Daifuku Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2019

DIGITALISATION ENERGY AUTOMATION INNOVATION ANNUAL REPORT 2019 PERFORMANCE KION Group 2 Key figures for 2019 KION Group overview Change in € million 2019 2018 2017 * 2019 / 2018 Order intake 9,111.7 8,656.7 7,979.1 5.3% Revenue 8,806.5 7,995.7 7,598.1 10.1% Order book ¹ 3,631.7 3,300.8 2,614.6 10.0% Financial performance EBITDA 1,614.6 1,540.6 1,457.6 4.8% Adjusted EBITDA ² 1,657.5 1,555.1 1,495.8 6.6% Adjusted EBITDA margin ² 18.8% 19.4% 19.7% – EBIT 716.6 642.8 561.0 11.5% Adjusted EBIT ² 850.5 789.9 777.3 7.7% Adjusted EBIT margin ² 9.7% 9.9% 10.2% – Net income 444.8 401.6 422.5 10.7% Financial position ¹ Total assets 13,765.2 12,968.8 12,337.7 6.1% Equity 3,558.4 3,305.1 2,992.3 7.7% Net financial debt 1,609.3 1,869.9 2,095.5 – 13.9% ROCE ³ 9.7% 9.3% 9.3% – Cash flow Free cash flow 4 568.4 519.9 474.3 9.3% Capital expenditure 5 287.4 258.5 218.3 11.2% Employees 6 34,604 33,128 31,608 4.5% 1 Figures as at balance sheet date 31/12/ 2 Adjusted for PPA items and non-recurring items 3 ROCE is defined as the proportion of adjusted EBIT to capital employed 4 Free cash flow is defined as cash flow from operating activities plus cash flow from investing activities 5 Capital expenditure including capitalised development costs, excluding right-of-use assets 6 Number of employees (full-time equivalents) as at balance sheet date 31/12/ * Key figures for 2017 were restated due to the initial application of IFRS 15 and IFRS 16 All amounts in this annual report are disclosed in millions of euros (€ million) unless stated otherwise. -

We Act Sustainably and Responsibly

SEW-EURODRIVE—Driving the world WITH TARGETED MEASURES, WE ACT SUSTAINABLY AND RESPONSIBLY Sustainability Report 2016/2017 2 3 INTRODUCTION I. COMPANY-WIDE GUIDELINES Dear readers, “People make the difference” is not just a slogan that we have written in large letters on the wall of our company headquarters in Bruchsal. “People make the difference” is a practiced motto throughout the entire SEW-EURODRIVE Group when dealing with our employees *), customers and competitors and is part of the foundations of our company. Since its founding in 1931, SEW-EURODRIVE has been an independent family business. And just like a family defines itself across generations, our thinking is not only focused on the fiscal year, but rather on entire generations. And we know that sustainability in all its facets only thrives when people promote it, maintain it and continue to develop it in a contemporary manner for future generations. Based on the guideline from the Global Reporting Initiative GRI, for this report we have consulted the employees in the parent company, as well as in our global subsidiaries as to which ecological, economic and social activities they perform and plan for a sustainable company culture and environment. Conclusion: Our motivated employees are developing powerful concepts for a better future, support all measures and projects with the highest level of commitment and implement them accordingly in a consistent and responsible manner. Economically and technically, we also do everything to be successful in the future and grow as a company. Because only as a healthy and innovative company can we continue to play an active role in family, society and the environment for a long time. -

Review of Agvsport.Com Generated on 2020-12-11

72 Your Website Score Review of Agvsport.com Generated on 2020-12-11 Introduction This report provides a review of the key factors that influence the SEO and usability of your website. The homepage rank is a grade on a 100-point scale that represents your Internet Marketing Effectiveness. The algorithm is based on 70 criteria including search engine data, website structure, site performance and others. A rank lower than 40 means that there are a lot of areas to improve. A rank above 70 is a good mark and means that your website is probably well optimized. Internal pages are ranked on a scale of A+ through E and are based on an analysis of nearly 30 criteria. Our reports provide actionable advice to improve a site's business objectives. Please contact us for more information. Table of Contents Search Engine Optimization Usability Mobile Technologies Visitors Social Link Analysis Iconography Good Hard to solve To Improve Little tough to solve Errors Easy to solve Not Important No action necessary Page 1/23 Search Engine Optimization Title Tag AGV Sport - AGV SPORT Length: 21 character(s) Ideally, your title tag should contain between 10 and 70 characters (spaces included). Make sure your title is explicit and contains your most important keywords. Be sure that each page has a unique title. Meta Description Welcome to PointLab We’ll Ensure You Always Get The Best Result. Lacinia in netus vel a, scelerisque mauris quis et, purus blandit sapien, pharetra, viverra volutpat risus non tortor, cras egestas et maecenas facilisi imperdiet quam fringilla dui mauris enim, nec arcu, interdum sit nisi est facilisi sodales viverra proin et. -

Automatic End of Line Buffer on AGV's Vitoria Seating Automatic End Of

Automatic end of line buffer on AGV’s Digital Manufacturing Vitoria Seating Barcelona 24th May 2019 Agenda 1 Faurecia Group. Faurecia Seating. Faurecia Vitoria 2 Context: Project & alternative solution 3 Buffer on AGV’s 4 People Vs Innovation, new technologies 5 Lessons Learn 2 Agenda 1 Faurecia Group 3 FAURECIA GROUP As a global leader in automotive technology, Faurecia provides innovative solutions to automotive challenges within its four strategic businesses: Faurecia Seating, Faurecia Interiors, Faurecia Clarion Electronics and Faurecia Clean Mobility 4 FAURECIA GROUP 5 Agenda 1 Faurecia Seating 6 Faurecia Seating #1 worldwide in mechanisms & seats structure #3 worldwide in complete seats €7,1 billion Value-added sales 2017 44,800 employees 74 productionemployees sites 19 R&D and D&D Global standard frame platform Full JIT services and seat component centers leader offer: covers, foams, accessories Full range of high> performance Personalized through Smart Comfort mechanisms solutions 23 Advanced mechatronic systems Seat Electronics countries 7 Faurecia Seating: strong presence in all automotive regions NORTH AMERICA EMEA 24% 56% 10 38 3 11 7,700 27,900 ASIA 16% SOUTH 21 AMERICA 4 7,000 4% 5 1 2,200 Products sales Plants R&D centers Employees 8 Footprint seating| 74 plants France Germany Poland Romania Caligny Neuburg Grojec Talmaciu Cercy la Tour Neuenstadt Jelcz Valcea Flers-en-Escrebieux UK Walbrzych³ Russia Magny-Vernois Banbury Czech Republic Saint Petersburg Montbéliard Spain Pisek Togliatti Nogent-sur- -

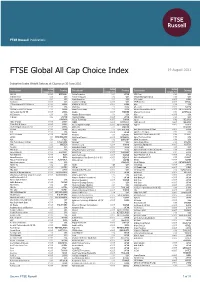

FTSE Global All Cap Choice Index

2 FTSE Russell Publications 19 August 2021 FTSE Global All Cap Choice Index Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 1&1 AG <0.005 GERMANY Activia Properties 0.01 JAPAN AES Corp. 0.03 USA 10X Genomics 0.03 USA Activision Blizzard 0.12 USA Affiliated Managers Group 0.01 USA 1Life Healthcare 0.01 USA Acuity Brands Inc 0.01 USA Affle (India) <0.005 INDIA 1st Source <0.005 USA Acushnet Holdings <0.005 USA AFI Properties <0.005 ISRAEL 21Vianet Group ADS (N Shares) <0.005 CHINA ADAMA (A) (SC SZ) <0.005 CHINA Aflac 0.06 USA 2U <0.005 USA Adani Gas 0.01 INDIA AfreecaTV <0.005 KOREA 360 DigiTech ADS (N Shares) 0.01 CHINA Adani Green Energy 0.01 INDIA African Rainbow Minerals Ltd <0.005 SOUTH AFRICA 360 Security (A) (SC SH) <0.005 CHINA Adapteo <0.005 SWEDEN Afterpay Touch Group 0.03 AUSTRALIA 3-D Systems 0.01 USA Adaptive Biotechnologies 0.01 USA Afya <0.005 USA 3i Group 0.02 UNITED Adastria Holdings <0.005 JAPAN AGCO Corp 0.01 USA KINGDOM A-Data Technology <0.005 TAIWAN Ageas 0.02 BELGIUM 3SBio (P Chip) <0.005 CHINA ADBRI <0.005 AUSTRALIA AGFA-Gevaert <0.005 BELGIUM 51job ADS (N Shares) <0.005 CHINA Adcock Ingram Holdings <0.005 SOUTH AFRICA Aggreko <0.005 UNITED 5I5j Holding Group (A) (SC SZ) <0.005 CHINA Addtech B 0.01 SWEDEN KINGDOM 77 Bank <0.005 JAPAN Adecco Group AG 0.02 SWITZERLAND Agile Group Holdings (P Chip) <0.005 CHINA 8x8 <0.005 USA Adeka <0.005 JAPAN Agilent Technologies 0.07 USA A.G.V. -

Midea Group Co., Ltd. the 2019 Annual Report

The 2019 Annual Report of Midea Group Co., Ltd. Midea Group Co., Ltd. The 2019 Annual Report 30 April 2020 1 The 2019 Annual Report of Midea Group Co., Ltd. Section I Important Statements, Contents and Definitions The Board of Directors, the Supervisory Committee, directors, supervisors and senior management of Midea Group Co., Ltd. (hereinafter referred to as the “Company”) hereby guarantee that the information presented in this report is free of any misrepresentations, misleading statements or material omissions, and shall together be wholly liable for the truthfulness, accuracy and completeness of its contents. All directors of the Company attended the Board meeting to review this Annual Report. There are no directors, supervisors, or senior management who do not warrant or who dispute the truthfulness, accuracy and completeness of the contents of this Annual Report. The financial statements for 2019 have been audited by PricewaterhouseCoopers China (LLP) and have obtained an unqualified audit report. Mr. Fang Hongbo, Chairman of the Board and CFO of the Company and Ms. Zhong Zheng, Director of Finance of the Company, have represented and warranted that the financial statements in this report are true and complete. The Board has considered and approved the following dividend payout plan for the year 2019: based on the 6,957,181,058 shares at the disclosure date of this report (the total share capital of 6,999,467,315 shares minus the repurchased 42,286,257 shares in the repo securities account at that date), it is proposed that the Company should distribute a cash dividend of RMB16 (tax inclusive) per 10 shares to all the shareholders and should not convert capital surplus into share capital. -

American Century Investments® Quarterly Portfolio Holdings Avantis

American Century Investments® Quarterly Portfolio Holdings Avantis® Emerging Markets Equity Fund May 28, 2021 Avantis Emerging Markets Equity Fund - Schedule of Investments MAY 28, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 99.0% Brazil — 5.7% AES Brasil Energia SA 9,500 25,975 Aliansce Sonae Shopping Centers SA 4,600 26,532 Alpargatas SA, Preference Shares(1) 3,300 29,640 Ambev SA, ADR 42,032 145,431 Anima Holding SA(1) 600 1,457 Arezzo Industria e Comercio SA 900 15,430 Atacadao SA 3,700 15,612 Azul SA, ADR(1)(2) 455 11,243 B2W Cia Digital(1) 900 10,344 B3 SA - Brasil Bolsa Balcao 40,800 136,295 Banco ABC Brasil SA, Preference Shares 2,400 7,805 Banco BMG SA, Preference Shares 4,900 4,560 Banco Bradesco SA 12,936 56,915 Banco Bradesco SA, ADR 42,901 217,937 Banco BTG Pactual SA 2,900 68,220 Banco do Brasil SA 15,860 101,672 Banco do Estado do Rio Grande do Sul SA, Class B Preference Shares 6,900 17,701 Banco Inter SA 1,500 19,166 Banco Inter SA, Preference Shares 6,900 29,524 Banco Mercantil do Brasil SA, Preference Shares 400 1,457 Banco Pan SA, Preference Shares 4,400 19,266 Banco Santander Brasil SA, ADR 6,130 48,366 BB Seguridade Participacoes SA 5,300 23,878 BR Malls Participacoes SA(1) 13,500 29,374 BR Properties SA 5,500 10,036 BrasilAgro - Co. Brasileira de Propriedades Agricolas 1,500 9,072 Braskem SA, ADR(1)(2) 1,253 24,897 BRF SA, ADR(1) 14,207 70,040 C&A Modas Ltda(1) 4,900 13,012 Camil Alimentos SA 3,100 5,895 CCR SA 23,400 61,826 Centrais Eletricas Brasileiras SA, ADR(2) 1,464 12,122 Centrais -

Cemat ASIA 2020 International Trade Fair for Materials Handing, Automation Technology, Transport Systems and Logistics

CeMAT ASIA 2020 International Trade Fair for Materials Handing, Automation Technology, Transport Systems and Logistics 3-6 November 2020 Shanghai New International Expo Centre After Show Report www.cemat-asia.com 101,057 Trade Visitors 324 Matchmaking Organized by the Organizers Nearly 80,000 sqm. Exhibition Area 30+ Concurrent Forums and Activities Over 700 Exhibitors 164 Buyer Delegations 1 Staging a high caliber exhibition in Asia-Pacific region, the industrial mega-show organized by Deutsche Messe AG, Hannover Milano Fairs Shanghai and the Chinese partners rounded off on 6 November at the Shanghai New International Expo Centre. Themed with “Smart Logistics”, CeMAT ASIA, ICCE ASIA and E-PACK TECH welcomed over 700 notable enterprises at a total display area of nearly 80,000 sqm. As the annual industrial feast, the four-day events attracted total 101,057 visitors, which was a very exciting and positive result for this year’s situation. “The trade fair industry is always the magical place where people can find tremendous opportunities and unexpected connections,” said by Gary Liu, Managing Director of Hannover Milano Fairs Shanghai, “The crowds of visits strongly prove that our shows are still the leading platforms for manufactures to expand their business and exchange industrial perspective. Here, innovation and cooperation happen in every corner. It’s so good to see that our shows win the trust and satisfaction by most of our participants in this challenging time.” 2 Exhibition Highlights Covered nearly 80,000 sqm. exhibition area, -

English Nippon Express Group Corporate Philosophy

English Nippon Express Group Corporate Philosophy Our Mission Be a Driving Force for Social Development Our Challenge Create New Ideas and Value that Expand the Field of Logistics Our Pride Inspire Trust Every Step of the Way 01 Nippon Express Group brings customers’ possibilities to reality. There are often many solutions, but only one way is the way. We use our determination to find the best way to overcome hurdles and take our customers across the finish line. Our focus is never on whether or not we can do something. Instead, it’s on the excitement of how we will tackle the task in front of us. Our work is almost scientific. We make observations, formulate a hypothesis, make predictions and then test them. We continue this process until we find the best way to accomplish any project - large or small. We believe that logistics drives a more vibrant society, and we will continue to exercise innovative thinking as we open new roads to serve our customers. 02 Building a high-quality logistics system in Asia 03 Episode 1 The future of ASEAN logistics as seen from cross-border transport Southeast Asia has developed since the early 2000s to In addition, we are expanding logistics hubs for become the “world’s factory”. Today, the region is distribution-side logistics of consumer goods and experiencing rising internal demand spurred on by building a logistics infrastructure tailored to the unique economic growth, transforming it into a “consumer market characteristics of each country. This includes market”. providing high value-added logistics services such as The international flow of goods has also grown from cold chain and Halal logistics solutions. -

Adidas-Salomon ANNUAL REPORT 2002 >PASSION for SPORT

adidas-Salomon ANNUAL REPORT 2002 > PASSION FOR SPORT SPORT IS ABOUT EXCELLING AS AN INDIVIDUAL. ABOUT WORKING TOGETHER AS A TEAM. SPORT CELEBRATES AND ADVANCES THE IDEALS OF FAIRNESS, COMPETITION AND EXCELLENCE. SPORT MEANS DIFFERENT THINGS TO DIFFERENT PEOPLE. BUT THERE IS ONE THING COMMON TO ALL: PASSION. AND IT’S EXACTLY THAT PASSION THAT DEFINES EVERYTHING WE DO. OUR TARGETS 2002 TARGETS 2002 RESULTS 2003 TARGETS GROW SALES BY AT LEAST 5% > SALES GREW 7% TO REACH RECORD LEVEL > GROW SALES BY AROUND 5% OF € 6.5 BILLION INTRODUCE TWO REVOLUTIONARY > NEW adidas INNOVATIONS STRONGLY > EXPAND AND COMMERCIALIZE adidas FOOTWEAR INNOVATIONS: RECEIVED: adidas FOOTWEAR TECHNOLOGY: CLIMACOOL® (SALES TARGET: 500,000 PAIRS) CLIMACOOL® (1 MILLION PAIRS SOLD) CLIMACOOL® 2 (SALES TARGET: a3® (SALES TARGET: 250,000 PAIRS) a3® (500,000 PAIRS SOLD) 2 MILLION PAIRS) a3® (SALES TARGET: 750,000 PAIRS) DELIVER DOUBLE-DIGIT CURRENCY-NEUTRAL > CURRENCY-NEUTRAL SALES GREW 23% > DELIVER DOUBLE-DIGIT CURRENCY-NEUTRAL SALES GROWTH IN ASIA, NORTH AMERICA AND IN ASIA, 14% IN NORTH AMERICA AND 37% SALES GROWTH IN ASIA AND NORTH AMERICA AT TAYLORMADE-adidas GOLF AT TAYLORMADE-adidas GOLF DELIVER GROSS MARGIN OF 41 TO 43% > GROSS MARGIN REACHED 43.2% > DELIVER GROSS MARGIN OF 42 TO 43% IMPROVE DSO AND STOCK TURN FOR THE > INVENTORIES REDUCED BY 7%, > DECREASE WORKING CAPITAL AS A GROUP RECEIVABLES UP LESS THAN PERCENTAGE OF NET SALES SALES GROWTH, AGING IMPROVED REDUCE DEBT BY UP TO € 100 MILLION > DEBT REDUCED BY € 181 MILLION > REDUCE DEBT BY AT LEAST € 100 MILLION DRIVE BOTTOM-LINE EARNINGS UP 5 TO 10% > EARNINGS UP 10% > DRIVE EARNINGS GROWTH OF 10 TO 15% INCREASE SHAREHOLDER UNDERSTANDING > TOP DAX-30 PERFORMER AGAIN IN 2002 > MAINTAIN AND EXPAND SHAREHOLDER AND CONFIDENCE IN GROUP STRATEGY CONFIDENCE /// PASSION FOR SPORT FORSPORT /// PASSION PASSION FOR SPORT /// Passion /// Financial Highlights /// Letter to the Shareholders PASSION FOR SPORT > DETERMINATION AND EMOTION ARE EVIDENT IN THE FACE OF EVERY ATHLETE. -

Investcorp Acquires POC

The Investcorp Newsletter Investcorp acquires POC Corporate Investments Investcorp acquires POC and NDTCCS Real Estate The acquisition of Multifamily Residential Portfolio Investcorp and BDI The third Chairman Summit New Joiners New CFO & Head of Corporate Investment in North America Guest Feature Dr. Hani Khalil Findakly The Review | November 2015 2 Welcome and retaining star talent. revolutionary manufacturer of skiing and cycling helmets, gear and accessories, Over the course of our fiscal year 2015, to our portfolio. POC is a deal I am we deployed $1 billion in Corporate particularly excited about and one that Investment and Real Estate deals across continues our long history of involvement all our key markets in the Middle East with consumer sporting businesses, which and North Africa, Europe and the started with Riva Boats in 1984, followed United States. Meanwhile, the Firm by Helly Hansen, Dainese, AGV and now generating $1.5 billion in total proceeds POC. from successful realizations in 2015 demonstrated our ability to maximize While we have no plans to slow down value through exits and complemented and are actively monitoring a number our buy-side activity. Taking a step back of situations across a range our markets, and looking at the six-year period to we will always analyse every detail of a FY15, total realization proceeds totalled deal in order to ensure maximum value $7.5 billion with total capital deployed creation. in new and add-on investments over this Away from investment activity, we have period hitting $4.3 billion. further strengthened the backbone of When you consider the global economic Investcorp by moving one step closer backdrop we have been operating in over to opening our office in Doha, having nvestcorp has begun its new fiscal the past few years, Investcorp’s ability received approval from the regulator. -

Autonomous Transporting Autonomous

Transporting Transportieren AUTONOMOUS TRANSPORTING AUTONOMOUS At your service - worldwide TÜNKERS Maschinenbau GmbH EXPERT-TÜNKERS GmbH Am Rosenkothen 4-12 Seehofstraße 56-58 40880 Ratingen 64653 Lorsch Germany Germany Tel.: +49 2102 4517-0 Tel.: +49 6251 592-0 [email protected] [email protected] www.tuenkers.de www.expert-tuenkers.de HELU GmbH SOPAP Automation SAS Seehofstraße 56-58 P. A. Ardennes Emeraude 64653 Lorsch Rue Henri Faure Germany BP 11 09, 08090 TOURNES Tel.: +49 6251 592-280 France [email protected] Tel.: +33 3 24 52 94 64 [email protected] ARGENTINA – TÜNKERS DE ARGENTINA S.A. CHINA – TÜNKERS China HUNGARY – TÜNKERS Slovakia s.r.o. MEXICO – TUNKERS DE MÉXIKO S.A. DE C.V. SINGAPORE – DAB Technology Pte. Ltd. THAILAND – DAB Technology Co., Ltd. Velez Sarsfield 1516 – Quilmes (1879) Tuenkers Machinery & Automation Roentgenova 26 Prolongación Uranga #93-C 21 Woodlands Industrial Park E1 H20 424/15 Kanchanapisek Rd. Provincia de Buenos Aires Technology Co., Ltd. Shanghai SK85101 Bratislava Colonia San Juan Cuautlancingo #03-04 Dokmai, Pravet, Tel.: +54 11 2100-2900 Building 4, No. 768 Chenxiang Road, Tel.: +421 905 564 691 Código Postal 72761, Cuautlancingo, Puebla Singapore 757720 Bangkok 10250 [email protected] Jiading District, Shanghai P.R. [email protected] Tel.: +52 222 393 5547 Tel.: +65 68913286 Tel.: +66 97 072 8972 ––––––––––––– China, 201802 ––––––––––––– [email protected] [email protected] [email protected] AUSTRALIA – Romheld Australia Pty. Ltd. Tel.: +86 21 39171070 INDIA – TÜNKERS Automation India Private Ltd. ––––––––––––– ––––––––––––– ––––––––––––– 30/115 Woodpark Rd [email protected] 402 Supreme Head Quarters 36 NETHERLANDS – TÜNKERS Maschinenbau GmbH SLOVAKIA – TÜNKERS Slovakia s.r.o.