Budapest, Hungary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gratuities Gratuities Are Not Included in Your Tour Price and Are at Your Own Discretion

Upon arrival into Budapest, you will be met and privately transferred to your hotel in central Budapest. On the way to the hotel, you will pass by sights of historical significance, including St. Stephen’s Basilica, a cross between Neo-Classical and Renaissance-style architecture completed in the late 19th century and one of Budapest’s noteworthy landmarks. Over the centuries, Budapest flourished as a crossroads where East meets West in the heart of Europe. Ancient cultures, such as the Magyars, the Mongols, and the Turks, have all left an indelible mark on this magical city. Buda and Pest, separated by the Danube River, are characterized by an assortment of monuments, elegant streets, wine taverns, coffee houses, and Turkish baths. Arrival Transfer Four Seasons Gresham Palace This morning, after meeting your driver and guide in the hotel lobby, drive along the Danube to see the imposing hills of Buda and catch a glimpse of the Budapest Royal Palace. If you like, today you can stop at the moving memorial of the Shoes on the Danube Promenade. Located near the parliament, this memorial honors the Jews who fell victim to the fascist militiamen during WWII. Then drive across the lovely 19th-century Chain Bridge to the Budapest Funicular (vertical rail car), which will take you up the side of Buda’s historic Royal Palace, the former Hapsburg palace during the 19th century and rebuilt in the Neo-Classical style after it was destroyed during World War II. Today the castle holds the Hungarian National Gallery, featuring the best of Hungarian art. -

Budapest and Central Danube Region

Touristic areas of the Budapest and Central Danube Region www.hungary.com Talent for entertaining Forest Tourinform Office Etyek-Buda wine region Residence Kunság wine region Castle National Park Castle ruin Region’s border Museum Highway Thermal/wellness bath Railway Airport Ferry World Heritage Budapest – Central Danube Region “Why Budapest and its surrounding area?” This is the obvious question holiday makers will ask when planning their travels, and we hope to provide the answer. Budapest, Heroes’ Square Budapest because: • it is the cultural, political and transportation centre of Hungary; • it is built on both side of the Danube, the great European river that is registered as a World Heritage panorama; • nature is safeguarded in two national parks and a number of environmental protection areas; • it has represented a “multicultural Europe” for centuries – over 200 nearby villages are populated by Hungarians, Serbs, Slovaks and Germans (Swabians); • it has a strong artistic and cultural heritage; • there’s always something happening: festivals, concerts, theatre perform- ances, sports competitions, exhibitions, church events, wine celebrations or handicraft fairs; • there are many outdoor activities to enjoy: trekking, rock climbing, biking, horse riding, golf, rowing, swimming, potholing or fl ying; • its restaurants offer not only Hungarian cuisine – and wine and palinka – but food from all over the world. Don’t hesitate – come to Budapest, the centre of things! Széchenyi Thermal Baths (We have marked our suggested “must-see” destinations with ***. However, these are naturally subjective selections, and we hope that our guests will fi nd their own three-star experiences.) MT ZRT www.itthon.hu Visegrád Castle Games 1 Budapest – Central Danube Region Budapest Buda Castle and Chain Bridge When you arrive in Budapest, head to the centre and drink in the view of the city’s two parts, divided by the Danube and linked by the bridges that cross it. -

Budapest Guide English.Pdf

Contents 5 Handy information 5 City transport 11 Museums, Churches 14 14 Cultural Avenue 22 Sights, Sightseeing 26 11 Antiques road show 36 42 26 Music, Theatres, Events 38 Beyond Budapest 40 Medicinal baths, Caves 42 40 Leisure 44 Shopping 47 38 Restaurants, Entertainment 49 44 Maps 6, 24–25, 51, 55 Legend « Tram ó Opening hours 6, 24–25, 51, 55 « Suburban railway % Admission ç Bus é Budapest Card è Castle bus accepted 49 ë Publisher: Tourism Office of Budapest Trolleybus A1 Map coordinate the official tourism marketing organization of Budapest Publication manager: László Paszternák 1 Metro 1 1 Site of museum © All rights reserved G Edited by Turizmus Kft. · Editor: Brigitta Vajk · Design: András Nász 2 Metro 2 on map 3 Metro 3 G1 Site of bath, Translation: CHFI Bt. Cover: Future Card Stúdió · Maps: TOPOGRÁF Photos: Tourist Office of Budapest photo archives ≥ Phone number cave on map The publisher does not accept responsibility for damages arising from any changes in information contained in this publication. ¥ Fax [1] Photo Publication closed: November 2005 Printing: PAUKER Printing House Co. www.budapestinfo.hu 3 Dear Readers I would like to welcome you to Budapest, a city which not only greets its guests with a rich history and unique cultural heritage, but also where we, the residents, can witness day by day its resurgence. That tourism is one of the most important economic branches of Budapest is evident in the rise in the number of tourists visiting the capital, and the growth of the quantity and quality of tourism services. Year on year several new hotels spring up in Budapest, numerous old buildings are reconstructed, and new cultural and tourism establishments are born. -

Grand Alpine Express: Budapest to Venice

Grand Alpine Express: Budapest to Venice https://www.irtsociety.com/journey/grand-alpine-express-budapest-to-venice/ Overview The Highlights - Travel through Hungary, Austria, Switzerland, Slovenia,and Italy, with six nights on board the comfortable Golden Eagle Danube Express - Two nights at the Four Seasons Hotel Gresham Palace, Budapest and two nights at the five-star Hotel Danieli in Venice - City tours of Budapest, Vienna, Innsbruck, Zürich, Milan, Trieste, Ljubljana and Venice - Lunch on beautiful Lake Como - Visit stunning Lake Bled in Slovenia - Scenic rail climbs at Semmering & St. Gotthard Pass - Ride on the Achenseebahn, Europe's oldest steam-powered cog railway - Private concert in Vienna, featuring the Vienna Supreme Orchestra - Fully inclusive of meals, drinks, gratuities, touring, & transfers The Society of International Railway Travelers | irtsociety.com | (800) 478-4881 Page 1/5 The Tour The Grand Alpine Express is a scenic feast for the eyes. From the classic capital cities of Budapest and Vienna, venture deep into the Austrian Tyrol before heading across the valleys of the Swiss Alps and onward through the Italian Lake District as you visit Como and Garda before heading into the lesser-known but equally beautiful country of Slovenia and its crown jewel, Lake Bled. Traverse some of the most scenic railway lines in the world as the Golden Eagle Danube Express weaves its way through tunnels, across viaducts, and over mountain passes. Journey's end will be in the stunning maritime city of Venice, an outstanding mixture of Gothic and Renaissance palaces perched on the edge of the Italian coast. A perfect end to a memorable journey of alpine discovery. -

Budapest Information

BUDAPEST INFORMATION WHY HUNGARY, BUDAPEST? Hungary has always been a hub and a meeting point in the very heart of Europe. You can find here the footprints of the Barbarians, the Roman and Ottoman Empires. You can trace the early Catholicism as well as visit the largest operating synagogue in Europe. Full-fledged market economy and a unique blend of cultural, architectural, culinary and everyday lifestyles mark the whole country, particularly the beautiful capital city of Budapest. Easy access from overseas. Short flights from all European capitals, more and more low-cost airlines operating flights to Hungary, see our current available flights in the proposal. Cultural wealth, integral part of European culture. The possibility of listening of contemporary and classical music, opera performed by internationally renowned stars, fiery local gypsy music, top class jazz, the ever popular operetta, folk music and dance in one of Budapest’s numerous concert halls, opera house, restaurants, bars and music clubs. There are a variety of museums, art galleries and exhibition halls to explore. Budapest • Pearl of the Danube. There are few more suitable places worldwide where the uplifting cultural experience could better be combined with the rejuvenating experience of a health spa treatment than Budapest. Scenic beauties. The protected Puszta-regions, the Great Plain, the romantic Danube Bend with historic sites, pretty baroque towns like Eger, Lake Balaton the largest fresh water lake of Central Europe, are pleasant places for leisure time programs. Well-developed infrastructure for conferences and incentives. Deluxe and five star hotels, well skilled and knowledgeable guides, legendary art of cuisine, widely varied, extraordinary venues. -

A MAGYAR Szállodák És Éttermek Szövetsége Alapszabálya, SZERVEZETI ÉS MŰKÖDÉSI SZABÁLYZATA, Címlistája 2013

A MAGYAR SZÁLLODÁK ÉS ÉTTErmEK szÖVETSÉGE ALAPszaBálya, SZERVEZETI ÉS MŰKÖDÉSI SZABÁLYZATA, CÍMLISTÁJA 2013 (módosítva a 2012. november 22–23-án Egerben megtartott XXXVIII. Közgyűlés határozatai alapján) A kiadványban szereplő adatok a Magyar Szállodák és Éttermek Szövetsége tulajdonát képezik, felhasználásuk, közlésük kizárólag a Szövetség előzetes írásos hozzájárulásával történhet. Szerkesztés lezárva: 2013. február 28. A címlista a tagok által a www.hah.hu honlapra feltöltött, illetve módosított adatok alapján készült. Az időközben történt adatváltozások a www.hah.hu honlapon láthatók. Megjelenik a Magyar Szállodák és Éttermek Szövetsége hivatalos lapja, a Turizmus Panoráma különszámaként, a Turizmus Kft. támogatásával. Kiadja a Turizmus Kft. 1074 Budapest, Munkás utca 9. Telefon: 1/266-5853 Telefax: 1/338-4293 www.turizmus.com ISSN 1587-5741 Nyomdai munkálatok: Aduprint Kft. A kiadvány szakmai tartalmát a Magyar Szállodák és Éttermek Szövetsége bocsátotta a kiadó rendelkezésére. A MAGYAR SZÁLLODÁK ÉS ÉTTERMEK SZÖVETSÉGE TISZTELETBELI ELNÖKEI HONORARY PRESIDENTS Alapító elnök Founder President † RÓZSA MIKLÓS 1968–1976 † Pável Jánosné 1977–1978 † Somogyi Jenő 1979–1986 dr. Gyökössy Gyula 1987–1989 † Somogyi Jenő 1990–1991 dr. Rubovszky András 1992–1993 Kovács István 1994–1995 Bocsák László 1996–1997 dr. Rubovszky András 1998–1999 † dr. Wolff Péter 2000–2003 dr. Niklai Ákos 2004–2005 Kopócsy Andrea 2006–2009 dr. Erdei János 2010–2011 3 TARTALOMJEGYZÉK Határozat. 15 Alakuló.határozat.és.végzés .. .. .. .. .. .. .. .. .. .. .. .. .. . -

5-Day Budapest City Guide a Preplanned Step-By-Step Time Line and City Guide for Budapest

5 days 5-day Budapest City Guide A preplanned step-by-step time line and city guide for Budapest. Follow it and get the best of the city. 5-day Budapest City Guide 2 © PromptGuides.com 5-day Budapest City Guide Overview of Day 1 LEAVE HOTEL Tested and recommended hotels in Budapest > Take Metro Line 2 (Red) to Batthyány tér station 09:00-09:20 Batthyány Square The best view of the Page 5 Hungarian Parliament Take Metro Line 2 (Red) from Batthyány tér station to Kossuth tér station (Direction: Örs Vezér tere) - 10’ 09:30-10:00 Kossuth Square Historic square Page 5 Take a walk to Hungarian Parliament 10:00-11:00 Hungarian Parliament One of the most Page 6 imposing parliament Take a walk to the House of Hungarian Art Nouveau - buildings in the world 10’ 11:10-11:55 House of Hungarian Art Nouveau Hidden treasure of Art Page 6 Nouveau architecture Take a walk to Szabadság Square - 5’ 12:00-12:30 Szabadság Square Grand and spacious Page 7 square Take a walk to St. Stephen’s Basilica - 15’ 12:45-13:55 St. Stephen's Basilica Imposing Page 8 neo-Renaissance Lunch time church Take a walk to Váci Street 15:30-16:40 Váci Street Budapest's most Page 8 upscale shopping street Take a walk to Danube Promenade - 10’ 16:50-17:35 Danube Promenade Stunning view over the Page 9 Danube and Buda side END OF DAY 1 of the city © PromptGuides.com 3 5-day Budapest City Guide Overview of Day 1 4 © PromptGuides.com 5-day Budapest City Guide Attraction Details 09:00-09:20 Batthyány Square (Batthyány tér, Budapest) THINGS YOU NEED TO KNOW The historic Main Street (Fő utca) also Batthyány Square is a charming town crosses the square square directly opposite of Parlament on Another monument commemorates Ferenc Buda side. -

Central European Classics (Budapest to Prague)

TRAIN : The Danube Express JOURNEY : Central European Classics (Budapest to Prague) Journey Duration : Upto 8 Days Day 1 - Budapest Arrivals day in Budapest where you will be met and transferred to the five-star Four Seasons Hotel Gresham Palace for a two-night stay. Enjoy a welcome reception dinner in the elegant surrounds of this art nouveau landmark, where you can meet your fellow travellers on this highly anticipated journey. Day 2 - Budapest Budapest is actually two cities separated by the Danube. The old city of Buda and the imposing Royal Palace, dominates the city with stunning views across the Danube to the commercial heart of Pest. Our city tour includes the Royal Palace, St. Mathias Church and a panoramic view of the city from Gellert Hill. We will also see the Citadel, the Opera House, St Stephen’s Cathedral, Heroes Square and the City Park. The rest of the day is at leisure so you can stroll along the banks of the Danube, visit the historic Great Market Hall with its endless variety of delicious foods and wines or head to one of the city’s famous thermal baths for a rejuvenating dip. Alternatively you can relax at the hotel and indulge in the hotel’s luxurious spa with infinity-edge pool or make use of the state-of-the-art fitness centre. This evening we will enjoy a beautiful dinner cruise along the Danube. Day 3 - Keszthely After breakfast join the Golden Eagle Danube Express at Nugyati station after a reception in the Imperial Waiting Room and head to Keszthely on the western shore of Lake Balaton. -

Central European Classics: Budapest to Prague

Central European Classics: Budapest to Prague https://www.irtsociety.com/?post_type=journeys&p=5056 Overview The Highlights - Travel through five European countries, with three nights on board the Golden Eagle Danube Express - Sightseeing in Budapest - Visit Bratislava and the Soviet War Memorial at Slavín - Enjoy concert at Lichtenstein Palace in Vienna - Explore Krakow, with an optional tour of the Auschwitz-Birkenau museum - Enjoy tram tour of Prague - 2-night stay at glorious Four Seasons Hotel Gresham Palace in Budapest - 2-night stay at five-star Four Seasons Hotel in Prague for 2 nights The Tour The Society of International Railway Travelers | irtsociety.com | (800) 478-4881 Page 1/4 Central European Classics, Budapest to Prague by Luxury Train, equals excitement and romance. Explore captivating landscapes and charmed cities, combined with architectural masterpieces from some of Europe’s most poignant periods, with a fascinating insight into modern European culture and traditions. Travel on the comfortable Golden Eagle Danube Express. This short journey is perfect for those who might want to test out a luxury rail journey. Or, it can be combined with the 7-day Castles of Transylvania tour for a longer European holiday. Itinerary Day 1: Budapest, Hungary Arrive today in Budapest, where you will be met and transferred to the five-star Four Seasons Hotel Gresham Palace (or similar) for a two-night stay. Enjoy a welcome reception dinner in the elegant surroundings of this art nouveau landmark, where you can meet your fellow travelers on this highly anticipated journey. Day 2: Budapest, Hungary Budapest is actually two cities separated by the Danube. -

Hedonistic Budapest Classic by Day, Cool by Night, the Hungarian Capital Is an All-Time Thrill

INSTANTESCAPES hedonistic BudaPeSt Classic by day, cool by night, the Hungarian capital is an all-time thrill. Dive in! argain haute cuisine, sprawling outdoor WHAT TO SEE & DO l While lolling in the steamy waters of Buda’s l At the Great Market Hall (Vámház Körút 1-3; Heat haze: from left, let off steam in the Széchenyi l Kick off in the heart of things – on baths is a great way to sweat off a hangover, piaconline.hu; 12 ), citizens bargain for meats, baths; breakfast like a king in the glitzy interior of the city’s grand main boulevard, Andrássy Ut, earning one there is even more enjoyable. spices and veg at ground level, while the first New York Café; the impressive Hungarian Parliament bars and pneumatic nightclubs – it’s easy Building; statue of King Béla IV, in Heroes’ Square which runs from downtown Pest through to On Saturday nights, Széchenyi or Lukács 7 floor hawks tourist tat and local grub. Grab to over-indulge in Budapest. Luckily, the the tranquil expanses of City Park ( 1 on map). host raucous ‘sparties’, attracting local a crispy lángos (deep-fried flatbread) from Expect to encounter an army of joggers B You’ll pass the imposing Neo-Renaissance twentysomethings and tourists (take flip- the eponymous stall and settle down at the trudging the isle’s periphery; skilled ‘ultimate Hungarian capital’s peerless thermal baths can Opera House 2 , innumerable stunning flops and a towel; tickets £18; see lukacsbaths. Panoráma Bár to observe the throng. Frisbee’ matches; and scores of infants facades and finally reach Heroes’ Square 3 , com or szechenyispabaths.com/sparties). -

Turizmus Magyarországon 2004

itthon otthon van Turizmus Magyarországon 2004 www.itthon.hu Itthon otthon van MAGYARORSZÁG Kedves Olvasó! Köszöntjük Önt a magyar turizmusirányítás és az egész turisztikai szakma nevében. A legfrissebb statisztikai adatokat tartalmazó kiadványunk ha- gyományosan, hosszú évek óta jelenik meg annak érdekében, hogy az érdeklődők a számok tükrében is képet alkothassanak a magyar idegen- forgalom fő tendenciáiról, ezen belül is az ágazat legfontosabb szereplői- ről, a szolgáltatókról. Mint az Ön előtt is ismeretes, Magyarország csaknem egy esztendeje az Európai Unió tagja. Tagságunk számos újdonságot hozott már eddig is, és úgy gondoljuk, még több kihívást jelent a jövőre nézve. A turizmus, mint a magyar gazdaság egyik húzóágazata mindig élvezte a mindenkori kormányzat támogatását. Különösen igaz ez az idei esztendőre, hiszen 2005. január elsejével a turisztikai ágazatot önálló kormányhivatal irányít- ja, a regionális fejlesztésért és felzárkóztatásért felelős tárca nélküli mi- niszter felügyelete alatt. Ez új távlatokat nyit az ágazat számára, különösen az átfogó koncepciók megvalósítása, a regionális fejlesztések összehan- golása és az uniós források felhasználása tekintetében. Sorra véve hazánk sokszínű természeti és kulturális értékeit, büszkén ál- lapíthatjuk meg, hogy az élcsapat tagjai vagyunk. Csupán három területet kiemelve: gazdag a magyar termálvíz-készlet, színesek, változatosak kul- turális rendezvényeink, kiváló a magyar gasztronómia és a magyar borok. Mindezeken túlmenően számos lehetőséget rejt a magyar idegenforgalmi kínálat, -

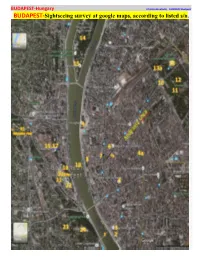

BUDAPEST-Sightseeing Survey at Google Maps, According to Listed S/N

BUDAPEST-Hungary Christos Gkoutzelis, HUNGARY-Budapest BUDAPEST-Sightseeing survey at google maps, according to listed s/n. 1. Liberty Bridge (Szabadsag hid) Liberty Bridge (Szabadság híd,is maybe the less attractive bridge in the city center ) is the one located at the southern end of city center, leading to Gellert Hill. The 333.6 m long bridge was built between 1894 and 1896. Its middle part was destroyed during World War II but it was rebuilt in 1945, and further restoration work was conducted to eliminate all war-related damage between 2007 and 2009. The bridge's main ornaments, four falcon-like bronze statues sitting on top of the bridge's four central masts (these are actually turuls, a mythological bird that represents power, strength and nobility in Hungary), were also restored. The bridge was originally named after the Emperor Franz Joseph, but it was renamed Liberty Bridge when the country was liberated from the Nazi occupation by the Soviet army at the end of World War II in 1945. The same year, the Liberation Monument was erected at the top of Gellert Hill. This imposing statue takes on the form of a woman holding a palm leaf above her head and can best be admired while crossing the bridge. 2. Corvinus University of Budapest (250m,3min from Szabadsag hid) In 1846, József Industrial School was opened gates for economics and trade for upper grade students. The immediate forerunner of the Corvinus University,the Faculty of Economics of the Royal Hungarian University, was established in 1920. The University admitting more than 14,000 students offers educational programmes inagricultural sciences, business administration, economics, and social sciences, and most these disciplines assure it a leading position in Hungarian higher education and is among the best institutions on various national and international rankings.