2006 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2007

股份代號:035 Stock Code: 035 Annual Report 2007 2007 二零零七年年報 年 報 Annual2007 Report 00 FEC AR07 cover output.indd 1 2007/7/30 10:48:26 AM We are well-positioned to capture every opportunity for our rapid hotel expansion plan in China. We fi rmly believe that the keys to success are effectively implementing our strategies, injecting the right resources and bringing in the right people. 00 Far East Con Looking.indd 章節1:1 2007/7/30 10:28:31 AM Corporate Information PLACE OF INCORPORATION PRINCIPAL BANKERS Cayman Islands Hong Kong Citic Ka Wah Bank Limited EXECUTIVE DIRECTORS Hang Seng Bank Limited Deacon Te Ken CHIU, J.P. (Chairman) Chong Hing Bank Limited David CHIU, Tan Sri Dato’, B.Sc. Nanyang Commercial Bank Limited (Deputy Chairman and The Hongkong and Shanghai Chief Executive Offi cer) Banking Corporation Limited Dennis CHIU, B.A. Wing Hang Bank Limited Craig Grenfell WILLIAMS, B. ENG. (CIVIL) Malaysia Alliance Bank Malaysia Berhad NON-EXECUTIVE DIRECTORS Southern Bank Berhad Ching Lan JU CHIU, J.P. Daniel Tat Jung CHIU Singapore The Hongkong and Shanghai INDEPENDENT NON-EXECUTIVE Banking Corporation Limited DIRECTORS Australia Jian Yin JIANG Australia and New Zealand Banking Kwok Wai CHAN Group Limited Peter Man Kong WONG, J.P. Commonwealth Bank of Australia China CHIEF OPERATING OFFICER Construction Bank of China Denny Chi Hing CHAN The Industrial and Commercial Bank of China Limited QUALIFIED ACCOUNTANT, REGISTERED OFFICE CHIEF FINANCIAL OFFICER AND P.O. Box 1043, Ground Floor, COMPANY SECRETARY Caledonian House, Mary Street, Bill Kwai Pui MOK, B.A., M.B.A., A.I.C.P.A., C.P.A. -

OFFICIAL RECORD of PROCEEDINGS Thursday, 14 April

LEGISLATIVE COUNCIL ─ 14 April 2016 7379 OFFICIAL RECORD OF PROCEEDINGS Thursday, 14 April 2016 The Council continued to meet at Nine o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE JASPER TSANG YOK-SING, G.B.M., G.B.S., J.P. THE HONOURABLE ALBERT HO CHUN-YAN THE HONOURABLE LEE CHEUK-YAN THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE CHAN KAM-LAM, S.B.S., J.P. THE HONOURABLE LEUNG YIU-CHUNG THE HONOURABLE EMILY LAU WAI-HING, J.P. THE HONOURABLE TAM YIU-CHUNG, G.B.S., J.P. THE HONOURABLE ABRAHAM SHEK LAI-HIM, G.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, G.B.S., J.P. THE HONOURABLE FREDERICK FUNG KIN-KEE, S.B.S., J.P. THE HONOURABLE VINCENT FANG KANG, S.B.S., J.P. THE HONOURABLE WONG KWOK-HING, B.B.S., M.H. 7380 LEGISLATIVE COUNCIL ─ 14 April 2016 PROF THE HONOURABLE JOSEPH LEE KOK-LONG, S.B.S., J.P., Ph.D., R.N. THE HONOURABLE JEFFREY LAM KIN-FUNG, G.B.S., J.P. THE HONOURABLE ANDREW LEUNG KWAN-YUEN, G.B.S., J.P. THE HONOURABLE WONG TING-KWONG, S.B.S., J.P. THE HONOURABLE CYD HO SAU-LAN, J.P. DR THE HONOURABLE LAM TAI-FAI, S.B.S., J.P. THE HONOURABLE CHAN HAK-KAN, J.P. THE HONOURABLE CHAN KIN-POR, B.B.S., J.P. DR THE HONOURABLE PRISCILLA LEUNG MEI-FUN, S.B.S., J.P. THE HONOURABLE CHEUNG KWOK-CHE THE HONOURABLE WONG KWOK-KIN, S.B.S. THE HONOURABLE IP KWOK-HIM, G.B.S., J.P. -

JOURNALISTS CAUGHT BETWEEN TWO FIRES Hong Kong Media Faces Serious Harassment and Self-Censorship

JOURNALISTS CAUGHT BETWEEN TWO FIRES Hong Kong media faces serious harassment and self-censorship 2015 ANNUAL REPORT REPORT OF THE HONG KONG JOURNALISTS ASSOCIATION JULY 2015 Journalists caught between two fires: Hong Kong media faces serious harassment and self-censorship 1 Contents Introduction and recommendations ................................................................... 2 Section 1 MEDIA CAUGHT IN ‘ONE COUNTRY, TWO SYSTEMS’ ROW .......................... 4 Occupy Central drama unfolds .................................................................................... 4 Newspaper advertisements pulled ............................................................................... 5 Media credibility in doubt ........................................................................................... 6 “I am frightened”, says website founder ...................................................................... 6 Jimmy Lai hits the headlines ....................................................................................... 7 Leung blasts “pro-independence” views ...................................................................... 7 The promise and the reality ......................................................................................... 8 Section 2 JOURNALISTS FACE VIOLENCE WHILE CARRYING OUT DUTIES .............. 10 Journalists lack protection during occupy protests .................................................... 10 “Reporters? so what!” ............................................................................................... -

2005 Annual Report

上海 Shanghai 廣州 Guangzhou 香港 Hong Kong 澳門 Macau Annual Report 2005 二零零五年年報 Annual Report 2005 二零零五年年報 1 FINANCIAL YEAR 2005 was a successful year that we achieved a 169% growth in earnings. It was an achievement of the long- term strategies, which we formulated three years ago. We confidently believe it is just the beginning of our long-term growth with more years ahead. Annual Report 2005 Far East Consortium Inter national Limited Corporate Information 2 PLACE OF INCORPORATION PRINCIPAL BANKERS Cayman Islands Hong Kong Bank of China (Hong Kong) Limited EXECUTIVE DIRECTORS Citic Ka Wah Bank Limited Deacon Te Ken CHIU, J.P. (Chairman) Hang Seng Bank Limited David CHIU, Dato’, B.Sc. (Deputy Chairman Liu Chong Hing Bank Limited and Chief Executive Officer) Nanyang Commercial Bank Limited Craig Grenfell WILLIAMS, B. ENG. (CIVIL) The Hongkong and Shanghai Banking Corporation Limited Dennis CHIU, B.A. Wing Hang Bank Limited NON-EXECUTIVE DIRECTORS Malaysia Ching Lan JU CHIU, J.P. Alliance Bank Malaysia Berhad Dick Tat Sang CHIU, M.A. Southern Bank Berhad Daniel Tat Jung CHIU Singapore INDEPENDENT NON-EXECUTIVE The Hongkong and Shanghai Banking DIRECTORS Corporation Limited Kee Leong CHEE, Datuk David Kwok Kwei LO Australia Jian Yin JIANG Australia and New Zealand Banking Group Limited Commonwealth Bank of Australia CHIEF OPERATING OFFICER Denny Chi Hing CHAN China Construction Bank of China QUALIFIED ACCOUNTANT Industrial and Commercial Bank of China Bill Kwai Pui MOK, M.B.A., A.I.C.P.A., C.P.A. REGISTERED OFFICE COMPANY SECRETARY P.O. Box 1043, Ground Floor, Byron Ting Sau LEE, L.L.M., M.B.A., C.P.A. -

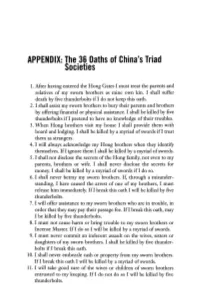

APPENDIX: the 36 Oaths of China's Triad Societies

APPENDIX: The 36 Oaths of China's Triad Societies 1. Mter having entered the Hong Gates I must treat the parents and relatives of my sworn brothers as mine own kin. I shall suffer death by five thunderbolts if I do not keep this oath. 2. I shall assist my sworn brothers to bury their parents and brothers by offering financial or physical assistance. I shall be killed by five thunderbolts if I pretend to have no knowledge of their troubles. 3. When Hong brothers visit my house I shall provide them with board and lodging. I shall be killed by a myriad of swords if I treat them as strangers. 4. I will always acknowledge my Hong brothers when they identify themselves. If I ignore them I shall be killed by a myriad of swords. 5. I shall not disclose the secrets of the Hong family, not even to my parents, brothers or wife. I shall never disclose the secrets for money. I shall be killed by a myriad of swords if I do so. 6. I shall never betray my sworn brothers. If, through a misunder standing, I have caused the arrest of one of my brothers, I must release him immediately. If I break this oath I will be killed by five thunderbolts. 7. I will offer assistance to my sworn brothers who are in trouble, in order that they may pay their passage fee. If I break this oath, may I be killed by five thunderbolts. 8. I must not cause harm or bring trouble to my sworn brothers or Incense Master. -

Public Health and Municipal Services Ordinance

Chapter: 132 PUBLIC HEALTH AND MUNICIPAL SERVICES Gazette Number Version Date ORDINANCE Long title 30/06/1997 To make provision for public health and municipal services. (Amended 10 of 1986 s. 2) [11 November 1960] G.N.A. 132 of 1960 (Originally 30 of 1960; 15 of 1935) Part: I PRELIMINARY 30/06/1997 Section: 1 Short title 30/06/1997 This Ordinance may be cited as the Public Health and Municipal Services Ordinance. (Amended 10 of 1986 s. 3) Section: 2 Interpretation L.N. 194 of 2003 01/01/2004 (1) In this Ordinance, unless the context otherwise requires- "advertisement" (宣傳、宣傳品) includes any structure or apparatus erected, used, or intended to be used, solely for the display of advertisements; "analysis" (分析) includes micro-biological assay but no other form of biological assay, and "analyse" (分析) shall be construed accordingly; "animal" (動物) includes reptiles, but does not include birds or fish; "Authority" (主管當局) means the public officer designated to be the Authority by the provisions of section 3; (Amended 78 of 1999 s. 7) "bath" (浴、沐浴) includes shower bath and turkish bath; "billiard establishment" (桌球場所) means any place opened, kept or used for the purpose of playing billiards, snooker, pool or similar games; (Added 53 of 1988 s. 3) "book" ( 書籍) includes a document, periodical, magazine, newspaper, pamphlet, music-score, picture, print, engraving, etching, deed, photograph, map, chart, plan or manuscript, and any other article or thing of a like nature provided for the use of the public in any library; (Replaced 50 of 1979 s. 2) "canopy" (簷篷) means any shade, shelter or other structure not carrying a floor load which- (a) projects from a wall of a building and is cantilevered or supported by brackets, posts or other means; or (b) is erected on any building or in or over any open space adjacent to or on a building and is supported by posts or other means; (Added 43 of 1972 s. -

City Film Industry: Hong Kong It Is Probable That This Has Everything to Do with My Transplant from Shanghai to Hong Kong at the Age of 5

City film industry: Hong Kong It is probable that this has everything to do with my transplant from Shanghai to Hong Kong at the age of 5. When I got there, I spoke nothing but Shanghainese, whereas Cantonese was, and still is, the local dialect. For some time, I was totally alienated, and it was like the biggest nightmare of my life. It might not be conscious, but certainly I have an intense feeling for geographical upheavals. Wong Kar-wei Learning objectives ● To understand the history of Hong Kong in relationship to China and Great Britain ● To situate the development of the Hong Kong film industry in that history ● To contextualize the two versions of martial arts films embodied by the two stars Bruce Lee and Jackie Chan and the two waves of urban films, the heroes cycle and the New Wave, in the particular history of Hong Kong ● To analyze the cinematic representations of Hong Kong in their particular and appropriate urban, regional, diasporic, transnational, and postmodern contexts Introduction This lesson continues the discussion of the triangulated relationship of a real particular city, the city–state of Hong Kong, the formation of its film industry, and its imaginary construction by its cinema. Hong Kong cinema is the third largest film producer in the world and frequently outsells Hollywood. Its immense cultural output shows the traces of its unique history in an explicit dialogue with its colonial heritage, its Chinese roots, and its transnational context. Hong Kong culture is shaped by British colonialism, the legacy of China, the simultaneous intentional articulation of separation from China by a diasporic community and, finally, the transnational education, orientation, and business connection of the post- Second World War generation. -

A Study of Kau Wah Keng Old Village & Surrounding Areas

Supported by A Study of Kau Wah Keng Old Village & Surrounding Areas Written and Translated by Dr. Kelvin K. Chow The University of Hong Kong, School of Chinese & Jao Tsung-I Academy (July 2019) 1 Table of Contents Table of Contents 2 1. Foreword 3 2. Changes in the Vicinity of Kau Wah Keng Old Village 5 2.1 Lai Chi Kok 5 2.2 Mei Foo Sun Chuen 9 2.3 Jao Tsung-I Academy 12 2.4 Kau Wah Keng New Village 16 3. History of Kau Wah Keng Old Village 18 3.1 Historical Overview of Kau Wah Keng Old Village 18 3.2 Living Environment 20 3.3 Education 27 3.4 Entertainment 30 3.5 Connections with Famous Chinese 31 4. Intangible Cultural Heritage 39 4.1 Seafarers and Overseas Connections 39 4.2 Unicorn Dance 42 4.3 Autumn Grave-visiting, Tai Wong Ye Spirit Tablet, 44 Lantern lighting 5. Development Outlook of Kau Wah Keng Old Village 48 5.1 Current Life and Co-existence with the Surrounding 48 Communities 5.2 A Historical Trail of Sustainable Development 49 6. Conclusion 50 Appendices: Maps 52 References 54-59 2 1. Foreword Kau Wah Keng formerly known as “Dog Climbing Path” (狗爬徑) is located southeast of Kwai Chung. The original name arose because the mountain roads were steep and villagers had to scramble up steep hillsides to get to the surrounding areas. The name was later changed to Kau Wah Keng or “Ninth Shining Path” (九華徑) as villagers thought the name was vulgar and also likened the villagers to dogs. -

Annual Report 2009 001 Far East Consortium International Limited ANNUAL REPORT 2009

Stock Code: 035 Annual Report 2009 001 Far East Consortium International Limited ANNUAL REPORT 2009 Corporate Information We believe the strategic initiatives being implemented will position the Group in a strong footing to capture future opportunities and the Group will have a good mix of recurring cashfl ow and development income streams. Our pri- ority is to deliver consistent long term return to our shareholders and we are confi dent we have the right model to achieve this objective. 002 Far East Consortium International Limited ANNUAL REPORT 2009 PLACE OF INCORPORATION PRINCIPAL BANKERS Cayman Islands Hong Kong Cathay United Bank Company, Limited Chong Hing Bank Limited Citic Ka Wah Bank Limited EXECUTIVE DIRECTORS Dah Sing Bank, Limited Deacon Te Ken CHIU, J.P. (Chairman) DBS Bank (Hong Kong) Limited David CHIU, Tan Sri Dato’, B.Sc. Hang Seng Bank Limited (Deputy Chairman and Nanyang Commercial Bank Limited Chief Executive Officer) Public Bank (Hong Kong) Limited Dennis CHIU, B.A. The Hongkong and Shanghai Craig Grenfell WILLIAMS, B. ENG. (CIVIL) Banking Corporation Limited Wing Hang Bank Limited Malaysia NON-EXECUTIVE DIRECTORS Affin Islamic Bank Berhad Ching Lan JU CHIU, J.P. Affrin Bank Berhad Daniel Tat Jung CHIU OCBC Bank (Malaysia) Berhad Public Bank Berhad Singapore INDEPENDENT NON-EXECUTIVE DIRECTORS The Hongkong and Shanghai Jian Yin JIANG Banking Corporation Limited Kwok Wai CHAN Australia Peter Man Kong WONG, J.P. Australia and New Zealand Banking Group Limited Commonwealth Bank of Australia Limited MANAGING DIRECTOR China Chris Cheong Thard HOONG, B. ENG, ACA Construction Bank of China DBS Bank (China) Limited The Industrial and Commercial Bank of China Limited CHIEF OPERATING OFFICER Denny Chi Hing CHAN REGISTERED OFFICE P.O. -

Christian Encounters with Chinese Culture

Christian Encounters with Chinese Culture Essays on Anglican and Episcopal History in China Edited by Philip L. Wickeri Hong Kong University Press The University of Hong Kong Pokfulam Road Hong Kong www.hkupress.org © 2015 Hong Kong University Press ISBN 978-988-8208-38-8 (Hardback) All rights reserved. No portion of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or any information storage or retrieval system, without prior permission in writing from the publisher. British Library Cataloguing-in-Publication Data A catalogue record for this book is available from the British Library. 10 9 8 7 6 5 4 3 2 1 Printed and bound by Paramount Printing Co., Ltd., Hong Kong, China Contents Series Introduction vii Philip L. WICKERI List of Contributors ix List of Illustrations xi Foreword xiii Paul KWONG Acknowledgments xv Abbreviations xvii Introduction 1 Philip L. WICKERI Society, Education, and Culture Chapter 1 The Protestant Episcopal China Mission and Chinese Society 25 Edward Yihua XU Chapter 2 Female Education and the Early Development of St. Stephen’s Church, Hong Kong (1865–1900s) 47 Patricia P. K. CHIU Chapter 3 R. O. Hall and the Christian Study Centre on Chinese Religion 65 Fuk-tsang YING The Prayer Book Chapter 4 Rethinking Church through the Book of Common Prayer in Late Qing and Early Republican China 81 Chloë STARR Chapter 5 An Analysis of the Compilation and Writing of the Book of Common Prayer in the Chung Hua Sheng Kung Hui 103 Feng GUO Parishes Chapter 6 Christianity and Chinese Nationalism: St. -

Annual Report 2007 二零零七年年報 CONTENTS

Far East Holdings International Limited 遠東控股國際有限公司 股份代號 : 0036 Stock Code : 0036 Annual Report 2007 二零零七年年報 CONTENTS PAGE(S) CORPORATE INFORMATION 2 BUSINESS PROFILE 3 MANAGING DIRECTOR AND CHIEF EXECUTIVE OFFICER’S STATEMENT 4 PROFILE OF THE DIRECTORS AND SENIOR MANAGEMENT 8 DIRECTORS’ REPORT 11 CORPORATE GOVERNANCE REPORT 18 INDEPENDENT AUDITOR’S REPORT 22 CONSOLIDATED INCOME STATEMENT 24 CONSOLIDATED BALANCE SHEET 25 BALANCE SHEET 27 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY 28 CONSOLIDATED CASH FLOW STATEMENT 29 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 31 FIVE YEARS FINANCIAL SUMMARY 94 PARTICULARS OF PROPERTIES HELD BY THE GROUP 95 The English text of this Annual Report shall prevail over the Chinese text. 01 ANNUAL REPORT 2007 Far East Holdings International Limited CORPORATE INFORMATION PLACE OF INCORPORATION REMUNERATION COMMITTEE Hong Kong Mr. Duncan Chiu, B.Sc. (Chairman) Dr. Lee G. Lam BOARD OF DIRECTORS Mr. Eugene Yun Hang Wang, MBA Executive Directors: PRINCIPAL BANKERS Deacon Te Ken Chiu, J.P. (Chairman) Mr. Duncan Chiu, B.Sc. (Managing Director and Bank of China (Hong Kong) Limited Chief Executive Officer) The Hongkong and Shanghai Banking Mr. Dennis Chiu, B.A. Corporation Limited The Bank of East Asia Limited Non-executive Directors: Hang Seng Bank Limited Tan Sri Dato’ David Chiu, B.Sc. Mr. Daniel Tat Jung Chiu REGISTERED OFFICE Mr. Derek Chiu, B.A. 16th Floor, Far East Consortium Building Mr. Desmond Chiu, B.A. 121 Des Voeux Road Central Ms. Margaret Chiu, LL.B. Hong Kong Ms. Min Tang, B.Sc. PRINCIPAL OFFICE Independent Non-executive Directors: Room 1802-1804, 18th Floor Dr. Lee G. -

Balance Sheet 18

Far East Technology International Limited CONTENTS PAGE(S) CORPORATE INFORMATION 2 BUSINESS PROFILE 3 PROFILE OF THE DIRECTORS AND SENIOR MANAGEMENT 4 MANAGING DIRECTOR AND CHIEF EXECUTIVE OFFICER’S STATEMENT 7 DIRECTORS’ REPORT 10 AUDITORS’ REPORT 16 CONSOLIDATED INCOME STATEMENT 17 CONSOLIDATED BALANCE SHEET 18 BALANCE SHEET 20 ANNUAL CONSOLIDATED STATEMENT OF CHANGES IN EQUITY 21 REPORT 2004 CONSOLIDATED CASH FLOW STATEMENT 22 NOTES TO THE FINANCIAL STATEMENTS 24 FIVE YEARS FINANCIAL SUMMARY 60 PARTICULARS OF PROPERTIES HELD BY THE GROUP 61 The English text of this Annual Report shall prevail over the Chinese text. P.01 Far East Technology International Limited CORPORATE INFORMATION PLACE OF INCORPORATION PRINCIPAL BANKERS Hong Kong Bank of China (Hong Kong) Limited The Hongkong and Shanghai Banking BOARD OF DIRECTORS Corporation Limited Executive Directors: The Bank of East Asia Limited Hang Seng Bank Limited Deacon Te Ken Chiu, J.P. (Chairman) Duncan Chiu, B.Sc. (Managing Director and Chief Executive Officer) REGISTERED OFFICE Dennis Chiu, B.A. 16th Floor, Far East Consortium Building 121 Des Voeux Road Central Non-executive Directors: Hong Kong Dato’ David Chiu, B.Sc. Daniel Tat Jung Chiu PRINCIPAL OFFICE Derek Chiu, B.A. Room 1802-1804, 18th Floor Desmond Chiu, B.A. Far East Consortium Building Margaret Chiu, LL.B. 121 Des Voeux Road Central Hong Kong Independent Non-executive Directors: ANNUAL Chi Man Ma SHARE REGISTRARS REPORT Dr. Lee G. Lam Computershare Hong Kong Investor Services 2004 Ryan Yen Hwung Fong Limited COMPANY SECRETARY