Financial Networks and Systemic Risk in China's Banking System

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Case 20-35623 Document 28 Filed in TXSB on 12/09/20 Page 1 of 5

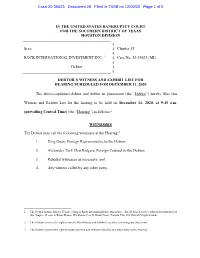

Case 20-35623 Document 28 Filed in TXSB on 12/09/20 Page 1 of 5 IN THE UNITED STATES BANKRUPTCY COURT FOR THE SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION § In re: § Chapter 15 § ROCK INTERNATIONAL INVESTMENT INC.,1 § Case No. 20-35623 (MI) § Debtor. § § DEBTOR’S WITNESS AND EXHIBIT LIST FOR HEARING SCHEDULED FOR DECEMBER 11, 2020 The above-captioned debtor and debtor in possession (the “Debtor”) hereby files this Witness and Exhibit List for the hearing to be held on December 11, 2020, at 9:45 a.m. (prevailing Central Time) (the “Hearing”) as follows:2 WITNESSES The Debtor may call the following witnesses at the Hearing:3 1. Xing Guan, Foreign Representative to the Debtor; 2. Alexander Teck Chai Ridgers, Foreign Counsel to the Debtor; 3. Rebuttal witnesses as necessary; and 4. Any witness called by any other party. 1 The Debtor in this chapter 15 proceeding is Rock International Investment Inc. The Debtor’s service address for purposes of this chapter 15 case is Ritter House, Wickhams Cay II, Road Town, Tortola VG1110, British Virgin Islands. 2 The Debtor reserves the right to amend this Witness and Exhibit List after reviewing any objections. 3 The Debtor reserves the right to cross-examine any witness called by any other party at the Hearing. Case 20-35623 Document 28 Filed in TXSB on 12/09/20 Page 2 of 5 DEBTORS’ EXHIBITS DISPOSITION DESCRIPTION W/D AFTER TRIAL MARK OFFER ADMIT OBJECT EXHIBIT Declaration of Foreign Representative 1 Pursuant to 11 U.S.C. § 1515 and Rule 1007(a)(4) of the Federal Rules of Bankruptcy Procedure and in Support of Verified Petition for (I) Recognition of Foreign Proceeding, (II) Recognition of Foreign Representative, and (III) Related Relief under Chapter 15 of the Bankruptcy Code [Docket No. -

SWIFT GPI: One Year Along the Road, Status Update for Romanian Community

SWIFT GPI: one year along the road, status update for Romanian community Janssen Marianna, SWIFT Payments specialist EMEA 7th of November 2018, Bucharest SWIFT gpi_Romanian BF_November 2018_Confidentiality restricted 1 Current gpi adoption: status update SWIFT gpi_Romanian BF_November 2018_Confidentiality restricted 2 Unparalleled growth in adoption, traffic and corridors Very large community 300~ 200+ 80+% including the 1st bank in Romania: countries covered SWIFT cross-border payments Banca Transilvania represented Millions live payments 85 700+ 100+Mio 30+% banks live country corridors payments sent as gpi since go live - cross-border MT103 35 top 50 banks 500K payments/day sent as gpi . Over 50% of SWIFT gpi payments are credited to end beneficiaries Delivering within 30 minutes real value . More than 100 billion USD are being sent daily via gpi . Banks are saving costs thanks to quicker investigations handling and a significantly reduced number of payment enquiries SWIFT gpi_Romanian BF_November. 2018_ConfidentialityPositive restricted reactions from corporates 3 85 banks are live, with more than 180 banks in the implementation phase 85 gpi banks live Nordea Bank Toronto–Dominion Bank Danske Bank Alfa-Bank State Savings Bank of Ukraine Vietinbank DNB Bank Royal Bank of Canada SEB E.SUN Commercial Bank ICICI Bank Bank of Nanjing Scotiabank Ebury Kapital Bank Shanghai Rural Commercial Bank ING Barclays China Guangfa Bank BIDV Canadian Imperial Bank of Commerce Rabobank China Minsheng Bank Shanghai Pudong ABN AMRO Bank China Merchants -

Conglomeration Unbound: the Origins and Globally Unparalleled Structures of Multi-Sector Chinese Corporate Groups Controlling Large Financial Companies

CONGLOMERATION UNBOUND: THE ORIGINS AND GLOBALLY UNPARALLELED STRUCTURES OF MULTI-SECTOR CHINESE CORPORATE GROUPS CONTROLLING LARGE FINANCIAL COMPANIES XIAN WANG, ROBERT W. GREENE & YAN YAN* ABSTRACT Unlike other major financial markets, Mainland China is home to many mixed conglomerates that control a range of large financial and non-financial firms. This Article examines the Leninist origins of these financial-commercial conglomerates (“FCCs”), and how legal and policy changes in the 1980s and 1990s enabled FCC growth during the 2000s. An underexplored topic of research, Mainland China’s FCCs are mostly not subject to group-wide regulation and this Article finds that due to complex ownership structures brought about, in part, by legal ambiguity, potential risks these entities pose to financial markets can be unclear to regulators—in 2019, issues at one FCC-controlled bank ultimately sparked market-wide distress. Using a dataset built by the authors, this Article estimates that by 2017, FCC-controlled companies accounted for thirteen to nineteen percent of Mainland China’s commercial banking assets, over one- * Xian Wang is an Associate Dean at the National Institute of Financial Research in the People’s Bank of China School of Finance at Tsinghua University. Robert W. Greene is a Vice President at Patomak Global Partners, a Nonresident Scholar at the Carnegie Endowment for International Peace, and a Fellow at the Program on International Financial Systems. Yan Yan is a Senior Research Fellow at the National Institute of Financial Research in the People’s Bank of China School of Finance at Tsinghua University. This research would not have been possible without the diligent research of Zhang Siyu. -

STOXX Greater China 480 Last Updated: 01.08.2017

STOXX Greater China 480 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.9 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 80.6 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.5 3 3 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 51.5 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 50.8 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.3 6 6 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 32.0 7 9 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.8 8 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 31.1 9 8 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.0 10 10 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.6 11 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 20.0 12 11 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.0 13 13 TW0003008009 6451668 3008.TW TW05PJ LARGAN Precision TW TWD Y 19.7 14 15 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.4 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.4 17 19 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. -

STOXX Asia 1200 Last Updated: 02.07.2018

STOXX Asia 1200 Last Updated: 02.07.2018 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Y 211.1 1 1 JP3633400001 6900643 7203.T 690064 Toyota Motor Corp. JP JPY Y 151.1 2 3 TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 147.6 3 2 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 90.4 4 4 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 67.8 5 5 JP3902900004 6335171 8306.T 659668 Mitsubishi UFJ Financial Group JP JPY Y 63.7 6 6 JP3435000009 6821506 6758.T 682150 Sony Corp. JP JPY Y 55.4 7 10 INE040A01026 B5Q3JZ5 HDBK.BO IN00CH HDFC Bank Ltd IN INR Y 54.1 8 7 JP3436100006 6770620 9984.T 677062 Softbank Group Corp. JP JPY Y 53.6 9 8 JP3735400008 6641373 9432.T 664137 Nippon Telegraph & Telephone C JP JPY Y 49.9 10 9 INE002A01018 6099626 RELI.BO IN0027 Reliance Industries Ltd IN INR Y 48.6 11 20 JP3890350006 6563024 8316.T 656302 Sumitomo Mitsui Financial Grou JP JPY Y 47.1 12 12 JP3854600008 6435145 7267.T 643514 Honda Motor Co. Ltd. JP JPY Y 45.6 13 14 JP3236200006 6490995 6861.T 649099 Keyence Corp. JP JPY Y 45.4 14 13 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 45.4 15 11 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 42.5 16 17 JP3496400007 6248990 9433.T 624899 KDDI Corp. -

An Analysis of Chengdu's Position in the Global Economy Report

‘GLOBAL CHENGDU’: AN ANALYSIS OF CHENGDU’S POSITION IN THE GLOBAL ECONOMY REPORT to the City of Chengdu September 2018 Prof. Dr. Ben Derudder Prof. Dr. Kathy Pain Executive summary The last decades witnessed the rise of an intensely interconnected world in which cities are seen to play an important role. This has led to new policy and research questions focusing on how key cities are positioned in the global economy. Against this backdrop, in this report we: (1) present an analysis of Chengdu’s connectivity profile in the global economy by making use of the Globalization and World Cities (GaWC) research network’s operational database for researching cities at the global scale; (2) present a grounded interpretation of this profile based on fieldwork and site visits in Chengdu in August 2018; (3) and, drawing on the above, present a set of tailored policy recommendations for strategically enhancing Chengdu’s global connectivity. GaWC’s approach to the understanding of cities’ position in the global economy is unique in that (1) it is grounded in state-of-the-art scientific research, (2) has been corroborated by earlier policy research for major cities (including Sydney and Abu Dhabi) and global urban stakeholders (including MasterCard and CBRE), (3) advances a unique relational perspective on how cities are positioned and evolve, and (4) combines systematic quantitative analysis (firm network analysis-based examinations of cities in the global economy) with in-depth qualitative analysis (interview-based examinations of how cities fit into the location strategies of global firms). Using the central importance of producer service firms in the creation of global urban economies, GaWC identifies the work carried out in their office networks across cities as the constituents of a ‘world city network’. -

Chinese Bankers' Survey 2017

www.pwchk.com Chinese Bankers’ Survey 2017 Executive summary January 2018 January 2018 Chinese Bankers Survey 2017 PwC 2 Preface firewalls to mitigate risks right from the We are pleased to present the Chinese Bankers’ beginning or to prevent them from spreading. Survey 2017 report, prepared jointly by the China The regulatory environment has also been Banking Association (CBA) and PwC. Now in its shifting towards tougher supervision, as well as ninth year, the report tracks developments in the stricter compliance and accountability. The sector from the perspective of Chinese bankers. China Banking Regulatory Commission (CBRC) This year’s survey digs deep into the core issues has imposed a series of measures to tackle while maintaining a broad scope. Dr. Ba Shusong, irregularities in the sector by requiring banks to the Project Leader, together with the project team, strengthen self- inspections, conduct regulatory interviewed 14 senior bankers to get their insights examinations and introduce tougher penalties. into the sector. Seven of these bankers are at C-suite According to the survey, over 90% of level (Directors, Vice-presidents, or above). The respondents are strongly or very strongly aware interviews complement an online survey covering 31 of increasing pressure from the regulators. provinces in mainland China (excluding Hong Kong, Macau and Taiwan). With a total of 1,920 valid The Report of the 19th Party Congress argues responses collected over eight months, the survey that in order to build a modern economy, sampling process takes into account participants’ emphasis must be placed on developing the real geographical regions, grades, types of financial economy. -

SWIFT Gpi for Corporates Cross-Border Payments, Transformed

SWIFT gpi for corporates Cross-border payments, transformed Oct, 2018 Spotlight on cross-border payment challenges Martin Schlageter Peter Claus-Landi Brooke Tilton Michel Verholen Head of Treasury Operations Director banking initiatives Vice President, Treasury Operations Director, Global Treasury Center Roche General Electric Viacom Zoetis Speed Transparency Tracking Remittance information “Critical business “Many times we don’t “I’m not able to tell when the “We miss information regarding requires faster payment have visibility on the fees money hits the beneficiary’s the invoice and the payer execution” lifted along the way” bank account” for timely reconciliation” SWIFT gpi for corporates - October 2018 2 Time for SWIFT gpi SWIFTgpi Faster payments 1 Same day use of funds* Accessible by any bank Traceable End-to-end payment tracking 2 & payment confirmation Core transaction SLA rulebook banks Transparent fees 3 Deducts and FX Reaching any bank Full remittance data 4 Unaltered reconciliation info Accessible by any corporate SWIFT gpi for corporates - October 2018 3 SWIFT gpi: secure, faster, traceable & transparent cross-border payments Intermediary Traceable Your bank bank 2 End-to-end payment tracking & payment confirmation gpi a1700db1-90b2-4948-83d8-6309c5c34a3d Invoice SWIFTgpi Your company Rulebook $ 1 Faster payments Same day use of funds* Beneficiary’s bank Beneficiary 3 Transparent fees Deducts and FX 4 Full remittance data Unaltered reconciliation info SWIFT gpi for corporates - October 2018 4 *Within the time zone of the -

An Analysis of State-Owned Enterprises and State Capitalism in China

U.S.-China Economic and Security Review Commission October 26, 2011 An Analysis of State‐owned Enterprises and State Capitalism in China By Andrew Szamosszegi and Cole Kyle __________________________________________________ Prepared by Capital Trade, Incorporated Washington, DC Table of Contents I. Executive Summary ................................................................................................................. 1 II. Introduction ............................................................................................................................ 4 III. Overview of state capitalism in China .................................................................................... 5 A. Economic footprint of SOEs ............................................................................................... 11 1. Output and value added ............................................................................................. 12 2. Fixed investment ........................................................................................................ 14 3. Employment and wages ............................................................................................. 16 4. Taxes/revenues ........................................................................................................... 19 5. The observable SOE share of output .......................................................................... 20 B. Comparison of the observable state sector and the private sector .................................. 22 -

Shandong Ruyi Technology Group Co Ltd Manufacturing 1Q19 Credit Report 19 June 2019 China

Shandong Ruyi Technology Group Co Ltd Manufacturing 1Q19 Credit report 19 June 2019 China SHANDONG RUYI TECHNOLOGY GROUP CAPITAL STRUCTURE (CNYm) Amount Amount Pro forma Pro forma Issuance Pro forma Instrument Issuers Coupon Maturity outstanding as outstanding as amount amount date leverage at 31-Dec-18 at 31-Mar-19 (CNYm) (USDm) Short-term secured loans <1 year 1,860 NA(1) NA(1) NA(1) Long-term secured loans >1 year 2,505 NA(1) NA(1) NA(1) Finance lease >1 year 1,400 1,400 1,400 203 Offshore secured bonds(2) 18-May-16 2022-23 2,167 2,167 773 112 Total secured debt 7,932 3,566 2,173 314 0.9x Other short-term loans 5,960 7,202 7,202 1,042 Other long-term loans(2) 2,658 4,612 7,356 1,065 Onshore bonds 2015-19 5.5-7.9% 2019-23 5,703 6,203 6,203 898 Offshore bonds 2016-18 6.95-7.5% 2019-22 6,419 6,419 6,419 929 Total debt 28,672 28,002 29,353 4,248 11.6x Cash and cash equivalent(3) 8,953 8,359 9,710 1,405 External guarantee 2,011 2,011 2,011 Credit facilities (mostly uncommitted)(4) 3,139 3,139 3,139 Net debt 19,719 19,643 19,643 2,843 7.8x LTM adj. EBITDA(4) 2,531 Source: Debtwire, company filings 1) No breakdown of loan types for 1Q19; 2) 51.8%-owned subsidiary, SMCP, announced early redemption of EUR notes due-2023 on 10 May, which are to be refinanced by new EUR 265m amortizing term loan and a EUR 200m revolving credit facilities, with five-year maturity. -

Bank' S Statement of Cash Flows for the Year Ended 31 December 2019

Mission Inclusive finance delivers better life. Vision Build a service-oriented, value-creating, full-edged regional banking group with optimal experience and reputation. Core Values Sincerity Responsibility Creation Benet 1 Contents Important Notice 01 Definitions 02 Adhere to Customer-centricity Put customers at the center of all operation and management activities. Take "customer-centricity" as the Bank's core management concept, and reect it in strategy formulation, evaluation and assessment, resource alloca- Company Prole 03 tion, organizational structure, channels and processes, and sales and risk control. Answer, deal with and solve the three fundamental questions of "where are customers, how to acquire customers, and how to serve customers". Change the product-oriented sales and service mode dominated by deposits and loans, start from Honors and Awards 04 and focus on the needs, experience and development of customers in all the work. Business Highlights 05 Message from Leaders 07 1 1.1 Accounting Data and Financial Indicators Highlights 15 1.2 Business Overview 19 1.3 Management Discussion and Analysis 22 You could use the following ways to access to this report and performance information disclosed by the company. Printed Annual Download on Ocial WeChat Report Mobile Website Account Adhere t o Adhere t o Inclusive Finance Digital Transformation Take inclusive nance as the fundamental path towards practicing the mission of the Company, build the brand image of "Stay close to the people, facilitate the people and benet the people", adhere to the business positioning of serving "Agriculture, rural areas and farmers, small and micro enterprises, scientic and technological innovation enterprises, and community residents", clearly dene the business practice of "generating revenue from hard work and professionalism with integrity", and guide the business towards the fundamental purpose of nancial services. -

Ping an Bank Co., Ltd. 2018 Annual Report

Ping An Bank Co., Ltd. 2018 Annual Report [English translation for reference only. Should there be any inconsistency between the Chinese and English versions, the Chinese version shall prevail.] Section I Important Notes, Contents and Interpretations Important Notes 1.1. The board of directors (hereinafter referred to as the “Board”), the supervisory committee, the directors, the supervisors and senior management of the Bank guarantee the authenticity, accuracy and completeness of the contents of the Annual Report, in which there are no false representations, misleading statements or material omissions, and are severally and jointly liable for its contents. 1.2. The 23rd meeting of the 10th session of the Board of the Bank deliberated the 2018 Annual Report together with its summary. The meeting required 14 directors to attend, and 13 directors attended the meeting. Director Ip So Lan did not attend the meeting for business affairs and entrusted Director Yao Jason Bo to exercise voting rights on behalf of her. This Annual Report was approved unanimously at the meeting. 1.3. The 2018 financial report prepared by the Bank was audited by PricewaterhouseCoopers Zhong Tian LLP (hereinafter referred to as “PwC”) according to the China standards on Auditing and PwC issued a standard unqualified auditors’ report. 1.4. Xie Yonglin (the Bank’s Chairman), Hu Yuefei (the President), and Xiang Youzhi (the CFO/the head of the Accounting Department) guarantee the authenticity, accuracy and completeness of the financial report contained in the 2018 Annual Report. 1.5. The forward-looking statements such as plans for the future involved in the Report do not constitute a substantial commitment for investors.