2019 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

NZX Celebrates World Investor Week

NZX Limited Level 1, NZX Centre 11 Cable Street PO Box 2959 Wellington 6140 New Zealand Tel +64 4 472 7599 www.nzx.com 1 October 2018 NZX celebrates World Investor Week NZX is celebrating World Investor Week by continuing to provide an increased range of opportunities for New Zealanders to learn about companies listed on the market. Retail investor evenings will be held by the NZX in Christchurch, Wellington and Auckland this week, offering a great chance for local attendees to increase their knowledge of companies listed on New Zealand’s exchange and ask the leaders of these businesses any questions. The exchange’s inaugural investor evenings sold out in 36 hours demonstrating the unprecedented demand from retail investors to hear first-hand from some of New Zealand’s most well-known businesses. NZX Head of Issuer Relationships Joanna Lawn commented: “Connecting retail investors and listed companies is part of our ongoing efforts to provide a better platform for customers to tell their stories, and to educate the New Zealand public about the benefits of investing in the share market.” “As an exchange we need to do our bit to encourage new investors into the New Zealand market and embark on their investing journey. These evenings are a simple but significant step towards achieving this.” World Investor Week is a global campaign promoted by International Organisation of Securities Commissions to raise awareness about the importance of investor education and protection, while highlighting the various initiatives of securities regulators in these two areas. Companies at NZX’s retail investor evenings include: Chorus, Cooks Global Foods, Fisher Funds, Infratil, Kathmandu, Mainfreight, Meridian Energy, Ryman Healthcare, Sanford, Scales Corporation, and six UK investment trust companies. -

The Climate Risk of New Zealand Equities

The Climate Risk of New Zealand Equities Hamish Kennett Ivan Diaz-Rainey Pallab Biswas Introduction/Overview ØExamine the Climate Risk exposure of New Zealand Equities, specifically NZX50 companies ØMeasuring company Transition Risk through collating firm emission data ØCompany Survey and Emission Descriptives ØPredicting Emission Disclosure ØHypothetical Carbon Liabilities 2 Measuring Transition Risk ØTransition Risk through collating firm emissions ØAimed to collate emissions for all the constituents of the NZX50. ØUnique as our dataset consists of Scope 1, Scope 2, and Scope 3 emissions, ESG scores and Emission Intensities for each firm. ØCarbon Disclosure Project (CDP) reports, Thomson Reuters Asset4, Annual reports, Sustainability reports and Certified Emissions Measurement and Reduction Scheme (CEMAR) reports. Ø86% of the market capitilisation of the NZX50. 9 ØScope 1: Classified as direct GHG emissions from sources that are owned or controlled by the company. ØScope 2: Classified as indirect emissions occurring from the generation of purchased electricity. ØScope 3: Classified as other indirect GHG emissions occurring from the activities of the company, but not from sources owned or controlled by the company. (-./01 23-./014) Ø Emission Intensity = 6789 :1;1<=1 4 Company Survey Responses Did not Email No Response to Email Responded to Email Response Company Company Company Air New Zealand Ltd. The a2 Milk Company Ltd. Arvida Group Ltd. Do not report ANZ Group Ltd. EBOS Ltd. Heartland Group Holdings Ltd. Do not report Argosy Property Ltd. Goodman Property Ltd. Metro Performance Glass Ltd. Do not report Chorus Ltd. Infratil Ltd. Pushpay Holdings Ltd. Do not report Contact Energy Ltd. Investore Property Ltd. -

Notice of Annual Meeting 2020

KATHMANDU HOLDINGS LIMITED Notice of Annual Meeting 2020 Will be held online at: www.virtualmeeting.co.nz/kmd20 Wednesday, 25 November 2020 at 11am NZDT NOTICE OF ANNUAL MEETING 2020 3 Kathmandu Holdings Limited (ARBN 139 836 918) Notice of annual meeting NOTICE IS GIVEN that the eleventh Annual Meeting of Auditor remuneration Kathmandu Holdings Limited (“the Company”) will be Resolution 4. held online at www.virtualmeeting.co.nz/kmd20, on That the Board be authorised to fix the remuneration Wednesday, 25 November 2020 at 11:00am (NZDT). of the Company’s auditor for the ensuing year. The Board has decided to hold a virtual-only Annual Meeting given the current uncertainties The Board unanimously supports resolutions caused by COVID-19 and the restrictions on 1 to 4 and recommends that shareholders gatherings and travel that have applied to date, vote in favour of them at the meeting. and may be in place at the time of the meeting. Item 4: Other business AGENDA To consider any other business, including shareholder questions, properly brought before the meeting. Item 1: Chairman’s address By order of the Board Item 2: Group CEO’s address Item 3: Resolutions To consider and, if thought fit, to pass the following ordinary resolutions: Frances Blundell Company Secretary Re-election of Directors 21st October 2020 Resolution 1. That John Harvey be re-elected as a Director of the Company. Resolution 2. That Philip Bowman be re-elected as a Director of the Company. Resolution 3. That Brent Scrimshaw be re-elected as a Director of the Company. -

FISHER FUNDS from the UNDERGROWTH 3 Getting to Know

From the UndergrowthJuly 2014 At a Glance as at 30 June 2014 Moat or Momentum? You can tell when there is a bit of heat in a market – everyone talks about it and wants Unit Prices ($) to be part of it. If the New Zealand share market is not hot, it’s certainly balmy. A New Zealand Growth Fund 5.3906 bunch of companies are planning to list in order to feed “buoyant investor demand” and investors are seemingly prepared to consider all and any IPO, regardless of the Australian Growth Fund 2.5674 company’s pedigree. Actually, that’s harsh, all companies have a pedigree. It’s just hard International Growth Fund 1.3674 to understand why investors get frothy about a company that hasn’t made any money or get excited about buying something when its owners are wanting to sell (if it’s that KiwiSaver Growth Fund 1.4678 good, why are they selling?). KiwiSaver Conservative Fund 1.2920 IPO enthusiasm is not unique to New Zealand – so far this year, there have been 144 Property & Infrastructure Fund 1.5769 IPOs in the US raising $US30 billion, making it the busiest year since 2000. Investors are excited about new companies coming to the market in New Zealand and in the US High Income Fund 1.0222 because both share markets have enjoyed good times for the past two or three years, and investors don’t want the good times to end. Net Performance (June 2014) Momentum investing is a centuries old phenomenon. It essentially involves backing winners – buying the sort of investments that have recently been successful, on the New Zealand Growth Fund 0.6% assumption that past trends will continue. -

FS IISNZSF 20210430 Class a Instintfi 465922

30 April 2021 Russell Investments NZ Shares Fund Fund facts Rolling 1 year performance history Inception date Fund Benchmark 14 February 2013 40% Benchmark 30% S&P/NZX 50 Index (gross) 20% and including imputation credits 10% Currency 0% 2014 2015 2016 2017 2018 2019 2020 2021 NZD Performance review Period ending 30/04/2021 1 3 1 3 5 Since month months year years years inception % % % %p.a. %p.a. %p.a. Gross fund performance 1.5 -1.3 23.7 16.3 14.7 16.2 Benchmark return* 1.4 -2.8 21.6 15.6 14.4 15.6 Excess return 0.2 1.6 2.1 0.7 0.3 0.5 *From 1 July 2016 this is S&P/NZX 50 Index (gross and including imputation credits). Prior to 30 June 2016 this was the Russell New Zealand Domestic Index including imputation credits (previously known as the Russell NZ Tradable Gross Index). Prior to 1 December 2014 the benchmark was the NZX50 Index including imputation credits. Performance is calculated on exit price. Fund commentary The Russell Investments New Zealand Shares Fund outperformed the benchmark in April. Contributing to the Fund’s outperformance was strong stock selection within the industrials space; notably an underweight to Auckland International Airport (AIA) and an overweight to Mainfreight. AIA fell amid concerns over the outlook for long-haul international travel, while Mainfreight – the market’s most expensive stock and our largest overweight position – hit fresh record highs during the month. Stock selection within the information technology sector was also positive in April. -

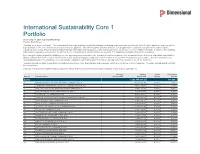

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions -

Download South Island Index

The long winding road The Deloitte South Island Index A review of the performance of South Island listed companies during the year to 30 June 2014 26th Edition Introduction Over the past twelve months the Deloitte South Island Index continued on its phenomenal rate of growth from Welcome to the 26th Edition of the previous year, gaining a remarkable $2.92 billion (35.3%) in the year ended 30 June 2014 despite the the Deloitte South Island Index. 3.0% decline in the most recent quarter. One of the key milestones achieved during the year was the Index In this edition we reflect on the breaking through the $10 billion barrier for the first time. An encouraging outcome from the past twelve performance of South Island months is that the remarkable growth was well spread, listed companies during the most with all sectors tracked exhibiting growth. Movements in June 2014 recent quarter and review the The month of June resulted in a slight increase in value with the Deloitte South Island Index increasing by past year to 30 June 2014. 0.9%. Over the same period all the indices tracked also had minor movements, with the Dow Jones gaining 0.7%, the NZX 50 dipping 0.7% and the ASX All Ords decreasing by 1.7%. Quarterly movements – Q2 2014 Despite the slight increase in June, the Deloitte South Island Index had its first decline in two years – falling $351.6 million (3.0%) in market capitalisation since 31 March 2014. This result was shaped by a disappointing quarter for the Bio-technology and Retail sectors, which reduced by $180.5 million and $132.1 million in market capitalisation respectively. -

Australia & New Zealand Report 2018

DISCLOSURE INSIGHT ACTION Australia & New Zealand Report 2018 On behalf of over 650 investors with US$87 trillion in assets. CDP Report 2018 | Published February 2019 Contents 3 CEO foreword 14 Appendix I List of disclosing companies in Australia & 4 Disclosure in 2018 New Zealand 5 Climate Change: Australia & New 18 Appendix II Zealand insights Responding companies in Australia & New Zealand – supply chain program 9 Water Security: Driving water stewardship 19 Appendix III Non-responding companies in Australia & 10 Forests: Building sustainable New Zealand supply chains 12 CDP Australia & New Zealand Awards 2018 13 Investor Signatories & Members in Australia & New Zealand Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2018 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

Russell Investments NZ Shares Fund

31 December 2020 Russell Investments NZ Shares Fund Fund facts Rolling 1 year performance history Inception date Fund Benchmark 14 February 2013 40% Benchmark 30% S&P/NZX 50 Index (gross) 20% and including imputation credits 10% Currency 0% 2014 2015 2016 2017 2018 2019 2020 NZD Performance review Period ending 31/12/2020 1 3 1 3 5 Since month months year years years inception % % % %p.a. %p.a. %p.a. Gross fund performance 2.7 12.1 16.3 17.1 16.8 17.1 Benchmark return* 2.6 11.5 14.6 17.0 16.8 16.7 Excess return 0.2 0.6 1.7 0.1 -0.1 0.4 *From 1 July 2016 this is S&P/NZX 50 Index (gross and including imputation credits). Prior to 30 June 2016 this was the Russell New Zealand Domestic Index including imputation credits (previously known as the Russell NZ Tradable Gross Index). Prior to 1 December 2014 the benchmark was the NZX50 Index including imputation credits. Performance is calculated on exit price. Fund commentary The Russell Investments NZ Shares Fund outperformed the benchmark in the December quarter. Much of the Fund’s outperformance was driven by strong stock selection within the healthcare sector; namely overweight holdings in Pacific Edge, Summerset Group and EBOS Group. All three stocks posted strong, double-digit gains for the quarter and remain amongst our largest overweight holdings. Stock selection within the industrials space was also positive, including an overweight to Mainfreight. Mainfreight hit a series of record highs amid an increase in first-half business activity and improving operations across New Zealand, Australia and the Americas. -

Download Fact Sheet

As of 31 July 2021 Market overview In a month with a lot of noise and very little information, bond yields dropped in For more information on our Funds, July and share markets generally climbed slightly. Gold bounced as, along with please contact: bonds, the metal benefited from safe-haven status as the market see-sawed from fears of inflation to fears that the growth resurgence may not last (fuelled by Delta David Boyle variant scare stories). Head of Sales & Marketing During August, many NZ and Australian companies will report their June year Level 29, SAP Tower results and take the opportunity to update investors with outlook statements. The 151 Queen Street, Auckland US reporting season is already well underway and has been strong in terms of New Zealand reported results. Outlook statements have been a little cautious, and we expect a P 0800 646 833 similar vein to prevail in Australasia this season – earnings growth for the year E [email protected] should generally be strong. However, with central banks slowly removing www.mintasset.co.nz monetary accommodation and businesses facing rising cost pressures FY22, we expect some conservatism in outlook statements. The NZ market fell slightly (on the last day of the month in fact). Real Estate stocks were stronger on some expectation that a few of the NZ REITs could be added to the FTSE / NAREIT global index. Z Energy held a relatively upbeat investor day, and Mainfreight delivered again with very positive comments at their AGM. Kathmandu and NZ travel related stocks suffered from the lockdowns in Australia. -

Russell Investments NZ Shares Fund

31 August 2021 Russell Investments NZ Shares Fund Fund facts Rolling 1 year performance history Inception date Fund Benchmark 14 February 2013 40% Benchmark 30% S&P/NZX 50 Index (gross) 20% and including imputation credits 10% Currency 0% 2014 2015 2016 2017 2018 2019 2020 2021 NZD Performance review Period ending 31/08/2021 1 3 1 3 5 Since month months year years years inception % % % %p.a. %p.a. %p.a. Gross fund performance 5.5 7.5 14.4 14.2 14.1 16.1 Benchmark return* 5.0 7.4 11.4 13.3 13.4 15.5 Excess return 0.5 0.0 3.0 0.9 0.7 0.7 *From 1 July 2016 this is S&P/NZX 50 Index (gross and including imputation credits). Prior to 30 June 2016 this was the Russell New Zealand Domestic Index including imputation credits (previously known as the Russell NZ Tradable Gross Index). Prior to 1 December 2014 the benchmark was the NZX50 Index including imputation credits. Performance is calculated on exit price. Fund commentary The Russell Investments NZ Shares Fund outperformed the benchmark in August. Contributing to the Fund’s outperformance was a material overweight exposure and strong stock selection within the healthcare space; notably overweights to Summerset Group and EBOS Group. Both stocks posted strong, double-digit gains on the back of better-than-expected earnings results. An overweight to cancer diagnostic firm Pacific Edge was also positive; the stock hitting new heights on news it was dual listing on the Australian Securities Exchange as a foreign exempt entity.