Annual Report 2014 Annual Report 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

How to Get to the Galapagos Islands

Specialist Galapagos Trip Advisors Lowest Price Guaranteed #1 Online Seller of Galapagos Tours Free Trip Planning Special Oers ARRIVING FROM EUROPE Carriers: KLM, LUFTHANSA, IBERIA, LAN, AVIANCA, AIR FRANCE, How to Get to the BRITISH AIRWAYS, AMERICAN AIRLINES, UNITED-CONTINENTAL AIRLINES, DELTA Routes: From local airport connecting in Madrid or Amsterdam directly or other European city connecting to the US. Galapagos Islands Possible stops in Central or South America ARRIVING FROM JAPAN, CHINA & REST OF ASIA Carriers: KLM, LUFTHANSA, ALL NIPPON AIRWAYS, AIR CHINA, JAPAN AIRLINES, AMERICAN AIRLINES, UNITED-CONTINENTAL ARRIVING FROM THE UNITED STATES & CANADA AIRLINES, DELTA Carriers: AMERICAN AIRLINES, UNITED-CONTINENTAL AIRLINES , Routes: DELTA, COPA, AIR CANADA, LAN, AVIANCA, AEROMEXICO, TAME From Beijing connecting in Atlanta, Houston, Los Angeles, Routes: Local airport-connecting ight in Atlanta, Houston, Frankfurt, or Tokyo. Miami or New York-Quito. From Tokyo connecting in Amsterdam, Atlanta, Dallas, Possible stops in Central or South America Houston, Washington. Possible stops in Central or South America. ARRIVING FROM AFRICA Carriers: KLM, AIR FRANCE, SOUTH AFRICAN AIRWAYS, IBERIA Routes: From your nearby international airport connecting to a major international airport in Europe or Brazil. Possible stop in South America. ARRIVING FROM AUSTRALIA & NEW ZEALAND ARRIVING FROM INDIA OR THE MIDDLE EAST Carriers: QUANTAS, LAN, AIR NEW ZEALAND, AMERICAN Carriers: KLM, LUFTHANSA, AIR FRANCE, AIR INDIA, IBERIA, DELTA, AIRLINES, UNITED-CONTINENTAL AIRLINES, DELTA EGYPTAIR, EMIRATES, AMERICAN AIRLINES, UNITED-CONTINENTAL Routes: From Sydney or Auckland connecting in Chicago, AIRLINES San Francisco, Los Angeles, New York, or Santiago (Chile). Routes: From your nearby international airport connecting to a Possible stops in North or South America. -

Page 1 of 205 9/1/2009

Page 1 of 205 As filed with the Securities and Exchange Commission on September 1, 2009 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F Amendment No. 1 REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 333-131938 Commission file number 333-145838-02 Commission file number 333-145838-01 TAM S.A. TAM Capital Inc. TAM Linhas Aéreas S.A. (Exact name of registrant as (Exact name of registrant as (Exact name of registrant as specified in its charter) specified in its charter) specified in its charter) Not applicable Not applicable TAM Airlines S.A. (Translation of registrant (Translation of registrant (Translation of registrant name into English) name into English) name into English) The Federative Republic of Brazil Cayman Islands The Federative Republic of Brazil (State or other jurisdiction of (State or other jurisdiction of (State or other jurisdiction of incorporation or organization) incorporation or organization) incorporation or organization) 4512 4512 4512 (Primary Standard Industrial (Primary Standard Industrial (Primary Standard Industrial Classification Code Number) Classification Code Number) Classification Code Number) Not applicable Not applicable Not applicable (I.R.S. Employer Identification Number) (I.R.S. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Integrated Report 2020 Index

INTEGRATED REPORT 2020 INDEX 4 28 70 92 320 PRESENTATION CORPORATE GOVERNANCE SECURITY METHODOLOGY SWORN STATEMENT 29 Policies and practices 71 Everyone’s commitment 93 Construction of the report 31 Governance structure 96 GRI content index 35 Ownership structure 102 Global Compact 5 38 Policies 103 External assurance 321 HIGHLIGHTS 74 104 Glossary CORPORATE STRUCTURE LATAM GROUP EMPLOYEES 42 75 Joint challenge OUR BUSINESS 78 Who makes up LATAM group 105 12 81 Team safety APPENDICES 322 LETTER FROM THE CEO 43 Industry context CREDITS 44 Financial results 47 Stock information 48 Risk management 83 50 Investment plan LATAM GROUP CUSTOMERS 179 14 FINANCIAL INFORMATION INT020 PROFILE 84 Connecting people This is a 86 More digital travel experience 180 Financial statements 2020 navigable PDF. 15 Who we are 51 270 Affiliates and subsidiaries Click on the 17 Value generation model SUSTAINABILITY 312 Rationale buttons. 18 Timeline 21 Fleet 52 Strategy and commitments 88 23 Passenger operation 57 Solidary Plane program LATAM GROUP SUPPLIERS 25 LATAM Cargo 62 Climate change 89 Partner network 27 Awards and recognition 67 Environmental management and eco-efficiency Presentation Highlights Letter from the CEO Profile Corporate governance Our business Sustainability Integrated Report 2020 3 Security Employees Customers Suppliers Methodology Appendices Financial information Credits translated at the exchange rate of each transaction date, • Unless the context otherwise requires, references to “TAM” although a monthly rate may also be used if exchange rates are to TAM S.A., and its consolidated affiliates, including do not vary widely. TAM Linhas Aereas S.A. (“TLA”), which operates under the name “LATAM Airlines Brazil”, Fidelidade Viagens e Turismo Conventions adopted Limited (“TAM Viagens”), and Transportes Aéreos Del * Unless the context otherwise requires, references to Mercosur S.A. -

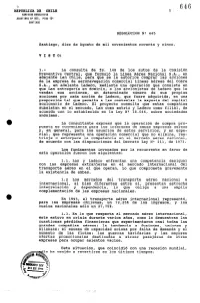

'P RBPIJBLICA DB CHILE RESOLUCION Ng 445 Santiago

‘P .l 646 RBPIJBLICA DB CHILE .L (MISION CRESOLUTIVA AGUSTINAS N’ 853, PISO 12’ SANTIAGO RESOLUCION Ng 445 Santiago, diez de Agosto de mil novecientos noventa y cinco. VIBTO: 1 La consulta de fs. 148 de los autos de la Comisión Prkentiva Central, que formuló la Linea Aerea Nacional S.A., en adelante Lan Chile, para gue se le autorice comprar las acciones de la empresa de aeronavegación comercial Lineas Aéreas del Cobre S.A., en adelante Ladeco, mediante una operación gue consiste en que Lan entregaría en dominio, a los accionistas de Ladeco que le vendan sus acciones, un determinado número de sus propias acciones por cada acción de Ladeco, que fuere adquirida, en una proporción tal que permita a Lan controlar la mayoría del capital accionario de Ladeco. El proyecto consulta que estas compañias subsistan en el mercado, Lan como matriz y Ladeco como filial, de acuerdo con lo establecido en la Ley NP 18.046, sobre sociedades anónimas. La consultante expresó que la operación de compra pro- puesta es conveniente para los intereses de ambas empresas aéreas y, en general, para los usuarios de estos servicios, y en espe- cial, que representa una operación comercial gue no elimina, res- trinje o entorpece la competencia en el mercado aéreo nacional, de acuerdo con las disposiciones del Decreto Ley NQ 211, de 1973. Los fundamentos invocados por la recurrente en favor de esta operación fueron los siguientes: 1.1. Lan y Ladeco enfrentan una competencia desigual con las empresas extranjeras en el mercado internacional del transporte aéreo en el que operan, lo gue compromete gravemente la existencia de ambas. -

Capital Increase Presentation

Enel Américas Capital Increase February 27th, 2019 Table of Contents Our Track Record Transaction Rationale Transaction Structure Closing Remarks 2 Our Track Record 3 Proposed Equity Capital Increase Facilitates Pursuit of Proven Growth Strategy Formation of Successful Up to US$ 3.5 Bn Continued the Largest Delivery of Capital Increase Growth Private Utility Growth and Capital Structure Strategy & Company in Shareholder Optimization to Consolidation LatAm Value Unlock Growth Created Americas- Organic Facilitates execution of Minority investors buyout focused growth vehicle growth strategy with leading market Captured efficiencies Privatization and position Cash flow optimization consolidation Expanded Free Market Unlocked efficiencies and Enel X segments Credit enhancement Enel X expansion Simplified structure Inorganic Higher market capitalization, float and Reduced leakage Acquired Enel Dx São liquidity Paulo and Enel Dx Goiás evidencing strong value creation capabilities 4 Our Track Record Sustainability, Growth, Efficiencies and Value Creation 2016 2018 I&N(3) End users MM 14.1 24.5 EBITDA US$ Bn 2.4 3.4 Growth Net Income US$ Bn 1.0 1.7 CAPEX US$ Bn 1.2 1.7 Group simplification Number of companies 43 32(4) Opex reduction Cumulated efficiencies(1,5) US$ MM ~ 130 ~ 420 Shareholder return Total Dividends US$ Bn 0.3 0.5 Value creation People benefited(1) MM (cumulated) 1.4 2.7 Sustainability commitment Index Member Number of indexes 0 4(2) Notes: 3. Infrastructure & Networks 5 1. Base year 2015 4. Not including acquired -

Memoria Anual 2014 Memoria Anual 2014

MEMORIA ANUAL 2014 MEMORIA ANUAL 2014 Índice NUESTRA EMPRESA OPERACIONES SOSTENIBILIDAD 105 Carta de Bienvenida 4 Operación Internacional de Pasajeros 60 Estrategia de Negocios 8 Argentina 63 ESTADOS FINANCIEROS Historia 10 Brasil 64 Flota 15 Chile 66 Estados Financieros 113 Destinos 21 Colombia 67 Filiales y Coligadas 251 Personas 30 Ecuador 69 Declaración Jurada 280 Información de la compañía 32 Perú 70 Operación de Carga 72 Programas de Fidelidad 74 Propiedades, Plantas y Equipos 76 GOBIERNO CORPORATIVO GESTIÓN 2014 Directorio 34 Entorno de la Industria 79 Ejecutivos 37 Marco Regulatorio 81 Prácticas Gobierno Corporativo 44 Resultados Financieros 87 Estructura de Propiedad y 51 Premios y Reconocimientos 92 Principales Accionistas Información Bursátil 93 Política Financiera 55 Información Adicional 99 Hechos Esenciales 100 Factores de Riesgo 102 2 MEMORIA ANUAL 2014 / NUESTRA EMPRESA HISTORIA CARTA DE BIENVENIDA FLOTA DESTINOS INFORMACIÓN DE LA COMPAÑIA PERSONAS ESTRATEGIA DE NEGOCIOS FILIALES Y COLIGADAS 3 MEMORIA ANUAL 2014 / NUESTRA EMPRESA Carta de bienvenida El 2014 fue un año de CARTA MAURÍCIO AMARO Durante 2014, la Compañía avanzó en su plan de renovación de flota, con el objetivo renovación para LATAM El 2014 fue un año de renovación para de reducir el número de modelos operados, LATAM Airlines Group, en el que hemos dado retirando gradualmente modelos menos Airlines Group, en el pasos importantes en el camino a conquistar eficientes y asignando las aeronaves más nuestra misión y convertirnos así en uno de adecuadas para cada uno de sus mercados. que hemos dado pasos los tres grupos de aerolíneas más importantes El plan de renovación de flota forma parte de del mundo. -

Estudio Para El Fomento De La Aviación Intrarregional

ESTUDIO PARA EL FOMENTO DE LA AVIACIÓN INTRARREGIONAL Informe Final Definitivo Diciembre del 2016 Licitación N° 725‐1‐LE16 Documento preparado para: Jefe de Estudio: Marcelo Villena, Ph.D. marcelo.villena@scl‐econometrics.cl // [email protected] 1. INTRODUCCIÓN ........................................................................................................ 1 2. ESTUDIO DE CASOS ................................................................................................... 4 2.1. Asociados Latinoamericanos de Transporte Aéreo (ALTA)............................................. 4 2.2. LC Perú (ex LC Busre) (Perú) ........................................................................................ 15 2.3. GOL y Azul (Brasil) ...................................................................................................... 27 2.4. Transportes Aéreos Militares Ecuatorianos‐TAME (Ecuador) ...................................... 41 2.5. Viva Colombia (Colombia) .......................................................................................... 52 2.6. Principales Conclusiones del Estudio de Casos ............................................................ 58 3. DETERMINANTES DE LA DEMANDA EN LA MACROZONA NORTE ............................ 64 3.1. Caracterización socioeconómica de la macrozona norte ............................................. 64 3.2. Comportamiento de la demanda ................................................................................ 82 3.3. Estacionalidad en el tráfico ........................................................................................ -

Empresas De Trabajos Aéreos Especiales Certificadas

EMPRESAS DE TRABAJOS AÉREOS ESPECIALES CERTIFICADAS NO. CERT. RAZON SOCIAL VIGENTE CANCELADO CDO-AA- 01 FUMIVILLA LTDA. FUMIGACIONES AEREAS DE VILLANUEVA X CDO-AA- 02 SERVICIOS AEROAGRICOLAS DEL LLANO S.A.S SADELL S.A.S X CDO-AA- 03 FADELCE LTDA. FUMIGACIONES AEREAS DEL CESAR X CDO-AA- 04 AMA LTDA. AVIONES Y MAQUINARIAS AGRICOLAS X CDO-AA- 05 SFA LTDA. SERVICIO DE FUMIGACION AEREA DEL CASANARE X CDO-AA- 06 COMERCIALIZADORA ECO LTDA. X CDO-AA- 07 FUMICOL S.A. FUMIGACIONES AEREAS DE COLOMBIA, ANTES LTDA. X CDO-AA- 08 SERVICIO AÉREO ORIENTE (SAO) X CDO-AA- 09 AEROPENORT X CDO-AA- 10 AEROTEC LTDA. ASPERSIONES TECNICAS DEL CAMPO X CDO-AA- 11 FAGAN S. EN C." FUMIGACION AEREA LOS GAVANES X CDO-AA- 12 SERVICIOS AÉREOS AGRICOLAS DE CASANARE (SAAC) X CDO-AA- 13 AERO SANIDAD AGRICOLA S. EN C. "ASA LTDA." X CDO-AA- 14 AEROSERVICIOS MAJAGUAL "ASEM LTDA" X CDO-AA- 15 FARI LTDA. FUMIGACIONES AEREAS DEL ARIARI X CDO-AA- 16 FUMIGARAY S.A. SERVICIOS DE FUMIGACION AEREA GARAY ANTES, LTDA. X CDO-AA- 17 AVIOCESAR SAS AMBULANCIA AEREA X CDO-AA- 18 QUIMBAYA EXPLORACION Y RECURSS GEOMETRICOS X CDO-AA- 19 TAES X CDO-AA- 20 COMPAÑÍA COLOMBIANA DE AEROSERVICIOS X CDO-AA- 21 COMPAÑÍA AEROAGRICOLA DE GIRARDOT "AGIL" X CDO-AA- 22 COMPAÑÍA AEROEXPRESS (AEROFOTOGRAFIA) X CDO-AA- 23 AMBULANCIAS AÉREAS DE COLOMBIA LTDA X CDO-AA- 24 GLOBAL SERVICE AVIATION ESA X CDO-AA- 25 RIOSUR - AMBULANCIA X CDO-AA- 26 AVIONES PUBLICITARIOS DE COLOMBIA S.AS AERIAL SIGN X CDO-AA- 27 MEDICALFLY S.A.S X CDO-AA- 28 FUNDACION CARDIOVASCULAR X CDO-AA- 29 TECNIAEREAS DE COLOMBIA SAS X CDO-AA- 30 SOLAIR AMBULANCIA X CDO-AA- 31 COLCHARTER X CDO-AA- 32 SERVICIOS AEREOS ESPECIALES SAE - GLOBAL LIFE AMBULANCIAS X CDO-AA- 33 ISATECH CORPORATION AEROFOTOGRAFIA X CDO-AA- 34 GOODFLY CO SAS AMBULANCIA AEREA X CDO-AA- 35 SOCIEDAD AEROAGRICOLA DE AMBALEMA SAMBA X CDO-AA- 36 MG MEDICAL GROUP X CDO-AA- 37 LANS X CDO-AA- 38 COMPAÑÍA AEROAGRICOLA INTEGRAL SAS - CAAISA X CDO-AA- 39 CELTA LTDA. -

Boletin 3068 De Registros Del 11 Febrero Al 17 Febrero De 2012 Publicado 23 Febrero De 2012

BOLETIN 3068 DE REGISTROS DEL 11 FEBRERO AL 17 FEBRERO DE 2012 PUBLICADO 23 FEBRERO DE 2012 Para los efectos señalados en el artículo 47 del Código Contencioso Administrativo, se informa que: Contra los actos de inscripción en el registro mercantil que aparecen relacionados en el presente boletín proceden los recursos de reposición y de apelación. Contra el acto que niega la apelación procede el recurso de queja. El recurso de reposición deberá interponerse ante la misma Cámara de Comercio de Bogotá, para que ella confirme, aclare o revoque el respectivo acto de inscripción. El recurso de apelación deberá interponerse ante la misma Cámara de Comercio de Bogotá, para que la Superintendencia de Industria y Comercio confirme, aclare o revoque el acto de inscripción expedido por la primera entidad. El recurso de queja deberá interponerse ante la Superintendencia de Industria y Comercio, para que ella determine si es procedente o no el recurso de apelación que haya sido negado por la Cámara de Comercio de Bogotá. Los recursos de reposición y apelación deberán interponerse por escrito dentro de los cinco días hábiles siguientes a esta publicación. El recurso de queja deberá ser interpuesto por escrito dentro de los cinco días siguientes a la notificación del acto por medio del cual se resolvió negar el de apelación. Al escrito contentivo del recurso de queja deberá anexarse copia de la providencia negativa de la apelación. Los recursos deberán interponerse dentro del término legal, expresar las razones de la inconformidad, expresar el nombre y la dirección del recurrente y 1 relacionar cuando sea del caso las pruebas que pretendan hacerse valer. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010.