Q4 2020 Investor Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notice of Annual Meeting and Special Meeting of Unitholders and Management Information Circular

Notice of Annual Meeting and Special Meeting of Unitholders and Management Information Circular March 24, 2017 BOYD GROUP INCOME FUND NOTICE OF ANNUAL MEETING AND SPECIAL MEETING OF UNITHOLDERS TO BE HELD MAY 12, 2017 NOTICE IS HEREBY GIVEN that the Annual Meeting and Special Meeting of the Unitholders of Boyd Group Income Fund (the “Fund”) will be held at the Hilton Winnipeg Airport Suites Hotel, 1800 Wellington Avenue, Winnipeg, Manitoba on Friday, May 12 at 1:00 p.m. (local time) for the following purposes: 1. to receive the consolidated financial statements of the Fund for the year ended December 31, 2016 and the Auditor’s Report thereon; 2. to appoint Trustees for the ensuing year; 3. to elect nominees of the Fund to serve as Directors of The Boyd Group Inc. and Boyd Group Holdings Inc.; 4. to appoint auditors for the ensuing year and authorize the Board of Trustees to fix their remuneration; 5. to pass a special resolution, confirming an amendment to the Trust Declaration, adding Section 12.12, Nominations of Trustees 6. to transact such other business as may properly come before the Meeting, or any adjournment thereof. Unitholders who are unable to attend the meeting in person are requested to complete, date and sign the enclosed form of Proxy and return it, in the envelope provided, to the Secretary-Treasurer of the Fund, c/o Computershare Trust Company of Canada, 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1, Attention: Proxy Department or via Phone: 1-866-732-8683, or by Internet voting at www.investorvote.com, at least 24 hours prior to the Meeting or any adjournment thereof, failing which the Proxy will be invalid. -

Fpbonds Corporate FM.Vp

FP Bonds — Corporate 2018 1 Introduction FP Bonds – Corporate 2018, the third edition to be published by Grey House Publishing Canada, lists outstanding publicly and privately held debt securities – together with their features and provisions – issued by Canadian incorporated companies, as well as brand new introductory material related to the corporate bond market. Separate tables list convertible, exchangeable, retractable and extendible debt issues. An additional table lists outstanding asset-backed securities. Corporate debt issues outstanding as at May 8, 2018 have been included. An important part of investing in the debt market is determining the quality of a debt issue. Credit ratings are forward looking measures which assess an entity’s ability to make timely payments of interest and principal. As such, a credit rating combines both quantitative and qualitative analysis. FP Bonds – Corporate 2018 includes ratings supplied by Dominion Bond Rating Service(DBRS). The DBRS ratings, dated May 8, 2018, are presented in two tables, in addition to being shown with each issue. The first table lists issues by rating, from lowest to highest. Generally, a DBRS rating of BBB is considered to be investment grade and anything below that could be considered as non-investment grade or high-yield debt. As well, unrated securities are also considered to be high-yield if its spread to a comparable Government of Canada issue is substantially higher than the spread between investment-grade corporate bonds and Government of Canada issues. A second table -

Investor Presentation

AUTOCANADA INVESTOR PRESENTATION SCOTIABANK CONFERENCE SEPTEMBER 15, 2020 Forward-Looking Statements Certain information contained in this presentation looks forward in time and deals with other than historical or current facts for AutoCanada Inc. (the “Company”). The use of any of the words “could”, “expect”, “believe”, “will”, “projected”, “estimated”, “anticipated” and similar expressions and statements relating to matters that are not historical facts are intended to identify forward- looking information and are based on the Company’s current belief or assumptions as to the outcome and timing of such future events. In particular, forward-looking statements in this presentation include, but are not limited to, references to the future operations and performance of the Company or its segments. Although the Company believes that the expectations reflected by the forward-looking statements in this presentation are reasonable, these statements have been based on assumptions and factors concerning future events that may prove to be inaccurate. Actual future results may differ materially. The Company’s annual information form for the year ended December 31, 2019 and other documents filed with securities regulatory authorities (accessible through the SEDAR website www.sedar.com) describe the risks, material assumptions and other factors that could influence actual results and which are incorporated herein by reference. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise. 2 WHO WE ARE AutoCanada Overview A Leading North American Multi-Location Automobile Dealership Group At a Glance1 • One of Canada’s largest multi-location automobile dealership groups with 3,700 49 13 Franchises in Canada Franchises in Illinois, U.S. -

DFA Canada Canadian Vector Equity Fund - Class a As of July 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada Canadian Vector Equity Fund - Class A As of July 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of -

Autocanada Inc

AUTOCANADA INC. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS For the period ended March 31, 2012 As of May 8, 2012 READER ADVISORIES The Management’s Discussion & Analysis (“MD&A”) was prepared as of May 8, 2012 to assist readers in understanding AutoCanada Inc.’s (the “Company” or “AutoCanada”) consolidated financial performance for the three month period ended March 31, 2012 and significant trends that may affect AutoCanada’s future performance. The following discussion and analysis should be read in conjunction with the unaudited consolidated financial statements and accompanying notes (the “Interim Consolidated Financial Statements”) of AutoCanada for the three months ended March 31, 2012, the consolidated financial statements and accompanying notes of the Company for the year ended December 31, 2011 and management’s discussion and analysis for the year ended December 31, 2011. Results are reported in Canadian dollars. Certain dollar amounts have been rounded to the nearest thousand dollars. References to notes are to the Notes of the Consolidated Financial Statements of the Company unless otherwise stated. To provide more meaningful information, this MD&A typically refers to the operating results for the three-month period ended March 31, 2012 of the Company, and compares these to the operating results of the Company for the three-month period March 31, 2011. This MD&A contains forward-looking statements. Please see the section “FORWARD-LOOKING STATEMENTS” for a discussion of the risks, uncertainties and assumptions used to develop our forward-looking information. This MD&A also makes reference to certain non-GAAP measures to assist users in assessing AutoCanada’s performance. -

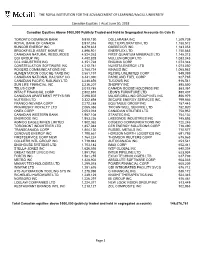

THE ROYAL INSTITUTION for the ADVANCEMENT of LEARNING/Mcgill UNIVERSITY

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Canadian Equities │ As at June 30, 2018 Canadian Equities Above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) TORONTO DOMINION BANK 9,910,190 DOLLARAMA INC 1,209,739 ROYAL BANK OF CANADA 8,917,316 KELT EXPLORATION LTD 1,188,512 SUNCOR ENERGY INC 6,879,833 QUEBECOR INC 1,183,053 BROOKFIELD ASSET MGMT INC 4,896,921 ENERFLEX LTD 1,150,883 CANADIAN NATURAL RESOURCES 4,524,263 FIRST QUANTUM MINERALS LTD 1,145,213 CGI GROUP INC 4,482,828 MULLEN GROUP LTD 1,083,045 CCL INDUSTRIES INC 4,351,728 ENCANA CORP 1,073,348 CONSTELLATION SOFTWARE INC 4,212,781 NUVISTA ENERGY LTD 1,073,050 ROGERS COMMUNICATIONS INC 3,788,734 KINAXIS INC 1,065,983 ALIMENTATION COUCHE-TARD INC 3,581,197 RECIPE UNLIMITED CORP 949,389 CANADIAN NATIONAL RAILWAY CO 3,441,390 PARKLAND FUEL CORP 927,785 CANADIAN PACIFIC RAILWAY LTD 3,240,856 TUCOWS INC 916,541 SUN LIFE FINANCIAL INC 3,236,207 SHOPIFY INC 895,850 TELUS CORP 3,013,785 CANADA GOOSE HOLDINGS INC 883,361 INTACT FINANCIAL CORP 2,802,815 LEON'S FURNITURE LTD 880,407 CANADIAN APARTMENT PPTYS REI 2,498,502 MAJOR DRILLING GROUP INTL INC 856,979 NUTRIEN LTD 2,322,898 SECURE ENERGY SERVICES INC 799,566 FRANCO-NEVADA CORP 2,272,288 EQUITABLE GROUP INC 787,443 PRAIRIESKY ROYALTY LTD 2,065,386 TRICAN WELL SERVICE LTD 782,920 ONEX CORP 2,053,018 CANADIAN UTILITIES LTD 758,952 CANADIAN WESTERN BANK 1,987,108 STANTEC INC 754,132 ENBRIDGE INC 1,953,226 LASSONDE INDUSTRIES INC 745,893 AGNICO EAGLE MINES LIMITED 1,902,362 COGECO COMMUNICATIONS -

Management Information & Proxy Circular

(formerly reporting as Boyd Group Income Fund) Notice of Annual Meeting and Special Meeting of Shareholders and Management Information Circular May 25, 2020 BOYD GROUP SERVICES INC. (formerly reporting as Boyd Group Income Fund) NOTICE OF ANNUAL MEETING AND SPECIAL MEETING OF SHAREHOLDERS TO BE HELD JUNE 29, 2020 NOTICE IS HEREBY GIVEN that the annual meeting and special meeting (“Meeting”) of the holders of common shares (“Shareholders”) of Boyd Group Services Inc. (“BGSI”) will be held at BGSI’s head office at 1745 Ellice Avenue, Unit C1, Winnipeg, Manitoba on Monday, June 29, 2020 at 1:00 p.m. (local time) for the following purposes: 1. to receive the consolidated financial statements of Boyd Group Income Fund for the year ended December 31, 2019 and the Auditor’s Report thereon; 2. to fix the number of Directors at nine; 3. to appoint Directors for the ensuing year; 4. to appoint auditors for the ensuing year and authorize the Board of Directors to fix their remuneration; 5. to vote on an advisory resolution on BGSI’s approach to executive compensation; 6. to approve a special resolution to amend BGSI’s articles to allow the Directors to appoint one or more additional directors, who shall hold office for a term expiring not later than the close of the next annual meeting, and not to exceed one third of the number of directors elected at the previous annual meeting of shareholders, as described in the Information Circular; and 7. to transact such other business as may properly come before the Meeting, or any adjournment thereof. -

Awards of Excellence in Corporate Reporting JUDGES’ BOOK 2016

Awards of Excellence in Corporate Reporting JUDGES’ BOOK 2016 A proud heritage, a bright future We celebrate a milestone Presentation is also changing dramatically. this year–the 65th anniversary Organizations today augment printed materials of the Awards of Excellence with electronic formats that cover a spectrum of in Corporate Reporting social media platforms and include mobile apps (CR Awards). and dynamic interactive analytical tools. A lot has changed in corporate reporting in that time and the Raising the bar CPA Canada is proud to recognize the companies program has evolved to help reporters stay ahead and Crown organizations that rise to meet these of those changes. When it launched in 1951 as ever-evolving challenges. Spotlighting excellence the Annual Report Awards, the competition was sets a clear path for others. Yesterday’s innovations open to public companies only. Judges reviewed become today’s table stakes. The bar moves higher. hard copy annual reports that contained very little information beyond the fi nancials. Some Fostering continual improvement is a primary 40 years later, Management Discussion and objective of the CR Awards. All entrants receive Analysis was added. In the 1990s the program feedback from the judges that shows how they further expanded to include environmental measured up against benchmarks and provides reporting and corporate governance disclosures. advice for improvement. The Electronic Disclosure category was included in 2001. We opened the competition to Crown organizations in 2007. Moving forward with strength Looking back on 65 years gives important context about where corporate reporting has been. The Increasingly complex needs require landscape will continue to change and strong sophisticated reporting Canadian companies will continue to respond in kind. -

Autocanada Inc

AUTOCANADA INC. Conference Call Announcement – Annual and Fourth Quarter 2013 Results and Discussion Edmonton, Alberta (February 3, 2014) AutoCanada Inc. (“AutoCanada”) (TSX:ACQ) will release its earnings report for the three month period and year ended December 31, 2013 on Thursday, March 20, 2014 after the close of markets. It will also be posted on the Company’s website at http://www.autocan.ca . The Company will then host its financial analyst conference call on Friday, March 21, 2014 at 11:00 a.m. Eastern Time (9:00 a.m. Mountain Time) to discuss its fourth quarter and annual financial results for 2013. Participants may join the call by dialing 1-647-427-7451 in Toronto or dialing 1-888-231-8192 at the scheduled time of 11:00 a.m. Eastern Time. Pat Priestner, Chief Executive Officer will lead the discussion and will be accompanied by Tom Orysiuk, President and Chief Financial Officer and Steve Rose, Senior Vice-President, Sales, Marketing and Corporate Operations. The discussion will be followed by a question and answer period. Thank you for your interest in AutoCanada and we look forward to your participation in the conference call. About AutoCanada AutoCanada is one of Canada’s largest multi-location automobile dealership groups, currently operating 32 franchised dealerships in six provinces and has over 1,500 employees. AutoCanada currently sells Chrysler, Dodge, Jeep, Ram, FIAT, Chevrolet, GMC, Buick, Infiniti, Nissan, Hyundai, Subaru, Mitsubishi, Audi, and Volkswagen branded vehicles. In 2012, our dealerships sold approximately 30,000 vehicles and processed approximately 309,000 service and collision repair orders in our 333 service bays during that time. -

Franklin Bissett Core Plus Bond Fund August 31, 2021

Franklin Bissett Core Plus Bond Fund August 31, 2021 Franklin Bissett Core Plus Bond August 31, 2021 Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. The portfolio holdings list excludes cash and other net items as foreign currency forwards. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date 2989129 407 INTERNATIONAL INC 9,300,000 $12,199,182 0.59% 6.47% 07/27/29 35085ZBV7 407 INTERNATIONAL INC 3,840,000 $3,621,772 0.18% 2.84% 03/07/50 35085ZBW5 407 INTERNATIONAL INC 1,500,000 $1,531,260 0.07% 1.80% 05/22/25 B0YW9V5 407 INTERNATIONAL INC 2,000,000 $2,551,940 0.12% 5.75% 02/14/36 BFXQN77 407 INTERNATIONAL INC 1,000,000 $1,015,090 0.05% 2.47% 09/08/22 BYQGL28 407 INTERNATIONAL INC 1,900,000 $2,009,345 0.10% 3.35% 05/16/24 00287YBV0 ABBVIE INC 2,140,000 $2,911,454 0.14% 2.95% 11/21/26 DDD1156339 -

Autocanada Inc

2018 Annual Information Form Dated: March 14, 2019 Annual Information Form Table of Contents GENERAL DISCLOSURE MATTERS 1 CAPITAL STRUCTURE 35 Certain References and Glossary 1 AutoCanada Inc. 35 Date of Information 1 CREDIT RATINGS 36 Forward Looking Information 1 DIVIDENDS/DISTRIBUTIONS 37 Non-GAAP Measures 3 Dividend Policy 37 CORPORATE STRUCTURE 4 Historical Distributions 37 Intercorporate Relationships 4 MARKET FOR SECURITIES 38 OVERVIEW AND DEVELOPMENT OF 5 OUR BUSINESS Trading Price and Volume 38 Overview 5 Prior Sales 38 History 6 DIRECTORS AND OFFICERS 39 Significant Acquisitions 8 Corporate Cease Trade Orders or Bankruptcies 40 Our Operations 9 Personal Bankruptcies 40 Sources of Revenue and Gross Profit 9 Conflicts of Interest 40 Locations 14 Charter of the Audit Committee 40 Acquisitions, Divestitures, Investments and Relocations 15 Composition of the Audit Committee 40 Competition 17 Relevant Education and Experience 40 Our Competitive Strengths 17 External Auditor Service Fees (by category) 42 Inventories 18 LEGAL PROCEEDINGS AND Automobile Dealership Franchise Agreements 19 REGULATORY ACTIONS 42 Financing 21 INTEREST OF MANAGEMENT AND Marketing 23 OTHERS IN MATERIAL Management Information Systems 24 TRANSACTIONS 42 Employees 24 TRANSFER AGENT AND REGISTRAR 42 Our Intellectual Property and Proprietary Rights 25 Regulatory Matters and Policies 25 MATERIAL CONTRACTS 43 RISK FACTORS 26 INTEREST OF EXPERTS 43 Risks Related to Our Business and the Industry in ADDITIONAL INFORMATION 43 Which We Operate 26 SCHEDULE A — GLOSSARY OF TERMS 44 SCHEDULE B — AUDIT COMMITTEE CHARTER 46 General Disclosure Matters Certain References and management’s expected usage of GAAP and non-GAAP financial measures; Glossary expectations of reduced supply of off- lease vehicles in the future; In this Annual Information Form (“AIF”), unless the context otherwise requires, references to expectations that an extended “AutoCanada”, “ACI”, the “Company”, “we”, “us”, manufacturer’s warranty will increase our “our” or similar terms refer to AutoCanada Inc. -

Blt-17-Autocanada

Issue #17 - 2010 15 November, 2010 Dynamic action by AutoCanada Co-operation pays dividends An impressive example of what can be achieved through co-operation started as a series of consumer complaints to the VSA about a Victoria dealership that is part of the AutoCanada group. Rather than focus on one dealership and simply satisfying specific consumers, AutoCanada's Chief Executive Officer, Pat Priestner, and Tom Orysiuk, Vice-President and Chief Financial Officer, conducted a national internal review of their procedures. continued Page 2/. A checklist every dealer understand these disclosures will have an should note: opportunity to ask someone they know for AutoCanada's internal systems review led to assistance. The consumer will sign the multiple issues and changes for the group's disclosure statement only when both are B.C. dealers. The changes are as follows: satisfied the consumer is fully aware of the 1. On top of the VSA’s required training and disclosures. any manufacturer training, AutoCanada 8. There will be more frequent individual will provide sensitivity training to all dealer inspections by senior personnel of salespeople to assure they understand the AutoCanada. special needs of some consumers. 9. Any complaints involving B.C. dealerships 2. Instigate a consistent process to ensure all are to be brought to the attention of the used vehicles for sale are inspected for newly created compliance position. safety, damage, out-of-province and other 10. Hire a “compliance officer” to oversee declarations. compliance with the regulations in the 3. Establish fair and appropriate gross-up provinces in which AutoCanada operates.