MSCA Newsletter

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Crossing Busy Streets

Plymouth Square Park Northport e 3rd Ter NW 55th Ave McKenna 47th 1/2 v Wyn Ascot Ct 55th Ave A d Tioga Ct lvd I-35W 5 e Elem Ath Ave 55th Ave B C D ham E Tioga B F 5 v d th A 55 Park Ave NE Sailor La Old Osseo Rd C n Hilltop T W Canyon La E River Rd a e i 4th St x r w r e f E N v Park 3rd St NW o in Anoka 47th Ave NE 47th Ave NE 47th Ave NE G 47th Ave NE r o A Bellvue L d Bicentennial Ct r Lions Ave11th NW t n a 54th Ave County h H k p a Park North e e o Park g 46th 1/2 Ave NE W Charles HWY 100 r H i 2nd St NW Chatham Rd NE g B Riverfront r Knox Ave 2 W N 5th Ave NW o n N Girard Ave Thom Ct t e h 12th Ave NW Irving Ave d St Logan Ave l Brooklyn Blvd a James Ave Colfax Ave Bryant Ave v 53rd Pl L Penn Ave City Hall i D Fremont Ave t Oliver Ave Emerson Ave Perry d Twin M g Dupont Ave Queen Ave s e Lilac Dr Camden Ave Regional g 8 r h D R a Russell Ave Humboldt Ave 46th Ave NE 46th Ave NE 46th Ave NE t r t y Johnson St NE How many does it take to get from your e s i Park r w Newton Ave e Lake Park s D H 53rd Ave e Ivanhoe Pl NE H 53rd Ave N r Silver Lake Rd 14th Ave NW r r 15th Ave NW 16th Ave NW Polk St NE N 17th Ave NW d Main St NE e 1st St NW T 53rd Ave N v A l Tyler St NE s T home to your school? r E h o h Taylor St NE Keyes le y O D S Fillmore St NE h Mississippi River i o m in University Ave NE r g l Park B N 4th St l County Rd E e Minneapolis45th Ave 45th Ave NE Walkingvd RoutesCounty Rd E for Youth BROOKLYN 45th Ave NE 2nd St NE N 1 W 8th Ave NW Lakeside C E 32nd Ave NW 52nd Ave W r 4 e 8 52nd Ave N t 52nd Ave N L Tony Schmidt i Upton Ave N e h Park y n OK, nowt calculate how many miles your school is h n k George Hill & 2nd 1/2 St NE 44th 1/2 Ave NE d A Neighborhood Walking Route Stinson Blvd NE Shingle T d CENTER s A County Park Trac Signal o v r Bright Water a e v a MPS High Schools r 17th Ave SW l from your home. -

January MSCA Backup12.40

2006 Corporate Sponsors American Engineering Testing, Inc. The Avalon Group Barna, Guzy & Steffen, Ltd. news Bremer Bank, N.A. CB Richard Ellis Volume 20, Number 1 January 2006 CSM Corporation Cambridge Commercial Realty Colliers Feature The Collyard Group, L.L.C. What Every Real Estate Professional Should Dalbec Roofing Know About New Market Tax Credits Fantastic Sams General Growth Properties, Inc. by Tony Pasko, Bremer Bank, N.A. Great Clips, Inc. hat if you could borrow 100% of the New Market Tax Credits (NMTC) came into Griffin Companies cost of developing or substantially being in December of 2000 as part of the renovating your new shopping Community Renewal Tax Relief Act of 2000. H.J. Development, Inc. W center project, only pay debt service on 70% These tax credits are intended to stimulate J.E. Dunn – North Central and have the government pay a return on the investment in “low income communities” as Jones Lang LaSalle remaining 30%? While it may take some time defined by census data. While NMTC’s are and effort, New Market Tax Credits can help directed at businesses, many commercial KKE Architects, Inc. you do just that. Landform Tax Credits continued on page 2 Larkin Hoffman Daly & Lindgren Ltd. M & I Bank Madison Marquette Snapshot Messerli & Kramer, P.A. Shops at Plymouth Creek – Lot 5 Midwest Maintenance & Mechanical, Inc. Location: Southwest Corner of Project Morcon Construction Entrance at Hwy 55 and Vicksburg, Plymouth Northstar Partners/Cushman & Wakefield Month/Year to Open: Under Construction. Oppidan, Inc. Anticipated Tenant Delivery: April ‘06 Opus Northwest LLC Lot 5 Ownership: Plymouth Creek PCL Construction Ventures, LLC Park Midwest Commercial Real Estate Underlying Owner: CSM Corporation Paster Enterprises, LLC Lot 5 Developer & Managing Partner: RLK Incorporated Mosborg Ventures, LLC RSM McGladrey, Inc. -

Radio Shack Closing Locations

Radio Shack Closing Locations Address Address2 City State Zip Gadsden Mall Shop Ctr 1001 Rainbow Dr Ste 42b Gadsden AL 35901 John T Reid Pkwy Ste C 24765 John T Reid Pkwy #C Scottsboro AL 35768 1906 Glenn Blvd Sw #200 - Ft Payne AL 35968 3288 Bel Air Mall - Mobile AL 36606 2498 Government Blvd - Mobile AL 36606 Ambassador Plaza 312 Schillinger Rd Ste G Mobile AL 36608 3913 Airport Blvd - Mobile AL 36608 1097 Industrial Pkwy #A - Saraland AL 36571 2254 Bessemer Rd Ste 104 - Birmingham AL 35208 Festival Center 7001 Crestwood Blvd #116 Birmingham AL 35210 700 Quintard Mall Ste 20 - Oxford AL 36203 Legacy Marketplace Ste C 2785 Carl T Jones Dr Se Huntsville AL 35802 Jasper Mall 300 Hwy 78 E Ste 264 Jasper AL 35501 Centerpoint S C 2338 Center Point Rd Center Point AL 35215 Town Square S C 1652 Town Sq Shpg Ctr Sw Cullman AL 35055 Riverchase Galleria #292 2000 Riverchase Galleria Hoover AL 35244 Huntsville Commons 2250 Sparkman Dr Huntsville AL 35810 Leeds Village 8525 Whitfield Ave #121 Leeds AL 35094 760 Academy Dr Ste 104 - Bessemer AL 35022 2798 John Hawkins Pky 104 - Hoover AL 35244 University Mall 1701 Mcfarland Blvd #162 Tuscaloosa AL 35404 4618 Hwy 280 Ste 110 - Birmingham AL 35243 Calera Crossing 297 Supercenter Dr Calera AL 35040 Wildwood North Shop Ctr 220 State Farm Pkwy # B2 Birmingham AL 35209 Center Troy Shopping Ctr 1412 Hwy 231 South Troy AL 36081 965 Ann St - Montgomery AL 36107 3897 Eastern Blvd - Montgomery AL 36116 Premier Place 1931 Cobbs Ford Rd Prattville AL 36066 2516 Berryhill Rd - Montgomery AL 36117 2017 280 Bypass -

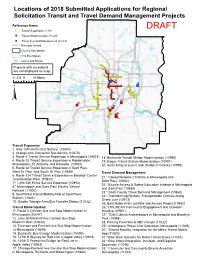

Locations of 2018 Submitted Applications for Regional Solicitation Transit and Travel Demand Management Projects

Locations of 2018 Submitted Applications for Regional Solicitation Transit and Travel Demand Management Projects Reference Items )" Transit Expansion (1-10) DRAFT " Transit Modernization (11-20) " Travel Demand Management (21-33) Principle Arterial County Boundaries City Boundaries Lakes and Rivers Projects with an asterisk 6 are not displayed on map. 13 4 0 2.5 5 10 Miles 28 ") 11 ")25 3 12 17 5 10 ")9 ") § 19 20 ") ") 1 ")14 18") ")16 2 ") 15 Transit Expansion 1. Hwy 169 Interim Bus Service (10843) 2. Orange Line Connector Bus Service (10870) 3. Route 4 Transit Service Expansion in Minneapolis (10923) 18. Burnsville Transit Station Modernization (10990) 4. Route 32 Transit Service Expansion in Robbinsdale, 19. Eagan Transit Station Modernization (10991) Minneapolis, St. Anthony, and Roseville (10928) 20. Solar Array at East Creek Station in Chaska (10999) 5. Route 68 Transit Service Expansion in Saint Paul, West St. Paul, and South St. Paul (10930) Travel Demand Management 6. Route 724 Transit Service Expansion in Brooklyn Center 21.* Closed Network Carshare in Minneapolis and and Brooklyn Park (10932) Saint Paul (10804) 7.* I-494 SW Prime Service Expansion (10994) 22.* Bicycle Access & Safety Education Initiative in Minneapolis 8.* Minneapolis and Saint Paul Electric Vehicle and Saint Paul (10834) Network (11000) 23.* Scott County Travel Demand Management (10860) 9. SouthWest Transit Mobility Hub at SouthWest 24.* Transforming Renters' Transportation Choices Along Station (11024) Green Line (10913) 10. Golden Triangle Area Bus Transfer Station (11032) 25. East Metro First-Last Mile Job Access Project (10942) Transit Modernization 26.* HOURCAR Community Engagement and Outreach 11. Route 6 Corridor Bus and Stop Modernization in Initiative (10961) Minneapolis (10647) 27.* TDM Cultural Ambassadors in Minneapolis and Brooklyn 12. -

NOTABLE TRANSACTIONS Q3 2015 We’Re Proud to Present Our Notable Transactions Report for the Third Quarter of 2015

NOTABLE TRANSACTIONS Q3 2015 We’re proud to present our Notable Transactions report for the third quarter of 2015. We’re confident that it will help to keep you informed on deals closing in our market. Thank you to the many MNCAR volunteers for dedicating your time and expertise in developing this report. - Matt Anfang, Executive Director Many thanks to our Market Experts who assisted with this report: OFFICE INDUSTRIAL GREATER MN Tom Stella - Chair Jason Butterfield Reed Christianson Tom Sullivan - Chair Eric Batiza Chris Garcia Nick Leviton Kevin Brink Greg Follmer Cushman & Cushman & Transwestern Cushman & Colliers International CGC Commercial Colliers International INH Properties Greg Follmer Wakefield/NorthMarq Wakefield/NorthMarq Wakefield/NorthMarq Minneapolis-St. Paul Real Estate Minneapolis-St Paul Commercial RE Sean Coatney Matt Delisle Jerry Driessen Dan Lofgren Brent Masica Andy McIntosh Matt Oelschlager Dave Holappa Shelley Jones Core Commercial Colliers International CBRE Liberty Property Trust Cushman & CSM CBRE Holappa Commercial The Jones Group Real Estate Minneapolis-St. Paul Wakefield/NorthMarq Real Estate Lynette Dumalag Chris Gliedman Mike Honsa Brent Karkula Duane Poppe Eric Rossbach Phil Simonet Jack Tornquist Barb Phelps Jamey Shandley NTH CBRE Transwestern CBRE Transwestern Colliers International Paramount CBRE Paramark Hamilton Minneapolis-St Paul Corporation Real Estate RETAIL Eric King Andrew Manthei Jim Montez Cushman & KW Commercial Cushman & Wakefield/NorthMarq Midwest Wakefield/NorthMarq Dan Mossey - Chair David Daly Patrick Daly Jesseka Doherty Lisa Diehl Ian Halker Tim Igo Brad Kaplan Kraus-Anderson CBRE Mid-America Mid-America Diehl & Colliers International Suntide Cushman & Realty Real Estate Real Estate Partners Minneapolis-St Paul Wakefield/NorthMarq Jeff Nordness Kevin O’Neil Bob Pfefferle Essence Real Estate Colliers International Hines Minneapolis-St. -

Minnesota 55402-4012

U.S. Department of Housing and Urban Development Minneapolis Field Office 920 Second Avenue South, Suite 1300 Minneapolis, Minnesota 55402-4012 As requested, enclosed are lists of HUD Affordable Rental Housing in your requested area. The amount and type of assistance may vary per building but the majority of the buildings have Project-Based Section 8 subsidy, where the tenant pays 30% of their adjusted gross monthly income for rent. The difference between the amounts paid by the resident and the rent charged by the owner is paid by the Department of Housing and Urban Development (HUD). Although HUD provides the funding, the responsibility for operating the program rests with the site manager. After selecting a building(s) from the list, please contact the on-site manager from the phone number(s) provided. They can answer questions regarding your eligibility and the availability of units, as each site maintains its own waiting list and takes your application. The list shows the number of units in the building as well as the population they are designated to serve. Rent: Generally, a HUD affordable housing tenant pays 10 percent of gross income or 30 percent of adjusted income, WHICHEVER IS HIGHER, but not less than $25, for rent including utilities. HUD pays the difference between the tenant's share and the regular rental to the owner as housing assistance. If utilities are designated to be paid by the resident, a utility allowance is subtracted in determining the actual rent paid to the project. Utilities are then paid by the tenant directly to the utility company as billed. -

Spring 2011 Working.Indd

S In this Issue: V P o The Schell’s Brewery Tradition l PAGE 16 R u m Announcing the 2011 Equal Eyes I e Photo Contest N PAGE 20 33 Spotlight on Region 9’s G “Big Cities” N QUAL PAGE 21 u E m Lake Vermilion State Park 2 b PAGE 36 e 0 r Classif-Eyeds: Hillcrest Golf Club PAGE 41 1 124 New Department: 1 The Chair’s Corner YES PAGE 44 Offi cial Publication of the Minnesota Association of Assessing Offi cers www.mnmaao.orgE Spring 2011 | Equal Eyes 1 Volume 33 Number 124 SPRING 2011 Article to suggest, letter to the editor, or any other correspondence for EQUAL EYES? Send to: EQUAL EYES Equal Eyes Managing Editor PO Box 41576 Features Plymouth, MN 55441 12 Getting to Know the Editorial Committee’s [email protected] Newest Members 16 The Schell’s Brewery Tradition 20 2011 Equal Eyes Photo Contest Announcement 21 Spotlight on MAAO Region 9 “Big Cities” 34 Region 9 Big Cities Featured Property: Eidem Historical Farm 36 Lake Vermilion State Park 43 Property Tax Working Group Update 10 42 Departments 3 In the Know 4 Boards, Directors, Chairs, and Representatives 16 6 President’s Connection 8 Commissioner’s Comments 9 MAAP Update 10 Let’s Get Acquainted 34 11 Out of the Past 15 Meet Minnesota’s New SAMA & AMA Designees 18 Course Reviews 40 International Items 36 Equal Eyes Classif-Eyeds Cover Photo 41 Image Courtesy of MN Department of Natural Resources 42 Revisiting the Retirees Visit 44 The Chair’s Corner the MAAO website at: www.mnmaao.org 46 Transitions 48 What’s New on the MAAO Website The statements made or opinions expressed by authors in Equal Eyes do not necessarily represent a policy position of the Minnesota Association of Assessing Offi cers. -

Minneapolis-St. Paul | Retail Q1 2017

Research & Forecast Report MINNEAPOLIS-ST. PAUL | RETAIL Q1 2017 The Changing Demographic of Consumers Presents a Break with Retailers of the Past Vacancy & Absorption Trends The vacancy rate in the Minneapolis-St. Paul retail market Market Indicators increased for the third straight quarter, rising to 6.1 percent in Relative to prior period Q1 2017 quarter one of 2017. Vacancy has been steadily increasing from VACANCY end of year 2015 when at that time, it was at 4.4 percent. There was 28,426 square feet of negative absorption, which was NET ABSORPTION largely due to regional shopping centers metro-wide reporting RENTAL RATE negative 152,446 square feet of absorption. Some of the negative absorption was due to Sears closing in Coon Rapids, vacating 132,700 square feet. Net Absorption Changes on the Horizon for Fast Casual Dining 872,912 1,111,241 Fast casual retail expansion activity continues to remain strong in 1,000,000 632,849 508,759 431,134 the Twin Cities, while long-standing sit-down chain restaurants like 500,000 251,879 Applebee’s, Ruby Tuesday’s and Buffalo Wing Wings are projected 0 (28,426) to decline as diners are consistently opting for convenience, (246,509) (143,478) SF Absorbed affordability and healthier options. The competitive and ever- (500,000) (335,329) changing nature of the restaurant retail landscape is forcing the (1,000,000) (962,017) retail giants of the past to reinvent themselves as newcomers in 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 the market continue to emerge. -

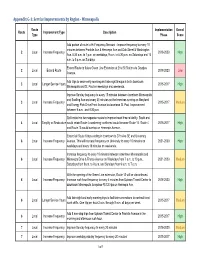

Appendix G‐1: Service Improvements by Region ‐ Minneapolis

Appendix G‐1: Service Improvements by Region ‐ Minneapolis Route Implementation Overall Route Improvement Type Description Type Phase Score Add portion of route to Hi-Frequency Network - Improve frequency to every 10 minutes between Franklin Ave & Hennepin Ave and Oak Street & Washington 2 Local Increase Frequency 2018-2020 High Ave. 5:30 a.m. to 7 p.m. on weekdays, 9 a.m. to 6:30 p.m. on Saturdays and 10 a.m. to 5 p.m. on Sundays Extend Route to future Green Line Extension at 21st St Station via Douglas 2 Local Extend Route 2018-2020 Low Avenue. Add trips to serve early morning and late night lineups in both downtown 3 Local Longer Service Hours 2015-2017 High Minneapolis and St. Paul on weekdays and weekends. Improve Sunday frequency to every 15 minutes between downtown Minneapolis and Snelling Ave and every 30 minutes on the branches running on Maryland 3 Local Increase Frequency 2015-2017 Medium and Energy Park Drive/Front Avenue to downtown St. Paul. Improvement between 9 a.m. and 9:30 p.m. Split route into two separate routes to improve travel time reliability. South end 4 Local Simplify or Restructure would retain Route 4 numbering; north-end would become Route 15. Route 4 2015-2017 High and Route 15 would overlap on Hennepin Avenue. Extend all Route 6 trips ending in downtown to 27th Ave SE and University 6 Local Increase Frequency Avenue. This will increase frequency on University to every 10 minutes on 2021-2030 High weekdays and every 15 minutes on weekends. -

Appendixc Backgroundinformati

City of Brooklyn Center 2040 Comprehensive Plan Update Appendix C: Background Information 2018 TABLE OF CONTENTS SOCIO-ECONOMIC CONDITIONS MAPPING & BACKGROUND INFORMATION Metropolitan Council Forecasts 1 Introduction 37 Age Distribution 2 Metropolitan Council Community Designation 39 Household & Family Type 5 2030 Future Land Use Plan 41 Poverty Level 8 Community Dev. Activities & Projects 2016 42 Racial & Ethnic Composition 11 Natural Resources 46 English Proficiency 14 Metropolitan Council Transit Market Areas 48 Geographic Mobility 15 Existing Transit/Bus Routes 50 Education Levels 17 Housing – Age of Homesteaded Structures 52 Household Income Levels 19 Housing – Age of Rental/Multi-Family Structures 54 Vehicle Access 22 Housing – Sq Ft of Single-Family Homes 56 Travel Time to Work 23 Census Tracts with Concentrated Poverty 58 Mode of Transportation to Work 26 School District Boundaries 60 Employment 27 Parks, Park Classifications & Schools 61 Jobs in Brooklyn Center 28 Infrastructure (Water & Wastewater) 63 Jobs of Residents 31 HOUSING Metropolitan Council Housing Assessment 31 Year Housing Built 34 Housing Structure Type 36 SOCIO-ECONOMIC CONDITIONS The following section presents demographic and economic data for the City of Brooklyn Center. This data provides an understanding of key trends that influence land use and other important community systems. In many of the exhibits included in this section, additional data is also presented for Hennepin County and the 7-County Twin Cities Metropolitan Area. This additional data is intended to provide greater context to trends and patterns that likely extend well beyond Brooklyn Center’s border but nevertheless impact the community. Metropolitan Council Forecasts The Metropolitan Council prepares socio-economic forecasts for each community within the 7-County metropolitan area. -

Bottineau Gazette

BOTTINEAU GAZETTE A Publication of the Bottineau Neighborhood Association 2205 California Street ™ Minneapolis, MN ™ 55418 612.782.2145 ™ [email protected] In This Issue Public Comment Period NOTICE Regarding Cedar Services Site Neighborhood Meeting Cedar Services Comment Thursday, February 23rd Period.......................1 The Health Consultation for the Cedar 7:00 PM at Services Site has been completed and Eastside Neighborhood Services One River Mississippi..1 is available for viewing. The public th comment period ends on March 8 . OPEN FORUM Phone Numbers.........2 Cedar Services was an operating wood To help us prepare for the 3rd Ward treatment facility until 1972. It was Summit, the BNA Board of Directors Liquor and Livability...2 located at the southeast corner of St. will have a summary of what we have Anthony Boulevard and University heard are your top issues and priorities Rentwise Tenant Avenue. Around 1961, about 30,000 for the neighborhood. This is your Education..................2 gallons of PCP wood treatment fluid chance to correct us and add more was spilled after a truck accident on before the summit on March 4th. Third Ward Forum ......2 the site. This Health Consultation addresses that spill, which appears Bottineau Park News...3 to affect the groundwater in the Bottineau neighborhood. The report > GAF Getting There from contains background and historical Here .........................3 information, discussion about the also installed a new filter in the fume chemicals involved, conclusions, line, which Mr. Clark indicated seems Websites...................3 recommendations, pages of maps to have had a positive impact in itself. and more. The recommendation that He further said —it is a high priority for Calendar...................4 has the most impact on the Bottineau the Plant Staff to complete this neighborhood is that all private wells project going into March.“ Bottineau Neighborhood in the area should be tested. -

Annual Comprehensive Financial Report for the Year Ended

Annual Comprehensive Financial Report For the year ended December 31, 2020 City of Brooklyn Center, Minnesota Member of the Government Finance Officers Association of the United States ANNUAL COMPREHENSIVE FINANCIAL REPORT OF THE CITY OF BROOKLYN CENTER, MINNESOTA Dr. Reginald M. Edwards Acting City Manager Prepared By: FINANCE DIVISION DEPARTMENT OF FISCAL & SUPPORT SERVICES Mark Ebensteiner Finance Director Andrew Splinter Assistant Finance Director FOR THE YEAR ENDED DECEMBER 31, 2020 Member of Government Finance Officers Association of the United States and Canada This page has been left blank intentionally. CITY OF BROOKLYN CENTER, MINNESOTA TABLE OF CONTENTS Page No. INTRODUCTORY SECTION Letter of Transmittal 1 Principal Officials 9 Organizational Chart 10 Certificate of Achievement 11 FINANCIAL SECTION Independent Auditor's Report 13 Management's Discussion and Analysis 17 Basic Financial Statements Government-wide Financial Statements Statement of Net Position 29 Statement of Activities 30 Fund Financial Statements Governmental Funds Balance Sheet 32 Reconciliation of the Balance Sheet of Governmental Funds to the Statement of Net Position 35 Statement of Revenues, Expenditures and Changes in Fund Balances 36 Reconciliation of the Statement of Revenues, Expenditures and Changes in Fund Balances of Governmental Funds to the Statement of Activities 38 Statement of Revenues, Expenditures and Changes in Fund Balance: Budget and Actual General Fund 39 Tax Increment District No. 3 Special Revenue Fund 40 Proprietary Funds Statement