REFM Issue 2 June 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

At Last the Calm

At last the calm Stability comes to the PERE 50 now that franchises that were chewed up in the global financial crisis have seen their pre-crisis funds forgotten while the stronger groups have prospered via their second or third funds since then The PERE 50 ranking of private equity real estate firms, spots from 67 after great success with its value-add fund and following the twisted iron wreckage of the global financial Kildare Partners at number 41 off the back of its impressive crisis of 2008, now has some shape and stability to it. Unlike first-time raise culminating in November 2014. This is not last year when there were no fewer than 14 new entrants to to say that the other European franchises have not manu- the ranking, this time around we see just two firms mak- factured great success in their own fundraising these past ing their premiere - Greystar Real Estate Partners and five years, but they do lie in that twilight zone just outside Almanac Realty Investors. the top 50 having seen their positions in the 40 to 50 bracket This can be explained by the fact that the major banking taken up mainly by North American firms that have been franchises that used to rank so highly in this list have exited active due to their capital raising cycles such as DivcoWest, and been replaced by groups that have had the time to raise Carmel Partners, Tricon Capital Group, Paramount Group, at least two significant funds since 2010 as the shakedown Merlone Geier Partners and Fir Tree Partners. -

Colony Northstar 2016 Annual Report

2016 Annual Report To Our Stockholders Dear Fellow Stockholders, 2016 was a transformative year for Colony Capital, NorthStar Asset Management Group, and NorthStar Realty Finance, as all three companies’ shareholders overwhelmingly supported the tri-party merger to create Colony NorthStar, Inc., which closed on January 10, 2017. &RORQ\1RUWK6WDULVDZRUOGFODVVGLYHUVL¿HGHTXLW\5(,7ZLWKDQHPEHGGHGJOREDOLQYHVWPHQWPDQDJHPHQW EXVLQHVV2XUQHZIRRWSULQWLQFOXGHV • ELOOLRQFRQVROLGDWHGEDODQFHVKHHW • ELOOLRQHTXLW\PDUNHWFDSLWDOL]DWLRQOLVWHGRQWKH1HZ<RUN6WRFN([FKDQJHDQG06&,865(,7,QGH[ (the “RMZ”) constituent • ELOOLRQRIDVVHWVXQGHUPDQDJHPHQW • 2YHUHPSOR\HHVDFURVVRI¿FHV :HDUHWKULOOHGWRKDYHFRPSOHWHGWKLVWUDQVIRUPDWLRQDOWULSDUW\PHUJHUDQGFRXOGQRWEHPRUHH[FLWHGDERXW RXUIXWXUHSURVSHFWV:HKDYHDFRORVVDORSSRUWXQLW\EHIRUHXVDQGDUHRQO\EHJLQQLQJWRHQMR\WKHEHQH¿WVRI VLJQL¿FDQWO\HQKDQFHGVFDOHDQGPDUNHWSUHVHQFH7RWKDWHQGZHORRNIRUZDUGWRH[HFXWLQJRQWKHIROORZLQJ SULRULWLHVLQ • (YDOXDWHDQGFXUDWHWKHQHZO\FRPELQHGEXVLQHVVOLQHVDQGYHUWLFDOVWRRQO\WKRVHWKDWUHSUHVHQWWKHEHVW ULVNZHLJKWHGFXUUHQWLQFRPHDQGIXWXUHDSSUHFLDWLRQSRWHQWLDOZLWKGXUDEOHORQJGDWHGUHYHQXHVWUHDPV • Complete our goal of targeted cost synergies of the recently completed mergers (to date we have achieved DSSUR[LPDWHO\RIRXUPLOOLRQWDUJHW • 2QDVHOHFWLYHEDVLVKDUYHVWUHVLGXDOJDLQVDQGOLTXLGLW\IURPWKHVDOHRIFHUWDLQQRQVWUDWHJLFDVVHWVDQG EXVLQHVVOLQHVWKDWQRORQJHU¿WZLWKRXUJRIRUZDUGEXVLQHVVSODQRUWKDWPD\EHEHWWHUPDQDJHGLQDQ alternate structure, or in which we may no longer have an appropriate competitive advantage. • 7KRXJKWIXOO\H[WHQGWKHGXUDWLRQRIH[LVWLQJGHEWDQGUHGXFHRYHUDOOLQWHUHVWUDWHFRVWDFURVVDVVHWVDQG -

Wells Fargo Said to Prep First Risk Retention-Compliant Cmbs

JUNE 20, 2016 WWW.REALESTATEFINANCEINVESTMENT.COM The definitive source on commercial property sales, financing and investment WELLS FARGO SAID TO PREP MORTGAGE SPREAD UPDATE FIRST RISK RETENTION- TREASURIES FALLING, BORROWER SPREADS COMPLIANT CMBS STAYING FLAT eligible vertical slice, the sponsor is required BY SHERRY HSIEH to retain 5% of each class of securities issued in BY SAMANTHA ROWAN a transaction. There is also the L-shaped slice, Wells Fargo Bank is said to be planning the first which is a combination of the horizontal and commercial mortgage-backed securities deal vertical options. U.S. Treasuries, which down about that will be compliant with risk retention rules, CREFC attendees expressed concern that there 10-15 basis point last week, have been which are set to be implemented in December. is still a lack of clarity on what the regulators are down by as much as 30 basis points And although the CMBS industry hasn’t agreed expecting. “Risk retention [guidance] is very over the past 30 days and spreads for on the best way to comply with the rules, the light, only 25 to 50 pages or so, but there are a lot QSWX½\IHVEXIPSERWLEZIFIIRWXEFPI bank will reportedly use the so-called ‘vertical of blank spaces where the regulators are not very EGGSVHMRKXS'YWLQER ;EOI½IPH´W slice’ solution on its upcoming $1bn transaction, clear on what they want and I don’t think they are monthly analysis of mortgage rate market players told REFI. The offering is expected going to give us any clarity. We still don’t know if spreads. -

Attendee Bios

ATTENDEE BIOS Ejim Peter Achi, Shareholder, Greenberg Traurig Ejim Achi represents private equity sponsors in connection with buyouts, mergers, acquisitions, divestitures, joint ventures, restructurings and other investments spanning a wide range of industries and sectors, with particular emphasis on technology, healthcare, industrials, consumer packaged goods, hospitality and infrastructure. Rukaiyah Adams, Chief Investment Officer, Meyer Memorial Trust Rukaiyah Adams is the chief investment officer at Meyer Memorial Trust, one of the largest charitable foundations in the Pacific Northwest. She is responsible for leading all investment activities to ensure the long-term financial strength of the organization. Throughout her tenure as chief investment officer, Adams has delivered top quartile performance; and beginning in 2017, her team hit its stride delivering an 18.6% annual return, which placed her in the top 5% of foundation and endowment CIOs. Under the leadership of Adams, Meyer increased assets managed by diverse managers by more than threefold, to 40% of all assets under management, and women managers by tenfold, to 25% of AUM, proving that hiring diverse managers is not a concessionary practice. Before joining Meyer, Adams ran the $6.5 billion capital markets fund at The Standard, a publicly traded company. At The Standard, she oversaw six trading desks that included several bond strategies, preferred equities, derivatives and other risk mitigation strategies. Adams is the chair of the prestigious Oregon Investment Council, the board that manages approximately $100 billion of public pension and other assets for the state of Oregon. During her tenure as chair, the Oregon state pension fund has been the top-performing public pension fund in the U.S. -

P10 Holdings, Inc. Delaware 74-2961657 (State of Incorporation) (IRS Employer Identification No.)

Audited Annual Report to Shareholders for The Year Ended December 31, 2019 P10 Holdings, Inc. Delaware 74-2961657 (State of Incorporation) (IRS Employer Identification No.) 8214 Westchester Drive Suite 950 Dallas, TX 75225 (Address of principal executive office) (214) 999-0149 (Company’s telephone number) Common Stock $0.001 Par Value Trading Symbol: PIOE Trading Market: OTC Pink Open Market 110,000,000 Common Shares Authorized 89,411,175 Shares Issued and 89,234,816 Shares Outstanding As of March 27, 2020 Special Note Regarding Forward-Looking Statements The following stockholder letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements about historical or current facts, including, without limitation, statements about our business strategy, plans, and objectives of management and our future prospects, are forward-looking statements. You can identify forward-looking statements by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “seek,” “continue,” and other similar words. You should read statements that contain these words carefully because they discuss our future expectations, make projections of our future results of operations or financial condition, or state other “forward-looking” information. We claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 for all forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements are subject to risks, uncertainties and assumptions about our business that could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in the forward-looking statements. -

September 29, 2020

Plymouth County Retirement Association September 29, 2020 Meeting Materials BOSTON CHICAGO LONDON MIAMI NEW YORK PORTLAND SAN DIEGO MEKETA.COM Plymouth County Retirement Association Agenda Agenda 1. Estimated Retirement Association Performance As of August 31, 2020 2. Performance Update As of July 31, 2020 3. Current Issues Non-Core Real Estate RFP Respondent Review Non-Core Infrastructure Finalist Presentations 4. Disclaimer, Glossary, and Notes 2 of 129 Estimated Retirement Association Performance As of August 31, 2020 3 of 129 Plymouth County Retirement Association Estimated Retirement Association Performance Estimated Aggregate Performance1 August2 QTD YTD 1 YR 3 YR 5 YR 10 YR (%) (%) (%) (%) (%) (%) (%) Total Retirement Association 2.7 6.3 0.5 7.8 5.0 6.4 7.9 Policy Benchmark 3.1 6.8 3.0 10.1 6.9 7.7 8.5 Benchmark Returns August QTD YTD 1 YR 3 YR 5 YR 10 YR (%) (%) (%) (%) (%) (%) (%) Russell 3000 7.2 13.3 9.4 21.4 14.0 13.9 14.9 MSCI EAFE 5.1 7.6 -4.6 6.4 2.3 4.7 5.9 MSCI Emerging Markets 2.2 11.3 0.5 14.5 2.8 8.7 3.8 Barclays Aggregate -0.8 0.7 6.9 6.5 5.1 4.3 3.7 Barclays TIPS 1.1 3.4 9.6 9.0 5.7 4.6 3.7 Barclays High Yield 1.0 5.7 1.7 4.7 4.9 6.5 6.9 JPM GBI-EM Global Diversified (Local Currency) -0.3 2.7 -4.4 1.7 0.7 4.6 1.3 S&P Global Natural Resources 4.0 7.6 -13.0 -1.9 -0.1 5.6 1.5 Estimated Total Assets Estimate Total Retirement Association $1,106,611,546 1 The August performance estimates are calculated using index returns as of August 31, 2020 for each asset class. -

2019 ILGIF Annual Report

2019 ANNUAL REPORT TABLE OF CONTENTS A Message from the Treasurer ���������������������������������������������������������������������3 Fund Overview ������������������������������������������������������������������������������������������������5 Why Invest in Venture Capital?..........................................................................5 Overview..............................................................................................................6 History of ILGIF...................................................................................................6 ILGIF Goals..........................................................................................................6 Vision ..................................................................................................................6 Mission ................................................................................................................6 Illinois Venture Capital Landscape ��������������������������������������������������������������7 Investment Performance ������������������������������������������������������������������������������9 Investment Activity in 2019 ������������������������������������������������������������������������������������ 10 Key Investment Updates ����������������������������������������������������������������������������������������� 10 Economic Impact ������������������������������������������������������������������������������������������12 Equity, Diversity, and Inclusion �����������������������������������������������������������������13 -

Colony Capital Announces Fourth Quarter and Full Year 2020 Financial Results

Exhibit 99.1 COLONY CAPITAL ANNOUNCES FOURTH QUARTER AND FULL YEAR 2020 FINANCIAL RESULTS Boca Raton, February 25, 2021 - Colony Capital, Inc. (NYSE: CLNY) and subsidiaries (collectively, “Colony Capital,” or the “Company”) today announced financial results for the fourth quarter and full year ended December 31, 2020. The Company reported fourth quarter 2020: (i) total revenues of $339 million, (ii) GAAP net income attributable to common stockholders of $(141) million, or $(0.30) per share and (iii) Core FFO excluding gains/losses of $18.2 million, or $0.03 per share, and full year 2020: (i) total revenues of $1.2 billion, (ii) GAAP net income attributable to common stockholders of $(2.8) billion, or $(5.81) per share and (iii) Core FFO excluding gains/losses of $46.7 million, or $0.09 per share. Beginning in the fourth quarter 2020 Core FFO excludes results from discontinued operations, which was applied to prior periods. “We made transformational progress in 2020 towards our digital rotation, capped off by the first closing of DCP II at $4.2 billion earlier this year. The digital rotation is manifesting itself in our earnings, assets, and employees,” said Marc Ganzi, President and Chief Executive Officer. "Thanks to our amazing team, we delivered on all of the key pillars of that transition, despite the pressures of the pandemic. That foundational work positions us to capitalize on the powerful secular tailwinds supporting the continued growth and investment in digital infrastructure. We are looking forward to 2021 and the opportunity to collaborate with our partner companies and customers to build the next-generation networks connecting enterprises and consumers globally." 4Q 2020 HIGHLIGHTS Consecutive Quarter of Positive Core FFO Financial Summary • Positive Core FFO excluding gains/losses of $18.2 ($ in millions, except per share data and where noted) million reflecting the results of continuing operations. -

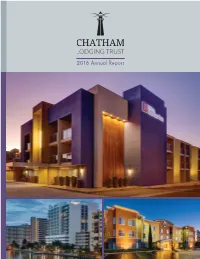

Chatham Lodging Trust 2016 Annual Report

2016 Annual Report 2016 CHATHAM LODGING TRUST | 2016 ANNUAL REPORT Chatham Lodging Trust is a self-advised, publicly-traded real estate investment trust focused primarily on investing in upscale extended-stay hotels and premium-branded, select-service hotels. Our high quality hotels are located in major markets with high barriers to entry, near primary demand generators for both business and leisure guests. Our primary objective is to generate attractive returns for our shareholders through investing in hotel properties at prices that provide strong returns on invested capital, paying meaningful dividends and generating long-term value appreciation. Chatham Lodging Trust 1 Dear Shareholder, Greetings to each of you and I hope this letter finds market where we acquired assets since 2013 was you well. A year ago, the outlook for 2016 was very Denver, Colorado, where economic growth has also encouraging not only for Chatham, but the entire been strong in comparison to the rest of the country. hotel industry. Two leading industry forecasters, STR, A misconception we sometimes encounter when Inc., and CBRE Hotels, estimated RevPAR growth meeting with interested parties is that select-service of 5.0 percent and 6.1 percent, much higher than the or limited-service assets are inferior to big box, 3.2 percent that was realized. branded, full-service hotels and therefore must not be As we look back 12 months later, those expectations as valuable, much less more valuable. However, having were ambitious given the lack of lodging demand driven by weaker economic growth and an uncertain political landscape that lingered for most of the year. -

Preqin Special Report: Northeast US Real Estate

Content Includes: Preqin Special Report: Northeast US Real Estate May 2015 Fundraising All Northeast US-focused funds closed in 2014 focus primarily on value added investments. Funds in Market Opportunistic funds account for the majority of Northeast US-focused funds in market. Fund Managers More than a third of Northeast US-based fund managers are raising their first fund. Institutional Investors Majority of Northeast US- based investors are below their target allocations to real estate. alternative assets. intelligent data. Download the data pack at: Preqin Special Report: Northeast US Real Estate www.preqin.com/USRE15 Foreword The Northeast contains some of the United States’ largest real estate markets and is home to some of the largest real estate players globally. It is also the base of many specialist real estate fund managers that have raised a combined $7.4bn over the last fi ve years. Over 550 real estate fund managers have set up shop in the Northeast US, with the majority based in the global hub of New York. Additionally, the Northeast US holds many large institutional investors that are willing to invest in real estate within their home region. In this report, we look at the state of the private real estate market in the Northeast US by examining historical fundraising, funds in market, fund managers and investors that are based in the region, drawing on the wealth of individual fi rm- and fund-level data available on Preqin’s Real Estate Online service. Key Findings Capital Raised by Private Real Estate Firms in the Last 10 Years ($bn) Total funds raised in the last 10 years $$397bn397bn by real estate fund managers based in Northeast US. -

Colony Capital Q4 2019 Supplemental Financial Presentation

Cautionary Statement Regarding Forward-Looking Statements This presentation may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the Company’s control, and may cause the Company’s actual results to differ significantly from those expressed in any forward-looking statement. Factors that might cause such a difference include, without limitation, the Company’s ability to build the leading digital real estate provider and funding source for the occupancy, infrastructure, equity and credit needs of the world’s mobile communications and data-driven companies, including whether the Company will be the only global REIT that owns, manages and operates assets across all major -

2010 Year-In Review

EntrepreneurZell Lurie Institute Year-in-Review FALL 2009/WInTER 2010 www.zli.bus.umich.edu FRoM THE ExECUTIVE DIRECToR In THIS ISSUE THoMAS C. KInnEAR With our reputation as a national leader in entre- Wolverine Venture Fund preneurship education firmly established during the Frankel Commercialization Fund past decade, the Samuel Zell and Robert H. Lurie Social Venture Fund Institute for Entrepreneurial Studies has continued to innovate deepening its substantial footprint on Awards & Scholarships the entrepreneurial ecosystem within the Stephen Marcel Gani Internships M. Ross School of Business, across the University Business Plan Competitions of Michigan campus and throughout the state of Entrepreneurial Multidisciplinary Action Projects Michigan. Within these pages many different venues Dare to Dream Student Start-up Grants are represented that serve to enrich the complex TechArb Incubator for Student Start-ups mosaic of new-venture creation and venture-capital Entrepreneur & Venture Club Highlights investment where our students learn and our gradu- ates pursue fulfilling careers. Thank you for your Institute’s 10 Year Anniversary Celebration continued support and participation as we prepare Entreplaooza Entrepreneurship Symposium our students for entrepreneurial success. Michigan Growth Capital Symposium Michigan Private Equity Conference Wolverine Venture Fund: Achieves Record $2 Million Return on HandyLab Acquisition Fund Award Recipients Michael Godwin and Jason Townsend (MBAs ’10) were honored with the David T. Shelby Award for their The acquisition of HandyLab Inc. by Becton Dickinson and Company in outstanding leadership of the Fund, in honor of the WVF’s first alumni manager and co-founder, David Shelby. november 2009, provided a record-setting $2 million return on the fund’s strategic venture capital investments in HandyLab increasing the WVF Student Members fund’s size to $5.2 million.