Day and Date

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Monthly Professional Factsheet Uk Opportunities Fund a Income Shares 31 August 2021

pro.en.xx.20210831.GB00BGV1T511.pdf UK Opportunities Fund A Income Shares For Investment Professionals Only FIDELITY INVESTMENT FUNDS 2 MONTHLY PROFESSIONAL FACTSHEET UK OPPORTUNITIES FUND A INCOME SHARES 31 AUGUST 2021 Strategy Fund Facts Leigh Himsworth identifies specific areas of the market that he believes are capable of Launch date: 01.09.11** delivering consistent growth. Within these themes, he employs disciplined cash flow Portfolio manager: Leigh Himsworth analysis to seek out companies capable of delivering earnings growth without Appointed to fund: 01.09.11 materially increasing their risk profile. On this basis, Leigh builds a high conviction Years at Fidelity: 7 portfolio of quality growth companies. Each holding in the portfolio has a weighting that Fund size: £602m allows it to make a meaningful contribution to performance. Risk management takes Number of positions in fund*: 55 into account factors that could impact a number of companies in the portfolio. Fund reference currency: UK Sterling (GBP) Fund domicile: United Kingdom Fund legal structure: OEIC Management company: FIL Investment Services (UK) Limited Capital guarantee: No Portfolio Turnover Cost (PTC): 0.48% Portfolio Turnover Rate (PTR): 182.08% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to increase the value of your investment over a period of 5 years or Other share classes may be available. Please refer to the prospectus for more details. more. • The fund will invest at least 70% in shares (and their related securities) of a blend of Launch date: 15.05.19 different sized UK companies. -

Entain Plc ("Entain" Or the “Group”)

12 August 2021 – Strictly embargoed until 1.30pm BST Entain plc ("Entain" or the “Group”) Total addressable market expected to grow more than three-fold to c.$160bn Extension into interactive entertainment with move into esports Entain plc (LSE: ENT), the global sports-betting, gaming and interactive entertainment group, is hosting an investor event today to outline the exciting growth opportunities ahead for the business. Entain’s two strategic pillars of growth and sustainability are the core drivers of our success. Sustainability is a strategic imperative and we are making significant progress with our sustainability charter that we will provide an update on in more detail later in the year. Today’s event will focus on the four key growth opportunities available to the Group: • Leadership in the US ($32bn market, from $6bn today) We are making significant progress in the growing US sports betting and iGaming market. BetMGM is firmly established as the number two operator in the market and is targeting a long-term market share of 20% to 25% of the North American online market, that we expect will grow from around $6bn today to around $32bn over the long term. • Grow our presence in core markets ($70bn market, from $40bn today) We are licenced in 27 countries today as well as operating in a number that are in the process of regulating. We have leadership positions in a significant number of these with an average market share currently of around 13% to 15%. We have a strong track record of driving organic growth and our markets have in-built growth as online betting and gaming extends its appeal and scale. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

MSCI UK SMID Cap Index (USD) (GROSS)

MSCI UK SMID Cap Index (USD) The MSCI UK SMID Cap Index captures mid and small cap representations across the UK equity market. With 319 constituents, the index covers approximately 28% of the free float-adjusted market capitalization in UK. CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (USD) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI United Year MSCI UK SMID Cap Kingdom MSCI UK SMID Cap 2020 -1.05 -10.43 MSCI United Kingdom 2019 32.11 21.13 235.94 2018 -18.85 -14.10 2017 27.37 22.38 200 2016 -10.40 -0.04 2015 3.27 -7.51 148.71 2014 -2.30 -5.35 2013 32.84 20.71 100 2012 32.18 15.30 2011 -8.82 -2.52 2010 20.00 8.80 2009 63.61 43.37 2008 -54.01 -48.32 0 2007 -4.80 8.39 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — GROSS RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr May 31, 1994 Div Yld (%) P/E P/E Fwd P/BV MSCI UK SMID Cap 2.86 2.85 39.93 19.12 8.80 9.20 9.09 8.94 1.99 59.89 18.61 2.59 MSCI United Kingdom 0.86 -0.67 27.28 14.54 3.72 5.52 4.70 6.27 3.68 23.02 12.12 1.86 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr May 31, (%) Period YYYY-MM-DD (%) 1994 MSCI UK SMID Cap 5.06 25.31 20.73 18.83 0.41 0.47 0.52 0.42 66.95 2007-05-23—2009-03-09 MSCI United Kingdom 0.99 19.84 16.61 15.88 0.22 0.33 0.32 0.30 63.42 2007-10-31—2009-03-09 1 Last 12 months 2 Based on monthly gross returns data 3 Based on ICE LIBOR 1M The MSCI UK SMID Cap Index was launched on Jun 05, 2007. -

FTSE Publications

2 FTSE Russell Publications FTSE 100 Semi Annual Equally 19 August 2021 Weighted Net Tax Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.95 UNITED Fresnillo 0.86 UNITED Prudential 0.92 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 1.06 UNITED GlaxoSmithKline 1.08 UNITED Reckitt Benckiser Group 1.02 UNITED KINGDOM KINGDOM KINGDOM Anglo American 0.91 UNITED Glencore 0.94 UNITED RELX 1.05 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.91 UNITED Halma 1.05 UNITED Rentokil Initial 1.04 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.04 UNITED Hargreaves Lansdown 0.98 UNITED Rightmove 1.09 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.96 UNITED Hikma Pharmaceuticals 1.03 UNITED Rio Tinto 0.96 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 1.11 UNITED HSBC Hldgs 0.94 UNITED Rolls-Royce Holdings 0.9 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 1.15 UNITED Imperial Brands 0.98 UNITED Royal Dutch Shell A 0.56 UNITED KINGDOM KINGDOM KINGDOM Avast 1.07 UNITED Informa 0.94 UNITED Royal Dutch Shell B 0.49 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 1.08 UNITED InterContinental Hotels Group 0.97 UNITED Royal Mail 0.99 UNITED KINGDOM KINGDOM KINGDOM Aviva 1 UNITED Intermediate Capital Group 0.99 UNITED Sage Group 1.06 UNITED KINGDOM KINGDOM KINGDOM B&M European Value Retail 1.04 UNITED International Consolidated Airlines 0.85 UNITED Sainsbury (J) 1.03 UNITED KINGDOM Group KINGDOM KINGDOM BAE Systems 1 UNITED Intertek -

Making Ladbrokes Favourite

Annual report and accounts 2010 Making Ladbrokes Favourite Ladbrokes is the most recognised betting brand in Britain and offers an all-embracing range of betting and gaming services via its retail, digital and telephone operations. In 2010 we took £15 billion in stakes which generated Group revenues of over £980 million. We are investing for the future with six clearly identified critical success factors that will help to make Ladbrokes favourite. Retail .com Mobile Telephone For further information about the Group go to: www.ladbrokesplc.com Contents Overview KPIs financial and non financial Page 06 Overview Chairman’s statement Page 02 Business and financial highlights 02 At a glance 04 Chairman’s statement 06 KPIs financial and non financial 04 Business review UK Retail Page 08 Chief Executive’s review 16 UK Retail 16 review Business 17 Other European Retail Chief Executive’s 18 Digital review 20 Telephone Page 21 Regulation 22 Financial review 24 Risks and how we manage them 27 Fair Play – Corporate responsibility at Ladbrokes 08 Governance Directors’ report Governance Board of directors Page Page 30 Board of directors 32 Corporate governance 37 Directors’ report 39 Directors’ remuneration report 30 37 Financial statements 52 Consolidated income statement 102 Company balance sheet 53 Consolidated statement of 103 Notes to the Company financial statements comprehensive income 111 Statement of directors’ responsibilities in relation 54 Consolidated balance sheet to the Company financial statements 55 112 Independent auditor’s report to -

DRIVING INNOVATION ACROSS OUR BUSINESS William Hill PLC Annual Report and Accounts 2011 Contents

William Hill PLC PLC Hill William Annual Report and Accounts 2011 Accounts and Report Annual DRIVING INNOVATION ACROSS OUR BUSINESS William Hill PLC Annual Report and Accounts 2011 Contents Overview William Hill at a glance 02 Chairman’s statement 04 Business review Chief Executive’s overview 06 Our market place 10 Divisional overview 12 ‘Setting the Pace’ showcases Financial review 20 some of the ways in which we are using innovation to drive our Managing our risks 22 business forward – developing Corporate responsibility 24 our business through our service, products, technology. Governance Board of Directors 34 2011 proved to be another year Directors’ Report 36 of continued financial progress, Directors’ Remuneration Report 39 reflecting the underlying strength of the business and benefitting from Statement on Corporate Governance 52 our innovations and investments. Report of the Nomination Committee 58 Report of the Audit and Risk Management Committee 60 £275.7m Operating profit1 generated in 2011 £1,136.7m Net revenue achieved in 2011 Financial statements Statement of Directors’ Responsibilities 63 53:47 Even balance between gaming (53%) Group Independent Auditor’s Report 64 and betting (47%) Group Financial Statements 66 More detail Parent Company Independent on page 20 Auditor’s Report 104 Parent Company Financial Statements 106 Five‑Year Summary 114 Shareholder Information 115 1 Operating profit/loss is defined as pre‑exceptional profit/loss before tax, interest and amortisation of Abbreviations and Glossary 116 £3.6m (2010: £3.6m) of certain Online intangible assets (see page 114). William Hill PLC Annual Report and Accounts 2011 William Hill at a glance Chairman’s statement Overview A WORLD LEADING GAMBLING BRAND. -

Let the World Play for Real’ by Extending Our Reach Into New Areas of Digital Entertainment on a Global Scale

Annual report & accounts accounts & report Annual 2011 For more information Annual report visit us online at & accounts let the world www.bwinparty.com 2011 play for real Inside 02 Overview 66 Board of Directors 03 Pro forma financial highlights 70 Governance this report 04 Our product verticals 75 Audit Committee report 06 Our business environment 77 Ethics Committee report 08 Chairman’s statement 78 Integration Committee report 10 Co-CEO’s review 79 Nominations Committee report 18 Our business model 80 Directors’ Remuneration report 20 Strategy 97 Other governance and statutory disclosures 22 Regulated and to-be- 100 Annual General Meeting regulated markets 102 Statement of Directors’ 24 Invest in our core assets responsibilities 26 Strategic alliances 28 New areas of digital entertainment 103 Financial statements 30 Act responsibly 104 Auditors’ report 32 Review of 2011 105 Consolidated statement of comprehensive income 47 Markets and risks 106 Consolidated statement 48 Sports betting of financial position 50 Casino & games 107 Consolidated statement 52 Poker of changes in equity 54 Bingo 108 Consolidated statement 55 Key risks of cashflows 110 Notes to the consolidated 58 Responsibility and relationships financial statements 59 Corporate responsibility 150 Company statement 61 Customers and responsible gaming of financial position 63 Employees 151 Company statement 64 Suppliers of changes in equity 64 Shareholders and other providers 152 Company statement of capital of cashflows 65 Environment and community 153 Share information 158 Notice of Annual General Meeting 162 Glossary and definitions See our online report at www.bwinparty.com Welcome Our strategy and vision stretches far beyond real money gaming on the internet: our aim is to ‘let the world play for real’ by extending our reach into new areas of digital entertainment on a global scale. -

Standard Life Global Equity 50:50 Pension Fund

Q2 Standard Life Global Equity 2021 50:50 Pension Fund 30 June 2021 The fund aims to provide long term growth by investing in a portfolio of UK and overseas equity assets. The Pension proportions held in each component are decided after reviewing the prospects for each market and will vary Investment Fund from time to time around the long term strategic asset allocation of 50% in UK equities and 50% in overseas equities. Both the UK and overseas components are actively managed by our investment team to try to take advantage of opportunities they have identified. Equity Fund The value of investments within the fund can fall as well as rise and is not guaranteed - you may get back less than you pay in. The fund may use derivatives for the purposes of efficient portfolio management, reduction of risk or to meet its investment objective if this is permitted and appropriate. The sterling value of overseas assets held in the fund may rise and fall as a result of exchange rate fluctuations. Quarterly Fund Manager Multi Asset Investing Team Fund Manager Start 30 Sep 2012 Launch Date 3 Feb 2003 Current Fund Size £1136.2m Fund Code HT Volatility Rating (0-7) 6 This document is intended for use by individuals who are familiar with investment terminology. Please contact your financial adviser if you need an explanation of the terms used. Fund Information * Composition by Region Fund % UK 49.6 North America 28.4 Europe ex UK 12.3 Emerging Market 6.0 Pacific Basin 1.5 Cash and Other 1.3 Japan 0.9 Top Ten Holdings Stocks Fund % AstraZeneca 3.5 Microsoft -

Exclusion List

Exclusion list ROBECO INSTITUTIONAL ASSET MANAGEMENT 1 Sustainability Inside Excluded companies: 61 Rimbunan Sawit Bhd 15 Bots Inc 62 Riverview Rubber Estates BHD 16 Bright Packaging Industry Bhd Controversial behavior 63 Salim Ivomas Pratama Tbk PT 17 Brilliant Circle Holdings International Ltd 1 G4S International Finance PLC 64 Sarawak Oil Palms Bhd 18 British American Tobacco Bangladesh Co Ltd 2 G4S PLC 65 Sarawak Plantation Bhd 19 British American Tobacco Chile Operaciones SA 3 Korea Electric Power Corp 66 Scope Industries Bhd 20 British American Tobacco Holdings The Netherlands BV 4 Oil & Natural Gas Corp Ltd1 67 Sin Heng Chan Malaya Bhd 21 British American Tobacco Kenya PLC 5 ONGC Nile Ganga BV 68 Sinar Mas Agro Resources & Technology Tbk PT 22 British American Tobacco Malaysia Bhd 6 ONGC Videsh Ltd 69 Socfin 23 British American Tobacco PLC 7 Vale Indonesia Tbk PT 70 Socfinasia SA 24 British American Tobacco Uganda Ltd 8 Vale SA2 71 Societe Camerounaise de Palmeraies 25 British American Tobacco Zambia PLC 72 Societe des Caoutchoucs de Grand-Bereby 26 British American Tobacco Zimbabwe Holdings Ltd Palm oil 73 SSMS Plantation Holdings Pte Ltd 27 Bulgartabac Holding AD 1 A Brown Co Inc 74 Sterling Plantations Ltd 28 Carreras Ltd/Jamaica 2 Agalawatte Plantations PLC 75 Subur Tiasa Holdings Bhd 29 Casey’s General Stores Inc 3 Anglo-Eastern Plantations PLC 76 Sungei Bagan Rubber Co Malaya Bhd 30 Cat Loi JSC 4 Astra Agro Lestari Tbk PT 77 Sunshine Holdings PLC 31 Ceylon Tobacco Co PLC 5 Astral Asia Bhd 78 Ta Ann Holdings Bhd 32 Champion -

This Is the Message

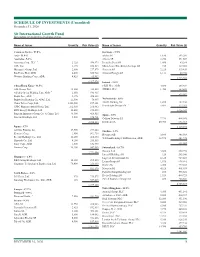

SCHEDULE OF INVESTMENTS (Unaudited) December 31, 2020 Sit International Growth Fund Investments are grouped by geographic region. Name of Issuer Quantity Fair Value ($) Name of Issuer Quantity Fair Value ($) Common Stocks - 97.0% Germany - 5.9% Asia - 31.8% adidas AG * 1,630 593,205 Australia - 5.0% Allianz SE 2,250 551,667 Atlassian Corp., PLC * 2,125 496,974 Deutsche Post AG 1,400 69,268 CSL, Ltd. 1,175 256,523 Muenchener Rueckversicherungs AG 435 129,028 Macquarie Group, Ltd. 2,600 277,579 Siemens AG 2,225 319,439 Rio Tinto, PLC, ADR 4,400 330,968 Siemens Energy AG * 1,112 40,754 Westpac Banking Corp., ADR 4,425 65,932 1,703,361 1,427,976 Ireland - 2.0% China/Hong Kong - 11.5% CRH, PLC, ADR 4,800 204,384 AIA Group, Ltd. 32,200 394,585 STERIS, PLC 1,950 369,603 Alibaba Group Holding, Ltd., ADR * 2,350 546,915 573,987 Baidu, Inc., ADR * 2,175 470,322 Budweiser Brewing Co. APAC, Ltd. 21,500 70,997 Netherlands - 3.6% China Tower Corp., Ltd. 1,342,000 197,341 ASML Holding NV 1,450 707,194 * CSPC Pharmaceutical Group, Ltd. 262,960 268,982 Koninklijke Philips NV 5,866 317,761 ENN Energy Holdings, Ltd. 18,400 270,098 1,024,955 Ping An Insurance Group Co. of China, Ltd. 33,500 410,515 Spain - 3.9% Tencent Holdings, Ltd. 9,000 654,761 Cellnex Telecom SA 7,733 464,038 3,284,516 Iberdrola SA 45,900 656,063 Japan - 9.7% 1,120,101 Astellas Pharma, Inc.