HONG KONG HONG KONG Luxury Residential

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Islands Hong Kong Skycity Marriott Hotel 5482 Islands Hong Kong Skycity Marriott Hotel 5483 Yau Tsim Mong Block 2, The Long Beach 5484 Kwun Tong Dorsett Kwun Tong, Hong Kong 5486 Wan Chai Victoria Heights, 43A Stubbs Road 5487 Islands Tower 3, The Visionary 5488 Sha Tin Yue Chak House, Yue Tin Court 5492 Islands Hong Kong Skycity Marriott Hotel 5496 Tuen Mun King On House, Shan King Estate 5497 Tuen Mun King On House, Shan King Estate 5498 Kowloon City Sik Man House, Ho Man Tin Estate 5499 Wan Chai 168 Tung Lo Wan Road 5500 Sha Tin Block F, Garden Rivera 5501 Sai Kung Clear Water Bay Apartments 5502 Southern Red Hill Park 5503 Sai Kung Po Lam Estate, Po Tai House 5504 Sha Tin Block F, Garden Rivera 5505 Islands Ying Yat House, Yat Tung Estate 5506 Kwun Tong Block 17, Laguna City 5507 Crowne Plaza Hong Kong Kowloon East Sai Kung 5509 Hotel Eastern Tower 2, Pacific Palisades 5510 Kowloon City Billion Court 5511 Yau Tsim Mong Lee Man Building 5512 Central & Western Tai Fat Building 5513 Wan Chai Malibu Garden 5514 Sai Kung Alto Residences 5515 Wan Chai Chee On Building 5516 Sai Kung Block 2, Hillview Court 5517 Tsuen Wan Hoi Pa San Tsuen 5518 Central & Western Flourish Court 5520 1 Related Confirmed / District Building Name Probable Case(s) Wong Tai Sin Fu Tung House, Tung Tau Estate 5521 Yau Tsim Mong Tai Chuen Building, Cosmopolitan Estates 5523 Yau Tsim Mong Yan Hong Building 5524 Sha Tin Block 5, Royal Ascot 5525 Sha Tin Yiu Ping House, Yiu On Estate 5526 Sha Tin Block 5, Royal Ascot 5529 Wan Chai Block E, Beverly Hill 5530 Yau Tsim Mong Tower 1, The Harbourside 5531 Yuen Long Wah Choi House, Tin Wah Estate 5532 Yau Tsim Mong Lee Man Building 5533 Yau Tsim Mong Paradise Square 5534 Kowloon City Tower 3, K. -

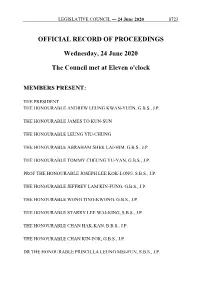

Official Record of Proceedings

LEGISLATIVE COUNCIL ― 24 June 2020 8723 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 24 June 2020 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE ANDREW LEUNG KWAN-YUEN, G.B.S., J.P. THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE LEUNG YIU-CHUNG THE HONOURABLE ABRAHAM SHEK LAI-HIM, G.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, G.B.S., J.P. PROF THE HONOURABLE JOSEPH LEE KOK-LONG, S.B.S., J.P. THE HONOURABLE JEFFREY LAM KIN-FUNG, G.B.S., J.P. THE HONOURABLE WONG TING-KWONG, G.B.S., J.P. THE HONOURABLE STARRY LEE WAI-KING, S.B.S., J.P. THE HONOURABLE CHAN HAK-KAN, B.B.S., J.P. THE HONOURABLE CHAN KIN-POR, G.B.S., J.P. DR THE HONOURABLE PRISCILLA LEUNG MEI-FUN, S.B.S., J.P. 8724 LEGISLATIVE COUNCIL ― 24 June 2020 THE HONOURABLE WONG KWOK-KIN, S.B.S., J.P. THE HONOURABLE MRS REGINA IP LAU SUK-YEE, G.B.S., J.P. THE HONOURABLE PAUL TSE WAI-CHUN, J.P. THE HONOURABLE CLAUDIA MO THE HONOURABLE MICHAEL TIEN PUK-SUN, B.B.S., J.P. THE HONOURABLE STEVEN HO CHUN-YIN, B.B.S. THE HONOURABLE FRANKIE YICK CHI-MING, S.B.S., J.P. THE HONOURABLE WU CHI-WAI, M.H. THE HONOURABLE YIU SI-WING, B.B.S. THE HONOURABLE MA FUNG-KWOK, S.B.S., J.P. THE HONOURABLE CHARLES PETER MOK, J.P. THE HONOURABLE CHAN CHI-CHUEN THE HONOURABLE CHAN HAN-PAN, B.B.S., J.P. -

PROPERTY and OTHER BUSINESSES 86,162 Households Enjoy Quality Living in Our Managed Properties

DEVELOPMENT IN MOTION EXECUTIVE MANAGEMENT’S REPORT PROPERTY AND OTHER BUSINESSES 86,162 households enjoy Quality Living in our managed properties 226,622 sq.m. Lettable Floor Area of MTR Shopping Malls to enhance customers’ shopping experience Development Rights for 2 Sites with 532,900 sq.m. Gross Floor Area obtained in May 2011 46 MTR Corporation The Hong Kong residential property market remained active WEst RAIL LINE PROPErtY DEVELOpmENT PlaN during the early months of 2011. As the year progressed, The Company acts as development agent for the West Rail however, a number of factors began to affect sentiment and property projects. transaction volumes diminished considerably in the second half of the year. Actual/ (Expected) During the year, banks began to tighten the mortgage credit Period of Expected Site Area package completion available to new buyers. This development came on top of Station (hectares) tenders date measures enacted in November 2010 by Government to raise Tuen Mun 2.65 Aug 2006 By phases from stamp duty on properties resold within a short term, and to 2012 – 2013 increase the down payments required for larger properties Nam Cheong 6.20 Oct 2011 By phases from 2017 – 2019 and for investment purposes. Government also introduced Tsuen Wan West 4.29 (2012) Under review various measures to increase land supply and announced the (TW5) Bayside revitalisation of the Home Ownership Scheme in a new form Tsuen Wan West 1.34 Jan 2012 2018 (TW5) Cityside and the new My Home Purchase Plan. Volatility in financial Tsuen Wan West (TW6) 1.39 Under review Under review markets also affected the property market. -

English Version

Indoor Air Quality Certificate Award Ceremony COS Centre 38/F and 39/F Offices (CIC Headquarters) Millennium City 6 Common Areas Wai Ming Block, Caritas Medical Centre Offices and Public Areas of Whole Building Premises Awarded with “Excellent Class” Certificate (Whole Building) COSCO Tower, Grand Millennium Plaza Public Areas of Whole Building Mira Place Tower A Public Areas of Whole Office Building Wharf T&T Centre 11/F Office (BOC Group Life Assurance Millennium City 5 BEA Tower D • PARK Baby Care Room and Feeding Room on Level 1 Mount One 3/F Function Room and 5/F Clubhouse Company Limited) Modern Terminals Limited - Administration Devon House Public Areas of Whole Building MTR Hung Hom Building Public Areas on G/F and 1/F Wharf T&T Centre Public Areas from 5/F to 17/F Building Dorset House Public Areas of Whole Building Nan Fung Tower Room 1201-1207 (Mandatory Provident Fund Wheelock House Office Floors from 3/F to 24/F Noble Hill Club House EcoPark Administration Building Offices, Reception, Visitor Centre and Seminar Schemes Authority) Wireless Centre Public Areas of Whole Building One Citygate Room Nina Tower Office Areas from 15/F to 38/F World Commerce Centre in Harbour City Public Areas from 5/F to 10/F One Exchange Square Edinburgh Tower Whole Office Building Ocean Centre in Harbour City Public Areas from 5/F to 17/F World Commerce Centre in Harbour City Public Areas from 11/F to 17/F One International Finance Centre Electric Centre 9/F Office Ocean Walk Baby Care Room World Finance Centre - North Tower in Harbour City Public Areas from 5/F to 17/F Sai Kung Outdoor Recreation Centre - Electric Tower Areas Equipped with MVAC System of The Office Tower, Convention Plaza 11/F & 36/F to 39/F (HKTDC) World Finance Centre - South Tower in Harbour City Public Areas from 5/F to 17/F Games Hall Whole Building Olympic House Public Areas of 1/F and 2/F World Tech Centre 16/F (Hong Yip Service Co. -

G.N. (E.) 97 of 2016 G.N

G.N. (E.) 97 of 2016 G.N. XX ELECTORAL AFFAIRS COMMISSION (ELECTORAL PROCEDURE) (ELECTION COMMITTEE) REGULATION (Cap 541 sub. leg. I) (Section 18 of the Regulation) NOTICE OF VALID NOMINATIONS ELECTION COMMITTEE SUBSECTOR ORDINARY ELECTIONS LEGAL SUBSECTOR Date of Election: 11 December 2016 The following candidates are validly nominated for the Legal subsector: Particulars as shown on Nomination Form Candidate Number Name of Candidate Address 1 YIP HOI LONG RICHARD 7D BLOCK 1 RONSDALE GARDEN 25 TAI HANG DRIVE HONG KONG 2 SHEK RANDY SHU MING UNIT 21B 21/F THE AUSTIN 8 WUI CHEUNG ROAD JORDON KOWLOON 3 KWOK KING HIN DOUGLAS FLAT 6A KADOORIE HILL 211 PRINCE EDWARD ROAD WEST HOMANTIN KOWLOON 4 POON SUK YING DEBORA SUITE 2203 A&B 22/F FAIRMONT HOUSE 8 COTTON TREE DRIVE CENTRAL HONG KONG 5 HO KWOK WAI ROOM 1105 11/F FAR EAST CONSORTIUM BUILDING 121 DES VOEUX ROAD CENTRAL HONG KONG 6 WONG KWOK TUNG GROUND FLOOR NO. 30 PAI TAU VILLAGE SHATIN NEW TERRITORIES 7 LIU SING LEE 2/F NO. 26 TAI AU MUN VILLAGE CLEAR WATER BAY ROAD SAI KUNG NEW TERRITORIES 8 DYKES PHILIP JOHN FLAT 6A BLOCK 3 MERIDIAN HILL 81 BROADCAST DRIVE KOWLOON TONG KOWLOON 9 CLANCEY JOHN JOSEPH 357-B G/F HANG HAU ROAD CLEARWATER BAY KOWLOON 10 WONG HUK KAM SUITE TS-1C BLOCK ONE FOREST HILL 31 LO FAI ROAD TAI PO NEW TERRITORIES 11 HARRIS GRAHAM ANTHONY FLAT B 20/F BLOCK 1 VISIONARY TUNG CHUNG NEW TERRITORIES 12 PANG YIU HUNG ROBERT FLAT B 3RD FLOOR TOWER 2 BROOM GARDEN 1 BROOM ROAD HAPPY VALLEY HONG KONG 13 CHEUNG YIU LEUNG FLAT B 8TH FLOOR BLOCK 8 LAGUNA VERDE HUNG HOM KOWLOON 14 CHEUNG -

Participating Buildings in Sha Tin District 沙田區的參與屋苑

Sha Tin (沙田) Estates (屋苑) Estate/Building 屋苑/大廈 10 Lok Fung Path 樂楓徑10號政府宿舍 6 Lok Fung Path 樂楓徑6號政府宿舍 Baycrest 觀瀾雅軒 Bayshore Towers 海栢花園 Belair Gardens 富豪花園 Castello 帝堡城 Chun Shek Estate 秦石邨 Chung On Estate 頌安邨 Chung Yeung Estate 駿洋邨 City One 置富第一城 City One Shatin 沙田第一城 Conifer Lodge 匡怡居 Double Cove (Phase 1) 迎海 Festival City 名城 Ficus Garden 榕翠園 Fok On Garden 福安花園 Fu Fai Garden 富輝花園 Fung Shing Court 豐盛苑 Fung Wo Estate 豐和邨 Garden Rivera 河畔花園 Garden Vista 翠湖花園 Glamour Garden 金輝花園 Golden Lion Garden Phase I 金獅花園第I期 Golden Lion Garden Phase II 金獅花園第II期 Grandway Garden 富嘉花園 Granville Garden 恆峰花園 Green Leaves Garden 翠麗花園 Greenary Villas Phase 2 寶翠小築二期 Estate/Building 屋苑/大廈 Greenview Garden 愉景花園 Greenwood Garden 翠華花園 Greenwood Terrace 華翠園 Heng On Estate 恆安邨 Hill Lodge 曉廬 Hill Paramount 名家匯 Hilton Plaza 希爾頓中心 Hin Keng Estate 顯徑邨 Hin Yiu Estate 顯耀邨 Hong Kong Baptist University Staff Quarters 香港浸會大學職員宿舍 Hong Lam Court 康林苑 Jat Min Chuen 乙明邨 Jubilee Garden 銀禧花園 Julimount Garden 瑞峰花園 Ka Keng Court 嘉徑苑 Ka Tin Court 嘉田苑 Kam Fung Court 錦豐苑 Kam Hay Court 錦禧苑 Kam Lung Court 錦龍苑 Kam On Court 錦鞍苑 Kam On Garden 金鞍花園 Kam Tai Court 錦泰苑 Kam Ying Court 錦英苑 Kwong Lam Court 廣林苑 Kwong Yuen Disciplined Services Quarters 廣源紀律部隊宿舍 Kwong Yuen Estate 廣源邨 La Costa 嘉華星濤灣 La Cresta 尚珩 Lake Silver 銀湖‧天峰 Lakeview Garden 湖景花園 Lee On Estate 利安邨 Estate/Building 屋苑/大廈 Lee Woo Sing College 香港中文大學和聲書院 Lek Yuen Estate 瀝源邨 Lung Hang Estate 隆亨邨 Ma On Shan Centre 馬鞍山中心 Marbella 迎濤灣 May Shing Court 美城苑 Mei Chung Court 美松苑 Mei Lam Estate 美林邨 Mei Pak Court 美柏苑 Mei Tin Estate 美田邨 Monte -

MTR Corporation Limited MTR Corporation

Prospectus MTR Corporation Limited (a company incorporated on 26th April 2000 under the Companies Ordinance of Hong Kong with company number 714016) and MTR Corporation (C.I.) Limited (a company organised under the laws of the Cayman Islands on 30th October 2000) (Unconditionally and Irrevocably Guaranteed by MTR Corporation Limited) US$3,000,000,000 Debt Issuance Programme For the issue of Notes with maturities of between one month and 30 years On 22nd December 1993, Mass Transit Railway Corporation (‘‘MTRC’’) entered into a US$1,000,000,000 Debt Issuance Programme (the ‘‘Programme’’). The maximum aggregate nominal amount of Notes (as defined below) which may be outstanding under the Programme was increased to US$2,000,000,000 with effect from 1st June 1999 and to US$3,000,000,000 with effect from 31st October 2006. On 30th June 2000 MTR Corporation Limited (‘‘MTRCL’’ or ‘‘the Company’’) replaced MTRC as the issuer of Notes under the Programme. All the assets and liabilities of MTRC vested in MTRCL and MTRCL has adopted all of the accounts of MTRC. MTR Corporation (C.I.) Limited (‘‘MTR Cayman’’) became an additional issuer of Notes under the Programme with effect from 9th April 2001 pursuant to an Amending and Restating Programme Agreement dated 9th April 2001 made between MTRCL, MTR Cayman and the Dealers named therein (MTRCL and MTR Cayman together being the ‘‘Issuers’’ and each an ‘‘Issuer’’). This Prospectus supersedes any previous prospectus, listing particulars or offering circular describing the Programme. Any Notes issued under the Programme on or after the date of this Prospectus are issued subject to the provisions described herein. -

Recommended District Council Constituency Areas

District : Sha Tin Recommended District Council Constituency Areas +/- % of Population Estimated Quota Code Recommended Name Boundary Description Major Estates/Areas Population (17,282) R01 Sha Tin Town Centre 21,347 +23.52 N Tung Lo Wan Hill Road, To Fung Shan Road 1. HILTON PLAZA 2. LUCKY PLAZA Tai Po Road - Sha Tin 3. MAN LAI COURT NE Sha Tin Rural Committee Road 4. NEW TOWN PLAZA 5. PEAK ONE E Sha Tin Rural Committee Road 6. PRISTINE VILLA Sand Martin Bridge 7. SCENERY COURT Shing Mun River Channel 8. SHA TIN CENTRE 9. SHATIN PLAZA SE Sand Martin Bridge 10. TUNG LO WAN Shing Mun River Channel, Lek Yuen Bridge 11. WAI WAH CENTRE Lion Rock Tunnel Road S Shing Mun River Channel SW Shing Mun River Channel Shing Chuen Road, Tai Po Road - Tai Wai W Tai Po Road – Tai Wai Shing Mun Tunnel Road NW Shing Mun Tunnel Road Tung Lo Wan Hill Road R1 District : Sha Tin Recommended District Council Constituency Areas +/- % of Population Estimated Quota Code Recommended Name Boundary Description Major Estates/Areas Population (17,282) R02 Lek Yuen 13,050 -24.49 N Fo Tan Road 1. HA WO CHE 2. LEK YUEN ESTATE NE Fo Tan Road, MTR (East Rail Line) 3. PAI TAU Lok King Street, Nullah, Sha Tin Road 4. SHEUNG WO CHE 5. WO CHE ESTATE (PART) : E Tai Po Road - Sha Tin, Fung Shun Street King Wo House Wo Che Street, Shing Mun River Channel 6. YAU OI TSUEN SE Shing Mun River Channel S Shing Mun River Channel Sand Martin Bridge Sha Tin Rural Committee Road Tai Po Road - Sha Tin, To Fung Shan Road SW To Fung Shan Road, Tung Lo Wan Hill Road W To Fung Shan Road NW To Fung Shan Road R2 District : Sha Tin Recommended District Council Constituency Areas +/- % of Population Estimated Quota Code Recommended Name Boundary Description Major Estates/Areas Population (17,282) R03 Wo Che Estate 18,586 +7.55 N Tai Po Road - Sha Tin, Fo Tan Road 1. -

Technical Notes

Technical Notes 1. Property Types Premises are categorised according to the use for which the occupation permit was originally issued, unless known to have been subsequently structurally altered. No specific check is made on current use and no attempt has been made to distinguish those domestic units used for non-domestic purposes and vice versa. 1.1 Private Domestic units are defined as independent dwellings with exclusive cooking facilities, bathroom and toilet. They are classified by reference to floor area as follows: Class A - saleable area less than 40 m 2 Class B - saleable area of 40 m 2 to 69.9 m 2 Class C - saleable area of 70 m 2 to 99.9 m 2 Class D - saleable area of 100 m 2 to 159.9 m 2 Class E - saleable area of 160 m 2 or above Public sector developments, including domestic units built under the Private Sector Participation, Home Ownership, Buy or Rent Option, Mortgage Subsidy, Sandwich Class Housing, Urban Improvement and Flat-for-Sale Schemes, etc. are not included in the statistical figures. Besides, rental estates built by the Hong Kong Housing Authority and the Hong Kong Housing Society, units sold under the Tenants Purchase Scheme, and Government-owned quarters are excluded. Quarters held by the People’s Liberation Army and the Hospital Authority, quarters attached to premises of utility companies, dormitories (including student dormitories in educational institutes), hotels and hostels are also excluded. Since 2002, village houses are no longer included in the stock, completions, take-up and vacancy figures. 1.2 Private Office premises comprise premises situated in buildings designed for commercial/business purposes. -

CT Catalyst Air Purification Service Job Reference of Residence

Homeasy Services Limited – CT Catalyst Air Purification Service Job Reference of Residence Apartments & Houses – New Territories (in alphabetical order) ** Different Phases with no other specific names will not be stated separately in the list. New Territories East Tseung Kwan O / Tiu Keng Leng / Hang Hau / Po Lam / Lohas Park Bauhinia Garden Kwong Ming Court Ocean Shores The Parkside Beverly Garden La Cite Noble On Ning Garden The Pinnacle Choi Ming Court Lohas Park (The Capital) Oscar By The Sea The Wings Chung Ming Court Lohas Park (Le Prestige) Park Central Tseung Kwan O Plaza Corinthia By The Sea Lohas Park (Le Prime) Radiant Towers Tsui Lam Estate East Point City Lohas Park Residence Oasis Twin Peaks (La Splendeur) Finery Park Lohas Park (Hemera) Serenity Place Verbena Heights Fu Ning Garden Ma Yau Tong Village Sheung Tak Estate Well On Garden Hau Tak Estate Maritime Bay The Beaumount Yee Ming Estate Hong Sing Gardens Metro Town The Grandiose Ying Ming Court Kin Ming Estate Metro Town (Le Point The Metro City Metro Town) King Lam Estate Nan Fung Plaza The Metro City (The Metropolis) Sai Kung / Clear Water Bay Bougainvillea Gardens Pak Shek Terrace Silver View Lodge Dynasty Lodge Pan Long Wan The Giverny (House) Habitat (House) Pik Uk Prison Married Quarters Ho Chung New Village Pik Uk Village Sha Tin Belair Gardens Green Leaves Garden Pictorial Garden Shui Chuen O Estate Castello Hong Lam Court Prima Villa Springfield Garden Chek Nai Ping Tsuen Kwong Lam Court Ravana Garden Sunshine Grove City One Shatin Kwong Yuen Estate Scenery -

List of Integrated Home Care Services Teams

Catchment Areas of Integrated Home Care Services (Frail Cases) (w.e.f 1.10.2020) (as at 10 September 2020) Operators of s/n District Zone IHCST serving Service Boundary Remarks Note in the Zone Hollywood Terrace, Pine Court, Robinson Heights, The Grand Panorama, Tycoon Court, 39 Conduit Road, Blessings A01 CHUNG WAN Garden, Realty Gardens, Robinson Place, 77/79 Peak Road, Chateau De Peak, Dynasty Court, Grenville House, Kellett A02 MID LEVELS EAST View Town Houses, Mount Austin Estate, Strawberry Hill, Tregunter, Villa Verde, Wing On Villa, Emerald Gardens, A03 CASTLE ROAD Euston Court, Greenview Gardens, Scenic Garden, Wisdom Court, Connaught Garden, Kwan Yick Building Phase II, A04 PEAK Kwan Yick Building Phase III, Hongway Garden, Midland Centre, Queen's Terrace, Soho 189, Centre Point, A05 UNIVERSITY (except Hong Kong University Centrestage, Grandview Garden, Parkway Court, Tung Fai Gardens, Island Crest, Western Garden, Yue Sun Mansion, and Pok Fu Lam Road) Central and A11 SAI YING PUN Central and St. James' 1 Western Admiralty, Central, Sheung Wan, Connaught Road West from number 1 to 179, Des Voeux Road West (odd numbers - A12 SHEUNG WAN Western Settlement (East) 343, even numbers - 308), Centre Street, Queen’s Road West (odd numbers from 1 to 383 even numbers from 2 to 356), A13 TUNG WAH Western Street (all even numbers), Water Street 2, First Street (odd numbers from 1 to 131, even numbers from 2 to 84), A14 CENTRE STREET Second Street (odd numbers from 1 to 83, even numbers from 2 to 88), Third Street (odd numbers from 1 to -

Company Name Address Telephone No

Company Name Address Telephone No. 7-Eleven Portion of Shop 1, G/F, Chuang's ENew 2299 1110 Territorieserprises Building, 382 Lockhart Road, Wan Chai, Hong Kong 7-Eleven G/F, 166 Wellington Street, Sheung Wan, Hong 2299 1110 Kong 7-Eleven Shop 1C, 1D & 1E, G/F, Queen's Terrace, 1 Queen 2299 1110 Street, Sheung Wan, Hong Kong 7-Eleven Shops F & G, G/F, Hollywood Garden, 222 2299 1110 Hollywood Road, Sheung Wan, Hong Kong 7-Eleven G/F & the Cockloft, 298 Des Voeux Road CeNew 2299 1110 Territoriesral, Sheung Wan, Hong Kong 7-Eleven Portion of Shop C, G/F, Man Kwong Court, 12 2299 1110 Smithfield, Hong Kong 7-Eleven G/F & Cockloft, 68 Tung Lo Wan Road, Tai Hang, 2299 1110 Hong Kong 7-Eleven Shop 26, G/F & Living Quarter 1/F in Block 6, Lai 2299 1110 Tak Tsuen, Tai Hang, Hong Kong 7-Eleven Shop 60 UG/F, Island Resort Mall, 28 Siu Sai Wan 2299 1110 Road, Chai Wan 7-Eleven Shop 5, G/F, The Peak Galleria, 118 Peak Road, 2299 1110 Hong Kong 7-Eleven Shop 289 on 2nd Floor, Shun Tak Centre, 200 2299 1110 Connaught Road CeNew Territoriesral, Hong Kong 7-Eleven Shop B Lower Deck Level, Central Pier, Star Ferry, 2299 1110 Hong Kong 7-Eleven G/F., 40 Elgin Street, Central, Hong Kong 2299 1110 7-Eleven G/F, 76 Wellington Street, Central, Kong Kong 2299 1110 7-Eleven Shop 1, G/F, 9 Chiu Lung Street, Central, Hong 2299 1110 Kong 7-Eleven G/F, Teng Fuh Commercial Building, 331-333 2299 1110 Queen's Road Central, Central, Hong Kong 7-Eleven Shop C, G/F., Haleson Building, 1 Jubilee St., 2299 1110 Central, Hong Kong Company Name Address Telephone No.