním zdrojem energie jsou jak konvenční zdroje (uhlí, lignit, zemní plyn, ropa, voda a jádro), tak i nekonvenční zdroje (vítr, slunce, zemědělský a komunální odpad). V roce 2015 bylo procentuální složení výroby elektrické energie následující: 69-70 % tepelné elektrárny, 15 % vodní elektrárny, 2 % jaderné elektrárny a 13 % obnovitelné zdroje. Indie je 5. největším výrobcem elektřiny na světě. Indie je zároveň 4. největším spotřebitelem energie na světě po Číně, USA a Rusku. Populace Indie se blíží počtu obyvatel Číny, ale energetická spotřeba Indie je pouhá jedna čtvrtina spotřeby Číny. V roce 2016 činí poptávka po elektřině cca 155 GW. Odhaduje se, že v letech 2021-22 to bude cca 217 GW. TIC, strana 1 1.2. Podíl jednotlivých zdrojů na celkové výrobě elektřiny Údaje jsou v gigawattech (GW), poslední sloupec udává procentuální zastoupení Rok 1997 2002 2007 2012 2015 2015 (%) uhlí 54,2 62,1 71,1 112,0 164,6 60,6% zemní plyn 6,6 11,1 13,7 18,4 23,1 8,5% diesel 0,3 1,1 1,2 1,2 1,2 0,4% hydro 21,7 26,1 36,4 42,6 41,3 15,2% malé hydro 3,4 3,8 1,4% jádro 2,2 2,7 3,9 4,8 5,8 2,1% vítr 0,4 0,8 4,1 16,5 24,2 8,9% solár 0,0 0,0 0,0 0,6 3,7 1,4% biomasa 0,5 0,9 1,9 3,8 4,1 1,5% Celkem 85,9 GW 104,9 GW 132,3 GW 203,3 GW 271,7 GW 100,0% 1.3. -

Download This Publication

b685_Chapter-06.qxd 12/30/2008 2:21 PM Page 135 Published in Indian Economic Superpower: Fiction or Future? Edited by Jayashankar M. Swaminathan World Scientific Publishing Company: 2009 CHAPTER 6 INDIA’S AVIATION SECTOR: DYNAMIC TRANSFORMATION John Kasarda* and Rambabu Vankayalapati† Introduction India is no longer a country of promise — it has arrived, and in a big way. Not long ago regarded as a relatively closed and staid demographic giant, the nation has emerged over the past decade as “open for business,” quickly joining global leaders in everything from IT and BPO to financial services and medical tourism. As India’s integration into the global economy accelerated, so did its annual GDP growth rate, averaging over 8% since 2003. In the fiscal year 2007, its GDP expanded by 9.4% and was forecasted to remain above 9% for the next three years.40 Foreign investment concurrently mushroomed, posi- tioning India as number two in the world (behind China) as the preferred location for FDI. Net capital inflows (FDI plus long-term commercial debt) exceeded USD24 billion. The country’s explosive economic growth has yielded a burgeoning middle class in which higher incomes have led to sharp rises in purchases of automobiles, motorbikes, computers, mobile phones, TVs, refrigerators, and branded con- sumer goods of all types. Rapidly rising household incomes have also generated a burst in air travel, both domestic and international. In just three years from 2003–2004 to 2006–2007, commercial aircraft enplanements in India rose from 48.8 million to nearly 90 million, a growth rate of almost 25% annually. -

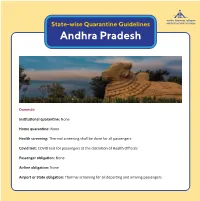

State-Wise Quarantine Guidelines Andhra Pradesh

State-wise Quarantine Guidelines Andhra Pradesh Domes�c Ins�tu�onal quaran�ne: None Home quaran�ne: None Health screening: Thermal screening shall be done for all passengers Covid test: COVID test for passengers at the discre�on of Health Officials Passenger obliga�on: None Airline obliga�on: None Airport or State obliga�on: Thermal screening for all depar�ng and arriving passengers. State-wise Quarantine Guidelines Andhra Pradesh Interna�onal Ins�tu�onal quaran�ne: For symptoma�c passengers as advised by health authori�es Home quaran�ne ● For all Interna�onal passengers except passengers coming through flights origina�ng from the United Kingdom, Brazil, South Africa, Europe and Middle East are advised to self-monitor their health for 14 days. ● All such passengers shall inform the State or Na�onal Call Centre in case they develop symptoms at any �me during the quaran�ne or self-monitoring of their health. ● For All interna�onal passengers coming or transi�ng from flights origina�ng from the United Kingdom, Brazil, South Africa has to give their sample in the designated area and exit the airport only a�er confirma�on of a nega�ve test report. ● Transit passengers from the United Kingdom, Brazil and South Africa who are found nega�ve on tes�ng at the airport shall be allowed to take their connec�ng flights and advised quaran�ne at home for 14 days. ● Non-Transit passengers shall give samples at the designated area and exit the airport. ● All other passengers from the Middle East who have to exit the des�na�on airport or take connec�ng flights to their final domes�c des�na�on shall give samples at the designated area and exit the airport. -

Kingfisher Airlines—King of Good Times Trapped in Bad Weather

CASE STUDY Kingfisher Airlines—King of Good Times Trapped in Bad Weather Dr. J.N Mukhopadhay Prof. Subhendu Dey Prof. Prithviraj Bannerjee Ms. Soumali Dutta Sr. V.P. (Ex) SREI, Dean, Associate Dean and Assistant Professor, Research Associate, Globsyn Business School, Head - Knowledge Cell, Globsyn Business School, Globsyn Business School, Kolkata Globsyn Business School, Kolkata Kolkata Kolkata Th is case is not intended to show eff ective or ineff ective handling of decision or business processes © 2012 by Knowledge Cell, Globsyn Business School, Kolkata. No part of this publication may be reproduced or transmitted in any form or by any means—electronic, mechanical, photocopying, recording or otherwise (including the internet)—without the permission of Globsyn Business School n October 4th, 2012, Mrs. Sushmita Chakarborti, subsidiary. Vittal Mallya’s son Vijay Mallya, who previously, wife of Mr. Manas Chakraborti, a Store Manager managed the Brewery and Spirits division of UBL, was Owith Kingfi sher Airlines, committed suicide elected by the shareholders as the Chairman of UB Group, at their South-West Delhi residence. She was battling in 1983. Mallya expanded the UB groups’ business into depression and wrote a suicide note stating that her pharmaceuticals, paints, petrochemicals, plastic, electro- husband works with Kingfi sher Airlines, where they have mechanical batteries, food products, carbonated beverages, not paid him salary for the last six months and due to acute Pizza chains, soft ware, TV channels, and IPL, transforming fi nancial crisis of the family, she committed suicide11. UB Group as one of the largest business conglomerates Kingfi sher Airlines, launched in 2003 by UB Group with defi ned corporate structure and corporate governance Chairman Vijay Mallya as a premium full-service carrier policy 2. -

SP's Aviation

SP’s AN SP GUIDE PUBLICATION ED BUYER ONLY) ED BUYER AS -B A NDI I 100.00 ( ` Aviation Sharp Content for Sharp Audience www.sps-aviation.com vol 19 ISSUE 12 • DEcEmbEr • 2016 MILITARY CIVIL • CarTER REAFFIRMS ROAD FORUM FOR REDRESSAL: MAP FOR THE NEXT US AIRSEWA LAUNCH DEFENSE SECRETARY • BOEING ENTERS TaNKER RACE WITH FMS OFFER reGiOnAl AviAtiOn: • exclusive interview JOHN SLATTERY, LAST WORD: EMBRAER COMMERCIAL INDIAN NAVY REJECTS TEJAS (LCA) • TIANJIN AIRLINES-EMBRAER, PERFECT FIT FOR CHINA’S REGIONAL EXPANSION MEBAA 2016 • REPORT: • WORRISOME SCENARIO AERO EXPO INDIA 2016 • exclusive interview: WIELAND TIMM, Business AviAtiOn: LUFTHANSA TECHNIK • BAOA REPORT RELEASE • exclusive interview: JAYANT NADKARNI, EXCLUSIVE PRESIDENT, BAOA • MIDDLE EAST IN IRELAND & INDIA THE MIDDLE PAT BREEN, IRELAND MINISTER OF STATE FOR EMPLOYMENT AND SMALL OF A CRISIS BUSINESS +++ GOVERNMENT SUPPORT TO ENTREPRENEURSHIP IS RNI NUMBER: DELENG/2008/24199 EXTREMELY IMPORTANT PAGE 8 SIMPLY THE LARGEST MEDIA FOR (IN ASIA) AERO INDIA 2017 WE AT SP’S, SP GUIDE PUBLICATIONS FOUNDED IN 1964 HENCE A BACKGROUND OF OVER 52 YEARS, BRING THE COLLECTION OF THE LARGEST NUMBER OF PUBLICATIONS (NINE IN TOTAL) AT UPCOMING AERO INDIA 2017 PUBLISHED DAILY ON DAY 1, DAY 2, DAY 3 EMAIL US AT: ADVERTISING@ SPGUIDEPUBLICATIONS.COM SHOW SPECIAL CALL US: SHOW SPECIAL +91 11 24644763 +91 11 24644693 +91 11 24620130 SHOW SPECIAL +91 11 24658322 SHOW SPECIAL CONTACT US: ROHIT GOEL +91 99999 19071 SHOW SPECIAL NEETU DHULIA +91 98107 00864 RAJEEV CHUGH +91 93128 36347 SHOW SPECIAL SIMPLY -

Vayu Issue V Sep Oct 2018

V/2018 Aerospace & Defence Review The IAF at 86 In Defence of the Rafale Interview with the CAS Air Combat Enablers Indian Women (Air) Power Out of Africa SAF-AP LEAP-INDIA-210x297-GB-V3.indd 1 18/08/2017 15:50 V/2018 V/2018 Aerospace & Defence Review 32 Interview 98 Out of Africa with the CAS The IAF at 86 In Defence of the Rafale Interview with the CAS Air Combat Enablers Indian Women (Air) Power Out of Africa Marshal BS Dhanoa gave a special address on the rationale behind the Cover : Pair of Dassault Rafales fully loaded Rafale acquisition programme as also with long range tanks and weaponry on the IAF’s modernisation roadmap. (photo : Rafale International) Air Combat Enablers This evocative article looks back to 42 the early 1960s when the Indian Air EDITORIAL PANEL Force deployed a flight of Canberra MANAGING EDITOR interdictor bombers to central Africa, in support of the United Nations in Vikramjit Singh Chopra In Vayu’s interview with Air Chief the Congo. As part of the motley ‘UN EDITORIAL ADVISOR Marshal BS Dhanoa, the CAS Air Force’, the IAF turned the tables, emphasised that the case for 114 new Admiral Arun Prakash providing the UN with their real ‘force fighters will be progressed through the multipliers’. The article includes some EDITORIAL PANEL Strategic Partnership route and as per very rare images then taken by Air Chapter VII of the DPP-16. The Chief Pushpindar Singh Marshal (retd) SC Lal. also refered to the FRA and AEW&C Air Marshal Brijesh Jayal requirement and importantly, on the Air Vice Marshal Manmohan Bahadur Raptors on a roll Dr. -

Leakproof Form-Work Gives Long Lasting Concrete

REGIONAL DEVELOPMENTS THROUGH AVIATION IN INDIA—CREATION OF NEW REGIONAL AIRPORTS AND REGIONAL AIRLINES —CreationRegionalCurrent Developments in Air and SpaceDevelopments Lawof new Regional through airports aviation and Regionalin India airlines Debabrat Mishra* Introduction One of the fastest growing aviation industries in the world is Indian Aviation Industry. With the liberalization of the Indian aviation sector, a rapid revolution has undergone in Indian aviation industry. Primarily it was a government-owned industry, but now it is dominated by privately owned full service airlines and low cost carriers. Around 75% share of the domestic aviation market is shared by private airlines. Earlier only few people could afford air travel, but now it can be afforded by a large number of people as it has become much cheaper because of stiff competition. The civil aviation traffic has seen an unprecedented traffic in the past few years on account of booming Indian economy, growing tourism industry, and entry of low cost carriers in the private sector, liberalization of international bi-lateral agreements and liberalization of civil aviation policy. In future also the civil aviation traffic is expected to grow at the same pace despite current slowdown due to global recession. But airport infrastructure has not kept pace with the growth of the civil aviation traffic. This has resulted in congestion and inefficient services in major airports, limited landing slots, inadequate parking bays and congestion during peak hours for airlines. Development of quality infrastructure will have an impact on international competitiveness and economic growth. This requires faster development of civil aviation infrastructure on public private partnership mode. -

20203316422Imfor 2000Crs 20000Ncds Vedanta

economic/commercial risk of investing in the Debentures. Potential investors should conduct their own investigation, due diligence and analysis before applying for the Debentures. Nothing in this Private Placement Offer Letter should be construed as advice or recommendation by the Issuer to subscribers to the Debentures. Potential investors should also consult their own advisors on the implications of application, allotment, sale, holding, ownership and redemption of these Debentures and matters incidental thereto. The Issuer confirms that, as of the date hereof, this Private Placement Offer Letter (including the documents incorporated by reference herein, if any) contains all information that is material in the context of the Issue of the Debentures, is accurate in all material respects and does not contain any untrue statement of a material fact. It has not omitted any material fact necessary to make and the statements made herein are not misleading in the light of the circumstances under which they are made. No person has been authorized to give any information or to make any representation not contained or incorporated by reference in this Private Placement Offer Letter or in any material made available by the Issuer to any potential investor pursuant hereto and, if given or made, such information or representation must not be relied upon as having been authorized by the Issuer. The Issuer reserves the right to withdraw the private placement of the Debentures Issue prior to the issue closing date(s) in the event of any unforeseen development adversely affecting the economic and regulatory environment or any other force majeure condition including any change in the applicable laws. -

A Study of Mergers & Acquisitions in Aviation Industry in India and Their

A Study of Mergers & Acquisitions in Aviation Industry in India and Their Impact on the Operating Performance and Shareholder Wealth Nisarg A Joshi Ahmedabad Institute of Technology Jay M Desai Ahmedabad Institute of Technology ABSTRACT The objective of this paper is to study, why organisations take the inorganic mode of expansion. However, the main focus is on studying the operating performance and shareholder value of acquiring companies and comparing their performance before and after the merger. To conduct a uniform research and arrive at an accurate conclusion, we restrict our research to only Indian companies. To get a perspective on India, we study aviation sector. We will test feasibility that mergers improve operating performance of acquiring companies. However on studying the cases, we conclude that as in previous studies, mergers do not improve financial performance at least in the immediate short term. INTRODUCTION The air travel market grew up originally to meet the demand of business travelers as companies became increasingly wide-spread in their operations. On the other hand, rising income levels and extra leisure time led holidaymakers to travel to faraway places for their vacation. A further stimulus to the air travel market was provided by the deregulation and the privatization of the aviation industry. State- owned carriers that hitherto enjoyed monopoly status were now exposed to competition from private players. However, one development that changed the entire landscape of the industry was the emergence of low cost carriers (LCCs). These carriers were able to offer significantly cheaper fares on account of their low-cost business models and thereby attract passengers who might not otherwise be willing to fly.