DRIVING INNOVATION ACROSS OUR BUSINESS William Hill PLC Annual Report and Accounts 2011 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View Annual Report

blue: 97C 93M 23Y 10K blue: 97C 93M 23Y 10K Welcome to Playtech Playtech Limited Source The leading supplier of online gaming software Introduction of Success As the world’s largest publicly-traded online gaming software supplier, Playtech offers Annual Report and Accounts cutting-edge, value-added solutions to the industry’s leading operators. Our licensees Annual Report and Accounts 2010 For the year ended 31 December 2010 include both experienced online operators and new entrants, such as land-based and state-owned entities. Philosophy Our philosophy is based on deep and stable partnerships with our licensees, and our success based on a commitment to achieving excellence through cooperation and shared goals. Technology Playtech’s leading gaming products are supported by the most sophisticated operator platform in the industry. Products can be fully integrated into a unique cross-platform capability, enabling the same content to run across multiple channels, with a single player wallet. Innovation With one of the industry’s largest and most experienced R&D teams, Playtech is dedicated to the continual development of innovative technology solutions and content. Sustainability Playtech has developed a robust and sustainable business model, where its resources and core values are aligned both with the Group’s strategic goals and those of its licensees. Casino Games Poker Bingo Sport IMS: Integrated Operator Platform Playtech Limited Head Office 2nd Floor St George’s Court Upper Church Street Douglas Live & TV Internet Mobile TV Gaming Lottery Isle of Man IM1 1EE Gaming Broadcast Machines www.playtech.com Playtech Limited Annual Report and Accounts 2010 blue: 97C 93M 23Y 10K blue: 97C 93M 23Y 10K Welcome to Playtech Playtech Limited Source The leading supplier of online gaming software Introduction of Success As the world’s largest publicly-traded online gaming software supplier, Playtech offers Annual Report and Accounts cutting-edge, value-added solutions to the industry’s leading operators. -

Monthly Professional Factsheet Uk Opportunities Fund a Income Shares 31 August 2021

pro.en.xx.20210831.GB00BGV1T511.pdf UK Opportunities Fund A Income Shares For Investment Professionals Only FIDELITY INVESTMENT FUNDS 2 MONTHLY PROFESSIONAL FACTSHEET UK OPPORTUNITIES FUND A INCOME SHARES 31 AUGUST 2021 Strategy Fund Facts Leigh Himsworth identifies specific areas of the market that he believes are capable of Launch date: 01.09.11** delivering consistent growth. Within these themes, he employs disciplined cash flow Portfolio manager: Leigh Himsworth analysis to seek out companies capable of delivering earnings growth without Appointed to fund: 01.09.11 materially increasing their risk profile. On this basis, Leigh builds a high conviction Years at Fidelity: 7 portfolio of quality growth companies. Each holding in the portfolio has a weighting that Fund size: £602m allows it to make a meaningful contribution to performance. Risk management takes Number of positions in fund*: 55 into account factors that could impact a number of companies in the portfolio. Fund reference currency: UK Sterling (GBP) Fund domicile: United Kingdom Fund legal structure: OEIC Management company: FIL Investment Services (UK) Limited Capital guarantee: No Portfolio Turnover Cost (PTC): 0.48% Portfolio Turnover Rate (PTR): 182.08% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to increase the value of your investment over a period of 5 years or Other share classes may be available. Please refer to the prospectus for more details. more. • The fund will invest at least 70% in shares (and their related securities) of a blend of Launch date: 15.05.19 different sized UK companies. -

BBC EXECUTIVE BOARD 11 DECEMBER 2007 1000 - 1430 Room 3028, 3Rd Floor, Broadcasting House

BBC EXECUTIVE BOARD 11 DECEMBER 2007 1000 - 1430 Room 3028, 3rd floor, Broadcasting House Attendees..............................................................................................................................1 Agenda..................................................................................................................................2 1. MINUTES FROM EXECUTIVE BOARD ON 13 NOVEMBER 2007 AND CONFERENCE CALLS HELD ON 16 AND 20 NOVEMBER 2007 .......................................3 2. DIRECTOR REPORTS ..................................................................................................3 3. BBC CORPORATE COMMUNICATIONS: THE WAY FORWARD...............................3 4. TALENT AT THE BBC ...................................................................................................4 5. DIGITAL SWITCHOVER................................................................................................4 6. bbc.co.uk SERVICE REVIEW........................................................................................4 7. APPOINTMENTS...........................................................................................................5 8. GAELIC PUBLIC VALUE TEST (PVT)...........................................................................5 9. DIGITAL MEDIA INTIATIVE...........................................................................................6 10. TRAINING AND EQUAL OPPORTUNITIES REPORT ..................................................6 12. MANAGEMENT RESPONSE TO OFCOM’S DISCUSSION -

Ivision and the BBC: Building Public Value

Observatorio (OBS*) Journal, 5 (2008), 041-055 1646-5954/ERC123483/2008 041 iVision and the BBC: Building Public Value Michael Klontzas, City University, London, UK Abstract Breaking with conventional wisdom that sees public service broadcasters as conveyors of content in line with historically shaped socio-political ideals, centred on quality, access, diversity and independence, evidence suggests that PSB is often the driving force behind key technological innovations serving public policy aims. In the drive towards wholesale digitalisation and the accelerated introduction of an information society, this hitherto understated function is now deemed critical and comes to the fore. More specifically, recent public policy initiatives in the UK, culminating to the 2006 White Paper, openly assign the mission of contributing to the process of ‘building digital Britain’ to the BBC, the flagship public service broadcaster. This vision of digitalisation is defined in broad terms in the policy discourse, as involving all platforms indiscriminately. The BBC’s contribution, designed to entice users to a digital future and simultaneously cement the continued relevancy of the institution in the 21st century, finds expression in a variety of implemented and proposed digital services deliverable over a range of digital platforms, including television and radio, the internet and mobile networks. This paper seeks to interrogate the host of controversial and closely scrutinised internet services offered by the BBC in the light of the digital vision articulated in the public policy discourse. These services shift the emphasis away from the time-honoured broadcasting paradigm to a more interactive approach. Through widespread application of emerging Web 2.0 practices, the users are now invited to participate, and generate and share their own content. -

Entain Plc ("Entain" Or the “Group”)

12 August 2021 – Strictly embargoed until 1.30pm BST Entain plc ("Entain" or the “Group”) Total addressable market expected to grow more than three-fold to c.$160bn Extension into interactive entertainment with move into esports Entain plc (LSE: ENT), the global sports-betting, gaming and interactive entertainment group, is hosting an investor event today to outline the exciting growth opportunities ahead for the business. Entain’s two strategic pillars of growth and sustainability are the core drivers of our success. Sustainability is a strategic imperative and we are making significant progress with our sustainability charter that we will provide an update on in more detail later in the year. Today’s event will focus on the four key growth opportunities available to the Group: • Leadership in the US ($32bn market, from $6bn today) We are making significant progress in the growing US sports betting and iGaming market. BetMGM is firmly established as the number two operator in the market and is targeting a long-term market share of 20% to 25% of the North American online market, that we expect will grow from around $6bn today to around $32bn over the long term. • Grow our presence in core markets ($70bn market, from $40bn today) We are licenced in 27 countries today as well as operating in a number that are in the process of regulating. We have leadership positions in a significant number of these with an average market share currently of around 13% to 15%. We have a strong track record of driving organic growth and our markets have in-built growth as online betting and gaming extends its appeal and scale. -

Henry Jenkins Convergence Culture Where Old and New Media

Henry Jenkins Convergence Culture Where Old and New Media Collide n New York University Press • NewYork and London Skenovano pro studijni ucely NEW YORK UNIVERSITY PRESS New York and London www.nyupress. org © 2006 by New York University All rights reserved Library of Congress Cataloging-in-Publication Data Jenkins, Henry, 1958- Convergence culture : where old and new media collide / Henry Jenkins, p. cm. Includes bibliographical references and index. ISBN-13: 978-0-8147-4281-5 (cloth : alk. paper) ISBN-10: 0-8147-4281-5 (cloth : alk. paper) 1. Mass media and culture—United States. 2. Popular culture—United States. I. Title. P94.65.U6J46 2006 302.230973—dc22 2006007358 New York University Press books are printed on acid-free paper, and their binding materials are chosen for strength and durability. Manufactured in the United States of America c 15 14 13 12 11 p 10 987654321 Skenovano pro studijni ucely Contents Acknowledgments vii Introduction: "Worship at the Altar of Convergence": A New Paradigm for Understanding Media Change 1 1 Spoiling Survivor: The Anatomy of a Knowledge Community 25 2 Buying into American Idol: How We are Being Sold on Reality TV 59 3 Searching for the Origami Unicorn: The Matrix and Transmedia Storytelling 93 4 Quentin Tarantino's Star Wars? Grassroots Creativity Meets the Media Industry 131 5 Why Heather Can Write: Media Literacy and the Harry Potter Wars 169 6 Photoshop for Democracy: The New Relationship between Politics and Popular Culture 206 Conclusion: Democratizing Television? The Politics of Participation 240 Notes 261 Glossary 279 Index 295 About the Author 308 V Skenovano pro studijni ucely Acknowledgments Writing this book has been an epic journey, helped along by many hands. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

Day and Date

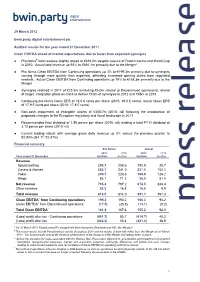

29 March 2012 bwin.party digital entertainment plc Audited results for the year ended 31 December 2011 Clean EBITDA ahead of market expectations due to faster than expected synergies ● Pro forma# total revenue slightly ahead at €816.0m despite closure of French casino and World Cup in 2010. Actual total revenue up 93% to €691.1m primarily due to the Merger* ● Pro forma Clean EBITDA from Continuing operations up 3% to €199.3m primarily due to synergies coming through more quickly than expected, offsetting increased gaming duties from regulated markets. Actual Clean EBITDA from Continuing operations up 79% to €168.3m primarily due to the Merger ● Synergies realised in 2011 of €23.3m (including €5.0m related to Discontinued operations), ahead of target. Integration plans on-track to deliver €40m of synergies in 2012 and €65m in 2013 ● Continuing pro forma Clean EPS of 18.5 € cents per share (2010: 19.0 € cents); actual Clean EPS of 17.9 € cents per share (2010: 17.8 € cents) ● Non-cash impairment of intangible assets of €408.7m (2010: nil) following the introduction of proposed changes to the European regulatory and fiscal landscape in 2011 ● Recommended final dividend of 1.56 pence per share (2010: nil) making a total FY11 dividend of 3.12 pence per share (2010: nil) ● Current trading robust with average gross daily revenue up 2% versus the previous quarter to €2.93m (Q4 11: €2.87m) Financial summary Pro forma# Actual 2011 2010 2011 2010 Year ended 31 December €million €million €million €million Revenue Sports betting 259.7 258.6 193.9 -

MSCI UK SMID Cap Index (USD) (GROSS)

MSCI UK SMID Cap Index (USD) The MSCI UK SMID Cap Index captures mid and small cap representations across the UK equity market. With 319 constituents, the index covers approximately 28% of the free float-adjusted market capitalization in UK. CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (USD) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI United Year MSCI UK SMID Cap Kingdom MSCI UK SMID Cap 2020 -1.05 -10.43 MSCI United Kingdom 2019 32.11 21.13 235.94 2018 -18.85 -14.10 2017 27.37 22.38 200 2016 -10.40 -0.04 2015 3.27 -7.51 148.71 2014 -2.30 -5.35 2013 32.84 20.71 100 2012 32.18 15.30 2011 -8.82 -2.52 2010 20.00 8.80 2009 63.61 43.37 2008 -54.01 -48.32 0 2007 -4.80 8.39 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — GROSS RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr May 31, 1994 Div Yld (%) P/E P/E Fwd P/BV MSCI UK SMID Cap 2.86 2.85 39.93 19.12 8.80 9.20 9.09 8.94 1.99 59.89 18.61 2.59 MSCI United Kingdom 0.86 -0.67 27.28 14.54 3.72 5.52 4.70 6.27 3.68 23.02 12.12 1.86 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr May 31, (%) Period YYYY-MM-DD (%) 1994 MSCI UK SMID Cap 5.06 25.31 20.73 18.83 0.41 0.47 0.52 0.42 66.95 2007-05-23—2009-03-09 MSCI United Kingdom 0.99 19.84 16.61 15.88 0.22 0.33 0.32 0.30 63.42 2007-10-31—2009-03-09 1 Last 12 months 2 Based on monthly gross returns data 3 Based on ICE LIBOR 1M The MSCI UK SMID Cap Index was launched on Jun 05, 2007. -

Gaming-Sports Partnerships*

Gaming-Sports Partnerships* Updated 7/6/2021 USA / # Gaming Company League Team Announced International Provisions Synopsis 169 Golden Nugget Rocket 6/30/21 USA Marketing Golden Nugget will have on- Online Gaming Mortgage site branding at the event. The Classic casino will be giving away prizes and offering exclusive (PGA) promotional casino and sportsbook bonuses for tournament attendees. 168 Bally's Phoenix 6/30/21 USA Market Bally's is the exclusive sports Mercury access, betting partner of the Phoenix (WNBA) marketing Mercury over 15 years beginning July 1, 2021. Upon the Phoenix Mercury's receipt of a mobile sports betting license from the Arizona Dept. of Gaming, Bally's will, among other things, host and manage an online and mobile sports betting service in Arizona, operate a retail sportsbook in the vicinity of the Phoenix Suns Arena, and promote its business in connection with Phoenix Mercury games. 167 Sportradar NHL 6/29/21 USA Data, Having served as the NHL’s Streaming official global data distributor since 2015, Sportradar will now distribute the NHL’s official data and statistics to media, technology and sports betting companies worldwide, including real-time data from the NHL’s new Puck and Player Tracking technology. The deal also awards Sportradar rights to provide sports betting operators with live streams of NHL games via operators’ digital betting platforms in legalized markets. 166 Kindred/Unibet Stewart-Haas 6/23/21 USA Marketing Through the Unibet brand, Racing Kindred Group will serve as a (Nascar) primary sponsor for two NASCAR Cup Series at Indianapolis Motor Speedway and Martinsville Speedway (VA). -

William Hill PLC Annual Report and Accounts 2010 W Illia M H Ill

William Hill PLC PLC Hill William William Hill PLC Greenside House Annual Report and Accounts 2010 50 Station Road Wood Green London N22 7TP T 020 8918 3600 Annual Report and Accounts 2010 Accounts and Report Annual F 020 8918 3775 Registered number: 421 2563 England Transforming. Innovating. Performing. Contents Overview William Hill at a glance 01 Chairman’s statement 02 Business review Business Chief Executive’s overview 04 Divisional overview 08 Financial review 16 Regulatory review 19 Managing our risks 22 Corporate responsibility 24 William Hill is the UK’s leading bookmaker and one of the most recognised and trusted betting and gaming brands in the country. Well-known for our 75-year sports-betting heritage, Governance Board of Directors 34 we also offer a full range of gaming products. Directors’ Report 36 We are continuously evolving our product range to meet the changing demands of a wide Directors’ Remuneration Report 39 and diverse customer base looking for an Statement on Corporate Governance 46 exciting and entertaining gambling experience. Report of the Nomination Committee 51 On the high street, online, on the phone and Report of the Audit and Risk on the move, William Hill offers a market-leading Management Committee 52 betting and gaming experience. Financial statements Financial Statement of Directors’ Responsibilities 54 ‘The Home of Betting’ showcases some of the ways we are developing Group Independent Auditor’s Report 55 our business through our service, Group Financial Statements 57 products, technology and our people. Parent Company Independent Auditor’s Report 106 Parent Company Financial Statements 108 Five-Year Summary 117 Shareholder Information 118 Abbreviations and Glossary 119 William Hill PLC Annual Report and Accounts 2010 William Hill at a glance William Hill at a glance Chairman’s statement We are one of Overview the best-known and most trusted names in the gambling industry.