Trade Clustering and Power Laws in Financial Markets

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Identifying Chart Patterns with Technical Analysis

746652745 A Fidelity Investments Webinar Series Identifying chart patterns with technical analysis BROKERAGE: TECHNICAL ANALYSIS BROKERAGE: TECHNICAL ANALYSIS Important Information Any screenshots, charts, or company trading symbols mentioned are provided for illustrative purposes only and should not be considered an offer to sell, a solicitation of an offer to buy, or a recommendation for the security. Investing involves risk, including risk of loss. Past performance is no guarantee of future results Stop loss orders do not guarantee the execution price you will receive and have additional risks that may be compounded in pe riods of market volatility. Stop loss orders could be triggered by price swings and could result in an execution well below your trigg er price. Trailing stop orders may have increased risks due to their reliance on trigger pricing, which may be compounded in periods of market volatility, as well as market data and other internal and external system factors. Trailing stop orders are held on a separat e, internal order file, place on a "not held" basis and only monitored between 9:30 AM and 4:00 PM Eastern. Technical analysis focuses on market action – specifically, volume and price. Technical analysis is only one approach to analyzing stocks. When considering which stocks to buy or sell, you should use the approach that you're most comfortable with. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. Past performance is no guarantee of future results. -

Everything You Wanted to Know About Candlestick Charts Is an Unregulated Product Published by Thames Publishing Ltd

EEvveerryytthhiinngg yyoouu wwaanntteedd ttoo kknnooww aabboouutt ccaannddlleessttiicckk cchhaarrttss by Mark Rose • Read candlestick charts accurately • Spot patterns quickly and easily • Use that information to make profitable trading decisions Contents Chapter 1. What is a candlestick chart? 3 Chapter 2. Candlestick shapes: 6 Anatomy of a candle 6 Doji 7 Marubozo 8 Chapter 3. Candlestick Patterns 9 Harami (bullish / bearish) 9 Hammer / Hanging Man 11 Inverted Hammer / Shooting Star 13 Engulfing (bullish/ bearish) 14 Morning Star / Evening Star 15 Three White Soldiers / Three Black Crows 16 Piercing Line / Dark Cloud Cover 17 Chapter 4. The history of candlestick charts 18 Conclusion 20 Candlestick Cheat Sheet 22 2 Chapter 1. What is a candlestick chart? Before I start to talk about candlestick patterns, I’d like to get right back to basics on candles: what they are, what they look like, and why we use them … Drawing lines When you look at a chart of market prices, you can usually choose from line charts or candlestick charts. A line chart will take its price levels from the opening or closing prices according to the timeframe you have selected. So, if you’re looking at a one-minute line chart of closing prices, it will plot the closing price for each one-minute period – something like this … Line charts can be useful for looking at the “bigger picture” and finding long-term trends, but they simply cannot offer up the kind of information contained in a candlestick chart. Here is a one-minute candlestick chart for the same period … 3 At first glance, it might look a little confusing, but I can assure you that once you’re used to candlestick charts – you won’t look back. -

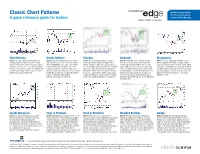

Classic Chart Patterns Chart Pattern Recognition a Quick Reference Guide for Traders Tools Provided by Recognia

StreetSmart Edge features Classic Chart Patterns Chart Pattern Recognition A quick reference guide for traders tools provided by Recognia. www.schwab.com/ssedge Triple Bottoms Double Bottoms Triangles Diamonds Megaphones Bullish: The Triple Bottom starts with prices Bullish: This pattern marks the reversal of a Bullish: Two converging trendlines as prices Bullish or Bearish: These patterns usually Bullish: The rare Megaphone Bottom—a.k.a. moving downward, followed by three sharp prior downtrend. The price forms two distinct reach lower/stable highs and higher lows. form over several months and volume will Broadening Pattern—can be recognized by its lows, all at about the same price level. Volume lows at roughly the same price level. Volume Volume diminishes and price swings between remain high during formation. Prices create successively higher highs and lower lows, which diminishes at each successive low and finally reflects weakening of downward pressure, an increasingly narrow range. Before the triangle higher highs and lower lows in a broadening form after a downward move. The bullish pattern bursts as the price rises above the highest high, tending to diminish as it forms, with some reaches its apex, the price breaks out above pattern, then the trading range narrows after is confirmed when, usually on the third upswing, confirming as a sign of bullish price reversal. pickup at each low and less on the second low. the upper trendline with a noticeable increase peaking highs and uptrending lows trend. The prices break above the prior high but fail to fall Bearish Counterpart: Triple Top. Finally the price breaks out above the highest in volume, confirming the bullish continuation breakout direction signals the resolution to below this level again. -

Option-Implied Term Structures

Federal Reserve Bank of New York Staff Reports Option-Implied Term Structures Erik Vogt Staff Report No. 706 December 2014 Revised January 2016 This paper presents preliminary findings and is being distributed to economists and other interested readers solely to stimulate discussion and elicit comments. The views expressed in this paper are those of the author and are not necessarily reflective of views at the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author. Option-Implied Term Structures Erik Vogt Federal Reserve Bank of New York Staff Reports, no. 706 December 2014; revised January 2016 JEL classification: G12, G17, C58 Abstract This paper proposes a nonparametric sieve regression framework for pricing the term structure of option spanning portfolios. The framework delivers closed-form, nonparametric option pricing and hedging formulas through basis function expansions that grow with the sample size. Novel confidence intervals quantify term structure estimation uncertainty. The framework is applied to estimating the term structure of variance risk premia and finds that a short-run component dominates market excess return predictability. This finding is inconsistent with existing asset pricing models that seek to explain the variance risk premium’s predictive content. Key words: variance risk premium, term structures, options, return predictability, nonparametric regression. _________________ Vogt: Federal Reserve Bank of New York (e-mail: [email protected]). The author is especially thankful to his dissertation chair, George Tauchen, and his dissertation committee members, Tim Bollerslev, Federico Bugni, Jia Li, and Andrew Patton, for their guidance and encouragement. -

![JNK [High Yield Bond ETF] Weekly Chart – 14-Period RSI Relative](https://docslib.b-cdn.net/cover/0482/jnk-high-yield-bond-etf-weekly-chart-14-period-rsi-relative-2070482.webp)

JNK [High Yield Bond ETF] Weekly Chart – 14-Period RSI Relative

JNK [High Yield Bond ETF] Weekly Chart – 14-Period RSI Relative Strength Index Signals Bullish Divergence Forming in High Yield Market Prices have defined a downtrend throughout calendar 2018, reaching the lowest level to begin Q3 (not pictured) Momentum on the other hand may be signaling support for a near-term advance, as the RSI held a higher low, remaining above the 40 level for the past three weeks as of this writing. However, gains will likely be limited by resistance at the MA Line, currently running parallel to a long-term downtrend line at the 36.40 level. If prices manage to break above resistance, with a concurrent rise above 50 RSI, that would be a signal to remain long. Alternatively, lower RSI readings indicating weak momentum would further establish that level of resistance. Longer-term, it appears a symmetrical triangle pattern may be forming on the weekly chart, implying a continuation of the recent downtrend. The downside price target for a breakaway from this pattern is $33.70 representing a 5.5% drop from current levels, coincidentally equal to the annual yield of this market. JNK [High Yield Bond ETF] Weekly Chart – 50 Week Moving Average Moving Average Line Overlays Long-term Falling Resistance Throughout Calendar 2018 Downloaded from www.hvst.com by IP address 192.168.160.10 on 09/29/2021 [High Yield Bond ETF] Daily Chart – Trading Volume w/ 50-Day MA Prices Test 2018 Lows in July, Reverse Closing Higher by End of Holiday Week High Yield Corporate Bond prices rose throughout July (not pictured) meeting resistance for a second time in as many months at the 36 level. -

Classic Patterns

CLASSIC PATTERNS TABLE OF CONTENTS Classic Patterns . Bullish Patterns: …………………………………………………………………………………………………………. 1 Ascending Continuation Triangle…………………………………………………………………….. 2 Bottom Triangle – Bottom Wedge…………………………………………………………………… 5 Continuation Diamond (Bullish) ……………………………………………………………………… 9 Continuation Wedge (Bullish) …………………………………………………………………………. 11 . Diamond Bottom…………………………………………………………………………………………….. 13 Double Bottom……………………………………………………………………………………………….. 15 Flag (Bullish) …………………………………………………………………………………………………… 19 . Head and Shoulders Bottom……………………………………………………………………………. 22 Megaphone Bottom………………………………………………………………………………………… 27 Pennant (Bullish) ……………………………………………………………………………………………. 28 Symmetrical Continuation Triangle (Bullish) …………………………………………………… 31 Triple Bottom………………………………………………………………………………………………….. 35 Upside Breakout……………………………………………………………………………………………… 39 Rounded Bottom…………………………………………………………………………………………….. 42 . Bearish Patterns…………………………………………………………………………………………………………. 45 Continuation Diamond (Bearish) …………………………………………………………………….. 46 Continuation Wedge (Bearish) ……………………………………………………………………….. 48 Descending Continuation Triangle…………………………………………………………………… 50 Diamond top…………………………………………………………………………………………………… 53 Double Top (Bearish) ……………………………………………………………………………………… 55 Downside Breakout…………………………………………………………………………………………. 60 Flag (Bearish) ………………………………………………………………………………………………….. 62 . Head and Shoulders top (Bearish) ………………………………………………………………….. 65 Megaphone Top……………………………………………………………………………………………… 71 Pennant -

Recognia Overview 3 What Is Technical Analysis?

ADVANCED TECHNICAL SCREENING WITH THE NEW FIDELITY STOCK AND ETF SCREENERS Peter Ashton VP, Retail and Self-Directed Investing 784579.1.0 Disclaimer The information presented here is for educational and informational purposes only. The inclusion of any specific securities detailed is for illustrative purposes only. No information contained in this presentation is intended to constitute a recommendation by Recognia to buy, sell, or hold any stock, option, or securities. 2 Agenda • An Event Driven Approach to Technical Analysis • Major Classes of Technical Events • Short-term Patterns • Indicators and Oscillators • Classic Chart Patterns • Using the New Fidelity Stock and ETF Screeners • Technical Screening for Stocks • Technical Screening for ETFs • Using Preset Expert Screens • Q & A Recognia Overview 3 What is Technical Analysis? • Looking for patterns and relationships in price and volume history that identify attitudes of buyers and sellers • Shifts in the balance of supply and demand • To assist in making investment and trading decisions Recognia Overview 4 An Example… Prices move in trends until … Something changes to affect supply and demand 5 Head & Shoulders Bottom Prices move in trends until … Something changes to affect supply and demand Marked by patterns in price and volume history Types of Technical Events 7 Technical Event Classes • Short-term Patterns • Based on the shape and relationship of candlesticks or price bars • Indicators & Oscillators • Classic Patterns 8 Hammer HammerHammer identified Shooting Star Hammer Hanging -

Understanding Classic Chart Patterns Recognia Inc

Understanding Classic Chart Patterns Recognia Inc. www.recognia.com 2009 ©Copyright Recognia Inc. Table of Contents Introduction ................................................................................................................................................................3 Head and Shoulders Top ...........................................................................................................................................5 Head and Shoulders Bottom .................................................................................................................................. 10 Symmetrical Triangle .............................................................................................................................................. 15 Ascending Triangle ................................................................................................................................................. 21 Descending Triangle ............................................................................................................................................... 27 Double Tops ............................................................................................................................................................. 33 Double Bottoms ....................................................................................................................................................... 38 Triple Top ................................................................................................................................................................ -

On Our Technical Watch

On Our Technical Watch 11 June 2021 By Lim Khai Xhiang l [email protected] Daily technical highlights – (KERJAYA, TECHBND) Daily Charting – KERJAYA (Trading Buy) About the Stock: Key Support & Resistance Levels Name Kerjaya Prospek 52 Week High/Low : 1.53/0.89 Last Price : RM1.23 : Group Bhd 3-m Avg. Daily Vol. : 2,068,586 Resistance : RM1.38 (R1) RM1.48 (R2) Bursa Code : KERJAYA Free Float (%) : 15% Stop Loss : RM1.10 CAT Code : 7161 Beta vs. KLCI : 1.0 Market Cap : RM1,522.0m Kerjaya Prospek Group Berhad (Trading Buy) • KERJAYA is principally involved in the construction of high-end commercial and high-rise residential buildings, property development and the manufacturing of lighting and kitchen solutions. • In FY20, the Group’s revenue fell 23% to RM811m and core net profit dropped 40% to RM90m. Its 1QFY21 results – with revenue of RM269m (+8% QoQ; +27% YoY) and core net profit of RM26m (-5% QoQ; +1% YoY) – were below expectations, affected by margin squeeze mainly due to elevated steel costs. • Still, looking ahead, consensus is expecting KERJAYA’s net profit to grow by 39% and 28% to RM125m and RM161m in FY21 and FY22, respectively. This translates to forward PERs of 12.2x this year and 9.5x next year respectively, compared to the 5-year historical mean of 12.3x. • Technically speaking, from a peak of RM1.53 in mid-April, the stock fell (likely due to renewed fears of economic lockdowns) to as low as RM1.08. • Following which, in mid-May, the stock found support at the 50% Fibonacci retracement level of RM1.19. -

Advanced Candlestick Charting Techniques: Becoming a Samurai Trader

Advanced Candlestick Charting Techniques: Becoming a Samurai Trader Steve Nison, CMT President: Candlecharts.com Web site: www. candlecharts.com E-mail: [email protected] Telephone: 732.254.8660 Evolution of the Candle Chart Stage 1- The line chart (closes only) Stage 2- The bar chart Stage 3- The anchor chart Stage 4- The candlestick chart high close open close close open open low 2 Constructing the Candle Line high Shadow close open Real Body open close low Real Bodies / Shadows Doji 3 3 LooksLooks goodgood onon thethe outsideoutside New high close for the move, but the doji is a warning 4 Spinning Tops Bears’ losing force 5 5 Using the size of real bodies to gauge force The shrinking size of the real bodies hint the bulls losing force 6 Doji after Tall White Can use for all time frames 7 NisonNison TradingTrading PrinciplePrinciple CandleCandle signalssignals mustmust bebe evaluatedevaluated andand actedacted uponupon withinwithin thethe marketmarket’’ss contextcontext 8 WhenWhen notnot toto useuse dojidoji OMNICARE INC 27.5 27.0 26.5 26.0 25.5 25.0 24.5 24.0 23.5 This stock has so many doji that they have little market implication 23.0 22.5 22.0 21.5 11 18 25 1 815 April 9 Doji in Context ¾¾ SpinningSpinning topstops andand dojidoji ¾¾DojiDoji inin contextcontext ofof priceprice -- isis thethe dojidoji atat aa newnew highhigh closeclose forfor thethe move?move? ¾¾DojiDoji inin contextcontext ofof direction:direction: doesdoes thethe dojidoji followfollow aa rally?rally? isis therethere aa trendtrend toto reverse?reverse? -

Nifty Outlook & Know About Powerful Oscillator – Relative Strength Index

Nifty Outlook & Know about Powerful Oscillator – Relative Strength Index 30th July, 2018 Relative Strength Index – Oscillator A Powerful Technical Tool • An oscillator is a technical analysis tool. An technical analyst bands an oscillator between two extreme values and then builds a trend indicator with the results. The analysts then use the trend indicator to discover short-term overbought or oversold conditions. • RSI- The relative strength index (RSI) is a technical indicator used in the analysis of financial markets. It is intended to chart the current and historical strength or weakness of a stock or market based on the closing prices of a recent trading period. The indicator should not be confused with its relative strength, that is compared with other stocks, market indices, sectoral indices, etc. Computation • Focusing merely on trend of stocks or indices, RSI focuses on average gains and average losses for a specified time period. (Default parameters 14 days). To make sure that the RSI always moves between 0 and 100, the indicator is normalized later by using the formula given below • RSI: 100-[100/ (1+RS)] RS: AVG UPS/AVG DOWNS AVG UPS: TOTAL GAINS IN LAST 14 DAYS/14 AVG DOWNS: TOTAL LOSSES IN LAST 14 DAYS/14 • It helps especially at the top of the rally or at the bottom of the fall. • At the Top or Bottom, trend gives more weightage to sentiments than internal strength or weakness. 6899.85 Overbought- Reading of RSI above the level of 70 means over bought or strong grip of Bulls. BAJAJFINSV [N16675] 6899.85, -0.39% 4690.04 Price Lnr IRIS 07/08/17 Mon D 0 5775 Op 5310.80 Hi 5495.00 5700 Lo 5310.80 5625 Cl 5433.05 5550 • Reading of RSI above 70 means over bought or strong5500 grip of Bulls. -

Technical Analysis Pulse 17/05/2020

Technical Analysis Pulse 17/05/2020 “: AL JAZEERA SERVICES Support, Resistance and Target levels for U Capital OMAN 20 INDEX Co. - Weekly Basis In line with our technical analysis. Currently Support Support Current Resistance Resistance Target No. Company Name we found the RSI, MFI and MACD are 2 1 Price 1 2 1 AL ANWAR CERAMIC TILES 0.012 0.121 0.130 0.136 0.149 - attractive to buy. So this week the trend will 2 AL ANWAR HOLDINGS CO 0.055 0.060 0.068 0.075 0.077 - be clear after the stock cross the resistance 3 AL JAZEERA SERVICES 0.135 0.141 0.150 0.170 0.180 - 4 AHLI BANK 0.105 0.110 0.115 0.116 0.118 - level of OMR 0.150 in upside momentum to 5 AL MADINA TAKAFUL CO SAOC 0.058 0.065 0.067 0.073 0.080 - 6 RAYSUT CEMENT 0.330 0.340 0.340 0.365 0.400 - be over the Short-Term of MA10. We expect 7 MUSCAT CITY DESALINATION 0.098 0.102 0.105 0.108 0.112 - the first target to be at OMR 0.160. 8 BANK MUSCAT 0.275 0.300 0.316 0.325 0.335 - 9 BANK NIZWA 0.077 0.080 0.090 0.106 0.110 - 10 SOHAR INTERNATIONAL BANK 0.075 0.080 0.080 0.100 0.105 - 11 GALFAR ENGINEERING & CONTRACTING0.035 0.040 0.055 0.057 0.060 - 12 HSBC BANK OMAN 0.080 0.088 0.088 0.120 0.131 - 13 NATIONAL BANK OF OMAN 0.145 0.150 0.153 0.170 0.180 - 14 OMAN CEMENT 0.200 0.205 0.222 0.240 0.260 - 15 AL BATINAH POWER 0.035 0.040 0.058 0.065 0.068 - 16 OMAN INV .