Corporate Governance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

State Bank of India

State Bank of India State Bank of India Type Public Traded as NSE: SBIN BSE: 500112 LSE: SBID BSE SENSEX Constituent Industry Banking, financial services Founded 1 July 1955 Headquarters Mumbai, Maharashtra, India Area served Worldwide Key people Pratip Chaudhuri (Chairman) Products Credit cards, consumer banking, corporate banking,finance and insurance,investment banking, mortgage loans, private banking, wealth management Revenue US$ 36.950 billion (2011) Profit US$ 3.202 billion (2011) Total assets US$ 359.237 billion (2011 Total equity US$ 20.854 billion (2011) Owner(s) Government of India Employees 292,215 (2012)[1] Website www.sbi.co.in State Bank of India (SBI) is a multinational banking and financial services company based in India. It is a government-owned corporation with its headquarters in Mumbai, Maharashtra. As of December 2012, it had assets of US$501 billion and 15,003 branches, including 157 foreign offices, making it the largest banking and financial services company in India by assets.[2] The bank traces its ancestry to British India, through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta, making it the oldest commercial bank in the Indian Subcontinent. Bank of Madras merged into the other two presidency banks—Bank of Calcutta and Bank of Bombay—to form the Imperial Bank of India, which in turn became the State Bank of India. Government of Indianationalised the Imperial Bank of India in 1955, with Reserve Bank of India taking a 60% stake, and renamed it the State Bank of India. In 2008, the government took over the stake held by the Reserve Bank of India. -

Sup Voice Sep-Oct 2013.Pmd

SEP.-OCT. 2013 SUP-VOICE FEDERATION NEWS CHECK-OFF: CONTEMPT CASE BY AISBOF JUSTICE AT LAST…… 10th September, 2013; as we stood in the Court with further plans to attack, demoralize, putdown and Hall No.11 of the Madras High Court, we had mixed humiliate people. “Ask them to express remorse!” “I feelings. Mr.Pratip Choudhuri, the former Chairman will dismiss all of them”, “I will meet you all in was to make a personal appearance in the contempt Supreme court” were some of the utterances, all proceedings in the Check – Off case filed by the filled with venom. The series of violations in Transfer Federation. And he appeared in person in the Policies and attacks on officers which have presence of the Hon’ble Justice. inconvenienced many need not be repeated. Lady Officers, who are 59 years, who were sick, who had 2. However much we all tried to forget, still, images problems were also mercilessly transferred of the past came flashing by. On the 4th of October, thousands of kilometers away. The word 2012 when the Federation leaders met him amidst compassion and mercy had lost its significance. a huge gathering of MD’s, DMD’s and CGM’s of all Indiscriminate transfers violating all agreed bilateral the circles, a pre-arranged audience to demonstrate policies took place. It was only fear and fear and his arrogance and dictatorship, he shouted and said fear all the way. “apologise and publish it in your website, make it public”. The intention was to embarrass and to insult. 3. Such a person, arrogance personified, stood Today, standing in the Court hall, when an in front of the Hon’ble Justice apologetically. -

Votes Cast Data for F.Y. 2019-20

Disclosure of Vote Cast by Tata Mutual Fund during the Financial Year 2019-2020 Proposal by Investee company’s Vote (For/ Type of meetings Quarter Meeting Date Company Name Management or Proposal's description Management Against/ Reason supporting the vote decision (AGM/EGM) Shareholder Recommendation Abstain) April-June 02-Apr-19 Piramal Enterprise Ltd Court Convened Management Resolution approving Scheme of Amalgamation pursuant to For For This is normal course of business and has no Meeting Sections 230 to 232 of the Companies Act, 2013 and other material impact for minority shareholders applicable provisions and Rules made thereof, if any, between Piramal Phytocare Limited (˜Transferor Company") and Piramal Enterprises Limited ("Transferee Company") and their respective Shareholders April-June 11-Apr-19 GlaxoSmithKline Consumer Postal Ballot Management Revision in the terms of payment of remuneration to Mr. Navneet For For This is normal course of business and has no Healthcare Limited Saluja, Managing Director (DIN: 02183350) material impact for minority share holders April-June 11-Apr-19 GlaxoSmithKline Consumer Postal Ballot Management Revision in the terms of payment of remuneration to Mr. Anup For For This is normal course of business and has no Healthcare Limited Dhingra, Director - Operations (DIN: 07602670) material impact for minority share holders April-June 11-Apr-19 GlaxoSmithKline Consumer Postal Ballot Management Revision in the terms of payment of remuneration to Mr. Vivek For For This is normal course of business and -

2012 Annual Report 2011

AnnualAnnual ReportReport 20112011 -- 20122012 STATE BANK OF TRAVANCORE JOURNEY THROUGH THE DECADES... (Rs. in crore) December December December March March March 1962 1972 1982 1992 2002 2012 1. Paid up Capital & Reserves 1.36 1.58 3.34 40.37 610.14 3866.16 2. Deposits 19 76 609 2736 13460 71470 3. Advances 7 54 357 1496 7436 55346 4. Gross Investment 7 21 192 969 6388 22473 5. Priority Sector Lendings ....... 13 130 616 2260 20287 6. Export Finance ....... 4 12 80 396 1506 7. Net Profit 0.09 0.08 0.28 5.09 120.93 510.46 8. No. of Branches 94 253 496 614 674 879 9. Number of Employees 1570 3866 8884 12258 12137 12597 CONTENTS Page Notice to Shareholders 2 Board of Directors 3 Management Committee 3 Report of the Board of Directors 4 Balance Sheet 29 Profit and Loss Account 30 Schedules to Accounts 31 Auditors Report 66 Report on Corporate Governance and Auditors Certificate 68 Disclosures under Pillar III of Basel II 81 Attendance slip & Proxy form 95 State Bank of Travancore Annual Report 2011-2012 -1- STATE BANK OF TRAVANCORE (Associate of the State Bank of India) HEAD OFFICE: THIRUVANANTHAPURAM NOTICE The Fifty Second Annual General Meeting of the Shareholders of the State Bank of Travancore will be held in the A.K.G. Memorial Hall, Gas House Junction, Palayam, Thiruvananthapuram- 695 034, on Saturday, the 26th May, 2012 at 3.30 P.M (Standard Time) to transact the following business: To discuss and adopt the Balance Sheet and Profit and Loss Account of the Bank made upto the 31st March 2012, the report of the Board of Directors and the Auditors Report on the Balance Sheet and Accounts. -

List of the Chairman/Managing Directors of Banks LIST of the CHAIRMAN and MANAGING DIRECTOR of the BANKS

List of the Chairman/Managing Directors of Banks LIST OF THE CHAIRMAN AND MANAGING DIRECTOR OF THE BANKS S. Name Designati Name of the bank Telephone No. Fax No. N on o. with Address Chairman Allahabad Bank 033-22420899 033-22104048 and 2, Nethaji Subhas Road, 1 Smt. S.A. Panse 033-22420878 033-22107424 Managing Kolkata 033-22420911 033-22488323 Director West Bengal -700001 Andhra Bank Chairman Ground Floor, 040-23240380 and Woodland Noke 2 Sh. B A Prabhakar 040-23240480 040-23242057 Managing Bhaudaji Road, 040-23230883 040-23230883 Director Matunga East, 040-23230001 Mumbai, MH Axis Bank 'Trishul', 3rd Floor,' Chairman / Opp. Samartheshwar 022-24252525 3 Sh. Sanjiv Misra Chair 079-26409321 Temple, Law Garden, 079-26409322 Person Ahmedabad Gujarat -380006 Bank of Baroda Chairman & Suraj Plaza-1, 0265-2362395 4 Sh. Ranjan Dhaawan Managing Sayaji Ganj, (0265) 236 1852 0265-2361824 Director Baroda-390005 0265-2361806 Bank of India Star House C - 5, "G" Block, 022 - 66684444 5 Sh. V R Iyer Chairman Bandra Kurla Complex, 022-66684422 022–40919191 Bandra (East), Mumbai 400 051 Bank of Maharashtra Chairman & Central Office, 6 Sh. Narendra Singh Managing 1501 Lok Mangal, 020-25532731 020-25533246 Director Shivaji Nagar, Pune-411005 Canara Bank Chairman Head Office and 080-22221581 7 Sh. R K Dubey 112, J C Road 080-22222704 Managing 080-22221582 Bangalore - 560 002 Director Chairman Central Bank of India and Chander Mukhi, 8 Sh. M.V Tanksale 022 – 6638 7777 022-22028122 Managing Nariman Point Director Mumbai – 400 021 Corporation Bank Corporate Office Chairman & Mangaladevi Temple Road 9 Sh. -

State Bank of India > Annual Report 2012-13 Notice

State Bank of India > Annual Report 2012-13 Notice STATE BANK OF INDIA (Constituted under the State Bank of India Act, 1955) The 58th Annual General Meeting of shareholders of State Bank of India will be held at the “Y. B. Chavan Auditorium”, Y. B. Chavan Centre, General Jagannath Bhosale Marg, Nariman Point, Mumbai-400021 (Maharashtra) on Friday, the 21st June 2013 at 03.00 P.M. for transacting the following business:- ‘‘to receive, discuss and adopt the Balance Sheet and the Profit and Loss Account of the State Bank made up to the 31st day of March 2013, the report of the Central Board on the working and activities of the State Bank for the period covered by the Accounts and the Auditor’s Report on the Balance Sheet and Accounts’’. Corporate Centre, State Bank Bhavan, (PRATIP CHAUDHURI) Madame Cama Road, CHAIRMAN Mumbai - 400 021 Date: 30th April, 2013 IMPORTANT INFORMATION Dividend Declared: `41.50 per share Dividend Payment Date: 17.06.2013 Period of Book Closure: 30.05.2013 TO 03.06.2013 RECORD DatE : 29.05.2013 PB 1 State Bank of India > Annual Report 2012-13 SBI GROUP STRUCTURE AS ON 31.03.2013 SBI FAMILY TREE SBI Domestic Banking Subsidiaries Non Banking Subsidiaries 75.07 State Bank of Bikaner & Jaipur 100 SBI Capital Markets Ltd. SBICAP Securities Ltd. 100 State Bank of Hyderabad SBICAP Ventures Ltd. 92.33 State Bank of Mysore SBICAP (UK) Ltd. SBICAP Trustees Co. Ltd. 100 State Bank of Patiala Ownership figures in % Ownership figures in % BICAP (Singapore Ltd.) 75.01 State Bank of Travancore 63.78 SBI DFHI Ltd. -

Annual Report 2019 - 2020

Annual Report 2019 - 2020 Baroda Fixed Maturity Plan - Series P Baroda Trustee India Private Limited REPORT OF THE BOARD OF DIRECTORS OF BARODA TRUSTEE INDIA PRIVATE LIMITED (FORMERLY KNOWN AS BARODA PIONEER TRUSTEE COMPANY PRIVATE LIMITED) TO THE UNIT HOLDERS OF THE SCHEMES OF BARODA MUTUAL FUND (FORMERLY KNOWN AS BARODA PIONEER MUTUAL FUND) FOR THE YEAR ENDED MARCH 31, 2020. The Board of Directors of Baroda Trustee India Private Limited (“Trustee Company” or “Trustee”), trustee to Baroda Mutual Fund (“Mutual Fund”), has pleasure in presenting the Twenty Sixth Annual Report and the audited accounts of the schemes of the Mutual Fund for the year ended March 31, 2020. BRIEF BACKGROUND OF THE SPONSOR, TRUST / MUTUAL FUND, TRUSTEE COMPANY AND AMC SPONSOR The Mutual Fund was set up as a trust under the name of BOB Mutual Fund by Bank of Baroda (“BOB”), who was the sole sponsor of the Mutual Fund, and the settlor of the Mutual Fund trust. BOB entrusted a sum of Rs. 10,00,000/- to the Board of Trustees of the Mutual Fund as the initial contribution towards the corpus of the Mutual Fund. Consequent to its acquisition of 51% in BOB Asset Management Company Limited (known then by this name) (“AMC”), Pioneer Global Asset Management S.p.A. (“PGAM”) became a co-sponsor of the Mutual Fund in 2008 and the name of the AMC was changed to Baroda Pioneer Asset Management Company Limited. By virtue of a Share Purchase Agreement executed between BOB, UniCredit S.p.A. (“UniCredit”) (earlier PGAM which got merged into UniCredit effective November 1, 2017), AMC and Trustee on December 28, 2017, BOB decided to acquire the shares held by UniCredit in the AMC and Trustee Company, subject to necessary regulatory approvals. -

Press Release

Press Release Quess Corp Appoints Three New Directors to Enhance Board Diversity ~Company expands Board of Directors~ Bangalore, August 24, 2015 – Quess Corp Limited, India’s leading business services provider, announced the induction of three new members to its Board. With these appointments, the total strength of the Board of Directors increases to eight directors. Among the newly appointed are, Mrs. Revathy Ashok, currently on several Board of Directors including Welspun Corp Limited, Shell MRPL Aviation Fuels And Services Limited and L&T Construction Equipment Limited as an Independent Director; Mr. Pratip Chaudhuri, former Chairman of State Bank of India (SBI) and currently on Board of Directors of several companies including CESC Limited and Sundaram Asset Management Company Limited; and Mr. Pravir Vohra, currently on the Boards of several companies including Thomas Cook (India) Limited and Goldman Sachs Asset Management (India) Private Limited. Mr. M K Sharma, who was part of the board as an Independent Director since July 2013, recently stepped down in June this year, consequent to his nomination as the Chairman of ICICI Bank Limited. Sharing his thoughts on the recent addition to the board, Ajit Isaac - Chairman & Managing Director of Quess Corp, said, “Quess’s search for diversity and multifaceted business wisdom has led us to Revathy Ashok, Pratip Chaudhuri and Pravir Vohra. They bring tremendous expertise in business strategy, financial structuring and operations that will help us, as Quess readies itself for a new phase of growth. Their diverse competencies will add capacity to an outstanding expanded Board and ensure that we continue to build value for our shareholders”. -

Banking E-Bulletin

SEPTEMBER 2019 VOLUME-50 Banking e-Bulletin CONTENTS Top RBI Speeches ............................. 03 Top Banking News .............................07 India’s Foreign Trade ......................103 Merchandise Trade .........................105 Services Trade ............................... 106 Top Banking Development ...............107 Top Expert Reports ..........................110 Top RBI Circulars.............................113 THE ASSOCIatED CHAMBERS OF COMMERCE AND INDUSTRY OF INDIA DEPARTMENT OF BANKING & FINANCIAL SERVICES ASSOCHAM Corporate Office: 5, Sardar Patel Marg, Chanakyapuri, New Delhi-110 021 Tel: 011-46550568 (Hunting Line) • Fax: 011-23017008, 23017009 • Web: www.assocham.org Dr. Rajesh Singh Kushagra Joshi Mob: +91-9871204880 Mob: +91-8447365357 E-mail: [email protected] E-mail: [email protected] TOP RBI SPEECHES Dimensions of India’s External Sector Resilience (Shri Shaktikanta Das, Gov- ernor, Reserve Bank of India - Thursday, September 19, 2019 - Delivered at the Bloomberg India Economic Forum 2019 in Mumbai) he international environment is clouded (Source: FDI Report, Financial Times, 2018). Net Twith very challenging conditions. Global foreign direct investment at US$ 18.3 billion in growth is slowing down and central banks April-July 2019 was higher than US$ 11.4 billion across the world are bracing up to counter in the corresponding period of 2018-19. it by easing monetary policy; but there is no Significant progress has been made in recession as yet. Trade wars have pushed external debt management since the external world trade into contraction and threaten to payment difficulties encountered in 1990 which morph into tech and currency wars, with no triggered wide-ranging structural adjustments evidence of any significant gains accruing to and reforms. The level of external debt at 19.7 anyone. -

List of the Chairman/Managing Directors of Banks LIST of the CHAIRMAN and MANAGING DIRECTOR of the BANKS

List of the Chairman/Managing Directors of Banks LIST OF THE CHAIRMAN AND MANAGING DIRECTOR OF THE BANKS S. Name Designati Name of the bank Telephone No. Fax No. N on o. with Address Chairman Allahabad Bank 033-22420899 033-22104048 and 2, Nethaji Subhas Road, 1 Smt. S.A. Panse 033-22420878 033-22107424 Managin g Kolkata 033-22420911 033-22488323 Director West Bengal -700001 Andhra Bank Chairman Gr ound Floor, 040-23240380 and Woodland Noke 2 Sh. B A Prabhakar 040-23240480 040-23242057 Managin g Bhaudaji Road, 040-23230883 040-23230883 Director Matunga East, 040-23230001 Mumbai, MH Axis Bank 'Trishul', 3rd Floor,' Chairman / Opp. Samartheshwar 022-24252525 3 Chair 079-26409321 Sh. Sanjiv Misra Temple, Law Garden, 079-26409322 Person Ahmedabad Guja rat -380006 Bank of Baroda Chairman & Suraj Plaza-1, 0265-2362395 4 Sh. Ranjan Dhaawan Managin g Sayaji Ganj, (0265) 236 1852 0265-2361824 Director Baroda-390005 0265-2361806 Bank of India Star House C - 5, "G" Block, 022 - 66684444 5 Sh. V R Iyer Chairman Bandra Kurla Complex, 022-66684422 022–40919191 Bandra (East), Mumbai 400 051 Bank of Maharashtra Chairman & Central Office, 6 Sh. Narendra Singh Managin g 1501 Lok Mangal, 020-25532731 020-25533246 Director Shivaji Nagar, Pune-411005 Canara Bank Chairman Head Office and 080-22221581 7 Sh. R K Dubey 112, J C Road 080-22222704 Managin g 080-22221582 Bangalore - 560 002 Director Chairman Central Bank of India and Chander Mukhi, 8 Sh. M.V Tanksale 022 – 6638 7777 022-22028122 Managin g Nariman Point Director Mumbai – 400 021 Corporation Bank Corporate Office Chairman & Mangaladevi Temple Road 9 Sh. -

Project Report: Retail Asset Products of SBI

IFBI Project Report: Retail Asset Products of SBI In Partial Fulfillment of PGDB course of IFBI Project Prepared by: XYZ PGDB Batch: Roll No: Table of Contents Sr. Topic Pag No. e No. 1. Overview of SBI 3 2. Symbol and Slogan of SBI 4 3. Branches of SBI 4 4. Associate Banks of SBI 4 5. International Presence 5 6. Management 6 7. Shareholding Pattern and Liquidity 7 8. Key Areas of Operation 7 9. History of SBI 8 10. Competitors of SBI 10 11. Different Products of SBI 11 12. Awards and Recognition 12 13. Project Study - Retail Asset Products 14 of SBI 14 i. Home Loan 16 ii. Car Loan 19 iii. Education Loan 22 iv. SBI Personal Loan 23 v. Loan against Property/Gold 25 Ornaments vi. Loan against Shares/Debentures 14. SWOT Analysis of SBI 26 15. Conclusion 27 16. Bibliography and References 28 2 OVERVIEW of sbi State Bank of India (SBI) is the largest banking and financial services company in India by revenue, assets and market capitalization. It is a state-owned corporation with its headquarters in Mumbai, Maharashtra. As of March 2011, it had assets of US$370 billion with over 13,000 outlets including 150 overseas branches and agents globally. The bank traces its ancestry to British India, through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta, making it the oldest commercial bank in the Indian Subcontinent. Bank of Madras merged into the other two presidency banks—Bank of Calcutta and Bank of Bombay—to form the Imperial Bank of India, which in turn became the State Bank of India. -

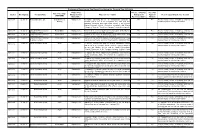

Sno Party Credit Grantor State Credit Grantor

OUTSTANDING SNO PARTY CREDIT GRANTOR STATE CREDIT GRANTOR BRANCH REGISTERED ADDRESS ASSET CLASSIFICATION DATE OF CLASSIFICATION OTHER BANK DIRECTOR 1 DIN FOR DIRECTOR 1 DIRECTOR 2 DIN FOR DIRECTOR 2 DIRECTOR 3 DIN FOR DIRECTOR 3 DIRECTOR 4 DIN FOR DIRECTOR 4 DIRECTOR 5 DIN FOR DIRECTOR 5 DIRECTOR 6 DIN FOR DIRECTOR 6 DIRECTOR 7 DIN FOR DIRECTOR 7 DIRECTOR 8 DIN FOR DIRECTOR 8 DIRECTOR 9 DIN FOR DIRECTOR 9 DIRECTOR 10 DIN FOR DIRECTOR 10 DIRECTOR 11 DIN FOR DIRECTOR 11 DIRECTOR 12 DIN FOR DIRECTOR 12 DIRECTOR 13 DIN FOR DIRECTOR 13 DIRECTOR 14 DIN FOR DIRECTOR 14 AMOUNT IN LACS ANJU JAIN W/O 1 A & J IMPEX ALLAHABAD BANK PUNJAB CHANDIGARH ARMB E-124, Phase-IV, Focal Point, Ludhiana 1394 LOSS 11-Sep-12 JANINDER JAIN 2 A D INDUSTRIES ALLAHABAD BANK MADHYA PRADESH BHAWARKUAN ROAD Plot I-1, Sector-4, Kheda, Pithampur, Dhar 222 LOSS 26-Feb-12 Vikas Gupta 51. D. P. NAGAR, ( 1 NO KALI CHARAN GHOSH ROAD 3 A S AGENCY ALLAHABAD BANK WEST BENGAL KOLKATA RECOVERY BRANCH 103.20108 LOSS 23-Apr-11 Arunashish Sarkar ,PO SINTHI , KOLKATA-700051 A2Z WASTE MANAGEMENT MEERUT Regd. Off : 0-116, 1st floor, DLF Shopping Mall, DLF STANDARD CHARTARD 4 ALLAHABAD BANK NEW DELHI GREEN PARK EXT. BR. 3345 DF-1 31-Dec-14 AMIT MITTAL 00058944 SMT.DIPALI MITTAL 00872628 SURENDER KR.TUTEJA 00594076 MANOJ GUPTA LIMITED City, Phase 1, Arjun Marg, Gurgaon, Haryana 122022 BANK AANJANEYA HOUSE,PLOT.NO,34,POSTAL COLONY, Mr. Shashikant Dr. Ullooppee S. 5 AANJANEYA LIFECARE LIMITE ALLAHABAD BANK MAHARASTRA INDUSTRIAL FINANCE BR - MUMBAI 1057.310186 DF2 30-Sep-13 K.K.Vishwanath Dr.