AEC Group – Barossa Product Gap Audit

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 BAROSSA WINE SHOW RESULTS CA TALOGUE Ne

#BarossaWS19 | #barossa |#barossawine |#barossa #BarossaWS19 SHARE THE GOODNEWS: 2019 BAROSSA WINE SHOW RESULTS CATALOGUE 42nd43rd BarossaBarossa WineWine ShowShow Major Sponsors 20192018 Barossa Wine Show Results Catalogue printed by: Judges & Committee Judges Committee Chairman of Judges Wine of Provenance Committee Chair Nick Ryan Judges Andrew Quin, Hentley Farm Andrew Wigan Panel Chair Judges Phil Reedman Committee PJ Charteris Louisa Rose Alex MacClelland, Bethany Wines Sue Bell Amanda Longworth, Adam Wadewitz Wine of Provenance Barossa Grape & Wine Association Associate Judge Bernadette Kaeding, Rojomoma Judges Katie Spain John Hughes, Rieslingfreak Mark Pygott, MW Peter Kelly, Thorn-Clarke Wines Tash Mooney Richard Langford, Two Hands Wines Phil Lehmann Brock Harrison, Elderton Wines Tim Pelquest-Hunt Will John, Yalumba Adrian Sparks Marie Clay, Treasury Wine Estates Kelly Wellington Helen McCarthy, Mountadam Vineyards Dave Bursey, Henschke Wines Associate Judges Mark Bulman Kate Hongell Ben Thoman Angus Seabrook Clare Dry Simon Mussared Greg Clack Caitlin Brown Brooke Blair Premium Section CLASSES 1 to 20 For wines vintaged from grapes grown in the Barossa Valley (Minimum 85%) Fortified Section CLASSES 21 to 24 For fortified wines vintaged from grapes grown in the Barossa Valley (Minimum 85%). Wines not necessarily commercially available. BAROSSA WINE SHOW 2019 1 RESULTS CATALOGUE Trophies 2019 Winners THE PERNOD RICARD WINEMAKERS - L HUGO GRAMP MEMORIAL TROPHY Best 2019 Riesling, Class 1 Class 1 – Entry 23 – 2019 Dandelion Vineyards -

2021 Barossa Wine Auction Catalogue Here

In April 2021, Barossa Grape & Wine Association together with Langton’s Fine Wines, present Australia’s most prestigious regional wine auction. An integral part of the Partnering with Langton’s Barossa Vintage Festival Fine Wine Auction House, since 1965, the Barossa the Barossa Wine Auction Wine Auction has now brings you an exclusive grown to become opportunity to access Australia’s premier rare and covetable wines. regional wine auction. Provenance is assured, with wines sourced directly from the winery and winemaker’s own collections. Barossa Wine Auction 2020 2 Barossa Live Auction Page 5-11 (auction lots beginning ‘B’) Friday 16 April 2021 Tickets $50pp includes Eden 9.30 am – 12.30pm Valley Riesling and Oysters on arrival and light refreshments Chateau Tanunda throughout. Basedow Road _ Tanunda, SA www.barossavintagefestival.com.au Sydney Live Auction Page 13-19 (auction lots beginning ‘S’) Dinner Thursday 29 April 2021 Hyatt Regency Sydney, NSW Tickets to be released in early 2021 Online Auction Page 21-31 (auction lots beginning ‘W’) Opens Friday 9 April 2021 Closes Sunday 2 May 2021 At langtons.com.au Barossa Wine Auction 2020 3 Barossa Live Auction o LOT N- Winery Barossa Bottle Set of 9 Vintage MV Price Guide $7000.00 - 8000.00 B01 Quantity 1 An extremely rare, highly collectable set of ultra fine Barossa wines, each one awarded a perfect 100 points, includes: 1 x 375ml BOTTLE of Seppeltsfield 1921 100 Year Old Para Vintage Tawny (Halliday) 1 x BOTTLE of Torbreck 2016 RunRig Shiraz Viognier (Joe Czerwinski) 1 x BOTTLE of Torbreck 2012 The Laird Shiraz (Robert Parker) 1 x BOTTLE of Penfolds 2013 Bin 95 Grange (Wine Spectator) 1 x BOTTLE of Chris Ringland 2002 Shiraz (Robert Parker) 1 x BOTTLE of Greenock Creek 1998 Roennfeldt Road Cabernet (Robert Parker) 1 x BOTTLE of Greenock Creek 1998 Roennfeldt Road Shiraz (Robert Parker) 1 x BOTTLE of Henschke 2015 Hill of Grace Shiraz (Wine Spectator/ Andred Caillard MW) 1 x BOTTLE of Standish Wine Co. -

Final Determination Signed 2018 20575 01 Redacted

RELEASED UNDER FOI ACT RELEASED UNDER FOI ACT RELEASED UNDER FOI ACT RELEASED UNDER FOI ACT RELEASED UNDER FOI ACT Road and Marine Assets - Periodic and Critical Road Maintenance Program File 2018/20575/01 - Document 001 (NOTE: Contact either Senior or Asset Engineer from Road and Marine Assets to Update/Edit the Program) Financial Urban Road Road Common Road Start End Length Width Area Number Total Lane Road Name Customer Description Cwy Treatment Treatment Detail Estimate Year Rural No Classification Name MM MM (km) (m) (m²) of Lanes Kms Naracoorte - Wimmera Highway between Naracoorte - Apsley Shoulder 15 Adverse effect on 2018/19 Rural 8347 Rural Connector Naracoorte - Apsley - 14.660 22.950 8.290 2.0 16580 0 0.00 Shoulder Sealing Apsley Rd. Sealing financial or property 2018/19 Rural 7200 Rural Arterial Sturt Highway Sturt Highway Nuriootpa to Wolf Blass U 65.520 67.840 2.320 8 18560 2 4.64 Asphalt 80mm P&R (K-NET:12914767) interests Port Augusta - Port Port Wakefield 2018/19 Rural 3500 Rural Arterial Fourth St to 400m south of Old Dublin RD R 252.230 253.870 1.640 8 16920 2 3.28 Asphalt 160mm P&R (K-NET:12914767) Wakefield Rd Highway 2018/19 Urban 3500 Urban Arterial Port Wakefield Rd Port Wakefield Rd North of Dublin R1 R2 249.000 251.200 2.200 9.2 24620 2 4.40 Asphalt 160mm P&R (K-NET:12914767) Port Augusta - Port Port Wakefield 800m North of Frost Rd to 400m South of Frost 2018/19 Urban 3500 Urban Arterial R 260.780 261.800 1.020 8.0 8160 2 2.04 Asphalt 160mm P&R (K-NET:12914767) Wakefield Rd Highway Rd Port Augusta - Port Port -

Charles Melton, `Grains of Paradise` Barossa Valley Shiraz 2016 Barossa Valley, South Australia, Australia

Charles Melton, `Grains of Paradise` Barossa Valley Shiraz 2016 Barossa Valley, South Australia, Australia PRODUCER Charles Melton Wines has produced premium Barossa red wines since 1984. At that time, Charlie and a small band of Barossan winemakers turned their winemaking efforts to what were then considered a couple of unfashionable varieties: Shiraz and Grenache. These wines were initially styled on those from the Rhône but are now considered leading examples of the varieties in their own right. VINEYARDS Shiraz grapes for the 'Grains of Paradise' come from the finest vineyard sites in the Barossa. For the 2016 vintage, much of the fruit was sourced from Charlie's 12 hectare Kirche vineyard in Krondorf. Relatively youthful at 40 years old, this vineyard produces some of the highest quality Cabernet grown in the Barossa, along with superb Shiraz. Most of the vineyard sits on loam and red clay, with the edge on the eastern side heading into the seam of black cracking clay (Bay of Biscay). So named because it surrounds the Zum Kripplen Christi Lutheran Church, built in 1864. VINTAGE Winter had lower rainfall than normal and these dry conditions carried on through to summer. This led to low bunch numbers and smaller berries which reduced yields but also resulted in more concentrated flavour and deeper colours. Above average temperatures led to earlier flowering, veraison and harvest. Vintage began the first week of February and was relatively compressed due to the ongoing warm weather. VINIFICATION The grapes were destemmed only and fermented at temperatures between 18-23°C with daily pump-overs. -

Management Plan Kaiserstuhl Conservation Park 2006

Department for Environment and Heritage Management Plan Kaiserstuhl Conservation Park 2006 www.environment.sa.gov.au This plan of management was adopted on 11 January 2006 and was prepared in pursuance of section 38 of the National Parks and Wildlife Act 1972. Government of South Australia Published by the Department for Environment and Heritage, Adelaide, Australia © Department for Environment and Heritage, 2006 ISBN: 1 921018 887 Front cover photograph courtesy of Bernd Stoecker FRPS and reproduced with his permission This document may be cited as “Department for Environment and Heritage (2006) Kaiserstuhl Conservation Park Management Plan, Adelaide, South Australia” FOREWORD Kaiserstuhl Conservation Park is located approximately 80 kilometres north-east of Adelaide and approximately 12 kilometres south-east of Tanunda, in the northern Mount Lofty Ranges. The 392 hectare park was proclaimed in 1979 to conserve a remnant block of native vegetation, in particular the northern-most population of Brown Stringybark (Eucalyptus baxteri). Kaiserstuhl Conservation Park preserves a substantial number of habitats for native fauna and helps to protect the soil and watershed of Tanunda Creek. More than 360 species of native plant are found within the reserve, many of which are of conservation significance. Bird species of conservation significance recorded within the reserve include the Diamond Firetail, White-browed Treecreeper, Elegant Parrot and Crescent Honeyeater. Kaiserstuhl Conservation Park also has a rich cultural heritage. The reserve is of significance to the Peramangk people and Ngadjuri people who have traditional associations with the land. Kaiserstuhl Conservation Park has also been a valuable source of material for botanical research. Dr Ferdinand von Mueller and Dr Hans Herman Behr collected Barossa Ranges plants from the area between 1844 and 1851. -

Vineyard Biosecurity Project Looks to Next Stage After Trial 11 July 2017, by Andrew Spence

Vineyard biosecurity project looks to next stage after trial 11 July 2017, by Andrew Spence electronic visitor book for each geofence, providing the visitor name, date of visit, timestamp and visit duration. The total number of boundary crosses for the pilot was 8,388. There were no significant biosecurity threats reported during the trial, which included the busy vintage period from February to April. The trial was attracted inquiries from as far afield as the United States and Spain. Canadian technology company Be Seen Be Safe provided the geofencing software for the trial, which Vinehealth Australia's Suzanne McLoughlin worked with was adapted from the poultry industry in Ontario. 31 vigneron during the Boundary Rider trial. Credit: James Elsby Participating growers included Chapel Hill Winery, Charles Melton Wines, D'Arenberg, Dorrien Winemaking, Gemtree Wines, Henschke Cellars, Noon Winery, Scholz Estate, St Hallett Wines, Finding a balance between maximizing the Torbreck Vintners, Wirra Vineyards and Wright biosecurity benefit and the ease of use for Vineyard Trust. vignerons will play a key role in determining the future of software to help keep pests and diseases Vinehealth Australia Technical Manager Suzanne out of vineyards. McLoughlin, who managed the pilot project, said teething problems included significant battery draw A six-month trial of a vineyard visitor management on mobile devices and inaccurate fence mapping. app in South Australia has ended with relevant agencies expected to soon make a decision on its She said finding a balance between a user-friendly future. system while still providing enough detail to be a valuable biosecurity tool was crucial. -

Tech Savvy Seniors South Australia Participating Local Government Library Services

Tech Savvy Seniors South Australia Participating Local Government Library Services TRAINING PROVIDER TRAINING LOCATION PHONE EMAIL WEBSITE Two Wells Library Adelaide Plains Council (08) 8520 2100 [email protected] www.apc.sa.gov.au 61 Old Port Wakefield Road, Two Wells 5501 Nuriootpa Library Barossa Council (08) 8563 8440 [email protected] www.barossa.sa.gov.au 43-51 Tanunda Road, Nuriootpa 5355 Tanunda Library Barossa Council (08) 8561 1300 [email protected] www.barossa.sa.gov.au 66-68 Murray Street, Tanunda 5352 Lyndoch Library Barossa Council (08) 8524 4009 [email protected] www.barossa.sa.gov.au 29 Barossa Valley Way, Lyndoch 5351 Mt Pleasant Library Barossa Council (08) 8568 2407 [email protected] www.barossa.sa.gov.au 130-132 Melrose Street, Mt Pleasant 5235 Angaston Library Barossa Council (08) 8564 2369 [email protected] www.barossa.sa.gov.au Washington Street, Angaston 5353 Mount Gambier Library City of Mount Gambier (08) 8721 2540 [email protected] www.mountgambier.sa.gov.au 6 Watson Terrace, Mount Gambier 5290 Port Lincoln Library City of Port Lincoln (08) 8621 2345 [email protected] www.portlincoln.sa.gov.au 2 London Street, Port Lincoln 5606 Victor Harbor Public Library City of Victor Harbor (08) 8551 0730 [email protected] www.victor.sa.gov.au/library 1 Bay Road, Victor Harbor 5211 Clare Library www.claregilbertvalleys.sa.gov.au/ Clare and Gilbert Valleys Council (08) 8842 3817 [email protected] 33 Old North Road, Clare 5453 clarelibrary -

Homing in on the Barossa

Homing in on the Barossa Famous for stellar cellar doors and top drops, the Barossa Valley also boasts an abundance of farm-fresh fare, restful retreats and a laid-back welcome, right on Adelaide’s doorstep. WORDS SIMON THOMSEN PHOTOGRAPHY John LAURIE Bethany Wines, Tanunda JULY 2013 QANTAS 53 FORAGinG barOssa valley Top row, from left: Apex Bakery, Prue and Stephen Henschke, Bethany Wines; middle row: Maggie Beer’s Farm Shop, Henschke Hill, Blond Coffee; bottom row: Hentley Farm Restaurant (two images), Casa Carboni Italian Cooking School MID SO MANY FAMOUS NAMES, from Maggie Maggie Beer’s Farm Shop old-school bakery produces ABeer to Peter Lehmann, the Barossa, a one-hour drive north-east of 50 Pheasant Farm Road (off Samuel excellent pies and pasties from Adelaide, is really just a big country family that sweeps visitors up Road), Nuriootpa. (08) 8562 4477. recipes dating back to the 1800s, as in its arms and adopts them. It’s home to Australia’s oldest family- maggiebeer.com.au well as sourdough breads and cakes. owned winery ( Yalumba) and iconic wines such as Penfolds Grange, The doyenne of Australian cooking’s Hill of Grace, Bethany, Jacob’s Creek and Greenock Creek, declared former restaurant is now a produce DRINK Australia’s number-one winery by US wine critic Robert Parker. store and cafe. While many of her Tscharke Wines Migrants from Prussia moved to the region in the early 1800s and products are familiar, there’s a great 376 Seppeltsfield Road, their love of food and wine, architecture and tradition live on in range of farm shop-only seasonal Marananga. -

Download Catalogue

Endeavour Group Limited. ABN: Page 1 of 3 Sale Results Catalogue All sales subject to the conditions printed in this catalogue Created on: 30/09/2021 1:29:59 AM F21BGWAS - Barossa Grape & Wine - Sydney Event Bidding closed 10:08 PM Thursday, April 29, 2021 A Buyers Premium of 15% excluding GST applies to all lots. All lots sold GST inclusive, except where marked '#'. AUSTRALIA > Australia A-E Lot No Description Vintage Quantity Bottle Winning Price Classification 1 BAROSSA Barossa Young Guns of Wine Red Wine Collection 12 Bottle MV 1 Set $4000.00000000 Set, Barossa Valley. A rare collection of wines from the winners and top- 0000000000 rated winemakers in the Young Gun Awards - future stars in the making - includes: 1x MAGNUM of Tomfoolery Burla Negra 2019 1x MAGNUM of Kalleske Greenock Shiraz 2017 1x MAGNUM of JC's Own Single Site Shiraz 2018 1x MAGNUM of Standish Wine Co. The Standish Shiraz 2016 1x BOTTLE of Spinifex La Maline Shiraz 2012 1x MAGNUM of Eperosa Magnolia 1896 Shiraz 2015 1x MAGNUM of Head Wines Ancestor Vine Grenache 2016 1x MAGNUM of Sami-Odi Shiraz 1x MAGNUM of Ruggabellus Quomodo Riesling 2012 1x MAGNUM of First Drop The Cream Shiraz 2009 1x MAGNUM of Rieslingfreak No 10. Zenit Riesling 2018 1x MAGNUM of Teusner Wines Righteous Mataro 2009 2 BROCKENCHACK Weekender Experience with 4 Magnums, Eden Valley. MV 1 Set $1700.00000000 Brockenchack’s ‘Big Gum & Granite Country’ Weekender 0000000000 Explore our vineyards in the rugged Eastern Barossa backcountry, staying two nights at our B&B between Eden Valley and Keyneton. -

Cycling Guide Gawler and Surrounds ©Copyright 2021

Cycling Guide Gawler and surrounds ©Copyright 2021 Gawler Environment and Heritage Association (GEHA) 42 Finniss Street, Gawler and Australian Educational Publications and Training (AEPaT) 30 Phillips Avenue, Gawler East Phone 08 8523 2859 [email protected] All rights reserved. Apart from any fair dealing permitted under the Copyright Act 1968, no part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior permission of GEHA and AEPaT. Disclaimer – while every effort is made to ensure the information contained in this publication is current and correct at the time of publishing, future changes may render the information incorrect. The publishers and author expressly disclaim liability or responsibility to any person using the information or advice contained herein. Author: Paul Koch Title: Cycling Guide, Gawler and Surrounds Subjects: Cycling in Gawler Cycling around Gawler Graphic design: Imogen Pip Design Photography: Paul Koch Mapping: Base map Carto Graphics Contents 1. Rides 2. Preface 3. Introduction 4. Cycling in general 6. Gawler as a cycling hub 7. Gawler and surrounds 8. Amenities in Gawler 9. Cycling groups and clubs 10. Using this guide 11. Riding surfaces 11. Challenges 12. Choosing a ride 13. Maps and Descriptions 1 Rides Navigating around Gawler •Gawler Rivers Paths -Tapa Pariara..................................................... 14 •Gawler VIC to Start of Stuart O’Grady Bikeway................................ 15 •VIC to Thiele Highway...................................................................... 16 •VIC to Kentish Road and Alexander Ave............................................ 17 •Redbanks Road to Gawler VIC.......................................................... 18 •Thiele Highway to VIC...................................................................... 19 •VIC to Wheatsheaf Inn via local roads............................................. -

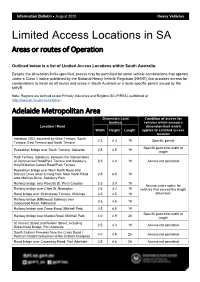

Consolidated Table of Limited Access Locations for SA

Information Bulletin August 2020 Heavy Vehicles Limited Access Locations in SA Areas or routes of Operation Outlined below is a list of Limited Access Locations within South Australia. Despite the dimension limits specified, access may be permitted for some vehicle combinations that operate under a Class 1 notice published by the National Heavy Vehicle Regulator (NHVR) that provides access for combinations to travel on all routes and areas in South Australia or a route specific permit issued by the NHVR. Note: Regions are defined as per Primary Industries and Regions SA (PIRSA), published at http://www.pir.sa.gov.au/regions. Adelaide Metropolitan Area Dimension Limit Condition of access for (metres) vehicles which exceed a Location / Road dimension limit which Width Height Length applies to a limited access location Adelaide CBD, bounded by West Terrace, South 2.5 4.3 19 Specific permit Terrace, East Terrace and North Terrace Specific permit for width or Pedestrian bridge over South Terrace, Adelaide 2.5 4.5 19 length Park Terrace, Salisbury, between the intersections of Commercial Road/Park Terrace and Salisbury 2.5 4.3 19 Access not permitted Hwy/Waterloo Corner Road/Park Terrace Pedestrian bridge over Main North Road and Malinya Drive when turning from Main North Road 3.5 4.5 19 onto Malinya Drive, Salisbury Park Railway bridge over Rosetta St, West Croydon 2.5 3.0 19 Access under notice for Railway bridge over Chief St, Brompton 2.5 3.2 19 vehicles that exceed the length Road bridge over St Andrews Terrace, Willunga 3.5 4.5 19 dimension -

Beautify’ Gawler Township

Date: Monday 29 March 2021 Embargo: None Pages: 2 Publication: All local media Feedback sought on Plan to ‘beautify’ Gawler Township Gawler’s appearance will be enhanced, its recognisable and distinct character reinforced, and general cleanliness and tidiness improved, as part of a plan drafted by Council. Town of Gawler has drafted its Beautification Plan and is now seeking the community’s feedback. The draft plan intends to identify and prioritise strategies to improve the overall appearance of the Township, including possible maintenance initiatives, service level changes, and opportunities for investment on beautification projects on key Township entrances and roundabouts across the Council area. It includes a review of the following Township entrances and roundabouts, and outlines recommendations on how they can be visually improved and maintained: Main North Road (north) entrance Redbanks Road entrance Main North Road (south) entrance Ryde Street entrance Barossa Valley Way entrance Calton Road entrance One Tree Hill Road entrance Eight roundabouts across the Council area The draft Beautification Plan has been developed with input and collaboration from Council's administration and Council Members. Ongoing collaboration with State Government agencies – which are responsible for the maintenance of many areas within the Township – is critical to the draft Plan’s implementation. The State Government is responsible for the maintenance of not just the arterial road pavements themselves in our area, but the verges in various locations. An example of this interface are the verges along Main North Road (southern end) along the Gawler Bypass and then into the urban areas of Evanston/Evanston Park. Further detail on respective areas of responsibility of the Council and the State Government is located in the draft Plan which has been prepared.