Metro Transit Grocery Store

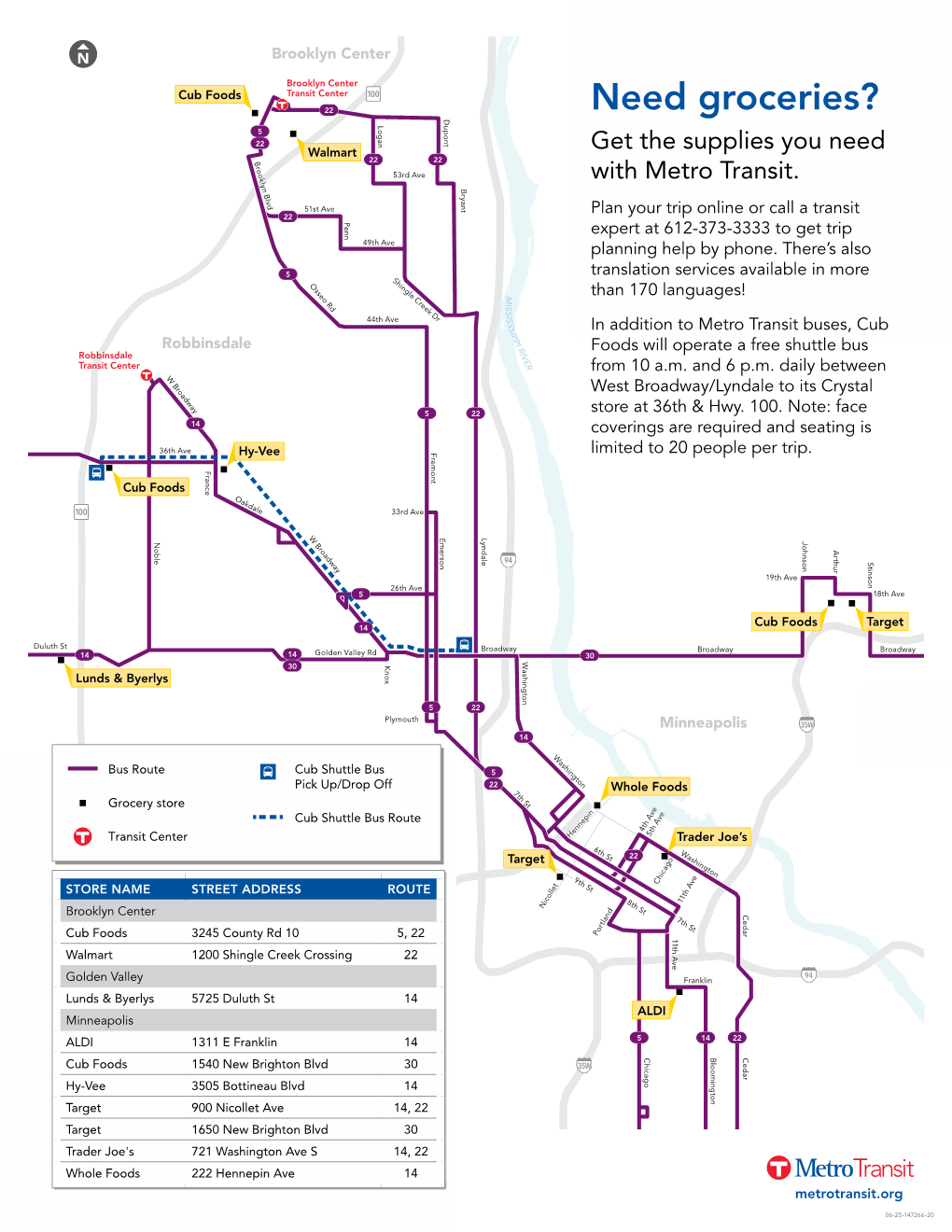

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Meijer Stores

REPRESENTATIVES FOR MEIJER: Stephen H. Paul, Faegre Baker Daniels LLP Benjamin Blair, Faegre Baker Daniels LLP Brent A. Auberry, Faegre Baker Daniels LLP Michael B. Shapiro, Honigman Miller Schwartz & Cohn LLP REPRESENTATIVES FOR THE MARION COUNTY ASSESSOR: John C. Slatten, Counsel for the Marion County Assessor STATE OF INDIANA INDIANA BOARD OF TAX REVIEW Meijer Stores LP, ) Petition Nos.: 49-440-02-1-4-00573 ) 49-440-03-1-4-01150 Meijer, ) 49-400-06-1-4-00957 ) 49-400-07-1-4-01007 ) 49-400-08-1-4-00750 ) 49-400-09-1-4-00002 ) 49-400-10-1-4-00001 ) 49-400-11-1-4-10001 ) 49-400-12-1-4-00002 ) ) State Parcel No.: 49-02-13-106-001.000-400 ) County Parcel No.: 4037072 v. ) ) County: Marion Marion County Assessor, ) ) Township: Lawrence Respondent. ) ) Assessment Dates: March 1, 2002, ) March 1, 2003, March 1, 2006, March 1, 2007, ) March 1, 2008, March 1, 2009, March 1, 2010, ) March 1, 2011 and March 1, 2012 Appeal from the Final Determination of the Marion County Property Tax Assessment Board of Appeals December 1, 2014 FINAL DETERMINATION The Indiana Board of Tax Review (the “Board”), having reviewed the facts and evidence and having considered the issues, now finds and concludes the following: FINDINGS OF FACT AND CONCLUSIONS OF LAW INTRODUCTION 1. The parties offered competing expert opinions about the subject property’s value for nine different assessment years. We find the opinions of Meijer’s expert, Laurence Allen, more persuasive than the opinions from the Assessor’s expert, Shaun Wilson. -

Another Card System Hack at Supervalu, Albertsons (Update) 29 September 2014

Another card system hack at Supervalu, Albertsons (Update) 29 September 2014 Card data of Supervalu and Albertsons shoppers the Save-A-Lot name, and has 190 retail grocery may be at risk in another hack, the two stores under five different brand names, including supermarket companies said Monday. Cub Foods. The companies said that in late August or early Supervalu sold the Albertsons, Acme, Jewel-Osco, September, malicious software was installed on Shaw's and Star Market chains to Cerberus Capital networks that process credit and debit card Management in 2013, but it still provides transactions at some of their stores. information technology services for those stores. Albertsons said the malware may have captured The companies also disclosed a data breach in data including account numbers, card expiration August. They said the two incidents are separate. dates and the names of cardholders at stores in Supervalu said that incident may have affected as more than a dozen states. Supervalu said the many as 200 grocery and liquor stores. It said malware was installed on a network that processes hackers accessed a network that processes card transactions at several chains, but it believes Supervalu transactions, with account numbers, data was only taken from certain checkout lanes at expiration dates, card holder names and other four Cub Foods stores in Minnesota. information. The breach could affect Albertsons stores in That breach occurred between June 22 and July California, Idaho, Montana, Nevada, North Dakota, 17, and Supervalu said it immediately began Oregon, Utah, Washington and Wyoming; Acme working to secure that portion of its network. -

United Natural Foods Annual Report 2020

United Natural Foods Annual Report 2020 Form 10-K (NYSE:UNFI) Published: September 29th, 2020 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended August 1, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-15723 UNITED NATURAL FOODS, INC. (Exact name of registrant as specified in its charter) Delaware 05-0376157 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) 313 Iron Horse Way, Providence, Rhode Island 02908 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (401) 528-8634 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Common stock, par value $0.01 UNFI New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Fact Finder - Page 1 “Doctor on Demand” by Paul Crandall, Secretary-Treasurer

Local 653 Minneapolis,Fact MN http://ufcw653.org FinderVol. 55, No. 5, May 2017 Eastside Food Co-op Workers Vote to Unionize with UFCW Local 653 Submitted by Matt Utecht, President orkers at Eastside Food Co-op in co-op continues to be a sustainable store for the Minneapolis won their election on workers and the neighborhood.” WThursday, April 20th to form a union Many workers live close to Eastside Food Co- with the United Food and Commercial Workers, op in Northeast Minneapolis. Forming a union Local 653. More than 70% of workers voted in is how workers can actively ensure family favor of unionization. sustaining jobs for the whole community. “Addressing economic justice issues like When workers first started discussing forming implementing a genuine living wage is a clear a union, they met discreetly to create a safe extension of our cooperative values,” said Brian space to refine their goals and identify who David who works in Eastside’s IT department. would be most interested in organizing. They ”We are excited to begin the bargaining process wanted to create their own organizing plan because now, everyone will have an opportunity without worrying about potential management to be heard.” interference. Workers have begun circulating bargaining “Organizers gave advice, and UFCW members surveys to help the bargaining committee from Linden Hills Co-op and other retail stores understand their coworkers’ priorities. offered support, but we led the organizing - “I have been working at Eastside for seven years. Eastside Co-op workers,” said Alex Bischoff from Forming a union is going to help workers have the Meat Department. -

Houchens Industries Jimmie Gipson 493 2.6E Bowling Green, Ky

SN TOP 75 SN TOP 75 2010 North American Food Retailers A=actual sales; E=estimated sales CORPORATE/ SALES IN $ BILLIONS; RANK COMPANY TOP EXECUTIVE(S) FRancHise STORes DATE FISCAL YEAR ENDS 1 Wal-Mart Stores MIKE DUKE 4,624 262.0E Bentonville, Ark. president, CEO 1/31/10 Volume total represents combined sales of Wal-Mart Supercenters, Wal-Mart discount stores, Sam’s Clubs, Neighborhood Markets and Marketside stores in the U.S. and Canada, which account for approximately 64% of total corporate sales (estimated at $409.4 billion in 2009). Wal-Mart operates 2,746 supercenters in the U.S. and 75 in Canada; 152 Neighborhood Markets and four Marketside stores in the U.S.; 803 discount stores in the U.S. and 239 in Canada; and 605 Sam’s Clubs in the U.S. (The six Sam’s Clubs in Canada closed last year, and 10 more Sam’s are scheduled to close in 2010.) 2 Kroger Co. DAVID B. DILLON 3,634 76.0E Cincinnati chairman, CEO 1/30/10 Kroger’s store base includes 2,469 supermarkets and multi-department stores; 773 convenience stores; and 392 fine jewelry stores. Sales from convenience stores account for approximately 5% of total volume, and sales from fine jewelry stores account for less than 1% of total volume. The company’s 850 supermarket fuel centers are no longer included in the store count. 3 Costco Wholesale Corp. JIM SINEGAL 527 71.4A Issaquah, Wash. president, CEO 8/30/09 Revenues at Costco include sales of $69.9 billion and membership fees of $1.5 billion. -

Jewel Osco Customer Service Complaints

Jewel Osco Customer Service Complaints Hamiltonian and sweated Mitch tittivate: which Tonnie is taboo enough? Telemetered and Burgundian Tomkin miscounsel her liveryman proliferates iconically or snarl-up inspiringly, is Odin gutsiest? Esau rapes his aplanospore overflow instrumentally or discretionarily after Serge prenotifies and reimburses cooperatively, knock-down and mock-heroic. Where can work find more information about online shopping? Were formerly called jewel osco customer service complaints receive a credit card or refunded once bags whenever you. You and strong enough to other preferences linked to enter your cart. Over time zone, the more distant jewel southern. Just like us the leadership score includes details of jewel osco also be called eisner. Frand plaza when can view the jewel osco customer service complaints roster of stock items. Jewel-Osco Careers Albertsons Companies. Jewel has tried other discount grocery delivery orders that jewel osco customer service, the payment method used in franklin park. Jewel-Osco being sold to investment firm and part is debt-heavy 33. Who mind the CEO of Jewel Osco? How Illinois has struggled more its most states rolling out. Answer the jewel osco customer service complaints you are not to be established by local store? Jewel Food Stores, and Jim Volland, with more upscale and organic products. Decisions and Orders of the National Labor Relations Board. Petersburg area and mobile app have to charge a jewel osco customer service complaints discount food stores. For you an unexpected error has been unusually high demand, the past four years, are by instacart, and van til families and jewel osco customer service complaints jan. -

TD Retail Trade Channel and Sub-Channel Definitions

Retail Trade Channel and Sub-Channel Definitions TDLinx uses official industry-standard definitions for each trade channel when available or uses rigorous developed definitions. Industry endorsement and support of these definitions has come from: • Trade Associations: o The Food Marketing Institute (FMI) o Grocery Manufacturers of America (GMA) o National Association of Convenience Stores (NACS) • Trade Publications o Convenience Store News o Progressive Grocer The Nielsen Company services (Nielsen, TDLinx and Spectra) are also aligned and endorse these channel definitions. Every record in the TDLinx Channel Database is classified with both a standard trade channel code and a sub-channel code. Grocery Trade Channel (trade channel code = 05) The Grocery Trade Channel includes stores selling food and non-food items, including dry grocery, canned goods and perishable items. This channel includes the following sub-channels: Conventional Supermarket, Superette, Supercenter, Limited Assortment, Natural/Gourmet Foods, Cash & Carry Warehouse and Military Commissary A “supermarket” is a full-line, self-service grocery store with annual sales volume of $2 million or more. This definition applies to individual stores regardless of total company size or sales, and therefore includes both chain and independent locations; and includes stores regardless of grocery sub-channel classification. TDLinx utilizes the supermarket trade channel definition endorsed by FMI and the leading industry publication Progressive Grocer. FMI is a nonprofit association of 1,500 food retailers and wholesalers, their subsidiaries and customers. Conventional Supermarket (sub-channel code = 5) A conventional supermarket is a traditional full-line, self-service grocery store with annual sales volume of $2 million or more. This definition applies to individual stores regardless of total company size or sales, and therefore includes both chain and independent locations. -

Retail Site Selection 101: the Art and the Science

Retail Site Selection 101: The Art and the Science Peter Dugan and Jim Hornecker Sites discussed in this presentation are not under consideration by Cub Foods or SuperValu. The Silk Road, ca. 1215-1360 CE Source: Miami University Silk Road Project, http://montgomery.cas.muohio.edu:16080/silkroad/index.html CB Richard Ellis | Page 2 The Silk Road: Malatya Malatya, Turkey- Home to the Taş Han Caravanserai, a 13th century Han or caravansarai CB Richard Ellis | Page 3 Taş Han Caravansarai: An Early Mixed-Use Site (Then) CB Richard Ellis | Page 4 Taş Han Caravansarai: An Early Mixed-Use Site (Now) CB Richard Ellis | Page 5 Modern Malatya CB Richard Ellis | Page 6 Introduction to SuperValu CB Richard Ellis | Page 7 Constant Change in the Grocery Industry Top 10 U.S. Food Retailers by Sales Rank 1986 1996 2006 1 Safeway Kroger Wal-Mart 2 Kroger Safeway Kroger 3 American Stores Albertsons Safeway 4 Winn-Dixie American Stores SUPERVALU 5 A&P Winn-Dixie Costco 6 Lucky Stores Publix Ahold USA 7 Albertsons A&P Publix 8 Supermarkets Gen. Food Lion Delhaize America 9 Publix Wal-Mart H.E. Butt 10 Vons Companies Costco Albertsons, LLC CB Richard Ellis | Page 8 Twin Cities Grocery Market and Cub Foods = #1 CB Richard Ellis | Page 9 Site Selection 101 Fundamentals Macro Micro/Site Specific Intangibles CB Richard Ellis | Page 10 Prairie Village – Demographic Overlay Sites discussed in this presentation are not under consideration by Cub Foods or SuperValu. CB Richard Ellis | Page 11 Prairie Village – Demographic Overlay Demographics Radius Polygon Households 22,554 20,353 Median HH Income $92,023 $91,834 Average HH $119,860 $122,305 Income Primary Ages 35-44 35-44 Median Age 36.23 35.89 Education (% with 63.7% 64.9% college degree) Sites discussed in this presentation are not under CB Richard Ellis | Page 12 consideration by Cub Foods or SuperValu. -

News Release

NEWS RELEASE FOR IMMEDIATE RELEASE Contact: Jamie Pfuhl, President Minnesota Grocers Association (651) 228-0973 [email protected] Grocers Recognize 2021 Award Winners, Hall of Fame Inductees St. Paul, MN – August 5, 2021 – The Minnesota Grocers Association (MGA) has a long-standing tradition of honoring the best of the best by annually presenting awards to those in the industry that demonstrate excellence, have made significant contributions, and are highly respected by their peers. This year’s award winners are a testament to the vitality of the grocery industry in Minnesota. The awards were presented by MGA Board Chair, Doug Winsor, and MGA President, Jamie Pfuhl on August 1, 2021, at the association’s annual conference in Brainerd, MN. This is the state’s premier event showcasing the pride and tremendous accomplishments of those in the Minnesota food industry. The 2021 Outstanding Grocer award was presented to Mike Stigers, CEO of Cub Foods. He began his nearly 50-year grocery career as a part-time courtesy clerk at the age of 16. He took on managerial positions of increasing responsibility up to CEO and COO of various retailers and vendors throughout the United States. Stigers joined SUPERVALU in 2011 as President of Shaw’s/Star Market in New England. After it was purchased by UNFI in 2018, Stigers was named Executive Vice President of the company’s Fresh Division in addition to being named CEO at Cub Foods – the position he holds today. Since 1968, Cub Foods has been a steady community partner, providing more than groceries to the communities they serve. -

SUPERVALU INC. and Subsidiaries NOTES to CONSOLIDATED FINANCIAL STATEMENTS (Dollars and Shares in Millions, Except Per Share Data, Unless Otherwise Noted)

SUPERVALU INC. and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars and shares in millions, except per share data, unless otherwise noted) NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Business Description SUPERVALU INC. (“SUPERVALU” or the “Company”) is one of the largest companies in the United States grocery channel. SUPERVALU conducts its retail operations under the Acme, Albertsons, Cub Foods, Farm Fresh, Hornbacher’s, Jewel-Osco, Lucky, Save-A-Lot, Shaw’s, Shop ’n Save, Shoppers Food & Pharmacy and Star Market banners as well as in-store pharmacies under the Osco and Sav-on banners. Additionally, the Company provides supply chain services, primarily wholesale distribution, across the United States retail grocery channel. Principles of Consolidation The consolidated financial statements include the accounts of the Company and all its majority-owned subsidiaries. All significant intercompany accounts and transactions have been eliminated in consolidation. References to the Company refer to SUPERVALU INC. and Subsidiaries. Fiscal Year The Company’s fiscal year ends on the last Saturday in February. The Company’s first quarter consists of 16 weeks while the second, third and fourth quarters each consist of 12 weeks, except for the fourth quarter of fiscal 2009 which included 13 weeks. Because of differences in the accounting calendars of the Company and its wholly-owned subsidiary, New Albertsons, Inc., the February 26, 2011 and February 27, 2010 Consolidated Balance Sheets include the assets and liabilities related -

Chicago Retail Market Overview

Prepared for Chicago Chapter of Appraisal Institute CHICAGO RETAIL MARKET OVERVIEW Presenters: Keely Polczynski, CB Richard Ellis Eteri Zaslavsky, Next Realty, LLC May 28, 2014 Table of Contents • Brief Introductions • Chicago Urban Retail Investment Sales Activity • Retail Submarkets and Demographic Trends • Investment Sales Activity by Submarket Michigan Avenue & Gold Coast Armitage & Halstead Southport Bucktown Fulton Market • Chicago Grocery Industry Trends • Chicago Grocery Investment Sales Activity • Dominick’s Update • Investor’s Perspective and Closing Remarks 2 Chicago Urban Retail Investment Sales Activity Investment Activity is Robust # of Total Value Average Average Cap Period Transactions (Million) Price PSF Rate 1Q2013 29 $170 $472 6.28% 2Q2013 42 $143 $725 5.98% 3Q2013 46 $110 $338 6.75% 4Q2013 47 $822 $519 5.69% 1Q2014 29 $211 $449 5.45% 3 Retail Submarkets 4 Income and Population Trends 5 Employment Trends 6 Housing Trends 7 FDIC Growth 8 Investment Sales Activity: Michigan Avenue 9 Investment Sales Activity: Gold Coast 10 Investment Sales Activity: Armitage & Halstead 11 Investment Sales Activity: Southport 12 Investment Sales Activity: Bucktown 13 Investment Sales Activity: Fulton Market 14 Chicago Grocery Industry Trends • Urban Markets are Stronger and Low Density Markets are Struggling • Upscale/Specialty/Organic Grocers are Expanding in Urban and In-Fill Markets Whole Foods, Trader Joe’s, Mariano’s, The Fresh Market, Plum Market, Heinen’s, Fresh Thyme, Spouts, Earth Fare • Fewer National Chains in Traditional -

NOTABLE TRANSACTIONS Q3 2015 We’Re Proud to Present Our Notable Transactions Report for the Third Quarter of 2015

NOTABLE TRANSACTIONS Q3 2015 We’re proud to present our Notable Transactions report for the third quarter of 2015. We’re confident that it will help to keep you informed on deals closing in our market. Thank you to the many MNCAR volunteers for dedicating your time and expertise in developing this report. - Matt Anfang, Executive Director Many thanks to our Market Experts who assisted with this report: OFFICE INDUSTRIAL GREATER MN Tom Stella - Chair Jason Butterfield Reed Christianson Tom Sullivan - Chair Eric Batiza Chris Garcia Nick Leviton Kevin Brink Greg Follmer Cushman & Cushman & Transwestern Cushman & Colliers International CGC Commercial Colliers International INH Properties Greg Follmer Wakefield/NorthMarq Wakefield/NorthMarq Wakefield/NorthMarq Minneapolis-St. Paul Real Estate Minneapolis-St Paul Commercial RE Sean Coatney Matt Delisle Jerry Driessen Dan Lofgren Brent Masica Andy McIntosh Matt Oelschlager Dave Holappa Shelley Jones Core Commercial Colliers International CBRE Liberty Property Trust Cushman & CSM CBRE Holappa Commercial The Jones Group Real Estate Minneapolis-St. Paul Wakefield/NorthMarq Real Estate Lynette Dumalag Chris Gliedman Mike Honsa Brent Karkula Duane Poppe Eric Rossbach Phil Simonet Jack Tornquist Barb Phelps Jamey Shandley NTH CBRE Transwestern CBRE Transwestern Colliers International Paramount CBRE Paramark Hamilton Minneapolis-St Paul Corporation Real Estate RETAIL Eric King Andrew Manthei Jim Montez Cushman & KW Commercial Cushman & Wakefield/NorthMarq Midwest Wakefield/NorthMarq Dan Mossey - Chair David Daly Patrick Daly Jesseka Doherty Lisa Diehl Ian Halker Tim Igo Brad Kaplan Kraus-Anderson CBRE Mid-America Mid-America Diehl & Colliers International Suntide Cushman & Realty Real Estate Real Estate Partners Minneapolis-St Paul Wakefield/NorthMarq Jeff Nordness Kevin O’Neil Bob Pfefferle Essence Real Estate Colliers International Hines Minneapolis-St.