State Bank of India > Annual Report 2012-13 Notice

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Comparative Analysis of Financial Performance of Nepal SBI Bank Limited, Himalayan Bank Limited and Kumari Bank Limited

A Comparative Analysis of Financial Performance of Nepal SBI Bank Limited, Himalayan Bank Limited and Kumari Bank Limited By: Sushma Rai Post Graduate Campus Faculty of Management T.U. Registration No.: 7-2-218-286-2002 A Thesis Submitted To: Office of the Dean Faculty of Management Tribhuvan University In partial fulfillment of the requirements of the degree of Masters of Business Studies (M.B.S.) Biratnagar, Nepal August, 2009 TRIBHUVAN UNIVERSITY Faculty of Management POST GRADUATE CAMPUS Biratnagar, Nepal Tel No. 021-526327 Ref. No.: RECOMMENDATION This is to certify that the thesis: Submitted by Sushma Rai Entitled A Comparative Analysis of Financial performance of Nepal SBI Bank Limited, Himalayan Bank Limited And Kumari Bank Limited has been prepared as approved by this Department in the prescribed format of Faculty of Management. This thesis is forwarded for examination. Supervisor Head of Department (Prof. Dr. Khagendra Acharya) (Prof. Dr. Madhav Bahadur Shrestha) ............................................. ..................................................... Campus Chief (Mr. Harihar Bhandari) Date: ............................. ......................................... TRIBHUVAN UNIVERSITY Faculty of Management POST GRADUATE CAMPUS Biratnagar, Nepal Tel No. 021-526327 Ref. No.: VIVA-VOCE SHEET We have conducted the Viva-Voce examination of the thesis presented by Sushma Rai entitled A Comparative Analysis of Financial Performance of Nepal SBI Bank Limited, Himalayan Bank Limited and Kumari Bank Limited and found the thesis to be the original work of the student and written according to the prescribed format. We recommend the thesis to be accepted as partial fulfillment the requirement for Master's Degree in Business Studies (M.B.S.) Viva-Voce Committee Chairperson, Research Committee: ......................................... Member (Thesis Supervisor): ........................................ -

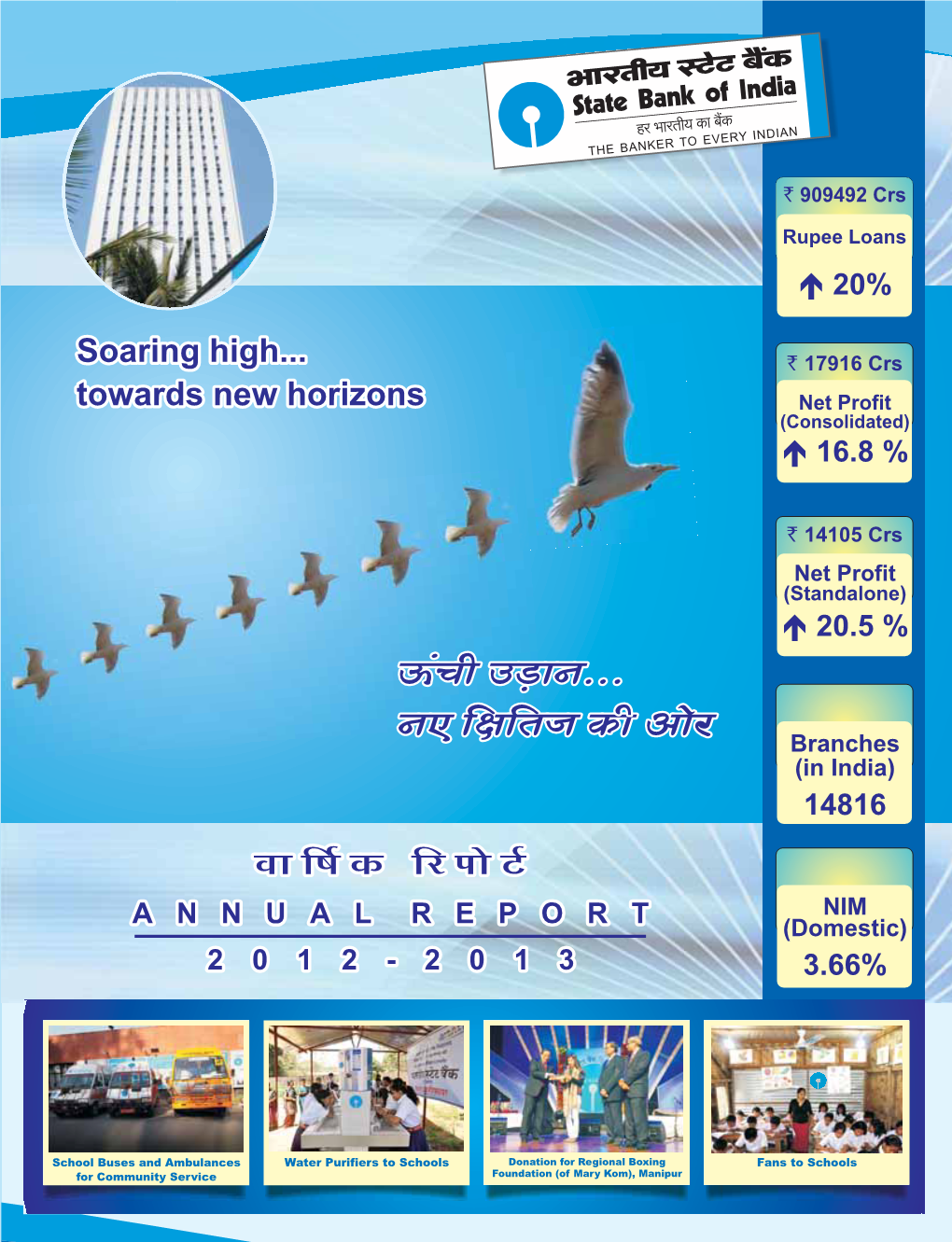

State Bank of India

State Bank of India State Bank of India Type Public Traded as NSE: SBIN BSE: 500112 LSE: SBID BSE SENSEX Constituent Industry Banking, financial services Founded 1 July 1955 Headquarters Mumbai, Maharashtra, India Area served Worldwide Key people Pratip Chaudhuri (Chairman) Products Credit cards, consumer banking, corporate banking,finance and insurance,investment banking, mortgage loans, private banking, wealth management Revenue US$ 36.950 billion (2011) Profit US$ 3.202 billion (2011) Total assets US$ 359.237 billion (2011 Total equity US$ 20.854 billion (2011) Owner(s) Government of India Employees 292,215 (2012)[1] Website www.sbi.co.in State Bank of India (SBI) is a multinational banking and financial services company based in India. It is a government-owned corporation with its headquarters in Mumbai, Maharashtra. As of December 2012, it had assets of US$501 billion and 15,003 branches, including 157 foreign offices, making it the largest banking and financial services company in India by assets.[2] The bank traces its ancestry to British India, through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta, making it the oldest commercial bank in the Indian Subcontinent. Bank of Madras merged into the other two presidency banks—Bank of Calcutta and Bank of Bombay—to form the Imperial Bank of India, which in turn became the State Bank of India. Government of Indianationalised the Imperial Bank of India in 1955, with Reserve Bank of India taking a 60% stake, and renamed it the State Bank of India. In 2008, the government took over the stake held by the Reserve Bank of India. -

Sup Voice Sep-Oct 2013.Pmd

SEP.-OCT. 2013 SUP-VOICE FEDERATION NEWS CHECK-OFF: CONTEMPT CASE BY AISBOF JUSTICE AT LAST…… 10th September, 2013; as we stood in the Court with further plans to attack, demoralize, putdown and Hall No.11 of the Madras High Court, we had mixed humiliate people. “Ask them to express remorse!” “I feelings. Mr.Pratip Choudhuri, the former Chairman will dismiss all of them”, “I will meet you all in was to make a personal appearance in the contempt Supreme court” were some of the utterances, all proceedings in the Check – Off case filed by the filled with venom. The series of violations in Transfer Federation. And he appeared in person in the Policies and attacks on officers which have presence of the Hon’ble Justice. inconvenienced many need not be repeated. Lady Officers, who are 59 years, who were sick, who had 2. However much we all tried to forget, still, images problems were also mercilessly transferred of the past came flashing by. On the 4th of October, thousands of kilometers away. The word 2012 when the Federation leaders met him amidst compassion and mercy had lost its significance. a huge gathering of MD’s, DMD’s and CGM’s of all Indiscriminate transfers violating all agreed bilateral the circles, a pre-arranged audience to demonstrate policies took place. It was only fear and fear and his arrogance and dictatorship, he shouted and said fear all the way. “apologise and publish it in your website, make it public”. The intention was to embarrass and to insult. 3. Such a person, arrogance personified, stood Today, standing in the Court hall, when an in front of the Hon’ble Justice apologetically. -

Resolution Plan Section 1: Public Section December 31, 2015

STATE BANK OF INDIA Resolution Plan Section 1: Public Section December 31, 2015 TABLE OF CONTENTS Section 1: Public Section Introduction Overview of the Bank I. Summary of the Resolution Plan A. Overview of the U.S. Resolution Plan B. Names of Material Entities C. Description of Core Business Lines D. Summary of Financial Information Regarding Assets, Liabilities, Capital and Major Funding Sources E. Description of Derivative and Hedging Activities F. Memberships in Material Payment, Clearing, and Settlement systems G. Description of Non-U.S. Operations H. Material Supervisory Authorities I. Principal Officers J. Resolution Planning Corporate Governance Structure and Processes K. Material Management Information Systems L. High-Level Description of Resolution Strategy Section 1: Public Section Introduction State Bank of India (the “Bank”) is a foreign banking organization duly organized and existing under the laws of India. In the United States, the Bank maintains (a) a New York state-licensed, insured branch (the “New York Branch”), (b) an Illinois state- licensed, insured branch (the “Chicago Branch,” and together with the New York Branch, the “Branches”), (c) a California state-licensed agency (the “Los Angeles Agency”), (d) a representative office in Washington, D.C. licensed by the Federal Reserve (the “Washington D.C. Representative Office”), and (e) a wholly-owned bank subsidiary that is chartered in California, State Bank of India (California) Ltd. (“SBIC”). The Bank has developed a U.S. resolution plan (“U.S. Resolution Plan”) -

Introduction Banking in India

Introduction Banking in India Banking in India originated in the last decades of the 18th century. The first banks were The General Bank of India which started in 1786, and the Bank of Hindustan, both of which are now defunct. The oldest bank in existence in India is the State Bank of India, which originated in the Bank of Calcutta in June 1806, which almost immediately became the Bank of Bengal. This was one of the three presidency banks, the other two being the Bank of Bombay and the Bank of Madras, all three of which were established under charters from the British East India Company. For many years the Presidency banks acted as quasi-central banks, as did their successors. The three banks merged in 1921 to form the Imperial Bank of India, which, upon India’s Independence became the State Bank of India. Origin of Banking in India Indian merchants in Calcutta established the Union Bank in 1839, but it failed in 1848 as a consequence of the economic crisis of 1848-49. The Allahabad Bank, established in 1865 and still functioning today, is the oldest Joint Stock bank in India. (Joint Stock Bank: A company that issues stock and requires shareholders to be held liable for the company’s debt) It was not the first though. That honor belongs to the Bank of Upper India, which was established in 1863, and which survived until 1913, when it failed, with some of its assets and liabilities being transferred to the Alliance Bank of Simla. When the American Civil War stopped the supply of cotton to Lancashire from the Confederate States, promoters opened banks to finance trading in Indian cotton. -

Votes Cast Data for F.Y. 2019-20

Disclosure of Vote Cast by Tata Mutual Fund during the Financial Year 2019-2020 Proposal by Investee company’s Vote (For/ Type of meetings Quarter Meeting Date Company Name Management or Proposal's description Management Against/ Reason supporting the vote decision (AGM/EGM) Shareholder Recommendation Abstain) April-June 02-Apr-19 Piramal Enterprise Ltd Court Convened Management Resolution approving Scheme of Amalgamation pursuant to For For This is normal course of business and has no Meeting Sections 230 to 232 of the Companies Act, 2013 and other material impact for minority shareholders applicable provisions and Rules made thereof, if any, between Piramal Phytocare Limited (˜Transferor Company") and Piramal Enterprises Limited ("Transferee Company") and their respective Shareholders April-June 11-Apr-19 GlaxoSmithKline Consumer Postal Ballot Management Revision in the terms of payment of remuneration to Mr. Navneet For For This is normal course of business and has no Healthcare Limited Saluja, Managing Director (DIN: 02183350) material impact for minority share holders April-June 11-Apr-19 GlaxoSmithKline Consumer Postal Ballot Management Revision in the terms of payment of remuneration to Mr. Anup For For This is normal course of business and has no Healthcare Limited Dhingra, Director - Operations (DIN: 07602670) material impact for minority share holders April-June 11-Apr-19 GlaxoSmithKline Consumer Postal Ballot Management Revision in the terms of payment of remuneration to Mr. Vivek For For This is normal course of business and -

(Subsidiary Banks) Act, 1959

THE STATE BANK OF INDIA (SUBSIDIARY BANKS) ACT, 1959 THE SUBSIDIARY BANKS GENERAL REGULATIONS, 1959 & THE STATE BANK OF HYDERABAD ACT, 1956 STATE BANK OF INDIA LAW DEPARTMENT CORPORATE CENTRE MUMBAI [As amended up to 27th June 2014] 1 © SBI, Law Department, Corporate Centre, Mumbai. (2014) [email protected] 2 THE STATE BANK OF INDIA (SUBSIDIARY BANKS) ACT, 1959 ………………………. 9 THE SUBSIDIARY BANKS GENERAL REGULATIONS, 1959 ……………..……………… 61 THE STATE BANK OF HYDERABAD ACT, 1956 ……………………………………..………. 83 Contents The State Bank of India (Subsidiary Banks) Act, 1959 .......................................................... 10 CHAPTER I ................................................................................................................................................. 10 PRELIMINARY ............................................................................................................................................... 10 1 Short title ..................................................................................................................................................... 10 2 Definitions ................................................................................................................................................... 10 CHAPTER II ................................................................................................................................................ 12 [CONSTITUTION OF NEW BANKS AND CHANGES OF NAME OF ANY SUBSIDIARY BANK] ............................................................................................................................................................................ -

1 Sri. V.R. Kallannavar Director KITSERD, State Bank of India

National Academy of RUDSETI Chitrapur Bhavan, 2nd Floor, 15th Cross, 8th Main, Malleswaram, Bangalore-55 List of Participants of the TTP from 20-06-2011 to 30-06-2011 - Conducted at Hotel CITADEL, Bangalore - B.No. 15 Sl. No. Name & Address of the participant Qualification Designation Sri. V.R. Kallannavar Director 1 B.A Director KITSERD, State Bank of India, Dariyapur & Kotnur Guda Layout, Gulbarga Sri. Ram Gopal Swarnakar 2 Director M.Com Director State Bank of India RSETI, Harda, M.P. Sri. Ganesh Prasad Pandey 3 Director M.Sc Director SBI RSETI, ADB Building Garhwa, Jharkhand Sri. Dinabandhu Roy Director 4 SBI RSETI, Lead Bank Office, Bank Colony B.A Director Pakur - 816107 Jharkhand Sri. K.N. Gupta Director 5 B.Sc, LLB Director SBI RSETI, Nowgong Chhatarpur - 471 201 M.P. Sri. Ramesh Kumar Sinha 6 Director B.Sc, LLB, CAIIB Director SBI RSETI, Sahibganj - 816 109, Jharkhand Sri. Subhasis Roy Director 7 B.Com, CAIIB Director SBI RSETI C/o SBI Latehar Branch Premises, Latehar - 829206, Jharkhand Sri. Prakash Vyankatesh Joshi SBI RSETI, Goa 8 B.Sc, CAIIB Director State Bank Building, 1st Floor, Near Municipal Garden, Margao, South Goa - 403601 Sri. S.P. Gupta Director 9 Baroda Swarojgar Vikas Sansthan M,A (Eco), CAIIB Director Near Rama Bal Girls P.G. College, Bakshari Road - Akbar Pur, Dist. Ambedkar Nagar - 224122, U.P. Sri. Alakh Prasad Srivastava Director 10 B.Sc (ag & Ah), CAIIB Director Baroda Swarojgar Vikas Sansthan 2017, Awas Vikas-3 Kalyanpur Panki Road Kanpur -208012, U.P. Sri. Mohammad Iqbal Director 11 JKB RSETI B.Sc Director Reshi Complex Bijbehara, Anantnag, J& K Sri. -

List-Of-Public-Sector-Banks-In-India

1 List of Public Sector Banks in India Anchor Bank Merged Bank Established Headquarter Vijaya Bank Bank of Baroda 1908 Vadodara, Gujarat Dena Bank Bank of India 1906 Mumbai, Maharashtra Bank of Maharashtra 1935 Pune Maharashtra Canara Bank Syndicate Bank 1906 Bengaluru, Karnataka Central Bank of India 1911 Mumbai, Maharashtra Indian Bank Allahabad Bank 1907 Chennai, Tamil Nadu Indian Overseas Bank 1937 Chennai, Tamil Nadu Punjab & Sind Bank 1908 New Delhi, Delhi Oriental Bank of Commerce Punjab National Bank 1894 New Delhi, Delhi United Bank of India State Bank of Bikaner & Jaipur State Bank of Hyderabad State Bank of Indore State Bank of India 1955 Mumbai, Maharashtra State Bank of Mysore State Bank of Patiala State Bank of Travancore Bhartiya Mahila Bank UCO Bank 1943 Kolkata, West Bengal Andhra Bank Union Bank of India 1919 Mumbai, Maharashtra Corporation Bank List of Private Sector Banks in India Bank Name Established Headquarters HDFC Bank 1994 Mumbai, Maharashtra Axis Bank 1993 Mumbai, Maharashtra Bandhan Bank 2015 Kolkata, West Bengal CSB Bank 1920 Thrissur, Kerala City Union Bank 1904 Thanjavur, Tamil Nadu DCB Bank 1930 Mumbai, Maharashtra Dhanlaxmi Bank 1927 Thrissur, Kerala Federal Bank 1931 Aluva, Kerala 2 Bank Name Established Headquarters ICICI Bank 1994 Mumbai, Maharashtra IDBI Bank 1964 Mumbai, Maharashtra IDFC First Bank 2015 Mumbai, Maharashtra IndusInd Bank 1994 Mumbai, Maharashtra Jammu & Kashmir Bank 1938 Srinagar, Jammu and Kashmir Karnataka Bank 1924 Mangaluru, Karnataka Karur Vysya Bank 1916 Karur, Tamil Nadu Kotak -

Government of India Ministry of Commerce & Industry Department

Government of India Ministry of Commerce & Industry Department of Commerce Directorate General of Foreign Trade Udyog Bhawan, New Delhi Dated 09. 07. 2015 Trade Notice No. 07/2015 To 1. All IEC Holders 2. All EPCs / All Chambers of Trade and Industries 3. FIEO/ASSOCHAM/CII 4. All RA’s of DGFT Subject: Operationalisation of online payments through debit / credit cards. In keeping with the Digital India vision of Hon'ble Prime Minister, and taking yet another crucial step towards paperless, online functioning in 24x7 environment, Directorate General of Foreign Trade has launched the facility of online payment of application fees through Credit/Debit cards and electronic fund transfer from 53 Banks (List annexed). 2. As a measure of Trade Facilitation and Ease of Doing Business, DGFT has already operationalised the facility of Online filing of various applications by the exporters/importers under the Foreign Trade Policy (2015-20). Early this year, DGFT also operationalised the facility of online submission of applications for issue of online Importer Exporter Code in digital format or e-IEC for exporters/importers. Now with the online payment facility being available from 53 banks, as well as through Credit and Debit cards, it would be possible to not only apply online for e-IEC and benefits under various schemes under Foreign Trade Policy but also make online payment of required application fee. 3. The charges applicable for using internet banking, debit/credit cards will be as follows: Transaction Visa / Master Card Credit card transaction: Processing 1.45% of payment amount per transaction. Charges Visa / Master Card/Rupay Debit Card transactions: For transactions upto Rs.2000/- : 0.75% of payment amount per transaction. -

TILAK MAHARASHTRA UNIVERSITY, PUNE Dissertation

TILAK MAHARASHTRA UNIVERSITY, PUNE Dissertation submitted for the partial fulfillment of M.Phil (Vidyanishnat) Degree “THE ANALYSIS OF THE PERFORMANCE OF MAJOR BANKS AFTER FINANCIAL SECTOR REFORMS” Researcher Mr Jeevan J Nagarkar M.A.(Eco), PGDFM Guide Dr. Santosh Dastane M.A.(Eco) Ph.D. Director, Neville Wadia Institute of Management Studies and Research NEHRU SAMAJIKSHASTRA VIDYASTHAN TILAK MAHARASHTRA UNIVERSITY Gultekdi, Pune – 411037 July - 2008 CERTIFICATE This is to certify that the work incorporated in the M.Phil (Vidyanishnat) Dissertation titled as, “The Analysis of the Performance of Major Banks After Financial Sector Reforms”, submitted by Mr. Jeevan Jayant Nagarkar has been carried out under my guidance. Such material as has been duly acknowledged is authentic with best of my knowledge, in this dissertation. DECLARATION I declare on oath that the references and literature, which are used in my dissertation, entitled, “The Analysis of the Performance of Major Banks After Financial Sector Reforms”, are from original sources and are acknowledged at the appropriate places in the dissertation. I declare further that I have not used this information for any other purpose, other than my research. Date – July 1, 2008 Place: Pune (NAGARKAR J J) ACKNOWLEDGEMENT I take great privilege to thank my research guide Dr. Santosh Dastane, Director N. Wadia Institute of Management Studies and Research, Pune, for accepting me as his research student of M Phil & for the help and support he extended towards me. I am grateful to him for his valuable guidance throughout my research, right from the collection of the data to its analysis. I also take the opportunity to thank Dr Praveen Jadhav, HOD, Dept of Economics TMV & Prof Jyoti Patil for their continuous support & guidance during the period of my research. -

Banks: Evolution, 1 Types & Functions

BANKS: EVOLUTION, 1 TYPES & FUNCTIONS BANK: DEFINITION The word bank is derived from Latin word ‘bancus’, French word ‘banque’, Italian word ‘banca’, meaning "table"; German word ‘banc’, meaning bench or counter. Benches were used as makeshift desks or exchange counters during the Renaissance by Jewish bankers, who used to make their transactions atop desks covered by green tablecloths. The Indian Banking Regulations Act, 1949 defines the term Banking as the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and withdrawal by cheque, draft, order or otherwise. According to the Indian Banking Regulations Act, 1949 a Banking Company means any company which transacts the business of banking. Thus, a company which is engaged in the manufacture of goods or carries on any trade and which accepts deposits of money from the public merely for the purpose of financing its business as such manufacturer or trader shall not be deemed to transact the business of banking. The activities specified in the Act as banking activities are lending, borrowing, accepting and discounting of bills, dealing in foreign currency, deposit lockers, transfer of money etc. The Act prohibits a bank from buying and selling goods and also from holding immovable property. EVOLUTION OF BANKING There was no such word as ‘banking’ before 1640, although the practice of safe-keeping and savings flourished in the temple of Babylon as early as 2000 B.C. The first bank called the ‘Bank of Venice’ was established in Venice, Italy in 1157 to finance the monarch in his wars.