Registration Document Including Annual Financial Report Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Jaguara and Miranda Hpps: Operational, Commercial and Financial Characteristics Legal Disclaimer

Jaguara and Miranda HPPs: operational, commercial and financial characteristics Legal disclaimer We have prepared this document solely for informational purposes. You should not definitively rely upon it or use it to form the definitive basis for any decision, contract, commitment or action whatsoever, with respect to any proposed transaction or otherwise. We have prepared this document and the analyses contained in it based, in part, on certain assumptions and information. Our use of such assumptions and information does not imply that we have independently verified or necessarily agree with any of such assumptions or information, and we have assumed and relied upon the accuracy and completeness of such assumptions and information for purposes of this document. Neither ENGIE Brasil Energia S.A. nor its directors, officers, employees, agents, shareholders and/or affiliates make any representation or warranty, express or implied, in relation to the accuracy or completeness of the information contained in this document or any oral information provided in connection herewith, or any data it generates and accept no responsibility, obligation or liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information. ENGIE Brasil Energia S.A. and its shareholders expressly disclaim any and all liability which may be based on this document and any errors therein or omissions therefrom. Neither ENGIE Brasil Energia S.A. nor its directors, officers, employees, agents, shareholders and/or affiliates make any representation or warranty, express or implied, that any transaction has been or may be effected on the terms or in the manner stated in this document, or as to the achievement or reasonableness of future projections, management targets, estimates, prospects or returns, if any. -

Iconic Inclusive Growth Initiatives, Earmarked by B4IG Members

Iconic inclusive growth initiatives, earmarked by B4IG members 22/08/2019 The following are among the more than fifty initiatives earmarked by B4IG coalition members towards the platform. Some of these projects will be scaled, expanded or replicated through the B4IG incubator; others will be part of a B4IG innovation hub of inclusive business models that can be shared and emulated by other companies. These examples demonstrate the experience and resources that member companies bring to B4IG. More broadly, they show concretely the role that business can play in addressing inequalities of opportunity, gender and territory, and building truly inclusive societies. Company Name: Accenture Initiative Name: Inclusive Future of Work Inclusive Growth Lever: Equal Opportunity Countries Active: France, Ireland, Spain, United Arab Emirates, UK, US Description: Accenture’s Inclusive Future of Work initiative aims to help mid-career employees in routine roles transition to automation-resilient work. The Inclusive Future of Work Launchpad is geographically focused, bringing together key stakeholders from local business, government and non- profit sectors to identify and scale innovative products and services that address the obstacles to career change commonly encountered by experienced workers in less complex roles. The Launchpad has reached 300 people to date and is applying to the B4IG Incubator to expand its international network of organizations and experts involved, to access further funding to take successful models to scale, and to provide additional services to help workers equipped with new skills thrive in the digital economy. Company Name: Agropur Initiative Name: 1,000 First Days of Life Total Project Funding: 2 million CAD Inclusive Growth Lever: Equal Opportunity Countries Active: Canada Description: Agropur and Olo Foundation share a common goal: to support families in need to ensure babies are born healthy and to promote the development of sound eating habits in early childhood. -

Climate and Energy Benchmark in Oil and Gas Insights Report

Climate and Energy Benchmark in Oil and Gas Insights Report Partners XxxxContents Introduction 3 Five key findings 5 Key finding 1: Staying within 1.5°C means companies must 6 keep oil and gas in the ground Key finding 2: Smoke and mirrors: companies are deflecting 8 attention from their inaction and ineffective climate strategies Key finding 3: Greatest contributors to climate change show 11 limited recognition of emissions responsibility through targets and planning Key finding 4: Empty promises: companies’ capital 12 expenditure in low-carbon technologies not nearly enough Key finding 5:National oil companies: big emissions, 16 little transparency, virtually no accountability Ranking 19 Module Summaries 25 Module 1: Targets 25 Module 2: Material Investment 28 Module 3: Intangible Investment 31 Module 4: Sold Products 32 Module 5: Management 34 Module 6: Supplier Engagement 37 Module 7: Client Engagement 39 Module 8: Policy Engagement 41 Module 9: Business Model 43 CLIMATE AND ENERGY BENCHMARK IN OIL AND GAS - INSIGHTS REPORT 2 Introduction Our world needs a major decarbonisation and energy transformation to WBA’s Climate and Energy Benchmark measures and ranks the world’s prevent the climate crisis we’re facing and meet the Paris Agreement goal 100 most influential oil and gas companies on their low-carbon transition. of limiting global warming to 1.5°C. Without urgent climate action, we will The Oil and Gas Benchmark is the first comprehensive assessment experience more extreme weather events, rising sea levels and immense of companies in the oil and gas sector using the International Energy negative impacts on ecosystems. -

Combined Ordinary and Extraordinary Shareholders’ Meeting of Danone Thursday 29 April 2021, at 2:30 P.M

NOTICE OF MEETING COMBINED ORDINARY AND EXTRAORDINARY SHAREHOLDERS’ MEETING OF DANONE THURSDAY 29 APRIL 2021, AT 2:30 P.M. DANONE Registered Office: 17, boulevard Haussmann, 75009 Paris – France A French Société Anonyme with a share capital of €171,657,400 552 032 534 RCS Paris CONTENTS CHAIRMAN’S MESSAGE 3 KEY FIGURES 2020 4 SUMMARY OF THE COMPANY’S SITUATION DURING THE LAST FISCAL YEAR 5 FINANCIAL RESULTS OF THE COMPANY DURING THE LAST FIVE FISCAL YEARS AND OTHER SIGNIFICANT INFORMATION 11 AGENDA OF THE SHAREHOLDERS’ MEETING 12 HOW TO PARTICIPATE IN THE SHAREHOLDERS’ MEETING? 13 HOW TO COMPLETE YOUR VOTING FORM? 16 YOUR BOARD OF DIRECTORS IN 2020 18 APPOINTMENT AND RENEWALS OF TERMS OF OFFICE PROPOSED TO THE SHAREHOLDERS’ MEETING 19 REPORT FROM THE BOARD OF DIRECTORS AND RESOLUTIONS SUBMITTED TO THE SHAREHOLDERS’ MEETING 24 SPECIAL REPORTS OF THE STATUTORY AUDITORS 46 TRANSFER OF SECURITIES INTO A DIRECT REGISTERED ACCOUNT 54 REQUEST FOR ADDITIONAL INFORMATION 55 WARNING – COVID-19 IN THE CONTEXT OF THE COVID-19 HEALTH CRISIS, THE SHAREHOLDERS’ MEETING OF 29 APRIL 2021 WILL BE HELD BEHIND CLOSED DOORS, WITHOUT THE SHAREHOLDERS AND OTHER PERSONS ENTITLED TO ATTEND BEING PHYSICALLY PRESENT. SHAREHOLDERS ARE INVITED TO CAST THEIR VOTE REMOTELY, PRIOR TO THE SHAREHOLDERS’ MEETING. YOU WILL FIND MORE INFORMATION IN THIS DOCUMENT. CHAIRMAN’S MESSAGE Ladies and Gentlemen, dear Shareholders, I am pleased to inform you that Danone’s Shareholders Meeting will be held on Thursday, 29 April 2021 at 2:30 pm. I regret not being able to welcome you to this Shareholders’ Meeting that I will have the honor to chair for the first time. -

Nuclear Hvac

NUCLEAR HVAC ENGIE Axima, your key partner ENGIE Axima your local partner for engineering, procurement, construction and operation maintenance of your nuclear HVAC projects. Gravelines With a network of GravelinesDunkerque Lille Boulogne-sur-Mer Dunkerque Lille Boulogne-sur-MerPenly St-Omer Dieppe Chooz Cherbourg Penly St-Omer Amiens Paluel Dieppe Chooz FlamanvilleCherbourg Amiens Compiègne Cattenom officies Paluel Rouen Flamanville Compiègne Cattenom Phalsbourg Engineering Procurement Construction Rouen PARIS Saint-Brieuc Caen Reims Metz ENGIE_axima RÉFÉRENCES COULEUR Brest Phalsbourg Haguenau • Design of HVAC & air treatment systems, • Qualification of the equipment (either • Installation of HVAC systems in in France ChartresPARIS Nogent/Seine gradient_MONO_WHITE Saint-Brieuc MontaubanCaen Reims Metz 22/10/2015 Brest Nancy HaguenauSTRASBOURG Landivisiau de Bretagne LeChartres Mans Nogent/Seine Troyes 24, rue Salomon de Rothschild - 92288 Suresnes - FRANCE of process fluids, process vacuum, and by analysis or testing). coordination with other work packages. Montauban Tél. : +33 (0)1 57 32 87 00 / Fax : +33 (0)1 57 32 87 87 Quimper Web : www.carrenoir.com WHITE cooling systems, including the preparation Landivisiau de BretagneRennesLe Mans Orléans Troyes Nancy Epinal STRASBOURGColmar Lorient Chaumont • Long-term partnership with reputable • Testing, commissioning, acceptance, Quimper Angers Fessenheim of the technical specifications for the VannesRennes St-LaurentOrléans Epinal MulhouseColmar suppliers for the procurement of all operation -

Danone Quality & Food Safety Commitments

DANONE QUALITY & FOOD SAFETY COMMITMENTS DANONE | NOVEMBER 2018 LIVING QUALITY AT ALL TIMES Quality and Food Safety are fundamental for Danone. We would not be able to fulfil our company mission to "Bring health through food to as many people as possible" , if we did not start with safe food of the highest quality. BE We believe people should always be able ED E to trust and enjoy our products and services. R FF ER I We make the solid promise to honour our F C I commitment on the quality and integrity E E of our products and services all along R N P Excel in quality T the value chain, and to offer superior food experiences and innovations. E everywhere, everyday B to deliver our promise To deliver our promise to consumers and to consumers customers, each of us at Danone has the duty and customers to "Excel in Quality everywhere, everyday", contributing to the four pillars which sustain our Danone Quality ambition. B b E e At Danone, we engage our 100,000 employees TR pr to Live Quality at all times, making us trusted, USTED ou preferred, efficient and proud of what we do d … BECAUSE WE ALL CARE. Emmanuel Faber Danone Chairman and CEO BE TRUSTED BE PREFERRED Because everything we do impacts on people’s lives Today, people have diverse ways of buying and (health, well-being, growth…), at Danone we have the duty consuming food and beverages, and they are adopting to ensure that all our stakeholders trust our products and healthier and more sustainable eating and drinking services. -

The Royal Institution for the Advancement

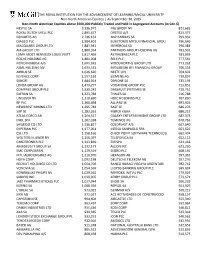

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Non-North American Equities │ As September 30, 2019 Non-North American Equities above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) NESTLE SA 3,136,972 ING GROEP NV 822,665 ROYAL DUTCH SHELL PLC 2,895,677 ORSTED A/S 813,377 NOVARTIS AG 2,736,152 BNP PARIBAS SA 799,331 DIAGEO PLC 1,984,601 SUMITOMO MITSUI FINANCIAL GROU 796,646 MACQUARIE GROUP LTD 1,881,942 IBERDROLA SA 796,483 AIA GROUP LTD 1,880,954 PARTNERS GROUP HOLDING AG 781,932 LVMH MOET HENNESSY LOUIS VUITT 1,817,469 ASTRAZENECA PLC 781,059 ROCHE HOLDING AG 1,801,008 RELX PLC 777,561 NOVO NORDISK A/S 1,695,931 WOOLWORTHS GROUP LTD 771,262 ASML HOLDING NV 1,633,531 MITSUBISHI UFJ FINANCIAL GROUP 766,553 AIRBUS SE 1,626,620 NESTE OYJ 764,602 KEYENCE CORP 1,557,193 SIEMENS AG 739,857 SANOFI 1,484,014 DANONE SA 733,193 LONZA GROUP AG 1,479,277 VODAFONE GROUP PLC 723,852 COMPASS GROUP PLC 1,339,242 DASSAULT SYSTEMES SE 720,751 SAFRAN SA 1,323,784 THALES SA 716,788 UNILEVER NV 1,319,690 HSBC HOLDINGS PLC 707,830 BP PLC 1,300,498 ALLIANZ SE 693,905 NEWCREST MINING LTD 1,295,783 BASF SE 686,276 SAP SE 1,283,261 MERCK KGAA 686,219 ATLAS COPCO AB 1,264,517 GALAXY ENTERTAINMENT GROUP LTD 683,373 ENEL SPA 1,262,338 TEMENOS AG 670,763 SHISEIDO CO LTD 1,236,827 COLOPLAST A/S 667,640 EXPERIAN PLC 1,177,061 INTESA SANPAOLO SPA 663,622 CSL LTD 1,158,166 CHECK POINT SOFTWARE TECHNOLOG 662,404 WOLTERS KLUWER NV 1,156,397 TELEFONICA SA 652,113 CARDTRONICS PLC 1,143,839 ENI SPA 641,418 AMADEUS IT GROUP SA -

Análise De Empresas Sanepar

23 de maio Análise de Empresas Sanepar COMPORTAMENTO DAS PRINCIPAIS BOLSAS Alteramos a recomendação para Neutra após RECOMENDAÇÃO Sanepar PN interferência no reajuste anual de tarifas SAPR11 NEUTRO O TCE definiu que a Sanepar poderá implementar um aumento PREÇO-ALVO UPSIDE tarifário parcial de 8,37% (abaixo da proposta da AGEPAR, de 12%); 86,00 26,47% No entanto, a criação de um comitê para discutir o aumento anual pendente de 4% deixa a porta aberta para uma solução. Caso Sanepar PN contrário, o litígio legal seria a única opção para a Sanepar; 68,00 A decisão não é definitiva, mas, por enquanto, inviabiliza as Preço (R$) Valor de Merc. (R$M) 7.213 perspectivas construtivas sobre o ambiente regulatório de Preço Mín./Máx. 52 sem. (R$) 46,18 - 55,0 saneamento no estado do Paraná. Vol. Méd. Diário 3 meses (R$ M) 51,0 Acreditamos que neste contexto, a antecipação das parcelas pendentes da revisão tarifária de 2017 perde força. Alteramos a recomendação para SAPR11, de Compra para Neutra, Projeções 19E 20E enquanto reduzimos o preço-alvo para R$ 86,00/unit.. EBITDA 1.646 2.188 Em um movimento sem precedentes, o Tribunal de contas do Paraná “TCE” P/L 5,7 5,1 decidiu por um repasse parcial reajuste tarifário anual da Sanepar em 8,37%, EV/EBITDA 4,4 3,8 anulando os 12,13% calculado pelo regulador estadual AGEPAR. O TCE está Div. Yield 8,7% 9,8% ligado ao legislativo estadual do Paraná, tendo o papel principal de supervisionar o uso de fundos públicos pelo estado e abordar reclamações sobre atos ilícitos de autoridades públicas. -

REIPPP Projects

REIPPP Projects Window 1 Projects Net capacity Technology Project Location Technology Developer Contractor Status MW supplier Klipheuwel – Dassiefontein Group 5, Dassiesklip Wind Energy Facility Caledon, WC Wind 26,2 Sinovel Operational Wind Energy fFcility Iberdrola MetroWind Van Stadens Wind Port Elizabeth, EC Wind 26,2 MetroWind Sinovel Basil Read Operational Farm Hopefield Wind Farm Hopefield, WC Wind 65,4 Umoya Energy Vestas Vestas Operational Noblesfontein Noblesfontein, NC Wind 72,8 Coria (PKF) Investments 28 Vestas Vestas Operational Red Cap Kouga Wind Farm – Port Elizabeth, EC Wind 77,6 Red Cap Kouga Wind Farm Nordex Nordex Operational Oyster Bay Dorper Wind Farm Stormberg, EC Wind 97,0 Dorper Wind Farm Nordex Nordex Operational South Africa Mainstream Jeffreys Bay Jeffereys Bay, EC Wind 133,9 Siemens Siemens Operational Renewable Power Jeffreys Bay African Clean Energy Cookhouse Wind Farm Cookhouse, EC Wind 135,0 Suzlon Suzlon Operational Developments Khi Solar One Upington, NC Solar CSP 50,0 Khi Dolar One Consortium Abengoa Abengoa Construction KaXu Solar One Pofadder, NC Solar CSP 100,0 KaXu Solar One Consortium Abengoa Abengoa Operational SlimSun Swartland Solar Park Swartland, WC Solar PV 5,0 SlimSun BYD Solar Juwi, Hatch Operational RustMo1 Solar Farm Rustenburg, NWP Solar PV 6,8 RustMo1 Solar Farm BYD Solar Juwi Operational Mulilo Renewable Energy Solar De Aar, NC Solar PV 9,7 Gestamp Mulilo Consortium Trina Solar Gestamp, ABB Operational PV De Aar Konkoonsies Solar Pofadder, NC Solar PV 9,7 Limarco 77 BYD Solar Juwi Operational -

2019 Annual Report Annual 2019

a force for good. 2019 ANNUAL REPORT ANNUAL 2019 1, cours Ferdinand de Lesseps 92851 Rueil Malmaison Cedex – France Tel.: +33 1 47 16 35 00 Fax: +33 1 47 51 91 02 www.vinci.com VINCI.Group 2019 ANNUAL REPORT VINCI @VINCI CONTENTS 1 P r o l e 2 Album 10 Interview with the Chairman and CEO 12 Corporate governance 14 Direction and strategy 18 Stock market and shareholder base 22 Sustainable development 32 CONCESSIONS 34 VINCI Autoroutes 48 VINCI Airports 62 Other concessions 64 – VINCI Highways 68 – VINCI Railways 70 – VINCI Stadium 72 CONTRACTING 74 VINCI Energies 88 Eurovia 102 VINCI Construction 118 VINCI Immobilier 121 GENERAL & FINANCIAL ELEMENTS 122 Report of the Board of Directors 270 Report of the Lead Director and the Vice-Chairman of the Board of Directors 272 Consolidated nancial statements This universal registration document was filed on 2 March 2020 with the Autorité des Marchés Financiers (AMF, the French securities regulator), as competent authority 349 Parent company nancial statements under Regulation (EU) 2017/1129, without prior approval pursuant to Article 9 of the 367 Special report of the Statutory Auditors on said regulation. The universal registration document may be used for the purposes of an offer to the regulated agreements public of securities or the admission of securities to trading on a regulated market if accompanied by a prospectus or securities note as well as a summary of all 368 Persons responsible for the universal registration document amendments, if any, made to the universal registration document. The set of documents thus formed is approved by the AMF in accordance with Regulation (EU) 2017/1129. -

CARBON FOOTPRINT – CO2 Emissions (Scope 1, 2 & 3)

ENVIRONMENT CARBON FOOTPRINT – CO2 Emissions (Scope 1, 2 & 3) GRI Standards : 402-1: Energy 305-1, 305-2, 305-3,305-4, 305-5: Emissions EXECUTIVE SUMMARY Sanofi has committed to limit the impacts linked to its activities on the environment. One of the major challenges of the Sanofi Planet Mobilization program consists in reducing its Greenhouse Gas (GHG) emissions: • direct emissions related to Scope 1 and 2 (industrial, R&D and tertiary sites, including the medical representative’s fleet) • indirect emissions related to scope 3, associated with the value chain activities (transportation and distribution, purchased goods and services, waste generation, etc.) Carbon Footprint Factsheet 1 Published in April 2021 TABLE OF CONTENTS 1. BACKGROUND ............................................................................................................ 3 2. GREENHOUSE GAS EMISSIONS RELATED TO SCOPE 1 & 2 ................................ 3 2.1. Dashboard: objectives and progress ...................................................................... 3 2.2. Key figures ................................................................................................................. 3 2.3. Highlights ................................................................................................................... 4 3. GREENHOUSE GAS EMISSIONS RELATED TO SCOPE 3 ....................................... 6 3.1. Context ....................................................................................................................... 6 3.2. Key -

Optimising the Concentrating Solar Power Potential in South Africa Through an Improved GIS Analysis

energies Article Optimising the Concentrating Solar Power Potential in South Africa through an Improved GIS Analysis Dries. Frank Duvenhage 1,* , Alan C. Brent 1,2 , William H.L. Stafford 1,3 and Dean Van Den Heever 4 1 Engineering Management and Sustainable Systems, Department of Industrial Engineering, the Solar Thermal Energy Research Group and the Centre for Renewable and Sustainable Energy Studies, Stellenbosch University, Stellenbosch 7602, South Africa; [email protected] (A.C.B.); wstaff[email protected] (W.H.L.S.) 2 Sustainable Energy Systems, School of Engineering and Computer Science, Victoria University of Wellington, Wellington 6140, New Zealand 3 Green Economy Solutions, Natural Resources and the Environment, Council for Scientific and Industrial Research, Stellenbosch 7600, South Africa 4 Legal Drone Solutions, Stellenbosch 7600, South Africa; [email protected] * Correspondence: [email protected] Received: 11 May 2020; Accepted: 16 June 2020; Published: 23 June 2020 Abstract: Renewable Energy Technologies are rapidly gaining uptake in South Africa, already having more than 3900 MW operational wind, solar PV, Concentrating Solar Power (CSP) and biogas capacity. CSP has the potential to become a leading Renewable Energy Technology, as it is the only one inherently equipped with the facility for large-scale thermal energy storage for increased dispatchability. There are many studies that aim to determine the potential for CSP development in certain regions or countries. South Africa has a high solar irradiation resource by global standards, but few studies have been carried out to determine the potential for CSP. One such study was conducted in 2009, prior to any CSP plants having been built in South Africa.