Future of the Global Monetary and Financial System: 75 Years After Bretton Woods

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Conduct of Monetary Policy, Report of the Federal Reserve Board, July 24

CONDUCT OF MONETARY POLICY HEARING BEFORE THE COMMITTEE ON BANKING AND FINANCIAL SERVICES HOUSE OF REPRESENTATIVES ONE HUNDRED FIFTH CONGRESS FIRST SESSION JULY 24, 1997 Printed for the use of the Committee on Banking and Financial Services Serial No. 105-25 U.S. GOVERNMENT PRINTING OFFICE 42-634 CC WASHINGTON : 1997 For sale by the U.S. Government Printing Office Superintendent of Documents, Congressional Sales Office, Washington, DC 20402 ISBN 0-16-055923-5 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis HOUSE COMMITTEE ON BANKING AND FINANCIAL SERVICES JAMES A. LEACH, Iowa, Chairman BILL MCCOLLUM, Florida, Vice Chairman MARGE ROUKEMA, New Jersey HENRY B. GONZALEZ, Texas DOUG BEREUTER, Nebraska JOHN J. LAFALCE, New York RICHARD H. BAKER, Louisiana BRUCE F. VENTO, Minnesota RICK LAZIO, New York CHARLES E. SCHUMER, New York SPENCER BACHUS, Alabama BARNEY FRANK, Massachusetts MICHAEL N. CASTLE, Delaware PAUL E. KANJORSKI, Pennsylvania PETER T. KING, New York JOSEPH P. KENNEDY II, Massachusetts TOM CAMPBELL, California FLOYD H. FLAKE, New York EDWARD R. ROYCE, California MAXINE WATERS, California FRANK D. LUCAS, Oklahoma CAROLYN B. MALONEY, New York JACK METCALF, Washington LUIS V. GUTIERREZ, Illinois ROBERT W. NEY, Ohio LUCILLE ROYBAL-ALLARD, California ROBERT L. EHRLICH JR., Maryland THOMAS M. BARRETT, Wisconsin BOB BARR, Georgia NYDIA M. VELAZQUEZ, New York JON D. FOX, Pennsylvania MELVIN L. WATT, North Carolina SUE W. KELLY, New York MAURICE D. HINCHEY, New York RON PAUL, Texas GARY L. ACKERMAN, New York DAVE WELDON, Florida KEN BENTSEN, Texas JIM RYUN, Kansas JESSE L. JACKSON JR., Illinois MERRILL COOK, Utah CYNTHIA A. -

Retirement Accumulation 18 VIII CONTENTS

Nonfi nancial Defi ned Contribution Pension Schemes in a Changing Pension World Nonfi nancial Defi ned Contribution Pension Schemes in a Changing Pension World VOLUME 2 GENDER, POLITICS, AND FINANCIAL STABILITY Robert Holzmann, Edward Palmer, and David Robalino, editors © 2013 International Bank for Reconstruction and Development / The World Bank 1818 H Street NW Washington DC 20433 Telephone: 202-473-1000 Internet: www.worldbank.org Some rights reserved 1 2 3 4 15 14 13 12 This work is a product of the staff of The World Bank with external contributions. Note that The World Bank does not necessarily own each component of the content included in the work. The World Bank therefore does not warrant that the use of the content contained in the work will not infringe on the rights of third parties. The risk of claims resulting from such infringement rests solely with you. The findings, interpretations, and conclusions expressed in this work do not necessarily reflect the views of The World Bank, its Board of Executive Directors, or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorse- ment or acceptance of such boundaries. Nothing herein shall constitute or be considered to be a limitation upon or waiver of the privileges and immunities of The World Bank, all of which are specifically reserved. -

Estados Unidos Más Allá De La Crisis

ESTADOS UNIDOS MÁS ALLÁ DE LA CRISIS coordinadores dídimo castillo fernández marco a. gandásegui, hijo presentación theotonio dos santos presentación john saxe-fernández por theotonio dos santos carlos eduardo martins orlando caputo leiva jaime ornelas delgado marco a. gandásegui, hijo adrián sotelo valencia katia cobarrubias hernández daniel munevar fabio grobart sunshine dídimo castillo fernández alejandro i. canales james martin cypher jorge hernández martínez darío salinas figueredo luis suárez salazar silvina maría romano jaime zuluaga nieto maría josé rodríguez rejas catalina toro pérez gian carlo delgado ramos HC103 E77 2012 Estados Unidos: más allá de la crisis / coordinación, Dídimo Castillo Fernández, Marco A. Gandásegui ; por Theotonio Dos Santos [y otros diecinueve]. — México : Siglo XXI Editores, Consejo Latinoamericano de Ciencias Sociales, Facultad de Ciencias Políticas y Sociales de la uaem, 2012. 537 p. — (Sociología y política) isbn: 978-607-03-0437-8 Estados Unidos – Condiciones sociales. Estados Unidos – Condiciones económicas. Estados Unidos – Política y gobier- no. Castillo Fernández, Dídimo, editor. ii. Gandásegui, Marco A., editor. iii. Dos Santos, Theotonio, colaborador. iv. t. v. Ser. primera edición, 2012 © siglo xxi editores, s. a. de c. v. © consejo latinoamericano de ciencias sociales © facultad de ciencias políticas y sociales de la uaem isbn 978-607-03-0437-8 derechos reservados. prohibida su reproducción total o parcial por cualquier medio. impreso en litográfica ingramex, s. a. de c. v. centeno 162-1, col. granjas esmeralda, 09810, iztapalapa, df, méxico. PRESENTACIÓN theotonio dos santos Hasta nuestros amigos más solidarios nos preguntan: ¿por qué tantos libros sobre Estados Unidos? ¿Por qué no estudian América Latina? La respuesta está en parte en este libro: porque para comprender América Latina tenemos que estudiar a Estados Unidos desde nuestro punto de vista. -

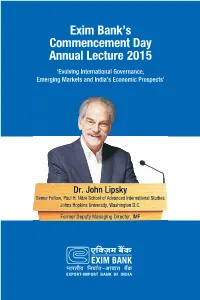

Exim Bank's Commencement Day Annual Lecture 2015

Exim Bank’s Commencement Day Annual Lecture 2015 ‘Evolving International Governance, Emerging Markets and India’s Economic Prospects’ Dr. John Lipsky Senior Fellow, Paul H. Nitze School of Advanced International Studies Johns Hopkins University, Washington D.C. Former Deputy Managing Director, IMF 101 This is the Thirtieth Exim Bank Commencement Day Annual Lecture, delivered at the Y. B. Chavan Centre, Mumbai - 400 021 on Monday, March 23, 2015. No part of this Lecture may be reproduced without the permission of Export-Import Bank of India. The views and interpretations in this document are those of the author and not ascribable to Export-Import Bank of India. Evolving International Governance, Emerging Markets and India’s Economic Prospects Dr. John Lipsky Senior Fellow Foreign Policy Institute The Paul H. Nitze School of Advanced International Studies Johns Hopkins University Washington, DC I’m honoured to be speaking today at this important event sponsored by EXIM Bank - an institution that is playing a key role in promoting India’s trading relationships with partners around the world - and I would like to thank the management of EXIM for the opportunity to be here. Of course, EXIM Bank’s kind invitation to be the 2015 Commencement Speaker led me to look back at the institution’s history. I found it somewhat surprising that the institution commenced operations just 33 years ago. Perhaps the promotion of India’s international commercial relations previously hadn’t seemed so central to India’s future progress and prosperity, as it does today. Of course, it is sobering, daunting, but also amazing and energizing to realize how much has changed in just that relatively brief span since EXIM’s founding. -

Holzmann Steen J0rgensen

SP DISCUSSION PAPER NO. 0006 21314 Public Disclosure Authorized Social Risk Management: 0 QANew Conceptual Framework for Social Protection and Beyond Public Disclosure Authorized ~ =F_ Robert Holzmann Steen J0rgensen February2000 Public Disclosure Authorized Public Disclosure Authorized Prot tton LABOR MARKETS, PENSIONS SOCIAEASSISTANCE T HE W O R L D B A N K Social Risk Management: A new conceptual framework for Social Protection and beyond Robert Holzmann Steen J0rgensen` February 2000 Social Protection Discussion Paper No. 0006 Abstract This paper proposes a new definition and conceptual framework for Social Protection grounded in Social Risk Management. The concept repositions the traditional areas of Social Protection (labor market intervention, social insurance and social safety nets) in a framework that includes three strategies to deal with risk (prevention, mitigation and coping), three levels of formality of risk management (informal, market-based, public) and many actors (individuals, households, communities, NGOs, governments at various levels and international organizations) against the background of asymmetric information and different types of risk. This expanded view of Social Protection emphasizes the double role of risk management instruments - protecting basic livelihood as well as promoting risk taking. It focuses specifi- cally on the poor since they are the most vulnerable to risk and typically lack appropriate risk management instruments, which constrains them from engaging in riskier but also higher return activities and hence gradually moving out of chronic poverty. Director, Social Protection, Hurnan Development Network, The World Bank Tel.: (1-202) 473.0004, Email: [email protected] Sector Manager, Social Protection, Human Development Network, The World Bank Tel.: (1-202) 473.4062, Email: [email protected] I. -

The Redesign of EMU in a Global Perspective Bios for Speakers

Forward to a New Normal: The redesign of EMU in a global perspective Brussels, November 26, 2013 Berlaymont, Salle Schuman Bios for Speakers 09:00-10:30 Competitiveness, structural reforms and growth in an international perspective. Chair: Servaas Deroose (Deputy Director General, DG ECFIN) Speakers: John Lipsky (Distinguished Visiting Scholar, Johns Hopkins SAIS) PierCarlo Padoan (Deputy Secretary General, OECD) Discussants: Marcel Fratzscher (President, DIW Berlin) André Sapir (Professor, Université libre de Bruxelles) Servaas Deroose has been Deputy Director-General at the European Commission's Directorate-General for Economic and Financial Affairs since 2010. In this capacity, he co-ordinates the DG's work on EU governance, integrated macroeconomic surveillance, EU2020, competitiveness and fiscal policy. After graduating in economics from the University of Ghent, Servaas Deroose worked as a researcher at the Economics Faculty of the University of Ghent. He joined the European Commission in 1985 and has worked mainly in the fields of macroeconomic surveillance (economic forecasts, economic policy co-ordination, and budgetary policy) and EMU-related issues (economic convergence, euro adoption, imbalances). John Lipsky served as First Deputy Managing Director of the International Monetary Fund from 2006 to 2011. He retired from the IMF in November 2011 and is currently a Distinguished Visiting Scholar at Johns Hopkins School of Advanced International Studies. Before coming to the Fund, Mr. Lipsky was Vice Chairman of the JPMorgan Investment Bank. Previously, Mr. Lipsky served as JPMorgan's Chief Economist, and as Chase Manhattan Bank's Chief Economist and Director of Research. He served as Chief Economist of Salomon Brothers, Inc. from 1992 until 1997. -

Robert Holzmann World Bank Topics

Population Aging, Public Expenditures and Financial/Economic Crises: (Re-)establishing priorities? Brussels Economic Forum 2009 Beyond the crisis: a changing economic landscape Brussels, May 15, 2009 Robert Holzmann World Bank Topics I.I. Aging and public expenditure: From projections to policy simulations II. Aging, economic crisis and the future of multimulti--pillarpillar pension schemes I. Aging and public expenditure: Beyond projections … ••KudosKudos to AWG: Very impressive process, approach and results; international best practice ••PopulationPopulation aging is a worldworld--widewide phenomenon but the “North” is subject to two effects: Increasing share of elderly and low or negative labor force growth, with consequences for expenditure shares as well as benefit levels (through internal rate of return, i.e. employment plus productivity growth) ••ForFor EUEU--widewide policy actions important to move beyond projections to policy simulations about key triggers to avoid expenditure crisis while delivering expected social benefits Old-age dependency ratio (ratio of people aged 65 or above relative to the working-age population) 80 70 60 50 40 30 20 10 0 Africa India World Asia Oceania Latin United Northern China Russian Europe EU27 Japan America States America Federation 1950 2000 2050 Table 3. Annual Growth Rates of the Labor Force, 2005–50 Percent Country Medium variant Zero migration Difference China −0.28 −0.25 0.03 Europe and Russia −0.68 −0.85 −0.17 High Income East Asia and Pacific −0.56 −0.75 −0.19 North America 0.44 −0.12 −0.56 Latin America a nd Caribbean 0.83 0.95 0.12 Low and Middle Income East Asia and Pacific 0.79 0.86 0.07 Middle East, North Africa, and Turkey 1.36 1.38 0.02 South and Central Asia 1.25 1.29 0.04 Sub-Saharan Africa 2.32 2.34 0.02 Total 0.77 0.77 0.00 Sources: United Nations (2005); author’s calculations. -

U.S., Chinese Officials Named to Key IMF Posts - Print Document - Proquest Page 1 of 2

U.S., Chinese Officials Named to Key IMF Posts - Print document - ProQuest Page 1 of 2 Back to document U.S., Chinese Officials Named to Key IMF Posts Reddy, Sudeep. Wall Street Journal (Online) [New York, N.Y] 13 July 2011: /. Abstract (summary) WASHINGTON--The International Monetary Fund said Tuesday it would install White House aide David Lipton as its No. 2 official and elevate Zhu Min of China to a newly created deputy managing director post. Full Text WASHINGTON--The International Monetary Fund said Tuesday it would install White House aide David Lipton as its No. 2 official and elevate Zhu Min of China to a newly created deputy managing director post. The appointments by new IMF managing director Christine Lagarde--who took over last week after serving as France's finance minister--maintain the longstanding arrangement in which a European fills the top post and an American takes the No. 2 role. The addition of Mr. Zhu, however, is a new move designed to balance the fund's traditional leadership with representation from emerging markets. Mr. Lipton, special assistant to the president for international economic affairs, was the Treasury Department's top international official in the Clinton administration. He will effectively serve as a link between the IMF and the U.S., the institution's top funder and most powerful member. Mr. Lipton, 57 years old, will become a senior adviser to Ms. Lagarde on July 26 before taking his new role as first deputy managing director on Sept. 1. He will succeed John Lipsky, who will remain through November as a special adviser to the IMF chief. -

A Viable International Tax-Order for Cross-Border Pensions

University of Konstanz Department of Economics A Viable International Tax-Order for Cross-Border Pensions Bernd Genser & Robert Holzmann Working Paper Series 2018-02 https://ideas.repec.org/s/knz/dpteco.html A Viable International Tax-Order for Cross-Border Pensions Bernd Genser 1 and Robert Holzmann 2 (March 1, 2018) Abstract There is strong evidence that the existing pattern of cross-border pension taxation in OECD countries and beyond is extremely diverse and inconsistent and thus generates a double equity dilemma for individuals and countries alike. We argue that this dilemma cannot be solved within the current double-taxation treaty network and therefore propose a new conceptual framework for the taxation of old-age pensions in a world of high and increasing cross-border mobility of workers and pensioners. We demonstrate that a coordinated move to a front- loaded pension tax system and exclusive source taxation would pave the way for an international pension tax order which eliminates the double equity dilemma. As an additional innovative element of front-loaded pension taxation we discuss the decoupling of individual tax assessment and tax payment which may prove helpful by smoothing transitional effects when the front-loaded pension tax system is introduced. Keywords: pension taxation, international taxation, international migration, double taxation convention JEL classification numbers: H2, H20, H55, H87, F22 1 Professor of Economics, University of Konstanz (retired) 2 Professor of Economics and Fellow of the Austrian Academy of Sciences (Vienna), with honorary chairs at the Centre of Excellence in Population Ageing Research, University of New South Wales (Sydney) and the Social Security Research Centre, University of Malaya (Kuala Lumpur) 2 1 Introduction In many OECD countries the taxation of old-age income has become an issue in recent tax reforms. -

What Are NDC Pension Systems? What Do They Bring to Reform Strategies?

[Final Revision: 06 March 2004] What are NDC Pension Systems? What Do They Bring to Reform Strategies? Axel Börsch-Supan Mannheim Institute for the Economics of Aging (MEA), Mannheim University National Bureau of Economic Research (NBER), Cambridge, Mass., USA ABSTRACT This paper has two parts. Part 1 presents the basic ideas underlying notional defined contribution (NDC) systems and discusses their main advantages and disadvantages. We argue that a NDC system is mainly a political device. It makes parametric reform, badly needed to stabilize the pay-as-you-go (PAYG) pillars all over the World, easier because it exposes the trade-offs and clarifies concepts. It may also change the microeconomics of labor supply and savings. It does not, however, change the macroeconomics of PAYG systems and thus does not substitute for the introduction of pre-funded second and third pillars. NDC systems can be installed as individual account systems, as done most prominently in Sweden. However, they can also be mimicked by a set of rules in a conventional defined benefits PAYG system, showing that NDC systems are more a political than economic devices. Part 2 describes how the German pension reform proposals made in late summer 2003 effectively introduce a NDC system without explicit NDC-type accounting. Address: Mannheim Research Institute for the Economics of Aging, (MEA), Department of Economics, Mannheim University L13,17 D-68131 Mannheim, Germany e-mail: [email protected] Acknowledgements: This paper has been written for the World Bank – RFV Conference on NDC Pensions in Sandhamn, Sweden, September 29-30. It takes as point of departure and owes much intellectual debt to Richard Disney’s 1999 paper. -

Status and Progress in Cross-Border Portability of Social Security Benefits

DISCUSSION PAPER SERIES IZA DP No. 11481 Status and Progress in Cross-Border Portability of Social Security Benefits Robert Holzmann Jacques Wels APRIL 2018 DISCUSSION PAPER SERIES IZA DP No. 11481 Status and Progress in Cross-Border Portability of Social Security Benefits Robert Holzmann Austrian Academy of Sciences, University of New South Wales, University of Malaya, IZA and CESifo Jacques Wels University of Cambridge and Université libre de Bruxelles APRIL 2018 Any opinions expressed in this paper are those of the author(s) and not those of IZA. Research published in this series may include views on policy, but IZA takes no institutional policy positions. The IZA research network is committed to the IZA Guiding Principles of Research Integrity. The IZA Institute of Labor Economics is an independent economic research institute that conducts research in labor economics and offers evidence-based policy advice on labor market issues. Supported by the Deutsche Post Foundation, IZA runs the world’s largest network of economists, whose research aims to provide answers to the global labor market challenges of our time. Our key objective is to build bridges between academic research, policymakers and society. IZA Discussion Papers often represent preliminary work and are circulated to encourage discussion. Citation of such a paper should account for its provisional character. A revised version may be available directly from the author. IZA – Institute of Labor Economics Schaumburg-Lippe-Straße 5–9 Phone: +49-228-3894-0 53113 Bonn, Germany Email: [email protected] www.iza.org IZA DP No. 11481 APRIL 2018 ABSTRACT Status and Progress in Cross-Border Portability of Social Security Benefits The importance of cross-border portability of social benefits is increasing in parallel with the rise in the absolute number of international migrants and their share of the world population, and perhaps more importantly, with the rising share of world population that for some part of their life is working and/or retiring abroad. -

Canadian Journal of Economics and Political Science, Vol

- 50- References Aaron, Henry 1., 1966, "The Social Insurance Paradox," Canadian Journal ofEconomics and Political Science, Vol. 32 (August), pp. 371-74. _~, 1982, Economic Effects ofSocial Security (Washington: Brookings Institution). Agulnik, Phil, 2000, "Maintaining Incomes After Work: Do Compulsory Earnings-Related Pensions Make Sense?" Oxford Review ofEconomic Policy, Vol. 16, Issue 1, pp. 45- 56. _--" and Nicholas A, Barr 2000, "The PubliclPrivate Mix in u.K. Pension Policy," World Economics, Vol. 1 (January-March), pp. 69-80. Arenas de Mesa, Alberto, and Mario Marcel, 1999, "Fiscal Effects of Social Security Reform in Chile: The Case of the Minimum Pension" paper presented at the APEC second regional forum on pension funds reforms, Viiia del Mar, Chile, April 26-27. Asher, Mukul G., 1999, "The Pension System in Singapore," Social Protection Discussion PaperNo. 9919 (Washington: World Bank). Atkinson, A B., 1999, The Economic Consequences ofRolling Back the Welfare State (Cambridge, Massachusetts: MIT Press). Auerbach, Alan J., and Laurence 1. Kotlikoff, 1990, "Demographics, Fiscal Policy, and U.S. Saving in the 1980s and Beyond," in Tax Policy and the Economy, ed. by Lawrence H. Summers, Vol. 4 (Cambridge, Massachusetts: National Bureau of Economic Research and MIT Press). Auerbach, Alan J., et al., 1989, "The Economic Dynamics of Ageing Populations: The Case of Four OECD Countries," OECD Working Paper No. 62 (paris: OECD). Australia, Department of Family and Community Services, 1998, "The Australian System of Social Protection-What (overseas) Economists Should Know," paper presented at a research agenda conference on "Income Support, Labour Markets and Behaviour," Australian National University, Canberra. Barr, Nicholas A, 1979, "Myths My Grandpa Taught Me," Three Banks Review, No.