58174 Journalism School-Journal PPG.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ricks College Becomes Brigham Young University–I

A CASE STUDY OF ORGANIZATIONAL LEARNING AND TRANSITIONS IN HIGHER EDUCATION: RICKS COLLEGE BECOMES BRIGHAM YOUNG UNIVERSITY–IDAHO A Dissertation Presented in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy with a Major in Education in the College of Graduate Studies University of Idaho by LaNae Hammon Poulter November 15, 2007 Major Professor: Roger L. Scott, Ph.D. iii ABSTRACT This qualitative case study takes advantage of the opportunity to focus on organizational learning during a season of change in higher education as Ricks College became Brigham Young University–Idaho. This case investigates an organization dedicated to higher education which is experiencing rapid and extreme change in its physical, institutional, and human infrastructure. Open-ended questioning during interviews and focus groups inductively led to a view of the grand tour question: “How was organizational learning demonstrated during times of extreme change and the ongoing transition of becoming Brigham Young University–Idaho?” The researcher listened to 27 participants and wove their stories together to present a tapestry of the transition. Participants described their mixed response to the announcement that Ricks College would become BYU–Idaho. Then the purposefully selected administrators, faculty, staff, students, and community leader shared their experiences of the first five years as BYU–Idaho. Interrelated aspects of the transition guided the discussion: (1) faculty, (2) budget, (3) space, (4) degree programs, (5) support services, and (6) students. Even though the participants share common values as members of The Church of Jesus Christ of Latter-day Saints, these adults learned individually to adapt to a changing world. -

A Study of the Utah Newspaper War, 1870-1900

Brigham Young University BYU ScholarsArchive Theses and Dissertations 1966 A Study of the Utah Newspaper War, 1870-1900 Luther L. Heller Brigham Young University - Provo Follow this and additional works at: https://scholarsarchive.byu.edu/etd Part of the Journalism Studies Commons, and the Mormon Studies Commons BYU ScholarsArchive Citation Heller, Luther L., "A Study of the Utah Newspaper War, 1870-1900" (1966). Theses and Dissertations. 4784. https://scholarsarchive.byu.edu/etd/4784 This Thesis is brought to you for free and open access by BYU ScholarsArchive. It has been accepted for inclusion in Theses and Dissertations by an authorized administrator of BYU ScholarsArchive. For more information, please contact [email protected], [email protected]. A STUDY OF THE UTAH NEWSPAPER WAR, 1870-1900 A Thesis Presented to the Department of Communications Brigham Young University In Partial Fulfillment of the Requirements for the Degree Master of Arts by Luther L« Heller July 1966 ACKNOWLEDGMENTS The author is sincerely grateful to a number of people for the inspiration and guidance he has received during his graduate study at Brigham Young University and in the writing of this thesis0 Because of the limited space, it is impossible to mention everyone. However, he wishes to express his appreciation to the faculty members with whom he worked in Communications and History for the knowledge which they have imparted* The author is especially indebted to Dr, Oliver R. Smith, chairman of the author's advisory committee, for the personal interest and patient counselling which have been of immeasurable value in the preparation of this thesis. -

Utah Symphony 2014-15 Fnishing Touches Series

University of Utah Professors Emeriti Club NEWSLETTER #7 2013/2014________________________________________________________________________________________________March_2014 April Luncheon Presentation Michael A. Dunn April 8, 2014, Tuesday, 12:15 pm Michael Dunn is the Chief Marketing Officer for Surefoot, a Park City, UT-based corporation that operates retail ski boot and specialty running stores in the United States and six foreign countries. Before joining Surefoot he was the General Manager of KUED Channel 7 where he directed the operations of this highly regarded PBS affiliate in Salt Lake City. Prior to his public television experience he founded and operated Dunn Communications, Inc, a Salt Lake City advertising agency and film production company for 16 years. Among his peer distinctions are a gold and silver medal from the New York Film Festival and four CLIOs--an award considered the “Oscar” of the advertising industry. In the spring of 2000 he was honored by the American Advertising Federation, Utah Chapter, as the inaugural recipient of the Advertising Professional of the Year Award. Michael spent 13 years as a senior writer and producer for Bonneville Communications where he worked on the highly acclaimed Homefront campaign for the LDS Church, and Fotheringham & Associates (now Richter 7). As a documentarian, he recently completed A Message to the World, a film about Salt Lake City’s post-Olympic environmental message to the citizens of Torino, Italy. Dunn graduated from the University of Utah where he received both his Bachelor’s and Master’s degrees in Communication. Professionally he earned an APR certificate from the Public Relations Society of America. Michael and his wife Linda have three children and three grand children. -

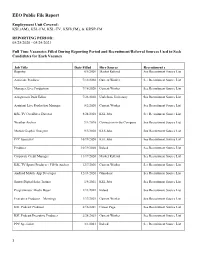

EEO-Public-File-Report-2020-2021

EEO Public File Report Employment Unit Covered: KSL(AM), KSL-FM, KSL-TV, KSFI(FM), & KRSP-FM REPORTING PERIOD: 05/25/2020 - 05/24/2021 Full Time Vacancies Filled During Reporting Period and Recruitment/Referral Sources Used to Seek Candidates for Each Vacancy Job Title Date Filled Hire Source Recruitment s Reporter 6/5/2020 Market Referral See Recruitment Source List Associate Producer 7/12/2020 Current Worker See Recruitment Source List Manager, Live Production 7/16/2020 Current Worker See Recruitment Source List Assignment Desk Editor 7/23/2020 Utah State University See Recruitment Source List Assistant Live Production Manager 8/2/2020 Current Worker See Recruitment Source List KSL TV OverDrive Director 8/24/2020 KSL Jobs See Recruitment Source List Weather Anchor 9/1/2020 Connection in the Company See Recruitment Source List Motion Graphic Designer 9/3/2020 KLS Jobs See Recruitment Source List PPC Specialist 10/19/2020 KSL Jobs See Recruitment Source List Producer 10/19/2020 Indeed See Recruitment Source List Corporate Credit Manager 11/17/2020 Market Referral See Recruitment Source List KSL TV Sports Producer / Fill-In Anchor 12/7/2020 Current Worker See Recruitment Source List Android Mobile App Developer 12/14/2020 Glassdoor See Recruitment Source List Senior Digital Sales Trainer 1/4/2021 KSL Jobs See Recruitment Source List Programmatic Media Buyer 1/11/2021 Indeed See Recruitment Source List Executive Producer – Mornings 1/17/2021 Current Worker See Recruitment Source List KSL Podcast Producer 2/16/2021 Career Page See Recruitment -

Biwiitfttpb (Concluded from Page 1) Btbbbbhbhpm- 44 Bbbbbbbbbbbbp- V

THE BROAD AX, CHICAGO, ILLINOIS, SATURDAY, DECEMBER 23, 1922 THE CHRISTMAS ISSUE OR THE TWENTY-SEVENT- H ANNIVERSARY AX EDITION OF THE BROAD 'LLLLLLLLLLLLLLLLLLLLLLLLLLLBIbh "STILL LOOKING BACKWARD AND FORWARD." CHAPTER IL BiwiitfttPB (Concluded from page 1) btbbbbHBHPm- 44 bbbbbbbbbbBBP- v. 'WmSilmMnsSfKiisiii&H dreds and hundreds of friends and formed Senator Cannon that "the papers of Utah for starting the long staunch supporters in all parts of this order had gone forth transferring the and bitter fight which was made on LaLLBLw BaLlB broad land and at the present time it 24th regiment to Fort Douglas; that Senator Cannon, which finally termi- LLLLBff IBaLLLB' bbbHbbLE -- jIIHHbhBsI has a regular mailing list of more than he could not recall nor revoke it," nated in hurling him headlong into his sixty feet long and it is now trans- and in spite of all the efforts put forth political grave. ported to the main postoffice by auto by the Tribune and Senator Cannon, It is still fresh in the minds of the from which it is transported through on October 21, 1896, the 24th regiment people in this city and throughout the 5" JflBaVs ii BBIs9SB9BiE93aBBBBBl the mails to all parts of the United proudly marched through the streets United States or throughout all parts IBBt Bfe 3bBbBB!j1bP Fort LHBBalliPw'arHBBBBBHBaMk ' ML BBBb .eBBBBlBBBlleS&SfilBHBMl States. of Salt Lake City on its way to of the world, for that matter, how The jbbbhBSs&bbIIbV 1906 bbbbbHEjK oMBKtu Many times copies containing its Douglas. Broad Ax in November, began LaLLLBIiF 'v iLLB HHK its terriffic, memorable, nation or BanananananananaKiLfvBanaaiMMw&L aaaaaaaaaaaaaaa bbbbbVSSPIubbbbbbbbbbbBTvJwix i ,v- iVIKceQtHHP bbbbbbbbbbbbbwIbImSibbbbbbt bright and sparkling editorials and One year after this incident the Salt or HaBaaaaaaaaaaaK-3vaaaaaaaaaaaj- g HHsf JPaBBBBBBH bbbbbbbLB'. -

Backgrounder: Deseret News, Salt Lake City, Utah

Backgrounder Deseret News: Interviewed 5/16/11 Newspaper Deseret News Owner Deseret News Publishing Company, a subsidiary of Deseret Management Corporation, a for-profit business holdings company owned by the Mormon Church (The Church of Jesus Christ of Latter-day Saints) Address 55 North 300 West, Salt Lake City, UT 84101 Phone number 801-236-6000 URL Deseretnews.com Circulation Daily 73,075; Sunday 79,433 President & CEO Name Clark Gilbert Start Date 2009 as CEO Deseret Digital; 2010 as CEO Deseret News Phone number 801-333-7497 E-mail [email protected] Newspaper Staff Total FTEs Publication cycle 7-days, a.m. Current Circulation Weekdays 73,075 Sundays 79,435 E-edition 20,261 Price Weekday newsstand $0.75 Sunday newsstand $2.00 Subscription annual $208.00 E-edition $43.80 Ancillary Businesses of Deseret News & Deseret DeseretNews.com, KSL.com, DeseretBook.com, Digital MormonTimes.com and LDSChurchNews.com Digital Pay wall? No Considering a pay wall? No Advertising Is your advertising staff able to provide competitive Yes digital services to merchants? Do you use "real time" ads? Yes Does your advertising department sell "digital services" Yes such as helping merchants with website production? Does your ad department sell electronic coupons or other Yes modern digital products? Other? Do you generate revenue in partnership with outside Yes, remnant providers digital vendors such as Yahoo? If so, who are they? Managing Editor Name Richard Hall Valid Sources, “Who Needs Newspapers?” project; 1916 Pike Pl., Ste 12 #60, Seattle, WA.98101 www.whoneedsnewspapers.org Backgrounder Deseret News: Interviewed 5/16/11 Start date Phone number 801- 237-2110 E-mail [email protected] V.P. -

New Media Training

new media training January 19, 2011 Salt Lake City Agenda SESSION 1: WHAT IS SOCIAL MEDIA & WHY DOES IT MATTER BALLROOM C Tom Love (Love Communications) Laura Mayes (Blog Con Queso, Kirtsy, Mom 2.0, Mighty Events) Clark Gilbert (Deseret Digital Media) SESSION 2: BREAKOUT SESSIONS Choose from one of the following Breakout Sessions: BREAKOUT A – CAMPAIGN ADVERTISING BALLROOM D (PRODUCTS, ISSUES, OR CANDIDATES) Liz Mair (Hynes Communications) Vincent Harris (Harris Media) Andrew Roos (Google) BREAKOUT B – SIX TOOLS IN SIXTY MINUTES BALLROOM C YouTube – Andrew Roos (Google) List-building – Rachael Herrscher (TodaysMama.com) LinkedIn – Jason Alba (JibberJobber.com) Facebook – Kuulai Hanamaikai (Love Communications) Geotagging – Monica Danna (Cosmopolitician.com) Twitter – Troy Pattee (Mom It Forward) SESSION 3: EFFECTIVE SOCIAL MEDIA STRATEGIES BALLROOM C Chris Nichols (utahREpro) Mike Petroff (Deseret Digital Media) Neil Chase (Federated Media) Julie Bazgan (Love Communications) Speakers JASON ALBA JULIE BAZGAN NEIL CHASE JibberJobber.com Director, Digital Marketing, Federated Media Love Communications Jason Alba is the CEO and creator of Julie is the Digital Marketing Director Neil Chase is Senior Vice President for JibberJobber.com, a web-based system at Love Communications. As an online Editorial at Federated Media, where he to organize and manage a job search marketing strategist and planner with works with more than 100 of the best (and the networking you do between job over 15 years of digital and marketing independent publishers on the Web. searches). Jason is a certified Personal communications experience, she has He has worked as an editor and page Branding Strategist and popular blogger developed digital branding, online lead designer at several newspapers and was and speaker about career management generation and eCommerce strategies Managing Editor at CBS MarketWatch, and social tools for professionals. -

2016 Year in Review

2016 YEAR IN REVIEW “WE HAVE DIFFERENT LIVES AND FACES, BUT OUR HEARTS HAVE COMMON PLACES” RAGTIME SHOWBOAT PORGY & BESS PUCCINI’S TRILOGY PETER PAN Dear Friends We are already gearing up for an Zions Bank for their unselfish devotion outstanding 2017 season this coming and support in making the renovation of summer as we celebrate 25 years of this historic theater possible. presenting world-class opera and musical theater here in Logan! We hope you We need your help as we begin our enjoyed the wonderful performances and celebration! Our year-end appeal for special events during our bigger-than- donations is now in full force. Will life 2016 festival this past summer that you partner with us as we enter the generated rave reviews and reminded us next quarter of a century of providing that “all men are created equal.” We are world-class productions on the stage, so grateful to you, our sponsors, patrons, ground-breaking education programs for and donors, for the leading roles you play students, and year-round programs in in our success. THANK YOU! We simply the Utah Theatre? Your donation of any could not do it without you! amount has the power to change lives and help us fulfill our mission: bringing The beautiful Utah Theatre will play a people together to share ennobling artistic major role this coming year, with classic experiences. films, special productions, concerts, and events featuring the Mighty Wurlitzer Gratefully, Organ. With our summer productions now being housed in both the Ellen Eccles and the Utah Theatres, we BOARD OF DIRECTORS are pleased to be able to expand our MICHAEL BALLAM Founding General Director programming. -

Utah's Anti-Polygamy Society, 1878-1884

Brigham Young University BYU ScholarsArchive Theses and Dissertations 1980 Utah's Anti-Polygamy Society, 1878-1884 Barbara Hayward Brigham Young University - Provo Follow this and additional works at: https://scholarsarchive.byu.edu/etd Part of the Family, Life Course, and Society Commons, History Commons, and the Mormon Studies Commons BYU ScholarsArchive Citation Hayward, Barbara, "Utah's Anti-Polygamy Society, 1878-1884" (1980). Theses and Dissertations. 4779. https://scholarsarchive.byu.edu/etd/4779 This Thesis is brought to you for free and open access by BYU ScholarsArchive. It has been accepted for inclusion in Theses and Dissertations by an authorized administrator of BYU ScholarsArchive. For more information, please contact [email protected], [email protected]. UTAHS antipolygamyANTI POLYGAMY SOCIETY 187818841878 1884 A thesis presented to the department of history brigham young university in partial fulfillment of the requirements for the degree master of arts by barbara hayward april 1980 this thesis by barbara J hayward is accepted intn its present form by the department of history of brigham young university as satisfying the thesis requirement for the degree of master of arts LZ u g3 e E campbell committdej chairmchaiem n A Aftzatz i 0ie S voodwood committee member wl 02 ca date Tteddc&warner beoartment5epartmentdepartment chaichalchairmanrmanaman typed by mary jo F schaub CONTENTS chapter page 1 introduction 1 2 MORMONS AND GENTILES 5 cormonsmormons 5 gentiles 10 anti polygamy measures before 1878 11 3 introduction -

Byu-Idaho Spring 2015

WELCOME BACK BYU-IDAHO SPRING 2015 INSIDE: President Clark reflects Map of Rexburg Simple secrets to success Places to ride Eight places to visit Amphitheater BYU-I Rexburg 2 Welcome Back BYU-I Spring 2015 S ta geCenter StageCenter SPRING 2015 BR IGHA M YO UNG UNI VERSITY -IDAH O P ERFORMI N G A R T S S ERI E S A. LINCOLN MIDAS WHALE PATRIOTS AND PIONEERS FEATURING BYU-IDAHO STUDENTS A ONE–MAN PLAY SATURDAY, MAY 30 FRIDAY AND SATURDAY, MAY 1-2 7:30 P.M., KIRKHAM AUDITORIUM AND SPECIAL GUESTS THE DALLAS BRASS 7:30 P.M., SNOW DRAMA THEATER SATURDAY, JULY 11 e folk rock duo Midas Whale features Jon is one-man, two-act play by actor Steve 7:30 P.M., BYU-IDAHO CENTER Peter Lewis and Ryan Hayes. Holgate dramatizes Lincoln’s life and presidency. 6 P.M., PRESHOW DINNER Tickets go on sale May 4. Tickets now on sale. e BYU-Idaho College of Performing and $6 BYUI students, $12 public $6 BYUI students, $12 public Visual Arts will present a major July concert to celebrate American patriots and pioneers. e Dallas Brass will join more than 200 THE FAB FOUR students, including Men’s Choir, Women’s Choir and Symphony Band. FRIDAY, MAY 8 7:30 P.M., HART AUDITORIUM Tickets go on sale June 1. 6:00 P.M., PRESHOW DINNER $3 BYUI students, $6 public e L.A. Times calls it “e best Beatles show in the world.” Tickets now on sale. $6 BYUI students, $12 public Preshow dinner $15 extra DUE WEST FRIDAY, JUNE 5 7:30 P.M., HART AUDITORIUM Due West is a country trio based out of Nashville. -

The Deseret News

The Deseret News SALT LAKE CITY 15C Nostrums in the Newsroom Raised Sights and Raised Expectations at the DeseretNews By Paul Swenson Nineteen Hundred and Seventy-Six was not a dull year for the 127-year-old Deseret News. Melvin Dummar, a Box Elder County service station operator, was named, along with The Church of Jesus Christ of Latter-day Saints, as a major beneficiary in a purported Howard Hughes will. Idaho's Teton Dam burst, leaving hundreds homeless in the path of the flood. Rep. Allan Howe was arrested and convicted of soliciting sex in Salt Lake City. Theodore Bundy, a University of Utah law student and former aide to the Governor of Washington, was found guilty of attempted kidnapping. In addition, the newspaper's "Pinpoint" investigative team capped its second year of existence with a Sigma Delta Chi award for the year's best piece of investigative print journalism in Utah, a documented indictment of misspent Salt Lake County funds. And then there was Gary Gilmore. Before his execution, Jan. 17, 1977, Gilmore and the press were locked in a painful embrace that neither party could—or would—quit. The manipulative Gilmore engineered the newsflow on front pages worldwide with a degree of control he had never been able to apply to his own life. It was an irresistable news story: a brutal killer who wanted to die, and in the process challenged the hypocrisy behind a death sentence that seemed tortuously slow to culminate. Never mind that Gilmore was the first person likely to be executed in the United States in nine years and that the future of capital punishment in America perhaps hung in the balance. -

Day 1, April 19, 2013: Morning Session - 8:40-9:45 A.M

14th Annual International Symposium on Online Journalism Day 1, April 19, 2013: Morning Session - 8:40-9:45 a.m. Strengthening Journalism in an Era of Digital Disruption Chair: Tom Rosenstiel, Executive Director, American Press Institute Keynote Speaker: Clark Gilbert, President and CEO, Deseret News Publishing Company, former professor at Harvard Business School Q & A: Tom Rosenstiel and Clark Gilbert Tom Rosenstiel: People like to use the word ‘disruption.’ I actually think it’s the wrong word now. This is opportunity. The technology provides those who want to produce journalism with so many more tools, it’s as if we were building houses with a saw, a hammer, screwdriver, and now we have all the tools that you could get at Home Depot to do that job better. People who felt disrupted need to feel as if there’s enormous potential and opportunity. The future of journalism—as it does for anything else—belongs to people who believe in the future. And optimism is extremely important to this. And in this first session, you’re going to hear from somebody who is really doing it on the ground. If you don’t Clark Gilbert, you are in for a really significant treat. Clark is the CEO of Deseret News Publishing Company and Deseret Digital Media. And he will explain to you why those are two different companies. He was Professor of Entrepreneurial Management at Harvard Business School. He worked closely with Clayton Christensen, who if you don’t know, is the author of Innovator’s Dilemma. Clark was involved in trying to innovate the university when he was Associate Academic Dean and Vice President of Brigham Young University in Idaho, in charge of online learning and distance education.