Browse the Program from the Conference

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Walter Heller Oral History Interview II, 12/21/71, by David G

LYNDON BAINES JOHNSON LIBRARY ORAL HISTORY COLLECTION LBJ Library 2313 Red River Street Austin, Texas 78705 http://www.lbjlib.utexas.edu/johnson/archives.hom/biopage.asp WALTER HELLER ORAL HISTORY, INTERVIEW II PREFERRED CITATION For Internet Copy: Transcript, Walter Heller Oral History Interview II, 12/21/71, by David G. McComb, Internet Copy, LBJ Library. For Electronic Copy on Compact Disc from the LBJ Library: Transcript, Walter Heller Oral History Interview II, 12/21/71, by David G. McComb, Electronic Copy, LBJ Library. GENERAL SERVICES ADNINISTRATION NATIONAL ARCHIVES AND RECORDS SERVICE LYNDON BAINES JOHNSON LIBRARY Legal Agreement Pertaining to the Oral History Interviews of Walter W. Heller In accordance with the provisions of Chapter 21 of Title 44, United States Code and subject to the terms and conditions hereinafter· set forth, I, Walter W. Heller of Minneapolis, Minnesota do hereby give, donate and convey to the United States of America all my rights, title and interest in the tape record- ings and transcripts of the personal interviews conducted on February 20, 1970 and December 21,1971 in Minneapolis, Minnesota and prepared for deposit in the Lyndon Baines Johnson Library. This assignment is subject to the following terms and conditions: (1) The edited transcripts shall be available for use by researchers as soon as they have been deposited in the Lyndon Baines Johnson Library. (2) The tape recordings shall not be available to researchers. (3) During my lifetime I retain all copyright in the material given to the United States by the terms of this instrument. Thereafter the copyright in the edited transcripts shall pass to the United States Government. -

Training Contracts, Employee Turnover, and the Returns from Firm-Sponsored General Training

DISCUSSION PAPER SERIES IZA DP No. 10835 Training Contracts, Employee Turnover, and the Returns from Firm-Sponsored General Training Mitchell Hoffman Stephen V. Burks JUNE 2017 DISCUSSION PAPER SERIES IZA DP No. 10835 Training Contracts, Employee Turnover, and the Returns from Firm-Sponsored General Training Mitchell Hoffman University of Toronto and NBER Stephen V. Burks University of Minnesota, Morris and IZA JUNE 2017 Any opinions expressed in this paper are those of the author(s) and not those of IZA. Research published in this series may include views on policy, but IZA takes no institutional policy positions. The IZA research network is committed to the IZA Guiding Principles of Research Integrity. The IZA Institute of Labor Economics is an independent economic research institute that conducts research in labor economics and offers evidence-based policy advice on labor market issues. Supported by the Deutsche Post Foundation, IZA runs the world’s largest network of economists, whose research aims to provide answers to the global labor market challenges of our time. Our key objective is to build bridges between academic research, policymakers and society. IZA Discussion Papers often represent preliminary work and are circulated to encourage discussion. Citation of such a paper should account for its provisional character. A revised version may be available directly from the author. IZA – Institute of Labor Economics Schaumburg-Lippe-Straße 5–9 Phone: +49-228-3894-0 53113 Bonn, Germany Email: [email protected] www.iza.org IZA DP No. 10835 JUNE 2017 ABSTRACT Training Contracts, Employee Turnover, and the Returns from Firm-Sponsored General Training* Firms may be reluctant to provide general training if workers can quit and use their gained skills elsewhere. -

Kermit Gordon and Walter W

Kermit Gordon and Walter W. Heller Oral History Interview –JFK #2, 9/14/1972 Administrative Information Creator: Kermit Gordon and Walter W. Heller Interviewer: Larry J. Hackman and Joseph A. Pechman Date of Interview: September 14, 1972 Place of Interview: Washington, D.C. Length: 50 pp. Biographical Note Gordon, Kermit; Economist, Member, Council of Economic Advisers (1961-1962). Heller, Walter W.; Economist, Chairman, Council of Economic Advisers (1961-1964). Gordon and Heller discuss wage-price guideposts, the steel crises in 1962 and 1963, John F. Kennedy’s [JFK] relationship with the business community, and their efforts regarding tax reform and a tax cut bill, among other issues. Access Restrictions No restrictions. Usage Restrictions Copyright of these materials have passed to the United States Government upon the death of the interviewees. Users of these materials are advised to determine the copyright status of any document from which they wish to publish. Copyright The copyright law of the United States (Title 17, United States Code) governs the making of photocopies or other reproductions of copyrighted material. Under certain conditions specified in the law, libraries and archives are authorized to furnish a photocopy or other reproduction. One of these specified conditions is that the photocopy or reproduction is not to be “used for any purpose other than private study, scholarship, or research.” If a user makes a request for, or later uses, a photocopy or reproduction for purposes in excesses of “fair use,” that user may be liable for copyright infringement. This institution reserves the right to refuse to accept a copying order if, in its judgment, fulfillment of the order would involve violation of copyright law. -

Contract Theory and the Limits of Contract Law

Columbia Law School Scholarship Archive Faculty Scholarship Faculty Publications 2003 Contract Theory and the Limits of Contract Law Alan Schwartz Robert E. Scott Columbia Law School, [email protected] Follow this and additional works at: https://scholarship.law.columbia.edu/faculty_scholarship Part of the Contracts Commons Recommended Citation Alan Schwartz & Robert E. Scott, Contract Theory and the Limits of Contract Law, 113 YALE L. J. 541 (2003). Available at: https://scholarship.law.columbia.edu/faculty_scholarship/339 This Article is brought to you for free and open access by the Faculty Publications at Scholarship Archive. It has been accepted for inclusion in Faculty Scholarship by an authorized administrator of Scholarship Archive. For more information, please contact [email protected]. Article Contract Theory and the Limits of Contract Law Alan Schwartz* and Robert E. Scottt* CONTENTS I. IN TROD U CTION ................................................................................. 543 II. JUSTIFYING AN EFFICIENCY THEORY OF CONTRACT ........................ 550 A . W hat Firms M axim ize .................................................................. 550 B. Why the State Should Help Firms ................................................ 555 III. THE ENFORCEMENT FUNCTION ........................................................ 556 A. Enforcement Often Is Unnecessary.............................................. 557 B. EncouragingRelation-Specific Investment .................................. 559 C. -

A Monetary History of the United States, 1867-1960’

JOURNALOF Monetary ECONOMICS ELSEVIER Journal of Monetary Economics 34 (I 994) 5- 16 Review of Milton Friedman and Anna J. Schwartz’s ‘A monetary history of the United States, 1867-1960’ Robert E. Lucas, Jr. Department qf Economics, University of Chicago, Chicago, IL 60637, USA (Received October 1993; final version received December 1993) Key words: Monetary history; Monetary policy JEL classijcation: E5; B22 A contribution to monetary economics reviewed again after 30 years - quite an occasion! Keynes’s General Theory has certainly had reappraisals on many anniversaries, and perhaps Patinkin’s Money, Interest and Prices. I cannot think of any others. Milton Friedman and Anna Schwartz’s A Monetary History qf the United States has become a classic. People are even beginning to quote from it out of context in support of views entirely different from any advanced in the book, echoing the compliment - if that is what it is - so often paid to Keynes. Why do people still read and cite A Monetary History? One reason, certainly, is its beautiful time series on the money supply and its components, extended back to 1867, painstakingly documented and conveniently presented. Such a gift to the profession merits a long life, perhaps even immortality. But I think it is clear that A Monetary History is much more than a collection of useful time series. The book played an important - perhaps even decisive - role in the 1960s’ debates over stabilization policy between Keynesians and monetarists. It organ- ized nearly a century of U.S. macroeconomic evidence in a way that has had great influence on subsequent statistical and theoretical research. -

The Federal Trade Commission and Online Consumer Contracts

SMITH – FINAL THE FEDERAL TRADE COMMISSION AND ONLINE CONSUMER CONTRACTS Hilary Smith Consumer contracts have long posed a challenge for traditional contract enforcement regimes. With the rise in quick online transactions involving clickwrap and browsewrap contracts, these challenges only become more pressing. This Note identifies the problems inherent in the current system and explores proposals and past attempts to improve online consumer contract interpretation and enforcement. Ultimately, this Note identifies the Federal Trade Commission (“FTC”) as an appropriate and effective agency to provide the much-needed change to online consumer contract enforcement. Based upon its authority under Section 5 of the Federal Trade Commission Act to regulate unfair business practices, the broad discretion that Congress has afforded the FTC, and its successful incursion into the related field of online privacy law, the FTC is uniquely situated to promulgate a new online consumer contracting regime. This Note illustrates the basis and precedent for such a step and explores the form and effects of FTC involvement in online consumer contracts. I. Introduction ............................................................... 513 II. Background on End User License Agreements and Consumer Contracts .................................................. 514 A. Impact of Online Contracting on Consumer Contracts ............................................................. 514 B. Problems with Online Consumer Contracts ....... 517 J.D. Candidate 2017, Columbia Law School; B.A. 2014, Columbia University. Many thanks to Professor Robert Scott for his guidance throughout the research and writing process. Additional thanks to the staff and editors of the Columbia Business Law Review for their assistance in preparing this Note for publication. SMITH – FINAL No. 2:512] THE FTC AND ONLINE CONSUMER CONTRACTS 513 III. -

4000 Contract Law: General Theories

4000 CONTRACT LAW: GENERAL THEORIES Richard Craswell Professor of Law, Stanford Law School © Copyright 1999 Richard Craswell Abstract When contracts are incomplete, the law must rely on default rules to resolve any issues that have not been explicitly addressed by the parties. Some default rules (called ‘majoritarian’ or ‘market-mimicking’) are designed to be left in place by most parties, and thus are chosen to reflect an efficient allocation of rights and duties. Others (called ‘information-forcing’ or ‘penalty’ default rules) are designed not to be left in place, but rather to encourage the parties themselves to explicitly provide some other resolution; these rules thus aim to encourage an efficient contracting process. This chapter describes the issues raised by such rules, including their application to heterogeneous markets and to separating and pooling equilibria; it also briefly discusses some non- economic theories of default rules. Finally, this chapter also discusses economic and non-economic theories about the general question of why contracts should be enforced at all. JEL classification: K12 Keywords: Contracts, Incomplete Contracts, Default Rules 1. Introduction This chapter describes research bearing on the general aspects of contract law. Most research in law and economics does not explicitly address these general aspects, but instead proceeds directly to analyze particular rules of contract law, such as the remedies for breach. That body of research is described below in Chapters 4100 through 4800. There is, however, some scholarship on the general nature of contract law’s ‘default rules’, or the rules that define the parties’ obligations in the absence of any explicit agreement to the contrary. -

What Have We Learned Since October 1979?

Panel Discussion I Moderation.” Recessions have become less fre- What Have We Learned Since quent and milder, and quarter-to-quarter volatility October 1979? in output and employment has declined signifi- cantly as well. The sources of the Great Moderation Ben S. Bernanke remain somewhat controversial, but, as I have argued elsewhere, there is evidence for the view he question asked of this panel is, that improved control of inflation has contributed “What have we learned since October in important measure to this welcome change in 1979?” The evidence suggests that we the economy (Bernanke, 2004). Paul Volcker and have learned quite a bit. Most notably, his colleagues on the Federal Open Market Com- Tmonetary policymakers, political leaders, and mittee deserve enormous credit both for recogniz- the public have been persuaded by two decades ing the crucial importance of achieving low and of experience that low and stable inflation has stable inflation and for the courage and persever- very substantial economic benefits. ance with which they tackled America’s critical This consensus marks a considerable change inflation problem. from the views held by many economists at the I could say much more about Volcker’s time that Paul Volcker became Fed Chairman. In achievement and its lasting benefits, but I am sure 1979, most economists would have agreed that, that many other speakers will cover that ground. in principle, low inflation promotes economic Instead, in my remaining time, I will focus on growth and efficiency in the long run. However, some lessons that economists have drawn from many also believed that, in the range of inflation the Volcker regime regarding the importance of rates typically experienced by industrial countries, credibility in central banking and how that credi- the benefits of low inflation are probably small— bility can be obtained. -

Putting Auction Theory to Work

Putting Auction Theory to Work Paul Milgrom With a Foreword by Evan Kwerel © 2003 “In Paul Milgrom's hands, auction theory has become the great culmination of game theory and economics of information. Here elegant mathematics meets practical applications and yields deep insights into the general theory of markets. Milgrom's book will be the definitive reference in auction theory for decades to come.” —Roger Myerson, W.C.Norby Professor of Economics, University of Chicago “Market design is one of the most exciting developments in contemporary economics and game theory, and who can resist a master class from one of the giants of the field?” —Alvin Roth, George Gund Professor of Economics and Business, Harvard University “Paul Milgrom has had an enormous influence on the most important recent application of auction theory for the same reason you will want to read this book – clarity of thought and expression.” —Evan Kwerel, Federal Communications Commission, from the Foreword For Robert Wilson Foreword to Putting Auction Theory to Work Paul Milgrom has had an enormous influence on the most important recent application of auction theory for the same reason you will want to read this book – clarity of thought and expression. In August 1993, President Clinton signed legislation granting the Federal Communications Commission the authority to auction spectrum licenses and requiring it to begin the first auction within a year. With no prior auction experience and a tight deadline, the normal bureaucratic behavior would have been to adopt a “tried and true” auction design. But in 1993 there was no tried and true method appropriate for the circumstances – multiple licenses with potentially highly interdependent values. -

Module 4: Moral Hazard - Linear Contracts

Module 4: Moral Hazard - Linear Contracts Information Economics (Ec 515) George Georgiadis · A principal employs an agent. ◦ Timing: ◦ 1. The principal o↵ers a linear contract of the form w (q)=↵ + βq. – ↵ is the salary, β is the bonus rate. 2. The agent chooses whether the accept or reject the contract. – If the agent accepts it, then goto t =3. – If the agent rejects it, then he receives his outside option U, the principal receives profit 0, and the game ends. 3. The agent chooses action / e↵ort a A [0, ]. 2 ⌘ 1 4. Output q = a + " is realized, where " (0,σ2) ⇠N 5. The principal pays the agent, and the parties’ payo↵s are realized. The principal is risk neutral. His profit function is ◦ E [q w (q)] − The agent is risk averse. His utility function is ◦ r(w(q) c(a)) U (w, a)=E e− − − ⇥ ⇤ with a2 c (a)=c 2 Rationality assumptions: ◦ 1. Upon observing the contract w ( ), the agent chooses his action to maximize his · expected utility. 1 2. The principal, anticipating (1), chooses the contract w ( ) to maximize his expected · profit. First Best Benchmark: Suppose the principal could choose the action a. ◦ – We call this benchmark the first best or the efficient outcome. – Equivalent to say that the agent’s action is verifiable or contractible. Principal solves: ◦ max E [a + ✏ w (q)] a,w(q) − r(w(q) c(a)) s.t. E e− − U Individual Rationality (IR) − ≥ ⇥ ⇤ Solution approach: ◦ rx rEx[x] – Jensen’s inequality = Ex [ e− ] e− ) − – Because the principal chooses the action, optimal wage must be independent of q; i.e., w (q)=↵ – Because a higher w (q) decreases the principal’s profit and increases the agent’s payo↵, (IR) must bind. -

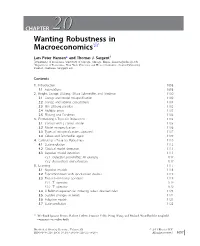

CHAPTER 2020 Wanting Robustness in Macroeconomics$

CHAPTER 2020 Wanting Robustness in Macroeconomics$ Lars Peter Hansen* and Thomas J. Sargent{ * Department of Economics, University of Chicago, Chicago, Illinois. [email protected] { Department of Economics, New York University and Hoover Institution, Stanford University, Stanford, California. [email protected] Contents 1. Introduction 1098 1.1 Foundations 1098 2. Knight, Savage, Ellsberg, Gilboa-Schmeidler, and Friedman 1100 2.1 Savage and model misspecification 1100 2.2 Savage and rational expectations 1101 2.3 The Ellsberg paradox 1102 2.4 Multiple priors 1103 2.5 Ellsberg and Friedman 1104 3. Formalizing a Taste for Robustness 1105 3.1 Control with a correct model 1105 3.2 Model misspecification 1106 3.3 Types of misspecifications captured 1107 3.4 Gilboa and Schmeidler again 1109 4. Calibrating a Taste for Robustness 1110 4.1 State evolution 1112 4.2 Classical model detection 1113 4.3 Bayesian model detection 1113 4.3.1 Detection probabilities: An example 1114 4.3.2 Reservations and extensions 1117 5. Learning 1117 5.1 Bayesian models 1118 5.2 Experimentation with specification doubts 1119 5.3 Two risk-sensitivity operators 1119 5.3.1 T1 operator 1119 5.3.2 T2 operator 1120 5.4 A Bellman equation for inducing robust decision rules 1121 5.5 Sudden changes in beliefs 1122 5.6 Adaptive models 1123 5.7 State prediction 1125 $ We thank Ignacio Presno, Robert Tetlow, Franc¸ois Velde, Neng Wang, and Michael Woodford for insightful comments on earlier drafts. Handbook of Monetary Economics, Volume 3B # 2011 Elsevier B.V. ISSN 0169-7218, DOI: 10.1016/S0169-7218(11)03026-7 All rights reserved. -

The Transformation of Economic Analysis at the Federal Reserve During the 1960S

The Transformation of Economic Analysis at the Federal Reserve during the 1960s by Juan Acosta and Beatrice Cherrier CHOPE Working Paper No. 2019-04 January 2019 The transformation of economic analysis at the Federal Reserve during the 1960s Juan Acosta (Université de Lille) and Beatrice Cherrier (CNRS-THEMA, University of Cergy Pontoise) November 2018 Abstract: In this paper, we build on data on Fed officials, oral history repositories, and hitherto under-researched archival sources to unpack the torturous path toward crafting an institutional and intellectual space for postwar economic analysis within the Federal Reserve. We show that growing attention to new macroeconomic research was a reaction to both mounting external criticisms against the Fed’s decision- making process and a process internal to the discipline whereby institutionalism was displaced by neoclassical theory and econometrics. We argue that the rise of the number of PhD economists working at the Fed is a symptom rather than a cause of this transformation. Key to our story are a handful of economists from the Board of Governors’ Division of Research and Statistics (DRS) who paradoxically did not always held a PhD but envisioned their role as going beyond mere data accumulation and got involved in large-scale macroeconometric model building. We conclude that the divide between PhD and non-PhD economists may not be fully relevant to understand both the shift in the type of economics practiced at the Fed and the uses of this knowledge in the decision making-process. Equally important was the rift between different styles of economic analysis. 1 I.