Understanding Classic Chart Patterns Recognia Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Technical Analysis, Liquidity, and Price Discovery∗

Technical Analysis, Liquidity, and Price Discovery∗ Felix Fritzy Christof Weinhardtz Karlsruhe Institute of Technology Karlsruhe Institute of Technology This version: 27.08.2016 Abstract Academic literature suggests that Technical Analysis (TA) plays a role in the decision making process of some investors. If TA traders act as uninformed noise traders and generate a relevant amount of trading volume, market quality could be affected. We analyze moving average (MA) trading signals as well as support and resistance levels with respect to market quality and price efficiency. For German large-cap stocks we find excess liquidity demand around MA signals and high limit order supply on support and resistance levels. Depending on signal type, spreads increase or remain unaffected which contra- dicts the mitigating effect of uninformed TA trading on adverse selection risks. The analysis of transitory and permanent price components demonstrates increasing pricing errors around TA signals, while for MA permanent price changes tend to increase of a larger magnitude. This suggests that liquidity demand in direction of the signal leads to persistent price deviations. JEL Classification: G12, G14 Keywords: Technical Analysis, Market Microstructure, Noise Trading, Liquidity ∗Financial support from Boerse Stuttgart is gratefully acknowledged. The Stuttgart Stock Exchange (Boerse Stuttgart) kindly provided us with databases. The views expressed here are those of the authors and do not necessarily represent the views of the Boerse Stuttgart Group. yE-mail: [email protected]; Karlsruhe Institute of Technology, Research Group Financial Market Innovation, Englerstrasse 14, 76131 Karlsruhe, Germany. zE-mail: [email protected]; Karlsruhe Institute of Technology, Institute of Information System & Marketing, Englerstrasse 14, 76131 Karlsruhe, Germany. -

Candlestick Patterns

INTRODUCTION TO CANDLESTICK PATTERNS Learning to Read Basic Candlestick Patterns www.thinkmarkets.com CANDLESTICKS TECHNICAL ANALYSIS Contents Risk Warning ..................................................................................................................................... 2 What are Candlesticks? ...................................................................................................................... 3 Why do Candlesticks Work? ............................................................................................................. 5 What are Candlesticks? ...................................................................................................................... 6 Doji .................................................................................................................................................... 6 Hammer.............................................................................................................................................. 7 Hanging Man ..................................................................................................................................... 8 Shooting Star ...................................................................................................................................... 8 Checkmate.......................................................................................................................................... 9 Evening Star .................................................................................................................................... -

Investing with Volume Analysis

Praise for Investing with Volume Analysis “Investing with Volume Analysis is a compelling read on the critical role that changing volume patterns play on predicting stock price movement. As buyers and sellers vie for dominance over price, volume analysis is a divining rod of profitable insight, helping to focus the serious investor on where profit can be realized and risk avoided.” —Walter A. Row, III, CFA, Vice President, Portfolio Manager, Eaton Vance Management “In Investing with Volume Analysis, Buff builds a strong case for giving more attention to volume. This book gives a broad overview of volume diagnostic measures and includes several references to academic studies underpinning the importance of volume analysis. Maybe most importantly, it gives insight into the Volume Price Confirmation Indicator (VPCI), an indicator Buff developed to more accurately gauge investor participation when moving averages reveal price trends. The reader will find out how to calculate the VPCI and how to use it to evaluate the health of existing trends.” —Dr. John Zietlow, D.B.A., CTP, Professor of Finance, Malone University (Canton, OH) “In Investing with Volume Analysis, the reader … should be prepared to discover a trove of new ground-breaking innovations and ideas for revolutionizing volume analysis. Whether it is his new Capital Weighted Volume, Trend Trust Indicator, or Anti-Volume Stop Loss method, Buff offers the reader new ideas and tools unavailable anywhere else.” —From the Foreword by Jerry E. Blythe, Market Analyst, President of Winthrop Associates, and Founder of Blythe Investment Counsel “Over the years, with all the advancements in computing power and analysis tools, one of the most important tools of analysis, volume, has been sadly neglected. -

Identifying Chart Patterns with Technical Analysis

746652745 A Fidelity Investments Webinar Series Identifying chart patterns with technical analysis BROKERAGE: TECHNICAL ANALYSIS BROKERAGE: TECHNICAL ANALYSIS Important Information Any screenshots, charts, or company trading symbols mentioned are provided for illustrative purposes only and should not be considered an offer to sell, a solicitation of an offer to buy, or a recommendation for the security. Investing involves risk, including risk of loss. Past performance is no guarantee of future results Stop loss orders do not guarantee the execution price you will receive and have additional risks that may be compounded in pe riods of market volatility. Stop loss orders could be triggered by price swings and could result in an execution well below your trigg er price. Trailing stop orders may have increased risks due to their reliance on trigger pricing, which may be compounded in periods of market volatility, as well as market data and other internal and external system factors. Trailing stop orders are held on a separat e, internal order file, place on a "not held" basis and only monitored between 9:30 AM and 4:00 PM Eastern. Technical analysis focuses on market action – specifically, volume and price. Technical analysis is only one approach to analyzing stocks. When considering which stocks to buy or sell, you should use the approach that you're most comfortable with. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. Past performance is no guarantee of future results. -

Technical-Analysis-Bloomberg.Pdf

TECHNICAL ANALYSIS Handbook 2003 Bloomberg L.P. All rights reserved. 1 There are two principles of analysis used to forecast price movements in the financial markets -- fundamental analysis and technical analysis. Fundamental analysis, depending on the market being analyzed, can deal with economic factors that focus mainly on supply and demand (commodities) or valuing a company based upon its financial strength (equities). Fundamental analysis helps to determine what to buy or sell. Technical analysis is solely the study of market, or price action through the use of graphs and charts. Technical analysis helps to determine when to buy and sell. Technical analysis has been used for thousands of years and can be applied to any market, an advantage over fundamental analysis. Most advocates of technical analysis, also called technicians, believe it is very likely for an investor to overlook some piece of fundamental information that could substantially affect the market. This fact, the technician believes, discourages the sole use of fundamental analysis. Technicians believe that the study of market action will tell all; that each and every fundamental aspect will be revealed through market action. Market action includes three principal sources of information available to the technician -- price, volume, and open interest. Technical analysis is based upon three main premises; 1) Market action discounts everything; 2) Prices move in trends; and 3) History repeats itself. This manual was designed to help introduce the technical indicators that are available on The Bloomberg Professional Service. Each technical indicator is presented using the suggested settings developed by the creator, but can be altered to reflect the users’ preference. -

Technical Analysis: Technical Indicators

Chapter 2.3 Technical Analysis: Technical Indicators 0 TECHNICAL ANALYSIS: TECHNICAL INDICATORS Charts always have a story to tell. However, from time to time those charts may be speaking a language you do not understand and you may need some help from an interpreter. Technical indicators are the interpreters of the Forex market. They look at price information and translate it into simple, easy-to-read signals that can help you determine when to buy and when to sell a currency pair. Technical indicators are based on mathematical equations that produce a value that is then plotted on your chart. For example, a moving average calculates the average price of a currency pair in the past and plots a point on your chart. As your currency chart moves forward, the moving average plots new points based on the updated price information it has. Ultimately, the moving average gives you a smooth indication of which direction the currency pair is moving. 1 2 Each technical indicator provides unique information. You will find you will naturally gravitate toward specific technical indicators based on your TRENDING INDICATORS trading personality, but it is important to become familiar with all of the Trending indicators, as their name suggests, identify and follow the trend technical indicators at your disposal. of a currency pair. Forex traders make most of their money when currency pairs are trending. It is therefore crucial for you to be able to determine You should also be aware of the one weakness associated with technical when a currency pair is trending and when it is consolidating. -

Trade Clustering and Power Laws in Financial Markets

Theoretical Economics 15 (2020), 1365–1398 1555-7561/20201365 Trade clustering and power laws in financial markets Makoto Nirei Graduate School of Economics, University of Tokyo John Stachurski Research School of Economics, Australian National University Tsutomu Watanabe Graduate School of Economics, University of Tokyo This study provides an explanation for the emergence of power laws in asset trad- ing volume and returns. We consider a two-state model with binary actions, where traders infer other traders’ private signals regarding the value of an asset from their actions and adjust their own behavior accordingly. We prove that this leads to power laws for equilibrium volume and returns whenever the number of traders is large and the signals for asset value are sufficiently noisy. We also provide nu- merical results showing that the model reproduces observed distributions of daily stock volume and returns. Keywords. Herd behavior, trading volume, stock returns, fat tail, power law. JEL classification. G14. 1. Introduction Recently, the literature on empirical finance has converged on a broad consensus: Daily returns on equities, foreign exchange, and commodities obey a power law. This striking property of high-frequency returns has been found across both space and time through a variety of statistical procedures, from conditional likelihood methods and nonpara- metric tail decay estimation to straightforward log-log regression.1 A power law has also been found for trading volume by Gopikrishnan et al. (2000)andPlerou et al. (2001). Makoto Nirei: [email protected] John Stachurski: [email protected] Tsutomu Watanabe: [email protected] We have benefited from comments by the anonymous referees, Daisuke Oyama, and especially Koichiro Takaoka. -

Market Analysis Technical Handbook Maryann [email protected] Fred Meissner, Jr

Concepts in technical analysis Technical Analysis Market Analysis | United States 18 July 2007 A Handbook of the basics Mary Ann Bartels +1 212 449 8038 Technical Research Analyst MLPF&S Market Analysis Technical Handbook [email protected] Fred Meissner, Jr. CMT +1 212 449 2603 Technical Research Analyst We cover the basics of Trend, Momentum and other MLPF&S technical indicators and methods [email protected] Table of Contents Introduction 3 Trends 5 Price Momentum Indicators 14 Reversals 17 The Importance of Volume 24 Support and Resistance 28 Market Breadth 31 Market Sentiment 39 The Fibonacci Concept 43 Putting It Together 49 Merrill Lynch does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Refer to important disclosures on page 53. 10633344 Concepts in technical analysis 18 July 2007 Contents Introduction 3 Trends 5 Price Momentum Indicators 14 Reversals 17 The Importance of Volume 24 Support and Resistance 28 Market Breadth 31 Market Sentiment 39 The Fibonacci Concept 43 Putting It Together 49 2 Concepts in technical analysis 18 July 2007 Introduction Price action of stocks, or financial markets in general, is a reflection of human nature. Price trends seem to be determined by investors’ decisions in response to a complex mix of psychological, sociological, political, economic and monetary factors. Technical analysis attempts to measure the strength of these trends and to forewarn of potential changes in these trends. -

True Support and Resistance

True Support and Resistance True Support and Resistance Support and resistance lines are one of the basic tenants of technical analysis. The method normally used for establishing support and resistance is by finding high and low price levels that the market has failed to exceed previously. However, this technique has certain failings. One of the more common has to do with the occurrence of what is called "false breakouts". Quite often the market will just exceed the resistance or support lines and return, fooling a large percentage of traders along the way. Obviously, such lines are important, but they normally are not the true support and resistance lines. This statement may seem strange, considering how pervasive the thought that these lines are all important indicators of market direction. But these lines as static and the markets are anything but static. So if these lines are not the true support and resistance lines, what is? True support and resistance lines can more accurately be defined, “As lines that have established themselves with support and resistance within the flow of the market and are supported by price action (defined as the highs and lows touching and giving support to).” To help clarify this definition, lets look at some examples. Figure 1 Figure 2 As the examples show, true resistance and support are based on the actual limits established by the price action and are rarely perfectly horizontal. The majority establish themselves in a diagonal line with its incline either up or down. They intertwine through the price action affecting each time price bars touch them. -

Everything You Wanted to Know About Candlestick Charts Is an Unregulated Product Published by Thames Publishing Ltd

EEvveerryytthhiinngg yyoouu wwaanntteedd ttoo kknnooww aabboouutt ccaannddlleessttiicckk cchhaarrttss by Mark Rose • Read candlestick charts accurately • Spot patterns quickly and easily • Use that information to make profitable trading decisions Contents Chapter 1. What is a candlestick chart? 3 Chapter 2. Candlestick shapes: 6 Anatomy of a candle 6 Doji 7 Marubozo 8 Chapter 3. Candlestick Patterns 9 Harami (bullish / bearish) 9 Hammer / Hanging Man 11 Inverted Hammer / Shooting Star 13 Engulfing (bullish/ bearish) 14 Morning Star / Evening Star 15 Three White Soldiers / Three Black Crows 16 Piercing Line / Dark Cloud Cover 17 Chapter 4. The history of candlestick charts 18 Conclusion 20 Candlestick Cheat Sheet 22 2 Chapter 1. What is a candlestick chart? Before I start to talk about candlestick patterns, I’d like to get right back to basics on candles: what they are, what they look like, and why we use them … Drawing lines When you look at a chart of market prices, you can usually choose from line charts or candlestick charts. A line chart will take its price levels from the opening or closing prices according to the timeframe you have selected. So, if you’re looking at a one-minute line chart of closing prices, it will plot the closing price for each one-minute period – something like this … Line charts can be useful for looking at the “bigger picture” and finding long-term trends, but they simply cannot offer up the kind of information contained in a candlestick chart. Here is a one-minute candlestick chart for the same period … 3 At first glance, it might look a little confusing, but I can assure you that once you’re used to candlestick charts – you won’t look back. -

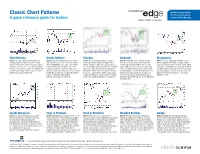

Classic Chart Patterns Chart Pattern Recognition a Quick Reference Guide for Traders Tools Provided by Recognia

StreetSmart Edge features Classic Chart Patterns Chart Pattern Recognition A quick reference guide for traders tools provided by Recognia. www.schwab.com/ssedge Triple Bottoms Double Bottoms Triangles Diamonds Megaphones Bullish: The Triple Bottom starts with prices Bullish: This pattern marks the reversal of a Bullish: Two converging trendlines as prices Bullish or Bearish: These patterns usually Bullish: The rare Megaphone Bottom—a.k.a. moving downward, followed by three sharp prior downtrend. The price forms two distinct reach lower/stable highs and higher lows. form over several months and volume will Broadening Pattern—can be recognized by its lows, all at about the same price level. Volume lows at roughly the same price level. Volume Volume diminishes and price swings between remain high during formation. Prices create successively higher highs and lower lows, which diminishes at each successive low and finally reflects weakening of downward pressure, an increasingly narrow range. Before the triangle higher highs and lower lows in a broadening form after a downward move. The bullish pattern bursts as the price rises above the highest high, tending to diminish as it forms, with some reaches its apex, the price breaks out above pattern, then the trading range narrows after is confirmed when, usually on the third upswing, confirming as a sign of bullish price reversal. pickup at each low and less on the second low. the upper trendline with a noticeable increase peaking highs and uptrending lows trend. The prices break above the prior high but fail to fall Bearish Counterpart: Triple Top. Finally the price breaks out above the highest in volume, confirming the bullish continuation breakout direction signals the resolution to below this level again. -

Option-Implied Term Structures

Federal Reserve Bank of New York Staff Reports Option-Implied Term Structures Erik Vogt Staff Report No. 706 December 2014 Revised January 2016 This paper presents preliminary findings and is being distributed to economists and other interested readers solely to stimulate discussion and elicit comments. The views expressed in this paper are those of the author and are not necessarily reflective of views at the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author. Option-Implied Term Structures Erik Vogt Federal Reserve Bank of New York Staff Reports, no. 706 December 2014; revised January 2016 JEL classification: G12, G17, C58 Abstract This paper proposes a nonparametric sieve regression framework for pricing the term structure of option spanning portfolios. The framework delivers closed-form, nonparametric option pricing and hedging formulas through basis function expansions that grow with the sample size. Novel confidence intervals quantify term structure estimation uncertainty. The framework is applied to estimating the term structure of variance risk premia and finds that a short-run component dominates market excess return predictability. This finding is inconsistent with existing asset pricing models that seek to explain the variance risk premium’s predictive content. Key words: variance risk premium, term structures, options, return predictability, nonparametric regression. _________________ Vogt: Federal Reserve Bank of New York (e-mail: [email protected]). The author is especially thankful to his dissertation chair, George Tauchen, and his dissertation committee members, Tim Bollerslev, Federico Bugni, Jia Li, and Andrew Patton, for their guidance and encouragement.