Consolidated Annual Report 2020 MAXIMA GRUPĖ Consolidated Annual Report 2020 | 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retail of Food Products in the Baltic States

RETAIL OF FOOD PRODUCTS IN THE BALTIC STATES FLANDERS INVESTMENT & TRADE MARKET SURVEY Retail of food products in the Baltic States December 2019 Flanders Investment & Trade Vilnius Retail of Food Products in the Baltic States| December 2019 1 Content Executive summary ................................................................................................................................. 3 Overview of the consumption market Baltic States ................................................................................ 4 Economic forecasts for the Baltic States ............................................................................................. 4 Lithuania .......................................................................................................................................... 4 Latvia ............................................................................................................................................... 5 Estonia ............................................................................................................................................. 6 Structure of distribution and market entry in the Baltic States ............................................................ 13 Structure ............................................................................................................................................ 13 Market entry ..................................................................................................................................... 14 Key -

The World's Leading Global M&A Partnership Since 1973

IMAP The world’s leading global M&A partnership since 1973 www.imap.com IMAP DEALBOOK 2017-2018 IMAP DEALBOOK 2017-2018 Contents FOREWORD 6 ABOUT IMAP 8 12 18 28 38 Automotive Building Business Consumer Products Services & Retail & Services 76 86 98 106 Healthcare Industrials Materials, Real Estate Chemicals & Mining 48 52 58 66 Education Energy Financial Food & & Training & Utilities Services Beverage 112 128 Technology Transport & Logistics Jurgis V Oniunas IMAP Chairman “We deliver, transaction after transaction, intimate industry-related knowledge, excellence in execution and the very best tailored M&A financial advice.” 7 Foreword There is little room for doubt that we are close deals across sectors and on a global living in unsteady times. World trade is under scale. Thanks to ongoing commitment, cross- pressure amid rising protectionism and the border collaboration and distinguished sector geopolitical system is going through tectonic expertise, IMAP continues to hold its position as shifts. Technological disruption, demographic one of the world’s leading global M&A advisories imbalances and immigration are also having an for the mid-market. We know our clients come impact. Moreover, there is a rising realization back to us because we deliver, transaction after that the business cycle may soon reverse transaction, intimate industry-related knowledge, into recession. And yet, at IMAP we remain excellence in execution and the very best positive about the promise of opportunity from tailored M&A financial advice. major advances in science, technology and medicine, changing the way we think about About 35% of IMAP deals are cross-border, many issues, from logistics to aging. -

This Article Was Originally Published in Issue 6.3 Of

Year 6, Issue 3 CEE APRIL 2019 Legal Matters 2019 Corporate Counsel Handbook ELİG GÜRKAYNAK Attorneys at Law INTEGRITY EFFICIENCY COMMITMENT ELIG Gürkaynak Attorneys-at-Law is an eminent, independent Turkish law firm founded in 2005. The firm is based in Istanbul. Widely recognized as having the leading competition law practice in Turkey, our team consists of 45 dedicated competition law specialists led by Gönenç Gürkaynak, the firm’s partner with more than 20 years competition law experience, along with four partners and two counsel. Our competition law team at ELIG Gürkaynak Attorneys-at-Law has a unique understanding and significant experience in a range of industries including pharmaceuticals, transportation & airlines, food & agricultural products, manufacturing, telecommunications, media & technology, healthcare & medical devices, energy, tobacco, construction and defense. In addition to our unparalleled experience in merger control issues, our team has vast experience in defending companies before the Turkish Competition Board in all phases of antitrust investigations, abuse of dominant position cases, leniency handlings, and before the courts on issues of private enforcement of competition law, along with appeals of the administrative decisions of the Turkish Competition Authority. ELIG (Gürkaynak) Attorneys-at-Law is still the first name … when it comes to We take pride in being able to assist our clients in all fields of law. “competition advice in Turkey. The team is led by Gönenç Gürkaynak and consists Our areas of expertise particularly include: competition law of 45 specialists… and - uniquely in Turkey - a full-time, in-house competition • corporate law • M&A • contracts law • white collar irregularities and economist. -

Baltic Top 50 2014

panoramaTHE COFACE ECONOMIC PUBLICATIONS July 2014 BALTIC TOP 50 2014 CONTENTS Coface is publishing its second edition of the Baltic Top 50. The companies are ranked based on their turnover in 2013. Figures for 2013 show the continuing recovery of the Baltic states. The / 02 Coface Baltic Top 50: Ranking and methodology total turnover of the top players in the North increased by 2.2% to EUR 36.2 billion. Whereas net profits fell from 2011 to 2012, companies have now reported a sharp rise of 54.6%. / 03 Country analysis and country ranking Top 3 largest companies in the Baltics / 07 Sector analysis and It is hard to beat the three top companies in the Baltics. With a sector ranking turnover of EUR 6.1 billion, the oil and gas giant Orlen Lietuva is again number 1, although it has some problems to contend with. Both Coface contacts second-placed Vilniaus Prekyba (EUR 3 billion) and the third-placed / 09 Maxima Grupe (EUR 2.5 billion) increased their turnover by around 6% and net profits by around 20%. Country Analysis Lithuania, already home to a majority of the top companies in 2012 (29), was able to further strengthen its leading position (+2). Unsurprisingly, the country also contributed the largest share in turnover (71.5% or almost EUR 26 billion, +2.7%). Although the Latvian economy still exhibits the highest GDP growth in 2013, its top players were not able to continue their double-digit growth rates from the previous year. In total, turnover by the eleven (-1 company) Latvian top companies decreased by 2.9%. -

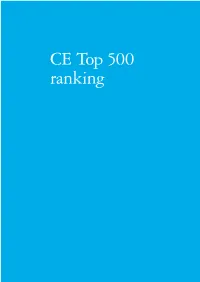

CE Top 500 Ranking

CE Top 500 ranking Central Europe Top 500 2014 43 Rank Company name Country Industry* Revenues from Revenues Net income Net income LY sales change (%) change (%) Rank 2013 2013-2012 2013 2013-2012 1 PKN Orlen Poland E&R 27,037.2 -5.8% -26.1 -106.4% 1 2 MOL Hungary E&R 18,121.1 -5.5% -65.1 -112.0% 2 3 ŠKODA AUTO Czech Republic Mfg 10,311.2 -1.4% 454.4 -25.7% 3 4 Metinvest Ukraine Mfg 9,619.0 -1.3% 294.4 -14.7% 4 5 DTEK Ukraine E&R 8,721.6 8.9% 313.1 -45.8% 7 6 ČEZ Czech Republic E&R 8,344.0 -2.6% 1,353.1 -15.3% 6 7 Energorynok Ukraine E&R 8,033.1 0.8% 4.7 10.1% 8 8 Jeronimo Martins Polska Poland CB&T 7,806.4 13.0% N/A N/A 12 9 PGNiG Poland E&R 7,627.7 11.1% 480.4 -1.8% 13 10 PGE Poland E&R 7,158.6 -1.7% 1,044.1 25.6% 10 11 Naftogaz of Ukraine Ukraine E&R 7,010.8 -25.8% -1,176.6 -10.6% 5 12 RWE Supply & Trading CZ Czech Republic E&R 6,920.8 -4.0% 923.1 -55.4% 11 13 Lotos Poland E&R 6,791.1 -14.2% 29.3 -90.4% 9 14 Volkswagen Slovakia Slovakia Mfg 6,524.3 -1.0% 45.4 -73.3% 14 15 Orlen Lietuva Lithuania E&R 6,067.3 -3.2% N/A N/A 16 16 AUDI Hungaria Motor Hungary Mfg 5,856.3 5.8% 314.4 -6.0% 19 17 AGROFERT Czech Republic Mfg 5,825.9 10.5% 215.6 -10.2% 20 18 KGHM Poland E&R 5,725.5 -10.3% 731.9 -28.2% 15 19 Petrom Romania E&R 5,477.1 -7.2% 1,091.8 23.2% 18 20 GE Infrastructure CEE Hungary Mfg 5,187.5 3.2% 463.6 -33.0% 22 21 Ukrzaliznytsia Ukraine CB&T 4,796.9 -6.2% 51.2 -40.4% 21 22 Slovnaft Slovakia E&R 4,738.1 2.0% 35.1 -32.4% 23 23 Lotos Paliwa Poland E&R 4,666.7 0.0% N/A N/A 24 24 Tauron Poland E&R 4,543.2 -23.2% 330.1 13.5% 17 25 Kia Motors -

Pianeta Distribuzione 2012

PL Documento in versione interattiva: www.largoconsumo.info/072012/CitatiPia2012.pdf SOMMARIO INTERATTIVO DI PIANETA DISTRIBUZIONE 2012 Per l'acquisto del fascicolo, o di sue singole parti, rivolgersi al servizio Diffusione e Abbonamenti [email protected] Tel. 02.3271.646 Fax. 02.3271840 LE FONTI DI QUESTO PERCORSO DI LETTURA E SUGGERIMENTI PER L'APPROFONDIMENTO DEI TEMI: Pianeta Distribuzione Osservatorio D'Impresa Rapporto annuale sul grande dettaglio internazionale Leggi le case history di comunicazioni d'impresa Un’analisi ragionata delle politiche e delle strategie di sviluppo dei grandi gruppi di Aziende e organismi distributivi internazionali, food e non food e di come competono con la attivi distribuzione locale a livello di singolo Paese. Tabelle, grafici, commenti nei mercati considerati in giornalistici, interviste ai più accreditati esponenti del retail nazionale e questo internazionale, la rappresentazione fotografica delle più importanti e recenti Percorso di lettura strutture commerciali in Italia e all’estero su Pianeta Distribuzione. selezionati da Largo Consumo http://www.intranet.largoconsumo.info/intranet/Articoli/PL/VisualizzaPL.asp (1 di 16)09/11/2009 11.46.44 PL Pianeta Distribuzione, fascicolo 7/2012, n°pagina 0, lunghezza n.d. Tipologia: Breve Spese fisse sempre più pesanti per gli italiani dal 1992 Notizie in corso - Negli ultimi venti anni la spesa delle famiglie destinata ai Proposte editoriali sugli consumi obbligati (bollette, affitti, servizi bancari e assicurativi, carburanti, stessi argomenti: spese sanitarie, trasporti, eccetera) è aumentata di oltre 7 punti percentuali passando dal 32,3% sul totale dei consumi del 1992 al 39,5% del 2011. È il dato più significativo che emerge da un'analisi dell'Ufficio Studi Confcommercio sull'evoluzione e l'incidenza delle spese obbligate sui consumi delle famiglie. -

Presentation of Q1 2021: Restart of Business 29 April 2021 Disclaimer

Presentation of Q1 2021: Restart of business 29 April 2021 Disclaimer This presentation has been prepared by the management of AB Novaturas, with its registered office at A. Mickevičiaus g. 27, LT-44245, Kaunas, Lithuania (the “Company” or “Novaturas”). This presentation does not constitute or form any part of any offer or invitation or inducement to sell or issue, or any solicitation of any offer to purchase or subscribe for, any securities of Novaturas, nor shall it or any part thereof or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefore. The information and opinions contained herein are provided as at the date of this presentation and are subject to change without notice. Neither the Company nor its affiliates or advisers, representatives are under an obligation to correct, update or keep current the information contained in this presentation or to publicly announce the result of any revision to the information and opinions made herein. Furthermore, neither the delivery of this presentation nor any further discussions of the Company and/or its group with any of the recipients shall, under any circumstances, create any implication that there has been no change in the affairs of the Company since such date. Neither this presentation nor any copy of it not the information contained in it may be taken or transmitted into the United States, United Kingdom, Canada, Australia or Japan or distributed, directly or indirectly, in the United States, United Kingdom, Canada, Australia or Japan -

Ab Novaturas Consolidated Interim Financial

AB NOVATURAS CONSOLIDATED INTERIM FINANCIAL STATEMENTS AND CONSOLIDATED INTERIM REPORT for the six-month period ended 30 June 2021 (unaudited) AB Novaturas Consolidated Financial Statements and Interim Report for the Six-Month Period Ended 30 June 2021 Beginning of reporting period 1 January 2021 End of reporting period 30 June 2021 Business name Novaturas, AB (further – “Novaturas” or “the Company”) (The Company’s financial statements and activity ratios are presented consolidated with the results of subsidiaries; separate reports of the parent company are not presented.) Legal form Public limited company Registration date 16 December 1999 Registration number 135567698 LEI code 097900BGCW0000042109 Manager of register State Enterprise Centre of Registers Company address A. Mickevičiaus str. 27, LT-44245 Kaunas Telephone +370 37 321 264 Fax +370 37 321 130 Website www.novaturasgroup.com AB Novaturas Consolidated Financial Statements and Interim Report for the Six-Month Period Ended 30 June 2021 2 Table of Contents Management report ................................................................................................................................................................. 4 Main ratios ....................................................................................................................................................................... 6 Segment information ...................................................................................................................................................... -

ECR Baltic General Meeting 10Th of June 2013 at 12:00

ECR Baltic General Meeting 10th of June 2013 at 12:00 TALLINK HOTEL RIGA ELIZABETES 24 Anti-trust caution and Competition Law Compliance ECR Baltic will not enter into any discussion, activity or conduct that may infringe, on its part or on the part of its members and participants, any applicable competition laws. By way of example, members and participants shall not discuss, communicate or exchange any commercially sensitive information, including non-public information relating to prices, marketing and advertisement strategy, costs and revenues, trading terms and conditions and conditions with third parties, including purchasing strategy, terms of supply, trade programs or distribution strategy. This applies not only to discussion in formal meetings but also to informal discussions before, during or after meetings. Message to new members, participants and/or people taking part for the first time: Please note that taking part in ECR Europe’s and ECR Baltic activities is subject to having read and understood ECR Europe’s EC Competition Law Compliance Program. If you have not done so, please do so now. http://www.ecr-baltic.org/f/docs/clcp.pdf AGENDA (1) : 11:30 – 12:00 Welcome coffee and registration ============= 12:00 – 12:15 Welcome message ECR Baltic 12:15 – 12:45 Supply Chain block started with guest speaker: Jaroslaw Bogusz, Global Account Manager, Nielsen Italy OSA (On Shelf Availability) solution. How to minimize Out of Stocks and increase sales? o Out of Stocks – unresolved issue? o Shoppers reactions on Out of Stocks. Loss of -

Bulgaria: Retail Market Update

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Voluntary - Public Date: 5/18/2015 GAIN Report Number: BU1516 Bulgaria Post: Sofia Retail Market Update Report Categories: Retail Foods Market Development Reports Approved By: Russell J. Nicely, Agricultural Attaché Prepared By: Alexander Todorov, Marketing Assistant Report Highlights: This report contains information about Bulgaria’s retail food and beverage market. General Information Currently the number of modern grocery outlets in Bulgaria stands at nearly 3,900, which represents about 11% of total grocery retail outlets. According to one of the leading market research companies (iCAP), the leading top 50 retailers currently hold a combined market share of 46% which is likely to reach 50% in 2015 and close to 55% in 2016. The remaining 54% is held by almost 31,000 traditional grocery stores throughout the country. Retail chains operating in Bulgaria will continue to open new outlets. The latest retail survey made and published in the economic analyses section of a respected Bulgarian media outlet (Capital) shows that retail companies will continue to optimize their networks and close loss-making outlets. Discounters will see the most dynamic market growth. With the deepening of the economic crisis in 2012/2013 and reduced consumer purchasing power, tensions between local food suppliers and retailers intensified. The government drafted new legislation to regulate relations between food manufacturers and retailers, providing more favorable treatment for the first ones. The legislation was vetoed by the President at the second Parliament vote and never went into force. -

Riga Retail Market

Riga retail market Latvia 2010 Economy “Despite a fall in GDP of 17.5%, Latvia seems to have achieved something many thought impossible: an internal devaluation, meaning regaining competitiveness not by currency depreciation but by deep cuts in wages and public spending” states the Economist. Indeed, early in 2010 the Standard & Poor’s rating agency upgraded its outlook on Latvia from negative to stable. The shift of local businesses to the export markets has improved the country’s balance of trade and led to the much needed current account surplus. Along with overall improvement, Latvian export has become more diverse, evolving from predominately service industries to the increased export of goods. Internally, consumer confidence has been gradually improving since the second half of 2009 despite significant wage declines and household debt burden. The marginally positive news, however, remain shadowed by the grim unemployment indicators expected to peak in mid 2010. Latvian banking sector remains conservative as 25.5% of the mortgage loan portfolio or some 3.9 billion Lats (5.55 billion Euros) delay at least some payments, recorded by the Latvian Financial and Capital Commission. The upcoming parliament elections and low credibility of the politicians adds uncertainty in the government ranks, in the light of solving two critical economic issues - job (re)creation and budget balancing for Euro adoption. Central Statistical Bureau, State Employment Agency, Bank of Latvia data. f – forecast. 2 Shopping centres completion in the pipeline for 2010 - Galleria Riga (36,000 sqm GLA). Meanwhile, same period notable extensions include - Spice Home (22,000 sqm GLA) in Spice and Supply Cinnamon cinema (4,000 sqm total area) in Alfa shopping centre. -

European Grocery Real Estate Attracts Investor Appetite

The European Grocery Real Estate Market European grocery real estate attracts investor appetite – March 2021 – Contents At a Glance 03 Real Estate Leasing Market 42 Introduction 06 Real Estate Investment Market 49 Consumer Market 10 Innovation and Trends 59 Drivers of Food Consumption 12 Outlook 65 Food Sales 16 E-Commerce and Grocery Sales 21 Bibliography 70 Operator Landscape 25 Contacts 77 European Grocery Operators 27 Operating Concepts 34 Current Developments and Outlook 38 Contents 02 At a Glance 03 At a Glance 01 The European grocery market is the largest retail sector in Europe, estimated 04 Consumers have historically shown reluctance in purchasing groceries online at €2.0 trillion in sales in 2020. While it benefits greatly from the daily needs of due to delivery costs, scheduling considerations, and the perishable nature of growing populations, allowing it to outperform various retail categories, the fresh produce. With many consumers being reluctant or unable to visit food overall revenue growth is still closely linked to consumers’ purchasing power. stores during the major pandemic-driven lockdowns across Europe, demand for In times of economic growth, stronger disposable incomes offer retailers home delivery rose rapidly, notably during periods of lockdown. Though online opportunities to introduce new higher-margin products and services, leading grocery e-commerce is expected to contract post pandemic, a proportion of the to higher growth rates. During periods of uncertainty, consumers generally COVID-19 shift in grocery spending towards online may remain permanent as focus on affordability, which slows overall revenue growth, but rarely leads to the online channel welcomes new customers.