(Effective from August 21, 2018) the Following Stock Margin Ratios Are for Reference Only, Which Are Subjecte

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD

UOB KAY HIAN (SINGAPORE) PRIVATE LIMITED MARGIN STOCK LIST - HONG KONG MARKET 1 April 2021 Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD. SA HK 2 CLP HOLDINGS LTD. A HK 3 HONG KONG AND CHINA GAS CO. LTD. A HK 4 WHARF (HOLDINGS) LTD. A HK 5 HSBC HOLDINGS PLC SA HK 6 POWER ASSETS HOLDINGS LTD. SA HK 8 PCCW LTD. C HK 10 HANG LUNG GROUP LTD. A HK 11 HANG SENG BANK LTD. SA HK 12 HENDERSON LAND DEVELOPMENT CO. LTD. A HK 14 HYSAN DEVELOPMENT CO. LTD. B HK 16 SUN HUNG KAI PROPERTIES LTD. SA HK 17 NEW WORLD DEVELOPMENT CO. LTD. A HK 19 SWIRE PACIFIC LTD. 'A' A HK 23 BANK OF EAST ASIA, LTD. A HK 27 GALAXY ENTERTAINMENT GROUP LTD. A HK 38 FIRST TRACTOR CO LTD. - H SHARES D HK 41 GREAT EAGLE HOLDINGS LTD. C (Max Net Loan H$10M) HK 45 HONGKONG AND SHANGHAI HOTELS, LTD. B (Max Net Loan H$10M) HK 53 GUOCO GROUP LTD. B (Max Net Loan H$10M) HK 56 ALLIED PROPERTIES (HK) LTD. D HK 62 TRANSPORT INTERNATIONAL HOLDINGS LTD. D (Max Net Loan H$1M) HK 66 MTR CORPORATION LTD. SA HK 69 SHANGRI-LA ASIA LTD. A HK 81 CHINA OVERSEAS GRAND OCEANS GROUP LTD. C HK 83 SINO LAND CO. LTD. A HK 86 SUN HUNG KAI & CO. LTD. D HK 87 SWIRE PACIFIC LTD. 'B' A (Max Net Loan H$10m) HK 101 HANG LUNG PROPERTIES LTD. A HK 107 SICHUAN EXPRESSWAY CO. -

Stock Margin Ratio (Effective from July 01, 2020) the Following Stock

Stock Margin Ratio (Effective from July 01, 2020) The following stock margin ratios are for reference only, which are subjected to change as determined by the market conditions, client’s trading accounts status and other relevant factors. We deserve the right to vary margin ratios and/or stop offering loan for financing margin trading at all times under any circumstances without prior notice to clients. Margin Ratio Stock Code Name of stock (%) 1 HK Equity CK HUTCHISON HOLDINGS LTD 70 2 HK Equity CLP HOLDINGS LTD 70 3 HK Equity HONG KONG & CHINA GAS 70 4 HK Equity WHARF HOLDINGS LTD 70 5 HK Equity HSBC HOLDINGS PLC 70 6 HK Equity POWER ASSETS HOLDINGS LTD 70 7 HK Equity HONG KONG FINANCE INVESTMENT 0 8 HK Equity PCCW LTD 60 9 HK Equity KEYNE LTD 0 10 HK Equity HANG LUNG GROUP LTD 60 11 HK Equity HANG SENG BANK LTD 70 12 HK Equity HENDERSON LAND DEVELOPMENT 70 14 HK Equity HYSAN DEVELOPMENT CO 50 15 HK Equity VANTAGE INTERNATIONAL 0 16 HK Equity SUN HUNG KAI PROPERTIES 70 17 HK Equity NEW WORLD DEVELOPMENT 70 18 HK Equity ORIENTAL PRESS GROUP LTD 0 19 HK Equity SWIRE PACIFIC LTD - CL A 70 20 HK Equity WHEELOCK & CO LTD 70 21 HK Equity GREAT CHINA PROPERTIES HOLDI 0 22 HK Equity MEXAN LTD 0 23 HK Equity BANK OF EAST ASIA LTD 50 24 HK Equity BURWILL HOLDINGS LTD 0 25 HK Equity CHEVALIER INTERNATIONAL HOLD 0 26 HK Equity CHINA MOTOR BUS CO 10 27 HK Equity GALAXY ENTERTAINMENT GROUP L 70 28 HK Equity TIAN AN CHINA INVESTMENT 0 29 HK Equity DYNAMIC HOLDINGS LTD. -

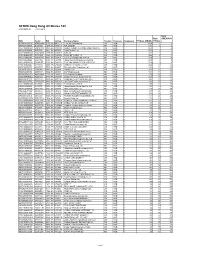

STOXX Hong Kong All Shares 180 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 180 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

An Assessment of Environmental and Social Transparency of Food Related Companies Currently Listing in Hong Kong Stock Exchange

An assessment of Environmental and Social transparency of food related companies currently listing in Hong Kong Stock Exchange October 2017 Hong Kong 1 Executive Summary Oxfam Hong Kong seeks to better understand opportunities to engage with companies in Hong Kong. Oxfam Hong Kong commissioned CSR Asia to conduct a benchmarking exercise to assess the Environmental and Social transparency in the food, beverages, and agricultural products sectors in Hong Kong. The aims of this exercise were: To assess food companies’ Environment and Social transparency To summarise the Environment and Social transparency of selected companies. To assess what companies are doing to create more inclusive business models relating to both products and value chains, and to engage with issues associated with access to food products for poor people. To make recommendations on the business case for food companies to implement responsible business policies In total, 61 companies were benchmarked in this study. Data was compiled from publicly available information published in 2015 including corporate websites, annual reports and sustainability reports. Overall, the level of disclosure by the 61 companies is relatively low and indeed they were failed. Only 3 companies achieved over 30 points and 55 of the companies scoring below 20 points. This may seem disappointing at first but it should be recognized that the GRI indicators are very comprehensive and that most companies in Hong Kong are a long way from being able to report on them. Companies demonstrated weak performance in both categories in which the average score of social and environment are 12.5 and 8.7 respectively. -

2010 PUF Detailed Schedule of Investments

PERMANENT UNIVERSITY FUND DETAIL SCHEDULES OF INVESTMENT SECURITIES AND INDEPENDENT AUDITORS’ REPORT August 31, 2010 Independent Auditors’ Report The Board of Regents of The University of Texas System The Board of Directors of The University of Texas Investment Management Company We have audited, in accordance with auditing standards generally accepted in the United States of America, the financial statements of the Permanent University Fund (the “PUF”), as of and for the year ended August 31, 2010, and have issued our unqualified report thereon dated October 29, 2010. We have also audited the accompanying schedule of PUF’s equity securities (Schedule A), preferred stocks and convertible securities (Schedule B), purchased options (Schedule C), debt securities (Schedule D), investment funds (Schedule E), cash and cash equivalents (Schedule F), hedge fund investment pools (Schedule G), and the private investment pools (Schedule H) as of August 31, 2010. These schedules are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these Schedules based on our audit. In our opinion, the Schedules referred to above, when read in conjunction with the financial statements of the PUF referred to above, present fairly, in all material respects, the information set forth therein. October 29, 2010 PERMANENT UNIVERSITY FUND SCHEDULE A EQUITY SECURITIES August 31, 2010 SECURITY SHARES VALUE COST ($) ($) DOMESTIC COMMON STOCKS ACTUATE SOFTWARE CORP................................................................ 198,496 791,999 963,243 AES CORP.............................................................................................. 21,740 222,618 249,543 AKAMAI TECHNOLOGIES INC............................................................... 22,610 1,041,643 970,133 ALCOA INC............................................................................................. 104,043 1,062,279 1,295,450 ALEXANDERS INC................................................................................. -

CUNY 9-30-14 Holdings W $ Amounts.Xlsx

City University of New York (CUNY) Portfolio Holdings by Manager as of September 30, 2014 Manager A Total Size of Holding Region/Country/Security ($000) North America - Dev. United States Yum Brands Inc 120.2 Europe - Dev. Luxembourg Tenaris Sa 246.3 Portugal Jeronimo Martins 97.1 United Kingdom Bhp Billiton Plc 118.0 Sabmiller Plc 208.3 Standard Chart Plc 217.2 Asia/Pacific - Dev. Hong Kong Aia Group Ltd 276.7 China Mobile Ltd 355.1 Hang Lung Group 127.5 Hang Lung Prop 113.7 Swire Pacific 217.1 Swire Pacific 39.5 Swire Properties L 44.7 Europe - Emg. Hungary Danubius Hotel 0.0 Gedeon Richter Plc 115.2 Legend: EGR* = Earnings Growth Rate, "---" = Not Available Sources: MSCI Inc. and FactSet Fundamentals City University of New York (CUNY) Portfolio Holdings by Manager as of September 30, 2014 Manager A Total Size of Holding Region/Country/Security ($000) Poland Bk Pekao 197.4 Russia Lukoil Oil Company 280.9 Magnit Pjsc 178.6 Turkey Akbank 172.7 Bim Birlesik Magaz 151.5 T Garanti Bankasi 168.1 South/Latin America - Emg. Brazil Bco Bradesco Sa 8.7 Bradesco Banco 291.1 Cia Souza Cruz 99.8 Lojas Renner Sa 115.9 Multiplan Empreend 97.3 Petrobras-Petroleo Brasilier 193.3 Petrobras-Petroleo Brasilier 23.6 Ultrapar Participa 219.5 Vale Sa 244.7 Vale Sa 37.1 Chile Banco Santander-Chile 132.6 Mexico Consorcio Ara Sab 1.6 Fomento Economico Mexicano 302.2 Gpo Fin Banorte 249.9 Grupo Aeroportuario Sureste 125.7 Organizaci Soriana 52.1 Legend: EGR* = Earnings Growth Rate, "---" = Not Available Sources: MSCI Inc. -

Hong Kong Marginable Securities List

MRS-101 HK Marginable Securities List (with effect from 1 September 2021) The default single counter concentration limit is up to SGD100,000 per counter. Shares with single counter concentration limit higher than SGD100,000 are also listed in the Group A/B/C list. Exch Exch Exch No HK Counter Valuation % No HK Counter Valuation % No HK Counter Valuation % Symbol Symbol Symbol 1 01530 3SBio Inc 70 28 02009 BBMG Corp 70 55 01898 China Coal Energy Co Ltd 85 China Communications 2 02018 AAC Technologies Holdings Inc 70 29 00863 BC Technology Group Ltd 50 56 01800 85 Construction Co Ltd China Communications Services 3 03383 Agile Group Holdings Ltd 70 30 06160 BeiGene Ltd 70 57 00552 85 Corp Ltd Beijing Capital International China Conch Venture Holdings 4 01288 Agricultural Bank of China Ltd 85 31 00694 85 58 00586 85 Airport Co Ltd Ltd 5 01299 AIA Group Ltd 100 32 00392 Beijing Enterprises Holdings Ltd 70 59 00939 China Construction Bank Corp 100 Beijing Enterprises Water Group 6 00753 Air China Ltd 85 33 00371 70 60 03818 China Dongxiang Group Co Ltd 50 Ltd Beijing Jingneng Clean Energy China East Education Holdings 7 01789 AK Medical Holdings Ltd 70 34 00579 50 61 00667 70 Co Ltd Ltd Beijing Tong Ren Tang Chinese 8 09926 Akeso Inc 70 35 03613 70 62 00670 China Eastern Airlines Corp Ltd 85 Medicine Co Ltd China Education Group Holdings 9 09988 Alibaba Group Holding Ltd 100 36 09626 Bilibili Inc 70 63 00839 70 Ltd Alibaba Health Information 10 00241 70 37 06993 Blue Moon Group Holdings Ltd 70 64 06818 China Everbright Bank Co Ltd 85 Technology -

MRS-101 1/6 Page

MRS-101 HK Marginable Securities List (with effect from 1 March 2020) Exch Exch Exch No HK Counter Valuation % No HK Counter Valuation % No HK Counter Valuation % Symbol Symbol Symbol Beijing Enterprises Water Group 1 01530 3SBio Inc 70 28 00371 70 55 00939 China Construction Bank Corp 100 Ltd 2 02018 AAC Technologies Holdings Inc 70 29 Upgrade 00588 Beijing North Star Co Ltd 85 56 03818 China Dongxiang Group Co Ltd 70 Beijing Tong Ren Tang Chinese China East Education Holdings 3 03383 Agile Group Holdings Ltd 70 30 03613 70 57 Upgrade 00667 85 Medicine Co Ltd Ltd 4 01288 Agricultural Bank of China Ltd 85 31 02588 BOC Aviation Ltd 85 58 00670 China Eastern Airlines Corp Ltd 85 China Education Group Holdings 5 01299 AIA Group Ltd 100 32 02388 BOC Hong Kong Holdings Ltd 100 59 00839 70 Ltd Brilliance China Automotive 6 00753 Air China Ltd 85 33 Upgrade 01114 85 60 06818 China Everbright Bank Co Ltd 85 Holdings Ltd 7 09988 Alibaba Group Holding Ltd 85 34 01211 BYD Co Ltd 85 61 01257 China Everbright Greentech Ltd 70 Alibaba Health Information BYD Electronic International Co 8 00241 70 35 00285 70 62 00257 China Everbright International Ltd 85 Technology Ltd Ltd C&D International Investment 9 01060 Alibaba Pictures Group Ltd 70 36 01908 70 63 00165 China Everbright Ltd 85 Group Ltd Reduce 10 03319 A-Living Services Co Ltd 70 37 00341 Cafe de Coral Holdings Ltd 70 64 03333 China Evergrande Group 70 Valn Canvest Environmental 11 02600 Aluminum Corp of China Ltd 85 38 01381 70 65 06881 China Galaxy Securities Co Ltd 85 Protection Group Co Ltd -

Updated April 2009

® ™ LexisNexis SmartIndexing Technology New Company Terms Updated April 2009 A-B........................................................................................................................1 C ...........................................................................................................................2 D-E........................................................................................................................4 F-G........................................................................................................................4 H-I.........................................................................................................................4 J-K ........................................................................................................................5 L-M........................................................................................................................5 N-O .......................................................................................................................6 P-Q-R....................................................................................................................7 S ...........................................................................................................................8 T-U........................................................................................................................9 V-W.......................................................................................................................9 -

Copy of Default Margin List

IRESSCode Name Current Margin (%) New Margin (%) 0001.HKE CK HUTCHISON HOLDINGS LTD 10 10 0002.HKE CLP HOLDINGS LTD 10 10 0003.HKE HONG KONG & CHINA GAS 20 20 0004.HKE WHARF HOLDINGS LTD 20 20 0005.HKE HSBC HOLDINGS PLC 10 10 0006.HKE POWER ASSETS HOLDINGS LTD 10 10 0007.HKE HOIFU ENERGY GROUP LTD 50 40 0008.HKE PCCW LTD 20 20 0009.HKE NINE EXPRESS LTD 70 100 0010.HKE HANG LUNG GROUP LTD 20 20 0011.HKE HANG SENG BANK LTD 10 10 0012.HKE HENDERSON LAND DEVELOPMENT 10 10 0014.HKE HYSAN DEVELOPMENT CO 20 20 0015.HKE VANTAGE INTERNATIONAL 70 70 0016.HKE SUN HUNG KAI PROPERTIES 10 10 0017.HKE NEW WORLD DEVELOPMENT 10 10 0018.HKE ORIENTAL PRESS GROUP LTD 40 30 0019.HKE SWIRE PACIFIC LTD - CL A 10 10 0020.HKE WHEELOCK & CO LTD 20 20 0021.HKE GREAT CHINA PROPERTIES HOLDI 100 100 0023.HKE BANK OF EAST ASIA LTD 20 25 0024.HKE BURWILL HOLDINGS LTD 50 50 0025.HKE CHEVALIER INTERNATIONAL HOLD 40 30 0026.HKE CHINA MOTOR BUS CO 30 40 0027.HKE GALAXY ENTERTAINMENT GROUP L 20 15 0028.HKE TIAN AN CHINA INVESTMENT 30 20 0030.HKE BAN LOONG HOLDINGS LTD 100 100 0031.HKE CHINA AEROSPACE INTL HLDG 50 40 0032.HKE CROSS-HARBOUR HOLDINGS LTD 30 30 0033.HKE ASIA INVESTMENT FINANCE GROU 100 100 0034.HKE KOWLOON DEVELOPMENT CO LTD 30 30 0035.HKE FAR EAST CONSORTIUM INTERNAT 30 30 0036.HKE FAR EAST HOLDINGS INTL LTD 100 100 0037.HKE FAR EAST HOTELS & ENT LTD 100 100 0038.HKE FIRST TRACTOR CO-H 40 40 0039.HKE CHINA BEIDAHUANG INDUSTRY 70 70 0040.HKE GOLD PEAK INDUSTRIES HOLDING 100 100 0041.HKE GREAT EAGLE HOLDINGS LTD 25 25 0042.HKE NORTHEAST ELECTRIC DEVELOP-H 50 50 0043.HKE CP POKPHAND CO LTD 30 30 0044.HKE HONG KONG AIRCRAFT ENGINEERG 30 30 0045.HKE HONGKONG & SHANGHAI HOTELS 25 30 0050.HKE HONG KONG FERRY(HOLDINGS)CO. -

Tianda Securities Limited Marginable Stock List Effective Date: 29/09/2020

Tianda Securities Limited Marginable Stock List Effective Date: 29/09/2020 Stock Margin Code Stock Name Ratio 1 CK HUTCHISON HOLDINGS LTD. 70% 2 CLP HOLDINGS LTD. 70% 3 HONG KONG AND CHINA GAS CO. LTD., THE 70% 4 WHARF (HOLDINGS) LTD., THE 60% 5 HSBC HOLDINGS PLC 70% 6 POWER ASSETS HOLDINGS LTD. 70% 8 PCCW LTD. 40% 10 HANG LUNG GROUP LTD. 60% 11 HANG SENG BANK LTD. 70% 12 HENDERSON LAND DEVELOPMENT CO. LTD. 70% 14 HYSAN DEVELOPMENT CO. LTD. 60% 16 SUN HUNG KAI PROPERTIES LTD. 70% 17 NEW WORLD DEVELOPMENT CO. LTD. 60% 18 KECK SENG INVESTMENTS (HONG KONG) LTD. 30% 19 SWIRE PACIFIC LTD. 'A' 70% 20 MELCO INTERNATIONAL DEVELOPMENT LTD. 50% 23 BANK OF EAST ASIA, LTD., THE 60% 25 CHEVALIER INTERNATIONAL HOLDINGS LTD. 20% 26 CHINA MOTOR BUS CO., LTD. 40% 27 GALAXY ENTERTAINMENT GROUP LTD. 60% 28 TIAN AN CHINA INVESTMENTS CO. LTD. 40% 31 CHINA AEROSPACE INTERNATIONAL HOLDINGS LTD. 20% 32 CROSS-HARBOUR (HOLDINGS) LTD., THE 40% 34 KOWLOON DEVELOPMENT CO. LTD. 40% 35 FAR EAST CONSORTIUM INTERNATIONAL LTD. 40% 38 FIRST TRACTOR CO LTD. - H SHARES 20% 41 GREAT EAGLE HOLDINGS LTD. 50% 44 HONG KONG AIRCRAFT ENGINEERING CO. LTD. 50% 45 HONGKONG AND SHANGHAI HOTELS, LTD., THE 40% 50 HONG KONG FERRY (HOLDINGS) CO. LTD. 40% 52 FAIRWOOD HOLDINGS LTD. 40% 53 GUOCO GROUP LTD. 30% 54 HOPEWELL HOLDINGS LTD. 50% 56 ALLIED PROPERTIES (HK) LTD. 30% 57 CHEN HSONG HOLDINGS LTD. 30% 62 TRANSPORT INTERNATIONAL HOLDINGS LTD. 30% 64 GET NICE HOLDINGS LTD. 20% 66 MTR CORPORATION LTD. -

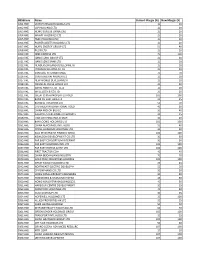

STOXX Greater China 80 Last Updated: 01.04.2016

STOXX Greater China 80 Last Updated: 01.04.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 96.7 1 1 TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 83.1 2 2 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 59.9 3 3 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 54.6 4 4 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 46.7 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 34.2 6 6 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 31.6 7 8 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 30.7 8 7 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 27.7 9 9 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 24.1 10 10 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 21.4 11 11 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 17.1 12 12 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 16.5 13 14 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 16.1 14 15 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 15.7 15 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 15.7 16 17 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 14.7 17 18 TW0002412004 6287841 2412.TW TW003S Chunghwa Telecom Co Ltd TW TWD Y 13.6 18 16 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 12.3 19 19 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 11.7 20 21 HK0006000050 6435327 0006.HK 643532 POWER ASSETS HOLDINGS LTD HK HKD Y 11.7 21 23 TW0001301000 6348544 1301.TW TW009Y Formosa Plastics Corp TW TWD Y 11.5 22 22 HK0011000095 6408374 0011.HK 640837 Hang Seng Bank Ltd.