Report to the Community 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DISTRIBUTION: National Register Property File Nominating Authority (Without Nomination Attachment) NPS Form 10-900 OMB No

NP8 Form 1MOO* 0*IB Aftptwti No. 10244011 United States Department of the Interior National Park Service Section number ___ Page SUPPLEMENTARY LISTING RECORD NRIS Reference Number: 91001728 Date Listed: 5/28/92 Edemar Ohio WV Property Name: County: State: Multiple Name This property is listed in the National Register of Historic Places in accordance with the attached nomination documentation subject to the following exceptions, exclusions, or amendments, notwithstanding the National Park Service certification included inxthe nomination documentation. ;.gnature of the Keeper Date of Action Amended Items in Nomination: The WV SHPO intended to nominate this property as Buildings, but District was inadvertently checked. The form is officially amended to classify Edemar as Buildings. DISTRIBUTION: National Register property file Nominating Authority (without nomination attachment) NPS Form 10-900 OMB No. 1024-0018 (Rev. 8-86) United States Department of the Interior National Park Service NATIONAL REGISTER OF HISTORIC PLACES REGISTRATION FORM Qf ;T * 1QQ1 1. Name of Property flEGISTER historic name: "Edemar" other name/site number: Stifel Fine Arts Center 2 . Location street & number: 1330 National Road _______________________ not for publication: N/A city/town: Wheeling _________________________ vicinity: N/A state: WV county: Ohio ________ code: 069 zip code: 26003 3 . Classification Ownership of Property: Private _________ Category of Property: District Number of Resources within Property: Contributing Noncontributing __2 buildings sites -

2020 Region X CEDS Update

2020 Update Comprehensive Economic Development Strategy (CEDS) Region X Bel-O-Mar Regional Council Wheeling, West Virginia Submitted to: U.S. Economic Development Administration Philadelphia, PA Table of Contents I. Introduction ................................................................................................................................1 A. Purpose .................................................................................................................................1 B. Council Organization ...........................................................................................................2 C. Jurisdiction and Boundaries .................................................................................................2 D. General Description of the Area ..........................................................................................5 1. History............................................................................................................................5 2. Geographic Location and Proximity to Markets ............................................................6 3. Natural Features .............................................................................................................7 II. Summary Background – The Economic Development Conditions of the Region .....................8 A. Population and Labor Force Characteristics ........................................................................8 1. Population ......................................................................................................................8 -

2008-Hall of Fame-Cover

Wheeling Hall of Fame Board During the early planning stages for the Wheeling Civic Center, one The preamble from the Ordinance establishing the Hall of Fame of the members of the committee suggested that a “Hall of Fame” should Board reads as follows: be included in the Center to give recognition to former residents and present “A Hall of Fame to honor Wheeling citizens and former citizens for residents who had attained considerable distinction in some specific field outstanding accomplishments in all walks of life shall be established in the halls and thus brought honor to their home city. of the Wheeling Civic Center. While outstanding public services were rendered The City Council studied the matter and solicited suggestions for by our founding fathers and early citizens, these worthy deeds are recognized guidelines and procedures. On February 3, 1977, council passed an ordinance (No.6179) creating by historical publications and appropriately honored in other halls, museums, the Hall of Fame Board. In July 1977 the Mayor, with the approval of and memorials. Therefore, honorees in the Wheeling Hall of Fame shall be Council, appointed 18 citizens to serve on the Board with designated terms selected on the basis of accomplishments after 1863 (later amended to 1836). of two, four, and six years. The Board also includes a representative of City For purposes of selection and designation, the human endeavors of the honorees Council and the chairman of the Civic Center Board as an ex-officio member. shall be divided into the following six major categories: The membership of the Board has changed as new appointments have (1) Music and Fine Arts (4) Sports and Athletics been made by the Mayor and Council from time to time. -

December 8, 2010 5:00 P.M

WEST LIBERTY UNIVERSITY BOARD OF GOVERNORS December 8, 2010 5:00 p.m. R. Emmett Boyle Conference Center AGENDA 1. Call to Order .......................................................................................................................... Mr. Joseph 2. Chairperson Comments .......................................................................................................... Mr. Joseph 3. Approval of Minutes* Full Board 10/13/10 ............................................................................ 5 Min........................... Mr. Joseph Executive Committee 10/06/10 4. Honorary Degree* ............................................................................... 5 Min.................... Dr. McCullough 5. Natural Resources Lease* ................................................................ 15 Min............................ Mr. Wright 6. Timber Sale* ..................................................................................... 15 Min............................ Mr. Wright 7 President’s Report ........................................................................... 15 Min.............. President Capehart Campus Reports 8. Adjournment *Action Items West Liberty University Board of Governors Minutes October 13, 2010 Attendance: Beverly Burke, Richard Carter, George Couch, Brian Joseph, Patrick Kelly, Paul Limbert, Jim Stultz, Ann Thomas, Michael Turrentine, Richard Whitehead Unable to Attend: Robert Steptoe, Michael Stolarczyk, Jim Stultz Administration/Faculty/Staff: Robin Capehart, Scott Cook, -

2017 Induction June 3 Wheeling Hall of Fame Board

2017 Induction June 3 Wheeling Hall of Fame Board During the early planning stages for the Wheeling Civic Center, one of the The preamble from the Ordinance establishing the Hall of Fame Board reads members of the committee suggested that a “Hall of Fame” should be included as follows: in the Center to give recognition to former residents and present residents who “A Hall of Fame to honor Wheeling citizens and former citizens for outstanding had attained considerable distinction in some specific field and thus brought accomplishments in all walks of life shall be established in the halls of the honor to their home city. Wheeling Civic Center. While outstanding public services were rendered by The City Council studied the matter and solicited suggestions for guidelines our founding fathers and early citizens, these worthy deeds are recognized by and procedures. historical publications and appropriately honored in other halls, museums, and On February 3, 1977, council passed an ordinance (No.6179) creating the memorials. Therefore, honorees in the Wheeling Hall of Fame shall be selected Hall of Fame Board. In July 1977 the Mayor, with the approval of Council, on the basis of accomplishments after 1863 (later amended to 1836). For appointed 18 citizens to serve on the Board with designated terms of two, four, purposes of selection and designation, the human endeavors of the honorees and six years. The Board also includes a representative of City Council and the shall be divided into the following six major categories: chairman of the Civic Center Board as an ex-officio member. (1) Music and Fine Arts (4) Sports and Athletics The membership of the Board has changed as new appointments have been (2) Business and Industry* (5) Public Service made by the Mayor and Council from time to time. -

Lights, Camera

Travel/Advice/Books INSIDE : Anniversary/D4 D Special Activities/D4 Sunday News-Register Antiques/D5 Calendar/D6 FEBRUARY 28, 2016 LIFE Grapevine LINDA COMINS Local Author Envisions Earlier City Lights, Camera ... While Wheeling Mayor Andy McKenzie was giving his “State of the City” address at noon Tues - day, Wheeling resident Chuck Wood was in a different place sharing his take on the town of 166 years ago. ACTION! Wood spoke at Lunch With Books at the Ohio County Public Library and read excerpts from his new novel, “Wheeling 1850.” A scientist and fan of historical fic - tion, Wood said he takes inspira - tion from author Anne Perry whose books “combine good sto - rytelling about social issues and people doing interesting things with a murder mystery.” His unpublished novel also is a murder mystery, set in a time when Wheeling was booming and growing, with construction under - way throughout the city. It was, he pointed out, an earlier era when Wheeling was reinventing itself. The main characters of Wood’s book are Henry Russell, a profes - sor at the fictional Zane College in File and AP Photos Wheeling, and his 20-year-old The Bellaire Bridge is seen as shown in the motion picture “The Silence of the Lambs.” Inset, clockwise from top left, are daughter, Athena. Mixing histori - movie posters from “Fools’ Parade,” “Out of the Furnace,” “The Silence of the Lambs” and “Reckless.” All of these films cal figures with made-up people, had scenes shot on location in the Ohio Valley. the author creates a friendship between Athena and the future real-life author, Rebecca Harding (later Davis). -

2018-19 Annual Report

WLU FOUNDATION | 2018-19 ANNUAL REPORT 1 The Foundation DEAR FRIENDS, WLU FOUNDATION STAFF I’m pleased to report that fiscal year 2019 was a time of supports, continued growth for the WLU Foundation. Revenue strengthens increased 19% and contributions increased 51% over the previous fiscal year! and sustains The endowment has increased 44% since fiscal year West Liberty 2016 and last year alone, we welcomed 11 new members University through to our Nathan Shotwell Planned Giving Society. In 2019, we also saw a huge 44% increase in the number of new fundraising, donors giving their first charitable contribution ever to investment and the WLU Foundation. stewardship of All of this positive momentum can be credited to a few important factors. First, it is a GINNI MCFARLAND FINDLEY NICK MUSGRAVE testimony to your generous commitment to West Liberty University and its students. Finance Administrator Development Coordinator private funds. Secondly, it is inspired by the responsible leadership of President Stephen Greiner. Lastly, it is supported day in and day out by our staff and by our Board of Directors, led by Chairman David Croft. WLU FOUNDATION BOARD OF DIRECTORS The WLU Foundation is fortunate to have a dedicated Board of Directors. Thank you for your service! VISION STATEMENT: As part of our five-year strategic direction, we plan to continue these positive trends. The WLU Foundation will build We are prepared to face continued challenges presented by the realities of limited donor trust through ethical resources with strength and creativity. E. Marc Abraham James Frum Honorary Board Members practices and communication Marty Adams Stephen Greiner, Ex Officio R. -

Guide to Historic Sites in West Virginia

AMERICAN HERITAGE TRAVELER HERITAGE Guide t o Historic Sites in West Virginia Virginia and remain with the Union as are all located inside the 1,650-acre Northern Panhandle West Virginia. Three floors contain Oglebay Park. The visitors center, located exhibits including 13 original Civil War six miles to the southwest, features inter - Grave Creek battle flags, Gov. Francis H. Pierpont’s active displays such as a talking map of Archaeological Complex desk, and the original 1859 courtroom. the 18th-century town and a model Around 250 B.C. the Adena people (304) 238-1300 or www.wvculture.org/ steamboat. (304) 232-3087 or constructed this 62-foot-high, multiple- museum/WVIHmod.html www.nps.gov/whee level burial mound, which visitors can walk West Virginia Penitentiary atop. On the two-acre grounds is the Delf Mid-Ohio Valley Norona Museum, which contains exhibits For more than 150 years the state incarcer - about this pre-Columbian people that ated its most dangerous criminals in this 1876 Gothic prison. Ninety-minute guided Blennerhassett Island lived in northern West Virginia between Historical State Park 250 B.C. and 150 B.C. (304) 843-4128 tours wind through the first floor cellblock, or www.wvculture.org/museum/ cafeteria, recreation yard, and solitary This 511-acre island off the coast of Park - GraveCreekmod.html confinement quarters. The 600-square-foot ersburg features a Civil-War-era log cabin museum contains artifacts such as officer and the 1802 Putnam House, which can Wellsburg Historic District batons and the electric chair used to be seen on a 30-minute, two-mile narrated Founded in 1791, this Ohio River town execute serial killer Harry Powers in 1932. -

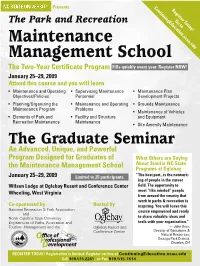

Maintenance Management School the Two-Year Certificate Program Fills Quickly Every Year

Presents ContinuingEducation.ncsu.edu Register Today! The Park and Recreation Go to Maintenance Management School The Two-Year Certificate Program Fills quickly every year. Register NOW! January 25–29, 2009 Attend this course and you will learn • Maintenance and Operating • Supervising Maintenance • Maintenance Plan Objectives/Policies Personnel Development Projects • Planning/Organizing the • Maintenance and Operating • Grounds Maintenance Maintenance Program Problems • Maintenance of Vehicles • Elements of Park and • Facility and Structure and Equipment Recreation Maintenance Maintenance • Site Amenity Maintenance The Graduate Seminar An Advanced, Unique, and Powerful Program Designed for Graduates of What Others are Saying About Similar NC State the Maintenance Management School Programs at Oglebay January 25–29, 2009 Limited to 25 participants. “ The best part...is the network- ing of people in the career Wilson Lodge at Oglebay Resort and Conference Center field. The opportunity to Wheeling, West Virginia meet “like minded” people from around the country that work in parks & recreation is Co-sponsored by Hosted by inspiring. You will leave this National Recreation & Park Association course empowered and ready and North Carolina State University to share valuable ideas and Department of Parks, Recreation and tools with your organization.” Tourism Management and the Oglebay Resort and — John Oros, Conference Center Director of Operations & Natural Resources, Geauga Park District, Chardon, OH REGISTER TODAY! Registration is limited. Register on-line at ContinuingEducation.ncsu.edu, Call 919.515.2261, or Fax 919.515.7614 . The Park and Recreation Maintenance Management School January 25–29, 2009 Why You Should Attend First Year Curriculum As a first year student you will The Maintenance Management School is a comprehen- become aware of effective profes- sive two-year professional development program espe- sional techniques of maintenance cially designed for park and recreation personnel. -

S^EST Llhtsmly

ff % ?Ixft It- S^EST LlHtsMlY Tg cvi-aai TO THE GRAND COUNCIL OF THE INTERNATIONAL FRATERNITY OF DELTA SIGIviA PI March 27, I960 Gentlemen; We, the undersigned members of the Business Club, hereby petition for a charter to establish a chapter of the INTERNATIONAL FRATERNITY OF DELTA SIGMA PI on the campus of the West Liberty State College, at West Liberty, West Virginia. Having been organized for the sole purpose of petitioning the INTERNATIONAL FRATERNITY OF DELTA SIGI^IA PI, we are fully aware of the high ideals, the purposes, the aims, and the requirements of the FRATERNITY. In seeking this affiliation, we pledge ourselves to uphold the CONSTITUTION and BY-LAWS of tne organization, and to observe faithfully the rules and regulations set forth by the FRATERNITY. Witness to our signatures: -y/)A:rJ\Jayo -^^ . \ ^r^-^ PRESIDENT VICE-PRESIDENT � d-^l^'K�-e^ A^X- ((^xtOA l^.>iY^i:Je. -if^.j,...J J)^M,^. -U^iXL^ m�Mm:. -nJ'^t Jr.^ 4^Hr^ ^^gVy.JL �- <L/.. J) h.^j. UJUUii..,^ 7<tiA^^i^^ dfVr'y. .^L^f^(^^. ^H^-^^'^^'-' (^^^.<x^.<:.^-<'^X^^ ^njL^ C , .y^~2A,cn~*^ \'-l Dr. Paul N, Elbin, President West Liberty State College West Liberty State College Paul N. Elbin, President West Liberty, West Virginia March 24, 1960 Mr, J. D, Thompson Executive Director DELTA SIGMA. PI 330 South Campus Avenue Oxford, Ohio Dear Mr. Thompson: The application of our Business Club for recognition by Delta Sigma Pi has my approval, as well as the approval of the entire Administrative Committee. I believe our Club has worthy leadership and that the fraternity will be able to realize its objectives. -

Cvbvisitorsguide2020.Pdf

Visit WHEELING 2020VISITORS GUIDE HISTORY. EXPERIENCE. TRADITION. The Wheeling-Ohio County Convention & Visitors Bureau does not warrant or guarantee the quality of accommodations, restaurants, and other facilities listed in the guide. A LEGACY OF HOSPITALITY MORE THAN 90 YEARS AGO, a tradition of generous hospitality began at the summer estate of Earl W. Oglebay. Today, the picturesque beauty of Oglebay’s property has grown to 2,000 acres of year-round recreational activities and exceptional overnight accommodations amid the property’s natural beauty. Wheeling-Ohio County Convention and Visitors Bureau WHEELING, WV 465 Lodge Drive | Wheeling, WV 877-436-1797 | www.oglebay.com Letter from the DIRECTOR Wheeling is a culturally alive and diverse city located on the I-70 corridor between Columbus, Ohio, and Pittsburgh, Pennsylvania. With big-city amenities not found in most small towns and a scenic location along the Ohio River, Wheeling has so much to offer visitors and residents. Steeped in rich history and bursting with activities for all ages, you will find Wheeling a place with vibrant landmarks, an iconic resort and park, destination retail, and a unique restaurant scene. HERE’S AN INSIDER TIP FOR VISITORS: Talk to people while you are here. Wheelingites are friendly and eager to share their favorite spots to eat, shop, play, and relax. From all of us, “Welcome to Wheeling." Discover artwork in unexpected places. EXPLORE THE ARTS IN WHEELING! Oglebay Institute’s Stifel Fine Arts Center & School of Dance 1330 National Rd, Wheeling • www.oionline.com Artworks Around Town in Centre Market 2200 Market St., Wheeling • www.artworksaroundtown.com The Artisan Center 3 1400 Main St., Wheeling • www.artisancenter.com Whether you're spending a day in Wheeling, a weekend, or a week, planning a trip to maximize your time can be a challenge. -

2011 Induction April 16 1980 INDUCTEES

2011 Induction April 16 1980 INDUCTEES 2011 Induction Ceremony April 16, 2011 Business, Industry and Professions - Ralph R. Kitchen Business, Industry and Professions - Dr. James Edmund Reeves Education and Religion - The Most Rev. Bishop Bernard W. Schmitt Music and Fine Arts - Dennis Magruder Philanthropy - Elizabeth Stifel Kline Philanthropy - George W. Lutz Public Service - John Edward “Jack” Fahey Program National Anthem MOST REV. JOHN J. SWINT, D.D. WILLIAM E. WEISS CLARA M. WELTY Invocation - The Reverend Jeremiah F. McSweeney 1879 - 1962 1879 - 1942 1879 - 1960 (EDUCATION AND RELIGION) (BUSINESS AND INDUSTRY) (PHILANTHROPY) Master of Ceremonies - Jim Squibb, Chairman, Wheeling Hall of Fame Board Bishop of the Diocese of Wheeling for 40 As a young pharmacist, he started to In her lifetime, a generous contributor to Official Welcome from City of Wheeling years. Leader in education and religion. manufacture a single drug product for the local and national charities, with a special Induction of Honorees into the Wheeling Hall of Fame - By Hall of Fame Board Members Directed an expansive building program of local market. By the early 1930’s his Sterling concern for the aged. At her death, she left churches, schools and hospitals. Founder of Drug Company was the world’s largest a permanent trust which made possible the Responses - By Hall of Fame Inductees or their Representatives Wheeling College. Named Archbishop by manufacturer of proprietary remedies, with construction and operation of Welty Closing Remarks - Jim Squibb Pope Pius XII in 1954 on his fiftieth plants world wide. Also a founder of American Memorial Home. Later, the trust made Benediction - The Reverend Mark E.