Active QQQ Covered Call Strategies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Income Solutions: the Case for Covered Calls an Advantageous Strategy for a Low-Yield World

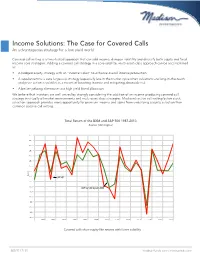

Income Solutions: The Case for Covered Calls An advantageous strategy for a low-yield world Covered call writing is a time-tested approach that can add income, dampen volatility and diversify both equity and fixed income core strategies. Adding a covered call strategy in a core-satellite, multi-asset-class approach can be accomplished as: • A hedged equity strategy with an “income kicker” to enhance overall income production • A supplement to a core large-cap strategy (especially late in the market cycle when valuations are long-in-the-tooth and price action is volatile) as a means of boosting income and mitigating downside risk • A better-yielding alternative to a high yield bond allocation We believe that investors are well-served by strongly considering the addition of an income-producing covered call strategy in virtually all market environments and multi-asset class strategies. Madison’s active call writing/active stock selection approach provides more opportunity for premium income and alpha from underlying security selection than common passive call writing. Total Return of the BXM and S&P 500 1987-2013 Rolling Returns Source: Morningstar Time Period: 1/1/1987 to 12/31/2013 Rolling Window: 1 Year 1 Year shift 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 Return 0.0 S&P 500 -5.0 -10.0 CBOE S&P 500 Buywrite BXM -15.0 -20.0 -25.0 -30.0 -35.0 -40.0 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 S&P 500 TR USD Covered calls show equity-likeCBOE returns S&P 500 with Buyw ritelower BXM volatility Source: Morningstar Direct 888.971.7135 madisonfunds.com | madisonadv.com Covered Call Strategy(A) Benefits of Individual Stock Options vs. -

Structured Products in Asia

2015 ISSUE: NOVEMBER Structured Products in Asia hubbis.com 1st Leonteq has received more than 20 awards since its foundation in 2007 THE QUINTESSENCE OF OUR MISSION STATEMENT LET´S REDEFINE YOUR INVESTMENT EXPERIENCE Leonteq’s explicit goal is to make a difference through particular transparency in structured investment products and to be the preferred technology and service partner for investment solutions. We count on experienced industry experts with a focus on achieving client’s goals and a fi rst class IT infrastructure, setting new stand- ards in stability and fl exibility. OUR DIFFERENTIATION Modern platform • Integrated IT platform built from ground up with a focus on automation of key processes in the value chain • Platform functionality to address increased customer demand for transparency, service, liquidity, security and sustainability Vertical integration • Control of the entire value chain as a basis for proactive service tailored to specifi c needs of clients • Automation of key processes mitigating operational risks Competitive cost per issued product • Modern platform resulting in a competitive cost per issued product allowing for small ticket sizes LEGAL DISCLAIMER Leonteq Securities (Hong Kong) Limited (CE no.AVV960) (“Leonteq Hong Kong”) is responsible for the distribution of this publication in Hong Kong. It is licensed and regulated by the Hong Kong Securities and Futures Commission for Types 1 and 4 regulated activities. The services and products it provides are available only to “profes- sional investors” as defi ned in the Securities and Futures Ordinance (Cap. 571) of Hong Kong. This document is being communicated to you solely for the purposes of providing information regarding the products and services that the Leonteq group currently offers, subject to applicable laws and regulations. -

EQUITY DERIVATIVES Faqs

NATIONAL INSTITUTE OF SECURITIES MARKETS SCHOOL FOR SECURITIES EDUCATION EQUITY DERIVATIVES Frequently Asked Questions (FAQs) Authors: NISM PGDM 2019-21 Batch Students: Abhilash Rathod Akash Sherry Akhilesh Krishnan Devansh Sharma Jyotsna Gupta Malaya Mohapatra Prahlad Arora Rajesh Gouda Rujuta Tamhankar Shreya Iyer Shubham Gurtu Vansh Agarwal Faculty Guide: Ritesh Nandwani, Program Director, PGDM, NISM Table of Contents Sr. Question Topic Page No No. Numbers 1 Introduction to Derivatives 1-16 2 2 Understanding Futures & Forwards 17-42 9 3 Understanding Options 43-66 20 4 Option Properties 66-90 29 5 Options Pricing & Valuation 91-95 39 6 Derivatives Applications 96-125 44 7 Options Trading Strategies 126-271 53 8 Risks involved in Derivatives trading 272-282 86 Trading, Margin requirements & 9 283-329 90 Position Limits in India 10 Clearing & Settlement in India 330-345 105 Annexures : Key Statistics & Trends - 113 1 | P a g e I. INTRODUCTION TO DERIVATIVES 1. What are Derivatives? Ans. A Derivative is a financial instrument whose value is derived from the value of an underlying asset. The underlying asset can be equity shares or index, precious metals, commodities, currencies, interest rates etc. A derivative instrument does not have any independent value. Its value is always dependent on the underlying assets. Derivatives can be used either to minimize risk (hedging) or assume risk with the expectation of some positive pay-off or reward (speculation). 2. What are some common types of Derivatives? Ans. The following are some common types of derivatives: a) Forwards b) Futures c) Options d) Swaps 3. What is Forward? A forward is a contractual agreement between two parties to buy/sell an underlying asset at a future date for a particular price that is pre‐decided on the date of contract. -

Covered Calls Uncovered Roni Israelov and Lars N

Financial Analysts Journal Volume 71 · Number 6 ©2015 CFA Institute Covered Calls Uncovered Roni Israelov and Lars N. Nielsen Typical covered call strategies collect the equity and volatility risk premiums but also embed exposure to a naive equity reversal strategy that is uncompensated. This article presents a novel risk and performance attribu- tion methodology that deconstructs the strategy into these three exposures. Historically, the equity exposure contributed most of the risk and return. The short volatility exposure realized a Sharpe ratio of nearly 1.0 but contributed only 10% of the risk. The equity reversal exposure contributed approximately 25% of the risk but provided little return in exchange. The authors propose a risk-managed covered call strategy that eliminates the uncompensated equity reversal exposure. This modified covered call strategy has a superior Sharpe ratio, reduced volatility, and reduced downside equity beta. quity index covered calls are the most easily by natural buyers can lead to a risk premium. accessible source of the volatility risk pre- Litterman (2011) suggested that long-term inves- Emium for most investors.1 The volatility risk tors, such as pensions and endowments, should be premium, which is absent from most investors’ port- natural providers of financial insurance and sellers folios, has had more than double the risk-adjusted of options. returns (Sharpe ratio) of the equity risk premium, Yet, many investors remain skeptical of covered which is the dominant source of return for most call strategies. Although deceptively simple—long investors. By providing the equity and volatility equity and short a call option—covered calls are not risk premiums, equity index covered calls’ returns well understood. -

S&P/TSX 60 Covered Call Indices Methodology

S&P/TSX 60 Covered Call Indices Methodology April 2021 S&P Dow Jones Indices: Index Methodology Table of Contents Introduction 2 Index Objective 2 Index Series 2 Supporting Documents 2 Index Construction 3 Approaches 3 Pricing 3 Index Calculations 3 Currency of Calculation and Additional Index Return Series 5 Base Date and History Availability 5 Index Governance 6 Index Committee 6 Index Policy 7 Announcements 7 Holiday Schedule 7 Unexpected Exchange Closures 7 Recalculation Policy 7 Contact Information 7 Index Dissemination 8 Index Data 8 Web site 8 Appendix: Adjustment for Corporate Actions 9 Special Dividends 9 Disclaimer 11 S&P Dow Jones Indices: S&P/TSX 60 Covered Call Indices Methodology 1 Introduction Index Objective The S&P/TSX 60 Covered Call Indices measures the performance of a strategy that writes covered calls on the iShares S&P/TSX 60 Index ETF (TSX:XIU). Index Series The index series consists of the following indices: Rebalancing Target Option Moneyness Index Frequency Moneyness Multiplier (m) S&P/TSX 60 Covered Call 2% OTM Monthly 2% OTM 1.02 Monthly Index (CAD) TR S&P/TSX 60 Covered Call 2% OTM Quarterly 2% OTM 1.02 Quarterly Index (CAD) TR Supporting Documents This methodology is meant to be read in conjunction with supporting documents providing greater detail with respect to the policies, procedures and calculations described herein. References throughout the methodology direct the reader to the relevant supporting document for further information on a specific topic. The list of the main supplemental documents for -

Covered Call Strategies: One Fact and Eight Myths Roni Israelov and Lars N

Financial Analysts Journal Volume 70 · Number 6 ©2014 CFA Institute PERSPECTIVES Covered Call Strategies: One Fact and Eight Myths Roni Israelov and Lars N. Nielsen A covered call is a long position in a security and a short position in a call option on that security. Equity index covered calls are an attractive strategy to many investors because they have realized returns not much lower than those of the equity market but with much lower volatility. However, a number of myths about the strategy—from why it works to why an investor should or should not invest—have surfaced, and many of them are erroneously considered “common knowledge.” The authors review the underlying risk and returns of covered call strategies and dispel eight common myths about them. covered call is a combination of a long posi- For obvious reasons, strategies that may offer tion in a security and a short position in a call equity-like expected returns but with lower volatility A option on the same security. The combined and market exposure (beta) generate strong investor position caps the investor’s upside on the underlying interest. As a case in point, covered call strategies security at the option’s strike price in exchange for have been gaining popularity: Growth in assets under an option premium. Figure 1 shows the covered call management in covered call strategies has been over payoff diagram, including the option premium, at 25% per year over the past 10 years (through June expiration when the call option is written at a $100 2014), with over $45 billion currently invested.2 strike with a $25 option premium. -

Equity Options Strategy

EQUITY OPTIONS STRATEGY Covered Call (Buy/Write) DESCRIPTION A stockowner who would regret losing the stock during a nice rally should think An investor who buys or owns stock and writes call options in the equivalent carefully before writing a covered call. The only sure way to avoid assignment is amount can earn premium income without taking on additional risk. The to close out the position. It requires vigilance, quick action, and might cost extra premium received, adds to the investor’s bottom line regardless of outcome. It to buy the call back especially if the stock is climbing fast. offers a small downside ‘cushion’ in the event the stock slides downward and can OUTLOOK boost returns on the upside. The covered call writer is looking for a steady or slightly rising stock price for at Predictably, this benefit comes at a cost. For as long as the short call position least the term of the option. This strategy not appropriate for a very bearish or a is open, the investor forfeits much of the stock’s profit potential. If the stock very bullish investor. price rallies above the call’s strike price, the stock is increasingly likely to be called away. Since the possibility of assignment is central to this strategy, it makes SUMMARY more sense for investors who view assignment as a positive outcome. This strategy consists of writing a call that is covered by an equivalent long stock Because covered call writers can select their own exit price (i.e., strike plus position. It provides a small hedge on the stock and allows an investor to earn premium received), assignment can be seen as success; after all, the target premium income, in return for temporarily forfeiting much of the stock’s upside price was realized. -

Covered Calls

Trading around a position using covered calls Roger Manzolini June 23, 2011 1 Money and Investing Trading around a position using covered calls Roger Manzolini June 23, 2011 Roger Manzolini June 23, 2011 2 Disclaimer This presentation is the creation of Roger Manzolini and is to be used for informational use only Roger is not a certified financial planner nor a financial advisor of any kind, so use of this information is at your own risk None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security Roger Manzolini June 23, 2011 3 More Disclaimer The content in this presentation should not be considered as a recommendation to buy or sell a security All information is intended for educational purposes only and in no way should be considered investment advice Options involve risk and are not suitable for all investors. All rights and obligations of options instruments should be fully understood by individual investors before entering any trade Additional caution: My peers call me Maddog Roger Manzolini June 23, 2011 4 Agenda Introduction Option Basics Covered Calls Trading Examples Comparison of Approaches Roger Manzolini June 23, 2011 5 Introduction High Level Strategic View Portion of money to be managed 10% but not more Money Options used to generate money than $30K Engine High risk/high return (30% or more) Investment Stocks / Bonds used to grow money 75-50% Portfolio Moderate risk/moderate return (8-12%) CDs / Treasury Bills used -

Covered Call Strategies

THE ART OF COVERED CALL WRITING A SOURCE OF TAX EFFICIENT INCOME August 2021 1.866.998.8298 WWW.HARVESTPORTFOLIOS.COM THTHE EP OAWRTE RO FO FO CVOERVERDED CALL OPTIONS By CMicAhaeLl KLov aWcs, PRresiIdeTntI &N CEOG Introduction Harvest ETFs uses a combination of strategies to produce growth and income in its funds. Harvest starts with a careful selection of the stocks that make up its active ETFs, choosing them through a criterion that includes, among others, global reach and sector dominance, free cash flow, a history of dividend growth and brand value. An important part of the Harvest model is the use of covered call options to generate extra income. When strong, global businesses with growing dividend streams are combined with the call option strategy it is a powerful energizer. Harvest writes calls on up to 33% of each position on our Equity Income ETFs, generating an attractive tax efficient income while participating in the growth of the companies where it is invested. Part I: Call Options Explained A call option is an agreement between two parties that give the option buyer the right, but not the obligation, to buy a stock at a fixed price within a specified time frame. The buyer pays a fee to the seller for that right. The seller keeps the fee regardless of what happens later. Here's an easy way to look at it. Suppose you decide to buy a house and agree on a price. You pay the seller a small fee that allows you to lock in that price for the next 30 days while you think about it. -

Amended Opinion of the Commission

UNITED STATES OF AMERICA before the SECURITIES AND EXCHANGE COMMISSION SECURITIES EXCHANGE ACT OF 1934 Release No. 78049A / July 7, 2016 INVESTMENT ADVISERS ACT OF 1940 Release No. 4420A / July 7, 2016 INVESTMENT COMPANY ACT OF 1940 Release No. 32146A / July 7, 2016 ADMINISTRATIVE PROCEEDING File No. 3-15141 In the Matter of MOHAMMED RIAD and KEVIN TIMOTHY SWANSON AMENDED OPINION OF THE COMMISSION CEASE-AND-DESIST PROCEEDING INVESTMENT ADVISER PROCEEDING INVESTMENT COMPANY PROCEEDING Grounds for Remedial Action Antifraud Violations Respondents, who were associated with registered investment adviser, made fraudulent misstatements and omitted material facts in a closed-end fund’s shareholder reports regarding the fund’s use of new derivative investments and their effect on the fund’s performance and risk exposure. Held, it is in the public interest to bar respondents from associating with a broker, dealer, investment adviser, municipal securities dealer, or transfer agent; order respondents to cease and desist from committing or causing any violations or further violations of the provisions violated; order disgorgement; and assess civil penalties of $130,000 against each respondent. 2 APPEARANCES: Richard D. Marshall of Katten Muchin Rosenman LLP, for respondents. Robert M. Moye, Benjamin J. Hanauer, and Jeffrey A. Shank, for the Division of Enforcement. Petition for review filed: June 4, 2014 Last brief received: February 15, 2016 Oral argument: March 16, 2016 I. Introduction Respondents Mohammed Riad and Kevin Timothy Swanson appeal from an administrative law judge’s initial decision finding that they violated the antifraud provisions of the securities laws while associated with an investment adviser responsible for managing the portfolio of a closed-end investment company, the Fiduciary/Claymore Dynamic Equity Fund (the “Fund”).1 Based on our independent, de novo review of the record, we find that both respondents committed fraud by misrepresenting and omitting material information about new derivatives in the Fund’s 2007 annual and May 2008 semiannual reports. -

What to Consider When Writing Covered Calls

T R A N S C R I P T What to consider when writing covered calls Nicholas Delisse: My name is Nicholas DeLisse, I’m with Fidelity’s Trading Strategy Desk. Of course, joining me today is Cale Bearden, also with the Trading Strategy Desk. We have a great session planned today, and this is one of my favorite topics, of course, to cover in this type of environment. But before we get too deep into it, I do of course encourage everyone to take a look at those group coaching sessions, they can be easily accessed through just simply going to Fidelity.com/coaching. And we also offer various classrooms on technical analysis, we have classes on technical analysis on options trading, if you haven’t traded options before. In addition to even our platform, Active Trader Pro. And those can be accessed either through the Learning Center or going to Fidelity.com/classroom. A great place to start that in essence, our team, we’re a group of trading coaches, and we’re here to help you be a more successful, more comfortable, more knowledgeable trader, whether you’re trading options, or whether you’re looking to employ technical analysis. One thing about the session that we’re going to be doing today on writing covered calls that always sticks out to me is, I remember talking to a client about this particular session, and encouraged him to watch a recording of another, similar webinar that we’d done. This client had been trading covered 1 calls for almost about 20 years. -

Guggenheim Defined Portfolios, Series 2063 Covered Call & Income

Guggenheim Defined Portfolios, Series 2063 Covered Call & Income Portfolio of CEFs, Series 46 Zacks Income Advantage Strategy Portfolio, Series 52 ® GUGGENHEIM LOGO PROSPECTUS PART A DATED OCTOBER 8, 2020 Portfolios containing securities selected by Guggenheim Funds Distributors, LLC with the assistance of Zacks Investment Management for Zacks Income Advantage Strategy Portfolio, Series 52 An investment can be made in the underlying closed-end funds in the trusts directly rather than through the trusts. These direct investments can be made without paying the sales charge, operating expenses and organizational costs of the trusts. The Securities and Exchange Commission has not approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense. INVESTMENT SUMMARY End Funds featuring the potential for current income, diversification and overall liquidity. Overview What is a Covered Call Writing Strategy? Guggenheim Defined Portfolios, Series 2063 is a unit investment trust that consists of Call options are contracts representing the the Covered Call & Income Portfolio of CEFs, right to purchase a common stock at a specified Series 46 (the “Covered Call Trust”) and the price, known as the “strike price,” at a specified Zacks Income Advantage Strategy Portfolio, future date, known as the “expiration date,” in Series 52 (the “Zacks Trust”) (collectively exchange for an option premium. referred to as the “trusts” and individually referred to as a “trust”). Guggenheim Funds Certain Closed-End Funds held within the Distributors, LLC (“Guggenheim Funds” or the trust’s portfolio employ an option strategy of “sponsor”) serves as the sponsor of the trusts.