Abcs (And Ds) of Understanding Vars

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Monetary History of the United States, 1867-1960’

JOURNALOF Monetary ECONOMICS ELSEVIER Journal of Monetary Economics 34 (I 994) 5- 16 Review of Milton Friedman and Anna J. Schwartz’s ‘A monetary history of the United States, 1867-1960’ Robert E. Lucas, Jr. Department qf Economics, University of Chicago, Chicago, IL 60637, USA (Received October 1993; final version received December 1993) Key words: Monetary history; Monetary policy JEL classijcation: E5; B22 A contribution to monetary economics reviewed again after 30 years - quite an occasion! Keynes’s General Theory has certainly had reappraisals on many anniversaries, and perhaps Patinkin’s Money, Interest and Prices. I cannot think of any others. Milton Friedman and Anna Schwartz’s A Monetary History qf the United States has become a classic. People are even beginning to quote from it out of context in support of views entirely different from any advanced in the book, echoing the compliment - if that is what it is - so often paid to Keynes. Why do people still read and cite A Monetary History? One reason, certainly, is its beautiful time series on the money supply and its components, extended back to 1867, painstakingly documented and conveniently presented. Such a gift to the profession merits a long life, perhaps even immortality. But I think it is clear that A Monetary History is much more than a collection of useful time series. The book played an important - perhaps even decisive - role in the 1960s’ debates over stabilization policy between Keynesians and monetarists. It organ- ized nearly a century of U.S. macroeconomic evidence in a way that has had great influence on subsequent statistical and theoretical research. -

Monte Carlo Simulations of the Nested Fixed-Point Algorithm

MONTE CARLO SIMULATIONS OF THE NESTED FIXED-POINT ALGORITHM Erik P. Johnson Working Paper # WP2011-011 October 2010 http://www.econ.gatech.edu/research/wokingpapers School of Economics Georgia Institute of Technology 221 Bobby Dodd Way Atlanta, GA 30332–0615 c by Erik P. Johnson. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including c notice, is given to the source. Monte Carlo Simulations of the Nested Fixed-Point Algorithm Erik P. Johnson Working Paper # WP2011-11 October 2010 JEL No. C18, C63 ABSTRACT There have been substantial advances in dynamic structural models and in the economet- ric literature about techniques to estimate those models over the past two decades. One area in which these new developments has lagged is in studying robustness to distribu- tional assumptions and finite sample properties in small samples. This paper extends our understanding of the behavior of these estimation techniques by replicating John Rust’s (1987) influential paper using the nested fixed-point algorithm (NFXP) and then using Monte Carlo techniques to examine the finite sample properties of the estimator. I then examine the consequences of the distributional assumptions needed to estimate the model on the parameter estimates. I find that even in sample sizes of up to 8,000 observations, the NFXP can display finite sample bias and variances substantially larger than the theoret- ical asymptotic variance. This is also true with departures from distributional assumptions, with the mean square error increasing by a factor of 10 for some distributions of unobserved variables. -

DP Econometrics 2

This document was generated at 9:20 AM on Friday, November 08, 2013 13 – Econometric Applications of Dynamic Programming AGEC 637 - 2013 I. Positive analysis using a DP foundation: Econometric applications of DP One of the most active areas of research involving numerical dynamic optimization, is the use of DP models in positive analysis. This work seeks to understand the nature of a particular problem being solved by a decision maker. 1 By specifying explicitly the optimization problem being solved, the analyst is able to estimate the parameters of a structural model, as opposed to the easier and more come reduced form approach. This approach was first develop by John Rust (1987) and I draw here directly on his original paper to explain how this is done. He provides a more complete description of his approach in Rust (1994a and 1994b). My focus here will be quite narrow and serves only as an introduction to this literature. A more generally and up-to-date review of approaches for the estimation of the parameters of dynamic optimization problems is provided by Keane et al. (2011). Recall that Rust’s paper was “Optimal Replacement of GMC Bus Engines: An Empirical Model of Harold Zurcher.” The state variable xt denotes the accumulated mileage (since last replacement) of the GMC bus engines of the bus fleet in the Madison, Wisconsin. Harold Zurcher must make the choice as to whether to carry out routine maintenance, θ θ i=0, or replace the engine, i=1. Each period the operating costs, c(xt, 1) where is a vector of parameters to be estimated. -

Inattentive Consumers

Inattentive Consumers Ricardo Reis∗ Department of Economics and Woodrow Wilson School, Princeton University, Princeton, NJ 08544, USA Abstract This paper studies the consumption decisions of agents who face costs of acquiring, absorbing and processing information. These consumers rationally choose to only sporadically update their information and re-compute their optimal consumption plans. In between updating dates, they remain inattentive. This behavior implies that news disperses slowly throughout the population, so events have a gradual and delayed effect on aggregate consumption. The model predicts that aggregate consumption adjusts slowly to shocks, and is able to explain the excess sensitivity and excess smoothness puzzles. In addition, individual consumption is sensitive to ordinary and unexpected past news, but it is not sensitive to extraordinary or predictable events. The model further predicts that some people rationally choose to not plan, live hand-to-mouth, and save less, while other people sporadically update their plans. The longer are these plans, the more they save. Evidence using U.S. aggregate and microeconomic data generally supports these predictions. JEL classification codes: E2, D9, D1, D8 ∗I am grateful to N. Gregory Mankiw, Alberto Alesina, Robert Barro, and David Laibson for their guidance and to Andrew Abel, Susanto Basu, John Campbell, Larry Christiano, Mariana Colacelli, Benjamin Friedman, Jens Hilscher, Yves Nosbusch, David Romer, John Shea, Monica Singhal, Adam Szeidl, Bryce Ward, Justin Wolfers, and numerous seminar participants for useful comments. The Fundação Ciência e Tecnologia, Praxis XXI and the Eliot Memorial fellowship provided financial support. Tel.: +1-609-258-8531; fax: +1-609-258-5349. E-mail address: [email protected]. -

Present 1995-1996 Mark Bils, University of Rochester Bo Honore, Princeton U

DEPARTMENT OF ECONOMICS SHORT-TERM VISITORS 1995 – Present 1995-1996 Mark Bils, University of Rochester Bo Honore, Princeton University 1996-1997 George Loewenstein, Carnegie Mellon University Dan Peled, Technion - Israel Institute of Technology Motty Perry, Hebrew University of Jerusalem Arnold Zellner, University of Chicago 1997-1998 Costas Meghir, University College of London Dan Peled, Technion - Israel Institute of Technology Motty Perry, Hebrew University of Jerusalem Andrew Postlewaite, University of Pennsylvania 1998-1999 James J. Heckman, University of Chicago 1999-2000 Robert Trivers, Rutgers University Wilbert van der Klaauw, University of North Carolina - Chapel Hill 2000-2001 Richard Blundell, University College London Kyle Bagwell, Columbia University Dennis Epple, Carnegie-Mellon University -- CANCELLED Narayana Kocherlakota, University of Minnesota (Bank of Montreal) Dale Mortensen, Northwestern University 2001-2002 Peter Howitt, Brown University (Bank of Montreal) Bo Honore, Princeton University Tim Kehoe, University of Minnesota Antonio Merlo, University of Pennsylvania Peter Norman, University of Wisconsin Angela Redish, University of British Columbia (Bank of Montreal) 2002-2003 John Abowd, Cornell University George Neumann, Iowa University 2003-2004 Tyler Cowan, George Mason University Ayse Imrohoroglu, University of Southern California 2004-2005 Derek Neal, University of Chicago Christopher Flinn, New York University 2005-2006 Christopher Flinn, New York University Enrique Mendoza, University of Maryland Derek Allen -

This PDF Is a Selection from an Out-Of-Print Volume from the National Bureau of Economic Research

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: New Directions in Economic Research Volume Author/Editor: NBER Volume Publisher: NBER Volume URL: http://www.nber.org/books/unkn71-6 Publication Date: 1971 Chapter Title: Front matter to "New Directions in Economic Research" Chapter Author: Various Chapter URL: http://www.nber.org/chapters/c4173 Chapter pages in book: (p. -13 - 0) NATIONAL BU.REAU OF ECONOMIC RESEARCH, INC. 51ST ANNUAL REPORT, SEPTEMBER, 1971 DIRECTIONS IN ECONOMIC RESEARCH COPYRIGHT ©1971BY NATIONAL BUREAU OF ECONOMIC RESEARCH, INC. 261 MADISON AVENUE, NEW YORK, N. Y. 10016 ALL RIGHTS RESERVED PRINTED IN THE UNITED STATES OF AMERICA The National Bureau of Economic Research was organized in 1920 in response to a growing demand for objective deter- mination of the facts bearing upon economic problems, and for their interpretation in an impartial manner. The National Bureau concentrates on topics of national importance that are susceptible of scientific treatment. The National Bureau seeks not merely to determine and interpret important economic facts, but to do so under such auspices and with such safeguards as shall make its findings carry conviction to all sections of the nation. No report of the research staff may be published without the approval of the Board of Directors. Rigid provisions guard the National Bureau from becoming a source of profit to its members, directors, or officers, and from becoming an agency for propaganda. By issuing its findings in the form of scientific reports, en- tirely divorced from recommendations on policy, the National Bureau hopes to aid all thoughtful men, however divergent their views of public policy, to base their discussions upon objective knowledge as distinguished from subjective opinion. -

A Dynamic Programming Model of Retirement Behavior

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: The Economics of Aging Volume Author/Editor: David A. Wise, editor Volume Publisher: University of Chicago Press Volume ISBN: 0-226-90295-1 Volume URL: http://www.nber.org/books/wise89-1 Conference Date: March 19-22, 1987 Publication Date: 1989 Chapter Title: A Dynamic Programming Model of Retirement Behavior Chapter Author: John P. Rust Chapter URL: http://www.nber.org/chapters/c11588 Chapter pages in book: (p. 359 - 404) 12 A Dynamic Programming Model of Retirement Behavior John Rust 12.1 Introduction This paper derives a model of the retirement behavior of older male workers from the solution to a stochastic dynamic programming prob- lem. The worker's objective is to maximize expected discounted utility over his remaining lifetime. At each time period t the worker chooses control variables (ct,dt) where ct denotes the level of consumption expenditures and dt denotes the decision whether to work full-time, part-time, or to exit the labor force. The model accounts for the se- quential nature of the retirement decision problem and the role of expectations of the uncertain future values of state variables (xt) such as the worker's future lifespan, health status, marital or family status, employment status, and earnings from employment, assets, Social Se- curity retirement, disability, and Medicare payments. Given specific assumptions about workers' preferences and expectations, the model generates a predicted stochastic process for the variables {ct,dt,xt}. This paper, however, focuses on the inverse or "revealed preference" prob- lem: given data on {ct,dt,xt}, how can one go backward and "uncover" the worker's underlying preferences and expectations? One can formalize the revealed preference problem as a problem of statistical inference. -

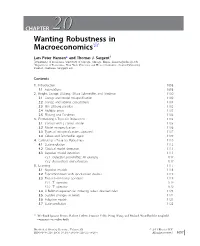

CHAPTER 2020 Wanting Robustness in Macroeconomics$

CHAPTER 2020 Wanting Robustness in Macroeconomics$ Lars Peter Hansen* and Thomas J. Sargent{ * Department of Economics, University of Chicago, Chicago, Illinois. [email protected] { Department of Economics, New York University and Hoover Institution, Stanford University, Stanford, California. [email protected] Contents 1. Introduction 1098 1.1 Foundations 1098 2. Knight, Savage, Ellsberg, Gilboa-Schmeidler, and Friedman 1100 2.1 Savage and model misspecification 1100 2.2 Savage and rational expectations 1101 2.3 The Ellsberg paradox 1102 2.4 Multiple priors 1103 2.5 Ellsberg and Friedman 1104 3. Formalizing a Taste for Robustness 1105 3.1 Control with a correct model 1105 3.2 Model misspecification 1106 3.3 Types of misspecifications captured 1107 3.4 Gilboa and Schmeidler again 1109 4. Calibrating a Taste for Robustness 1110 4.1 State evolution 1112 4.2 Classical model detection 1113 4.3 Bayesian model detection 1113 4.3.1 Detection probabilities: An example 1114 4.3.2 Reservations and extensions 1117 5. Learning 1117 5.1 Bayesian models 1118 5.2 Experimentation with specification doubts 1119 5.3 Two risk-sensitivity operators 1119 5.3.1 T1 operator 1119 5.3.2 T2 operator 1120 5.4 A Bellman equation for inducing robust decision rules 1121 5.5 Sudden changes in beliefs 1122 5.6 Adaptive models 1123 5.7 State prediction 1125 $ We thank Ignacio Presno, Robert Tetlow, Franc¸ois Velde, Neng Wang, and Michael Woodford for insightful comments on earlier drafts. Handbook of Monetary Economics, Volume 3B # 2011 Elsevier B.V. ISSN 0169-7218, DOI: 10.1016/S0169-7218(11)03026-7 All rights reserved. -

On the Mechanics of Economic Development*

Journal of Monetary Economics 22 (1988) 3-42. North-Holland ON THE MECHANICS OF ECONOMIC DEVELOPMENT* Robert E. LUCAS, Jr. University of Chicago, Chicago, 1L 60637, USA Received August 1987, final version received February 1988 This paper considers the prospects for constructing a neoclassical theory of growth and interna tional trade that is consistent with some of the main features of economic development. Three models are considered and compared to evidence: a model emphasizing physical capital accumula tion and technological change, a model emphasizing human capital accumulation through school ing. and a model emphasizing specialized human capital accumulation through learning-by-doing. 1. Introduction By the problem of economic development I mean simply the problem of accounting for the observed pattern, across countries and across time, in levels and rates of growth of per capita income. This may seem too narrow a definition, and perhaps it is, but thinking about income patterns will neces sarily involve us in thinking about many other aspects of societies too. so I would suggest that we withhold judgment on the scope of this definition until we have a clearer idea of where it leads us. The main features of levels and rates of growth of national incomes are well enough known to all of us, but I want to begin with a few numbers, so as to set a quantitative tone and to keep us from getting mired in the wrong kind of details. Unless I say otherwise, all figures are from the World Bank's World Development Report of 1983. The diversity across countries in measured per capita income levels is literally too great to be believed. -

Structural Methods for Labor Economics Fall 2008 Course

Department of Economics, UC Berkeley Economics 250c: Structural Methods for Labor Economics Fall 2008 Course Outline and Reading List The goal of the course is to provide a selective overview of more “structural” methods in labor economics and empirical micro, including single period models and dynamic choice problems. Students are assumed to be familiar with basic econometrics and consumer demand theory, and with “reduced form” methods such as regression, instrumental variables, etc. Three recommended text books are: J. Angist and S. Pischke, Mostly Harmless Econometrics. Princeton Press, forthcoming 2008. I have managed to get an advanced copy of this text -- paper copies will be available to class members. This is highly recommended for people who want to catch up on classic reduced form methods. K. Train, Discrete Choice Methods with Simulation. Cambridge U. Press, 2003. J. Adda and R. Cooper, Dynamic Programming: Theory and Applications. MIT Press, 2003. These three are all relatively easy reading. I also recommend the “What’s New in Econometrics?” (WNiE) lectures by G. Imbens and J. Wooldridge (especially lectures 6, 11, 9, and 7, in that order) which are available at the NBER website. Preliminary Outline (Incomplete and subject to additions/changes). 1. Introductory Lecture: Structural vs. Alternative Approaches Background reading: Daniel McFadden. “Economics Choices.” AER, June 2001. Edward E. Leamer. “Let's Take the Con Out of Econometrics.” AER March 1983. 2. Simple Static Choice Models Michael Ransom. “An Empirical Model of Discrete and Continuous Choice in Family Labor Supply.” Review of Economics and Statistics 69 (3) (1987): 465-472. (See also: Michael Ransom. -

Pricing Uncertainty Induced by Climate Change∗

Pricing Uncertainty Induced by Climate Change∗ Michael Barnett William Brock Lars Peter Hansen Arizona State University University of Wisconsin University of Chicago and University of Missouri January 30, 2020 Abstract Geophysicists examine and document the repercussions for the earth’s climate induced by alternative emission scenarios and model specifications. Using simplified approximations, they produce tractable characterizations of the associated uncer- tainty. Meanwhile, economists write highly stylized damage functions to speculate about how climate change alters macroeconomic and growth opportunities. How can we assess both climate and emissions impacts, as well as uncertainty in the broadest sense, in social decision-making? We provide a framework for answering this ques- tion by embracing recent decision theory and tools from asset pricing, and we apply this structure with its interacting components to a revealing quantitative illustration. (JEL D81, E61, G12, G18, Q51, Q54) ∗We thank James Franke, Elisabeth Moyer, and Michael Stein of RDCEP for the help they have given us on this paper. Comments, suggestions and encouragement from Harrison Hong and Jose Scheinkman are most appreciated. We gratefully acknowledge Diana Petrova and Grace Tsiang for their assistance in preparing this manuscript, Erik Chavez for his comments, and Jiaming Wang, John Wilson, Han Xu, and especially Jieyao Wang for computational assistance. More extensive results and python scripts are avail- able at http://github.com/lphansen/Climate. The Financial support for this project was provided by the Alfred P. Sloan Foundation [grant G-2018-11113] and computational support was provided by the Research Computing Center at the University of Chicago. Send correspondence to Lars Peter Hansen, University of Chicago, 1126 E. -

ΒΙΒΛΙΟΓ ΡΑΦΙΑ Bibliography

Τεύχος 53, Οκτώβριος-Δεκέμβριος 2019 | Issue 53, October-December 2019 ΒΙΒΛΙΟΓ ΡΑΦΙΑ Bibliography Βραβείο Νόμπελ στην Οικονομική Επιστήμη Nobel Prize in Economics Τα τεύχη δημοσιεύονται στον ιστοχώρο της All issues are published online at the Bank’s website Τράπεζας: address: https://www.bankofgreece.gr/trapeza/kepoe https://www.bankofgreece.gr/en/the- t/h-vivliothhkh-ths-tte/e-ekdoseis-kai- bank/culture/library/e-publications-and- anakoinwseis announcements Τράπεζα της Ελλάδος. Κέντρο Πολιτισμού, Bank of Greece. Centre for Culture, Research and Έρευνας και Τεκμηρίωσης, Τμήμα Documentation, Library Section Βιβλιοθήκης Ελ. Βενιζέλου 21, 102 50 Αθήνα, 21 El. Venizelos Ave., 102 50 Athens, [email protected] Τηλ. 210-3202446, [email protected], Tel. +30-210-3202446, 3202396, 3203129 3202396, 3203129 Βιβλιογραφία, τεύχος 53, Οκτ.-Δεκ. 2019, Bibliography, issue 53, Oct.-Dec. 2019, Nobel Prize Βραβείο Νόμπελ στην Οικονομική Επιστήμη in Economics Συντελεστές: Α. Ναδάλη, Ε. Σεμερτζάκη, Γ. Contributors: A. Nadali, E. Semertzaki, G. Tsouri Τσούρη Βιβλιογραφία, αρ.53 (Οκτ.-Δεκ. 2019), Βραβείο Nobel στην Οικονομική Επιστήμη 1 Bibliography, no. 53, (Oct.-Dec. 2019), Nobel Prize in Economics Πίνακας περιεχομένων Εισαγωγή / Introduction 6 2019: Abhijit Banerjee, Esther Duflo and Michael Kremer 7 Μονογραφίες / Monographs ................................................................................................... 7 Δοκίμια Εργασίας / Working papers ......................................................................................