Krishnapatnam Industrial Node Development Plan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Environmental Impact Assessment of Krishnapatnam Industrial North Node

Andhra Pradesh Industrial National Industrial Corridor Development Infrastructure Corporation Corporation (NICDC) Limited. ENVIRONMENTAL IMPACT ASSESSMENT OF KRISHNAPATNAM INDUSTRIAL NORTH NODE Executive Summary August 2020 SUBMITTED BY L&T Infra Engineering C11811311 RP005, Rev. 0 L&T Infrastructure Engineering Ltd. Client: National Industrial Corridor Development Corporation Limited NICDC Project: Project No.: EIA Krishnapatnam North Node C1181311 Title: Document No.: Rev.: Executive Summary RP005 0 This document is the property of L&T Infrastructure Engineering Ltd. and File path: must not be passed on to any person or body not authorised by us to receive it l:\ports\2018\c1181311 - eia krishnapatnam node\working\reports\executive nor be copied or otherwise made use of either in full or in part by such person or summary\executive summmary english.docx body without our prior permission in writing. Notes: 1. Revision Details: IRR 0 31.08.2020 First Submission VHR SAP TKSS SNV Sign Init. Sign. Init. Init. Sign. Rev. Date Details . Prepared Checked Approved Table of Contents EIA Krishnapatnam North Node C1181311 Executive Summary RP005 rev. 0 TABLE OF CONTENTS 1 Introduction .....................................................................................................................................1 2 Project Site ......................................................................................................................................1 3 Justification of the Project ............................................................................................................3 -

LHA Recuritment Visakhapatnam Centre Screening Test Adhrapradesh Candidates at Mudasarlova Park Main Gate,Visakhapatnam.Contact No

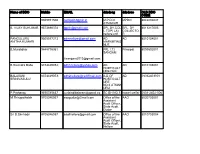

LHA Recuritment Visakhapatnam centre Screening test Adhrapradesh Candidates at Mudasarlova Park main gate,Visakhapatnam.Contact No. 0891-2733140 Date No. Of Candidates S. Nos. 12/22/2014 1300 0001-1300 12/23/2014 1300 1301-2600 12/24/2014 1299 2601-3899 12/26/2014 1300 3900-5199 12/27/2014 1200 5200-6399 12/28/2014 1200 6400-7599 12/29/2014 1200 7600-8799 12/30/2014 1177 8800-9977 Total 9977 FROM CANDIDATES / EMPLOYMENT OFFICES GUNTUR REGISTRATION NO. CASTE GENDER CANDIDATE NAME FATHER/ S. No. Roll Nos ADDRESS D.O.B HUSBAND NAME PRIORITY & P.H V.VENKATA MUNEESWARA SUREPALLI P.O MALE RAO 1 1 S/O ERESWARA RAO BHATTIPROLU BC-B MANDALAM, GUNTUR 14.01.1985 SHAIK BAHSA D.NO.1-8-48 MALE 2 2 S/O HUSSIAN SANTHA BAZAR BC-B CHILAKURI PETA ,GUNTUR 8/18/1985 K.NAGARAJU D.NO.7-2-12/1 MALE 3 3 S/O VENKATESWARULU GANGANAMMAPETA BC-A TENALI. 4/21/1985 SHAIK AKBAR BASHA D.NO.15-5-1/5 MALE 4 4 S/O MAHABOOB SUBHANI PANASATHOTA BC-E NARASARAO PETA 8/30/1984 S.VENUGOPAL H.NO.2-34 MALE 5 5 S/O S.UMAMAHESWARA RAO PETERU P.O BC-B REPALLI MANDALAM 7/20/1984 B.N.SAIDULU PULIPADU MALE 6 6 S/O PUNNAIAH GURAJALA MANDLAM ,GUNTUR BC-A 6/11/1985 G.RAMESH BABU BHOGASWARA PET MALE 7 7 S/O SIVANJANEYULU BATTIPROLU MANDLAM, GUNTUR BC-A 8/15/1984 K.NAGARAJENDRA KUMAR PAMIDIMARRU POST MALE 8 8 S/O. -

Ddos Nellore.Pdf

Name of DDO Mobile EMAIL ddodesg ddodesc OLD DDO CODE 9949911508 [email protected] M.P.D.O MPDO 8042202047 ATMAKUR B. VIJAY SUKUMAR 9573696378 [email protected] SPL.DY.COL SPL. DY 8011217005 L.TGP( LA) COLLECTO nellore unit R PANGULURU 9505517213 [email protected] AD AD 8010104001 ANITHA KUMARI MARKETING NLR B.Muralidhar 9848775361 PRL I.T.I Principal 8091502001 SANGAM [email protected] B.Ravindra Babu 8374449052; [email protected] AD AD 8010103001 HORTICULT URE NLR BALASANI 8374449053; [email protected] A.D OF AD 08012403001 SRINIVASULU HORTICULT URE NO.II,ATMAK URU P.Praharaju 9550785637 [email protected] SC BH NO.5 hostel welfar 0801-2402-006 M.Thirupathaiah 9705346067 [email protected] Office of the AAO 8030703001 Assistant Audit Officer, State Audit, Gudur Sri D.Simhadri 9705346057 [email protected] Office of the AAO 8010703004 Assistant Audit Officer, State Audit, Nellore G.VIJAYA LAKSHMI 9963694222; [email protected] Office of the DAO 8010703002 Assistant Audit Officer, State Audit (MANDAL PARISHAD), Nellore G.VIJAYA LAKSHMI 9963694222; [email protected] Office of the DAO 8010703003 Assistant Audit Officer, State Audit (ZP), Nellore T.Venkateswarlu 9849904497 [email protected] ABCWO ASST.BC 08012403001 NELLORE WELFARE OFFICER KAPARAPU 9494938251; [email protected] ASST CANE AST. CANE 8011308001 LOKESWAR COMMISSIO COMMISSIO NER NER ,PAPPULU STREET ,STONEHOU SEPET,NELL ORE K.Omkar Rao 9492555116 [email protected] ASS COMM ACL 8031503002 OF LABOUR GUDUR Sri P. Venkata 9492555115 [email protected] ASST ACL 8011503008 Narayana COMM OF LABOUR NELLORE Prabhu Kumar [email protected] AC.LEGAL AD 8011609001 Rayana METROLOG Y NELLORE Moldireddy.Sudhakar 9440902265; [email protected] A.C. -

Master Plan and Zonal Development Plan for NUDA Region

Request for Proposal (RFP) For Preparation of Perspective Plan, Master Plan and Zonal Development Plan for NUDA Region NELLORE URBAN DEVELOPMENT AUTHORITY Door No:26-1-891 Near Shirdi Sai temple B.V.Nagar, Mini By-Pass Road,Nellore SPSR Nellore District Andhra Pradesh, India Email: [email protected] REQUEST FOR PROPOSAL (RFP) Consultancy Services for 1) Review of General Town Planning Scheme (Master Plan) for Nellore Municipal Corporation in GIS format and Preparation of new Master Plan for merging villages of Nellore Municipal corporation, Sullurupeta Municipality and Naidupeta Nagarpanchayat in GIS format with special emphasis on Urban Infrastructure, Transportation plan and Investment Plan. 2) Preparation of Perspective Plan, Master Plan and ZDPs for the entire NUDA Region in GIS format in synchronize with the ULBs. 3) Detailed Zoning Regulations. SECTION – 1 BRIEF INTRODUCTION RFP-NUDA 1 Introduction 1.1 Nellore Urban Development Authority (NUDA) was constituted on 24.03.2017 vide G.O.MS.No. 108, MA&UD DePartment, Government of Andhra Pradesh under powers granted under sections 3 and 4 of the Andhra Pradesh Metropolitan Region and Urban Development Authorities Act, 2016, with the areas for a total area of 1644.17 Sq.Kms stretching from Nellore Municipal Corporation, Kavali, Guduru, Sullurupeta Municipalities and Naidupeta Nagarapanchayat and 156 villages in 21 mandals (i.e. 145 villages in 19 mandals in SPSR Nellore District and 11 villages in 2 mandals in Chittoor District). The population of NUDA region as per Census 2011 is 13.01 Lakhs 1.2 As said above the functions of NUDA will be governed by under Andhra Pradesh Metropolitan Region and Urban Development Authorities Act 2016 with the objective of achieving orderly (planned) growth and environmental up gradation wherever necessary. -

Physical Science 15 ------9493511572

SSC PUBLIC EXAMINATIONS, MARCH - 2015 :: SPOT VALUATION :: TENTATIVE SENIORITY LIST :: SPSR NELLORE DISTRICT SUBJECT :- PHY.SCI. No of Years Handling Whether in dealing X Class if yes, X Class DESIGNATION S/NO Name of the MANDAL NAME OF THE SCHOOL NAME OF THE TEACHER WITH SURNAME (including HM) in the present handling CELL NO REMARKS (with Subject) academic year subject SA CADRE LP CADRE (2014-2015) 1 OZILI APRS CHILAMANCHENU B. Vidyasagar PGT-PS Yes PS 24 9490413938 2 SYDAPURAM MMLWO HS TALUPUR I SREEDHAR SA-PS YES SCIENCE 22 0 9493525449 3 SULLURPET GHS SULLURPET G MADHUSUDHAN BABU SA-PS YES PS 21 9440994826 4 KAVALI MPL HS VR NAGAR B.Madhusudhana Raju SA-PS YES PS 20 9000390788 5 VAKADU PJN GHS VAKADU Smt A Nagamani SA-PS YES SCIENCE 19 9550640930 6 ALLUR RKJC ALLUR P.Sambaiah SA-PS YES PHYSICS 19 9441937729 7 VENKATAGIRI APSWRS GIRLS VENKATAGIRI C, Konaiah SA-PS Yes PS 18 18 9550930197 8 KAVALI APRS THUMMALAPENTA M.RAMESHCHANDRA PGT-PS YES PS 18 18 9493922110 9 OZILI ZPPHS KURUGONDA G MURALI SA-PS YES PS 17 9491448505 10 Nellore BVS Mpl Corp Girls High School, Nawabpet, NelloreM.Venkateswarlu SA-PS Yes P.S. 17 2 9866045253 11 SYDAPURAM MMLWO HS KALICHEDU V V RAMANAIAH SA-PS YES SCIENCE 16 0 9441539390 12 CHILLAKUR ZPPHS PCV PALEM B Srinivasulu SA-PS YES PS 15 8985939395 13 VENKATAGIRI RVM HS VENKATAGIRI K V USHAHARINI SA-PS yes PS 15 9492937007 14 Kodavalur APTW JR.COLLEGE (G), C S PURAM Paleti.Venkateswara rao PGT-PS Yes Physical science 15 ------ 9493511572 15 Indukurpet GAHS, MYPADU Devarapalli Ravindra Babu SA-PS YES PS 15 0 16 CHILLAKUR ZPPHS CHILLAKUR V VIMALA SA-PS YES PS 14 9866226754 17 SULLURPET ZPPHS MANNARPOLUR A RAMESH SA-PS Yes PS 14 9989123204 18 BUCHIREDDYPALEM ZPHS, Damaramadugu P.V. -

KPCL Showcase Presentation, Dec 2020

Spotlight on Krishnapatnam Port Adani Ports and SEZ Ltd., December 2020. Contents A Group profile B Company profile C Krishnapatnam port (KPCL) the transformative asset D KPCL assets – Marine, Terminal and Evacuation Infrastructure E KPCL operational efficiency post agreement F KPCL future outlook G ESG, CSR H Annexure 2 Adani Group: A world class infrastructure & utility portfolio Adani Transport & Logistics Energy & Utility Portfolio Portfolio • Marked shift from B2B to B2C businesses– 63.5% 100% 75% 75% • AGL – Gas distribution network to serve key APSEZ SRCPL ATL AGEL geographies across India Port & Logistics Rail T&D Renewables • AEML – Electricity 100% 75% 37.4% distribution network that powers the AAPT APL AGL Gas DisCom financial capital of Abbot Point 75% IPP India AEL • Adani Airports – To Incubator operate, manage and develop eight airports in the country • Locked in Growth 2020 – 100% 100% 100% 100% • Transport & Logistics - Airports and Roads AAHL ARTL AWL Data Airports Roads Water Centre • Energy & Utility – ~USD 54 bn1 Water and Data Centre Combined Market Cap Opportunity identification, development and beneficiation is intrinsic to diversification and growth of the group. 1 . As on November 27, 2020, USD/INR – 74 | Note - Percentages denote promoter holding 3 Light purple color represent public traded listed verticals Adani Group: Decades long track record of industry best growth rates across sectors Port Cargo Throughput (MT) Renewable Capacity (GW) Transmission Network (ckm) CGD7 (GAs8 covered) 161% 45% 12% 21% 2.5x 6x -

Hand Book of Statistics East Godavari District 2019

HAND BOOK OF STATISTICS EAST GODAVARI DISTRICT 2019 . CHIEF PLANNING OFFICER, E.G.DT., KAKINADA. Sri D. Muralidhar Reddy,I.A.S., District Collector & Magistrate, East Godavari, Kakinada. PREFACE I am delighted to release the Handbook of Statistics 2019 of East Godavari District with Statistical data of various departments for the year 2018-19. The Statistical data of different schemes implementing by various departments in the district have been collected and compiled in a systemic way so as to replicate the growth made under various sectors during the year. The Sector-wise progress has depicted in sector-wise tables apart from Mandal-wise data. I am sure that the publication will be of immense utility as a reference book to general public and Government and Non-Governmental agencies in general as well as Administrators, Planners, Research Scholars, Funding Agencies, Banks, Non-Profit Institutions etc., I am thankful to all District Officers and Heads of other Institutions for their co-operation by furnishing the information of their respective departments to the Chief Planning Officer for publication of this Handbook. I appreciate the efforts made by Chief Planning Officer, East Godavri District and his staff in collection and compilation of data to bring out this publication for 2018-19. Any suggestions meant for improvement of the Handbook are most welcome. Station : KAKINADA DISTRICT COLLECTOR Date : 25-10-2019 EAST GODAVARI, KAKINADA. OFFICERS AND STAFF ASSOCIATED WITH THE PUBLICATION 1. Sri K.V.K. Ratna Babu : Chief Planning Officer 2. Sri P. Balaji : Deputy Director 3. Smt. Aayesha Sultana : Statistical Officer 4. Sri G. -

Government of Andhra Pradesh

GOVERNMENT OF ANDHRA PRADESH FINANCE ACCOUNTS 2011-2012 VOLUME-2 TABLE OF CONTENTS (Both volumes contain contents of each other) Subject Page(s) Volume 1 Table of Contents (i)-(iii) Certificate of the CAG (iv)-(v) Guide to Finance Accounts (Introduction) 1-5 1. Statement of Financial Position 6-7 2. Statement of Receipts and Disbursements 8-9 3. Statement of Receipts (Consolidated Fund) 10-13 4. Statement of Expenditure (Consolidated Fund)- 14-19 By Function and Nature Notes to Accounts 20-33 Appendix-I: 34-36 Cash Balances and Investment of Cash Balances Volume 2 Part I 5. Statement of Progressive Capital Expenditure 38-43 6. Statement of Borrowings and Other Liabilities 44-49 (i) Subject Page(s) 7. Statement of Loans and Advances given by the Government 50-52 8. Statement of Grants-in-Aid given by the Government 53-54 9. Statement of Guarantees given by the Government 55-61 10. Statement of Voted and Charged Expenditure 62 Part II 11. Detailed Statement of Revenue and Capital Receipts by minor 64-90 heads 12. Detailed Statement of Revenue Expenditure by minor heads 91-153 13. Detailed Statement of Capital Expenditure 154-232 14. Detailed Statement of Investments of the Government 233-261 15. Detailed Statement of Borrowings and Other Liabilities 262-278 16. Detailed Statement on Loans and Advances given by the 279-346 Government 17. Detailed Statement on Sources and Application of funds for 347-350 expenditure other than on Revenue Account 18. Detailed Statement on Contingency Fund and Other Public 351-370 Account transactions 19. -

Handbook of Statistics 2014 Chittoor District Andhra Pradesh.Pdf

HAND BOOK OF STATISTICS CHITTOOR DISTRICT 2014 ***** Compiled and Published by CHIEF PLANNING OFFICER CHITTOOR DISTRICT SIDDHARTH JAIN I.A.S., District Collector & Magistrate, Chittoor District. PREFACE I am happy to release the Twenty EighthEdition of Hand Book of Statistics of Chittoor District which incorporates Statistical Data of various departments for the Year 2014. The Statistical Data in respect of various departments and schemes being implemented in the district are compiled in a systematic and scientific manner reflects the progress during the year. The sector-wise progress is given in a nutshell under the chapter “DISTRICT AT A GLANCE” apart from Mandal-wise data. The publication reflects the latest data on various aspects of the District Economy. The information has been given Mandal-wise in a concise form to facilitate an over all assessment of the District Economy for the year. This compilation will serve as a useful reference book for the General public, Planners, Administrators, Research Scholars, Bankers and also special Agencies that are involved in the formulation and implementation of various developmental programmes in the district. I am thankful to all District Officers and the heads of other institutions for extending their helping hand by furnishing their respective Statistical data to theChief Planning Officer for publication of this Hand Book. I appreciate the efforts made by Sri. Ch. V.S.BhaskaraSarma, Chief Planning Officer, Chittoor, other Officers and Staff Members of the Chief Planning Office in bringing out this publication which projects the development of the District during the year 2014. Any suggestions aimed at improving the quality of data incorporated in this Hand Book are most welcome. -

Ministry of Road Transport & Highways (2020-21)

7 MINISTRY OF ROAD TRANSPORT & HIGHWAYS ESTIMATES AND FUNCTIONING OF NATIONAL HIGHWAY PROJECTS INCLUDING BHARATMALA PROJECTS COMMITTEE ON ESTIMATES (2020-21) SEVENTH REPORT ___________________________________________ (SEVENTEENTH LOK SABHA) LOK SABHA SECRETARIAT NEW DELHI SEVENTH REPORT COMMITTEE ON ESTIMATES (2020-21) (SEVENTEENTH LOK SABHA) MINISTRY OF ROAD TRANSPORT & HIGHWAYS ESTIMATES AND FUNCTIONING OF NATIONAL HIGHWAY PROJECTS INCLUDING BHARATMALA PROJECTS Presented to Lok Sabha on 09 February, 2021 _______ LOK SABHA SECRETARIAT NEW DELHI February, 2021/ Magha, 1942(S) ________________________________________________________ CONTENTS PAGE COMPOSITION OF THE COMMITTEE ON ESTIMATES (2019-20) (iii) COMPOSITION OF THE COMMITTEE ON ESTIMATES (2020-21) (iv) INTRODUCTION (v) PART - I CHAPTER I Introductory 1 Associated Offices of MoRTH 1 Plan-wise increase in National Highway (NH) length 3 CHAPTER II Financial Performance 5 Financial Plan indicating the source of funds upto 2020-21 5 for Phase-I of Bharatmala Pariyojana and other schemes for development of roads/NHs Central Road and Infrastructure Fund (CRIF) 7 CHAPTER III Physical Performance 9 Details of physical performance of construction of NHs 9 Details of progress of other ongoing schemes apart from 10 Bharatmala Pariyojana/NHDP Reasons for delays NH projects and steps taken to expedite 10 the process Details of NHs included under Bharatmala Pariyojana 13 Consideration for approving State roads as new NHs 15 State-wise details of DPR works awarded for State roads 17 approved in-principle -

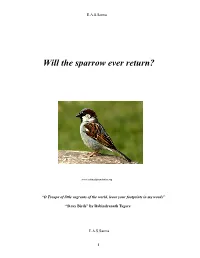

Will Sparrows Ever Return

E.A.S.Sarma Will the sparrow ever return? www.salimalifoundation.org “O Troupe of little vagrants of the world, leave your footprints in my words” “Stray Birds” by Rabindranath Tagore E.A.S.Sarma 1 E.A.S.Sarma I dedicate this book to my granddaughter, Tara and her generation, hoping that what we collectively think and do today, will ensure for them a future that is benign 2 E.A.S.Sarma About the author Dr. E.A.S.Sarma was a member of the Indian Administrative Service from 1965 to 2000. He opted for voluntary retirement from the government in 2000. He was Principal, Administrative Staff College of India (ASCI), Hyderabad from 2001 to 2004. He has settled down at Visakhapatnam in Andhra Pradesh (AP). He is presently the Convener of Forum for Better Visakha (FBV), an unregistered civil society forum set up in 2004. The Forum is engaged in promoting Right to Information Act, 2005 in the State. It is also involved in an election watch campaign and promotion of good governance in the offices of the State Government and the local authorities. FBV has been active in articulating the interests of the tribals, the fishing communities and the disadvantaged sections of the people living in the rural and the urban areas. For the last seven years, FBV has been associated closely with civil society movements in AP and elsewhere against projects that deprive the people's livelihoods, violate the laws and damage the environment. 3 E.A.S.Sarma Contents No. Chapter Page Preface 5 Acknowledgements 9 1 Where has the sparrow disappeared? 10 2 The urban contagion: The case of Vizag 15 3. -

Jurisdiction of Nellore Central Excise and Service Tax Commissionerate

Page 1 Annexure-A to Trade Notice No: 1 /2014 dated 07/10/2014 of Visakhapatnam Zone Jurisdiction of Nellore Central Excise and Service Tax Commissionerate Commissionerate Jurisdiction In the Revenue Districts of Dr.Y.S.Rajasekhara Reddy Kadapa District, Sri Potti Sriramulu NELLORE Nellore District and Prakasam District in the State of Andhra Pradesh Sl. Name of the Jurisdiction of the Division Name of the Jurisdiction of the Range No. Division Range The revenue Mandals of Kadapa, Brahmamgari matam, Chintakommadinne, Chennur, Khazipet, Badvel, Porumamilla, KADAPA Kalasapadu, Kasinayana, Sidhout, Gopavaram, Atluru, Ontimitta, Valluru, B.Koduru and Pendlimarri of Kadapa District The revenue Mandals of Proddatur, Rayachoti, T.Sundupalli, Lakkireddypalli, Ramapuram, Chakrayapet, Galivedu, Peddamudium, PRODDATUR Vempalli, Duvvuru, Sambepalli, Vemula, Jammalamadugu, Mylavaram, Chapadu, Mydukur, Kamalapuram, Veerapunayunipalli, In the Revenue District of Veeraballi, Rajupalem and Chinnamandem of Kadapa District Kadapa Division Dr.Y.S.Rajasekhara Reddy 1 (Central Excise Kadapa in the State of Andhra The revenue Mandals of Pulivendula, Lingala, Tonduru, Muddanuru, & Service Tax) CHILAMKUR Pradesh Simhadripuram, Kondapuram of Kadapa District. The revenue Mandals of Nandalur, Rajampet, Chitvel, Kodur, NANDALUR Pullampeta, Obulavaripalli and Penagaluru of Kadapa District. YERRAGUNTLA The entire Yerraguntla revenue Mandal of Kadapa District SERVICE TAX Entire Dr.Y.S.Rajasekhara Reddy Kadapa Revenue District RANGE Page 2 Annexure-A to Trade Notice No: