Equity Morning Mantra -11-11-2020.Cdr

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

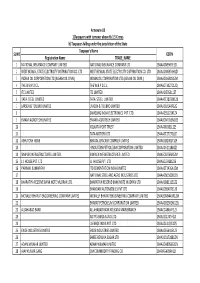

List of Approved Vendors for Items Controlled by QA(Mech) Directorate

List of Approved Vendors For Items controlled by QA(Mech) Directorate (As on date 25.04.2017) INDEX Sl. Page Category Clarification to No. Item be sought from a b c d e QA(Mech.) Directorate Controlled Items 1. Graduated release compressed air brake equipment for freight II Dir/I&L/Lko stock 2. Components of Graduated release compressed air brake equipment for Freight & Coaching stock (a) Auxiliary Reservoirs II DIR/I&L/LKO (b) Cut off Angle Cock with Vent II DIR/I&L/LKO (c) Dirt Collector assembly II DIR/I&L/LKO (d) Air Brake Hose coupling II DIR/I&L/LKO (e) Guard Emergency Brake Valve II DIR/I&L/LKO (f) Isolating Cock II DIR/I&L/LKO (g) Check Valve assembly II DIR/I&L/LKO (h) Pipes & Joints for Air Brakes II DIR/I&L/LKO (i) Pressure gauge for air brake System II DIR/I&L/LKO (j)Load sensing Device II DIR/I&L/LKO 3. Brake Cylinder Assembly II DIR/I&L/LKO 4. Brake Slack Adjuster and Spares for Freight Stock II DIR/I&L/LKO 5. Empty Load device I DIR/I&L/LKO 6. Spring Steel Rounds to material Gr. 60Si7 and Gr. 55Si7 II DIR/I&L/LKO 7. Spring Steel Rounds to material Gr. 52Cr4Mo2V and Gr. AISI II DIR/I&L/LKO 8650H 8. Hot Coiled Helical springs to material Gr. 60 Si7 and Gr. II DIR/I&L/LKO 52Cr4Mo2V for Freight stock 9. Hot Coiled Helical Springs for Locomotives II Dir/I&L/Lko 10. -

Titagarh Strengthens Its Strategy for Railway Propulsion Business in India-Enters Into Strategic Alliance with ABB” Issued by the Company

17th June, 2020 National Stock Exchange of India Limited Listing Compliance Department Exchange Plaza Bandra-Kurla Complex Bandra (E), Mumbai-400051 Scrip Code: TWL (EQ) BSE Limited Listing Compliance Department Phiroze Jeejeebhoy Towers Dalal Street, Mumbai-400001 Scrip Code: 532966 Dear Sirs Re: Press Release We enclose herewith a Press Release titled “Titagarh Strengthens its Strategy for Railway Propulsion Business in India-Enters into Strategic Alliance with ABB” issued by the Company. Please take the same on record. Thanking you, Yours faithfully, For TITAGARH WAGONS LIMITED Dinesh Arya Company Secretary Enclo: as above TITAGARH WAGONS LIMITED PRESS RELEASE ~TITAGARH STRENGHTENS ITS STRATEGY FOR RAILWAY PROPULSION BUSINESS IN INDIA~ ~ENTERS INTO STRATEGIC ALLIANCE WITH ABB ~ Titagarh Wagons Limited (TWL), flagship Company of the Titagarh Group, one of the market leaders in the railway rolling stock (trains and freight wagons) business in India and Italy has entered into an exclusive cooperation agreement with ABB, to address the large and growing business of propulsion equipment (traction converters) for the Indian railway EMU/MEMU market. According to the agreement, Titagarh and ABB will work together to design, develop and manufacture state of the art 3 phase IGBT based propulsion systems for EMU/MEMU which would be manufactured in Titagarh’s plant at Uttarpara, Kolkata with certain components being supplied by ABB. This agreement goes into effect immediately with the first units to be put into revenue service in less than 2 years. Titagarh has manufactured and supplied more than 300 EMU/MEMU coaches to the Indian Railways and is now executing an order for design, manufacture and supply of 102 state of the art metro coaches for Pune Metro ordered by the Maharashtra Metro Rail Corporation Limited. -

TITAGARH WAGONS a I D Steady Quarter

s p RESULT UPDATE a c d i M TITAGARH WAGONS a i d Steady quarter n I India Equity Research| Infrastructure - Railways Titagarh Wagons’ (TWL) Q2FY20 standalone revenue jumped 62% YoY to EDELWEISS RATINGS INR3bn driven by ramp up in execution in the wagons & coaches Absolute Rating BUY segment. This led to PAT surging 137% YoY to INR123mn. The company’s Investment Characteristics Growth performance could have been even better, but for issues in wheel sets availability, which impacted delivery of wagons to Indian Railways (IR); management expects the issue to be resolved by Q3FY20-end. Taking MARKET DATA (R: TITW.BO, B: TWL IN) cognizance of this, we trim FY20/21E earnings 4%/3%. Maintain ‘BUY’ CMP : INR 42 with revised SOTP‐based target price of INR61 (INR64 earlier) as we roll Target Price : INR 61 forward the valuation to March 2021E. 52-week range (INR) : 87 / 31 Share in issue (mn) : 115.6 M cap (INR bn/USD mn) : 5 / 68 Future order inflow key for domestic businesses Avg. Daily Vol. BSE/NSE (‘000) : 525.1 TWL received its maiden order for metro coaches in India worth INR10.6bn; this order from Pune Metro pertains to delivery of 36 trainsets. Including this, the company’s SHARE HOLDING PATTERN (%) order book stands at INR26bn (book-to-bill of 2.1x). Incremental order inflow from Current Q1FY20 Q4FY19 wagons (IR tender of about 10,000 wagons due to open in December 2019) and Promoters * 45.7 45.7 45.7 coaches (TWL targeting bids for metro rail projects) is a key catalyst for the stock, in MF's, FI's & BKs 9.8 10.1 10.1 our view. -

TWL Concall Transcript for Q3 FY21 Results

Titagarh Wagons Limited Q3 FY2021 Earnings Conference Call February 3, 2021 Management: Mr. Umesh Chowdhary – Vice Chairman & Managing Director Mr. Anil Kumar Agarwal – Director of Finance & CFO Mr. Saurav Singhania – Group Finance Controller Hosted by Page 1 of 18 Titagarh Wagons Limited February 03, 2021 Moderator: Ladies and gentlemen, good day and welcome to the Titagarh Wagons Limited Q3 FY2021 Earnings Conference Call hosted by ICICI Securities Limited. As a reminder, all participants’ lines will be in listen-only mode and there will be an opportunity for you to ask questions after the presentation concludes. Should you need assistance during the conference call, please signal an operator by pressing “*” then “0” on your touchtone phone. Please note that this conference is being recorded. I now hand the conference over to Mr. Renjith Sivaram from ICICI Securities. Thank you and over to you, Sir! Renjith Sivaram: Thanks, Bikram. Good afternoon all. We have the management of Titagarh Wagon with us represented by Mr. Umesh Chowdhary, the Vice Chairman and Managing Director; Mr. Anil Agarwal, Director Finance and Mr. Saurav Singhania, Group Financial Controller. We will have initial comments from the management followed by Q&A. Umesh Chowdhary: Very good afternoon everybody, I am Umesh Chowdhary, I am the CEO of Titagarh Wagons and I am joined by our CFO Mr. Anil Agarwal and Group Financial Controller and Vice President Strategy, Saurav Singhania. Thank you everybody for joining this Q3 earnings call of Titagarh Wagons. I guess, I had already covered in the last call the update as far as the post COVID situation for our industry is concerned, but and much of the performance has already been captured in this presentation that has been circulated but I would just try to give an overview of the business and rather than repeating the numbers just give a kind of a stock check of the environment. -

Annual Report 2013-14 1 Thereof for the Time Being in Force) Read with Schedule IV 9

INDIA POWER CORPORATION LIMITED CIN: L40105WB1919PLC003263 [formerly DPSC Limited] Registered Office: Plot No. X 1, 2&3, Block-EP, Sector –V, Salt Lake City, Kolkata – 700 091 Tel.: + 91 33 6609 4308/09/10, Fax: + 91 33 2357 2452 E: [email protected] | W: www.indiapower.com Notice of 94th Annual General Meeting NOTICE is hereby given that the Ninety Fourth Annual the conclusion of the Ninety Ninth AGM of the Company General Meeting of the Members of India Power Corporation to be held in the year 2019 (subject to ratification of Limited (Formerly known as DPSC Limited) will be held at appointment at every AGM), on such remuneration as may its Registered Office, Plot X 1, 2 & 3, Block EP, Sector – V, be mutually agreed upon between the Board of Directors Salt Lake City, Kolkata –700 091 on Saturday, the 13th Day of the Company and the Auditors plus reimbursement of of September, 2014 at 11.00 a.m. to transact the following service tax, travelling and out-of-pocket expenses.” business: - Special Business Ordinary Business 5. To consider and, if thought fit, to pass with or without 1. To receive, consider and adopt the Audited Statement of modification(s), the following Resolution as an Ordinary Profit and Loss for the financial year ended 31st March, Resolution: 2014, the Balance Sheet as on that date and the Reports of “RESOLVED THAT pursuant to the provisions of Sections the Board of Directors and the Auditors thereon. 149, 150, 152 and other applicable provisions, if any, of 2. To declare dividend on the Equity shares of the Company the Companies Act, 2013 and the Rules framed thereunder for the year ended 31st March, 2014. -

Betting Big on Mobility PHOTOS: SAJAL BOSE SAJAL PHOTOS: in Modern Commuter Railway Technol- Ogies – in 2015 Has Helped the Com- Pany to Achieve This Goal

BUSINESS INDIA u THE MAGAZINE OF THE CORPORATE WORLD Corporate Reports Betting big on mobility PHOTOS: SAJAL BOSE in modern commuter railway technol- ogies – in 2015 has helped the com- pany to achieve this goal. Today, TWL offers complete solution in mobility – whether it is wagons, passenger trains, ships or bridges. “Our strength is tech- nology. We are the only company in India to make both, freight and passen- ger rolling stock,” adds Chowdhary. A strong diverse portfolio All these activities of the company have not gone unnoticed in the indus- try. TWL has surprised the industry by outbidding large overseas and domestic players in passen- Umesh ger rolling stock manufactur- Chowdhary: ing and won the R1,200 crore metro rail order is order for designing and man- a big boost ufacturing of the aluminium metro rail coaches for Pune Metro in August last year. It was a big boost for the company, mak- ing it a new entrant in metro coach making. TWL, the R1,765 crore entity, has today built a strong diverse port- Titagarh Wagons firms up its position in passenger mobility folio in freight & components, tran- sit & propulsion, as also engineering & shipbuilding, of which freight he wagon industry has been “The scope becomes limited when you alone contributes 70 per cent of the struggling with capacity utili- are dependent on one particular seg- company’s revenue. Tsation, due to the volatility in ment,” explains Umesh Chowdhary, The TWL story is remarkable in its orders from the Indian Railways over vice-chairman & managing director, ability and has built through acquisi- the few years. -

Annual Report 2019-20

ANNUAL REPORT 2019-20 Issued by Director General RESEARCH DESIGNS AND STANDARDS ORGANISATION Manak Nagar, Lucknow – 226011 ANNUAL 2019-20 REPORT QUALITY POLICY OF RDSO “We at RDSO Lucknow are committed to maintain and update transparent standards of services to develop safe, modern and cost effective railway technology complying with statutory and regulatory requirements, through excellence in research, designs and standards by setting quality objectives, commitment to satisfy applicable requirements and continual improvements of the quality management system to cater to growing needs, demand and expectations of passenger and freight traffic on the railways through periodic review of quality management systems to achieve continual improvement and customer appreciation. It is communicated and applied within the organization and making it available to all the relevant interested parties.” Editorial Board: Dr. Ashish Agrawal, Executive Director/ Administration Krishna Kant, Sr. Library Information Assistant Research Designs and Standards Organisation Ministry of Railways Manak Nagar, Lucknow-226011 Website: www.rdso.indianrailways.gov.in E- Mail: [email protected]; [email protected] ANNUAL REPORT2019-20 CONTENTS CHAPTERS PAGE GENERAL 5 BRIDGES & STRUCTURES 13 COACHING STOCK 14 ELECTRICAL 19 ENERGY & ENVIRONMENT MANAGEMENT 22 ENGINE DEVELOPMENT 24 FINANCE AND ACCOUNTS 25 FREIGHT STOCK 27 GEO-TECHNICAL ENGINEERING 30 METALLURGICAL & CHEMICAL 37 MOTIVE POWER 43 PERSONNEL 48 POWER SUPPLY & EMU 50 PSYCHO-TECHNICAL 56 QUALITY ASSURANCE 58 RESEARCH 64 SIGNALLING 67 TELECOMMUNICATION 76 TESTING 79 TRACK 87 TRACK MACHINES & MONITORING 90 TRACTION INSTALLATION 94 TRAFFIC 96 UTHS 98 WORKS 100 ANNUAL 2019-20 REPORT APPENDIXES Appendix-I: Publications brought out during 2019-20 102 Appendix-II: Papers presented / published in important Seminars 114 / Journals during 2019-20. -

List of Nodal Officer

List of Nodal Officer Designa S.No tion of Phone (With Company Name EMAIL_ID_COMPANY FIRST_NAME MIDDLE_NAME LAST_NAME Line I Line II CITY PIN Code EMAIL_ID . Nodal STD/ISD) Officer 1 VIPUL LIMITED [email protected] PUNIT BERIWALA DIRT Vipul TechSquare, Golf Course Road, Sector-43, Gurgaon 122009 01244065500 [email protected] 2 ORIENT PAPER AND INDUSTRIES LTD. [email protected] RAM PRASAD DUTTA CSEC BIRLA BUILDING, 9TH FLOOR, 9/1, R. N. MUKHERJEE ROAD KOLKATA 700001 03340823700 [email protected] COAL INDIA LIMITED, Coal Bhawan, AF-III, 3rd Floor CORE-2,Action Area-1A, 3 COAL INDIA LTD GOVT OF INDIA UNDERTAKING [email protected] MAHADEVAN VISWANATHAN CSEC Rajarhat, Kolkata 700156 03323246526 [email protected] PREMISES NO-04-MAR New Town, MULTI COMMODITY EXCHANGE OF INDIA Exchange Square, Suren Road, 4 [email protected] AJAY PURI CSEC Multi Commodity Exchange of India Limited Mumbai 400093 0226718888 [email protected] LIMITED Chakala, Andheri (East), 5 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 6 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 7 NECTAR LIFE SCIENCES LIMITED [email protected] SUKRITI SAINI CSEC NECTAR LIFESCIENCES LIMITED SCO 38-39, SECTOR 9-D CHANDIGARH 160009 01723047759 [email protected] 8 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 9 SMIFS CAPITAL MARKETS LTD. -

Texmaco Rail & Engineering Ltd

July 7, 2016 Texmaco Rail & Engineering Ltd. Transforming from wagon manufacturer to integrated rail solution provider CMP INR 94 Target INR 119 Initiating Coverage – BUY Company Background Key Share Data Face Value (INR) 1.0 Texmaco Rail & Engineering (Texmaco), a part of Adventz Group of Mr. Saroj Equity Capital (INR Mn) 210.1 Poddar, is India’s largest railway wagon manufacturer with an annual capacity of Market Cap (INR Mn) 19,777.5 10,000 wagons near Kolkata, West Bengal. It also manufactures hydro mechanical 52 Week High/Low (INR) 154/89 equipment, bridges, structural equipment and steel castings (annual capacity of 6 months Avg. Daily Volume (BSE) 14,090 30,000 metric tonnes). It has recently acquired Kalindee Rail Nirman and Bright BSE Code 533326 Power, EPC service providers to Indian Railways (IR) & Metros in diverse areas, NSE Code TEXRAIL towards its quest to become an integrated rail solutions provider, targeting high Reuters Code TEXA.BO value contracts . It has JVs with Wabtec & Touax Rail. Investment Rationale Bloomberg Code TXMRE IN Well placed to benefit from growth drive of IR, volume growth to pick up Shareholding Pattern (as on 31 Mar 2016) Contrary to the subdued demand of ~5,000-6,000 wagons p.a. by IR, the sector is all set to get boost by massive pent-up demand in the replacement market 1 1 % and introduction of 10-20% freight loading through 25-tonne axle-load wagons P ro m o t er 2 5 % F II 's in FY17 which will augment higher demand for wagons. -

TITAGARH WAGONS LTD. Titagarh Wagons Ltd Initiating Coverage

26.07.2017 TITAGARH WAGONS LTD. Titagarh Wagons Ltd Initiating Coverage Sector: Capital Goods- Heavy Engineering Recommendation: BUY CMP: Rs. 121 Target: Rs. 178 MARKET DATA Domestic Demand to Spur Growth: The demand of wagons from Indian railways CMP(Rs.) 121.00 which was subdued from previous years is set to pick up with the opening of EPS (TTM) (Rs.) 2.34 DFC (Dedicated freight corridor from Mumbai to Delhi in FY19). Also the P/E(TTM) 51.70 railways has put aside Rs.9000 crores for coach and refurbishment of existing 52 Week High 135.80 coaches. This will help spur domestic demand of wagons and will benefit TWL to a large extent. 52 Week Low 96.00 Metro business to be a huge market in itself: There are currently 8 operational Equity (Rs. Mn.) 230.90 metro systems in India. A further 520 km of lines are under construction. Under Mkt. Cap (Rs. Mn.) 13876.60 the new metro procurement policy, 75% of coaches need to be manufactured CODES in India or by an entity having collaboration with some Indian manufacturer. BSE 532966 Titagarh after acquiring Firema Adler is the fourth player in India to pre-qualify NSE TWL for bidding of Metro projects. Currently the total size of rolling stock for metro projects in India is estimated to be Rs.55000 crores. This creates huge Bloomberg TWL@IN opportunity market for TWL. Overseas acquisition to catalyze growth: TWL acquired AFR group of France in PRICE VOLUME GRAPH 2010 followed by Firema Adler of Italy in 2015. The company currently acquired Sambre of Italy and entered in to a JV with Mateire Bridges to acquire know how Total Volume Close Price of Bailey bridges. -

Country Or Region

INDIA: Opportunities in the Railway Sector INDIA: Opportunities in the railway sector Page 1 of 6 Shantanu Sarkar Date ( Dec /23 /20 13) ID:# Summary According to the official website of t he Indian Railways (IR) and other published sources, it is the world’s second largest passenger system and the fourth lar gest freight carrier. The IR also operates suburban trains and metro systems in some cities. According to the official India Railway (IR) website and other published sources , e ach day 19,000 trains carry an average of 2.8 million tons of freight and mor e than 23 million people between 7,500 stations in a network spanning 40,389 miles. Nearly two thirds, or 12,000 trains, are for passenger travel while 7,000 are dedicated freight trains . R olling stock totals include approximately 2 30 ,000 freight and 60,0 00 passenger cars. There are currently four thousand diesel and over five thousand electric locomotives in operation plying long haul routes, of which about 32% are electrified . The Indian Railways also operates nine factories which manufacture about 250 electric locomotives , 250 diesel -electric locomotives and 3 ,000 passenger coaches each year for domestic use as well as for export. In addition, it produces ‘ traction motors, switch gears and control gears, cast & fabricated bogies, cast steel railroad w heels and forged axles ’. The Indian R ailways use s several gauges including 1,676 mm (5 ft 6 in) broad gauge; 1,435 mm (4 ft 8 1 ⁄2 in) standard gauge; the 1,000 mm (3 ft 3 3⁄8 in) meter gauge; and two narrow gauges, 762 mm (2 ft 6 in) and 610 mm (2 ft). -

FINAL DISTRIBUTION.Xlsx

Annexure-1B 1)Taxpayers with turnover above Rs 1.5 Crores b) Taxpayers falling under the jurisdiction of the State Taxpayer's Name SL NO GSTIN Registration Name TRADE_NAME 1 NATIONAL INSURANCE COMPANY LIMITED NATIONAL INSURANCE COMPANY LTD 19AAACN9967E1Z0 2 WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD 19AAACW6953H1ZX 3 INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) 19AAACI1681G1ZM 4 THE W.B.P.D.C.L. THE W.B.P.D.C.L. 19AABCT3027C1ZQ 5 ITC LIMITED ITC LIMITED 19AAACI5950L1Z7 6 TATA STEEL LIMITED TATA STEEL LIMITED 19AAACT2803M1Z8 7 LARSEN & TOUBRO LIMITED LARSEN & TOUBRO LIMITED 19AAACL0140P1ZG 8 SAMSUNG INDIA ELECTRONICS PVT. LTD. 19AAACS5123K1ZA 9 EMAMI AGROTECH LIMITED EMAMI AGROTECH LIMITED 19AABCN7953M1ZS 10 KOLKATA PORT TRUST 19AAAJK0361L1Z3 11 TATA MOTORS LTD 19AAACT2727Q1ZT 12 ASHUTOSH BOSE BENGAL CRACKER COMPLEX LIMITED 19AAGCB2001F1Z9 13 HINDUSTAN PETROLEUM CORPORATION LIMITED. 19AAACH1118B1Z9 14 SIMPLEX INFRASTRUCTURES LIMITED. SIMPLEX INFRASTRUCTURES LIMITED. 19AAECS0765R1ZM 15 J.J. HOUSE PVT. LTD J.J. HOUSE PVT. LTD 19AABCJ5928J2Z6 16 PARIMAL KUMAR RAY ITD CEMENTATION INDIA LIMITED 19AAACT1426A1ZW 17 NATIONAL STEEL AND AGRO INDUSTRIES LTD 19AAACN1500B1Z9 18 BHARATIYA RESERVE BANK NOTE MUDRAN LTD. BHARATIYA RESERVE BANK NOTE MUDRAN LTD. 19AAACB8111E1Z2 19 BHANDARI AUTOMOBILES PVT LTD 19AABCB5407E1Z0 20 MCNALLY BHARAT ENGGINEERING COMPANY LIMITED MCNALLY BHARAT ENGGINEERING COMPANY LIMITED 19AABCM9443R1ZM 21 BHARAT PETROLEUM CORPORATION LIMITED 19AAACB2902M1ZQ 22 ALLAHABAD BANK ALLAHABAD BANK KOLKATA MAIN BRANCH 19AACCA8464F1ZJ 23 ADITYA BIRLA NUVO LTD. 19AAACI1747H1ZL 24 LAFARGE INDIA PVT. LTD. 19AAACL4159L1Z5 25 EXIDE INDUSTRIES LIMITED EXIDE INDUSTRIES LIMITED 19AAACE6641E1ZS 26 SHREE RENUKA SUGAR LTD. 19AADCS1728B1ZN 27 ADANI WILMAR LIMITED ADANI WILMAR LIMITED 19AABCA8056G1ZM 28 AJAY KUMAR GARG OM COMMODITY TRADING CO.