The Ecommerce Tsunami-Part1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Food Delivery Brands Head-To-Head the Ordering Operation

FOOD DELIVERY BRANDS HEAD-TO-HEAD THE ORDERING OPERATION Market context: The UAE has a well-established tradition of getting everything delivered to your doorstep or to your car at the curb. So in some ways, the explosion of food delivery brands seems almost natural. But with Foodora’s recent exit from the UAE, the acquisition of Talabat by Rocket Internet, and the acquisition of Foodonclick and 24h by FoodPanda, it seemed the time was ripe to put the food delivery brands to the test. Our challenge: We compared six food delivery brands in Dubai to find the most rewarding, hassle-free ordering experience. Our approach: To evaluate the complete customer experience, we created a thorough checklist covering every facet of the service – from signing up, creating accounts, and setting up delivery addresses to testing the mobile functionality. As a control sample, we first ordered from the same restaurant (Maple Leaf, an office favorite) using all six services to get a taste for how each brand handled the same order. Then we repeated the exercise, this time ordering from different restaurants to assess the ease of discovering new places and customizing orders. To control for other variables, we placed all our orders on weekdays at 1pm. THE JUDGING PANEL 2 THE COMPETITIVE SET UAE LAUNCH OTHER MARKETS SERVED 2011 Middle East, Europe 2015 12 countries, including Hong Kong, the UK, Germany 2011 UAE only 2010 Turkey, Lebanon, Qatar 2012 GCC, including Bahrain, Kuwait, Qatar, Saudi Arabia 2015 17 countries, including India, the USA, the UK THE REVIEW CRITERIA: • Attraction: Looks at the overall design, tone of voice, community engagement, and branding. -

Global Delivery and Takeaway Food Market

+44 20 8123 2220 [email protected] Global Delivery and Takeaway Food Market Report 2021 https://marketpublishers.com/r/GD9E8CD81AE5EN.html Date: March 2021 Pages: 122 Price: US$ 2,350.00 (Single User License) ID: GD9E8CD81AE5EN Abstracts At the beginning of 2020, COVID-19 disease began to spread around the world, millions of people worldwide were infected with COVID-19 disease, and major countries around the world have implemented foot prohibitions and work stoppage orders. Except for the medical supplies and life support products industries, most industries have been greatly impacted, and Delivery and Takeaway Food industries have also been greatly affected. In the past few years, the Delivery and Takeaway Food market experienced a growth of XXX, the global market size of Delivery and Takeaway Food reached XXX million $ in 2020, of what is about XXX million $ in 2015. From 2015 to 2019, the growth rate of global Delivery and Takeaway Food market size was in the range of xxx%. At the end of 2019, COVID-19 began to erupt in China, Due to the huge decrease of global economy; we forecast the growth rate of global economy will show a decrease of about 4%, due to this reason, Delivery and Takeaway Food market size in 2020 will be XXX with a growth rate of xxx%. This is xxx percentage points lower than in previous years. As of the date of the report, there have been more than 20 million confirmed cases of CVOID-19 worldwide, and the epidemic has not been effectively controlled. Therefore, we predict that the global epidemic will be basically controlled by the end of 2020 and the global Delivery and Takeaway Food market size will reach XXX million $ in 2025, with a CAGR of xxx% between 2020-2025. -

Kopi Af Aktivlisten 2021-06-30 Ny.Xlsm

Velliv noterede aktier i alt pr. 30-06-2021 ISIN Udstedelsesland Navn Markedsværdi (i DKK) US0378331005 US APPLE INC 1.677.392.695 US5949181045 US MICROSOFT CORP 1.463.792.732 US0231351067 US AMAZON.COM INC 1.383.643.996 DK0060534915 DK NOVO NORDISK A/S-B 1.195.448.146 US30303M1027 US FACEBOOK INC-CLASS A 1.169.094.867 US02079K3059 US ALPHABET INC-CL A 867.740.769 DK0010274414 DK DANSKE BANK A/S 761.684.457 DK0060079531 DK DSV PANALPINA A/S 629.313.827 US02079K1079 US ALPHABET INC-CL C 589.305.120 US90138F1021 US TWILIO INC - A 514.807.852 US57636Q1040 US MASTERCARD INC - A 490.766.560 US4781601046 US JOHNSON & JOHNSON 478.682.981 US70450Y1038 US PAYPAL HOLDINGS INC 471.592.728 DK0061539921 DK VESTAS WIND SYSTEMS A/S 441.187.698 US79466L3024 US SALESFORCE.COM INC 439.114.061 US01609W1027 US ALIBABA GROUP HOLDING-SP ADR 432.325.255 US8835561023 US THERMO FISHER SCIENTIFIC INC 430.036.612 US22788C1053 US CROWDSTRIKE HOLDINGS INC - A 400.408.622 KYG875721634 HK TENCENT HOLDINGS LTD 397.054.685 KR7005930003 KR SAMSUNG ELECTRONICS CO LTD 389.413.700 DK0060094928 DK ORSTED A/S 378.578.374 ES0109067019 ES AMADEUS IT GROUP SA 375.824.429 US46625H1005 US JPMORGAN CHASE & CO 375.282.618 US67066G1040 US NVIDIA CORP 357.034.119 US17275R1023 US CISCO SYSTEMS INC 348.160.692 DK0010244508 DK AP MOLLER-MAERSK A/S-B 339.783.859 US20030N1019 US COMCAST CORP-CLASS A 337.806.502 NL0010273215 NL ASML HOLDING NV 334.040.559 CH0012032048 CH ROCHE HOLDING AG-GENUSSCHEIN 325.008.200 KYG970081173 HK WUXI BIOLOGICS CAYMAN INC 321.300.236 US4370761029 US HOME DEPOT INC 317.083.124 US58933Y1055 US MERCK & CO. -

Blackrock UK Smaller Companies PDF Factsheet

Adventurous 31 August 2021 Life Fund SW BlackRock UK Smaller Companies Life Asset Allocation (as at 31/07/2021) This document is provided for the purpose of UK Small Cap Companies 99.8% information only. This factsheet is intended for individuals who are familiar with investment Money Market 0.2% terminology. Please contact your financial adviser if you need an explanation of the terms used. This material should not be relied upon as sufficient information to support an investment decision. The portfolio data on this factsheet is updated on a quarterly basis. Fund Aim The fund aims for long-term growth by investing in UK smaller companies which the Fund Manager considers to have above average long-term growth prospects. The fund Sector Breakdown (as at 31/07/2021) invests solely through the BlackRock UK Consumer Discretionary 27.7% Smaller Companies Unit Trust. Industrials 25.1% Basic Fund Information Financials 12.2% Fund Launch Date 19/09/2001 Technology 11.3% Fund Size £5.3m Basic Materials 5.1% Sector ABI UK Smaller Other 4.9% Companies Energy 3.8% ISIN GB0030873565 Consumer Staples 3.8% MEX ID SWMUL Health Care 3.7% SEDOL 3087356 Telecommunications 2.5% Manager Name Roland Arnold Regional Breakdown (as at 31/07/2021) Manager Since 26/03/2015 Top Ten Holdings (as at 31/07/2021) WATCHES OF SWITZERLAND 2.9% GROUP PLC IMPAX ASSET MANAGEMENT 2.4% GROUP PLC TREATT PLC 2.2% The composition of asset mix and asset allocation may change at any time and exclude cash CVS GROUP PLC 2.1% unless otherwise stated BREEDON GROUP PLC 2.0% OXFORD INSTRUMENTS PLC 1.8% INTEGRAFIN HOLDINGS PLC 1.8% AUCTION TECHNOLOGY GROUP 1.7% PLC ERGOMED PLC 1.7% LEARNING TECHNOLOGIES GROUP 1.7% PL TOTAL 20.3% Page 1 Past Performance Fund Rating Information 100% Overall Morningstar **** Rating Morningstar Analyst Rating 50% FE fundinfo Crown Rating The FE fundinfo Crown Rating relates to this fund. -

Food Delivery Service in Question: the Development Of

Food Delivery Service in Question: The Development of Foodpanda in Taiwan and Its Problems about Labor Rights By Yu-Hsin Chang 張羽欣 Submitted to the Faculty of Department of International Affairs in partial fulfillment of the requirements for the degree of Bachelor of Arts in International Affairs Wenzao Ursuline University of Languages 2021 WENZAO URSULINE UNIVERSITY OF LANGAUGES DEPARTMENT OF INTERNATIONAL AFFAIRS This senior paper was presented by Yu-Hsin Chang 張羽欣 It was defended on November 28, 2020 and approved by Reviewer 1: Mark Lai, Associate Professor, Department of International Affairs Signature: _______________________________ Date: ________________________ Reviewer 2: Ren-Her Hsieh, Associate Professor, Department of International Affairs Signature: _______________________________ Date: ________________________ Advisor: Yu-Hsuan Lee, Assistant Professor, Department of International Affairs Signature: _______________________________ Date: ________________________ i Copyright © by Yu-Hsin Chang 張羽欣 2021 ii Food Delivery Service in Question: The Development of Foodpanda in Taiwan and Its Problems about Labor Rights Yu-Hsin Chang, B.A. Wenzao Ursuline University of Languages, 2021 Abstract In 2019, the food delivery platforms were sweeping across Taiwan. However, food delivery employees had experienced a series of problems. For example, a common traffic accident might risk their lives by catching more orders. Thus, the thesis’ focus is on employees’ working experience in the case of Foodpanda. The study explores how Foodpanda is becoming a new business and work through survey and in-depth interview with Foodpanda employees. I have a major finding of this study. It shows a sense of relative autonomy argued by the employees who choose this work because it is a flexible job that is very suitable for people who do not want to be restricted by time. -

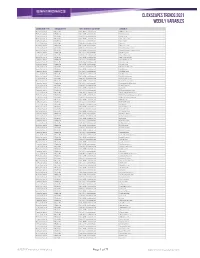

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

Online Platforms for Exchanging and Sharing Goods

CASE STUDY ONLINE PLATFORMS FOR EXCHANGING AND SHARING GOODS by Anders Fremstad 2/2/2015 A project of EXECUTIVE SUMMARY Americans own huge and underutilized stocks of consumer goods, including furniture, appliances, tools, toys, vehicles, and lodging. Websites like Craigslist, Couchsurfing, and NeighborGoods have lowered the transaction costs associated with acquiring secondhand goods and sharing underused goods, which may help us take advantage of this excess capacity. Indeed, advocates of the so-called sharing economy argue that technology can facilitate peer-to-peer transactions that enable us to save money, build community, and reduce environmental burdens. This case study evaluates the economic, social, and environmental effects of three online platforms. Craigslist provides an online market for local secondhand goods such as vehicles, furniture, appliances, and electronics. Couchsurfing matches travelers with hosts around the world who welcome guests into their homes. NeighborGoods helps people borrow and lend household goods free of charge. Together these case studies provide an overview of the role of online platforms as future economy initiatives. The economic benefits to these three platforms are significant, and likely to grow over time. Americans posted hundreds of millions of secondhand goods for sale on Craigslist in 2014, increasing access to affordable used goods. Couchsurfing has helped provide its members with millions of nights of free lodging, substantially reducing the cost of travel. While NeighborGoods has not achieved the scale of Craigslist or Couchsurfing, online platforms for sharing household goods could save Americans significant sums of money, especially if they can facilitate widespread ride-sharing and car-sharing. Online platforms may particularly improve the livelihoods of poor Americans. -

Mckinsey on Finance

McKinsey on Finance Perspectives on Corporate Finance and Strategy Number 59, Summer 2016 2 5 11 Bracing for a new era of The ‘tech bubble’ puzzle How a tech unicorn lower investment returns creates value 17 22 Mergers in the oil ‘ We’ve realized a ten-year patch: Lessons from strategy goal in one year’ past downturns McKinsey on Finance is a Editorial Board: David Copyright © 2016 McKinsey & quarterly publication written by Cogman, Ryan Davies, Marc Company. All rights reserved. corporate-finance experts Goedhart, Chip Hughes, and practitioners at McKinsey Eduardo Kneese, Tim Koller, This publication is not intended & Company. This publication Dan Lovallo, Werner Rehm, to be used as the basis offers readers insights into Dennis Swinford, Marc-Daniel for trading in the shares of any value-creating strategies and Thielen, Robert Uhlaner company or for undertaking the translation of those any other complex or strategies into company Editor: Dennis Swinford significant financial transaction performance. without consulting appropriate Art Direction and Design: professional advisers. This and archived issues of Cary Shoda McKinsey on Finance are No part of this publication Managing Editors: Michael T. available online at McKinsey may be copied or redistributed Borruso, Venetia Simcock .com, where selected articles in any form without the prior written consent of McKinsey & are also available in audio Editorial Production: Company. format. A series of McKinsey Runa Arora, Elizabeth Brown, on Finance podcasts is Heather Byer, Torea Frey, available on iTunes. Heather Hanselman, Katya Petriwsky, John C. Sanchez, Editorial Contact: Dana Sand, Sneha Vats McKinsey_on_Finance@ McKinsey.com Circulation: Diane Black To request permission to Cover photo republish an article, send an © Cozyta/Getty Images email to Quarterly_Reprints@ McKinsey.com. -

Sharing and Tourism: the Rise of New Markets in Transport

SHARING AND TOURISM: THE RISE OF NEW MARKEts IN TRANSPORT Documents de travail GREDEG GREDEG Working Papers Series Christian Longhi Marcello M. Mariani Sylvie Rochhia GREDEG WP No. 2016-01 http://www.gredeg.cnrs.fr/working-papers.html Les opinions exprimées dans la série des Documents de travail GREDEG sont celles des auteurs et ne reflèlent pas nécessairement celles de l’institution. Les documents n’ont pas été soumis à un rapport formel et sont donc inclus dans cette série pour obtenir des commentaires et encourager la discussion. Les droits sur les documents appartiennent aux auteurs. The views expressed in the GREDEG Working Paper Series are those of the author(s) and do not necessarily reflect those of the institution. The Working Papers have not undergone formal review and approval. Such papers are included in this series to elicit feedback and to encourage debate. Copyright belongs to the author(s). Sharing and Tourism: The Rise of New Markets in Transport Christian Longhi1, Marcello M. Mariani2 and Sylvie Rochhia1 1University Nice Sophia Antipolis, GREDEG, CNRS, 250 rue A. Einstein, 06560 Valbonne France [email protected], [email protected] 2University of Bologna, Via Capo di Lucca, 34 – 40126, Bologna, Italy [email protected] GREDEG Working Paper No. 2016-01 Abstract. This paper analyses the implications of sharing on tourists and tourism focusing on the transportation sector. The shifts from ownership to access, from products to services have induced dramatic changes triggered by the emergence of innovative marketplaces. The services offered by Knowledge Innovative Service Suppliers, start-ups at the origin of innovative marketplaces run through platforms allow the tourists to find solutions to run themselves their activities, bypassing the traditional tourism industry. -

Just Eat/Hungryhouse Appendices and Glossary to the Final Report

Anticipated acquisition by Just Eat of Hungryhouse Appendices and glossary Appendix A: Terms of reference and conduct of the inquiry Appendix B: Delivery Hero and Hungryhouse group structure and financial performance Appendix C: Documentary evidence relating to the counterfactual Appendix D: Dimensions of competition Appendix E: The economics of multi-sided platforms Appendix F: Econometric analysis Glossary Appendix A: Terms of reference and conduct of the inquiry Terms of reference 1. On 19 May 2017, the CMA referred the anticipated acquisition by Just Eat plc of Hungryhouse Holdings Limited for an in-depth phase 2 inquiry. 1. In exercise of its duty under section 33(1) of the Enterprise Act 2002 (the Act) the Competition and Markets Authority (CMA) believes that it is or may be the case that: (a) arrangements are in progress or in contemplation which, if carried into effect, will result in the creation of a relevant merger situation, in that: (i) enterprises carried on by, or under the control of, Just Eat plc will cease to be distinct from enterprises carried on by, or under the control of, Hungryhouse Holdings Limited; and (ii) the condition specified in section 23(2)(b) of the Act is satisfied; and (b) the creation of that situation may be expected to result in a substantial lessening of competition within a market or markets in the United Kingdom for goods or services, including in the supply of online takeaway ordering aggregation platforms. 2. Therefore, in exercise of its duty under section 33(1) of the Act, the CMA hereby makes -

Economic Perspectives

The Journal of The Journal of Economic Perspectives Economic Perspectives The Journal of Spring 2015, Volume 29, Number 2 Economic Perspectives Symposia The Bailouts of 2007–2009 Austan D. Goolsbee and Alan B. Krueger, “A Retrospective Look at Rescuing and Restructuring General Motors and Chrysler” W. Scott Frame, Andreas Fuster, Joseph Tracy, and James Vickery, “The Rescue of Fannie Mae and Freddie Mac” Charles W. Calomiris and Urooj Khan, “An Assessment of TARP Assistance to Financial Institutions” Robert McDonald and Anna Paulson, “AIG in Hindsight” Phillip Swagel, “Legal, Political, and Institutional Constraints on A journal of the the Financial Crisis Policy Response” American Economic Association Disability Insurance Jeffrey B. Liebman, “Understanding the Increase in Disability Insurance Benet 29, Number 2 Spring 2015 Volume Receipt in the United States” Pierre Koning and Maarten Lindeboom, “The Rise and Fall of Disability Insurance Enrollment in the Netherlands” James Banks, Richard Blundell, and Carl Emmerson, “Disability Benet Receipt and Reform: Reconciling Trends in the United Kingdom” Articles Darrell Dufe and Jeremy C. Stein, “Reforming LIBOR and Other Financial Market Benchmarks” Rainer Böhme, Nicolas Christin, Benjamin Edelman, and Tyler Moore, “Bitcoin: Economics, Technology, and Governance” Konstantin Kashin, Gary King, and Samir Soneji, “Systematic Bias and Nontransparency in US Social Security Administration Forecasts” Recommendations for Further Reading Spring 2015 The Journal of Economic Perspectives A journal of -

Detroit-Based Stockx Closes $110M Series C Led by DST Global, General Atlantic and GGV Capital; Names E-Commerce Veteran Scott Cutler CEO

Detroit-based StockX Closes $110M Series C Led by DST Global, General Atlantic and GGV Capital; Names e-commerce Veteran Scott Cutler CEO Largest VC funding round in Michigan history Co-founder Josh Luber to remain on executive leadership team and board of directors Detroit, Michigan - June 26, 2019 StockX, the world’s first ‘stock market of things’, has closed on a $110 million Series C funding round from investment firms DST Global, General Atlantic, and GGV Capital. The company also announced today the appointment of Scott Cutler as CEO. Cutler succeeds co-founder Josh Luber, who will continue to serve on the executive leadership team and board of directors. The raise, in which current investors GV and Battery Ventures also participated, represents the largest in Michigan VC history to date and values StockX at over $1 billion. The company, which surpassed a $1 billion annual GMV run rate in less than three years, plans to leverage the new investment to further expand its international growth with a specific focus on Europe and the Asian markets. StockX has customers in nearly 200 countries and upwards of 15 million monthly active users. The funding will also allow the brand to diversify its product categories and extend its offline reach with brick-and-mortar locations in key international markets. The first-of-its-kind online ‘bid/ask’ marketplace will focus heavily on product development and will continue to collaborate with some of the world’s foremost brands to release products directly on the StockX platform through its “initial product offerings.” “GGV Capital has long seen the value of investing in e-commerce disruptors and StockX is no exception.