I) Covered Call; Ii) Protective Put

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Here We Go Again

2015, 2016 MDDC News Organization of the Year! Celebrating 161 years of service! Vol. 163, No. 3 • 50¢ SINCE 1855 July 13 - July 19, 2017 TODAY’S GAS Here we go again . PRICE Rockville political differences rise to the surface in routine commission appointment $2.28 per gallon Last Week pointee to the City’s Historic District the three members of “Team him from serving on the HDC. $2.26 per gallon By Neal Earley @neal_earley Commission turned into a heated de- Rockville,” a Rockville political- The HDC is responsible for re- bate highlighting the City’s main po- block made up of Council members viewing applications for modification A month ago ROCKVILLE – In most jurisdic- litical division. Julie Palakovich Carr, Mark Pierzcha- to the exteriors of historic buildings, $2.36 per gallon tions, board and commission appoint- Mayor Bridget Donnell Newton la and Virginia Onley who ran on the as well as recommending boundaries A year ago ments are usually toward the bottom called the City Council’s rejection of same platform with mayoral candi- for the City’s historic districts. If ap- $2.28 per gallon of the list in terms of public interest her pick for Historic District Commis- date Sima Osdoby and city council proved Giammo, would have re- and controversy -- but not in sion – former three-term Rockville candidate Clark Reed. placed Matthew Goguen, whose term AVERAGE PRICE PER GALLON OF Rockville. UNLEADED REGULAR GAS IN Mayor Larry Giammo – political. While Onley and Palakovich expired in May. MARYLAND/D.C. METRO AREA For many municipalities, may- “I find it absolutely disappoint- Carr said they opposed Giammo’s ap- Giammo previously endorsed ACCORDING TO AAA oral appointments are a formality of- ing that politics has entered into the pointment based on his lack of qualifi- Newton in her campaign against ten given rubberstamped approval by boards and commission nomination cations, Giammo said it was his polit- INSIDE the city council, but in Rockville what process once again,” Newton said. -

Lecture 5 an Introduction to European Put Options. Moneyness

Lecture: 5 Course: M339D/M389D - Intro to Financial Math Page: 1 of 5 University of Texas at Austin Lecture 5 An introduction to European put options. Moneyness. 5.1. Put options. A put option gives the owner the right { but not the obligation { to sell the underlying asset at a predetermined price during a predetermined time period. The seller of a put option is obligated to buy if asked. The mechanics of the European put option are the following: at time−0: (1) the contract is agreed upon between the buyer and the writer of the option, (2) the logistics of the contract are worked out (these include the underlying asset, the expiration date T and the strike price K), (3) the buyer of the option pays a premium to the writer; at time−T : the buyer of the option can choose whether he/she will sell the underlying asset for the strike price K. 5.1.1. The European put option payoff. We already went through a similar procedure with European call options, so we will just briefly repeat the mental exercise and figure out the European-put-buyer's profit. If the strike price K exceeds the final asset price S(T ), i.e., if S(T ) < K, this means that the put-option holder is able to sell the asset for a higher price than he/she would be able to in the market. In fact, in our perfectly liquid markets, he/she would be able to purchase the asset for S(T ) and immediately sell it to the put writer for the strike price K. -

Introduction to Options

FIN-40008 FINANCIAL INSTRUMENTS SPRING 2008 Options These notes describe the payoffs to European and American put and call options|the so-called plain vanilla options. We consider the payoffs to these options for holders and writers and describe both the time vale and intrinsic value of an option. We explain why options are traded and examine some of the properties of put and call option prices. We shall show that longer dated options typically have higher prices and that call prices are higher when the strike price is lower and that put prices are higher when the strike price is higher. Keywords: Put, call, strike price, maturity date, in-the-money, time value, intrinsic value, parity value, American option, European option, early exer- cise, bull spread, bear spread, butterfly spread. 1 Options Options are derivative assets. That is their payoffs are derived from the pay- off on some other underlying asset. The underlying asset may be an equity, an index, a bond or indeed any other type of asset. Options themselves are classified by their type, class and their series. The most important distinc- tion of types is between put options and call options. A put option gives the owner the right to sell the underlying asset at specified dates at a specified price. A call option gives the owner the right to buy at specified dates at a specified price. Options are different from forward/futures contracts as a put (call) option gives the owner right to sell (buy) the underlying asset but not an obligation. The right to buy or sell need not be exercised. -

Futures and Options Workbook

EEXAMININGXAMINING FUTURES AND OPTIONS TABLE OF 130 Grain Exchange Building 400 South 4th Street Minneapolis, MN 55415 www.mgex.com [email protected] 800.827.4746 612.321.7101 Fax: 612.339.1155 Acknowledgements We express our appreciation to those who generously gave their time and effort in reviewing this publication. MGEX members and member firm personnel DePaul University Professor Jin Choi Southern Illinois University Associate Professor Dwight R. Sanders National Futures Association (Glossary of Terms) INTRODUCTION: THE POWER OF CHOICE 2 SECTION I: HISTORY History of MGEX 3 SECTION II: THE FUTURES MARKET Futures Contracts 4 The Participants 4 Exchange Services 5 TEST Sections I & II 6 Answers Sections I & II 7 SECTION III: HEDGING AND THE BASIS The Basis 8 Short Hedge Example 9 Long Hedge Example 9 TEST Section III 10 Answers Section III 12 SECTION IV: THE POWER OF OPTIONS Definitions 13 Options and Futures Comparison Diagram 14 Option Prices 15 Intrinsic Value 15 Time Value 15 Time Value Cap Diagram 15 Options Classifications 16 Options Exercise 16 F CONTENTS Deltas 16 Examples 16 TEST Section IV 18 Answers Section IV 20 SECTION V: OPTIONS STRATEGIES Option Use and Price 21 Hedging with Options 22 TEST Section V 23 Answers Section V 24 CONCLUSION 25 GLOSSARY 26 THE POWER OF CHOICE How do commercial buyers and sellers of volatile commodities protect themselves from the ever-changing and unpredictable nature of today’s business climate? They use a practice called hedging. This time-tested practice has become a stan- dard in many industries. Hedging can be defined as taking offsetting positions in related markets. -

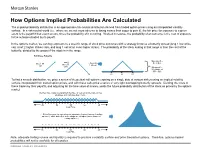

How Options Implied Probabilities Are Calculated

No content left No content right of this line of this line How Options Implied Probabilities Are Calculated The implied probability distribution is an approximate risk-neutral distribution derived from traded option prices using an interpolated volatility surface. In a risk-neutral world (i.e., where we are not more adverse to losing money than eager to gain it), the fair price for exposure to a given event is the payoff if that event occurs, times the probability of it occurring. Worked in reverse, the probability of an outcome is the cost of exposure Place content to the outcome divided by its payoff. Place content below this line below this line In the options market, we can buy exposure to a specific range of stock price outcomes with a strategy know as a butterfly spread (long 1 low strike call, short 2 higher strikes calls, and long 1 call at an even higher strike). The probability of the stock ending in that range is then the cost of the butterfly, divided by the payout if the stock is in the range. Building a Butterfly: Max payoff = …add 2 …then Buy $5 at $55 Buy 1 50 short 55 call 1 60 call calls Min payoff = $0 outside of $50 - $60 50 55 60 To find a smooth distribution, we price a series of theoretical call options expiring on a single date at various strikes using an implied volatility surface interpolated from traded option prices, and with these calls price a series of very tight overlapping butterfly spreads. Dividing the costs of these trades by their payoffs, and adjusting for the time value of money, yields the future probability distribution of the stock as priced by the options market. -

Chapter 2 Roche Holding: the Company, Its

Risk Takers Uses and Abuses of Financial Derivatives John E. Marthinsen Babson College PEARSON Addison Wesley Boston San Francisco New York London Toronto Sydney Tokyo Singapore Madrid Mexico City Munich Paris Cape Town Hong Kong Montreal Preface xiii Parti 1 Chapter 1 Employee Stock Options: What Every MBA Should Know 3 Introduction 3 Employee Stock Options: A Major Pillar of Executive Compensation 6 Why Do Companies Use Employee Stock Options 6 Aligning Incentives 7 Hiring and Retention 7 Postponing the Timing of Expenses 8 Adjusting Compensation to Employee Risk Tolerance Levels 8 Tax Advantages for Employees 9 Tax Advantages for Companies 9 Cash Flow Advantages for Companies 10 Option Valuation Differences and Human Resource Management 12 Problems with Employee Stock Options 26 Employee Motivation 26 The Share Price of "Good" Companies 27 Motivation of Undesired Behavior 28 vi Contents Performance Improvement 28 Absolute Versus Relative Performance 29 Some Innovative Solutions to Employee Stock Option Problems 29 Premium-Priced Stock Options 30 Index Options 30 Restricted Shares 34 Omnibus Plans 34 Conclusion 35 Review Questions 36 Bibliography 38 Chapter 2 Roche Holding: The Company, Its Financial Strategy, and Bull Spread Warrants 41 Introduction 41 Roche Holding AG: Transition from a Lender to a Borrower 43 Loss of the Valium Patent in the United States 43 Rapid Increase in R&D Costs, Market Growth, and Industry Consolidation 43 Roche's Unique Capital Structure 44 Roche Brings in a New Leader and Replaces Its Management Committee -

Module 6 Option Strategies.Pdf

zerodha.com/varsity TABLE OF CONTENTS 1 Orientation 1 1.1 Setting the context 1 1.2 What should you know? 3 2 Bull Call Spread 6 2.1 Background 6 2.2 Strategy notes 8 2.3 Strike selection 14 3 Bull Put spread 22 3.1 Why Bull Put Spread? 22 3.2 Strategy notes 23 3.3 Other strike combinations 28 4 Call ratio back spread 32 4.1 Background 32 4.2 Strategy notes 33 4.3 Strategy generalization 38 4.4 Welcome back the Greeks 39 5 Bear call ladder 46 5.1 Background 46 5.2 Strategy notes 46 5.3 Strategy generalization 52 5.4 Effect of Greeks 54 6 Synthetic long & arbitrage 57 6.1 Background 57 zerodha.com/varsity 6.2 Strategy notes 58 6.3 The Fish market Arbitrage 62 6.4 The options arbitrage 65 7 Bear put spread 70 7.1 Spreads versus naked positions 70 7.2 Strategy notes 71 7.3 Strategy critical levels 75 7.4 Quick notes on Delta 76 7.5 Strike selection and effect of volatility 78 8 Bear call spread 83 8.1 Choosing Calls over Puts 83 8.2 Strategy notes 84 8.3 Strategy generalization 88 8.4 Strike selection and impact of volatility 88 9 Put ratio back spread 94 9.1 Background 94 9.2 Strategy notes 95 9.3 Strategy generalization 99 9.4 Delta, strike selection, and effect of volatility 100 10 The long straddle 104 10.1 The directional dilemma 104 10.2 Long straddle 105 10.3 Volatility matters 109 10.4 What can go wrong with the straddle? 111 zerodha.com/varsity 11 The short straddle 113 11.1 Context 113 11.2 The short straddle 114 11.3 Case study 116 11.4 The Greeks 119 12 The long & short straddle 121 12.1 Background 121 12.2 Strategy notes 122 12..3 Delta and Vega 128 12.4 Short strangle 129 13 Max pain & PCR ratio 130 13.1 My experience with option theory 130 13.2 Max pain theory 130 13.3 Max pain calculation 132 13.4 A few modifications 137 13.5 The put call ratio 138 13.6 Final thoughts 140 zerodha.com/varsity CHAPTER 1 Orientation 1.1 – Setting the context Before we start this module on Option Strategy, I would like to share with you a Behavioral Finance article I read couple of years ago. -

Ice Crude Oil

ICE CRUDE OIL Intercontinental Exchange® (ICE®) became a center for global petroleum risk management and trading with its acquisition of the International Petroleum Exchange® (IPE®) in June 2001, which is today known as ICE Futures Europe®. IPE was established in 1980 in response to the immense volatility that resulted from the oil price shocks of the 1970s. As IPE’s short-term physical markets evolved and the need to hedge emerged, the exchange offered its first contract, Gas Oil futures. In June 1988, the exchange successfully launched the Brent Crude futures contract. Today, ICE’s FSA-regulated energy futures exchange conducts nearly half the world’s trade in crude oil futures. Along with the benchmark Brent crude oil, West Texas Intermediate (WTI) crude oil and gasoil futures contracts, ICE Futures Europe also offers a full range of futures and options contracts on emissions, U.K. natural gas, U.K power and coal. THE BRENT CRUDE MARKET Brent has served as a leading global benchmark for Atlantic Oseberg-Ekofisk family of North Sea crude oils, each of which Basin crude oils in general, and low-sulfur (“sweet”) crude has a separate delivery point. Many of the crude oils traded oils in particular, since the commercialization of the U.K. and as a basis to Brent actually are traded as a basis to Dated Norwegian sectors of the North Sea in the 1970s. These crude Brent, a cargo loading within the next 10-21 days (23 days on oils include most grades produced from Nigeria and Angola, a Friday). In a circular turn, the active cash swap market for as well as U.S. -

Tax Treatment of Derivatives

United States Viva Hammer* Tax Treatment of Derivatives 1. Introduction instruments, as well as principles of general applicability. Often, the nature of the derivative instrument will dictate The US federal income taxation of derivative instruments whether it is taxed as a capital asset or an ordinary asset is determined under numerous tax rules set forth in the US (see discussion of section 1256 contracts, below). In other tax code, the regulations thereunder (and supplemented instances, the nature of the taxpayer will dictate whether it by various forms of published and unpublished guidance is taxed as a capital asset or an ordinary asset (see discus- from the US tax authorities and by the case law).1 These tax sion of dealers versus traders, below). rules dictate the US federal income taxation of derivative instruments without regard to applicable accounting rules. Generally, the starting point will be to determine whether the instrument is a “capital asset” or an “ordinary asset” The tax rules applicable to derivative instruments have in the hands of the taxpayer. Section 1221 defines “capital developed over time in piecemeal fashion. There are no assets” by exclusion – unless an asset falls within one of general principles governing the taxation of derivatives eight enumerated exceptions, it is viewed as a capital asset. in the United States. Every transaction must be examined Exceptions to capital asset treatment relevant to taxpayers in light of these piecemeal rules. Key considerations for transacting in derivative instruments include the excep- issuers and holders of derivative instruments under US tions for (1) hedging transactions3 and (2) “commodities tax principles will include the character of income, gain, derivative financial instruments” held by a “commodities loss and deduction related to the instrument (ordinary derivatives dealer”.4 vs. -

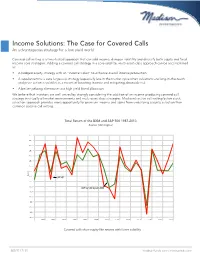

Income Solutions: the Case for Covered Calls an Advantageous Strategy for a Low-Yield World

Income Solutions: The Case for Covered Calls An advantageous strategy for a low-yield world Covered call writing is a time-tested approach that can add income, dampen volatility and diversify both equity and fixed income core strategies. Adding a covered call strategy in a core-satellite, multi-asset-class approach can be accomplished as: • A hedged equity strategy with an “income kicker” to enhance overall income production • A supplement to a core large-cap strategy (especially late in the market cycle when valuations are long-in-the-tooth and price action is volatile) as a means of boosting income and mitigating downside risk • A better-yielding alternative to a high yield bond allocation We believe that investors are well-served by strongly considering the addition of an income-producing covered call strategy in virtually all market environments and multi-asset class strategies. Madison’s active call writing/active stock selection approach provides more opportunity for premium income and alpha from underlying security selection than common passive call writing. Total Return of the BXM and S&P 500 1987-2013 Rolling Returns Source: Morningstar Time Period: 1/1/1987 to 12/31/2013 Rolling Window: 1 Year 1 Year shift 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 Return 0.0 S&P 500 -5.0 -10.0 CBOE S&P 500 Buywrite BXM -15.0 -20.0 -25.0 -30.0 -35.0 -40.0 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 S&P 500 TR USD Covered calls show equity-likeCBOE returns S&P 500 with Buyw ritelower BXM volatility Source: Morningstar Direct 888.971.7135 madisonfunds.com | madisonadv.com Covered Call Strategy(A) Benefits of Individual Stock Options vs. -

Options Slide Deck Updated Version

www.levelupbootcamps.com 4/4/21 Derivatives Option Strategies 4/4/21 LevelUp, LLC©2021 All rights reserved 1 1 Derivatives & Currency Management Option Strategies 4/4/21 LevelUp, LLC©2021 All rights reserved 2 2 Level Up, LLC©2021 All rights reserved 1 www.levelupbootcamps.com 4/4/21 Risk Management with Options Synthetic Positions • Synthetic Long & Short Forward Option Strategies • Synthetic Puts & Calls Multiple Option Strategies Single Option + Underlying Single Option Directionless Volatility Long U/L Risk Reduction Writing Puts • Long Straddle = LC + LP Covered Call = U/L + SC • Lower purchase cost • Short Straddle = SC + SP • Income enhancement • Fiduciary put = SP + Money Spreads • Reduce at favorable price cash to cover (ftn 13) “Small Moves Up or Down” • Target price realization The Greeks • Bull & Bear Call Spreads • Manza Case 1. Delta + & - • Bear & Bull Put Spreads Protective Put = U/L + LP 2. Gamma + • Insurance Calendar Spreads 3. Theta (time) - Collar = U/L + LP + SC Short “Its all about Theta” 4. Vega (Implied Vol) + • Risk Reversal • Long Calendar Spread Portfolio Mgt • Short Calendar Spread Short U/L Risk Reduction 1. Strategies using • Short U/L + Long Call volatility & market view • Short U/L + Short Put 2. Adjusting risk exposure 4/4/21 LevelUp, LLC©2021 All rights reserved 3 3 Single Option Strategies Refresher . just in case + + X S Long Call – LC S Short Call – SC - - X “writing” Want U/L up – bullish Want U/L down – bearish Right to buy at strike price X Obligated to sell at strike price X Max gain = ∞ when S -

11 Option Payoffs and Option Strategies

11 Option Payoffs and Option Strategies Answers to Questions and Problems 1. Consider a call option with an exercise price of $80 and a cost of $5. Graph the profits and losses at expira- tion for various stock prices. 73 74 CHAPTER 11 OPTION PAYOFFS AND OPTION STRATEGIES 2. Consider a put option with an exercise price of $80 and a cost of $4. Graph the profits and losses at expiration for various stock prices. ANSWERS TO QUESTIONS AND PROBLEMS 75 3. For the call and put in questions 1 and 2, graph the profits and losses at expiration for a straddle comprising these two options. If the stock price is $80 at expiration, what will be the profit or loss? At what stock price (or prices) will the straddle have a zero profit? With a stock price at $80 at expiration, neither the call nor the put can be exercised. Both expire worthless, giving a total loss of $9. The straddle breaks even (has a zero profit) if the stock price is either $71 or $89. 4. A call option has an exercise price of $70 and is at expiration. The option costs $4, and the underlying stock trades for $75. Assuming a perfect market, how would you respond if the call is an American option? State exactly how you might transact. How does your answer differ if the option is European? With these prices, an arbitrage opportunity exists because the call price does not equal the maximum of zero or the stock price minus the exercise price. To exploit this mispricing, a trader should buy the call and exercise it for a total out-of-pocket cost of $74.