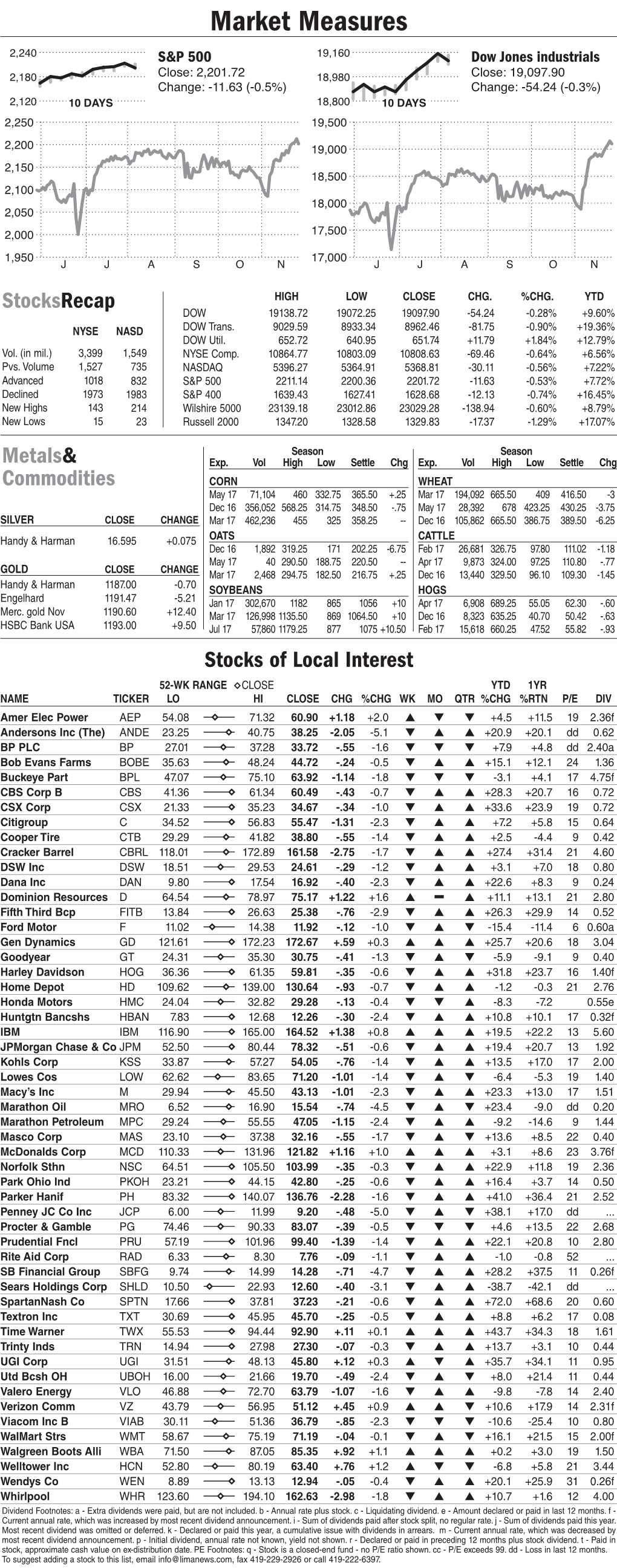

Market Measures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 United States District Court Eastern District of New York

Case 1:18-cv-07359-PKC-CLP Document 90 Filed 01/07/21 Page 1 of 21 PageID #: <pageID> UNITED STATES DISTRICT COURT EASTERN DISTRICT OF NEW YORK -------------------------------------------------------x KATHALEEN FREEMAN, et al., Plaintiffs, MEMORANDUM & ORDER 18-CV-7359 (PKC) (CLP) - against - 19-CV-2146 (PKC) (CLP) HSBC HOLDINGS PLC, HSBC BANK PLC, HSBC BANK MIDDLE EAST LIMITED, HSBC BANK USA, N.A., BARCLAYS BANK PLC, STANDARD CHARTERED BANK, ROYAL BANK OF SCOTLAND, N.V., CREDIT SUISSE AG, BANK SADERAT PLC, COMMERZBANK AG, and JOHN DOES 1–50, Defendants. -------------------------------------------------------x RYAN BOWMAN, et al., Plaintiffs, - against - HSBC HOLDINGS PLC, HSBC BANK PLC, HSBC BANK MIDDLE EAST LIMITED, HSBC BANK USA, N.A., BARCLAYS BANK PLC, STANDARD CHARTERED BANK, ROYAL BANK OF SCOTLAND, N.V., CREDIT SUISSE AG, BANK SADERAT PLC, COMMERZBANK AG, and JOHN DOES 1–50, Defendants. -------------------------------------------------------x PAMELA K. CHEN, United States District Judge: In November 2014, a group of American citizens killed or injured by terrorist attacks in Iraq between 2004 and 2011, and/or their families, filed an action, Freeman, et al. v. HSBC Holdings PLC, et al., 14-CV-6601 (PKC) (CLP) (“Freeman I”), against ten banking institutions— HSBC Holdings, PLC, HSBC Bank PLC, HSBC Bank Middle East Ltd., and HSBC Bank USA, 1 Case 1:18-cv-07359-PKC-CLP Document 90 Filed 01/07/21 Page 2 of 21 PageID #: <pageID> N.A. (the “HSBC Defendants”); Barclays Bank PLC; Standard Chartered Bank; Royal Bank of Scotland, N.V.; Credit Suisse AG; Bank Saderat PLC (“Bank Saderat”)1; and Commerzbank AG (“Commerzbank”)—as well as John Does 1–50, seeking damages pursuant to the Antiterrorism Act (the “ATA”), 18 U.S.C. -

Notice of Annual General Meeting to Be Held on 22 May 2009

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to any aspect of the proposals referred to in this document or as to the action you should take, you should consult a stockbroker, solicitor, accountant or other appropriate independent professional adviser. If you have sold or transferred all your shares in HSBC Holdings plc (the “Company”), you should at once forward this document and the accompanying Form of Proxy to the stockbroker, bank or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. This document should be read in conjunction with the Annual Report and Accounts and/or Annual Review in respect of the year ended 31 December 2008. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. The ordinary shares of HSBC Holdings plc trade under stock code 5 on The Stock Exchange of Hong Kong Limited. Shareholders may at any time choose to receive corporate communications in printed form or to receive notifications of their availability on HSBC’s website. To receive future notifications of the availability of corporate communications on HSBC’s website by email, or revoke or amend an instruction to receive such notifications by email, go to www.hsbc.com/ecomms. -

Chapter 11 ) INTELSAT

Case 20-32299-KLP Doc 495 Filed 07/09/20 Entered 07/09/20 15:11:39 Desc Main Document Page 1 of 16 IN THE UNITED STATES BANKRUPTCY COURT FOR THE EASTERN DISTRICT OF VIRGINIA RICHMOND DIVISION ) In re: ) Chapter 11 ) 1 INTELSAT S.A., et al., ) Case No. 20-32299 (KLP) ) Debtors. ) (Jointly Administered) ) DECLARATION OF DISINTERESTEDNESS OF HOGAN LOVELLS US LLP AS PROPOSED ORDINARY COURSE PROFESSIONAL I, Steven M. Kaufman, declare under penalty of perjury: 1. I am a Partner of Hogan Lovells US LLP, located at Columbia Square, 555 Thirteenth Street, NW, Washington, D.C. 2004 (“HLUS”). 2. Intelsat S.A. and its affiliates, as debtors and debtors in possession (collectively, the “Debtors”), have requested that HLUS continue to provide legal services to the Debtors as an ordinary course professional pursuant to section 327(e) of the Bankruptcy Code in the Debtors’ chapter 11 cases (collectively, the “Chapter 11 Cases”), and HLUS has agreed to provide such services. Such services may be provided by HLUS directly and/or through its affiliated businesses, including Hogan Lovells International LLP (collectively, the “Firm”), through arrangements with HLUS. 3. The Firm may have performed services in the past, may currently perform services, and may perform services in the future in matters unrelated to the Chapter 11 Cases for persons or entities that are parties in interest in the Chapter 11 Cases. See Schedule A attached 1 Due to the large number of Debtors in these Chapter 11 Cases, for which joint administration has been granted, a complete list of the Debtor entities and the last four digits of their federal tax identification numbers is not provided herein. -

Market Measures

Market Measures 2,080 S&P 500 17,800 Dow Jones industrials 2,020 Close: 2,056.50 17,440 Close: 17,528.27 Change: -4.49 (-0.2%) Change: -23.90 (-0.1%) 1,960 10 DAYS 17,080 10 DAYS 2,160 18,400 2,080 17,600 2,000 16,800 1,920 16,000 1,840 15,200 JASOND JASOND Stocks Recap HIGH LOW CLOSE CHG. %CHG. YTD DOW 17536.90 17437.34 17528.27 -23.90 -0.14% -1.65% NYSE NASD DOW Trans. 7614.09 7508.65 7566.70 -55.91 -0.73% -17.21% DOW Util. 582.92 578.01 582.40 +1.38 +0.24% -5.77% Vol. (in mil.) 2,422 1,283 NYSE Comp. 10225.99 10169.09 10217.41 -41.14 -0.40% -5.74% Pvs. Volume 1,389 691 NASDAQ 5041.27 4999.07 5040.99 -7.50 -0.15% +6.44% Advanced 1202 1008 S&P 500 2056.76 2044.20 2056.50 -4.49 -0.22% -0.12% Declined 1926 1848 S&P 400 1413.95 1400.33 1413.86 -2.24 -0.16% -2.66% New Highs 53 43 Wilshire 5000 21354.56 21165.08 21296.18 -58.38 -0.27% -1.72% New Lows 24 54 Russell 2000 1153.98 1140.02 1148.21 -6.55 -0.57% -4.69% Metals & Season Season Commodities Exp. Vol High Low Settle Chg Exp. Vol High Low Settle Chg CORN WHEAT Jul 16 25,572 597.50 373 373.75 -3 Mar 16 58,552 769 465.50 466.50 -1 May 16 50,286 514.25 367 367.75 -3 Jul 16 13,082 732 480.50 481 -1.75 SILVER CLOSE CHANGE Mar 16 179,546 512 360.50 361 -3.50 May 16 14,614 765.75 473 473.25 -1.25 OATS CATTLE Handy & Harman 13.945 -0.455 May 16 60 333.75 220 224.25 +3.75 Feb 16 18,059 437.00 121.97 136.15 -.87 Jul 16 6 351.50 223.25 227.50 +3 Jun 16 7,120 328.25 115.47 127.10 -.35 CLOSE CHANGE GOLD Mar 16 688 350.50 215 223.75 +4.25 Apr 16 11,607 422.75 123.05 137.37 -.65 Handy & Harman 1070.60 -1.30 SOYBEANS HOGS Engelhard 1073.47 +1.10 Mar 16 180,566 1216.25 847 861.25 -11.75 Jun 16 1,108 758.75 70.25 78.55 +.95 Merc. -

Credit Perspectives: Making Waves with 5G

HSBC Global Asset Management Credit Perspectives April 2019 Making waves with 5G Companies have been quick to tout the rise and development of 5G technologies. But, is 5G really changing the tide in telecommunications? Annika Rohweder, Credit Analyst for Global Credit, examines the real impact of 5G on the telecommunications sector and user experience. 5G is the fifth generation wireless technology, the successor to 4G. The main potential benefits of 5G are improved speed, reduced latency and higher capacity, which means that differences between wired and wireless communications will narrow. Offsetting these benefits is lower coverage as 5G is expected to rely primarily on mid- and high-frequency spectrum bands. High-frequency spectrum offers faster speeds in its coverage area, but has limited reach. This means that more network equipment will be required to cover the same area under 5G technology than under 4G, making large-scale build out more capital-intensive. A nationwide 5G build-out in the US would cost north of USD 10bn, excluding spectrum costs, which would likely be as high, if not higher. As a result, 5G will be limited to dense urban areas, at least initially and will likely be used together with 4G for the foreseeable future. Possible applications of 5G include fixed wireless 5G as an alternative to home broadband, enhancements in mobile communications, and machine-to-machine communications (M2M) or internet of things (IoT): Fixed wireless applications will be used to replace wired home broadband by installing antennas outside the home, hence foregoing last mile wiring, an often costly pursuit. Home broadband trials by mobile phone carriers, led by Verizon, have already started. -

AMR O. ALY Partner AMR O. ALY, Partner

AMR O. ALY, Partner Amr Aly is a member of the firm’s Patent Litigation and Counseling Practice. He focuses on patent litigation in the telecom, networking, data encryption and security, internet, biotechnology, banking, chemical and pharmaceutical industries. He has been involved in major complex litigations, including multiparty and multidistrict litigations; he has been a key member and leader of litigation teams that secured favorable pretrial results that were affirmed by the Federal Circuit. Before practicing law, Mr. Aly worked with major engineering companies for more than 10 years. There, he gained extensive experience in engineering and management. Mr. Aly is the named inventor of US Patent No. 4,999, 225, titled “Powder Thermal Spray Method for Spraying Non-Meltable Materials.” Mr. Aly holds a BA and BS in chemical engineering from Columbia University, AMR O. ALY where he played for the soccer team as two-time captain and All American. He Partner was a member of the 1984 US Olympic Soccer Team and awarded the NEW YORK Hermann Trophy (soccer’s equivalent of the Heisman Trophy) as the best Office: 212 407-1774 Email: [email protected] collegiate soccer player in 1984. Mr. Aly speaks conversational Arabic. PRACTICE GROUPS Intellectual Property Litigation Patent Litigation and Counseling Trademark, Advertising and Unfair Representative engagements prior to joining Jenner & Block include the Competition Practice following: EDUCATION Anuwave LLC v. Digi International Inc. (D. Del.). Served as lead counsel for Seton Hall University School of Law, JD, 1996 Digi International against infringement claims of patent directed to telecommunications using SMS communication channels. Identified prior Hofstra University, School of Business, MBA, 1989 art that was used to secure a very favorable settlement. -

AIP-Client-List.Pdf

Weekly Update 2021-09-27 #DTCC Public (White) AIP Member List (Distributors - Broker-Dealers/ Custodians / Clearing Firms) Participant Name Participant Type NSCC AIP Number Membership Live Date American Enterprise Investment Services Inc. {Ameriprise} Firm 3433 2/17/2012 American Portfolios Financial Services, Inc. Firm 9846 12/21/2015 Axos Clearing LLC Firm 0648 10/31/2016 Beta Capital Securities, LLC Firm 4394 12/9/2019 Cetera Investment Services LLC Firm 1768 9/5/2018 Charles Schwab & Co, Inc. Firm 3401 12/31/2009 Crowdkey, Inc. Firm 7291 12/13/2016 Dempsey Lord Smith, LLC Firm 5261 11/7/2016 Edward D. Jones & Co., L.P. Firm 1871 1/16/2013 Grove Point Investments, LLC Firm 3911 5/6/2021 HD Vest Investment Securities, Inc Firm 7242 7/24/2018 Hilltop Holdings, Inc. (formerly Southwest Securities, Inc.) Firm 1956 4/19/2013 ICapital Securities, LLC Firm 6523 5/18/2018 J.W.Korth & Company Limited Partnership Firm 9893 3/3/2016 Janney Montgomery Scott, LLC Firm 4073 4/16/2019 LPL Financial LLC Firm 3477 6/19/2013 LPL Financial LLC (AXA) Firm 6989 8/24/2015 # DTCC Public (White) AIP Member List (Distributors - Broker-Dealers/ Custodians / Clearing Firms) Participant Name Participant Type NSCC AIP Number Membership Live Date Matrix Trust Company Firm 1531 5/26/2015 Millennium Trust Company, LLC Firm 1659 7/20/2020 Morgan Stanley Smith Barney LLC Firm 1287 8/29/2014 National Financial Services LLC (NFS) Firm 3409 2/22/2011 National Securities Corporation Firm 9389 5/12/2016 Orion Advisor Services, LLC. Firm 8843 6/8/2018 Pershing LLC Firm 0838 10/1/2008 Provident Trust Group, LLC Firm 1237 7/11/2014 RBC Capital Markets, LLC Firm 3428 2/11/2011 Robert W. -

Matching Gift Programs * Please Note, This List Is Not All Inclusive

Companies With Matching Gift Programs * Please note, this list is not all inclusive. If your employer is not listed, please check with human resources to see if your company matches and the guidelines for matches. A AlliedSignal Inc. Archer Daniels Midland 3Com Corporation Allstate Foundation, Allstate Giving ARCO Chemical Co. 3M Company Altera Corp. Contributions Program Ares Advanced Technology AAA Altria Employee Involvement Ares Management LLC Abacus Capital Investments Altria Group Argonaut Group Inc. Abbot Laboratories AMB Group Aristokraft Inc. Accenture Foundation, Inc. Ambac Arkansas Best Corporation Access Group, Inc. AMD Corporate Giving Arkwright Mutual Insurance Co. ACE INA Foundation American Express Co. Armco Inc. Acsiom Corp. American Express Foundation Armstrong Foundation Adams Harkness and Hill Inc. American Fidelity Corp. Arrow Electronics Adaptec Foundation American General Corp. Arthur J. Gallagher ADC Foundation American Honda Motor Co. Inc. Ashland Oil Foundation, Inc. ADC Telecommunications American Inter Group Aspect Global Giving Program Adobe Systems Inc. American International Group, Inc. Aspect Telecommunications Associates ADP Foundation American National Bank and Trust Co. Corp. of North America A & E Television Networks of Chicago Assurant Health AEGON TRANSAMERICA American Standard Foundation Astra Merck Inc. AEP American Stock Exchange AstraZeneca Pharmaceutical LP AES Corporation Ameriprise Financial Atapco A.E. Staley Manufacturing Co. Ameritech Corp. ATK Foundation Aetna Foundation, Inc. Amgen Center Atlantic Data Services Inc. AG Communications Systems Amgen Foundation Atochem North America Foundation Agilent Technologies Amgen Inc. ATOFINA Chemicals, Inc. Aid Association for Lutherans AMN Healthcare Services, Inc. ATO FINA Pharmaceutical Foundation AIG Matching Grants Program Corporate Giving Program AT&T Aileen S. Andrew Foundation AmSouth BanCorp. -

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

Case 1:12-cv-00375-LJO-SKO Document 1 Filed 03/12/12 Page 1 of 50 1 KESSLER TOPAZ MELTZER & CHECK, LLP 2 Ramzi Abadou (Bar No. 222567) 580 California Street, Suite 1750 3 San Francisco, CA 94104 4 Telephone: (415) 400-3000 Facsimile: (415) 400-3001 5 [email protected] 6 Counsel for Plaintiff 7 [Additional counsel listed on signature page] 8 9 10 UNITED STATES DISTRICT COURT 11 EASTERN DISTRICT OF CALIFORNIA 12 13 LUCAS E. MCCARN, individually and on behalf ) Civil Action No.: of all others similarly situated, ) 14 ) 15 Plaintiff, ) ) 16 v. ) CLASS ACTION COMPLAINT ) 17 HSBC USA, INC., HSBC BANK USA, N.A., ) HSBC MORTGAGE CORPORATION, HSBC ) 18 REINSURANCE (USA) INC., UNITED ) JURY TRIAL DEMANDED 19 GUARANTY RESIDENTIAL INSURANCE CO., ) PMI MORTGAGE INSURANCE CO., ) 20 GENWORTH MORTGAGE INSURANCE ) CORP., REPUBLIC MORTGAGE INSURANCE ) 21 CO., MORTGAGE GUARANTY INSURANCE ) CORP., and RADIAN GUARANTY INC. ) 22 ) 23 Defendants. ) 24 25 26 27 28 Case 1:12-cv-00375-LJO-SKO Document 1 Filed 03/12/12 Page 2 of 50 1 INTRODUCTION 2 1. Defendants HSBC USA, Inc. (“HSBC USA”), HSBC Bank USA, N.A. (“HSBC 3 Bank”) and HSBC Mortgage Corp. (“HSBC Mortgage”), together with their affiliated reinsurer, 4 Defendant HSBC Reinsurance (USA), Inc. (“HSBC RE”) (collectively, “HSBC”), have acted in 5 concert with Defendants United Guaranty Residential Insurance Co., PMI Mortgage Insurance Co., 6 Genworth Mortgage Insurance Corp., Republic Mortgage Insurance Co., Mortgage Guaranty 7 Insurance Corp. and Radian Guaranty Inc. (collectively, the “Private Mortgage Insurers”) (together 8 with HSBC, “Defendants”) to effectuate a captive reinsurance scheme whereby, in violation of the 9 Real Estate Settlement Procedures Act of 1974 (“RESPA”): (a) illegal referral payments in the form of 10 purported reinsurance premiums were paid by the Private Mortgage Insurers to HSBC RE; and (b) 11 HSBC RE received an unlawful split of private mortgage insurance premiums paid by the Private 12 Mortgage Insurers’ customers referred by HSBC entities. -

HSBC USA Fact Sheet

About HSBC in the USA HSBC North America Holdings Inc. is the holding company for HSBC Holdings plc's operations in the United States. The company’s businesses serve customers in the following key areas: retail banking and wealth management, commercial banking, private banking, and global banking and markets. HSBC Bank USA, National Association (HSBC Bank USA, N.A.) serves customers through retail banking and wealth management, commercial banking, private banking, and global banking and markets segments. It operates bank branches in: California; Washington, D.C.; Florida; Maryland; New Jersey; New York; Pennsylvania; Virginia; and Washington. HSBC Bank USA, N.A. is the principal subsidiary of HSBC USA Inc., a wholly-owned subsidiary of HSBC North America Holdings Inc. HSBC Bank USA, N.A. is a Member of FDIC. Investment and brokerage services are provided through HSBC Securities (USA) Inc., (Member NYSE/FINRA/SIPC) and insurance products are provided through HSBC Insurance Agency (USA) Inc. HSBC USA Inc. ("HUSI") is a Maryland corporation and its principal business is to act as a holding company for its subsidiaries including HSBC Bank USA, N.A. Through HSBC Bank USA, N.A. and its subsidiaries, HUSI offers a full range of traditional banking products and services to individuals, including high net worth individuals, small businesses, corporations, institutions and governments. HSBC USA Inc. is a wholly-owned subsidiary of HSBC North America Holdings Inc. HSBC Holdings plc, the parent company of the HSBC Group, is headquartered in London. HSBC serves customers worldwide from offices in 64 countries and territories in our geographical regions: Europe, Asia, North America, Latin America, and Middle East and North Africa. -

Hsbc Spotlight on Us Trade a Regional Perspective on Us Internationalisation and Performance Northeast

HSBC SPOTLIGHT ON US TRADE A REGIONAL PERSPECTIVE ON US INTERNATIONALISATION AND PERFORMANCE NORTHEAST Written by the Economist Intelligence Unit EXECUTIVE SUMMARY NORTHEAST CORRIDOR GLOBALIZING COMPANIES IN THE NORTHEAST BOAST PROFIT To further explore a connection between how internation- MARGINS NEARLY TEN PERCENTAGE POINTS GREATER THAN ally focused a company may be and its profit potential, the THOSE OF THEIR DOMESTICALLY FOCUSED PEERS Economist Intelligence Unit (EIU) studied levels of inter- International trade first put the Northeast on the global nationalisation among a sample of companies across the map several centuries ago, when its vast ships ferried raw Northeast between 2007 and 2012, as part of a national materials across the Atlantic to the mother country. But the HSBC-sponsored study. For actionable insights, the EIU region long ago left behind its purely extractive ways. Today, also spoke to trade experts and globalising companies. sophisticated medical devices and machinery hatched by Of note are looming free-trade agreements which should highly educated university students and their predecessors boost exports further. The Northeast is much more “Eu- add tremendous value to local economies, with one-of-a- rope-oriented” than other parts of the country, said Michael kind, premium-priced goods and services sought the world Czinkota, professor of international business and trade at over. Georgetown University’s McDonough School of Business. “If you look at the East Coast, it’s logistics, it’s geographic dis- With the tailwinds of long-established trade pacts and oth- tance, but it’s also what I would call psychological distance ers on the horizon, the Northeast — made up of Connecticut, .. -

About HSBC in the USA HSBC North America Holdings Inc

About HSBC in the USA HSBC North America Holdings Inc. is the holding company for HSBC Holdings plc's operations in the United States with assets of US$307.8bn (US GAAP) at 30 June 2017. The company’s businesses serve customers in the following key areas: retail banking and wealth management, commercial banking, private banking, and global banking and markets. HSBC Bank USA, National Association (HSBC Bank USA, N.A.), with assets of US$191.9bn (US GAAP) at 30 June 2017, serves customers through retail banking and wealth management, commercial banking, private banking, and global banking and markets segments. It operates bank branches in: California; Connecticut; Delaware; Washington, D.C.; Florida; Maryland; New Jersey; New York; Pennsylvania; Virginia; and Washington. HSBC Bank USA, N.A. is the principal subsidiary of HSBC USA Inc., a wholly- owned subsidiary of HSBC North America Holdings Inc. HSBC Bank USA, N.A. is a Member of the FDIC. Investment and brokerage services are provided through HSBC Securities (USA) Inc., (Member NYSE/FINRA/ SIPC) and insurance products are provided through HSBC Insurance Agency (USA) Inc. HSBC Finance Corporation, through its subsidiaries, owns and services a portfolio of residential real estate loans. HSBC Finance Corporation is a subsidiary of HSBC North America Holdings Inc. HSBC USA Inc. ("HUSI") is a Maryland corporation and its principal business is to act as a holding company for its subsidiaries including HSBC Bank USA, N.A. Through HSBC Bank USA, N.A. and its subsidiaries, HUSI offers a full range of traditional banking products and services to individuals, including high net worth individuals, small businesses, corporations, institutions and governments.